Tactical Unmanned Aerial Vehicle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428642 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Tactical Unmanned Aerial Vehicle Market Size

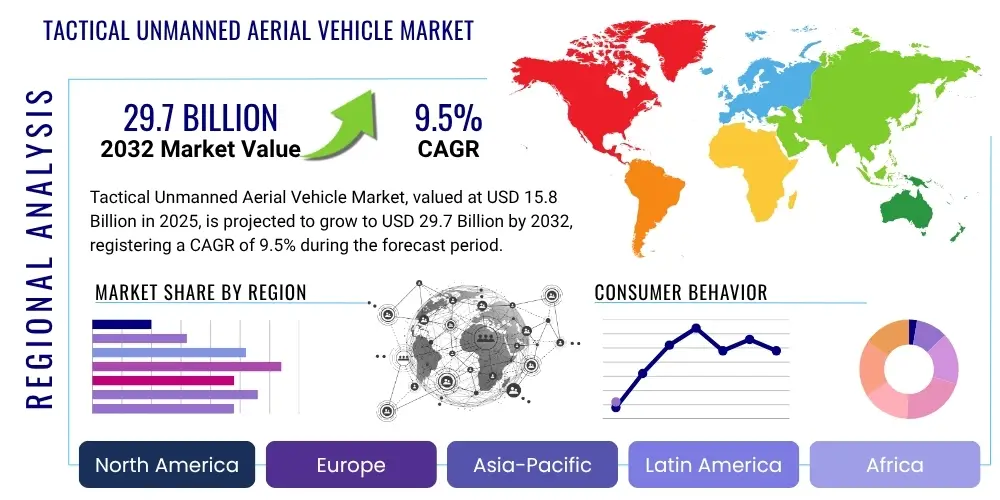

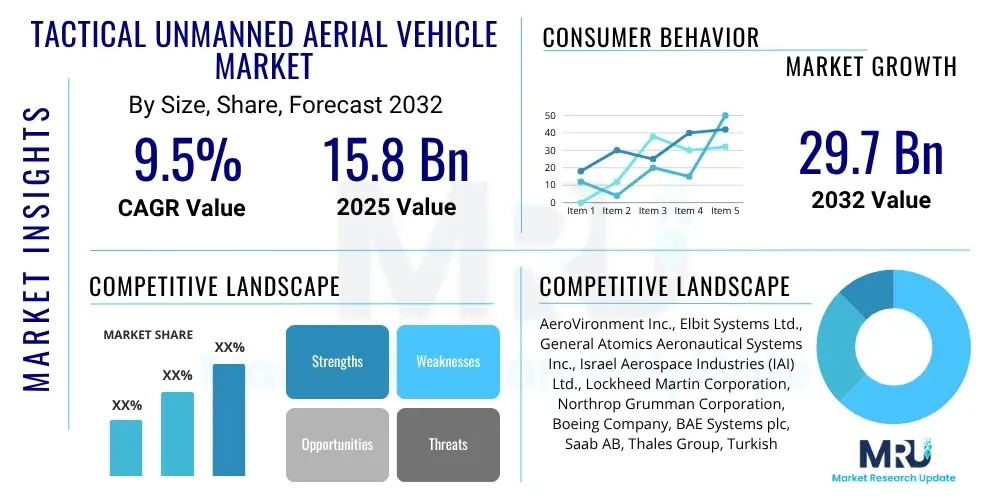

The Tactical Unmanned Aerial Vehicle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at USD 15.8 Billion in 2025 and is projected to reach USD 29.7 Billion by the end of the forecast period in 2032.

Tactical Unmanned Aerial Vehicle Market introduction

The Tactical Unmanned Aerial Vehicle (TUAV) market encompasses advanced, relatively small-sized uncrewed aircraft systems designed primarily for military and homeland security applications, operating typically within a few hundred kilometers of the frontline or operational area. These sophisticated systems serve critical roles including intelligence, surveillance, and reconnaissance (ISR), target acquisition, battle damage assessment, communications relay, and electronic warfare. TUAVs offer significant benefits by reducing human risk in hazardous environments, providing persistent observation capabilities, enhancing situational awareness for ground forces, and delivering cost-effective alternatives to manned aircraft for specific missions. Key driving factors for market growth include escalating geopolitical tensions worldwide, the increasing prevalence of asymmetric warfare demanding agile and discreet surveillance platforms, rapid technological advancements in sensor miniaturization and artificial intelligence, and a growing emphasis on network-centric warfare strategies where integrated data from TUAVs is crucial for decision-making. These vehicles are characterized by their deployability, stealth features, and ability to operate in complex and contested airspace, making them indispensable assets for modern defense forces globally. The continuous innovation in propulsion systems, payload capacities, and autonomous capabilities further propels the market forward, addressing diverse operational requirements from military reconnaissance to critical infrastructure protection and border security.

Tactical Unmanned Aerial Vehicle Market Executive Summary

The Tactical Unmanned Aerial Vehicle (TUAV) market is experiencing robust growth driven by evolving global security landscapes and rapid technological integration. Business trends indicate a strong emphasis on the development of multi-mission platforms, enhanced autonomy through artificial intelligence, and swarming capabilities to overwhelm adversarial defenses or conduct complex surveillance operations. Miniaturization of sensors and communication systems continues to be a pivotal trend, allowing for lighter, more versatile, and stealthier platforms. The market is also seeing increased investment in counter-UAV (C-UAV) technologies, reflecting the growing proliferation and threat posed by rogue or adversarial drone use, thereby creating a dual market for both offensive and defensive TUAV-related solutions. Regionally, North America remains a dominant force, fueled by substantial defense budgets, robust research and development activities, and the presence of leading defense contractors. Europe is investing heavily in modernizing its armed forces, with a focus on collaborative programs for next-generation TUAV systems, while the Asia Pacific region demonstrates significant growth, propelled by rising defense expenditures in countries like China, India, and South Korea, aiming to enhance their ISR capabilities amidst regional territorial disputes and security concerns. Latin America and the Middle East and Africa are emerging markets, primarily driven by counter-terrorism efforts, border surveillance needs, and internal security challenges. Segment trends highlight a demand for diverse platforms; fixed-wing TUAVs are favored for extended endurance and range, rotary-wing for vertical take-off and landing (VTOL) versatility in confined spaces, and increasingly, mini and micro-UAVs for portable, close-range reconnaissance. Payloads are shifting towards advanced multi-sensor integration, including electro-optical/infrared (EO/IR), synthetic aperture radar (SAR), and signals intelligence (SIGINT) systems, optimizing data collection and analysis. The convergence of these trends underscores a dynamic and strategically vital market segment.

AI Impact Analysis on Tactical Unmanned Aerial Vehicle Market

User questions regarding AI's impact on Tactical Unmanned Aerial Vehicles frequently center on how these advanced technologies enhance operational capabilities, the ethical implications of increased autonomy, and the cybersecurity challenges associated with AI integration. Key themes emerging from these inquiries include the desire for improved decision-making speed, the potential for reduced human cognitive load in complex missions, concerns about the reliability and trustworthiness of autonomous systems in critical situations, and the necessity for robust countermeasures against AI-enabled threats. Users are keenly interested in understanding how AI can facilitate swarming tactics, predictive maintenance, and real-time data analysis, transforming raw sensor data into actionable intelligence at the edge. There is also significant anticipation regarding AI's role in improving stealth characteristics and optimizing flight paths for evasion, alongside concerns about the legal frameworks and accountability for AI-driven actions in conflict zones. The overarching expectation is that AI will unlock unprecedented levels of efficiency and effectiveness, but not without addressing profound technical, ethical, and strategic considerations to ensure responsible deployment and mitigate associated risks.

- Enhanced Autonomy: AI enables TUAVs to perform complex tasks, such as navigation, target recognition, and decision-making, with reduced human intervention, boosting operational efficiency.

- Real-time Data Processing: AI algorithms process vast amounts of sensor data onboard, providing immediate, actionable intelligence to ground forces, crucial for time-sensitive missions.

- Improved Swarming Capabilities: AI facilitates coordinated multi-UAV operations, allowing synchronized reconnaissance, surveillance, or even attack patterns that are difficult to counter.

- Predictive Maintenance: AI analyzes flight data to predict component failures, optimizing maintenance schedules and increasing TUAV availability and lifespan.

- Adaptive Mission Planning: AI systems dynamically adjust flight paths and mission parameters in response to changing environmental conditions or detected threats, improving survivability and mission success.

- Advanced Target Recognition: Deep learning algorithms enable precise identification and classification of targets, even in cluttered or complex environments, reducing false positives.

- Enhanced Electronic Warfare: AI-powered TUAVs can identify and jam enemy communications or radar systems more effectively, adapting to new electronic threats in real-time.

- Cybersecurity Resilience: AI can be employed to detect and mitigate cyber threats against TUAV systems, although AI itself also introduces new attack vectors.

DRO & Impact Forces Of Tactical Unmanned Aerial Vehicle Market

The Tactical Unmanned Aerial Vehicle (TUAV) market is shaped by a complex interplay of dynamic forces, including robust drivers, critical restraints, and burgeoning opportunities, all influenced by broader impact factors. Key drivers propelling market expansion include the escalating global demand for enhanced intelligence, surveillance, and reconnaissance (ISR) capabilities, particularly in response to evolving asymmetric warfare tactics and persistent threats from non-state actors. The inherent advantage of TUAVs in reducing human risk during dangerous missions, coupled with their increasing sophistication in sensor technology, autonomy, and communication systems, further accelerates adoption. Additionally, the declining cost of manufacturing and operating these systems, alongside substantial defense budget allocations in major economies for modernization and technological superiority, provides a consistent impetus for growth. These systems are becoming indispensable for securing borders, protecting critical infrastructure, and supporting special operations with precision and agility.

However, the market also faces significant restraints that temper its growth trajectory. Stringent regulatory frameworks governing airspace integration, particularly for autonomous systems, present considerable challenges in terms of compliance and operational flexibility. Ethical concerns surrounding the use of lethal autonomous weapons systems (LAWS) and the potential for unintended collateral damage continue to spark debate and may influence development and deployment policies. Cybersecurity vulnerabilities represent a persistent threat, as sophisticated adversaries continually seek to exploit drone systems for espionage, data exfiltration, or hijacking, necessitating continuous investment in robust security measures. Furthermore, the high initial development costs for cutting-edge TUAV platforms, along with the complexity of integrating diverse payloads and software, can be a barrier for some defense programs, particularly in budget-constrained regions, leading to slower procurement cycles.

Despite these challenges, numerous opportunities exist for market participants. The emergence of new applications beyond traditional military roles, such as disaster response, environmental monitoring, and specialized law enforcement support, opens new revenue streams. Collaborations between defense contractors and commercial technology firms, particularly in AI, robotics, and advanced materials, can accelerate innovation and drive down costs through shared research and development efforts. The growing emphasis on multi-domain operations and the integration of TUAVs into manned-unmanned teaming (MUM-T) concepts present a substantial opportunity for developing highly synergistic and effective combat systems. Moreover, developing robust counter-UAV (C-UAV) solutions to protect against malicious drone use simultaneously presents a vital growth area for companies capable of offering comprehensive defensive measures. Geopolitical instability and ongoing regional conflicts globally serve as a significant impact force, directly influencing defense spending priorities and accelerating the demand for proven tactical surveillance and strike capabilities.

Segmentation Analysis

The Tactical Unmanned Aerial Vehicle (TUAV) market is meticulously segmented to provide a comprehensive understanding of its diverse applications, technological variations, and operational characteristics. This detailed segmentation helps in analyzing market dynamics by categorizing TUAVs based on their design, primary function, propulsion method, and operational reach. Understanding these segments is crucial for manufacturers to tailor their products to specific military and security requirements, and for strategic planners to identify gaps and opportunities within the defense technology landscape. The evolution of these segments reflects the continuous innovation aimed at enhancing capabilities, improving endurance, increasing payload versatility, and addressing specific mission profiles ranging from covert reconnaissance to direct engagement in complex combat environments.

- By Type

- Fixed-Wing: Designed for longer endurance and higher speeds, typically launched via catapult or runway.

- Rotary-Wing: Offers Vertical Take-Off and Landing (VTOL) capabilities, suitable for confined spaces and hovering reconnaissance.

- Hybrid: Combines the advantages of fixed-wing (endurance) and rotary-wing (VTOL) for enhanced versatility.

- Mini/Micro TUAVs: Extremely portable, hand-launched, for close-range intelligence and reconnaissance.

- By Payload

- Intelligence, Surveillance, and Reconnaissance (ISR) Payloads: Electro-optical/Infrared (EO/IR) cameras, Synthetic Aperture Radar (SAR), Moving Target Indicator (MTI).

- Signals Intelligence (SIGINT) Payloads: For intercepting and analyzing electronic signals.

- Electronic Warfare (EW) Payloads: For jamming enemy communications or radar.

- Lethal Payloads: Small missiles, guided munitions for precision strikes.

- Non-Lethal Payloads: Acoustic deterrents, riot control agents.

- Communications Relay Payloads: Extending communication range for ground forces.

- By Application

- Military: Frontline reconnaissance, target acquisition, battle damage assessment, special operations support.

- Homeland Security: Border patrol, critical infrastructure monitoring, event security.

- Border Patrol: Surveillance of national borders to prevent illegal crossings and smuggling.

- Special Operations: Covert intelligence gathering, high-risk mission support.

- Law Enforcement: Crowd control, search and rescue, surveillance in urban environments.

- By Range

- Short Range: Up to 50 km, typically for immediate tactical support.

- Medium Range: 50 km to 250 km, for broader tactical overwatch.

- Extended Range: Beyond 250 km, for deeper penetration and longer missions.

- By Endurance

- Short Endurance: Up to 2 hours, for rapid deployment and quick missions.

- Medium Endurance: 2 to 8 hours, for sustained tactical surveillance.

- Long Endurance: Greater than 8 hours, for persistent ISR and extended operational periods.

- By Propulsion

- Electric: Quieter, lower heat signature, ideal for mini/micro TUAVs and shorter missions.

- Internal Combustion: Higher power, longer endurance, typically for larger TUAVs.

- Hybrid: Combines electric and internal combustion for optimized performance, efficiency, and flexibility.

- Fuel Cell: Emerging technology offering extended endurance and silent operation.

Value Chain Analysis For Tactical Unmanned Aerial Vehicle Market

The value chain for the Tactical Unmanned Aerial Vehicle (TUAV) market is a complex ecosystem, starting from foundational research and development, progressing through manufacturing and integration, and culminating in deployment, operations, and long-term support for end-users. At the upstream analysis stage, the market relies heavily on a specialized network of suppliers providing critical raw materials such as advanced composites, aerospace-grade metals, and specialized electronics. This stage also includes manufacturers of key components like high-performance engines and electric motors, sophisticated avionics systems, miniaturized sensors (e.g., EO/IR, SAR, SIGINT), secure communication modules, and advanced flight control software. Innovation in these foundational components directly impacts the capabilities and cost-effectiveness of the final TUAV product, making strong supplier relationships and access to cutting-edge technology paramount for market leaders.

Moving downstream, the value chain involves prime defense contractors and system integrators who are responsible for designing, assembling, testing, and certifying the complete TUAV platforms. These entities often collaborate with various component suppliers and software developers to ensure seamless integration of diverse technologies into a cohesive, mission-ready system. The distribution channels for TUAVs are predominantly direct, involving direct sales and long-term contracts between manufacturers and government defense ministries, armed forces, and homeland security agencies. This direct engagement ensures that highly specific military requirements, security protocols, and customization needs are met through close collaboration during the procurement and deployment phases. Indirect channels are less common but can involve partnerships with larger defense conglomerates that act as prime contractors, incorporating TUAVs as part of broader defense system offerings or foreign military sales programs, where the original manufacturer might not directly interact with the end-user.

Post-sale, the value chain extends into comprehensive training programs for operators and maintenance personnel, ongoing technical support, spare parts provision, and system upgrades throughout the operational lifespan of the TUAVs. This long-term support is crucial due to the highly specialized nature and significant investment in these assets, ensuring sustained operational readiness and adaptability to evolving threat landscapes. The profitability at each stage is influenced by factors such as proprietary technology, economies of scale, regulatory compliance, and the ability to manage complex supply chains effectively. Strong integration across the value chain, from R&D to lifecycle support, is critical for delivering high-performance TUAV solutions and maintaining a competitive edge in this highly strategic and technologically intensive market.

Tactical Unmanned Aerial Vehicle Market Potential Customers

The primary potential customers and end-users of Tactical Unmanned Aerial Vehicles are predominantly governmental entities and defense organizations worldwide, driven by the imperative to enhance national security, maintain military superiority, and conduct effective intelligence and surveillance operations. The core buyers include national defense ministries, which procure TUAVs for their respective armed forces, encompassing army, navy, and air force branches. These military branches utilize TUAVs for a wide array of missions such as battlefield reconnaissance, target acquisition, border surveillance, convoy protection, and special operations support. The versatility and adaptability of TUAVs make them indispensable assets for augmenting conventional military capabilities and adapting to the complexities of modern warfare scenarios, including asymmetric conflicts and urban combat environments.

Beyond traditional military applications, homeland security agencies represent a significant and growing customer segment. These agencies deploy TUAVs for critical infrastructure protection, monitoring vast border areas to counter illegal crossings and smuggling, and providing airborne surveillance during large public events or in response to natural disasters. Intelligence agencies also constitute key end-users, leveraging TUAVs for clandestine information gathering, detailed aerial mapping, and monitoring of high-value targets, often requiring platforms with advanced stealth capabilities and sophisticated sensor suites. The demand from these diverse governmental bodies is continuously shaped by evolving geopolitical threats, regional instabilities, and national defense doctrines, leading to tailored procurement strategies focused on specific operational requirements and budget constraints.

Furthermore, specialized units within armed forces, such as special operations commands, are increasingly significant buyers, seeking highly portable, rapidly deployable, and technologically advanced TUAVs for niche, high-risk missions where discretion and agility are paramount. Law enforcement agencies, particularly those involved in tactical operations or large-scale surveillance, also represent a nascent but growing customer base, utilizing smaller TUAVs for situations like search and rescue, crime scene analysis, and monitoring of hazardous environments. The procurement cycle for these customers is typically long and involves rigorous testing, evaluation, and customization processes to ensure that the TUAV systems meet stringent performance, reliability, and security standards essential for mission-critical applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.8 Billion |

| Market Forecast in 2032 | USD 29.7 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AeroVironment Inc., Elbit Systems Ltd., General Atomics Aeronautical Systems Inc., Israel Aerospace Industries (IAI) Ltd., Lockheed Martin Corporation, Northrop Grumman Corporation, Boeing Company, BAE Systems plc, Saab AB, Thales Group, Turkish Aerospace Industries (TAI), Kratos Defense & Security Solutions Inc., Insitu Inc. (a Boeing company), Textron Inc. (AAI Corporation), Raytheon Technologies Corporation (now RTX Corporation), L3Harris Technologies Inc., DJI Technology Co. Ltd. (commercial focus with defense applications), Autel Robotics (commercial focus with defense applications), Rafael Advanced Defense Systems Ltd., Schiebel Elektronische Geraete GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tactical Unmanned Aerial Vehicle Market Key Technology Landscape

The technological landscape of the Tactical Unmanned Aerial Vehicle (TUAV) market is characterized by rapid advancements across multiple domains, driving significant improvements in performance, autonomy, and mission capabilities. Central to this evolution are sophisticated avionics systems that integrate flight control, navigation, and communication functionalities into highly compact and robust packages, enabling precise maneuverability and reliable operation in diverse and challenging environments. The increasing adoption of artificial intelligence (AI) and machine learning (ML) algorithms is profoundly transforming TUAVs, allowing for unprecedented levels of autonomy in tasks such as autonomous navigation, object detection and tracking, intelligent decision-making, and cooperative swarming operations, significantly reducing the cognitive load on human operators and enhancing mission effectiveness. This AI integration is critical for processing the vast amounts of data collected by advanced sensor payloads in real-time.

Miniaturization of sensors represents another pivotal technological trend, with high-resolution electro-optical/infrared (EO/IR) cameras, synthetic aperture radar (SAR), and signals intelligence (SIGINT) systems becoming smaller, lighter, and more powerful. This allows TUAVs to carry multiple sensor types simultaneously, providing comprehensive multi-spectral data for enhanced situational awareness without compromising endurance or payload capacity. Stealth materials and advanced aerodynamic designs are being continually refined to reduce radar cross-section and acoustic signatures, enabling TUAVs to operate more discreetly in contested airspace. Furthermore, the development of secure and resilient communication links, including satellite communications and cognitive radio technologies, ensures robust data transmission and control even in environments subjected to electronic jamming or cyberattacks, maintaining operational integrity and preventing unauthorized interception.

Propulsion system innovation is also a key area, with a growing shift towards hybrid-electric and fuel-cell technologies that offer extended endurance, reduced acoustic signatures, and greater fuel efficiency compared to traditional internal combustion engines, particularly beneficial for long-duration ISR missions. Moreover, the integration of advanced data fusion techniques allows for the seamless combination of inputs from multiple sensors and platforms, creating a more complete and accurate operational picture. The continuous evolution of counter-UAV (C-UAV) technologies, including advanced jamming systems, directed energy weapons, and kinetic interceptors, is also a significant aspect of the technological landscape, reflecting the dual nature of drone development as both an offensive and defensive capability. These technological innovations collectively underscore the dynamic and high-tech nature of the TUAV market, constantly pushing the boundaries of what these systems can achieve in complex military and security operations.

Regional Highlights

The global Tactical Unmanned Aerial Vehicle (TUAV) market exhibits distinct regional dynamics, influenced by geopolitical factors, defense spending, technological capabilities, and strategic priorities across different continents.

- North America: Dominates the global TUAV market, driven by significant defense investments from the United States and Canada, robust R&D capabilities, and the presence of major aerospace and defense contractors. The region prioritizes advanced ISR platforms, integration of AI for enhanced autonomy, and development of sophisticated counter-UAV systems, making it a hub for technological innovation.

- Europe: Represents a substantial market, characterized by ongoing military modernization programs across countries like the UK, France, Germany, and Italy. There is a strong focus on developing indigenous TUAV capabilities, often through multinational collaborative projects, to enhance border security, support NATO operations, and address evolving security threats.

- Asia Pacific (APAC): Emerges as the fastest-growing market, propelled by escalating defense budgets, regional territorial disputes, and the modernization efforts of countries such as China, India, Japan, South Korea, and Australia. Increased procurement of TUAVs for maritime surveillance, border monitoring, and counter-terrorism operations is a key driver in this region.

- Latin America: An emerging market with increasing adoption of TUAVs for homeland security applications, border surveillance, anti-narcotics operations, and disaster management. Countries like Brazil, Mexico, and Colombia are steadily investing in these systems, often seeking more cost-effective solutions for their specific security challenges.

- Middle East and Africa (MEA): This region shows significant demand for TUAVs primarily due to persistent geopolitical instability, ongoing conflicts, and extensive counter-terrorism campaigns. Countries like Saudi Arabia, UAE, Turkey, and Israel are significant players, investing in TUAVs for surveillance, reconnaissance, and targeted strike capabilities to maintain regional security and combat insurgencies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tactical Unmanned Aerial Vehicle Market.- AeroVironment Inc.

- Elbit Systems Ltd.

- General Atomics Aeronautical Systems Inc.

- Israel Aerospace Industries (IAI) Ltd.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Boeing Company

- BAE Systems plc

- Saab AB

- Thales Group

- Turkish Aerospace Industries (TAI)

- Kratos Defense & Security Solutions Inc.

- Insitu Inc. (a Boeing company)

- Textron Inc. (AAI Corporation)

- Raytheon Technologies Corporation (now RTX Corporation)

- L3Harris Technologies Inc.

- DJI Technology Co. Ltd.

- Autel Robotics

- Rafael Advanced Defense Systems Ltd.

- Schiebel Elektronische Geraete GmbH.

Frequently Asked Questions

What is a Tactical Unmanned Aerial Vehicle (TUAV

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager