Tire and Wheel Handling Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430546 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Tire and Wheel Handling Equipment Market Size

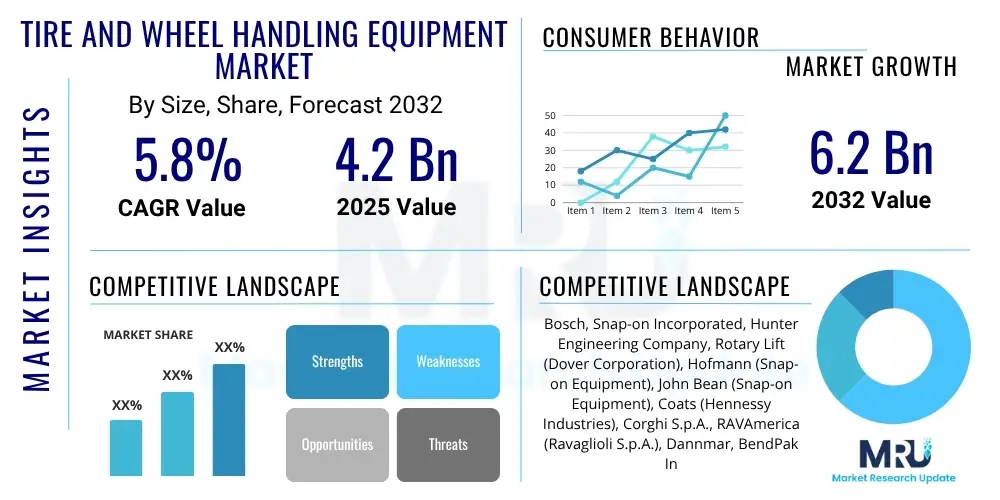

The Tire and Wheel Handling Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at $4.2 Billion in 2025 and is projected to reach $6.2 Billion by the end of the forecast period in 2032.

Tire and Wheel Handling Equipment Market introduction

The Tire and Wheel Handling Equipment Market encompasses a broad range of specialized machinery and tools designed to facilitate the safe, efficient, and ergonomic handling, installation, removal, and maintenance of tires and wheels across various industries. This equipment is crucial for operations ranging from automotive service and repair to heavy industrial applications like mining, construction, and aviation. The market's foundational drivers include the global expansion of vehicle fleets, increasing demands for operational safety and efficiency, and evolving regulatory standards that mandate proper equipment usage to prevent workplace injuries.

Products within this market segment are diverse, including tire changers, wheel balancers, tire lifts, wheel dollies, hydraulic jacks, tire inflation systems, and specialized handling robots. Each piece of equipment is engineered to address specific challenges associated with tire and wheel servicing, which can involve significant weight and complex manipulation. For instance, tire changers automate the process of mounting and dismounting tires from rims, while wheel balancers ensure smooth vehicle operation and extended tire life by detecting and correcting imbalances. These tools contribute directly to reducing manual labor, mitigating injury risks, and enhancing the overall speed and quality of service operations.

Major applications for tire and wheel handling equipment span the entire automotive aftermarket, including independent garages, franchised dealerships, and tire specialty shops, as well as original equipment manufacturing (OEM) facilities. Beyond automotive, the mining, construction, and aviation sectors rely heavily on robust, heavy-duty equipment for managing the large and specialized tires found on their machinery. The inherent benefits of these tools – improved safety for technicians, enhanced operational efficiency, reduced labor costs, and extended equipment lifespan – are pivotal factors driving sustained market demand. Additionally, the increasing complexity of modern tire and wheel assemblies, such as run-flat tires and larger diameters, necessitates the use of advanced, purpose-built handling solutions.

Tire and Wheel Handling Equipment Market Executive Summary

The Tire and Wheel Handling Equipment Market is experiencing dynamic growth, propelled by several key business trends including the increasing automation of workshops, the adoption of smart equipment, and a rising emphasis on ergonomic designs to improve technician safety and productivity. The automotive sector's continuous evolution, marked by larger wheel sizes, new tire technologies, and the proliferation of electric vehicles, directly impacts the demand for more advanced and specialized handling equipment. Furthermore, the global expansion of e-commerce and logistics services has created a surge in warehousing and distribution activities, which in turn fuels the need for efficient material handling solutions for commercial vehicle tires and wheels.

Regional trends indicate significant market expansion in Asia Pacific, driven by rapid industrialization, burgeoning automotive production, and increasing vehicle parc in countries like China, India, and Southeast Asian nations. North America and Europe, while representing mature markets, are characterized by a strong demand for high-end, technologically advanced, and automated solutions, often driven by stringent labor safety regulations and the adoption of Industry 4.0 principles in manufacturing and service centers. Latin America, the Middle East, and Africa are showing steady growth, primarily influenced by infrastructural development projects and the subsequent demand for heavy-duty construction and mining equipment, which require robust tire and wheel handling capabilities.

Segmentation trends highlight a notable shift towards automated and semi-automated equipment, particularly in high-volume settings where efficiency and precision are paramount. The market is also seeing increased demand for specialized equipment catering to heavy-duty applications in mining, construction, and aviation, where the sheer size and weight of tires necessitate specialized hydraulic and robotic systems. Moreover, the light-duty segment continues to thrive, driven by the vast number of automotive service centers globally. The integration of digital technologies, such as IoT sensors for predictive maintenance and software for inventory management, is also becoming a crucial differentiating factor across all segments, enabling enhanced operational intelligence and streamlined workflows.

AI Impact Analysis on Tire and Wheel Handling Equipment Market

User inquiries regarding Artificial Intelligence (AI) in the Tire and Wheel Handling Equipment market frequently revolve around its potential to revolutionize operational efficiency, enhance safety protocols, and enable predictive maintenance. Users are keenly interested in how AI can automate complex tasks, reduce human error, and optimize inventory management for tires and equipment. Common concerns include the initial investment costs, the need for skilled personnel to manage AI-integrated systems, potential job displacement, and data security implications. Expectations are high for AI to deliver smarter, more autonomous solutions that can analyze operational data to suggest improvements, anticipate equipment failures, and streamline the entire tire and wheel service ecosystem, thereby creating a more intelligent and responsive market environment.

- AI-driven automation in tire changing and balancing processes significantly reduces manual effort and improves precision.

- Predictive maintenance for handling equipment, leveraging AI to analyze usage patterns and sensor data, minimizes downtime and extends asset lifespan.

- Enhanced safety features through AI-powered vision systems and robotics, preventing accidents and ensuring correct handling procedures.

- Optimized inventory management for tires and spare parts, using AI algorithms to forecast demand and streamline logistics.

- AI integration in training simulations for technicians, providing realistic scenarios for mastering complex equipment operations.

- Development of smart, self-optimizing equipment that adapts to different tire and wheel specifications without constant manual calibration.

- Improved data analytics for service centers, offering insights into operational bottlenecks, technician performance, and customer service efficiency.

DRO & Impact Forces Of Tire and Wheel Handling Equipment Market

The Tire and Wheel Handling Equipment market is significantly shaped by a confluence of drivers, restraints, and opportunities, coupled with various impact forces. A primary driver is the continuous growth in global vehicle production and sales, which directly correlates with the demand for tire servicing and replacement across passenger, commercial, and off-road segments. Additionally, increasingly stringent safety regulations and occupational health standards worldwide compel service providers and industrial operators to invest in ergonomic and safe handling equipment, reducing manual strain and preventing injuries. The growing demand for automation and efficiency in workshops and manufacturing plants also acts as a strong driver, as businesses seek to optimize workflows and reduce labor costs.

Conversely, several restraints impede the market's full potential. The high initial investment costs associated with advanced and automated tire and wheel handling equipment can be a significant barrier for smaller businesses and independent workshops. Furthermore, the increasing complexity of modern equipment necessitates a skilled workforce for operation and maintenance, and a shortage of adequately trained technicians can hinder adoption rates. Economic downturns and geopolitical uncertainties can also negatively impact the automotive sector and associated aftermarket services, leading to reduced capital expenditure on new equipment. Moreover, the maintenance and operational complexities of sophisticated machinery sometimes deter smaller players from upgrading their existing fleet.

Despite these restraints, ample opportunities exist for market expansion and innovation. The proliferation of smart and IoT-enabled equipment offers significant potential for enhancing diagnostic capabilities, predictive maintenance, and remote monitoring, thereby improving operational uptime and efficiency. Emerging economies, particularly in Asia Pacific and Latin America, present vast untapped markets due to increasing motorization rates and developing infrastructure, leading to a surge in demand for both light-duty and heavy-duty equipment. Customization and modular solutions, allowing equipment to adapt to diverse applications and tire types, represent another growth avenue. Lastly, the integration of tire and wheel handling equipment with broader Industry 4.0 initiatives, such as factory automation and digital supply chains, promises to unlock new levels of productivity and data-driven decision-making across the value chain, driving substantial market transformation.

Segmentation Analysis

The Tire and Wheel Handling Equipment Market is comprehensively segmented to provide granular insights into its diverse components and target audiences. This segmentation allows for a detailed understanding of market dynamics across various product types, operational modes, application areas, capacity ranges, and end-user categories. The complexity of tire and wheel servicing, from small passenger vehicles to massive industrial machinery, necessitates a broad array of specialized tools and systems, each addressing unique requirements in terms of load, size, precision, and automation.

By dissecting the market along these distinct lines, stakeholders can identify specific niches, tailor product development, and refine marketing strategies. The rapid advancements in automation and digital integration are continuously influencing these segments, pushing manufacturers to innovate and offer more sophisticated solutions that cater to modern demands for efficiency, safety, and data-driven operations. Understanding these segmentations is critical for market participants to navigate the competitive landscape and capitalize on emerging trends effectively.

- By Product Type

- Tire Lifts

- Wheel Dollies

- Tire Changers

- Wheel Balancers

- Tire Inflators

- Hydraulic Jacks

- Specialized Forklifts and Manipulators

- Alignment Equipment

- Tire Repair Tools

- By Operation

- Manual

- Semi-Automatic

- Automatic

- Robotic Systems

- By Application

- Automotive Service Centers and Garages

- Tire Manufacturing Plants

- Mining and Construction Sites

- Aviation and Aerospace

- Logistics and Warehousing

- OEM Production Facilities

- Commercial Fleet Operators

- Agricultural Sector

- By Capacity

- Light-Duty (Passenger Vehicles)

- Medium-Duty (Commercial Vans, Light Trucks)

- Heavy-Duty (Trucks, Buses, Industrial Vehicles, OTR)

- By End-User

- Independent Garages

- Franchised Dealerships

- Tire Specialty Shops

- Fleet Maintenance Providers

- Industrial Sites

- Government and Public Transport Agencies

Value Chain Analysis For Tire and Wheel Handling Equipment Market

The value chain for the Tire and Wheel Handling Equipment Market begins with upstream activities, primarily involving the sourcing of raw materials and the manufacturing of essential components. This stage includes suppliers of metals such as steel and aluminum, hydraulic components, electric motors, electronic sensors, and advanced control systems. Key players in this segment are often specialized industrial component manufacturers that provide high-quality, durable parts crucial for the performance and longevity of the final equipment. Strong relationships with reliable suppliers are critical for ensuring consistent quality, managing costs, and enabling innovation in product design.

The core of the value chain lies in the manufacturing and assembly of the tire and wheel handling equipment itself. Manufacturers design, engineer, and produce a wide array of products, from basic manual tools to complex automated and robotic systems. This stage involves significant investment in R&D, advanced manufacturing processes, quality control, and testing to meet industry standards and customer expectations for safety, efficiency, and durability. Companies in this segment often specialize in certain types of equipment or cater to specific industry verticals, developing proprietary technologies and solutions.

Downstream activities encompass the distribution, sales, and aftermarket support of the equipment. Distribution channels are varied and include direct sales to large industrial clients and OEM facilities, as well as indirect channels through a network of distributors, wholesalers, and specialized retailers. Online platforms are also gaining traction, especially for smaller tools and parts. Aftermarket support, including installation, training, maintenance services, and spare parts supply, forms a critical part of the value chain, ensuring customer satisfaction and equipment uptime. Both direct sales and indirect partnerships are essential for market penetration, customer relationship management, and providing comprehensive service coverage across diverse geographic regions and customer segments.

Tire and Wheel Handling Equipment Market Potential Customers

The potential customer base for Tire and Wheel Handling Equipment is extensive and diversified, spanning across multiple industrial and automotive sectors that regularly engage in tire and wheel servicing, repair, and replacement. At the forefront are automotive service centers, which include independent garages, franchised dealerships, and specialized tire shops. These establishments require a full suite of equipment, from tire changers and balancers to lifts and alignment machines, to cater to the constant demand for vehicle maintenance and repair services for passenger cars, light trucks, and commercial vehicles. Their operational efficiency and service quality are directly tied to the reliability and modernity of their handling equipment.

Beyond the traditional automotive aftermarket, a substantial market exists within heavy-duty industrial applications. Mining and construction companies are significant end-users, requiring robust, high-capacity equipment to manage the massive, multi-ton tires found on their earthmoving machinery, excavators, and dump trucks. Similarly, the aviation sector, including airlines and maintenance, repair, and overhaul (MRO) facilities, relies on specialized equipment for handling aircraft wheels and tires, which often feature complex assemblies and strict safety protocols. Furthermore, logistics and warehousing operators, commercial fleet managers, and agricultural businesses also constitute important customer segments, each requiring specific types of handling equipment tailored to their unique operational scales and tire specifications, highlighting the broad applicability and necessity of these tools across a wide economic spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.2 Billion |

| Market Forecast in 2032 | $6.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Snap-on Incorporated, Hunter Engineering Company, Rotary Lift (Dover Corporation), Hofmann (Snap-on Equipment), John Bean (Snap-on Equipment), Coats (Hennessy Industries), Corghi S.p.A., RAVAmerica (Ravaglioli S.p.A.), Dannmar, BendPak Inc., Forward Lift (Dover Corporation), Atlas Auto Equipment, LiftKing Industries, Ranger Products (BendPak Inc.), CEMB, Sicam (Snap-on Equipment), Tech International, Branick Industries, Bishamon Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tire and Wheel Handling Equipment Market Key Technology Landscape

The Tire and Wheel Handling Equipment market is continuously evolving, driven by advancements in various technological domains aimed at enhancing efficiency, safety, and operational precision. A significant area of innovation is automation and robotics, where sophisticated robotic arms and automated guided vehicles (AGVs) are being integrated into tire manufacturing plants and large service centers. These systems perform repetitive and heavy tasks like tire mounting, balancing, and stacking, reducing manual labor, increasing throughput, and minimizing the risk of workplace injuries. The increasing complexity of modern tire and wheel assemblies, including larger diameters, lower profiles, and run-flat technologies, necessitates such automated precision to prevent damage during service.

Another crucial technological development involves the incorporation of advanced sensor technologies and the Internet of Things (IoT). Smart sensors are now embedded in equipment to monitor various parameters such as pressure, temperature, load, and operational status. This data is then transmitted via IoT platforms, enabling real-time diagnostics, predictive maintenance, and optimized resource allocation. For example, sensors can alert technicians to potential equipment malfunctions before they occur, thereby preventing costly downtime. Moreover, telematics and connectivity solutions allow for remote monitoring and software updates, ensuring that equipment always operates at peak performance and is aligned with the latest technological standards. This shift towards connected equipment is fundamentally transforming how tire and wheel handling operations are managed and maintained.

Furthermore, ergonomic design and material science play a vital role in the technological landscape. Manufacturers are increasingly focusing on designing equipment that minimizes physical strain on operators, incorporating features like adjustable heights, comfortable controls, and intuitive user interfaces. The use of advanced, lightweight yet strong materials enhances durability and maneuverability while reducing the overall weight of the equipment. Integration of augmented reality (AR) and virtual reality (VR) for training and troubleshooting is also emerging, providing immersive learning experiences and remote technical assistance. These technological advancements collectively contribute to a safer, more efficient, and ultimately more productive environment for tire and wheel handling professionals, shaping the future trajectory of the market.

Regional Highlights

- North America: A mature market characterized by high adoption of automated and technologically advanced equipment, driven by stringent safety regulations, a strong automotive aftermarket, and demand for efficiency. The US and Canada are key contributors, focusing on ergonomic designs and smart solutions.

- Europe: Similar to North America, Europe exhibits a strong preference for high-quality, precise, and environmentally friendly equipment. Germany, the UK, and France lead in adopting advanced automation and digital integration in both manufacturing and service sectors, influenced by Industry 4.0 initiatives.

- Asia Pacific (APAC): The fastest-growing region, fueled by booming automotive production, rapid industrialization, and expanding vehicle fleets in countries like China, India, Japan, and South Korea. This region shows robust demand for both cost-effective and advanced solutions, particularly in heavy-duty and OEM segments.

- Latin America: Experiencing steady growth driven by increasing vehicle ownership, urbanization, and infrastructural development projects. Brazil and Mexico are significant markets, with rising demand for both light-duty and medium-duty equipment to support expanding automotive service networks and commercial vehicle fleets.

- Middle East and Africa (MEA): Emerging market with growth propelled by investments in infrastructure, mining, and transportation sectors. The Gulf Cooperation Council (GCC) countries and South Africa are key areas, demonstrating increasing adoption of heavy-duty equipment for commercial and industrial applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tire and Wheel Handling Equipment Market.- Bosch

- Snap-on Incorporated

- Hunter Engineering Company

- Rotary Lift (Dover Corporation)

- Hofmann (Snap-on Equipment)

- John Bean (Snap-on Equipment)

- Coats (Hennessy Industries)

- Corghi S.p.A.

- RAVAmerica (Ravaglioli S.p.A.)

- Dannmar

- BendPak Inc.

- Forward Lift (Dover Corporation)

- Atlas Auto Equipment

- LiftKing Industries

- Ranger Products (BendPak Inc.)

- CEMB

- Sicam (Snap-on Equipment)

- Tech International

- Branick Industries

- Bishamon Industries

Frequently Asked Questions

What is the projected growth rate of the Tire and Wheel Handling Equipment Market?

The Tire and Wheel Handling Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032.

What are the primary drivers for the Tire and Wheel Handling Equipment Market?

Key drivers include increasing global vehicle production, stringent safety regulations, growing demand for automation and efficiency in service centers, and the expansion of e-commerce logistics requiring extensive commercial fleet maintenance.

How is AI impacting the Tire and Wheel Handling Equipment Market?

AI is enhancing market operations through automation, predictive maintenance for equipment, improved safety features via vision systems, optimized inventory management, and intelligent training simulations for technicians, leading to greater efficiency and precision.

Which regions are expected to show significant growth in this market?

Asia Pacific is projected to be the fastest-growing region due to rapid industrialization and booming automotive production, while North America and Europe will continue to adopt high-end, technologically advanced solutions.

What types of equipment are included in the Tire and Wheel Handling Equipment Market?

The market includes a wide range of products such as tire lifts, wheel dollies, tire changers, wheel balancers, hydraulic jacks, specialized forklifts, tire inflators, alignment equipment, and various tire repair tools.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager