Telecom Generator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430479 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Telecom Generator Market Size

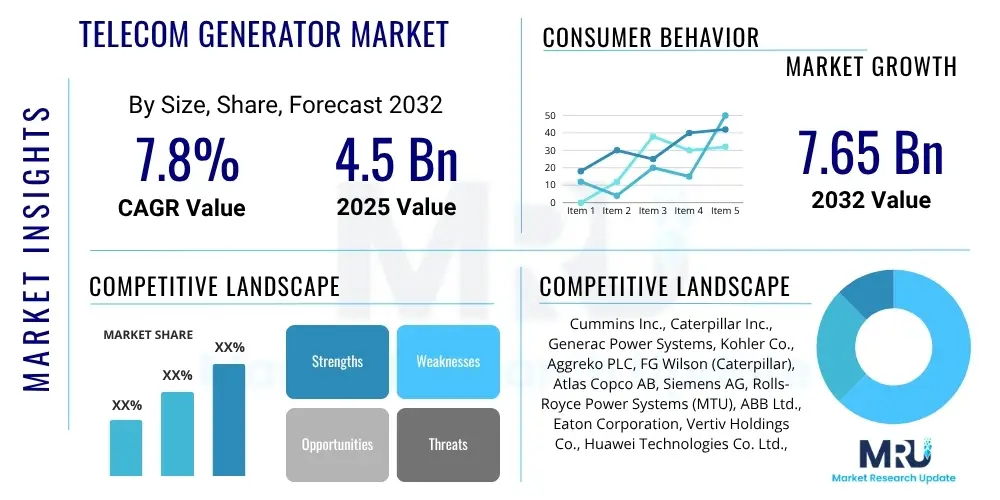

The Telecom Generator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at $4.5 Billion in 2025 and is projected to reach $7.65 Billion by the end of the forecast period in 2032.

Telecom Generator Market introduction

The Telecom Generator Market encompasses the global supply and demand for power generation units specifically designed to support telecommunications infrastructure. These generators serve as crucial backup or primary power sources for cellular base stations, data centers, switching facilities, and other critical communication nodes, ensuring uninterrupted connectivity and operational resilience. The increasing reliance on digital communication, coupled with the global expansion of 5G networks and a persistent challenge of grid instability in many regions, underscores the indispensable role of robust power solutions.

Products within this market range from conventional diesel and natural gas generators to more advanced hybrid systems integrating renewable energy sources like solar, and battery storage solutions. These units are engineered for high reliability, fuel efficiency, remote monitoring capabilities, and often compact footprints to suit diverse deployment environments, from urban rooftops to remote off-grid locations. The primary objective is to maintain network uptime, which is paramount for both consumer services and emergency communications.

Major applications include providing continuous power to remote cell towers, backing up core network infrastructure, powering small cell deployments, and ensuring resilience for data centers processing massive volumes of information. Benefits of these generators include guaranteed service continuity, enhanced network reliability, improved disaster preparedness, and operational flexibility. Key driving factors involve the rapid rollout of 5G networks demanding consistent power, the expansion of telecom infrastructure in developing economies with unreliable grids, increasing data consumption necessitating robust data centers, and the growing strategic importance of digital connectivity globally.

Telecom Generator Market Executive Summary

The Telecom Generator Market is experiencing dynamic shifts, driven by the global imperative for ubiquitous and resilient digital connectivity. Business trends indicate a strong move towards more sustainable and efficient power solutions, with hybrid generators and those integrating renewable energy sources gaining significant traction. Telecom operators and tower companies are increasingly investing in smart generator systems equipped with remote monitoring and predictive maintenance capabilities to optimize operational costs and enhance network reliability. Furthermore, there is a clear trend towards consolidation among generator manufacturers and service providers, aiming to offer integrated energy management solutions tailored for the complex demands of modern telecom networks.

Regionally, the market exhibits varied growth patterns. Asia Pacific, particularly countries like India, China, and Indonesia, is witnessing robust growth due to extensive 5G deployments, ongoing infrastructure expansion in rural areas, and the presence of often unreliable national grids. The Middle East and Africa are also emerging as significant growth hubs, propelled by ambitious digitalization agendas and the need to power vast numbers of remote communication sites. North America and Europe, while mature markets, are focusing on upgrading existing infrastructure with more energy-efficient and environmentally compliant generators, alongside enhancing grid resilience for critical telecom facilities, aligning with stricter emissions standards.

Segmentation trends highlight a pronounced shift towards generators with lower carbon footprints and enhanced energy autonomy. Hybrid generators, combining diesel or gas with solar photovoltaic and battery storage, are becoming preferred for both new installations and retrofits, especially in off-grid or poor-grid areas. The demand for smaller capacity generators (less than 10 kVA) is rising due to the proliferation of small cells and distributed network architectures, while larger capacities continue to be crucial for data centers and core network facilities. This evolution underscores a strategic industry move towards optimizing total cost of ownership through fuel efficiency, reduced maintenance, and improved environmental performance.

AI Impact Analysis on Telecom Generator Market

Users frequently inquire about how Artificial Intelligence can revolutionize the efficiency, reliability, and cost-effectiveness of telecom power infrastructure. Key themes revolve around leveraging AI for predictive maintenance to minimize downtime, optimizing fuel consumption in real-time, integrating seamlessly with smart grid solutions, and enabling autonomous operation of generator fleets. There is a strong expectation that AI will transition generators from reactive backup units to proactive, intelligent components of a broader energy management ecosystem, addressing challenges such as remote site monitoring, anomaly detection, and enhancing the overall sustainability profile of telecom operations. Concerns also include the initial investment in AI-enabled systems and the complexity of data integration, but the potential benefits in operational expenditure reduction and network uptime are highly anticipated.

- Predictive maintenance: AI algorithms analyze operational data (fuel levels, engine health, load patterns) to forecast potential failures, enabling proactive servicing and reducing unexpected downtime.

- Optimized fuel management: AI can dynamically adjust generator operation based on real-time power demand, grid availability, and fuel prices, significantly improving fuel efficiency and reducing operational costs.

- Remote monitoring and control: AI-powered platforms provide advanced insights and autonomous control capabilities, allowing operators to manage vast fleets of generators from a central location with minimal human intervention.

- Anomaly detection: AI can identify unusual performance patterns that may indicate emerging issues, preventing minor problems from escalating into major outages.

- Integration with renewable energy: AI facilitates the seamless integration and optimization of generators with solar panels, wind turbines, and battery storage systems, creating highly efficient hybrid power solutions.

- Energy efficiency: By learning usage patterns and environmental conditions, AI can suggest or implement optimal runtimes, start/stop cycles, and load sharing across multiple generators, reducing overall energy consumption.

DRO & Impact Forces Of Telecom Generator Market

The Telecom Generator Market is shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the relentless expansion of 5G networks globally, which demands significantly more power at base stations and requires robust backup systems to ensure continuous high-speed connectivity. Furthermore, the burgeoning growth in data consumption and IoT devices necessitates an increase in data center capacity, all of which rely heavily on uninterruptible power provided by generators. The persistent issue of unreliable grid infrastructure in many developing and even some developed regions solidifies the market's foundation, as generators serve as the ultimate safeguard against power outages. Government initiatives to promote digital inclusion and broadband access also indirectly fuel demand for reliable telecom power solutions.

However, the market faces notable restraints. The high initial capital expenditure associated with purchasing and installing telecom generators, especially larger or more advanced hybrid systems, can be a barrier for some operators. Environmental concerns surrounding emissions from traditional diesel generators, coupled with increasingly stringent global and regional environmental regulations, pose significant challenges, pushing manufacturers towards cleaner, more expensive technologies. Fuel logistics, particularly for remote sites, present ongoing operational complexities and costs. Additionally, noise pollution from generators in urban or densely populated areas can lead to public complaints and regulatory restrictions, influencing deployment choices.

Opportunities within the market are abundant, primarily driven by technological advancements and the push for sustainability. The development and adoption of hybrid power solutions, which combine traditional generators with renewable energy sources like solar and advanced battery storage, offer significant avenues for growth by reducing fuel consumption and environmental impact. The integration of IoT and remote monitoring technologies into generators allows for predictive maintenance and optimized fleet management, creating new service models and enhancing operational efficiency. Emerging markets in Asia Pacific, Latin America, and Africa, with their rapid infrastructure development and often challenging power grids, represent substantial untapped potential for generator deployment. Furthermore, the increasing focus on disaster preparedness and network resilience offers opportunities for specialized, robust generator solutions.

Segmentation Analysis

The Telecom Generator Market is broadly segmented based on various attributes, including generator type, power output capacity, specific application, and the end-user base. This segmentation provides a granular view of market dynamics, revealing key areas of growth, technological preference, and operational requirements across different facets of the telecommunications industry. Understanding these segments is crucial for manufacturers to tailor their product offerings and for service providers to identify target markets effectively, ensuring that the diverse power needs of modern telecom infrastructure are met with precision and efficiency.

- By Type

- Diesel Generators: Traditional and widely used for their reliability and power output, often employed as primary or backup power.

- Gas Generators: Utilizing natural gas or LPG, offering cleaner emissions and potentially lower fuel costs where gas infrastructure is available.

- Hybrid Generators: Combine conventional generators with renewable sources (e.g., solar, wind) and battery storage for enhanced fuel efficiency and reduced environmental footprint.

- Renewable Energy Generators (e.g., Solar, Wind with storage): Used in conjunction with other power sources, or as standalone primary sources in specific off-grid scenarios, increasingly important for sustainable operations.

- By Power Output

- Less than 10 kVA: Typically for small cells, remote monitoring equipment, or smaller base stations.

- 10-50 kVA: Common for medium-sized cellular base stations and remote communication towers.

- 50-100 kVA: Often deployed for larger base stations, small data centers, or network switching centers.

- Above 100 kVA: Primarily for large data centers, central offices, and critical core network infrastructure.

- By Application

- Cellular Base Stations: The most widespread application, ensuring uptime for mobile communication.

- Communication Towers: Powering diverse tower types, including macro and micro sites.

- Data Centers: Critical for uninterrupted operation of server farms and network equipment.

- Remote Switching Centers: Essential for maintaining connectivity in distributed network architectures.

- Others: Includes satellite ground stations, emergency communication vehicles, and specialized telecom facilities.

- By End-User

- Telecom Operators: Major purchasers for their vast network infrastructure.

- Tower Companies: Own and operate tower infrastructure for multiple operators, managing shared power solutions.

- Managed Service Providers: Offer comprehensive power solutions and maintenance to telecom clients.

Value Chain Analysis For Telecom Generator Market

The value chain for the Telecom Generator Market begins with the upstream suppliers of raw materials and core components, crucial for the manufacturing process. These include engine manufacturers, alternator producers, suppliers of control panels, fuel tanks, sound attenuating enclosures, and various electrical components. The quality and availability of these foundational elements directly impact the performance, reliability, and cost-effectiveness of the final generator product. Strong relationships with these suppliers are vital for ensuring a consistent supply chain, managing costs, and incorporating technological advancements in component design, which ultimately affects the competitiveness of generator manufacturers.

Further down the chain, the manufactured generators are then distributed and integrated into telecom infrastructure. This downstream activity involves generator manufacturers either selling directly to large telecom operators and tower companies or leveraging a network of distributors, system integrators, and value-added resellers. These intermediaries often provide not only the equipment but also crucial services such as site assessment, installation, commissioning, and ongoing maintenance. The distribution channel is critical for reaching diverse geographical locations and supporting the complex logistics of deploying power solutions to often remote or challenging telecom sites, ensuring comprehensive market coverage.

Direct distribution channels typically involve major generator manufacturers engaging in direct sales to large-scale telecom network operators or independent tower companies with significant purchasing power and technical expertise. This allows for customized solutions and closer client relationships. Indirect distribution channels, on the other hand, rely on a network of authorized dealers, regional distributors, and specialized system integrators who can offer localized support, installation services, and integrate generators with other power management systems. Both direct and indirect channels play a complementary role in ensuring generators reach their end-users efficiently, with the choice often depending on the scale of deployment, geographical reach, and the specific service requirements of the telecom client.

Telecom Generator Market Potential Customers

Potential customers for the Telecom Generator Market are predominantly organizations that operate or support critical telecommunications infrastructure, where continuous and reliable power is non-negotiable. These entities face the constant challenge of maintaining network uptime amidst grid instabilities, natural disasters, or the simple absence of grid power in remote locations. Their primary motivation for investing in telecom generators is to ensure service continuity, safeguard revenue streams, comply with regulatory uptime mandates, and maintain customer satisfaction, which are all directly tied to network availability. The increasing demand for mobile data, 5G services, and IoT connectivity further amplifies their need for robust power backup solutions.

The core end-users include major national and international telecom network operators, who own and manage vast networks of cellular base stations, switching centers, and data facilities. These operators require a wide range of generator types and capacities to power their diverse infrastructure. Additionally, independent tower companies, which manage shared tower infrastructure for multiple operators, represent a significant customer segment, as they are responsible for providing reliable power solutions to their co-located tenants. Their purchasing decisions are often driven by economies of scale and long-term operational efficiency.

Beyond traditional telecom entities, the customer base also extends to internet service providers (ISPs) operating their own network infrastructure, including local exchanges and regional data hubs. Government communication agencies, involved in public safety and emergency networks, also procure specialized telecom generators for mission-critical applications. The increasing proliferation of edge data centers and micro-data centers, often deployed by enterprises and cloud service providers, further expands the potential customer landscape, as these distributed facilities also require highly reliable and efficient power backup solutions to maintain their operational integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.5 Billion |

| Market Forecast in 2032 | $7.65 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cummins Inc., Caterpillar Inc., Generac Power Systems, Kohler Co., Aggreko PLC, FG Wilson (Caterpillar), Atlas Copco AB, Siemens AG, Rolls-Royce Power Systems (MTU), ABB Ltd., Eaton Corporation, Vertiv Holdings Co., Huawei Technologies Co. Ltd., Ericsson AB, Nokia Corporation, Delta Electronics Inc., Pramac S.p.A., Wartsila Corporation, Mitsubishi Heavy Industries Ltd., Yanmar Holdings Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Telecom Generator Market Key Technology Landscape

The technological landscape of the Telecom Generator Market is continually evolving, driven by the need for greater efficiency, reliability, and environmental sustainability. One of the most significant advancements is the widespread adoption of remote monitoring and control systems, often leveraging IoT (Internet of Things) capabilities. These systems allow operators to monitor generator performance, fuel levels, maintenance schedules, and fault conditions from a centralized location, reducing the need for on-site inspections and enabling predictive maintenance, which significantly lowers operational costs and improves response times to potential issues. Advanced sensors and data analytics are integral to these intelligent systems, transforming generators from simple power sources into smart, connected assets within the network.

Another pivotal technological shift is the increasing integration of hybrid power solutions. This involves combining traditional diesel or gas generators with renewable energy sources such as solar photovoltaic (PV) panels and advanced battery energy storage systems (BESS). Hybrid systems optimize fuel consumption by allowing generators to run only when necessary, or at their most efficient load, while renewable sources and batteries handle base loads or peak demands. This not only reduces fuel costs and carbon emissions but also extends the operational life of the generator and minimizes noise pollution, making them ideal for environmentally sensitive or off-grid sites. The intelligence to manage the power flow between these diverse sources efficiently is a key technological enabler.

Furthermore, there is a strong focus on developing generators with enhanced fuel efficiency, reduced emissions, and quieter operation. Engine manufacturers are continuously innovating to meet stricter environmental regulations, incorporating technologies like exhaust gas recirculation (EGR) and selective catalytic reduction (SCR). The drive for smaller footprints and modular designs is also prevalent, facilitating easier deployment in urban environments or on rooftops where space is limited. Predictive maintenance algorithms, often powered by AI, are becoming standard, using machine learning to analyze historical data and operational parameters to forecast equipment failures before they occur, thereby maximizing uptime and minimizing unscheduled service interruptions for critical telecom infrastructure.

Regional Highlights

- North America: A mature market characterized by robust grid infrastructure but a high demand for backup power due to increasing data traffic and severe weather events. Focus is on 5G network resilience, advanced hybrid power solutions, and compliance with stringent environmental regulations. Significant investments in upgrading existing telecom power infrastructure for greater efficiency and reliability are observed.

- Europe: Driven by strict environmental policies and a strong emphasis on renewable energy integration. The market sees high adoption of hybrid generators and cleaner fuel technologies, alongside smart energy management systems for telecom sites. Regulatory frameworks often encourage sustainable power solutions, influencing purchasing decisions and technological innovation.

- Asia Pacific (APAC): The fastest-growing region, fueled by massive 5G rollouts, rapid expansion of telecom infrastructure in developing economies, and often unreliable national grids. Countries like India, China, and Southeast Asian nations are witnessing significant investments in both new generator deployments and hybrid solutions for remote and rural connectivity.

- Latin America: Characterized by ongoing infrastructure development and prevalent grid instability, leading to consistent demand for reliable backup power solutions for expanding mobile networks. Opportunities exist in remote areas requiring off-grid power solutions and modernizing existing telecom power assets to improve network uptime.

- Middle East and Africa (MEA): A high-potential growth region with substantial investments in new telecom infrastructure, particularly in countries with large geographical areas and challenging power access. There is a strong demand for robust, high-temperature resistant generators and an increasing adoption of hybrid and solar-powered solutions for off-grid cell towers and remote communication hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Telecom Generator Market.- Cummins Inc.

- Caterpillar Inc.

- Generac Power Systems

- Kohler Co.

- Aggreko PLC

- FG Wilson (Caterpillar)

- Atlas Copco AB

- Siemens AG

- Rolls-Royce Power Systems (MTU)

- ABB Ltd.

- Eaton Corporation

- Vertiv Holdings Co.

- Huawei Technologies Co. Ltd.

- Ericsson AB

- Nokia Corporation

- Delta Electronics Inc.

- Pramac S.p.A.

- Wartsila Corporation

- Mitsubishi Heavy Industries Ltd.

- Yanmar Holdings Co. Ltd.

Frequently Asked Questions

What types of generators are commonly used in telecom applications?

Telecom applications primarily utilize diesel, gas, hybrid (combining traditional fuels with solar or wind and battery storage), and increasingly, pure renewable energy solutions with battery backup. Diesel generators are traditional, while hybrid systems offer enhanced fuel efficiency and environmental benefits, especially in remote or off-grid locations.

How does the rollout of 5G networks impact the demand for telecom generators?

The rollout of 5G networks significantly increases the demand for telecom generators as 5G base stations require more power and a highly reliable, uninterrupted supply. This drives the need for new installations and upgrades of existing backup power infrastructure to support higher data traffic and lower latency requirements, often favoring more efficient and hybrid solutions.

What are the primary environmental concerns associated with telecom generators and how are they addressed?

Primary environmental concerns include air pollution from emissions (particulate matter, NOx, SOx) and noise pollution, especially from diesel generators. These are addressed through stricter emission standards, adoption of cleaner fuels like natural gas, and the increasing integration of hybrid systems with renewable energy and battery storage to reduce reliance on fossil fuels and minimize operational hours of traditional generators.

What is a hybrid telecom generator and what are its main advantages?

A hybrid telecom generator combines a traditional generator (diesel or gas) with renewable energy sources (like solar panels) and battery energy storage. Its main advantages include significant fuel savings, reduced carbon emissions, lower operating costs, extended maintenance intervals, and quieter operation due to less reliance on the internal combustion engine.

How is AI impacting the operational efficiency and maintenance of telecom generators?

AI impacts telecom generators by enabling predictive maintenance, optimizing fuel consumption, and facilitating remote monitoring and control. AI algorithms analyze operational data to forecast potential failures, schedule proactive servicing, and dynamically adjust generator operation based on demand, leading to reduced downtime, lower operational costs, and improved overall network reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Standby Telecom Generator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Prime Telecom Generator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager