Tallow Fatty Acids Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430348 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Tallow Fatty Acids Market Size

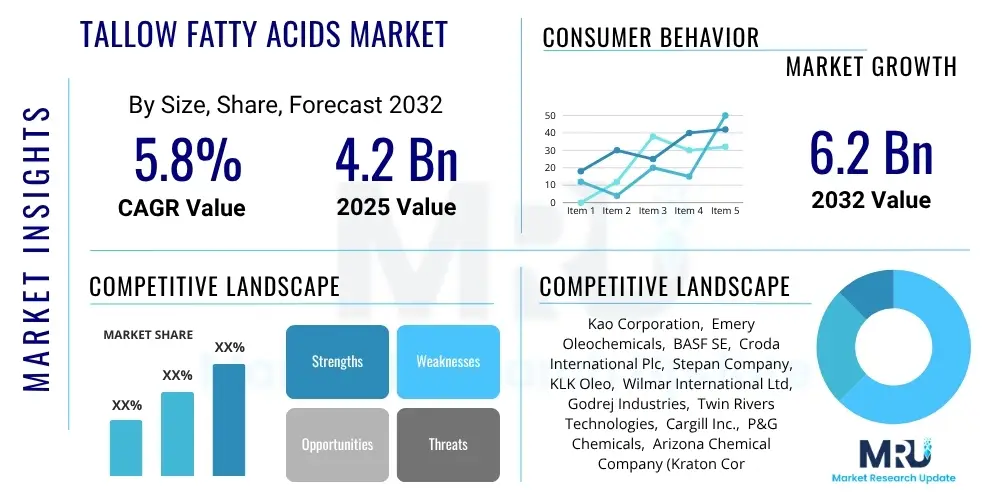

The Tallow Fatty Acids Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 4.2 Billion in 2025 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2032.

Tallow Fatty Acids Market introduction

Tallow fatty acids represent a vital segment within the global oleochemical industry, distinguished by their derivation from animal fats, predominantly bovine and ovine tallow. These sophisticated chemical compounds are obtained through a meticulously controlled hydrolysis process, which cleaves triglycerides into their constituent fatty acids and glycerol. The resulting mixture typically comprises a balanced composition of saturated fatty acids, such as stearic acid and palmitic acid, alongside unsaturated counterparts like oleic acid. This unique natural origin endows tallow fatty acids with inherent biodegradability and a favorable environmental profile when compared to many synthetic, petroleum-derived alternatives, making them increasingly attractive in a sustainability-conscious market.

The product's intrinsic benefits are manifold, encompassing robust cost-effectiveness, exceptional performance characteristics in various formulations, and commendable thermal stability. These attributes render tallow fatty acids indispensable across a diverse spectrum of major applications. In the realm of soaps and detergents, they function as primary surfactants, enhancing cleaning efficacy, foaming properties, and product consistency. Within the expansive personal care and cosmetics sector, they are prized for their emollient, emulsifying, and thickening capabilities in lotions, creams, and hair care products. Industrially, they serve critical roles as lubricants, rubber processing aids, and textile finishing agents, demonstrating their pervasive utility across the manufacturing landscape.

The overarching growth trajectory of the Tallow Fatty Acids Market is predominantly shaped by several compelling driving factors. A primary impetus is the burgeoning demand emanating from the rapidly expanding personal care, cosmetics, and household cleaning industries, which consistently seek naturally derived, high-performance ingredients. Furthermore, the persistent growth in various industrial applications, including automotive lubricants, polymer additives, and agricultural chemicals, underpins steady consumption. The global paradigm shift towards bio-based and sustainable chemical solutions, driven by heightened environmental awareness and regulatory pressures, further amplifies the appeal of tallow fatty acids as a responsible and efficient raw material, ensuring their continued relevance and market expansion in the foreseeable future.

Tallow Fatty Acids Market Executive Summary

The Tallow Fatty Acids Market is currently undergoing a transformative period, marked by several prominent business trends. Industry stakeholders are increasingly prioritizing vertical integration to secure raw material supplies and enhance operational control, extending from rendering operations to specialized oleochemical production. There is a discernible shift towards investing in advanced fractionation and purification technologies, enabling the creation of higher-purity, tailor-made fatty acid fractions that cater to niche applications in pharmaceuticals and advanced materials. Furthermore, strategic alliances and collaborative research initiatives are becoming prevalent, aimed at exploring novel sustainable production methods and diversifying the application portfolio of tallow fatty acids beyond traditional uses, thereby fostering innovation and competitive differentiation within the global market.

From a regional perspective, market dynamics present a diverse landscape. The Asia Pacific region is unequivocally positioned as the principal growth engine, propelled by vigorous industrialization, burgeoning population bases, and the concomitant expansion of manufacturing capacities across key economies such as China, India, and Indonesia. This growth is particularly pronounced in the personal care, textile, and chemical sectors, where demand for tallow fatty acids is escalating. Conversely, mature markets in North America and Europe demonstrate a more tempered yet stable growth trajectory. These regions are characterized by stringent regulatory environments that favor bio-based solutions and sophisticated R&D infrastructures, leading to the development of high-value specialty products and fostering sustainable consumption practices.

An analysis of market segments reveals distinct patterns and opportunities. The demand for stearic acid and oleic acid continues to dominate, driven by their foundational roles in the manufacturing of soaps, detergents, and rubber products. However, there is a notable increase in the uptake of fractionated fatty acids, which offer enhanced purity and precise functional properties, making them ideal for high-performance lubricants, sophisticated cosmetic formulations, and pharmaceutical excipients. The robust expansion of the personal care and cosmetics industry, coupled with consistent, resilient demand from the industrial lubricants and animal feed sectors, collectively contribute to the overall resilience and expansion of the market. This segmentation also highlights the increasing sophistication of end-user requirements, pushing manufacturers towards greater product customization and technological refinement.

AI Impact Analysis on Tallow Fatty Acids Market

Users frequently inquire about how Artificial Intelligence can revolutionize the production, distribution, and application of tallow fatty acids. Common concerns revolve around leveraging AI for optimizing complex hydrolysis and fractionation processes, ensuring consistent product quality, predicting raw material price fluctuations, and enhancing supply chain traceability for sustainable sourcing. There is also significant interest in AI's potential to accelerate research and development for new bio-based applications, as well as to improve the overall environmental footprint of the industry. The overarching expectation is that AI will introduce unprecedented levels of efficiency, precision, and sustainability.

- AI-driven process optimization for hydrolysis and distillation to maximize yield and purity.

- Predictive analytics for raw material sourcing, anticipating tallow availability and price fluctuations.

- Enhanced supply chain management through AI-powered logistics, improving traceability and reducing waste.

- Accelerated R&D for novel applications and product formulations using machine learning algorithms.

- Automated quality control systems ensuring consistent specifications for various end-use industries.

- Demand forecasting for end-products, optimizing production schedules and inventory management.

- Sustainability monitoring and optimization, tracking resource consumption and emissions in real time.

DRO & Impact Forces Of Tallow Fatty Acids Market

The Tallow Fatty Acids Market navigates a complex interplay of drivers, restraints, opportunities, and impactful forces that collectively dictate its growth trajectory and competitive landscape. A significant driver is the persistent and expanding demand from various end-use industries. The personal care and cosmetics sector consistently seeks natural, biodegradable ingredients for formulations, where tallow fatty acids serve as essential emollients, emulsifiers, and surfactants due to their proven efficacy and cost-efficiency. Concurrently, the robust industrial applications in sectors such as lubricants, rubber processing, textile manufacturing, and coatings further bolster demand, valuing the superior performance attributes these fatty acids offer. The global shift towards sustainable chemistry and bio-based raw materials, driven by increasing environmental consciousness and evolving regulatory mandates, also positions tallow fatty acids as an attractive and responsible alternative to petroleum-derived compounds, significantly contributing to their market expansion.

Despite these strong drivers, the market faces notable restraints that can impede its growth. Paramount among these is the inherent volatility in the pricing and availability of crude tallow, the primary raw material. Tallow supply is inextricably linked to the dynamics of the meat industry, which can be influenced by factors such as livestock population fluctuations, feed costs, disease outbreaks, and global trade policies, leading to unpredictable input costs for manufacturers. Furthermore, intense competition from alternative fatty acids derived from vegetable oils, particularly palm and soybean oils, poses a considerable challenge, as these alternatives often benefit from different supply chain structures and consumer perceptions. Additionally, environmental concerns associated with large-scale livestock farming, although tallow is a byproduct, can indirectly impact brand image and influence consumer preferences in certain environmentally conscious markets. Stringent regulatory frameworks pertaining to product purity, sustainability certifications, and specific application guidelines in various regions also add complexity and compliance costs for market players.

Looking ahead, the Tallow Fatty Acids Market is replete with strategic opportunities for growth and innovation. Continuous advancements in processing technologies, including more efficient hydrolysis methods, enhanced fractionation techniques, and advanced purification processes, enable manufacturers to produce higher-purity, specialized fatty acid fractions with tailored functionalities. These technological leaps unlock new potential applications in high-value segments like pharmaceuticals, advanced materials, and nutraceuticals. Moreover, the exploration of emerging bio-based sectors, such as the development of bioplastics, biolubricants, and advanced biofuels utilizing tallow fatty acids, presents substantial avenues for future market expansion. Geographically, significant opportunities exist in rapidly industrializing economies, particularly across Asia Pacific and Latin America, where burgeoning populations, rising disposable incomes, and increasing industrial output are fueling a surge in demand for basic chemicals and consumer goods. Strategic investments in research and development, coupled with fostering collaborative partnerships across the value chain, will be crucial for capitalizing on these burgeoning opportunities and ensuring long-term market competitiveness.

Segmentation Analysis

The Tallow Fatty Acids Market undergoes a comprehensive segmentation based on several crucial criteria, offering a nuanced and detailed understanding of its underlying structure, diverse demand patterns, and distinct growth vectors. This granular segmentation is instrumental for market participants to identify specific niches, assess competitive dynamics within each sub-market, and formulate targeted strategic initiatives. The primary segmentation distinguishes products based on the specific type of fatty acid, acknowledging the varied chemical compositions and functional attributes that each fraction brings to different applications. Further delineation by application elucidates the pervasive utility of tallow fatty acids across a vast array of manufacturing processes and consumer-oriented products, ranging from household essentials to highly specialized industrial components.

A meticulous analysis of these segmentations is paramount for stakeholders aiming to optimize their product development pipelines, refine their market entry strategies, and enhance the efficacy of their distribution networks globally. The performance of each segment is intricately influenced by a unique confluence of market drivers, prevailing regulatory landscapes, technological innovations, and evolving consumer preferences. For instance, segments catering to the personal care sector may exhibit different growth dynamics and responsiveness to trends like 'natural' or 'clean label' compared to industrial segments driven by performance metrics and cost-efficiency. This detailed segmentation framework therefore empowers businesses to gain deep insights into market behavior, anticipate future shifts, and make informed strategic decisions that align with the specific demands of their target customer bases.

Furthermore, segmentation by end-use industry provides a macro-level perspective on where these fatty acids are ultimately consumed. This includes major chemical industries that use them as intermediates, automotive sectors for lubricants and additives, agricultural applications for animal nutrition, and pharmaceutical formulations for excipients. Understanding the interplay between these segments not only clarifies current market composition but also highlights areas ripe for innovation and market penetration. The continuous evolution of these segments, driven by both supply-side advancements and demand-side shifts, necessitates ongoing analysis to maintain a competitive edge and explore novel opportunities within the dynamic tallow fatty acids ecosystem.

- By Type

- Stearic Acid: A saturated fatty acid widely used as a hardening agent, lubricant, and emulsifier in soaps, candles, cosmetics, and rubber processing. It is known for its stability and waxy texture.

- Oleic Acid: A monounsaturated fatty acid prominent for its use as an emulsifier, softener, and lubricant in personal care, detergents, and industrial oils. It provides fluidity and conditioning properties.

- Palmitic Acid: A saturated fatty acid frequently found in conjunction with stearic acid, used in soaps, cosmetics, and food processing (as an additive in some regions). Contributes to product stability and texture.

- Myristic Acid: A saturated fatty acid primarily utilized in detergents, soaps, and cosmetics for its cleansing and foaming capabilities, as well as an opacifying agent.

- Lauric Acid: Less common as a primary component in tallow but can be present in trace amounts or derived through fractionation; used in soaps and detergents for its strong surfactant properties.

- Others (e.g., Linoleic Acid, Capric Acid, Caprylic Acid): These fatty acids, present in smaller quantities, contribute to the overall functional profile and find specialized applications in niche markets such as flavorings, fragrances, and specialty lubricants.

- By Application

- Soaps and Detergents: Core application, providing cleaning, foaming, and emulsifying properties for household and industrial cleaning products. Essential for surfactant formulations.

- Personal Care and Cosmetics: Used as emollients, emulsifiers, thickeners, and conditioning agents in creams, lotions, shampoos, and makeup products, offering skin-friendly properties.

- Rubber and Plastics: Function as internal lubricants, mold release agents, and processing aids, improving the flow properties of polymers and the surface finish of manufactured goods.

- Lubricants and Greases: Incorporated into industrial lubricants, metalworking fluids, and greases to enhance lubricity, anti-wear properties, and stability under various operating conditions.

- Textiles: Employed as softeners, lubricants, and finishing agents in textile processing, improving the feel, drape, and sewability of fabrics.

- Coatings: Used as rheology modifiers, dispersants, and anti-settling agents in paints, varnishes, and inks, improving application properties and product stability.

- Animal Feed: Added as an energy source and nutritional supplement in livestock and poultry feed formulations, contributing to animal growth and health.

- Others (e.g., Biofuels, Pharmaceuticals, Oilfield Chemicals): Emerging and niche applications, including components for biodiesel, excipients in drug delivery, and defoamers or emulsifiers in oil and gas extraction processes.

- By End-Use Industry

- Chemicals: Major consumer as raw material for further synthesis of fatty amines, fatty alcohols, esters, and other oleochemical derivatives.

- Automotive: Utilized in the production of automotive lubricants, greases, and certain plastic components, contributing to vehicle performance and longevity.

- Food and Beverages (as processing aids/ingredients in certain non-direct food contact applications): While not a direct food ingredient in most regions, can be used in processing aids or in specialized feed applications.

- Agriculture (animal nutrition): Essential for fortifying animal feed, providing vital energy and fatty acid profiles for livestock health and productivity.

- Pharmaceuticals: Employed as excipients, binders, and emulsifiers in various pharmaceutical formulations and drug delivery systems, leveraging their inertness and compatibility.

- Others (e.g., Building & Construction, Paper & Pulp, Mining): Diverse applications include asphalt additives, flotation agents in mining, and components in paper sizing agents, showcasing broad industrial utility.

Value Chain Analysis For Tallow Fatty Acids Market

The value chain of the Tallow Fatty Acids Market is a multi-tiered structure commencing with its foundational upstream activities. This initial stage is intrinsically linked to the global livestock industry, where cattle and sheep farming provide the primary source of animal fat. Following animal processing, rendering plants play a pivotal role in converting animal byproducts, including crude fat, into refined tallow. The efficiency of these rendering operations, encompassing collection, processing, and purification of tallow, directly impacts the quality, availability, and cost-effectiveness of the raw material entering the subsequent stages. Establishing robust, sustainable relationships with a network of rendering facilities is paramount for oleochemical manufacturers to ensure a consistent and high-quality supply of crude tallow, thereby laying the groundwork for stable production of fatty acids.

Progressing downstream, the value chain transitions to the specialized oleochemical manufacturing sector. Here, refined tallow undergoes a series of complex chemical processes, prominently hydrolysis, where it is reacted with water under specific conditions to yield a mixture of fatty acids and glycerol. This crude fatty acid mixture then undergoes further sophisticated processing steps, including purification, distillation, and fractionation, to separate individual fatty acids like stearic, oleic, and palmitic acids, or to create specific blends tailored to diverse industrial requirements. These manufacturing facilities leverage advanced technologies to achieve high purity levels and desired functional characteristics, transforming basic tallow into value-added chemical intermediates. The innovation capabilities and operational excellence of these oleochemical producers are critical in determining the versatility and market reach of the final tallow fatty acid products.

The final stage of the value chain involves the intricate distribution channels and the ultimate consumption by a multitude of end-use industries. The distribution network is bifurcated into direct sales and indirect channels. Large industrial consumers, such as multinational chemical conglomerates, major personal care product manufacturers, or leading automotive lubricant producers, often engage in direct procurement agreements with oleochemical suppliers to ensure consistent supply volumes, leverage economies of scale, and benefit from bespoke product specifications. Conversely, for smaller enterprises, specialized applications, or geographically dispersed markets, indirect channels involving a network of distributors, agents, and chemical traders are indispensable. These intermediaries provide critical logistical support, inventory management, technical assistance, and localized market access, efficiently bridging the gap between producers and a diverse customer base. An optimized and responsive distribution strategy is key to maximizing market penetration and servicing a wide array of industrial and consumer segments.

Tallow Fatty Acids Market Potential Customers

The Tallow Fatty Acids Market caters to an exceptionally wide array of industries, establishing a highly diverse and robust customer base across the globe. Potential customers are essentially any entities that integrate tallow fatty acids into their manufacturing processes, product formulations, or as critical processing aids. This includes major chemical manufacturers who utilize these fatty acids as fundamental building blocks for synthesizing a vast range of downstream derivatives, such as fatty amines, fatty alcohols, and esters, which then find applications in even broader markets. The inherent blend of cost-effectiveness, biodegradability, and reliable performance makes tallow fatty acids an attractive raw material for companies committed to both economic efficiency and increasingly, environmental responsibility.

Specifically, the personal care and cosmetics industry constitutes a significant segment of potential customers, with manufacturers deploying tallow fatty acids in the formulation of a comprehensive range of products including soaps, shampoos, conditioners, moisturizers, anti-aging creams, and color cosmetics. Here, they function as essential emulsifiers, emollients, conditioning agents, and viscosity modifiers, contributing to product efficacy and consumer appeal. Similarly, the household and industrial cleaning sectors are substantial buyers, incorporating tallow fatty acids into detergents, fabric softeners, dishwashing liquids, and various cleaning agents due to their superior surfactant properties, which enhance cleaning power and foaming characteristics. Furthermore, the robust rubber and plastics industry relies on tallow fatty acids as crucial processing aids, internal lubricants, and mold release agents, which improve the workability of polymers, enhance surface finish, and optimize manufacturing efficiency for products ranging from tires to packaging materials.

Beyond these prominent consumer-facing industries, the industrial lubricants and greases market represents another pivotal customer segment, where tallow fatty acids are integral components, boosting lubricity, reducing friction, and extending the lifespan of machinery in diverse heavy industries. The animal feed industry forms a fundamental part of the customer base, utilizing tallow fatty acids as a high-energy nutritional supplement to enhance the growth, health, and productivity of livestock and poultry. Textile manufacturers also emerge as key customers, employing these fatty acids as softeners, lubricants, and anti-static agents to improve fabric feel, processability, and overall product quality. Additionally, the paints and coatings industry incorporates them for rheology modification, pigment dispersion, and improved film formation, while the pharmaceutical sector uses them as excipients and binders in various drug delivery systems. This extensive and varied demand profile underscores the foundational importance of tallow fatty acids across the global manufacturing ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.2 Billion |

| Market Forecast in 2032 | USD 6.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kao Corporation, Emery Oleochemicals, BASF SE, Croda International Plc, Stepan Company, KLK Oleo, Wilmar International Ltd, Godrej Industries, Twin Rivers Technologies, Cargill Inc., P&G Chemicals, Arizona Chemical Company (Kraton Corporation), Evonik Industries AG, Arkema S.A., Vantage Specialty Chemicals, Oleon NV, Permata Hijau Group, Aakash Chemicals, Chemrez Technologies Inc., Berg + Schmidt GmbH & Co. KG, IOI Oleochemical, Musim Mas Group, Ecogreen Oleochemicals, CREMER OLEO, VVF LLC, Faci S.p.A., H. Erhard P. Engel GmbH, Acme-Hardesty Co., Peter Greven GmbH & Co. KG, Sasol Ltd., AkzoNobel N.V. (now part of Nouryon), Ashland Global Holdings Inc., Lubrizol Corporation, Dow Chemical Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tallow Fatty Acids Market Key Technology Landscape

The Tallow Fatty Acids Market is underpinned by a sophisticated and continuously evolving technology landscape, crucial for converting raw tallow into a diverse range of high-value oleochemical products. The cornerstone of this transformation is the hydrolysis process, primarily achieved through high-pressure splitting or enzymatic hydrolysis. High-pressure splitting, utilizing elevated temperatures and pressures, efficiently breaks down triglycerides into their constituent fatty acids and glycerol, delivering high conversion rates. Enzymatic hydrolysis, while requiring more controlled conditions, offers advantages in terms of lower energy consumption and milder operating parameters, often resulting in higher purity and reduced byproduct formation. Subsequent to hydrolysis, crude fatty acids undergo a series of meticulous purification steps, including washing, drying, and bleaching, to eliminate impurities and meet stringent quality specifications demanded by various downstream industries.

Further technological refinement is observed in the areas of fractionation and distillation, which are pivotal for isolating specific fatty acid components and producing tailored blends. Fractionation techniques, such as solvent crystallization or dry fractionation, separate mixed fatty acids into individual components based on differences in their melting points, allowing for the isolation of specific fatty acids like stearic, oleic, or palmitic acid, or the creation of precise cuts. Distillation, particularly vacuum distillation, plays a critical role in further purifying these fractions based on their boiling points, achieving exceptional levels of purity and removing residual impurities or unwanted components. These advanced separation technologies enable manufacturers to produce specialized fatty acid grades with enhanced functional properties, catering to high-performance applications in cosmetics, pharmaceuticals, and industrial lubricants, where specific chain lengths and saturation levels are essential.

Beyond these core processes, other key technologies contribute significantly to the versatility and quality of tallow fatty acid derivatives. Hydrogenation, a catalytic process, is employed to saturate unsaturated fatty acids, thereby improving their oxidative stability, increasing melting points, and altering physical characteristics for applications requiring greater hardness or stability. Crystallization processes are also utilized for further purification and physical separation of fatty acid mixtures, enhancing the overall yield and purity of desired components. The integration of advanced process control systems, automation, and real-time analytical monitoring throughout these stages is paramount. These smart manufacturing approaches optimize reaction conditions, minimize energy and raw material waste, ensure consistent product quality, and significantly reduce operational costs, thereby driving efficiency and sustainability across the tallow fatty acid production landscape. Ongoing research explores novel bio-catalytic routes and solvent-free processing to further enhance environmental performance.

Regional Highlights

- North America: This region represents a mature yet robust market for tallow fatty acids, characterized by stable demand from well-established end-use industries. Key applications are prevalent in personal care, household detergents, industrial lubricants, and rubber processing. Stringent environmental regulations and a strong emphasis on sustainable sourcing further drive the adoption of bio-based ingredients. The market here is also a hub for technological innovation, with continuous efforts to develop higher-value specialty fatty acids and explore niche applications. Consumer awareness regarding product origins and environmental impact is high, influencing purchasing decisions and industry practices.

- Europe: The European market mirrors North America in its maturity and strong regulatory environment, which heavily influences product development and market dynamics. There is a significant focus on circular economy principles and sustainable practices within the robust European oleochemical industry. Countries such as Germany, France, the UK, and Italy are major consumers, particularly in cosmetics, soaps, and advanced chemical manufacturing. The region benefits from established industrial infrastructure and a strong R&D landscape, fostering innovation in green chemistry and bio-based solutions. Demand is also sustained by legislative pushes towards reducing reliance on fossil-based raw materials.

- Asia Pacific (APAC): Positioned as the most dynamic and fastest-growing market globally, the APAC region is experiencing exponential demand driven by rapid industrialization, urbanization, and a burgeoning middle-class population. Economic powerhouses like China and India, along with emerging economies in Southeast Asia, are witnessing significant growth in manufacturing activities across personal care, textiles, animal feed, and chemical sectors. This expansion is fueled by increasing disposable incomes and a growing consumer base, leading to substantial investments in new production capacities and expanding distribution networks. The region's lower manufacturing costs and readily available raw materials also contribute to its competitive advantage.

- Latin America: This region is an emerging market with considerable untapped potential for tallow fatty acids. Growth is primarily propelled by the expansion of consumer goods industries, particularly in personal care and cleaning products, coupled with increasing industrialization. Brazil and Mexico stand out as leading contributors to market demand, driven by their large domestic markets and evolving manufacturing capabilities. The agricultural sector, especially animal nutrition, also represents a foundational segment. Economic development, improving living standards, and increasing foreign investments are key factors stimulating market expansion and driving the adoption of versatile chemical inputs.

- Middle East and Africa (MEA): The MEA market is still in its nascent stages but is demonstrating gradual and consistent growth. Demand for tallow fatty acids is influenced by ongoing economic diversification efforts, significant infrastructure development projects, and a growing consumer base that is becoming more sophisticated in its preferences. Countries such as Saudi Arabia, UAE, and South Africa are leading the adoption in applications related to personal care, industrial lubricants, and basic chemicals. While the market size is currently smaller compared to other regions, increasing industrial investments and governmental initiatives to boost local manufacturing are expected to drive future growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tallow Fatty Acids Market.- Kao Corporation

- Emery Oleochemicals

- BASF SE

- Croda International Plc

- Stepan Company

- KLK Oleo

- Wilmar International Ltd

- Godrej Industries

- Twin Rivers Technologies

- Cargill Inc.

- P&G Chemicals

- Arizona Chemical Company (Kraton Corporation)

- Evonik Industries AG

- Arkema S.A.

- Vantage Specialty Chemicals

- Oleon NV

- Permata Hijau Group

- Aakash Chemicals

- Chemrez Technologies Inc.

- Berg + Schmidt GmbH & Co. KG

- IOI Oleochemical

- Musim Mas Group

- Ecogreen Oleochemicals

- CREMER OLEO

- VVF LLC

- Faci S.p.A.

- H. Erhard P. Engel GmbH

- Acme-Hardesty Co.

- Peter Greven GmbH & Co. KG

- Sasol Ltd.

- AkzoNobel N.V. (now part of Nouryon)

- Ashland Global Holdings Inc.

- Lubrizol Corporation

- Dow Chemical Company

Frequently Asked Questions

What are the primary applications of tallow fatty acids in the market?

Tallow fatty acids find extensive applications across various industries. Primarily, they are crucial in the manufacturing of soaps, detergents, and personal care products like shampoos and lotions, acting as emulsifiers, surfactants, and emollients. Industrially, they are vital components in lubricants, rubber processing aids, textile finishing agents, and also serve as an important energy source in animal feed formulations. Their versatility and functional properties make them indispensable in a broad spectrum of consumer and industrial goods.

How does the market for tallow fatty acids differentiate from other fatty acid sources?

The tallow fatty acids market is distinct due to its reliance on animal fat as a raw material, making it a byproduct of the meat industry. This differentiates it from fatty acids derived from vegetable oils like palm or soy, which have different supply chain dynamics and sustainability considerations. Tallow fatty acids often provide specific performance advantages in terms of cost-effectiveness, high-temperature stability, and unique textural properties, making them preferred in heavy-duty industrial applications and certain personal care formulations.

What are the key drivers propelling the growth of the tallow fatty acids market?

The growth of the tallow fatty acids market is significantly driven by the increasing demand from the personal care and cosmetics sector for natural ingredients, alongside robust consumption in industrial applications such as lubricants, rubber, and textiles. The growing global trend towards bio-based and sustainable chemical solutions, coupled with the inherent cost-effectiveness and biodegradability of tallow fatty acids, further stimulates their market expansion. Consistent demand from the animal feed industry also contributes substantially.

What are the main sustainability considerations for tallow fatty acids?

As a byproduct of the meat industry, tallow fatty acids inherently contribute to resource efficiency by utilizing materials that would otherwise be considered waste, enhancing their sustainability profile. However, broader sustainability concerns often relate to the environmental footprint of livestock farming itself. The industry is continuously exploring ways to improve the sustainability of tallow fatty acid production through optimized processing, reduced energy consumption, and responsible sourcing practices, aligning with circular economy principles.

Which geographical regions exhibit the most significant market potential for tallow fatty acids?

The Asia Pacific region currently presents the most significant growth potential for the tallow fatty acids market, driven by rapid industrialization, expanding economies, and increasing demand from its large population base in sectors like personal care, textiles, and animal feed. While North America and Europe are mature markets, they maintain stable demand and lead in specialty applications. Latin America and the Middle East & Africa also demonstrate emerging growth opportunities due to economic development and increasing industrial output.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager