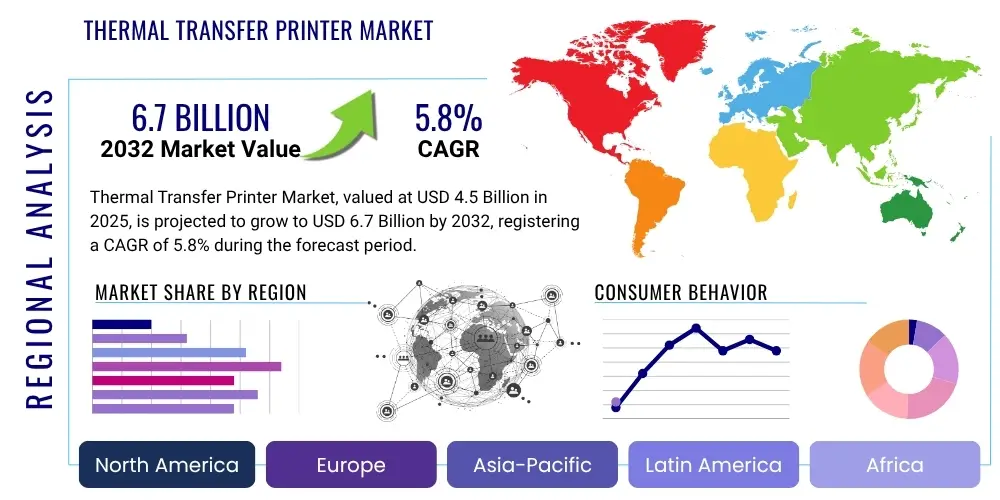

Thermal Transfer Printer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429129 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Thermal Transfer Printer Market Size

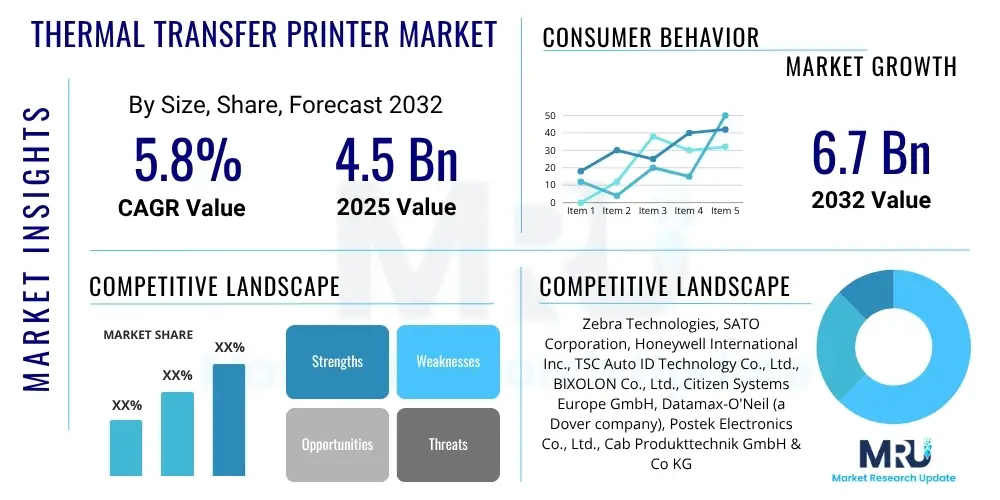

The Thermal Transfer Printer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 4.5 Billion in 2025 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2032.

Thermal Transfer Printer Market introduction

The Thermal Transfer Printer Market encompasses devices for producing durable labels, tags, and barcodes. These printers use a heated printhead to melt a ribbon (wax, wax-resin, or resin), transferring ink onto media like paper, polyester, or polypropylene. This method ensures excellent resistance to chemicals, abrasion, moisture, and extreme temperatures, making it vital for applications requiring robust identification. The technology offers superior print quality and longevity, critical for compliance and operational efficiency. The market is evolving with advancements in print speed, resolution, and connectivity to meet complex data capture and tracking demands.

Thermal transfer printers are valued for their versatility and precision, offering advantages in industrial and commercial settings. Their ability to print on diverse substrates, including challenging materials, supports comprehensive solutions for product identification, asset management, and supply chain logistics. Key benefits include sharp, clear images and scannable barcodes, adherence to stringent regulatory standards for high-quality labeling, and flexibility for variable data printing. The expansion of global supply chains and focus on traceability contribute significantly to sustained demand for these reliable printing solutions. This technology remains a cornerstone for operations demanding uncompromising label durability and scan accuracy.

Driving factors include the exponential growth of e-commerce, requiring efficient and accurate labeling for shipping and inventory management, and increasing adoption of industrial automation. Stringent regulatory mandates across healthcare, food and beverage, and chemicals for precise product identification and safety information further bolster demand. The continuous need for asset tracking in various industries also acts as a significant catalyst. Additionally, rising awareness and implementation of sustainable packaging, along with advancements in ribbon technology for enhanced performance and environmental friendliness, are shaping market dynamics and driving innovation.

Thermal Transfer Printer Market Executive Summary

The Thermal Transfer Printer Market shows robust growth, driven by global logistics, e-commerce, and complex supply chain management. Business trends focus on enhanced connectivity (Wi-Fi, Bluetooth), and integration with ERP/WMS. Manufacturers invest in R&D for more efficient, user-friendly models, emphasizing improved speeds, resolutions, and ribbon-saving features. There's a shift towards smart technologies and automation for Industry 4.0, aiming for predictive maintenance and optimized workflows. The competitive landscape features global players and regional manufacturers competing through innovation and partnerships.

Regional trends indicate Asia Pacific as a dominant and fast-growing market, fueled by its manufacturing sector, industrialization, and infrastructure investments, particularly in China and India. North America and Europe, while mature, maintain steady demand due to stringent labeling regulations in healthcare, food safety, and automotive, alongside modernization of industrial infrastructure. Latin America, the Middle East, and Africa are emerging with significant growth potential from increasing industrialization, urbanization, and rising adoption of organized retail and logistics. These regions offer market expansion opportunities, especially for mobile and desktop thermal transfer printer solutions.

Segment trends confirm industrial thermal transfer printers lead in revenue due to their robust build and high-volume capabilities. However, desktop and mobile segments show faster growth, driven by SMEs and field-service applications needing portability. In applications, transportation and logistics remain key, while healthcare and retail see accelerated adoption for compliance and inventory needs. The shift to sustainable printing influences ribbon dynamics, with focus on eco-friendly materials. Connectivity evolves, with wireless solutions gaining traction, reflecting a broader trend towards operational mobility and data accessibility.

AI Impact Analysis on Thermal Transfer Printer Market

User queries about AI's impact often concern efficiency, downtime reduction, and print quality improvement. Users seek predictive maintenance, optimized consumable usage, and greater automation in labeling. Concerns include integration cost, data privacy, and the learning curve. Expectations are that AI will transform printing into a dynamic, data-driven operation capable of self-optimization and proactive issue resolution, leveraging AI for smarter material handling, real-time quality checks, and seamless integration with industrial IoT, aiming for reliable, precise, and resource-efficient solutions.

- Predictive Maintenance: AI analyzes performance data to anticipate failures, enabling proactive maintenance and minimizing costly downtime, improving operational continuity.

- Optimized Consumable Usage: AI learns printing patterns to suggest optimal ribbon/media types and predict depletion, reducing waste and enhancing cost-effectiveness.

- Automated Quality Control: AI-powered vision systems detect print errors, smudges, or misalignments in real-time, ensuring high-quality output and preventing defective labels.

- Enhanced Workflow Automation: AI integrates with inventory systems, automatically generating and printing labels based on stock levels or orders, streamlining supply chain operations.

- Improved Data Security: AI analytics monitor printing networks for unusual activity, identify breaches, and protect sensitive data in labels, crucial for regulated industries.

- Personalization and Customization: AI enables dynamic label customization based on product attributes or customer preferences, supporting agile manufacturing and retail strategies.

DRO & Impact Forces Of Thermal Transfer Printer Market

The Thermal Transfer Printer Market is shaped by strong drivers, opportunities, and restraints. E-commerce growth is a primary driver, demanding high-quality, scannable, durable labels for tracking and inventory across logistics. Stringent regulations in pharmaceuticals, food & beverage, and chemicals mandate precise, tamper-proof labeling for traceability and safety. The global push for industrial automation and Industry 4.0 further accelerates printer adoption, as they are critical for asset identification and process control in automated production. These factors collectively create robust demand for advanced thermal transfer printing.

Despite strong drivers, restraints persist. Higher initial investment for industrial thermal transfer printers compared to direct thermal or inkjet can deter SMEs. Ongoing operational expenses from consumable ribbons lead to higher total cost of ownership. Environmental concerns regarding ribbon waste are pushing for sustainable solutions. Competition from other printing technologies, especially direct thermal for less critical applications, challenges market expansion and penetration in specific segments.

Opportunities are vast, including integration with IoT and AI for enhanced efficiency and predictive maintenance. Expansion into emerging economies (Asia Pacific, Latin America, Middle East) offers untapped potential due to rapid industrialization. Demand for customized and personalized labeling across industries opens new avenues for innovation. Development of sustainable ribbon materials and energy-efficient printer designs represents another opportunity, addressing environmental concerns and appealing to a broader, eco-conscious customer base. These opportunities drive strategic investments and technological advancements.

Segmentation Analysis

The Thermal Transfer Printer Market is segmented by type, print method, connectivity, application, and ribbon type, reflecting diverse end-user needs. This granular segmentation enables targeted product development, addressing specific operational requirements for durability, print volume, mobility, and environmental conditions. Printer types range from robust industrial units to versatile desktop and highly portable mobile printers, catering to different scales of operation and logistical demands. Each segment is crucial, driven by unique consumer behaviors, technological advancements, and regulatory frameworks specific to its domain, making segmentation vital for strategic market planning.

Further analysis shows varying growth and adoption. Industrial printers lead in market share due to high-volume capabilities in manufacturing and logistics. Mobile printers are growing faster, driven by demand for on-the-go labeling in retail, field services, and transportation for flexibility. Ribbon choice (wax, wax-resin, resin) depends on required label durability and environment. Connectivity is evolving, with wireless technologies (Wi-Fi, Bluetooth) gaining preference for mobile and networked printing, reducing infrastructure complexity. These trends highlight the market's dynamic nature and constant innovation needs.

- By Type

- Industrial Thermal Transfer Printers

- Desktop Thermal Transfer Printers

- Mobile Thermal Transfer Printers

- By Print Method

- Flat-Head Thermal Transfer Printers

- Near-Edge Thermal Transfer Printers

- By Connectivity

- USB

- Ethernet

- Wi-Fi

- Bluetooth

- Serial

- Parallel

- By Application

- Manufacturing and Industrial

- Retail and E-commerce

- Healthcare and Pharmaceuticals

- Transportation and Logistics

- Food and Beverage

- Government and Public Sector

- Others

- By Ribbon Type

- Wax Ribbons

- Wax-Resin Ribbons

- Resin Ribbons

Value Chain Analysis For Thermal Transfer Printer Market

The thermal transfer printer value chain starts with upstream suppliers providing critical raw materials and components: printheads, electronics, sensors, motors, and casings. Also crucial are suppliers of thermal transfer ribbons (wax, wax-resin, resin) and various media substrates (labels, tags). These suppliers often perform R&D to enhance performance, durability, and cost-effectiveness, directly impacting the final product quality. Strong relationships with reliable component providers are vital for manufacturers to ensure consistent quality and manage production costs.

Further along, printer manufacturers assemble these components, integrating hardware with proprietary software to create printing devices. This stage demands investment in manufacturing, quality control, and innovation to differentiate products by speed, resolution, connectivity, and robustness. Manufacturers use both direct and indirect distribution. Direct sales target large enterprises with complex integration needs, offering tailored solutions and dedicated support, fostering direct feedback and loyalty for customized product development.

Indirect distribution uses networks of authorized distributors, resellers, VARs, and system integrators. These partners extend market reach, especially to SMEs and specialized markets, providing localized sales, technical support, installation, and integration services, adding value for end-users. Downstream activities focus on post-sales support: maintenance, repairs, consumables, and software updates, critical for customer satisfaction. The entire value chain emphasizes efficiency, quality assurance, and robust logistics to deliver sophisticated thermal transfer printing solutions from sourcing to deployment and ongoing support.

Thermal Transfer Printer Market Potential Customers

The Thermal Transfer Printer Market serves diverse customers across industrial and commercial sectors needing durable, high-quality, long-lasting labels. Key end-users include manufacturing, for product labeling, work-in-process, and component identification to ensure efficiency and compliance. Transportation and logistics heavily rely on these printers for shipping labels, pallet tracking, and inventory management, facilitating seamless movement of goods. Retail and e-commerce use them for barcodes, price tags, and return labels, enabling quick inventory turns and efficient order fulfillment.

Healthcare and pharmaceuticals are critical sectors, driven by regulations for patient safety and product traceability. Thermal transfer printers are essential for medical records, prescription labels, specimen identification, and pharmaceutical product labeling, where accuracy and resistance to chemicals or sterilization are paramount. The food and beverage industry uses them for nutritional information, expiry dates, and allergen warnings, adhering to health and safety while ensuring product integrity. Government and public sector organizations also use this technology for asset tagging, administration, and secure document management requiring robust, readable labels.

Niche markets like automotive, electronics, chemicals, and jewelry also represent significant customer bases. Automotive uses thermal transfer labels for component tracking and VIN plates, needing extreme durability against harsh conditions. Electronics manufacturers employ them for circuit board labels and product ID. Chemical companies require labels resistant to aggressive substances for safety. Even horticulture uses durable plant tags for outdoor exposure. The broad applicability and critical need for reliable, permanent labeling ensure an expanding customer base, driving innovation to meet varied demands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.5 Billion |

| Market Forecast in 2032 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zebra Technologies, SATO Corporation, Honeywell International Inc., TSC Auto ID Technology Co., Ltd., BIXOLON Co., Ltd., Citizen Systems Europe GmbH, Datamax-O'Neil (a Dover company), Postek Electronics Co., Ltd., Cab Produkttechnik GmbH & Co KG, Brother Industries, Ltd., Seiko Instruments Inc., Toshiba Tec Corporation, Avery Dennison Corporation, Primera Technology, Inc., Kroy, Inc., Brady Corporation, GoDEX International, Dascom, Printronix, Domino Printing Sciences |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Transfer Printer Market Key Technology Landscape

The core thermal transfer technology applies heat to a ribbon, transferring ink onto a receiving material, yielding durable, scratch-resistant, and chemical-resistant prints, unlike direct thermal. Key advancements include higher-resolution printheads for sharper images and smaller barcodes, vital for detailed product information. Innovations in print speed have significantly increased throughput for high-volume industrial and logistics operations. Manufacturers continuously refine these core components to enhance printer reliability and extend operational life, delivering greater value to end-users.

Modern thermal transfer printers feature advanced connectivity, moving beyond USB and Ethernet to wireless technologies like Wi-Fi and Bluetooth. This supports greater operational flexibility and mobile printing solutions for field service and dynamic warehouse environments. IoT integration enables real-time monitoring of printer performance, consumable levels, and predictive maintenance, reducing downtime and optimizing resource management. Intelligent features like automatic ribbon detection and calibration simplify setup and ensure optimal print quality across different media. These enhancements make printers more intuitive, efficient, and connectable within enterprise IT, aligning with smart factory initiatives.

Material science also drives the technology landscape. Innovations in ribbon formulations introduce specialized options for extreme temperatures, outdoor exposure, or harsh chemicals, broadening application scope. A growing focus on sustainability leads to eco-friendly, recyclable ribbons. Software advancements, including sophisticated label design programs, printer management utilities, and robust security protocols for data integrity, are critical. These solutions enhance user experience, streamline operations, and ensure compliance, collectively advancing the market toward more intelligent, sustainable, and high-performance solutions.

Regional Highlights

- North America: A mature market with consistent demand driven by stringent regulations in healthcare, automotive, and food & beverage. Focus on automation, supply chain efficiency, and adoption of advanced features like IoT integration.

- Europe: Characterized by high adoption rates in manufacturing and logistics, influenced by evolving EU regulations for product traceability and environmental standards. Strong emphasis on sustainable printing solutions and industrial automation.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid industrialization, burgeoning e-commerce, and significant investments in manufacturing and logistics infrastructure, especially in China, India, and Southeast Asian countries.

- Latin America: An emerging market showing substantial growth potential due to increasing industrialization, urbanization, and the expansion of organized retail and logistics sectors. Demand for cost-effective and versatile solutions is rising.

- Middle East and Africa (MEA): Witnessing growth driven by infrastructure development, diversification of economies, and increasing adoption of modern inventory management and tracking systems across various industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Transfer Printer Market.- Zebra Technologies

- SATO Corporation

- Honeywell International Inc.

- TSC Auto ID Technology Co., Ltd.

- BIXOLON Co., Ltd.

- Citizen Systems Europe GmbH

- Datamax-O'Neil (a Dover company)

- Postek Electronics Co., Ltd.

- Cab Produkttechnik GmbH & Co KG

- Brother Industries, Ltd.

- Seiko Instruments Inc.

- Toshiba Tec Corporation

- Avery Dennison Corporation

- Primera Technology, Inc.

- Kroy, Inc.

- Brady Corporation

- GoDEX International

- Dascom

- Printronix

- Domino Printing Sciences

Frequently Asked Questions

What is a thermal transfer printer used for?

Thermal transfer printers are primarily used for generating durable, high-quality labels, barcodes, and tags that resist abrasion, chemicals, moisture, and extreme temperatures. They are essential for applications requiring long-lasting identification, such as asset tracking, product labeling in manufacturing, shipping and inventory in logistics, patient identification in healthcare, and compliance labeling in various regulated industries where label longevity and readability are critical.

How does thermal transfer printing work?

Thermal transfer printing operates by heating tiny dots on a printhead, which then melt ink from a ribbon onto a specific media material, such as paper, polyester, or polypropylene. This precise transfer creates a sharp, durable image that is permanently bonded to the surface. Unlike direct thermal printing, which uses heat-sensitive paper that darkens when heated, thermal transfer requires a ribbon and offers superior print longevity and resistance to environmental factors.

What are the benefits of thermal transfer printers?

The key benefits of thermal transfer printers include exceptional print durability, making labels resistant to fading, smudging, and damage from chemicals or harsh environments. They offer high print quality, producing clear and scannable barcodes and graphics. Their versatility allows printing on a wide range of media, and the prints have a long lifespan, crucial for applications requiring extended readability and adherence to strict regulatory standards over many years.

What is the difference between thermal transfer and direct thermal printing?

The primary difference lies in the use of a ribbon. Thermal transfer printing utilizes a thermal transfer ribbon, which contains the ink, to create durable prints on various media. Direct thermal printing, conversely, does not use a ribbon; instead, it uses specially coated, heat-sensitive paper that darkens when heated by the printhead. Direct thermal prints are typically less durable and prone to fading from heat, light, or abrasion, making thermal transfer preferred for longevity and resistance.

Is AI used in thermal transfer printers?

Yes, Artificial Intelligence is increasingly being integrated into thermal transfer printers to enhance performance and efficiency. AI applications include predictive maintenance to anticipate and prevent printer malfunctions, optimization of ribbon and media usage to reduce waste, automated quality control for detecting print errors in real-time, and seamless integration with inventory and supply chain management systems for greater workflow automation. AI helps create smarter, more reliable, and cost-effective printing solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager