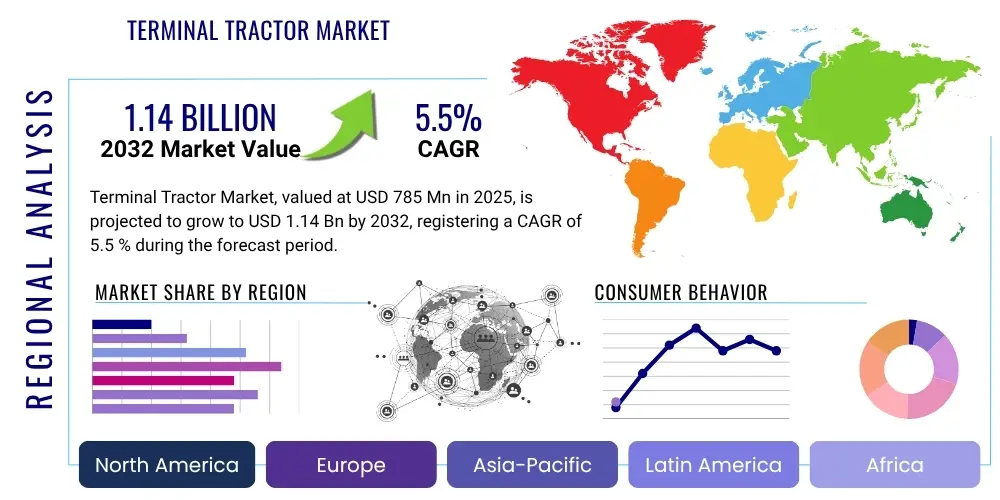

Terminal Tractor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428019 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Terminal Tractor Market Size

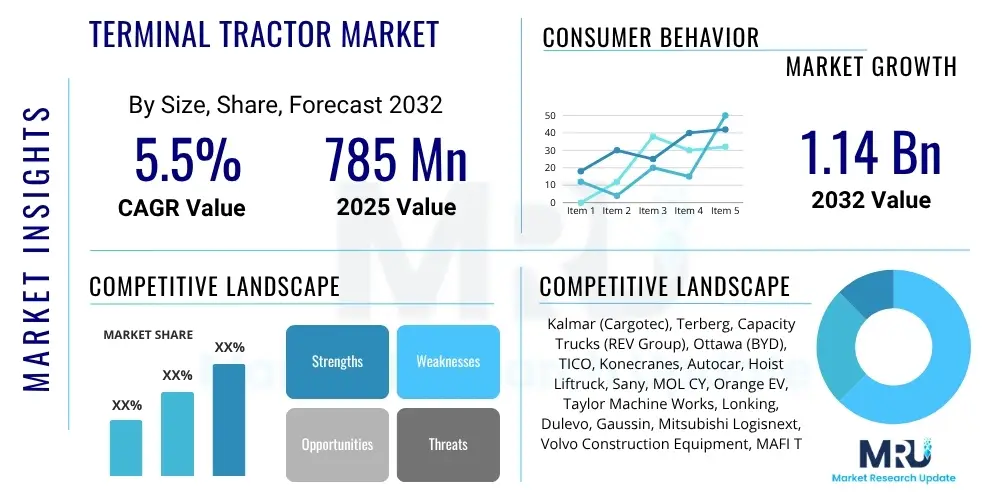

The Terminal Tractor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2025 and 2032. The market is estimated at USD 785 Million in 2025 and is projected to reach USD 1.14 Billion by the end of the forecast period in 2032.

Terminal Tractor Market introduction

The terminal tractor market encompasses specialized vehicles designed for moving semi-trailers, containers, and other heavy loads within confined areas such as logistics yards, ports, warehouses, and industrial facilities. These robust vehicles, also known as yard spotters, shunt trucks, or yard dogs, play a pivotal role in optimizing material handling operations by providing efficient and swift trailer repositioning. Unlike traditional road trucks, terminal tractors are engineered for short-distance, high-frequency movements, prioritizing maneuverability, visibility, and robust construction over highway speed or long-haul capabilities. Their unique design features, including a short wheelbase, elevated cab, and fifth-wheel lifting mechanism, enable rapid coupling and uncoupling of trailers, significantly reducing turnaround times and improving operational workflow in dynamic environments.

Major applications for terminal tractors span a wide array of industries, primarily concentrated within the logistics and transportation sector. Ports and container terminals rely heavily on these machines for moving intermodal containers between ship-to-shore cranes and storage areas or rail depots. Similarly, large distribution centers and e-commerce fulfillment hubs utilize terminal tractors to organize and load trailers for inbound and outbound shipments, ensuring smooth transitions within their complex supply chains. Manufacturing facilities also deploy these vehicles for internal material movement, supporting just-in-time inventory systems and optimizing the flow of goods between production lines and storage or shipping docks. The versatility and operational efficiency offered by terminal tractors make them indispensable assets in modern industrial and logistics landscapes.

The primary benefits derived from the deployment of terminal tractors include enhanced operational efficiency, improved safety standards, and reduced labor costs associated with manual trailer shunting. By automating and streamlining the process of moving trailers, businesses can significantly increase throughput and minimize delays, directly impacting productivity and profitability. The robust design and specialized features of terminal tractors contribute to a safer working environment by reducing the risks associated with manual maneuvering of heavy loads. Furthermore, their purpose-built nature allows for higher utilization rates and lower maintenance compared to using over-the-road trucks for yard operations, leading to substantial cost savings. Key driving factors for market growth include the burgeoning e-commerce sector, rapid expansion of global logistics networks, increasing port traffic, and a growing emphasis on optimizing supply chain efficiencies through specialized equipment.

Terminal Tractor Market Executive Summary

The Terminal Tractor Market is experiencing dynamic shifts driven by evolving business trends, regional economic developments, and technological advancements across various segments. A prominent business trend is the accelerating adoption of electric and alternative fuel terminal tractors, spurred by stringent environmental regulations and corporate sustainability initiatives. This shift is reshaping manufacturing priorities, with OEMs investing heavily in battery technology and charging infrastructure solutions. Additionally, the integration of telematics and fleet management systems is becoming standard, offering operators real-time data for predictive maintenance, route optimization, and enhanced operational oversight. The market also observes an increasing demand for rental and leasing options, providing greater financial flexibility for businesses seeking to manage capital expenditures while accessing cutting-edge equipment.

Regional trends highlight distinct growth patterns and market characteristics. North America and Europe, as mature markets, are characterized by a strong emphasis on fleet modernization, automation, and the transition to cleaner energy sources. These regions often lead in the adoption of advanced technologies like semi-autonomous features and sophisticated telematics. The Asia Pacific region is demonstrating the most significant growth, fueled by rapid industrialization, massive investments in port infrastructure, and the booming e-commerce sector in countries like China and India. Latin America and the Middle East & Africa are emerging as promising markets, driven by ongoing infrastructure development projects, increasing international trade volumes, and a growing need for efficient logistics solutions to support economic expansion.

Segmentation trends indicate a clear preference for specific types and capacities of terminal tractors depending on application needs. The electric/hybrid segment is projected to witness the highest growth rate, reflecting the global push for decarbonization in logistics. Conventional diesel-powered tractors continue to hold a substantial market share, particularly in regions where electric infrastructure is nascent or high-power demands are critical. In terms of application, ports and distribution centers remain the largest end-user segments, with increasing demand for high-capacity, durable machines capable of continuous operation. The emergence of automation is gradually influencing the market, with semi-autonomous models gaining traction for specific yard operations, promising enhanced efficiency and safety in controlled environments.

AI Impact Analysis on Terminal Tractor Market

Common user questions regarding AI's impact on the Terminal Tractor Market often revolve around the potential for fully autonomous operations, the integration of AI for predictive maintenance, implications for labor, and how AI can enhance overall operational efficiency and safety. Users are keen to understand the practical applications of AI, such as route optimization within complex logistics yards, real-time decision-making capabilities, and the role of AI in improving fuel efficiency and reducing emissions. There's also significant interest in the challenges associated with AI adoption, including infrastructure requirements, data security, and the return on investment for such advanced technologies. Overall, the themes reflect a blend of anticipation for transformative benefits and concerns about implementation complexities and potential disruptions.

- Autonomous Operations: AI enables the development of fully autonomous terminal tractors, allowing for unmanned trailer movement within restricted environments, significantly reducing labor costs and increasing operational hours.

- Predictive Maintenance: AI algorithms analyze real-time operational data from sensors to predict equipment failures, optimize maintenance schedules, and minimize unplanned downtime, thereby extending vehicle lifespan and reducing repair costs.

- Route Optimization & Fleet Management: AI-powered software optimizes routes within complex yards, reducing travel distances, congestion, and fuel consumption, while also enhancing overall fleet coordination and throughput efficiency.

- Enhanced Safety: AI-driven vision systems and sensors improve situational awareness, detect obstacles, and prevent collisions, leading to a safer working environment for both personnel and equipment.

- Increased Efficiency: AI facilitates smarter decision-making, such as dynamic load balancing and real-time task assignment, leading to faster trailer turnaround times and improved overall logistical flow.

- Fuel and Energy Optimization: For both conventional and electric models, AI can optimize power usage, acceleration, and braking patterns, leading to significant reductions in fuel consumption or battery drain.

- Data Analytics and Insights: AI provides deep insights into operational performance, identifying bottlenecks and inefficiencies that can be addressed to further optimize yard logistics.

DRO & Impact Forces Of Terminal Tractor Market

The Terminal Tractor Market is shaped by a complex interplay of drivers, restraints, and opportunities, all influenced by various internal and external impact forces. Key drivers include the relentless expansion of the global e-commerce sector, necessitating larger and more efficient distribution centers that rely on terminal tractors for rapid trailer management. Coupled with this is the continuous growth in global trade volumes, leading to increased activity in ports and container terminals, demanding robust and high-performing equipment for intermodal logistics. Furthermore, the growing emphasis on supply chain optimization and the need to reduce operational costs are compelling businesses to invest in specialized machinery that can enhance efficiency and safety in yard operations, positioning terminal tractors as critical assets for modern logistics. Regulatory pressures for emission reductions also act as a driver for the adoption of electric and alternative fuel models.

However, several restraints challenge market growth. The high initial capital expenditure required for purchasing terminal tractors, especially advanced electric or autonomous models, can be a significant barrier for smaller enterprises or those with tighter budgets. Additionally, the operational expenses associated with maintenance, spare parts, and fuel (or electricity for charging infrastructure) contribute to the total cost of ownership, which can deter potential buyers. A scarcity of skilled operators and maintenance technicians capable of handling sophisticated modern terminal tractors also poses a challenge, particularly in developing regions. Furthermore, the existing infrastructure in older facilities may not be conducive to the deployment of electric or fully autonomous vehicles, requiring substantial upgrades and investments.

Despite these restraints, numerous opportunities abound for market players. The accelerating trend towards automation and semi-autonomous capabilities in yard logistics presents a substantial growth avenue, promising enhanced efficiency and reduced reliance on human operators for repetitive tasks. The increasing focus on sustainability and environmental regulations is creating a robust market for electric and hybrid terminal tractors, offering manufacturers a clear path for product innovation and differentiation. Furthermore, the expansion of rental and leasing services provides a flexible acquisition model for end-users, potentially lowering the entry barrier and expanding the market reach. Emerging economies, particularly in the Asia Pacific and Latin America, with their rapidly developing logistics infrastructure and increasing industrialization, offer untapped potential for market penetration and growth, especially for more cost-effective and reliable solutions. Technological advancements in battery technology, telematics, and AI will continue to unlock new possibilities for enhanced performance and functionality.

Segmentation Analysis

The Terminal Tractor Market is comprehensively segmented across various parameters, allowing for a detailed understanding of market dynamics and identifying specific growth pockets. These segments provide insights into different product types, capacities, propulsion systems, and end-user applications, reflecting the diverse needs of the global logistics and industrial sectors. Analyzing these segments helps stakeholders tailor their offerings and strategies to specific market demands, ranging from heavy-duty port operations to agile warehouse management, and from conventional diesel models to advanced electric and autonomous variants. This granular view is essential for understanding competitive landscapes, identifying emerging trends, and forecasting future market trajectories. The market's segmentation highlights the industry's response to technological advancements, environmental concerns, and evolving operational requirements.

- By Type:

- Conventional (Road-legal and Non-Road legal)

- Electric

- Hybrid

- CNG/LPG

- By Tonnage Capacity:

- Below 50 Tons

- 50-100 Tons

- Above 100 Tons

- By Propulsion:

- Internal Combustion Engine (ICE)

- Electric

- Hybrid

- By Automation Level:

- Manual

- Semi-Autonomous

- Fully Autonomous

- By Application:

- Ports & Harbors

- Distribution & Logistics Centers

- Manufacturing Facilities

- Rail Terminals/Intermodal Facilities

- Airports

- Warehouses

Value Chain Analysis For Terminal Tractor Market

The value chain for the Terminal Tractor Market begins with a robust upstream segment, involving the sourcing of critical raw materials and components from a diverse network of suppliers. This includes high-grade steel for chassis and structural components, specialized engines and transmissions from automotive and industrial suppliers, advanced battery packs and electric motors for electric variants, and sophisticated electronic control units (ECUs), hydraulics, and tires. Major component manufacturers provide crucial subsystems like axles, braking systems, and fifth-wheel assemblies. The quality and reliability of these upstream components directly impact the performance, durability, and cost-effectiveness of the final terminal tractor product. Strong supplier relationships and effective supply chain management are paramount for manufacturers to ensure consistent quality, manage costs, and navigate potential supply disruptions, especially for specialized parts.

Moving through the value chain, the manufacturing and assembly phase involves the design, engineering, and production of the terminal tractors. Original Equipment Manufacturers (OEMs) integrate components from various suppliers, employing advanced manufacturing processes to assemble the specialized vehicles. This stage often includes significant R&D investment in areas such as engine efficiency, electric powertrain development, cab ergonomics, safety features, and increasingly, autonomous driving technologies. After manufacturing, the products enter the distribution channel, which can be direct or indirect. Direct channels involve OEMs selling directly to large corporate clients, government entities, or port authorities, often for bulk orders or customized solutions. This allows for direct customer engagement and tailored service offerings, fostering strong long-term relationships and facilitating direct feedback for product improvement.

Indirect distribution channels typically involve a network of authorized dealers, distributors, and rental companies. Dealers play a crucial role in market penetration, providing local sales, after-sales support, maintenance services, and spare parts availability. Rental and leasing companies also form a significant part of the downstream segment, offering flexible procurement options for businesses that prefer not to incur large upfront capital expenditures. This model is particularly attractive for operations with fluctuating demand or for those testing new technologies. The end-users, comprising ports and harbors, distribution and logistics centers, manufacturing facilities, and intermodal terminals, represent the final segment of the value chain. Their requirements drive innovation and product development, as manufacturers continuously strive to meet the evolving demands for efficiency, sustainability, safety, and technological integration. The effectiveness of the entire value chain hinges on seamless coordination, transparent communication, and continuous improvement across all stages to deliver high-quality, reliable, and cost-effective terminal tractor solutions to the end-users.

Terminal Tractor Market Potential Customers

The primary potential customers and end-users of terminal tractors are diverse entities within the vast logistics, transportation, and industrial sectors, all seeking to optimize their material handling and trailer shunting operations. At the forefront are ports and container terminals, which represent a significant segment due to the continuous flow of international trade and the necessity to efficiently move thousands of intermodal containers daily. These facilities require robust, high-capacity, and often highly automated terminal tractors to manage the intensive operational demands of loading, unloading, and storing containers between vessels, rail, and road transport. The efficiency of these operations directly impacts global supply chain fluidity and the overall competitiveness of the port.

Another major customer segment comprises large distribution and logistics centers, including those operated by e-commerce giants and third-party logistics (3PL) providers. With the explosive growth of online retail, these centers handle immense volumes of inbound and outbound freight, making efficient yard management critical. Terminal tractors are indispensable for quickly repositioning trailers at loading docks, organizing inventory within large yards, and facilitating cross-docking operations. The demand from this segment is driven by the need for speed, precision, and scalability to meet consumer expectations for rapid delivery, often requiring a fleet of diverse terminal tractors to handle various trailer types and operational intensities.

Beyond ports and distribution hubs, manufacturing facilities also constitute a substantial customer base, particularly those involved in heavy industries or just-in-time production. These plants use terminal tractors to move semi-trailers loaded with raw materials, work-in-progress components, and finished goods between different production stages, warehouses, and outbound shipping areas. The goal here is to maintain a seamless flow of materials, minimize bottlenecks, and ensure production schedules are met. Additionally, rail terminals, intermodal facilities, airports for cargo handling, and large corporate campuses with extensive internal logistics needs represent further potential customers. The growing trend of renting and leasing equipment also broadens the customer base, allowing smaller businesses or those with seasonal demand to access terminal tractor capabilities without the significant upfront capital investment, making the technology accessible to a wider array of industrial and commercial entities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 785 Million |

| Market Forecast in 2032 | USD 1.14 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kalmar (Cargotec), Terberg, Capacity Trucks (REV Group), Ottawa (BYD), TICO, Konecranes, Autocar, Hoist Liftruck, Sany, MOL CY, Orange EV, Taylor Machine Works, Lonking, Dulevo, Gaussin, Mitsubishi Logisnext, Volvo Construction Equipment, MAFI Transport-Systeme GmbH, CVS Ferrari S.p.A., Hyster-Yale Materials Handling, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Terminal Tractor Market Key Technology Landscape

The Terminal Tractor Market is undergoing a significant technological transformation, driven by demands for increased efficiency, reduced environmental impact, and enhanced safety. A core element of this evolution is the advancement in powertrain technologies. While traditional diesel internal combustion engines (ICE) remain prevalent, there is a strong and rapidly growing trend towards electrification. This includes fully electric terminal tractors powered by advanced lithium-ion batteries, offering zero direct emissions, reduced noise, and lower operational costs due to cheaper electricity and less maintenance. Hybrid electric models, combining ICE with electric propulsion, offer a transitional solution, providing a balance of extended range and reduced emissions. Research and development are also focused on improving battery energy density, charging speeds, and developing robust charging infrastructure to support these electric fleets effectively in demanding operational environments.

Beyond electrification, the integration of smart technologies and automation is profoundly reshaping the market. Telematics and IoT (Internet of Things) solutions are becoming standard, enabling real-time data collection on vehicle performance, location tracking, fuel consumption, and operational parameters. This data is crucial for fleet management systems that provide insights for route optimization, predictive maintenance scheduling, and overall operational efficiency improvements. Furthermore, the development of semi-autonomous and fully autonomous terminal tractors is a key technological frontier. This involves the integration of sophisticated sensor suites, including LiDAR, radar, cameras, and ultrasonic sensors, coupled with advanced AI and machine learning algorithms for perception, navigation, decision-making, and obstacle avoidance. These technologies promise to enhance safety by reducing human error, increase productivity through continuous operation, and optimize yard logistics with minimal human intervention.

Other significant technological advancements include improved cab ergonomics and human-machine interfaces (HMI) for manual operators, focusing on enhanced visibility, comfort, and intuitive controls to reduce driver fatigue and improve productivity. Advanced braking systems, stability control, and improved tire technologies contribute to better handling and safety. Furthermore, connectivity solutions, such as V2X (Vehicle-to-Everything) communication, are being explored to enable terminal tractors to communicate with other vehicles, infrastructure, and central control systems, further enhancing coordination and safety in complex operational areas. The emphasis is on creating a holistic ecosystem where the terminal tractor is not just a piece of machinery but an intelligent, connected component of a larger, optimized logistics system, continuously evolving through software updates and hardware enhancements to meet the dynamic demands of modern material handling.

Regional Highlights

- North America: A mature market characterized by high adoption rates of advanced terminal tractor technologies, including electric and semi-autonomous models. Strong focus on fleet modernization, regulatory compliance for emissions, and emphasis on operational efficiency in large distribution centers and ports. Significant investment in automation and integrated fleet management solutions.

- Europe: Driven by stringent environmental regulations and a strong commitment to decarbonization, Europe is a leading market for electric and hybrid terminal tractors. There's a high demand for sustainable and quiet operations, particularly in urban logistics and port environments. Innovation in charging infrastructure and telematics is also a key regional trend.

- Asia Pacific (APAC): The fastest-growing market globally, fueled by rapid industrialization, expanding e-commerce activities, and massive infrastructure development projects, especially in ports and logistics hubs across China, India, and Southeast Asian countries. Increasing demand for both conventional and new energy vehicles as economies scale up their logistics capabilities.

- Latin America: An emerging market experiencing steady growth driven by increasing international trade, port expansion projects, and the development of modern logistics infrastructure. While price sensitivity remains a factor, there is a growing recognition of the long-term benefits of specialized equipment for efficiency and safety.

- Middle East & Africa (MEA): This region is witnessing significant investment in port development and logistics infrastructure, particularly in the GCC countries and parts of Africa. The market is growing due to increasing trade volumes and the establishment of new industrial zones, leading to demand for robust terminal tractors adapted to challenging operating conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Terminal Tractor Market.- Kalmar (Cargotec Corporation)

- Terberg Special Vehicles

- Capacity Trucks (REV Group)

- Ottawa (BYD Company Ltd.)

- TICO Shunt Trucks

- Konecranes

- Autocar, LLC

- Hoist Liftruck Mfg., Inc.

- Sany Heavy Industry Co., Ltd.

- MOL CY n.v.

- Orange EV

- Taylor Machine Works, Inc.

- Lonking Holdings Limited

- Dulevo International S.p.A.

- Gaussin SA

- Mitsubishi Logisnext Co., Ltd.

- Volvo Construction Equipment (Volvo Group)

- MAFI Transport-Systeme GmbH

- CVS Ferrari S.p.A.

- Hyster-Yale Materials Handling, Inc.

Frequently Asked Questions

What is a terminal tractor and its primary function?

A terminal tractor, also known as a yard spotter or shunt truck, is a specialized vehicle designed to move semi-trailers and containers efficiently within confined areas such as logistics yards, ports, and distribution centers. Its primary function is to quickly and safely reposition trailers for loading, unloading, or storage, optimizing material flow and reducing turnaround times.

What are the main types of terminal tractors available in the market?

The main types include conventional diesel-powered models, electric terminal tractors which offer zero emissions and lower operating costs, and hybrid models that combine internal combustion with electric propulsion. There are also emerging categories based on automation levels, ranging from manual to semi-autonomous and fully autonomous systems.

How is AI impacting the terminal tractor market?

AI is significantly impacting the terminal tractor market by enabling advanced capabilities such as autonomous driving, predictive maintenance, and optimized fleet management. AI algorithms enhance safety through improved obstacle detection, increase efficiency by optimizing routes, and reduce downtime by forecasting maintenance needs, driving the industry towards smarter, more productive operations.

What are the key growth drivers for the Terminal Tractor Market?

Key growth drivers include the booming e-commerce sector, the expansion and modernization of global logistics and port infrastructure, and a growing emphasis on optimizing supply chain efficiencies. Additionally, increasing demand for sustainable and environmentally friendly solutions is driving the adoption of electric and alternative fuel terminal tractors.

Which region currently dominates the global Terminal Tractor Market?

While North America and Europe are mature markets with high adoption rates, the Asia Pacific (APAC) region is currently the fastest-growing and is projected to dominate the global Terminal Tractor Market in terms of volume and value. This growth is fueled by rapid industrialization, significant investments in port expansion, and the burgeoning e-commerce industry across countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Manual Trailer Terminal Tractor Market Statistics 2025 Analysis By Application (Port, Industry), By Type (Below 50 Tons, Between 50-100 Tons, Above 100 Tons), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Autonomous Trailer Terminal Tractor Market Statistics 2025 Analysis By Application (Port, Industry), By Type (Below 50 Tons, Between 50-100 Tons, Above 100 Tons), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Terminal Tractor Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Diesel, Hybrid, Electric, CNG), By Application (Airport, Marine, Oil & Gas, Logistics), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager