System on Chip Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428831 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

System on Chip Market Size

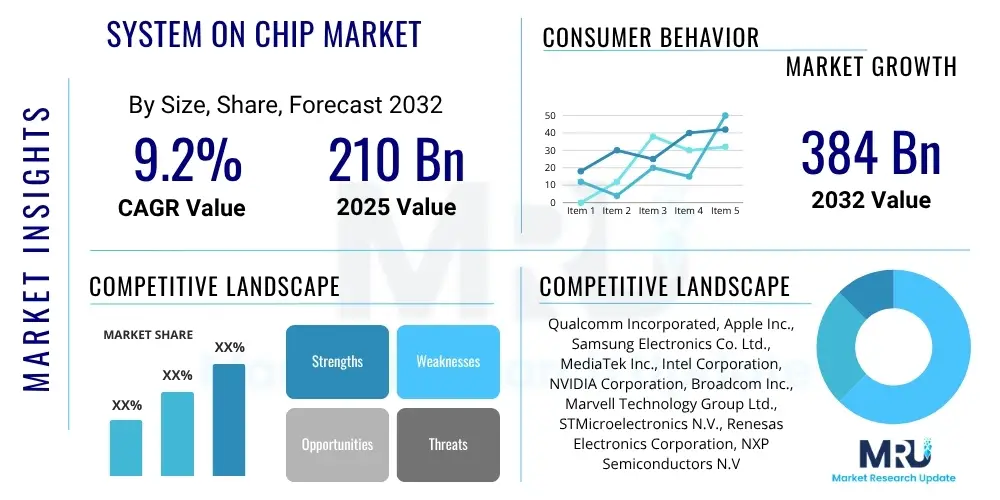

The System on Chip Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2025 and 2032. The market is estimated at USD 210 billion in 2025 and is projected to reach USD 384 billion by the end of the forecast period in 2032.

System on Chip Market introduction

The System on Chip SoC market is characterized by the integration of multiple electronic components and their functionalities into a single integrated circuit, serving as the computational brain for a vast array of modern electronic devices. These sophisticated chips encapsulate central processing units, graphics processing units, memory, inputoutput ports, and various other components, all consolidated onto a single silicon die. This design paradigm offers significant advantages in terms of performance optimization, power efficiency, and reduction in physical footprint, which are critical for the advancement of portable and intelligent technologies.

Major applications for SoCs span across diverse industries, predominantly fueling innovation in consumer electronics such as smartphones, tablets, smart wearables, and gaming consoles. Beyond personal devices, SoCs are integral to the burgeoning Internet of Things IoT ecosystem, enabling smart home devices, connected vehicles, and industrial automation. The core benefits derived from SoC adoption include enhanced computational speed, lower power consumption extending battery life, reduced manufacturing costs due to fewer discrete components, and improved reliability. These intrinsic advantages make SoCs indispensable for developing next-generation devices that demand high performance within stringent power and space constraints.

The market is primarily driven by the escalating demand for advanced portable devices, the proliferation of IoT devices requiring efficient processing at the edge, the rapid adoption of 5G technology necessitating powerful communication SoCs, and the increasing integration of complex electronic systems in the automotive sector. Furthermore, the relentless pursuit of artificial intelligence and machine learning capabilities at the device level, along with advancements in cloud computing infrastructure, continue to expand the scope and complexity of SoC designs. These factors collectively underscore the pivotal role SoCs play in shaping the future of digital technology and intelligent systems globally.

System on Chip Market Executive Summary

The System on Chip SoC market is experiencing robust growth, propelled by the relentless demand for higher integration, enhanced performance, and greater power efficiency across numerous electronic applications. Key business trends include the increasing specialization of SoCs for specific applications like AI accelerators, automotive infotainment, and edge computing, moving beyond general-purpose processors. There is a notable shift towards advanced process nodes, such as 3nm and 5nm, driving significant capital expenditure in foundry services. Furthermore, the market observes a continued consolidation among major players and strategic partnerships aimed at intellectual property IP development and supply chain resilience. The fabless business model remains prevalent, allowing companies to focus on design innovation while outsourcing manufacturing.

Regional trends highlight Asia Pacific APAC as the dominant force in terms of manufacturing capacity and consumer demand, largely driven by countries like China, Taiwan, South Korea, and Japan, which host major foundries and a vast electronics manufacturing ecosystem. North America continues to lead in SoC design innovation, particularly in high-performance computing, AI, and telecommunications. Europe shows steady growth, primarily fueled by advancements in the automotive and industrial sectors, where high-reliability and robust SoCs are crucial. Emerging markets in Latin America and the Middle East and Africa are witnessing increasing adoption of smart devices and IoT, translating into growing demand for SoCs, albeit from a smaller base.

Segment trends indicate significant expansion in specialized SoCs. The automotive segment is booming, with SoCs powering advanced driver-assistance systems ADAS, in-car infotainment, and electric vehicle control units. Artificial intelligence and machine learning SoCs are experiencing explosive growth, designed to handle complex AI workloads efficiently at the edge and in data centers. The consumer electronics segment, particularly smartphones and wearables, remains a foundational driver, constantly pushing for smaller, more powerful, and energy-efficient SoCs. Additionally, the industrial IoT and telecommunications sectors are increasingly demanding custom SoCs that offer enhanced security, real-time processing, and robust connectivity features, showcasing a diversified and dynamic market landscape.

AI Impact Analysis on System on Chip Market

User inquiries regarding AI's impact on the System on Chip market frequently revolve around the potential for enhanced processing capabilities, concerns about power consumption, the necessity for specialized hardware, and the broad application spectrum. Users are keen to understand how AI will influence the design and functionality of future SoCs, expecting significant improvements in on-device intelligence, real-time data processing, and predictive analytics. There is a strong interest in understanding the challenges of integrating complex AI algorithms into power-constrained environments, the role of dedicated AI accelerators, and the economic implications for manufacturers and end-users. The overarching theme is an expectation of a transformative shift, where SoCs become more intelligent and autonomous, albeit with concurrent demands for innovation in thermal management and energy efficiency.

- Increased demand for specialized AI accelerators and Neural Processing Units NPUs within SoCs.

- Development of edge AI SoCs for low-latency, real-time inference on devices.

- Enhanced integration of machine learning algorithms for power management and task scheduling within SoCs.

- Greater emphasis on heterogeneous computing architectures to optimize AI workload distribution.

- Challenges in designing SoCs capable of handling large AI models while maintaining power efficiency.

- Expansion of SoC applications into autonomous systems, medical diagnostics, and advanced robotics.

- Necessity for advanced packaging technologies to accommodate complex AI-centric chiplets and dies.

- Impact on software stacks and development tools to efficiently utilize AI-enabled SoC hardware.

- Push for novel memory architectures to support high-bandwidth AI data processing.

- Stimulation of research and development in neuromorphic computing architectures for next-generation SoCs.

DRO & Impact Forces Of System on Chip Market

The System on Chip SoC market is significantly influenced by a confluence of driving forces, inherent restraints, promising opportunities, and broader impact forces that collectively shape its trajectory. Key drivers include the exponential growth in demand for high-performance computing capabilities across various applications, the ubiquitous proliferation of IoT devices requiring efficient and compact processing units, and the global rollout of 5G networks which necessitates advanced SoCs for communication infrastructure and end-user devices. Furthermore, the rapid advancements in the automotive industry, particularly in electric vehicles and autonomous driving systems, create a substantial demand for sophisticated SoCs capable of complex sensor fusion, real-time decision-making, and infotainment. The continuous drive for miniaturization and energy efficiency in consumer electronics also acts as a primary catalyst for SoC innovation and adoption.

Despite the strong growth drivers, the SoC market faces several notable restraints. The exceptionally high research and development R&D costs associated with designing and manufacturing SoCs on advanced process nodes present a significant barrier to entry and a continuous challenge for even established players. The increasing complexity of SoC designs, integrating billions of transistors and diverse functionalities, leads to longer design cycles and higher verification costs. Geopolitical tensions, trade disputes, and natural disasters can severely impact global supply chains, causing disruptions in the availability of raw materials and manufacturing capacities. Moreover, thermal management issues in high-performance SoCs and the intense competition among market players to offer differentiated and cost-effective solutions also act as substantial impediments to market expansion and profitability.

Opportunities within the SoC market are abundant and diverse. The burgeoning field of edge artificial intelligence AI, where processing occurs closer to the data source, opens up new avenues for specialized, low-power AI SoCs. The growing demand for custom and application-specific integrated circuits ASICs in data centers and specialized computing tasks presents significant growth potential. Healthcare technologies, including portable diagnostic devices and remote monitoring systems, increasingly rely on advanced SoCs for their core functionality. Additionally, the industrial automation sector, driven by Industry 4.0 initiatives, offers substantial opportunities for robust and reliable SoCs that can withstand harsh environments and facilitate real-time control. The ongoing evolution towards chiplet architectures and advanced packaging also promises to unlock new levels of integration and performance, mitigating some of the traditional design complexities.

Segmentation Analysis

The System on Chip SoC market is comprehensively segmented to reflect the diverse technological applications, design methodologies, and end-user requirements that characterize its expansive landscape. Understanding these segments is crucial for analyzing market dynamics, identifying growth opportunities, and developing targeted strategies. The segmentation typically covers criteria such as the type of component integrated, the specific application areas these SoCs cater to, the end-user industries consuming these solutions, and the manufacturing process technologies employed. This granular view allows for a detailed assessment of market shares, competitive positioning, and future trends across various niches within the broad SoC ecosystem.

- By Type

- Digital SoCs

- Analog SoCs

- Mixed-Signal SoCs

- Hybrid SoCs

- By Application

- Consumer Electronics

- Smartphones

- Wearables

- Tablets

- Smart TVs

- Gaming Consoles

- Automotive

- ADAS (Advanced Driver-Assistance Systems)

- Infotainment Systems

- Electric Vehicle Management

- Telecommunications

- 5G Infrastructure

- Networking Equipment

- Client Devices

- Industrial

- Industrial Automation

- Robotics

- Smart Factories

- Healthcare

- Medical Imaging

- Wearable Health Devices

- Diagnostic Equipment

- Aerospace and Defense

- Data Center & Enterprise

- By End-User Industry

- Electronics Manufacturers

- Automotive Manufacturers

- Telecommunications Companies

- Industrial Equipment Manufacturers

- Healthcare Device Manufacturers

- IT & Data Center Providers

- By Technology Node

- 7nm and Below

- 10nm-16nm

- 20nm-28nm

- Above 28nm

- By Processing Type

- General Purpose Processor SoCs

- Application Specific SoCs ASICs

- Programmable SoCs FPGAs based

Value Chain Analysis For System on Chip Market

The value chain for the System on Chip market is intricate and highly specialized, beginning with fundamental upstream activities that lay the groundwork for chip design and fabrication. This upstream segment primarily involves intellectual property IP core providers, who develop and license crucial design blocks such as CPU cores, GPU cores, and communication interfaces, alongside Electronic Design Automation EDA tool vendors whose software is indispensable for chip design, verification, and simulation. Material suppliers providing silicon wafers, chemicals, and gases also constitute a critical part of the upstream segment, ensuring the availability of foundational components for semiconductor manufacturing. These upstream elements directly influence the efficiency, cost, and innovation capacity of the entire value chain.

Moving through the value chain, the core activities involve SoC design, conducted by fabless semiconductor companies, and manufacturing, predominantly performed by foundries such as TSMC, Samsung Foundry, and GlobalFoundries. After fabrication, assembly, testing, and packaging are carried out by Outsourced Semiconductor Assembly and Test OSAT companies. Downstream activities involve the integration of these finished SoCs into various electronic systems by original equipment manufacturers OEMs. These OEMs, ranging from smartphone manufacturers to automotive companies and industrial equipment providers, form the primary customer base for SoCs, incorporating them into their final products that are then distributed to end-users. The performance and capabilities of the SoC directly dictate the competitive advantage of these finished electronic products in the market.

The distribution channel for SoCs can be broadly categorized into direct and indirect routes. Direct distribution involves SoC manufacturers selling directly to large OEMs that require substantial volumes and custom solutions, often accompanied by extensive technical support and collaborative development. This direct approach fosters strong partnerships and allows for tailored product roadmaps. Indirect distribution typically involves a network of authorized distributors, value-added resellers VARs, and online marketplaces that cater to smaller OEMs, system integrators, and design houses. These indirect channels provide broader market reach, logistical support, and access to a wider range of standard or off-the-shelf SoC products. The choice of distribution strategy depends on factors such as market size, customer segment, and the level of customization required for the SoC solution.

System on Chip Market Potential Customers

The potential customers for System on Chip products represent a broad spectrum of industries, all seeking integrated, high-performance, and power-efficient processing solutions to power their next-generation devices and systems. At the forefront are consumer electronics manufacturers, who are constantly innovating in areas like smartphones, tablets, wearables, smart home devices, and gaming consoles, where the compactness, processing power, and energy efficiency of SoCs are paramount. These companies drive enormous volume demand and push the boundaries of design for mass-market adoption, seeking competitive advantages through superior user experience and advanced features.

Another significant customer segment is the automotive industry, which is undergoing a profound transformation driven by electric vehicles, autonomous driving, and advanced infotainment systems. Automotive manufacturers and Tier 1 suppliers require robust, reliable, and high-performance SoCs for ADAS, vehicle control units, in-car networking, and connected car applications. These customers prioritize functional safety, long-term support, and compliance with stringent industry standards, making their purchasing decisions highly specialized and long-term oriented.

Furthermore, telecommunications equipment providers, particularly those involved in 5G infrastructure deployment and client device development, constitute a vital customer base. They demand SoCs capable of high-speed data processing, efficient signal modulation, and secure communication. The industrial sector, including manufacturers of automation equipment, robotics, and smart factory solutions, also heavily relies on SoCs for real-time control, sensor integration, and ruggedized performance. Emerging customers in healthcare, aerospace, and data centers are increasingly adopting SoCs for specialized applications such as portable medical devices, satellite communication, and high-performance computing acceleration, underscoring the pervasive and expanding utility of System on Chip technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 210 billion |

| Market Forecast in 2032 | USD 384 billion |

| Growth Rate | 9.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Qualcomm Incorporated, Apple Inc., Samsung Electronics Co. Ltd., MediaTek Inc., Intel Corporation, NVIDIA Corporation, Broadcom Inc., Marvell Technology Group Ltd., STMicroelectronics N.V., Renesas Electronics Corporation, NXP Semiconductors N.V., Analog Devices Inc., Texas Instruments Incorporated, Huawei Technologies Co. Ltd. HiSilicon, Unisoc (Shanghai) Technologies Co. Ltd., Advanced Micro Devices AMD Inc., Microchip Technology Inc., Infineon Technologies AG, Toshiba Corporation, Imagination Technologies Group Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

System on Chip Market Key Technology Landscape

The System on Chip market is defined by a dynamic and rapidly evolving technological landscape, driven by the ceaseless pursuit of higher performance, greater efficiency, and miniaturization. At the forefront are advancements in semiconductor process nodes, with leading manufacturers continuously pushing towards smaller geometries such as 7nm, 5nm, and even 3nm. These smaller nodes enable the integration of more transistors into a given area, leading to significant boosts in computational power and reductions in power consumption, which are critical for high-end applications like mobile processors and data center accelerators. The complexity of these advanced nodes necessitates sophisticated lithography techniques, including Extreme Ultraviolet EUV lithography, which represents a major technological and financial investment.

Beyond basic scaling, the adoption of heterogeneous computing architectures is a pivotal trend. This involves integrating diverse processing units, such as specialized CPU cores, powerful GPU cores, dedicated Neural Processing Units NPUs for AI workloads, Digital Signal Processors DSPs, and custom accelerators, all optimized for specific tasks. This architectural approach allows SoCs to handle a wide range of computational demands with maximum efficiency, directing specific tasks to the most suitable processing element. Another key technology is the increasing utilization of chiplet architectures, where multiple smaller, functionally distinct chips are interconnected within a single package. Chiplets offer greater design flexibility, improved yield, and the ability to mix-and-match different process technologies, providing a modular approach to SoC design and manufacturing.

Furthermore, the emergence and growing adoption of open-source instruction set architectures like RISC-V are democratizing SoC design, offering a flexible and customizable alternative to proprietary architectures. This is particularly appealing for specialized applications and niche markets where custom silicon is beneficial. Advanced packaging technologies, including 2.5D and 3D stacking, are also critical, allowing for denser integration of memory and logic, reducing interconnection lengths, and improving overall system bandwidth and power efficiency. These technological advancements collectively contribute to the sophisticated capabilities of modern SoCs, enabling the development of groundbreaking electronic devices across diverse sectors, and are continuously shaping the competitive dynamics and innovation trajectory of the market.

Regional Highlights

- North America: This region is a powerhouse for SoC design innovation, particularly in high-performance computing, artificial intelligence, and telecommunications. Major technology companies and startups drive significant R&D investments, leading to cutting-edge SoC architectures for cloud infrastructure, autonomous vehicles, and advanced consumer devices. The region also boasts a robust ecosystem of EDA tool providers and IP core developers.

- Europe: Characterized by strong growth in the automotive, industrial, and medical sectors, Europe demands high-reliability and robust SoCs. Countries like Germany, France, and the UK are prominent in automotive electronics and industrial automation, fostering innovation in specialized SoCs for ADAS, IoT, and embedded systems. Emphasis on functional safety and cybersecurity in SoC design is a key regional highlight.

- Asia Pacific APAC: APAC is the largest and fastest-growing market for SoCs, driven by its expansive manufacturing capabilities and enormous consumer electronics market. Countries such as China, Taiwan, South Korea, and Japan host the world's leading foundries and assembly and test services, making the region central to the global SoC supply chain. Rapid adoption of smartphones, IoT devices, and 5G technology further fuels demand.

- Latin America: An emerging market for SoC consumption, Latin America is experiencing increasing demand driven by the growing penetration of smartphones, expanding internet infrastructure, and nascent IoT adoption across various industries. While design and manufacturing capabilities are limited, the region represents a significant growth opportunity for SoC deployment in telecommunications and consumer electronics.

- Middle East and Africa MEA: The MEA region is witnessing steady growth in SoC demand, primarily propelled by investments in 5G network deployment, smart city initiatives, and the increasing adoption of digital technologies. Telecommunications and consumer electronics are key drivers, with governments and enterprises focusing on digital transformation, creating a fertile ground for SoC-powered solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the System on Chip Market.- Qualcomm Incorporated

- Apple Inc.

- Samsung Electronics Co. Ltd.

- MediaTek Inc.

- Intel Corporation

- NVIDIA Corporation

- Broadcom Inc.

- Marvell Technology Group Ltd.

- STMicroelectronics N.V.

- Renesas Electronics Corporation

- NXP Semiconductors N.V.

- Analog Devices Inc.

- Texas Instruments Incorporated

- Huawei Technologies Co. Ltd. (HiSilicon)

- Unisoc (Shanghai) Technologies Co. Ltd.

- Advanced Micro Devices (AMD) Inc.

- Microchip Technology Inc.

- Infineon Technologies AG

- Toshiba Corporation

- Imagination Technologies Group Ltd.

Frequently Asked Questions

What is a System on Chip SoC and why is it important?

A System on Chip SoC is an integrated circuit that combines multiple electronic components and functionalities, such as CPUs, GPUs, memory, and I/O controllers, onto a single chip. Its importance stems from its ability to offer superior performance, reduced power consumption, smaller physical footprint, and lower manufacturing costs compared to traditional multi-chip designs, making it crucial for modern compact and high-performance electronic devices.

How is AI impacting the design and functionality of SoCs?

AI is profoundly impacting SoCs by driving the integration of specialized AI accelerators and Neural Processing Units NPUs, enabling efficient on-device machine learning and real-time inference. This leads to SoCs capable of more intelligent processing, improved power management through AI algorithms, and support for advanced applications in areas like autonomous driving and natural language processing.

Which industries are the primary consumers of System on Chip technology?

The primary consumers of System on Chip technology include consumer electronics manufacturers for devices like smartphones and wearables, the automotive industry for ADAS and infotainment systems, telecommunications companies for 5G infrastructure and client devices, and the industrial sector for automation and robotics. Emerging demand is also seen in healthcare and data centers.

What are the key drivers for the growth of the SoC market?

Key drivers for the SoC market's growth include the surging demand for advanced portable devices, the pervasive expansion of IoT ecosystems, the global rollout of 5G connectivity, and significant advancements in the automotive industry, particularly electric vehicles and autonomous driving. The continuous pursuit of miniaturization and energy efficiency across all electronics also acts as a powerful catalyst.

What challenges do SoC manufacturers face in the current market?

SoC manufacturers face several significant challenges, including exceptionally high research and development costs for advanced process nodes, increasing design complexity leading to longer development cycles, and geopolitical tensions that can disrupt global supply chains. Managing thermal output in high-performance SoCs and intense competition also present ongoing hurdles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- System On Chip Soc Market Size Report By Type (Digital, Analog, Mixed Signal), By Application (Automotive, Aerospace and Defense, IT and Telecommunication, Consumer Electronics, Industrial, Healthcare, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Wireless Gigabit Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (System on Chip (SOC), Integrated Circuit Chip (IC Chip)), By Application (Consumer Electronics, Networking, Commercial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager