Tire Retreading Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430052 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Tire Retreading Market Size

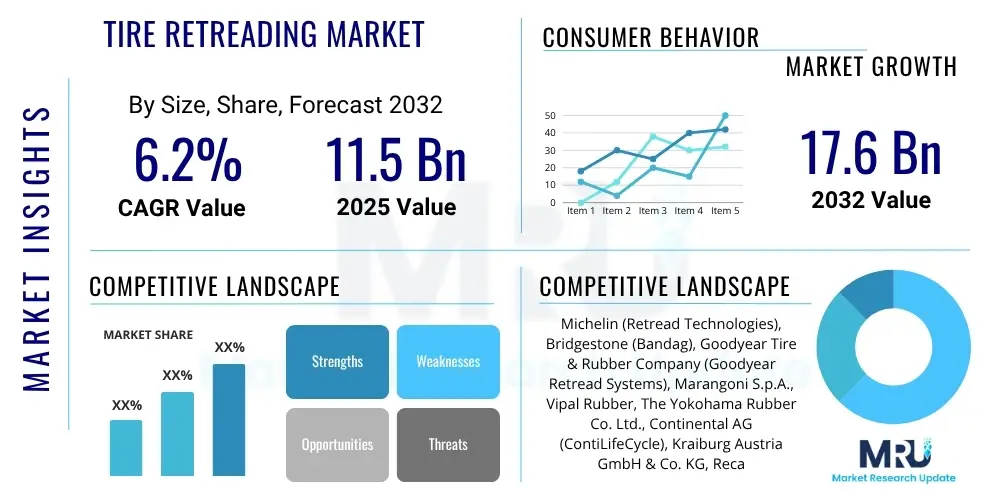

The Tire Retreading Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2032. The market is estimated at USD 11.5 billion in 2025 and is projected to reach USD 17.6 billion by the end of the forecast period in 2032.

Tire Retreading Market introduction

The Tire Retreading Market encompasses the process of re-manufacturing used tires, primarily commercial vehicle tires, by applying a new tread to the existing tire casing. This sustainable practice extends the lifespan of tires, reducing waste and raw material consumption. The product involves carefully inspecting a worn tire casing, buffing the old tread, and then applying a new tread rubber through either a pre-cure or mold cure process, restoring the tire to near-new performance specifications. Major applications include heavy-duty trucks and buses, aviation, and off-the-road (OTR) vehicles suchating in sectors like construction, mining, and agriculture, where tire costs are substantial and durability is paramount.

The primary benefits of tire retreading are significant cost savings for fleet operators, who can acquire a retreaded tire for a fraction of the price of a new tire, and substantial environmental advantages due to reduced carbon footprint and less waste sent to landfills. This process leverages the structural integrity of the tire casing, which often remains sound even after the original tread wears out. Key driving factors for market growth include the increasing emphasis on sustainable practices and circular economy principles, the rising cost of new tires and raw materials, and the expansion of logistics and transportation industries globally, particularly in emerging economies where cost efficiency is a major priority for fleet management.

Tire Retreading Market Executive Summary

The Tire Retreading Market is experiencing robust growth driven by escalating operational costs for commercial fleets, stringent environmental regulations pushing for circular economy models, and continuous advancements in retreading technologies that enhance product quality and performance. Business trends indicate a shift towards advanced inspection techniques, improved rubber compounds, and greater adoption of fleet management solutions that integrate retreaded tires into a holistic tire lifecycle strategy. Companies are increasingly investing in automation and data analytics to optimize the retreading process, ensuring consistency and reliability, which are critical for securing trust among fleet operators.

Regional trends reveal that Asia Pacific is emerging as a significant growth hub, propelled by rapid industrialization, expanding transportation infrastructure, and the proliferation of commercial vehicle fleets in countries such as China and India. North America and Europe, while mature markets, continue to demonstrate stable growth, supported by established retreading industries, strong regulatory frameworks promoting sustainability, and a high adoption rate among large logistics companies. Latin America and the Middle East and Africa are also showing promising potential due to economic development and increasing demand for cost-effective fleet maintenance solutions. These regions are actively exploring retreading as a viable alternative to new tire purchases.

Segment trends highlight that the truck and bus tire segment remains the dominant application, accounting for the largest share of the market, primarily due to the high volume of commercial road transport and the economic benefits retreading offers to these intensive operations. The aircraft tire retreading segment is also witnessing steady growth, driven by safety standards and the specialized nature of aviation maintenance, where retreading is a well-established and certified practice. Furthermore, the off-the-road (OTR) tire segment is gaining traction, especially in the mining and construction industries, where massive tires represent a substantial capital investment, making retreading an indispensable cost-saving measure for equipment uptime and operational efficiency.

AI Impact Analysis on Tire Retreading Market

User inquiries about AI's role in the Tire Retreading Market frequently center on its potential to enhance quality control, optimize production processes, and improve predictive maintenance for retreaded tires. Common themes include how AI can ensure the integrity of casings, reduce human error, and provide better insights into tire performance post-retreading. There is also significant interest in AI's ability to drive efficiency, automate decision-making in complex inspection tasks, and personalize product offerings based on fleet-specific usage patterns. Users anticipate AI will lead to more reliable, longer-lasting retreaded tires, ultimately bolstering the industry's reputation for quality and safety. The market expects AI to transition retreading from a traditional craft to a high-tech manufacturing process.

- AI-powered visual inspection systems enhance defect detection in tire casings, improving quality control.

- Predictive analytics optimize scheduling of retreading operations and inventory management for raw materials and casings.

- Machine learning algorithms analyze performance data to refine tread designs and rubber compounds for specific applications.

- Robotics integrated with AI can automate labor-intensive processes such as buffing and tread application, increasing precision and efficiency.

- AI-driven supply chain optimization improves logistics for casing collection and distribution of retreaded tires.

- Enhanced traceability through AI and IoT can track tire history and performance, improving lifecycle management.

- Customized retreading solutions developed using AI provide tailored performance for diverse fleet requirements.

DRO & Impact Forces Of Tire Retreading Market

The Tire Retreading Market is significantly shaped by a confluence of drivers, restraints, and opportunities, alongside various impact forces that influence its trajectory. Key drivers include the compelling cost efficiency offered by retreaded tires, which can be up to 30-50% cheaper than new ones, making them highly attractive to cost-conscious fleet operators. Furthermore, the growing global emphasis on environmental sustainability and circular economy principles is pushing industries to adopt practices that reduce waste and conserve resources, directly benefiting the retreading sector. The increasing volume of commercial vehicle traffic globally, especially in developing regions, also generates a consistent demand for tire maintenance solutions, including retreading. Volatility in raw material prices for new tire manufacturing makes retreading an even more appealing and stable alternative.

However, the market faces several restraints that could hinder its growth. A persistent challenge is the lingering perception among some end-users that retreaded tires are inferior in quality or safety compared to new tires, despite significant technological advancements proving otherwise. This perception often requires substantial educational efforts from industry players. Additionally, rapid innovations in new tire technology, such as longer-lasting compounds or improved fuel efficiency designs, can sometimes reduce the perceived need for retreading. Regulatory variations across different regions regarding tire safety standards and disposal methods also create complexities for market penetration. The overall lack of widespread awareness about the benefits and technological sophistication of modern retreading practices continues to be a barrier in certain markets.

Opportunities for growth are abundant within the Tire Retreading Market. Untapped markets, particularly in rapidly industrializing nations, present significant avenues for expansion as commercial fleets grow and seek economical solutions. Continuous technological innovation, including advancements in inspection techniques, rubber formulations, and automated processes, can further enhance the quality and reliability of retreaded tires, broadening their appeal. Government support for green initiatives, sustainability mandates, and tax incentives for recycling or reusing materials can provide a substantial boost to the industry. The ongoing growth in global logistics and e-commerce further fuels demand for commercial vehicles, indirectly creating a larger pool of potential casings for retreading. These opportunities, coupled with ongoing efforts to educate consumers, are poised to drive the market forward.

Segmentation Analysis

The Tire Retreading Market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation allows for targeted analysis of market trends, identifying key areas of growth, and understanding specific customer needs across various applications and technologies. The market is primarily categorized by processes, vehicle types, and end-use sectors, each with distinct characteristics influencing market demand and supply. Understanding these segments is crucial for businesses looking to strategically position themselves within the global retreading landscape, enabling them to develop specialized products and services that cater to specific market niches and optimize operational efficiencies.

- By Process

- Pre-cure Retreading: A tread rubber, already patterned and vulcanized, is applied to the buffed casing.

- Mold Cure Retreading: Unvulcanized rubber is applied to the casing, which is then cured in a mold to form the tread pattern.

- By Vehicle Type

- Truck and Bus Tires: Dominant segment, driven by commercial transportation.

- Aircraft Tires: High-safety, specialized application with strict regulatory oversight.

- Off-the-Road (OTR) Tires: Used in construction, mining, and agriculture; large, expensive tires making retreading highly economical.

- Light Commercial Vehicle (LCV) Tires: Emerging segment, smaller scale than heavy-duty.

- By End-Use

- Fleet Operators: Large transportation and logistics companies, primary buyers.

- Independent Dealers and Service Providers: Purchase retreads for resale or use in their service networks.

- Government and Public Transport Agencies: Utilize retreaded tires for their municipal fleets.

- Aviation Companies: Airlines and cargo carriers.

- Construction and Mining Companies: Heavy equipment operators.

- Agricultural Sector: Farm machinery operators.

Value Chain Analysis For Tire Retreading Market

The value chain for the Tire Retreading Market begins with the upstream activities focused on sourcing and preparing tire casings. This involves the collection of worn but structurally sound tire casings from fleet operators, tire dealers, and scrap yards. Rigorous inspection and sorting processes are critical at this stage to identify suitable casings that meet quality standards for retreading. Suppliers of raw materials such as tread rubber compounds, cushion gum, and bonding agents also form a crucial part of the upstream segment, ensuring the availability of high-quality materials required for the actual retreading process. The efficiency of casing collection and the quality of raw materials directly impact the final retreaded product.

The core of the value chain lies in the retreading process itself, performed by specialized retread manufacturers. These manufacturers undertake detailed inspections, buffing, repair, and the application of new tread using either pre-cure or mold cure techniques, followed by vulcanization. This stage adds significant value by transforming a worn casing into a high-performance, cost-effective tire. The distribution channel then takes over, moving the finished retreaded tires to end-users. This can involve direct sales from large retreaders to major fleet operators, allowing for personalized service and bulk orders. Alternatively, indirect channels, such as authorized dealers, distributors, and independent tire service centers, play a vital role in reaching a broader base of smaller fleets and individual commercial vehicle owners, providing accessibility and local support.

Downstream activities primarily involve the utilization of retreaded tires by various end-users, including commercial trucking fleets, public transportation authorities, aviation companies, and operators in the construction, mining, and agricultural sectors. These end-users benefit from the economic and environmental advantages of retreading, integrating these tires into their maintenance schedules. Post-usage, the cycle often loops back, with some retreaded casings potentially being suitable for a second or even third retreading, further maximizing their lifecycle. The entire value chain emphasizes sustainability and cost-efficiency, highlighting the collaborative efforts from casing collection to final deployment and potentially re-entry into the retreading process, ensuring maximum resource utilization.

Tire Retreading Market Potential Customers

The primary potential customers for the Tire Retreading Market are large-scale commercial fleet operators who manage extensive networks of vehicles. These include trucking companies, logistics providers, and parcel delivery services, where tire expenses represent a significant portion of their operational budget. Their decision-making is driven by a strong need for cost reduction without compromising safety or efficiency, making retreaded tires an ideal solution. The ability to significantly lower per-mile tire costs while maintaining performance standards is a key attractant for these heavy-duty users who operate continuously and require reliable and durable tire solutions for their long-haul and regional transportation needs. Building long-term relationships with these fleet operators through bulk purchasing agreements and comprehensive service contracts is critical.

Beyond the road transport sector, other major end-users include public transportation agencies, such as municipal bus services, which benefit from the economic and environmental advantages of retreading for their extensive urban fleets. Aviation companies, including commercial airlines and cargo carriers, are also significant customers, relying on highly specialized and certified aircraft tire retreading due to the stringent safety regulations and immense costs associated with new aviation tires. This segment values precision, certified quality, and the proven reliability of retreaded tires in demanding operational environments. The robust nature of aircraft tire casings allows for multiple retreads, making it a highly sustainable practice within the aviation industry, supported by strict regulatory approvals.

Furthermore, operators of heavy equipment in the off-the-road (OTR) sectors, specifically mining, construction, and agriculture, represent a substantial customer base. The tires used in these industries are exceptionally large, durable, and expensive, often costing tens of thousands of dollars per unit. For these operators, retreading offers immense cost savings and extends the operational life of highly specialized assets, directly impacting their bottom line and equipment uptime. Additionally, independent tire dealers and service centers also serve as indirect customers, purchasing retreaded tires from manufacturers to offer to smaller local businesses and individual commercial vehicle owners, fulfilling a broad range of market demands and acting as crucial intermediaries in the distribution network.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 11.5 billion |

| Market Forecast in 2032 | USD 17.6 billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin (Retread Technologies), Bridgestone (Bandag), Goodyear Tire & Rubber Company (Goodyear Retread Systems), Marangoni S.p.A., Vipal Rubber, The Yokohama Rubber Co. Ltd., Continental AG (ContiLifeCycle), Kraiburg Austria GmbH & Co. KG, Recamic (Michelin), Salvador Caetano Indústria S.A., Shandong Linglong Tyre Co. Ltd., Sumitomo Rubber Industries, Ltd., Treadco, MRF Tyres, Apollo Tyres Ltd., Nokian Tyres PLC, Cooper Tire & Rubber Company, Trelleborg AB, Kal Tire, CRM - Comercial de Rechapagem de Pneus e Acessórios, S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tire Retreading Market Key Technology Landscape

The Tire Retreading Market is undergoing a significant technological transformation, moving beyond traditional manual processes to incorporate advanced systems that enhance quality, efficiency, and safety. One of the most critical technologies is the use of non-destructive testing (NDT) methods for casing inspection. Technologies like shearography and X-ray inspection are routinely employed to detect internal structural defects, separations, or foreign objects within the tire casing that are not visible to the naked eye. This rigorous inspection process is fundamental to ensuring the integrity and safety of the retreaded tire, significantly reducing the risk of failures and extending the potential lifespan of the casing through multiple retreads. The precision offered by these technologies ensures only high-quality casings proceed to the next stages of retreading.

Further advancements are seen in automated buffing and tread application systems. Modern retreading plants increasingly utilize robotic buffing machines that precisely remove the worn tread and prepare the casing surface with consistent texture and dimension, crucial for optimal adhesion of the new tread rubber. Computerized tread builders ensure accurate application of the new tread material, whether it's a pre-cure strip or unvulcanized rubber for mold cure processes. These automated systems minimize human error, improve process consistency, and increase throughput. Additionally, innovations in rubber compounding continuously lead to the development of specialized tread compounds that offer enhanced durability, fuel efficiency, and traction characteristics, tailored for various applications and regional conditions, making retreaded tires more competitive with new tires in terms of performance.

The integration of digital technologies such as RFID (Radio-Frequency Identification) and IoT (Internet of Things) is also revolutionizing tire lifecycle management within the retreading sector. RFID tags embedded in tire casings allow for seamless tracking of each tire's history, including mileage, maintenance records, and previous retreading cycles. This data-driven approach enables fleet operators and retreaders to make informed decisions about tire management, optimizing retreading schedules and maximizing the value extracted from each casing. Furthermore, advanced diagnostic software and data analytics are used to monitor tire performance in real-time, offering insights into wear patterns and predicting maintenance needs, thereby extending tire life and reducing operational costs. These technologies collectively contribute to a more sophisticated, reliable, and sustainable tire retreading industry.

Regional Highlights

- North America: A mature market with established retreading infrastructure and high adoption rates, particularly among large commercial fleets. Strong regulatory frameworks and emphasis on cost-efficiency drive consistent demand.

- Europe: Characterized by stringent environmental regulations and a strong commitment to circular economy principles. Germany, France, and the UK lead in retreading adoption, supported by well-developed road networks and emphasis on sustainability.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid industrialization, expanding commercial vehicle fleets, and increasing focus on cost-effective fleet management in emerging economies like China, India, and Southeast Asian countries.

- Latin America: Exhibiting significant growth potential due to economic development, expanding logistics industries, and the increasing need for economical tire solutions across Brazil, Mexico, and Argentina.

- Middle East and Africa (MEA): An emerging market driven by infrastructure projects, growth in transportation, and increasing awareness of the economic benefits of retreading for diverse vehicle types in countries such as South Africa and UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tire Retreading Market.- Michelin (Retread Technologies)

- Bridgestone (Bandag)

- Goodyear Tire & Rubber Company (Goodyear Retread Systems)

- Marangoni S.p.A.

- Vipal Rubber

- The Yokohama Rubber Co. Ltd.

- Continental AG (ContiLifeCycle)

- Kraiburg Austria GmbH & Co. KG

- Recamic (Michelin)

- Salvador Caetano Indústria S.A.

- Shandong Linglong Tyre Co. Ltd.

- Sumitomo Rubber Industries, Ltd.

- Treadco

- MRF Tyres

- Apollo Tyres Ltd.

- Nokian Tyres PLC

- Cooper Tire & Rubber Company

- Trelleborg AB

- Kal Tire

- CRM - Comercial de Rechapagem de Pneus e Acessórios, S.A.

Frequently Asked Questions

What is tire retreading and how does it benefit fleet operators?

Tire retreading is the process of replacing the worn tread of a used tire with a new one, extending its lifespan. It primarily benefits fleet operators by offering significant cost savings, as a retreaded tire costs substantially less than a new tire, while also contributing to environmental sustainability through reduced waste and resource consumption.

Are retreaded tires safe and reliable for commercial vehicles?

Yes, modern retreaded tires are highly safe and reliable. They undergo rigorous inspection processes, including advanced non-destructive testing, and adhere to strict quality standards and certifications. Many commercial fleets, including airlines, rely on retreaded tires due to their proven performance and durability under demanding conditions.

What types of tires can be retreaded?

The majority of tires that can be retreaded are commercial vehicle tires, including those for trucks, buses, aircraft, and heavy off-the-road (OTR) equipment used in construction, mining, and agriculture. The suitability for retreading depends on the casing's structural integrity, which is assessed through detailed inspections.

How do retreaded tires contribute to environmental sustainability?

Retreaded tires significantly contribute to environmental sustainability by reducing the number of new tires manufactured, thus saving raw materials like rubber and oil. They also decrease the volume of end-of-life tires sent to landfills, lowering waste generation and the carbon footprint associated with tire production and disposal.

What is the typical lifespan of a retreaded tire compared to a new tire?

The lifespan of a high-quality retreaded tire is often comparable to that of a new premium tire, especially when used in appropriate applications and maintained correctly. Modern retreading processes and advanced tread compounds ensure excellent durability and performance, allowing fleets to achieve similar mileage per tire at a fraction of the cost.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager