Taurine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430393 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Taurine Market Size

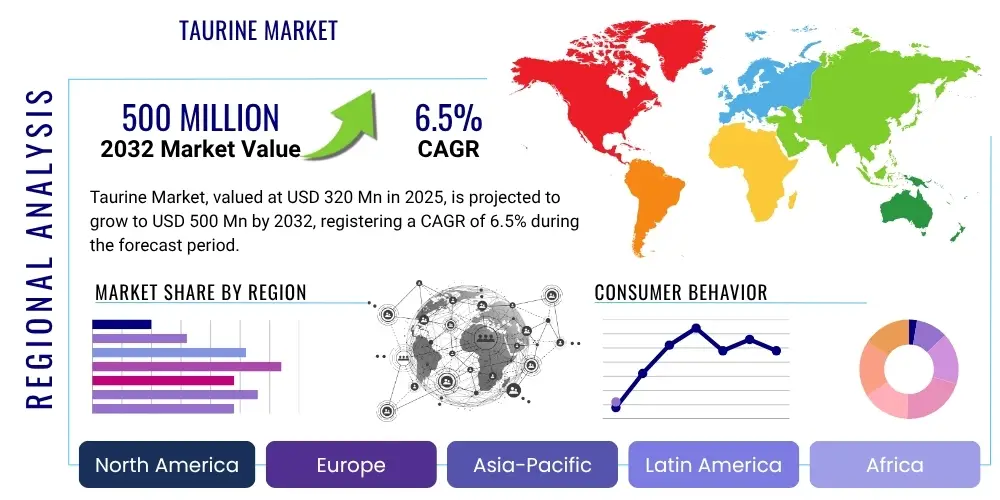

The Taurine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at $320 million in 2025 and is projected to reach $500 million by the end of the forecast period in 2032.

Taurine Market introduction

The global Taurine Market is characterized by the increasing demand for functional ingredients across various industries. Taurine, a conditionally essential amino acid, is naturally found in the human body and certain foods, playing a critical role in several physiological processes including cardiovascular function, skeletal muscle development, and nervous system health. Synthetically produced taurine has become a popular ingredient due to its versatility and established health benefits, making it a staple in numerous consumer products. Its antioxidant and anti-inflammatory properties further enhance its appeal in health-conscious markets.

The product, taurine, is typically manufactured through chemical synthesis, ensuring high purity and consistent supply for industrial applications. It is available in various grades, including food grade and pharmaceutical grade, catering to diverse industry requirements. Major applications span a broad spectrum, notably in energy drinks where it is a key component for perceived performance enhancement, as well as in infant formula for supporting neurological and retinal development. The benefits of taurine extend to improving exercise performance, protecting against oxidative stress, supporting healthy metabolism, and contributing to overall cellular integrity. These widespread benefits underpin its growing adoption across consumer goods.

Driving factors for the taurine market include a rising global awareness of health and wellness, leading to increased demand for functional foods and beverages that offer specific health advantages. The expanding popularity of energy drinks, particularly among younger demographics and athletes, significantly contributes to taurine consumption. Furthermore, the pet humanization trend has boosted the use of taurine in pet food formulations, recognizing its importance in feline and canine health. Ongoing research into new therapeutic applications for taurine in areas such as metabolic disorders and cardiovascular diseases also presents substantial growth opportunities, diversifying its market presence beyond traditional uses.

Taurine Market Executive Summary

The Taurine Market is currently experiencing robust growth, driven by evolving consumer preferences towards functional ingredients and the expansion of its application portfolio across multiple sectors. Business trends indicate a strong focus on research and development to uncover novel health benefits and improve production efficiencies, alongside strategic partnerships aimed at market expansion and supply chain optimization. Manufacturers are increasingly exploring sustainable production methods and clean label formulations to align with modern consumer demands for natural and transparent product offerings. The market also sees a trend towards customization and specialized taurine products tailored for specific dietary needs or health goals, such as those targeting athletes or individuals with specific nutritional deficiencies.

Regionally, the market exhibits diverse growth patterns. Asia Pacific stands as the largest producer and a significant consumer of taurine, primarily due to the established pharmaceutical and functional food industries in countries like China and Japan. This region also benefits from lower production costs and a vast consumer base. North America and Europe represent mature markets with high adoption rates in energy drinks, dietary supplements, and pet food, characterized by strong regulatory frameworks and a premium on product quality. Emerging economies in Latin America, the Middle East, and Africa are showing accelerated growth, fueled by increasing disposable incomes, urbanization, and the Westernization of dietary habits, leading to higher demand for processed foods and functional beverages.

Segmentation trends highlight the increasing importance of the nutraceuticals and pharmaceuticals segments, which are projected to exhibit the fastest growth rates. This is largely due to ongoing clinical research validating taurine's efficacy in various health conditions and the rising consumer interest in preventive healthcare. The food and beverage segment, particularly energy drinks, remains a dominant application area, albeit with some regulatory scrutiny in certain regions. Pet food continues to be a stable and growing segment as pet owners prioritize the nutritional well-being of their animals. The infant formula segment maintains consistent demand due to taurine's established role in early childhood development, with strict quality control ensuring its safe application.

AI Impact Analysis on Taurine Market

Users frequently inquire about how artificial intelligence can revolutionize the taurine market, focusing on areas like production efficiency, discovery of new applications, supply chain optimization, and personalized nutrition. Key themes include leveraging AI for more cost-effective synthesis methods, accelerating R&D for novel taurine derivatives or delivery systems, enhancing the resilience and transparency of the global supply chain, and enabling highly customized taurine-infused products based on individual health data. There is a strong expectation that AI will streamline operations, reduce waste, and unlock previously unconsidered market opportunities, ultimately leading to a more dynamic and responsive taurine industry.

- AI can optimize chemical synthesis processes, leading to higher yields and reduced production costs.

- Predictive analytics can forecast market demand more accurately, minimizing overproduction or shortages.

- AI driven drug discovery platforms can accelerate the identification of new therapeutic applications for taurine.

- Machine learning algorithms can analyze consumer health data to formulate personalized taurine supplements and functional foods.

- Real time supply chain monitoring through AI enhances transparency, tracks raw materials, and mitigates logistical risks.

- AI can identify quality control issues in manufacturing processes early, ensuring product consistency and safety.

- Automated market analysis tools can identify emerging trends and consumer preferences, guiding product development.

- Robotics and automation powered by AI can improve efficiency in packaging and warehousing operations.

- Smart sensors in production facilities can continuously monitor parameters, allowing for proactive adjustments to maintain optimal conditions.

- AI can facilitate sustainable practices by optimizing resource consumption and waste management in taurine production.

DRO & Impact Forces Of Taurine Market

The Taurine Market is significantly influenced by a confluence of drivers, restraints, and opportunities, alongside various impact forces that shape its competitive landscape and growth trajectory. A primary driver is the escalating consumer awareness regarding the health benefits of taurine, particularly its roles in cardiovascular health, muscle function, and neurological support, which propels its demand in dietary supplements and functional foods. The surging popularity of energy drinks globally, especially among younger demographics and sports enthusiasts, constitutes another substantial driver, as taurine is a key ingredient in most formulations. Furthermore, the growing trend of pet humanization and the recognized importance of taurine in pet health, particularly for feline diets, contribute significantly to market expansion. These factors collectively create a robust environment for sustained market growth.

Conversely, the market faces several restraints that could impede its expansion. Stringent regulatory frameworks in various countries concerning the permissible levels of taurine in food and beverages, as well as labeling requirements for health claims, can pose significant barriers for market players. Fluctuations in the prices of raw materials, which are often petrochemical derivatives, coupled with the complexities of the chemical synthesis process, can impact production costs and profit margins. Moreover, the availability of alternative functional ingredients and other amino acids that offer similar health benefits presents a competitive challenge, potentially limiting taurine's market share in certain applications. Consumer misconceptions or negative publicity surrounding energy drink ingredients can also periodically affect demand.

Despite these challenges, numerous opportunities exist for market participants to capitalize on. The untapped potential in emerging economies, characterized by rapidly growing middle classes and increasing health consciousness, offers significant avenues for market penetration. Innovations in personalized nutrition and functional medicine present opportunities for tailored taurine formulations that address specific individual health needs. Expanding research into new therapeutic applications for taurine, beyond its traditional uses, could unlock entirely new market segments, particularly in areas related to metabolic syndrome, diabetes, and neurodegenerative diseases. Additionally, the development of more sustainable and environmentally friendly production methods could enhance taurine's appeal and meet the demands of eco-conscious consumers, further cementing its long-term market viability.

Segmentation Analysis

The Taurine Market is comprehensively segmented to provide granular insights into its diverse applications, product types, and forms. This segmentation allows for a detailed understanding of consumer preferences, industry adoption rates, and market dynamics across various sectors. The primary segmentation categories reflect the broad utility of taurine, from human and animal nutrition to pharmaceutical applications. Each segment possesses unique growth drivers and market characteristics, contributing differently to the overall market trajectory. Analyzing these segments is crucial for stakeholders to identify promising growth areas and tailor their strategies effectively.

- By Application

- Energy Drinks

- Food & Beverages

- Pharmaceuticals

- Nutraceuticals

- Pet Food

- Infant Formula

- Others (e.g., cosmetics, industrial)

- By Product Type

- Food Grade

- Pharmaceutical Grade

- Feed Grade

- By Form

- Powder

- Liquid

Value Chain Analysis For Taurine Market

The value chain for the Taurine Market encompasses a series of interconnected stages, beginning from raw material procurement to the final distribution of the finished product to end-users. At the upstream level, the process primarily involves sourcing basic chemical precursors such as ethylenimine or ethanolamine, depending on the synthesis route employed. These raw materials are typically petrochemical derivatives, meaning their availability and price can be influenced by global oil and gas markets. Key suppliers in this stage are major chemical manufacturers that provide the foundational compounds required for taurine synthesis. The efficiency and cost-effectiveness of this initial sourcing phase significantly impact the overall production cost of taurine.

The midstream segment of the value chain focuses on the manufacturing and purification of taurine. This involves complex chemical synthesis processes, often employing multi-step reactions to produce crude taurine, followed by rigorous purification and crystallization techniques to achieve the desired purity levels (e.g., food grade, pharmaceutical grade). Manufacturers often invest heavily in R&D to optimize these synthesis processes, aiming for higher yields, reduced environmental impact, and lower operational costs. Quality control and assurance are paramount at this stage to ensure the final product meets stringent industry standards and regulatory requirements, especially for applications in pharmaceuticals and infant formula.

Downstream activities involve the formulation, packaging, and distribution of taurine. Once manufactured, taurine is supplied in bulk powder or liquid form to various industries. The distribution channels are predominantly B2B (business-to-business), where taurine producers directly sell to large-scale manufacturers in the food and beverage, pharmaceutical, nutraceutical, and pet food sectors. For smaller buyers or specialized applications, indirect channels involving distributors, wholesalers, and ingredient brokers play a crucial role. These intermediaries facilitate market access and provide value-added services such as inventory management and localized distribution. The efficiency of the distribution network is critical for ensuring timely delivery and maintaining product integrity across diverse geographic markets.

Taurine Market Potential Customers

The Taurine Market serves a broad spectrum of end-users and buyers, reflecting the versatile applications of this amino acid across various industries. These customers are primarily manufacturers and formulators who incorporate taurine as a key ingredient in their final products, targeting specific consumer needs related to health, nutrition, and performance. Understanding the diverse needs and purchasing behaviors of these potential customers is crucial for taurine suppliers to tailor their product offerings, marketing strategies, and distribution networks effectively. The expanding consumer base for functional products continues to broaden the scope of potential customers, driving innovation and market growth.

Among the most prominent end-users are manufacturers of energy drinks and other functional beverages. These companies integrate taurine for its purported role in enhancing mental and physical performance, often combining it with caffeine and other stimulants. The food and beverage industry also includes producers of fortified foods, sports nutrition products, and general health drinks that leverage taurine's antioxidant and metabolic benefits. These customers prioritize high-purity, food-grade taurine that integrates seamlessly into their existing formulations and complies with food safety regulations.

Another significant customer segment comprises pharmaceutical and nutraceutical companies. These entities utilize pharmaceutical-grade taurine in a range of dietary supplements, over-the-counter medications, and prescription drugs for conditions such as cardiovascular disease, diabetes, and certain neurological disorders. Their demand is driven by stringent quality standards, extensive clinical validation, and the need for consistent supply. Furthermore, infant formula manufacturers represent a vital customer group, incorporating taurine due to its essential role in the neurological and retinal development of infants. Lastly, pet food manufacturers constitute a substantial and growing customer segment, as taurine is critical for the cardiovascular and visual health of cats and, increasingly, dogs, reflecting the ongoing humanization of pets and heightened focus on animal welfare.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $320 million |

| Market Forecast in 2032 | $500 million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ajinomoto Co. Inc., Kyowa Hakko Bio Co. Ltd., Nippon Fine Chemical Co. Ltd., Shandong Taidong Chemical Co. Ltd., Hubei Grand Life Science & Technology Co. Ltd., Qianjiang Yongan Pharmaceutical Co. Ltd., Wuxi Maoye Biochemical Co. Ltd., Fushimi Pharmaceutical Co. Ltd., Livzon Group, Jiangsu Yuanyang Pharmaceutical Co. Ltd., Foodchem International Corporation, Shanghai Danfan Network Science & Technology Co. Ltd., Huazhong Pharma, Jiangsu Wujin, Pure Encapsulations LLC, NOW Foods, Jarrow Formulas, Life Extension, AdooQ Bioscience, TCI Chemicals |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Taurine Market Key Technology Landscape

The Taurine Market's technological landscape is primarily defined by advanced chemical synthesis methods, robust purification techniques, and emerging innovations aimed at enhancing production efficiency, purity, and sustainability. The dominant technology for commercial taurine production involves the chemical synthesis from raw materials such as ethylenimine or ethanolamine, followed by a series of precise reactions including amination and oxidation. Manufacturers continuously refine these processes to optimize reaction conditions, minimize by-product formation, and reduce energy consumption, ensuring high-yield production of high-quality taurine. The focus is on achieving pharmaceutical and food-grade purity levels, which necessitates sophisticated process control and analytical validation throughout the manufacturing chain.

Beyond traditional chemical synthesis, the industry is exploring and investing in alternative production technologies. Fermentation-based methods, while still nascent for large-scale commercial taurine production, represent an area of significant research and development. These biotechnological approaches aim to produce taurine using microbial strains, offering a potentially more sustainable and environmentally friendly alternative to chemical synthesis. Advances in genetic engineering and metabolic pathway engineering are crucial for improving the efficiency and yield of fermentative taurine production. Such innovations could reduce reliance on petrochemical derivatives and align with growing consumer demand for "natural" or bio-based ingredients.

Furthermore, critical technologies within the taurine market include advanced purification and crystallization techniques. These methods are essential for removing impurities and achieving the high purity standards required for various applications, especially in pharmaceuticals and infant formula. Membrane filtration, ion exchange chromatography, and sophisticated crystallization processes are employed to ensure the final product is free from contaminants and meets strict regulatory specifications. Packaging technologies also play a role, focusing on solutions that maintain taurine's stability and extend its shelf life, particularly for powder forms susceptible to moisture absorption. Overall, the technological landscape is dynamic, driven by a continuous push for efficiency, purity, and sustainable innovation.

Regional Highlights

- North America: This region is a significant consumer market for taurine, largely driven by the robust demand from the energy drink sector, dietary supplements, and sports nutrition industries. The United States and Canada are key contributors, characterized by a health-conscious consumer base and a high prevalence of functional food and beverage consumption. Stringent regulatory standards for ingredient safety and labeling also shape market dynamics here.

- Europe: Europe represents a mature market with high demand for taurine in functional foods, beverages, and pharmaceuticals. Countries such as Germany, the UK, and France are major consumers. The region is known for its strict quality control and regulatory environment, which influences product formulation and market entry strategies. Growing interest in preventive healthcare and natural ingredients also propels market growth.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for taurine, serving as both a primary production hub (especially China) and a major consumer. The rapid urbanization, increasing disposable incomes, and growing awareness of health benefits in countries like China, Japan, India, and South Korea fuel demand in infant formula, functional foods, and pet food. The region benefits from lower manufacturing costs and significant export capabilities.

- Latin America: This region is an emerging market for taurine, experiencing substantial growth in the consumption of energy drinks and functional beverages. Countries such as Brazil and Mexico are leading the demand, driven by a young population and evolving dietary patterns. Economic growth and increasing urbanization contribute to the expanding market for health and wellness products containing taurine.

- Middle East and Africa (MEA): The MEA market for taurine is gradually expanding, fueled by increasing health awareness, rising disposable incomes, and the growing availability of international food and beverage brands. Demand is primarily concentrated in urban centers within countries like Saudi Arabia, UAE, and South Africa, with applications mainly in energy drinks and some functional food products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Taurine Market.- Ajinomoto Co. Inc.

- Kyowa Hakko Bio Co. Ltd.

- Nippon Fine Chemical Co. Ltd.

- Shandong Taidong Chemical Co. Ltd.

- Hubei Grand Life Science & Technology Co. Ltd.

- Qianjiang Yongan Pharmaceutical Co. Ltd.

- Wuxi Maoye Biochemical Co. Ltd.

- Fushimi Pharmaceutical Co. Ltd.

- Livzon Group

- Jiangsu Yuanyang Pharmaceutical Co. Ltd.

- Foodchem International Corporation

- Shanghai Danfan Network Science & Technology Co. Ltd.

- Huazhong Pharma

- Jiangsu Wujin

- Pure Encapsulations LLC

- NOW Foods

- Jarrow Formulas

- Life Extension

- AdooQ Bioscience

- TCI Chemicals

Frequently Asked Questions

What is taurine primarily used for?

Taurine is primarily used as an ingredient in energy drinks, dietary supplements for cardiovascular and neurological health, infant formula for development, and pet food, especially for cats, to support heart and eye function.

Is synthetic taurine safe for consumption?

Yes, synthetically produced taurine is widely recognized as safe for consumption when used within recommended dosages and complies with regulatory standards. It is chemically identical to naturally occurring taurine.

Which region dominates the global taurine market?

The Asia Pacific region, particularly China, dominates the global taurine market in terms of both production capacity and consumption, driven by robust industrial growth and increasing health awareness.

What are the main drivers for taurine market growth?

Key drivers include rising consumer health awareness, increasing demand for functional foods and beverages, the sustained popularity of energy drinks, and the growing humanization of pets leading to taurine-fortified pet food.

How does taurine differ from other amino acids?

Taurine is a unique amino sulfonic acid, not an alpha-amino acid like most others. It is involved in various physiological functions such as osmoregulation, bile salt formation, and neuromodulation, but does not participate in protein synthesis.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hypotaurine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Taurine Market Size Report By Type (Food Grade, Pharmaceutical Grade), By Application (Beverage, Pet Food, Health Care Products, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Hypotaurine (CAS 300-84-5) Market Size Report By Type ( 98%, Others), By Application (Healthy Food, Drink, Feed, Medicine, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Hypotaurine (CAS 300-84-5) Market Statistics 2025 Analysis By Application (Healthy Food, Drink, Feed, Medicine), By Type (?98%), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Taurine Powder Market Statistics 2025 Analysis By Application (Beverage, Pet Food, Healthcare Products), By Type (Ethylene Oxide Method, Ethanol Amine Method), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager