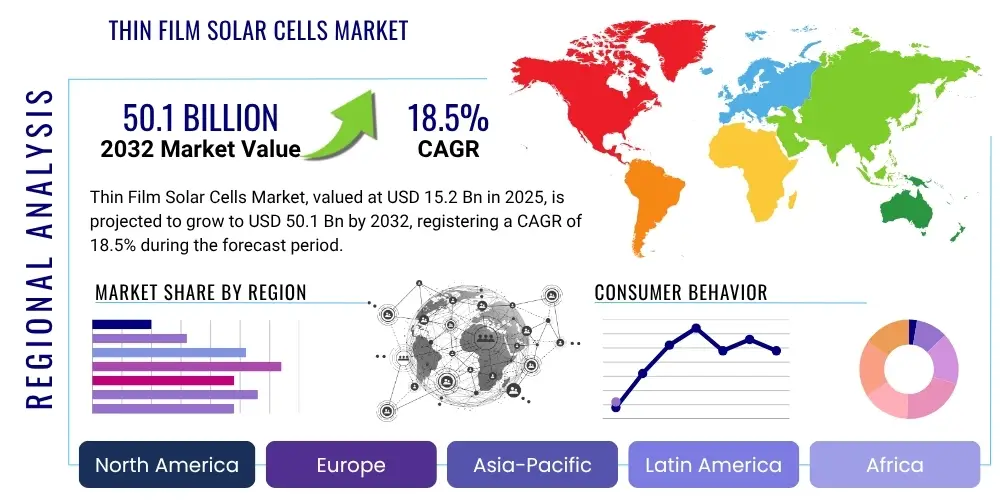

Thin Film Solar Cells Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431316 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Thin Film Solar Cells Market Size

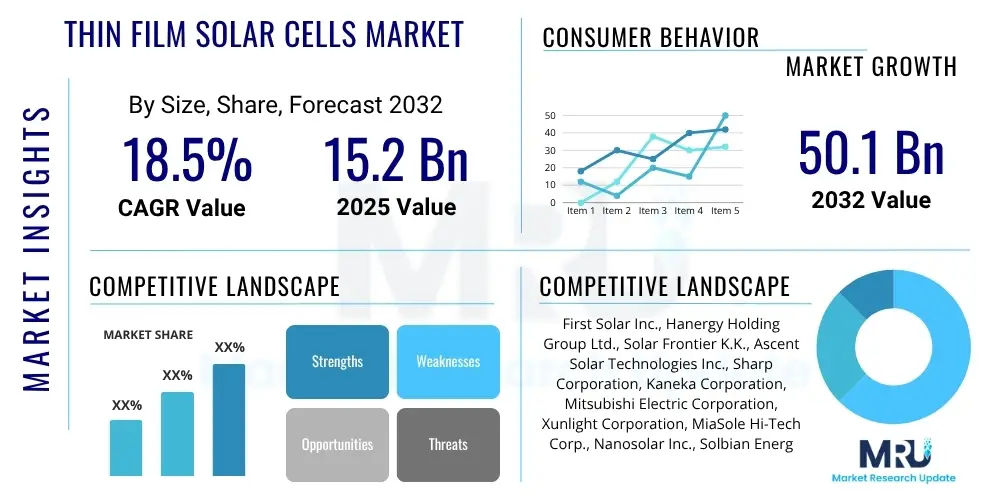

The Thin Film Solar Cells Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 15.2 Billion in 2025 and is projected to reach USD 50.1 Billion by the end of the forecast period in 2032.

Thin Film Solar Cells Market introduction

The Thin Film Solar Cells market encompasses a rapidly evolving segment within the broader solar energy industry, characterized by the use of ultra-thin layers of photovoltaic materials to convert sunlight into electricity. Unlike traditional crystalline silicon panels, thin film cells offer significant advantages such as flexibility, lighter weight, and superior aesthetic integration, making them ideal for a diverse range of applications from building-integrated photovoltaics (BIPV) to portable electronics and utility-scale power generation. These cells are produced using various semiconductor materials, including Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), and Amorphous Silicon (a-Si), each presenting unique performance characteristics and cost profiles.

The core product description involves solar cells fabricated by depositing one or more thin layers of photovoltaic material onto a substrate, such as glass, plastic, or metal. Major applications span residential and commercial rooftops, large-scale solar farms, automotive integration, and specialized flexible devices. The primary benefits include lower material consumption, enhanced performance in low-light conditions, and the potential for reduced manufacturing costs over the long term. Driving factors for this market's expansion include the global push for renewable energy sources, increasing governmental support and incentives for solar adoption, ongoing technological advancements that improve efficiency and durability, and a growing consumer demand for aesthetically pleasing and versatile solar solutions.

The inherent adaptability of thin film solar cells allows for seamless integration into a multitude of surfaces and structures, expanding the potential for solar energy harvesting beyond conventional panel installations. This versatility, coupled with continuous innovation in material science and manufacturing processes, positions thin film technology as a crucial component in achieving a sustainable energy future. The market is driven by both technological pull, with advancements pushing performance boundaries, and market push, as energy demands escalate and environmental concerns mandate a shift away from fossil fuels. The interplay of these factors solidifies the market's trajectory towards substantial growth and diversification in its application landscape.

Thin Film Solar Cells Market Executive Summary

The Thin Film Solar Cells market is experiencing robust growth driven by escalating global demand for renewable energy and continuous innovation in material science and manufacturing. Key business trends include increasing consolidation among major players, significant investments in research and development to enhance cell efficiency and reduce production costs, and a strategic focus on expanding into niche applications such as flexible electronics and BIPV. Companies are also prioritizing supply chain resilience and exploring new markets to diversify revenue streams. The competitive landscape is characterized by a balance of established manufacturers and innovative startups vying for market share through technological differentiation and strategic partnerships, all contributing to a dynamic and evolving industry environment.

Regionally, the market exhibits varied growth patterns. Asia Pacific stands out as the leading region, propelled by massive government initiatives, substantial investments in solar infrastructure, and a booming manufacturing sector in countries like China and India. Europe is also a significant market, driven by stringent renewable energy targets and strong adoption of BIPV solutions, especially in Germany and the UK. North America demonstrates consistent growth, fueled by technological advancements, favorable policies, and increasing corporate sustainability goals. These regional dynamics highlight a global commitment to solar energy, with localized drivers influencing market expansion and technology adoption across different geographies.

Segmentation trends reveal a strong performance from Cadmium Telluride (CdTe) cells, particularly in utility-scale projects due to their cost-effectiveness and proven track record. Copper Indium Gallium Selenide (CIGS) cells continue to carve out a significant niche, especially in flexible and high-efficiency applications, benefiting from their aesthetic appeal and superior performance in varied lighting conditions. Amorphous Silicon (a-Si) thin films, while having lower efficiencies, maintain relevance in certain specialized and low-cost applications where flexibility and transparency are paramount. The emergence of next-generation thin film technologies, such as perovskites, is poised to disrupt existing segments by offering even higher efficiencies and lower production costs, indicating a future market characterized by diverse material innovations and expanded application possibilities.

AI Impact Analysis on Thin Film Solar Cells Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the Thin Film Solar Cells market, focusing on areas like efficiency gains, manufacturing optimization, material discovery, and grid integration. The overarching themes include leveraging AI to accelerate R&D cycles, predict and prevent manufacturing defects, and enhance the overall performance and reliability of thin film modules. There is significant interest in AI's role in predictive maintenance for solar farms and optimizing energy output through smart grid management, indicating an expectation that AI will be a critical enabler for the next generation of solar technology. Users are keen to understand specific applications and tangible benefits that AI can bring to thin film solar cell production and deployment.

The impact of AI on the Thin Film Solar Cells market is multifaceted, extending from the initial design phase to the operational life cycle of solar installations. AI algorithms can analyze vast datasets of material properties, simulation results, and experimental data to identify optimal material compositions and device architectures for improved efficiency and stability. This accelerates the discovery of novel thin film materials, such as advanced perovskites or quantum dots, by significantly reducing the trial-and-error process typically associated with materials science research. Furthermore, AI-driven simulations can predict long-term performance under various environmental conditions, enabling more robust product development and reducing time-to-market for new thin film technologies.

In manufacturing, AI plays a crucial role in enhancing process control and quality assurance. Machine learning models can monitor production lines in real-time, identifying anomalies and predicting potential defects before they occur, thereby minimizing waste and increasing yield. This precision manufacturing is particularly vital for thin film cells where layer thickness and uniformity are critical to performance. Beyond production, AI optimizes the deployment and operation of thin film solar arrays through predictive maintenance, smart energy management, and improved grid integration. AI can forecast energy demand and supply, intelligently route power, and even detect subtle performance degradation in individual modules, ensuring maximum uptime and efficiency for solar installations, thus enhancing the overall return on investment for thin film solar projects.

- Accelerated material discovery and optimization through data analysis.

- Enhanced manufacturing process control and defect detection, leading to higher yields.

- Predictive maintenance for solar arrays, improving operational efficiency and lifespan.

- Optimized energy management and grid integration for better output and stability.

- Advanced simulation and modeling for improved cell design and performance prediction.

DRO & Impact Forces Of Thin Film Solar Cells Market

The Thin Film Solar Cells market is propelled by significant drivers such as increasing global electricity demand and the urgent need for sustainable energy solutions, supported by favorable government policies and incentives aimed at promoting solar energy adoption. Restraints on market growth include the lower conversion efficiencies of some thin film technologies compared to conventional silicon panels, along with challenges in material sourcing and the complexity of manufacturing processes. Opportunities arise from the expanding applications in niche sectors like flexible electronics and building-integrated photovoltaics (BIPV), as well as ongoing research into next-generation materials like perovskites. Impact forces, including raw material price volatility, geopolitical considerations, and intense competition from other renewable energy technologies, significantly influence the market's trajectory and profitability.

Key drivers underpinning the expansion of the thin film solar market include the global imperative to reduce carbon emissions and combat climate change, leading to aggressive renewable energy targets set by nations worldwide. The decreasing cost of thin film solar cells, driven by economies of scale and technological advancements, makes them increasingly competitive with traditional energy sources. Furthermore, their unique attributes, such as flexibility, lightweight design, and superior aesthetic appeal, open up new architectural and portable applications that crystalline silicon panels cannot address effectively. Government subsidies, tax credits, and feed-in tariffs in various countries provide critical financial incentives for both producers and consumers, stimulating market growth and accelerating deployment.

Despite these drivers, several restraints temper the market's full potential. The inherent lower efficiency of certain thin film technologies (e.g., amorphous silicon) compared to state-of-the-art crystalline silicon remains a significant hurdle, limiting their adoption in space-constrained applications. Manufacturing thin film cells often involves complex deposition processes and specialized equipment, contributing to higher initial capital expenditure. Additionally, the reliance on certain critical raw materials, such as indium, tellurium, and cadmium, can lead to supply chain vulnerabilities and price fluctuations, posing risks to consistent production. These restraints necessitate continuous innovation in material science and process engineering to overcome performance gaps and ensure long-term market viability.

Opportunities for growth are abundant, particularly in niche markets where thin film's unique properties provide a distinct advantage. The burgeoning BIPV sector, which integrates solar cells directly into building materials like facades and windows, represents a substantial growth avenue. The market for flexible and transparent solar cells for wearable electronics, smart textiles, and automotive applications is also expanding rapidly. Moreover, ongoing research into emerging thin film materials like perovskites and organic photovoltaics promises significant leaps in efficiency and cost reduction, potentially overcoming current technological limitations. The impact forces of global economic conditions, technological breakthroughs from competing renewable energy sectors (e.g., wind power, energy storage), and shifts in regulatory frameworks will continue to shape the competitive landscape and strategic decisions of market players.

Segmentation Analysis

The Thin Film Solar Cells market is comprehensively segmented to provide a detailed understanding of its diverse landscape, categorizing the market based on various factors such as type, application, and end-use. This segmentation allows for precise analysis of market trends, identifying growth opportunities and challenges within specific product categories and consumer sectors. Understanding these segments is crucial for stakeholders to tailor their strategies, optimize product offerings, and target the most promising areas for investment and expansion in the rapidly evolving solar energy domain. The market's complexity necessitates a granular breakdown to capture the nuances of technological differentiation and application-specific demands, guiding both producers and investors towards informed decision-making.

- By Type

- Cadmium Telluride (CdTe)

- Copper Indium Gallium Selenide (CIGS)

- Amorphous Silicon (a-Si)

- Others (Dye-Sensitized Solar Cells (DSSC), Organic Photovoltaics (OPV), Perovskite Solar Cells)

- By Application

- Utility Scale

- Commercial

- Residential

- Off-Grid

- Others (Portable, Automotive)

- By End-Use

- Building-Integrated Photovoltaics (BIPV)

- Flexible Electronics

- Automotive

- Portable Devices

- Power Generation

- Defense and Aerospace

- By Substrate

- Glass

- Flexible (Plastic, Metal Foil)

Value Chain Analysis For Thin Film Solar Cells Market

The value chain for the Thin Film Solar Cells market is a complex ecosystem spanning from raw material extraction to final product deployment and end-of-life management, highlighting the interconnectedness of various stages. Upstream activities involve the sourcing and processing of specialized raw materials such as glass, plastics, metals, and critical semiconductor components like tellurium, indium, gallium, and selenium. This stage is dominated by chemical suppliers and material manufacturers who provide the foundational elements required for thin film deposition. Midstream activities focus on the actual manufacturing of thin film modules, encompassing substrate preparation, deposition processes (e.g., sputtering, CVD), cell fabrication, module assembly, and quality control. Equipment manufacturers play a vital role here, supplying the advanced machinery needed for high-precision production.

Downstream analysis covers the distribution, installation, and operational aspects of thin film solar cells. The distribution channel involves a network of direct sales teams, distributors, wholesalers, and value-added resellers who connect manufacturers with end-users. Direct sales are common for large-scale utility projects, where manufacturers engage directly with project developers and EPC (Engineering, Procurement, and Construction) firms. Indirect channels, through distributors and integrators, serve the residential and commercial markets. Following distribution, system integrators and installers are responsible for the design, procurement of balance-of-system components, and installation of solar arrays. This phase often includes financing, permitting, and grid connection services, requiring specialized expertise in project management and electrical engineering.

Post-installation, the value chain extends to operation and maintenance (O&M) services, ensuring optimal performance and longevity of the solar installations. This includes monitoring, cleaning, repairs, and eventually, recycling of modules at the end of their lifespan. The direct and indirect channels signify different approaches to market access. Direct sales offer manufacturers greater control over branding and customer relationships, particularly for large projects. Indirect channels leverage the extensive networks of distributors and installers, enabling broader market penetration and reaching a diverse customer base, especially in fragmented markets. Each stage of this value chain presents distinct opportunities and challenges, with efficiency, cost-effectiveness, and sustainability being critical factors influencing competitiveness and profitability across the entire thin film solar cell ecosystem.

Thin Film Solar Cells Market Potential Customers

The potential customers for Thin Film Solar Cells are incredibly diverse, reflecting the versatility and unique advantages offered by this technology across various sectors. End-users and buyers range from large utility companies seeking cost-effective solutions for vast solar farms to individual residential consumers interested in aesthetically pleasing and flexible solar options for their homes. Commercial building owners are increasingly adopting thin film solutions for building-integrated photovoltaics (BIPV), where solar cells seamlessly merge with building facades or roofs, contributing to green building certifications and reducing operational costs. This broad appeal stems from thin film's ability to cater to both large-scale energy generation needs and niche, specialized applications where traditional solar panels may not be suitable.

Beyond traditional power generation, the market extends to specialized industrial applications and consumer goods. Automotive manufacturers are exploring thin film integration into vehicle roofs and bodies for supplementary power, enhancing fuel efficiency or powering auxiliary systems. The portable electronics industry finds thin film cells ideal for charging devices on the go, owing to their lightweight and flexible nature. Military and defense sectors leverage these characteristics for tactical power solutions in remote locations, while aerospace applications benefit from their high power-to-weight ratio. These diverse applications highlight a growing demand from sectors prioritizing flexibility, low weight, and integration capabilities alongside energy efficiency.

Furthermore, emerging markets and off-grid communities represent a significant customer base, where thin film solar cells can provide accessible and reliable electricity solutions without the need for extensive grid infrastructure. Government bodies and public sector organizations are also key buyers, investing in large-scale solar projects to meet renewable energy mandates and drive sustainable urban development. This extensive range of potential customers underscores the profound impact and wide applicability of thin film solar technology, indicating robust demand across multiple industries and consumer segments globally. The ability of thin film to adapt to different form factors and performance requirements makes it an attractive option for a multitude of buyers seeking innovative energy solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.2 Billion |

| Market Forecast in 2032 | USD 50.1 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | First Solar Inc., Hanergy Holding Group Ltd., Solar Frontier K.K., Ascent Solar Technologies Inc., Sharp Corporation, Kaneka Corporation, Mitsubishi Electric Corporation, Xunlight Corporation, MiaSole Hi-Tech Corp., Nanosolar Inc., Solbian Energie Alternative Srl, PowerFilm Solar Inc., Flisom AG, Heliatek GmbH, United Solar Ovonic LLC (now part of Ascent Solar Technologies), SoloPower Systems Inc., TSMC Solar Ltd., Global Solar Energy Inc., AVANCIS GmbH, SunPower Corporation (Maxeon Solar Technologies) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thin Film Solar Cells Market Key Technology Landscape

The technological landscape of the Thin Film Solar Cells market is characterized by continuous innovation aimed at improving efficiency, reducing costs, and expanding application versatility. Core manufacturing technologies involve various deposition techniques to apply thin layers of photovoltaic materials onto substrates. These include sputtering, where material is ejected from a target onto a substrate; chemical vapor deposition (CVD), involving chemical reactions on a heated substrate; close-spaced sublimation (CSS), a high-rate deposition method for CdTe; and electrodeposition, which uses an electrochemical process to deposit thin films. Each method offers distinct advantages in terms of material utilization, scalability, and control over film properties, driving the performance and cost-effectiveness of different thin film types.

Recent advancements are significantly shaping the market, with a strong focus on next-generation materials and tandem cell structures. Perovskite solar cells, for instance, have emerged as a highly promising technology, demonstrating rapidly improving efficiencies that are now comparable to conventional silicon, coupled with the potential for low-cost solution processing. Quantum dot solar cells and organic photovoltaics (OPV) are also gaining traction, offering unique advantages like transparency and flexibility for niche applications. Furthermore, the development of tandem cells, which combine different thin film materials (e.g., perovskite on silicon or CIGS) to absorb a broader spectrum of sunlight, is pushing the boundaries of theoretical efficiency limits, promising significantly higher power output from smaller areas.

Beyond material science, innovations in manufacturing processes are also critical. Advancements in roll-to-roll (R2R) printing techniques allow for high-throughput, low-cost production of flexible thin film cells, opening up new possibilities for mass-produced lightweight and adaptable solar solutions. The integration of transparent conductive oxides (TCOs) and advanced encapsulation materials further enhances durability and long-term stability, essential for widespread adoption. These technological evolutions, from novel material discovery to scalable manufacturing methods, are collectively driving the thin film solar cells market towards greater competitiveness, efficiency, and broader application across various industries, reinforcing its role in the global energy transition.

Regional Highlights

The global Thin Film Solar Cells market exhibits distinct regional dynamics, influenced by varying policy frameworks, economic conditions, and technological adoption rates. Asia Pacific, particularly countries like China, India, and Japan, dominates the market due to robust government support for renewable energy, significant investments in large-scale solar projects, and the presence of major manufacturing hubs. The region benefits from increasing energy demand, a strong push towards reducing carbon footprints, and a competitive manufacturing ecosystem that drives down production costs. This combination of factors has positioned Asia Pacific as a critical growth engine for the thin film solar industry, attracting substantial domestic and international investment.

Europe represents another vital market for thin film solar cells, propelled by ambitious renewable energy targets and strong environmental regulations. Countries such as Germany, the United Kingdom, and France are at the forefront of adopting BIPV solutions, leveraging thin film's aesthetic and integration advantages for urban development. The region's emphasis on sustainable building practices and smart grid initiatives further stimulates demand. North America, especially the United States, shows consistent growth, driven by technological innovation, supportive federal and state policies, and a rising corporate focus on sustainability. Research and development in advanced thin film materials and manufacturing techniques are particularly strong in this region, contributing to market expansion and efficiency improvements.

Latin America is an emerging market with significant growth potential, fueled by increasing energy needs, abundant solar resources, and a growing focus on diversifying energy mixes away from fossil fuels. Countries like Chile, Mexico, and Brazil are investing in solar infrastructure, creating new opportunities for thin film deployment. The Middle East and Africa (MEA) region also presents a burgeoning market, characterized by vast untapped solar potential and increasing government initiatives to develop large-scale renewable energy projects. As these regions continue to develop their renewable energy sectors, the demand for versatile and cost-effective thin film solar cells is expected to escalate, making them crucial contributors to the global market's expansion and diversification over the forecast period.

- North America: Strong R&D, favorable government incentives, increasing utility-scale and commercial adoption, focus on high-efficiency thin films.

- Europe: Driven by stringent renewable energy directives, high BIPV adoption, established market for sustainable building solutions, focus on aesthetically integrated solar.

- Asia Pacific (APAC): Leading market due to large-scale solar projects, robust manufacturing capabilities (China), government support, and surging energy demand.

- Latin America: Emerging market with vast solar resources, increasing investments in renewable energy infrastructure, and growing off-grid applications.

- Middle East and Africa (MEA): Significant untapped solar potential, increasing government commitment to large-scale renewable projects, and demand for energy diversification.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thin Film Solar Cells Market.- First Solar Inc.

- Hanergy Holding Group Ltd.

- Solar Frontier K.K.

- Ascent Solar Technologies Inc.

- Sharp Corporation

- Kaneka Corporation

- Mitsubishi Electric Corporation

- Xunlight Corporation

- MiaSole Hi-Tech Corp.

- Nanosolar Inc.

- Solbian Energie Alternative Srl

- PowerFilm Solar Inc.

- Flisom AG

- Heliatek GmbH

- United Solar Ovonic LLC (now part of Ascent Solar Technologies)

- SoloPower Systems Inc.

- TSMC Solar Ltd.

- Global Solar Energy Inc.

- AVANCIS GmbH

- SunPower Corporation (Maxeon Solar Technologies)

Frequently Asked Questions

What are the primary types of thin film solar cells?

The main types are Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), and Amorphous Silicon (a-Si). Each type utilizes different semiconductor materials and manufacturing processes, offering varying efficiencies and application suitability.

How do thin film solar cells compare to traditional silicon solar panels?

Thin film solar cells are typically lighter, more flexible, and can perform better in low-light conditions compared to traditional crystalline silicon panels. While they generally have lower conversion efficiencies, their versatility and aesthetic appeal make them suitable for niche applications like BIPV and portable electronics.

What are the major applications of thin film solar cells?

Thin film solar cells are widely used in utility-scale power plants, commercial and residential rooftops (especially BIPV), portable electronic devices, automotive integration, and off-grid power solutions due to their adaptability and lightweight nature.

What is the projected growth rate of the Thin Film Solar Cells Market?

The Thin Film Solar Cells Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032, driven by increasing demand for renewable energy and technological advancements.

Which regions are leading in the adoption of thin film solar technology?

Asia Pacific, particularly China and India, leads in thin film solar adoption due to strong government support and large-scale projects. Europe and North America also demonstrate significant growth driven by renewable energy targets and technological innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager