Tissue Diagnostics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428140 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Tissue Diagnostics Market Size

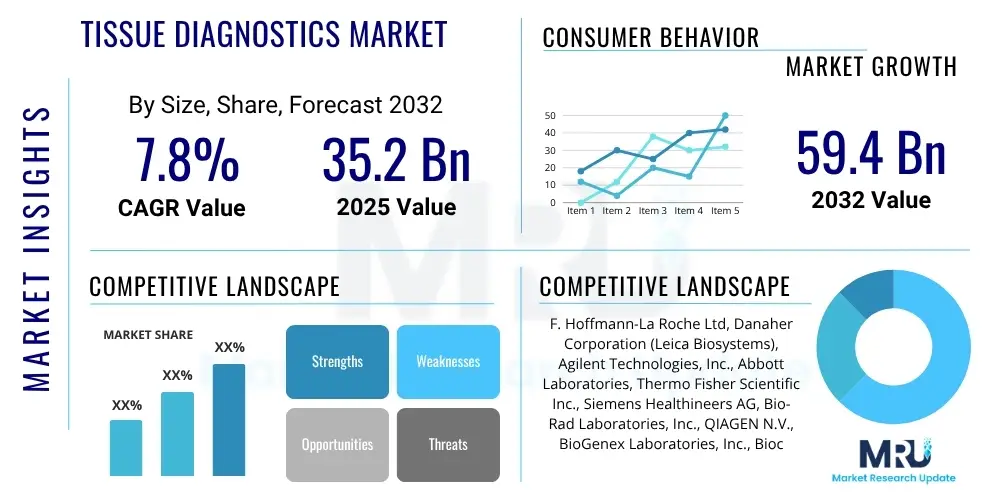

The Tissue Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 35.2 Billion in 2025 and is projected to reach USD 59.4 Billion by the end of the forecast period in 2032.

Tissue Diagnostics Market introduction

The Tissue Diagnostics Market encompasses a broad spectrum of medical technologies and services focused on analyzing tissue samples for the accurate diagnosis and prognosis of diseases, predominantly cancer. This vital field involves the examination of biopsies and surgical resections using advanced techniques to identify cellular and molecular abnormalities. Key products include specialized instruments such as automated stainers, slide scanners, and microscopy systems, along with a wide array of reagents, including antibodies for immunohistochemistry (IHC), probes for in situ hybridization (ISH), and various molecular pathology kits. Major applications span oncology, where it plays a crucial role in cancer staging, classification, and guiding treatment decisions, as well as infectious diseases, neurological disorders, and autoimmune conditions. The fundamental benefits of tissue diagnostics lie in its ability to provide definitive diagnoses, facilitate personalized medicine approaches, and improve patient outcomes through precise characterization of diseases. Driving factors for market expansion include the increasing global incidence of cancer, the growing adoption of personalized medicine, technological advancements in digital pathology and molecular analysis, and a heightened demand for accurate and early disease detection methods. The continuous innovation in diagnostic platforms, coupled with rising healthcare expenditures and an aging global population, further propels the market forward by enhancing diagnostic capabilities and workflow efficiencies in pathology laboratories worldwide. The integration of advanced imaging and analytical tools is transforming traditional pathology, making diagnoses more objective and reproducible.

Tissue Diagnostics Market Executive Summary

The Tissue Diagnostics Market is experiencing robust growth, primarily driven by the escalating global burden of cancer and the paradigm shift towards personalized medicine. Key business trends indicate a strong emphasis on automation, digitalization of pathology workflows, and the integration of artificial intelligence (AI) for enhanced diagnostic accuracy and efficiency. Strategic collaborations between diagnostic companies and pharmaceutical firms for companion diagnostics are also becoming increasingly prevalent, aiming to tailor treatments based on specific molecular profiles identified through tissue analysis. Regional trends highlight North America and Europe as established leaders due to advanced healthcare infrastructure, significant R&D investments, and high adoption rates of sophisticated diagnostic technologies. However, the Asia Pacific region is rapidly emerging as a high-growth market, propelled by improving healthcare access, rising awareness, and increasing investments in diagnostic capabilities, particularly in populous countries like China and India. Segment-wise, the immunohistochemistry (IHC) and in situ hybridization (ISH) segments continue to dominate due to their widespread utility in oncology, while the digital pathology and image analysis segment is projected to witness the fastest growth, driven by its potential to overcome geographical barriers, improve workflow, and facilitate remote consultations. The market is also seeing a surge in demand for molecular pathology techniques, which offer deeper insights into disease mechanisms and contribute significantly to targeted therapy selection. These collective trends underscore a dynamic market landscape focused on innovation, efficiency, and precision in disease diagnosis.

AI Impact Analysis on Tissue Diagnostics Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Tissue Diagnostics Market frequently revolve around its potential to revolutionize diagnostic accuracy, streamline pathology workflows, and address the global shortage of skilled pathologists. Users are often concerned about the reliability and validation of AI algorithms, the ethical implications of AI-driven diagnoses, and the challenges associated with data privacy and security in digital pathology platforms. There is significant interest in how AI can assist in cancer detection, grading, and prognosis, as well as its role in identifying novel biomarkers and facilitating the development of personalized treatment strategies. Expectations are high for AI to reduce diagnostic variability, improve turnaround times, and ultimately lead to more precise and timely patient care, while also pondering the necessary infrastructure and regulatory frameworks required for widespread adoption. The integration of AI tools promises to transform the daily practice of pathology, shifting pathologists' roles towards more complex analytical tasks and validation of AI outputs, rather than purely manual microscopic examination. This transformation necessitates ongoing training and adaptation within the pathology community to harness the full potential of these advanced technologies.

- Enhanced diagnostic accuracy through automated image analysis and pattern recognition.

- Increased efficiency in pathology labs by automating repetitive tasks like slide screening and quantification.

- Identification of subtle cellular and molecular features often missed by the human eye.

- Improved workflow and reduced turnaround times for tissue sample analysis.

- Development of predictive and prognostic biomarkers for personalized medicine.

- Facilitation of drug discovery and development by accelerating biomarker identification and validation.

- Standardization of diagnostic interpretations, reducing inter-pathologist variability.

- Support for remote pathology and telepathology, expanding access to expert diagnostics.

- Potential to mitigate the impact of the global shortage of trained pathologists.

- Integration with existing Laboratory Information Systems (LIS) for seamless data management.

DRO & Impact Forces Of Tissue Diagnostics Market

The Tissue Diagnostics Market is significantly influenced by a complex interplay of driving forces, constraining factors, and emerging opportunities, all of which are subject to various impact forces. The primary drivers include the continuously increasing global incidence and prevalence of various cancers, necessitating accurate and early diagnostic methods, alongside the growing adoption of personalized medicine approaches that rely on detailed tissue analysis for tailored treatments. Technological advancements in digital pathology, molecular diagnostics, and automation also act as strong propellers, enhancing diagnostic precision and laboratory efficiency. Conversely, the market faces significant restraints such as the high capital investment required for advanced tissue diagnostic instruments and the substantial cost associated with specialized reagents and consumables. Stringent regulatory approval processes for new diagnostic tests and devices, coupled with reimbursement challenges in various healthcare systems, can also impede market growth. Furthermore, the shortage of skilled pathologists and histotechnicians, particularly in developing regions, poses an operational challenge. Despite these hurdles, substantial opportunities lie in the integration of artificial intelligence and machine learning for advanced image analysis, expansion into emerging economies with developing healthcare infrastructures, and the growing research into novel biomarkers and companion diagnostics. External impact forces, such as shifts in healthcare policies, changes in public health priorities, economic fluctuations affecting healthcare budgets, and the evolving competitive landscape with new market entrants and strategic collaborations, constantly shape the market trajectory. These forces collectively dictate the pace and direction of innovation and adoption within the tissue diagnostics sector, requiring stakeholders to continuously adapt and strategically position themselves to capitalize on favorable trends while mitigating potential risks.

Segmentation Analysis

The Tissue Diagnostics Market is extensively segmented based on various criteria, including the types of products offered, the underlying technologies employed, the specific applications of these diagnostics, and the end-users benefiting from these solutions. This detailed segmentation provides a comprehensive understanding of the market structure, highlighting areas of high growth, technological innovation, and evolving demand patterns. Each segment plays a critical role in defining the overall landscape, ranging from the fundamental instrumentation and reagents to advanced software solutions and specialized diagnostic services. Understanding these distinctions is crucial for market players to develop targeted strategies and for healthcare providers to make informed decisions regarding diagnostic investments.

- By Product:

- Instruments

- Automated Slide Stainers

- Slide Scanners

- Microscopy Systems

- Tissue Processors

- Other Instruments (e.g., embedding centers, microtomes, cryostats)

- Reagents & Kits

- Antibodies (Primary, Secondary)

- Probes (DNA, RNA)

- Chromogens & Detection Systems

- Special Stains

- Fixatives & Embedding Media

- Blocking Reagents

- Wash Buffers

- Other Consumables

- Services

- Histopathology Services

- Immunohistochemistry Services

- In Situ Hybridization Services

- Digital Pathology & Image Analysis Services

- Contract Research Organization (CRO) Services

- Instruments

- By Technology:

- Immunohistochemistry (IHC)

- Direct IHC

- Indirect IHC

- In Situ Hybridization (ISH)

- Fluorescence In Situ Hybridization (FISH)

- Chromogenic In Situ Hybridization (CISH)

- Silver In Situ Hybridization (SISH)

- Digital Pathology & Image Analysis

- Whole Slide Imaging (WSI)

- Image Analysis Software

- Data Management Systems

- Special Stains

- Hematoxylin & Eosin (H&E)

- Masson's Trichrome

- Periodic Acid–Schiff (PAS)

- Other Specific Stains

- Molecular Pathology

- Polymerase Chain Reaction (PCR)

- Next-Generation Sequencing (NGS)

- Microarrays

- Fluorescent In Situ Hybridization (FISH) based Molecular Tests

- Immunohistochemistry (IHC)

- By Application:

- Oncology

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Gastric Cancer

- Melanoma

- Brain Cancer

- Lymphoma

- Other Cancers

- Infectious Diseases

- Neurological Disorders

- Autoimmune Diseases

- Other Applications (e.g., Nephrology, Dermatology)

- Oncology

- By End-User:

- Hospitals

- Diagnostic Laboratories

- Reference Laboratories

- Clinical Laboratories

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Pharmaceutical & Biotechnology Companies

Value Chain Analysis For Tissue Diagnostics Market

The value chain for the Tissue Diagnostics Market is intricate, involving multiple stages from initial research and development to final patient diagnosis and treatment guidance, highlighting the collaborative efforts across various stakeholders. The upstream segment of the value chain is dominated by raw material suppliers and manufacturers of core components, including highly purified chemical reagents, specialized plastics, glass slides, and precision optics used in instrument manufacturing. This also includes the development and production of primary and secondary antibodies, nucleic acid probes, and other sophisticated biological reagents crucial for diagnostic assays. Key players in this stage focus on innovation, quality control, and cost-effectiveness to supply robust components and reagents to instrument and kit manufacturers. The quality and specificity of these upstream products directly impact the accuracy and reliability of downstream diagnostic outcomes, making supplier relationships and supply chain resilience paramount for market participants.

Moving downstream, the value chain progresses to the manufacturing of integrated tissue diagnostic instruments, assay kits, and software solutions, followed by their distribution to end-users. This stage involves significant investment in R&D for product development, clinical validation, and regulatory approvals. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves manufacturers selling directly to large hospitals, diagnostic laboratory chains, and academic research institutions, offering personalized support, training, and maintenance services. This approach fosters strong customer relationships and allows for direct feedback on product performance. Indirect distribution, on the other hand, relies on a network of distributors, wholesalers, and third-party logistics providers, especially for reaching smaller laboratories, clinics, and expanding into geographically diverse or emerging markets. These intermediaries often provide regional market expertise, broader market access, and efficient inventory management, albeit at the cost of direct customer interaction.

The final stages of the value chain involve the actual application of tissue diagnostic tools by pathologists and laboratory technicians in hospitals, diagnostic laboratories, and research institutions. Here, the focus is on accurate sample processing, staining, analysis, and interpretation to deliver a diagnosis or provide prognostic information. The results from tissue diagnostics are then utilized by clinicians to inform treatment decisions, particularly in oncology where companion diagnostics guide targeted therapies. Further downstream, pharmaceutical and biotechnology companies leverage these diagnostic insights for drug discovery, clinical trials, and developing new therapeutic interventions. The effectiveness and efficiency of the entire value chain are critical for improving patient outcomes, reducing healthcare costs, and accelerating medical advancements. The seamless flow of products, information, and services across these interconnected stages ensures that advanced diagnostic capabilities are accessible and effectively utilized in clinical practice.

Tissue Diagnostics Market Potential Customers

The Tissue Diagnostics Market serves a diverse array of potential customers, each with specific needs and demands for diagnostic accuracy, efficiency, and advanced analytical capabilities. The primary end-users are hospitals, ranging from large academic medical centers to community hospitals, which require comprehensive tissue diagnostic solutions for their in-house pathology departments. These institutions utilize tissue diagnostics for routine disease screening, definitive diagnosis of complex conditions, surgical pathology, and often for supporting multidisciplinary tumor boards. Hospitals are particularly interested in integrated systems that offer high throughput, automation, and compatibility with existing Laboratory Information Systems (LIS) to manage a large volume of patient samples and ensure rapid turnaround times for critical diagnoses. The demand from hospitals is also driven by the need for personalized medicine, where specific biomarkers identified through tissue analysis guide therapeutic decisions, especially in oncology. The ability to perform a wide range of IHC and ISH tests, along with digital pathology capabilities, is paramount for these major healthcare providers.

Another significant customer segment comprises diagnostic laboratories, which include both large reference laboratories and smaller independent clinical pathology labs. Reference laboratories often handle highly specialized or complex tests, serving a broad geographical area and receiving samples from numerous healthcare facilities. These labs prioritize advanced, high-throughput automated systems and robust molecular diagnostic platforms to achieve economies of scale and maintain high levels of accuracy. Independent clinical labs, while smaller in scale, also require reliable and cost-effective tissue diagnostic solutions for their local patient populations. Both types of diagnostic laboratories seek solutions that can reduce manual intervention, minimize errors, and comply with stringent regulatory standards, ensuring the delivery of precise and timely diagnostic reports to referring physicians. The trend towards outsourcing specialized tests to reference labs also creates a sustained demand for sophisticated tissue diagnostic services within this segment.

Beyond clinical settings, academic and research institutes represent a crucial customer base, leveraging tissue diagnostics for basic scientific inquiry, translational research, and the development of new diagnostic assays and therapeutic targets. These institutions are often at the forefront of innovation, exploring novel biomarkers and applying cutting-edge technologies like next-generation sequencing to tissue samples. Their needs are typically focused on highly sensitive and specific research-use-only reagents, advanced image analysis software, and flexible instrumentation that can be adapted for experimental protocols. Pharmaceutical and biotechnology companies also constitute significant potential customers, particularly in the context of companion diagnostics development. These companies rely on tissue diagnostics to identify patient populations most likely to respond to a particular drug, select patients for clinical trials, and monitor therapeutic efficacy. Contract Research Organizations (CROs) further bridge the gap between research and clinical application, providing specialized tissue diagnostic services for preclinical and clinical trials on behalf of pharma and biotech clients, requiring high-quality, standardized, and scalable diagnostic platforms. The diversity of these customer segments underscores the broad applicability and critical importance of tissue diagnostics across the entire healthcare and life sciences ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 35.2 Billion |

| Market Forecast in 2032 | USD 59.4 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | F. Hoffmann-La Roche Ltd, Danaher Corporation (Leica Biosystems), Agilent Technologies, Inc., Abbott Laboratories, Thermo Fisher Scientific Inc., Siemens Healthineers AG, Bio-Rad Laboratories, Inc., QIAGEN N.V., BioGenex Laboratories, Inc., Biocare Medical, LLC, Cell Signaling Technology, Inc., Merck KGaA, Ventana Medical Systems, Inc. (a member of Roche Group), Sakura Finetek Japan Co., Ltd., Sysmex Corporation, Becton, Dickinson and Company (BD), Abcam plc, GenScript Biotech Corporation, PerkinElmer Inc., Enzo Biochem, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tissue Diagnostics Market Key Technology Landscape

The technological landscape of the Tissue Diagnostics Market is characterized by continuous innovation aimed at improving diagnostic accuracy, throughput, and efficiency. Immunohistochemistry (IHC) remains a cornerstone technology, utilizing highly specific antibodies to detect antigens in tissue sections, providing critical information for cancer diagnosis, prognosis, and therapeutic decision-making. Advancements in IHC involve multiplexing capabilities, allowing for the simultaneous detection of multiple biomarkers on a single slide, thereby conserving precious tissue samples and enhancing diagnostic insights. Automated IHC platforms have significantly increased throughput and reduced manual errors, standardizing staining protocols and improving reproducibility across laboratories. Similarly, In Situ Hybridization (ISH), including Fluorescence In Situ Hybridization (FISH) and Chromogenic In Situ Hybridization (CISH), is widely employed for detecting specific DNA or RNA sequences within tissue cells. These technologies are crucial for identifying gene amplifications, deletions, and translocations, which are vital for classifying certain cancers and guiding targeted therapies, such as HER2 testing in breast cancer. Innovations in ISH focus on developing more robust probes, improving signal detection, and integrating with automated systems for higher efficiency.

Digital pathology and whole slide imaging (WSI) represent a transformative shift in the market, converting traditional glass slides into high-resolution digital images that can be viewed, analyzed, and shared remotely. This technology addresses several challenges, including the need for expert second opinions across geographical distances, archiving, and facilitating educational programs. WSI systems are complemented by sophisticated image analysis software, which leverages advanced algorithms to quantify cellular features, tumor burden, and biomarker expression with unprecedented precision and objectivity, surpassing manual microscopic examination. The integration of artificial intelligence (AI) and machine learning (ML) within digital pathology platforms is rapidly evolving, enabling automated prescreening of slides for abnormalities, identification of subtle diagnostic patterns, and the development of predictive analytics for patient outcomes. AI-powered tools promise to enhance diagnostic accuracy, reduce inter-observer variability, and improve the overall efficiency of pathology workflows, helping to mitigate the increasing workload on pathologists and address workforce shortages.

Beyond traditional histopathology, molecular pathology techniques are playing an increasingly important role in tissue diagnostics, offering deeper insights into the genetic and epigenetic profiles of diseases. Polymerase Chain Reaction (PCR) based assays are used for detecting specific genetic mutations or pathogens in tissue samples, while Next-Generation Sequencing (NGS) allows for comprehensive genomic profiling of tumors, identifying a broad range of genetic alterations that can inform personalized treatment strategies. These molecular approaches are particularly critical in the era of precision oncology, where understanding the molecular landscape of a tumor is essential for selecting appropriate targeted therapies and identifying patients for clinical trials. The convergence of these technologies – from advanced staining and imaging to sophisticated molecular analysis and AI-driven insights – defines a dynamic and evolving landscape aimed at providing increasingly accurate, efficient, and comprehensive tissue-based diagnoses, ultimately leading to better patient care and accelerated biomedical research. Furthermore, the development of companion diagnostics, which link specific diagnostic tests to particular therapeutic drugs, exemplifies the critical role of these technologies in the realization of truly personalized medicine.

Regional Highlights

- North America: This region holds a dominant share in the Tissue Diagnostics Market, driven by high healthcare expenditure, advanced healthcare infrastructure, significant investments in research and development, and the early adoption of cutting-edge technologies like digital pathology and AI-powered diagnostic solutions. The presence of key market players, a high incidence of cancer, and a strong emphasis on personalized medicine further contribute to its leading position. The United States and Canada are pivotal markets within this region.

- Europe: Europe is another major market for tissue diagnostics, characterized by well-established healthcare systems, increasing awareness about early disease diagnosis, and favorable reimbursement policies. Countries such as Germany, the UK, France, and Italy are significant contributors, with a focus on implementing advanced diagnostic techniques and a growing demand for automated pathology solutions. Research collaborations and government initiatives to combat cancer are also propelling market growth.

- Asia Pacific (APAC): The APAC region is projected to witness the highest growth rate in the tissue diagnostics market. This growth is attributable to the increasing prevalence of chronic diseases, particularly cancer, improving healthcare infrastructure, rising disposable incomes, and greater access to advanced diagnostic technologies. Emerging economies like China, India, and Japan are investing heavily in healthcare, fostering a conducive environment for market expansion, with a rising demand for accurate and affordable diagnostic tests.

- Latin America: This region is experiencing steady growth, primarily due to increasing healthcare investments, improving access to diagnostic facilities, and a rising awareness of the importance of early disease detection. Brazil, Mexico, and Argentina are key countries where government initiatives and private sector participation are expanding the reach of tissue diagnostic services, although challenges related to infrastructure and skilled professionals persist.

- Middle East and Africa (MEA): The MEA market for tissue diagnostics is growing, albeit at a slower pace compared to other regions. Growth is driven by increasing healthcare modernization efforts, a rising burden of chronic diseases, and expanding medical tourism. However, market development in this region is uneven, with significant disparities in healthcare infrastructure and access to advanced technologies across different countries. Investments in public health and partnerships with international diagnostic providers are crucial for future growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tissue Diagnostics Market.- F. Hoffmann-La Roche Ltd

- Danaher Corporation (Leica Biosystems)

- Agilent Technologies, Inc.

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Siemens Healthineers AG

- Bio-Rad Laboratories, Inc.

- QIAGEN N.V.

- BioGenex Laboratories, Inc.

- Biocare Medical, LLC

- Cell Signaling Technology, Inc.

- Merck KGaA

- Ventana Medical Systems, Inc. (a member of Roche Group)

- Sakura Finetek Japan Co., Ltd.

- Sysmex Corporation

- Becton, Dickinson and Company (BD)

- Abcam plc

- GenScript Biotech Corporation

- PerkinElmer Inc.

- Enzo Biochem, Inc.

Frequently Asked Questions

Analyze common user questions about the Tissue Diagnostics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is tissue diagnostics?

Tissue diagnostics involves analyzing tissue samples, typically biopsies or surgical resections, using various laboratory techniques such as immunohistochemistry, in situ hybridization, and molecular pathology to diagnose diseases, primarily cancer, and guide treatment decisions.

How does AI impact the Tissue Diagnostics Market?

AI significantly impacts the market by enhancing diagnostic accuracy through automated image analysis, improving workflow efficiency, identifying subtle disease patterns, and developing predictive biomarkers, ultimately leading to more precise and faster diagnoses while addressing pathologist shortages.

What are the key technologies used in tissue diagnostics?

Key technologies include Immunohistochemistry (IHC) for protein detection, In Situ Hybridization (ISH) for nucleic acid detection, Digital Pathology & Image Analysis for digitizing and interpreting slides, and advanced Molecular Pathology techniques like PCR and NGS for genomic profiling.

What are the primary drivers of the Tissue Diagnostics Market?

The market is primarily driven by the rising global incidence of cancer, the increasing demand for personalized medicine, continuous technological advancements in diagnostic platforms, and a growing aging population requiring more frequent and accurate disease diagnoses.

What challenges does the Tissue Diagnostics Market face?

Challenges include the high capital cost of advanced equipment, the complexity of regulatory approvals, reimbursement issues, a shortage of skilled pathology professionals, and the need for robust data management and cybersecurity in digital pathology systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager