Torque Sensor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427875 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Torque Sensor Market Size

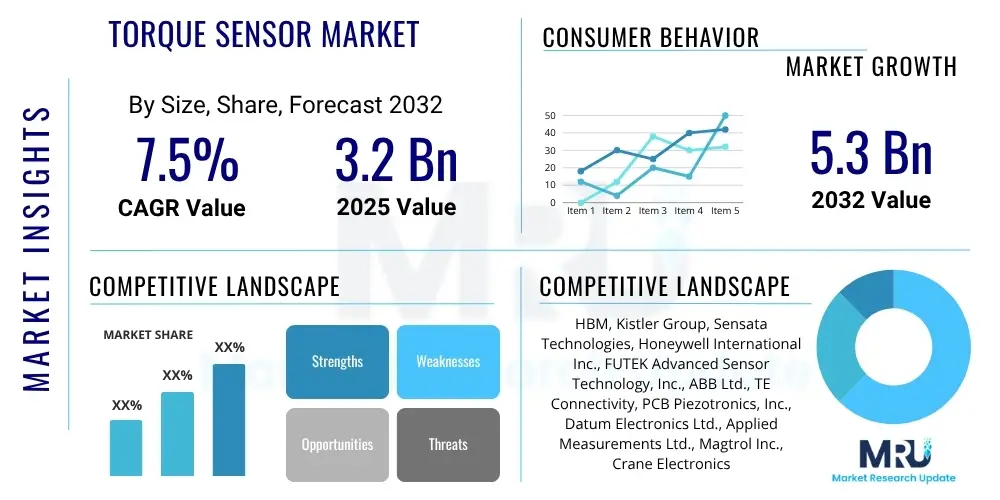

The Torque Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2032. The market is estimated at USD 3.2 Billion in 2025 and is projected to reach USD 5.3 Billion by the end of the forecast period in 2032. This substantial growth is primarily driven by escalating demand from critical industries such as automotive, industrial automation, and aerospace, all of which increasingly rely on precise torque measurement for optimal performance, safety, and efficiency. The adoption of advanced manufacturing techniques and the rise of smart factories further underscore the market's robust expansion trajectory, as industries seek greater automation and data-driven insights.

Torque Sensor Market introduction

Torque sensors are sophisticated devices engineered to measure torsional forces or moments, which are crucial for understanding rotational dynamics and stresses in various mechanical systems. These sensors convert the mechanical twisting motion into an electrical signal that can be analyzed, providing invaluable data for control, monitoring, and testing applications. Their fundamental role lies in ensuring operational integrity, improving efficiency, and enhancing safety across a multitude of industries. The precision and reliability offered by modern torque sensors make them indispensable components in an era defined by automation and stringent quality standards.

The product landscape of the torque sensor market encompasses a diverse range of devices, primarily categorized into rotary torque sensors and reaction torque sensors. Rotary torque sensors are designed to measure torque on rotating shafts, often employing non-contact technologies to transmit signals, making them ideal for dynamic applications. Reaction torque sensors, on the other hand, measure the stationary torque experienced by a fixed element, commonly used in testing and calibration setups. Key technologies employed include strain gauge-based sensors, which are highly accurate and robust, as well as Surface Acoustic Wave (SAW), optical, and magnetic sensors, each offering distinct advantages in terms of cost, precision, and environmental resilience. Recent innovations focus on miniaturization, wireless capabilities, and enhanced integration with digital systems.

Major applications for torque sensors span a wide economic spectrum. In the automotive industry, they are vital for electric power steering (EPS) systems, drivetrain efficiency, engine testing, and electric vehicle (EV) motor control, contributing significantly to vehicle performance and safety. Industrial automation leverages torque sensors in robotics, machine tools, and manufacturing lines for precise motion control, quality assurance, and predictive maintenance. The aerospace sector utilizes them for turbine testing, flight control systems, and component validation, where accuracy is paramount. Benefits derived from the deployment of torque sensors include enhanced precision in manufacturing processes, improved product quality, reduced downtime through early fault detection, optimized energy consumption, and increased operational safety by preventing overload and mechanical failures. These advantages collectively fuel the continuous growth and technological advancement within the torque sensor market, reinforcing their critical role in modern engineering and industrial practices.

Torque Sensor Market Executive Summary

The global Torque Sensor Market is undergoing significant transformation, driven by evolving business trends, distinct regional dynamics, and specialized segment-specific growth. Business trends are largely characterized by a pronounced shift towards digitalization, with manufacturers integrating wireless communication and IoT capabilities into torque sensors to facilitate real-time data acquisition and analysis. There is an increasing emphasis on miniaturization and cost-effectiveness, making these sensors more accessible for a broader array of applications, particularly in consumer electronics and smart devices. Furthermore, the demand for custom solutions, tailored to specific industrial requirements, is propelling innovation in sensor design and calibration methodologies, alongside a focus on robust designs capable of withstanding harsh operating environments. These trends collectively aim to enhance sensor intelligence, interoperability, and overall value proposition for end-users.

Regionally, Asia Pacific continues to emerge as the dominant force in the Torque Sensor Market, largely attributed to its burgeoning manufacturing sector, rapid industrialization, and the massive scale of automotive production, particularly in China, Japan, and India. The increasing adoption of electric vehicles and the expansion of smart factory initiatives in this region are significant growth catalysts. North America and Europe, while mature markets, are experiencing growth driven by advanced research and development activities, stringent safety regulations, and the widespread implementation of Industry 4.0 technologies. These regions lead in high-precision and specialized sensor applications, particularly in aerospace, medical devices, and advanced robotics. Latin America and the Middle East & Africa are demonstrating nascent but promising growth, fueled by infrastructure development, diversification of industrial bases, and rising investments in automation.

Segmentation trends reveal that rotary torque sensors are witnessing higher demand due to their applicability in dynamic systems, especially in automotive drivetrains and industrial machinery. By technology, strain gauge-based sensors maintain their leadership due to proven reliability and accuracy, though non-contact technologies like Surface Acoustic Wave (SAW) and magnetic sensors are gaining traction for their maintenance-free operation and resilience in harsh conditions. The automotive industry remains the largest end-use segment, propelled by the electrification of vehicles, ADAS (Advanced Driver-Assistance Systems) integration, and the continuous need for precise engine and transmission testing. Industrial automation and robotics represent another rapidly expanding segment, with torque sensors playing a pivotal role in enabling collaborative robots and optimizing complex manufacturing processes. These multifaceted trends underscore a dynamic market responding to global technological shifts and industrial requirements.

AI Impact Analysis on Torque Sensor Market

Common user questions regarding AI's impact on the Torque Sensor Market frequently revolve around how artificial intelligence can augment sensor capabilities, improve data interpretation, and drive new applications. Users are keen to understand how AI can enhance the accuracy and reliability of torque measurements, particularly in dynamic and complex environments, and whether AI can facilitate the integration of torque data into broader predictive maintenance and quality control systems. Concerns often include the computational overhead, the need for extensive training data, and the cybersecurity implications of connecting intelligent sensors to larger networks. Expectations are high for AI to unlock new levels of operational efficiency, enable smarter decision-making, and contribute to the development of fully autonomous systems that leverage real-time torque feedback for adaptive control and anomaly detection. The overarching theme is the transformation of raw torque data into actionable intelligence through AI-driven analytics.

The synergy between AI and torque sensors is poised to revolutionize industrial processes, moving beyond simple measurement to advanced diagnostics and predictive capabilities. By applying machine learning algorithms to vast datasets generated by torque sensors, anomalies can be detected with unprecedented precision, often before they manifest as critical failures. This enables proactive maintenance strategies, significantly reducing downtime and operational costs. Furthermore, AI can learn from historical torque profiles to predict equipment degradation, optimize performance parameters in real-time, and identify inefficiencies that might otherwise go unnoticed. This analytical depth transforms torque sensors from mere data providers into integral components of intelligent, self-optimizing systems. The computational power of AI also allows for more sophisticated sensor fusion, where torque data is combined with other sensor inputs (e.g., vibration, temperature) to provide a holistic view of system health and performance.

The integration of AI also addresses challenges related to environmental variations and sensor drift, as AI models can adapt and compensate for these factors, maintaining high accuracy over extended periods without constant manual recalibration. In manufacturing, AI-powered torque sensors can ensure quality control by identifying deviations in assembly processes, thereby minimizing defects and ensuring product consistency. For autonomous vehicles and robotics, AI leverages torque feedback for sophisticated motor control, path planning, and interaction with the environment, enabling smoother operation and greater safety. As AI capabilities continue to evolve, the impact on torque sensor development will likely include the creation of self-calibrating, self-diagnosing, and context-aware sensors, further embedding them as critical intelligence nodes within the broader framework of smart factories and intelligent systems. This symbiotic relationship promises to elevate the role of torque sensors from data collection to predictive insight and autonomous action, thereby maximizing their utility and contribution to industrial advancement.

- Predictive maintenance enablement through anomaly detection and trend analysis.

- Optimized process control by adjusting parameters based on real-time torque feedback and AI models.

- Enhanced data analytics, converting raw torque data into actionable insights for improved operational efficiency.

- Real-time anomaly detection and fault diagnosis, preventing catastrophic failures and reducing downtime.

- Facilitation of autonomous system control in robotics, vehicles, and machinery for adaptive performance.

- Improved sensor calibration and drift compensation through machine learning algorithms.

- Development of self-monitoring and self-diagnosing torque sensing systems.

- Advanced sensor fusion by integrating torque data with other sensor inputs for comprehensive system monitoring.

DRO & Impact Forces Of Torque Sensor Market

The Torque Sensor Market is profoundly influenced by a complex interplay of drivers, restraints, opportunities, and broader impact forces that shape its growth trajectory and competitive landscape. Key drivers include the escalating demand for industrial automation and robotics, where precise torque measurement is fundamental for operational efficiency, safety, and product quality. The rapid expansion of the automotive sector, particularly the surge in electric vehicle (EV) production and the integration of advanced driver-assistance systems (ADAS), significantly boosts the need for accurate torque sensing in powertrains, steering systems, and braking mechanisms. Furthermore, the global trend towards Industry 4.0 and smart manufacturing necessitates real-time data collection and analytical capabilities, making advanced torque sensors indispensable components in connected factory environments. Stringent regulatory requirements for safety and quality control in various industries also compel manufacturers to adopt high-precision torque measurement solutions, further fueling market expansion.

Despite robust growth drivers, the market faces notable restraints. The relatively high cost associated with high-precision torque sensors, especially those employing advanced technologies like wireless data transmission or non-contact measurement, can be a barrier for small and medium-sized enterprises (SMEs) or in cost-sensitive applications. The complexity involved in the calibration and integration of these sensors into existing systems often requires specialized expertise, which can deter some potential adopters. Moreover, torque sensors can be sensitive to environmental factors such as temperature fluctuations, electromagnetic interference, and mechanical vibrations, requiring robust designs and careful installation, adding to the overall system complexity and cost. Competition from alternative sensing methods or less sophisticated control systems in certain low-end applications also poses a restraint, although their lack of precision often limits their use in critical operations. These challenges necessitate continuous innovation to reduce costs, simplify integration, and enhance environmental resilience.

Opportunities for growth are abundant, particularly with the ongoing miniaturization of sensors, which opens doors for new applications in consumer electronics, medical devices, and wearables, where space is a premium. The development of wireless torque sensors and those with integrated IoT capabilities presents a significant opportunity to streamline data acquisition and enable predictive maintenance in remote or hard-to-access locations. Emerging economies, undergoing rapid industrialization and infrastructure development, offer untapped market potential as they increasingly invest in automation and modern manufacturing techniques. Furthermore, advancements in materials science and sensor fabrication technologies are paving the way for more durable, accurate, and cost-effective sensors. Impact forces like rapid technological advancements, evolving economic conditions affecting industrial investments, shifting regulatory landscapes dictating safety and environmental standards, and the resilience of global supply chains all exert considerable influence. Geopolitical stability and international trade policies also play a crucial role, affecting raw material costs, manufacturing locations, and market access, thereby directly impacting the market dynamics for torque sensors.

Segmentation Analysis

The Torque Sensor Market is comprehensively segmented across various dimensions to provide a granular understanding of its structure and dynamics. These segmentations are critical for market participants to identify niche opportunities, tailor product development strategies, and refine sales approaches. The market can be dissected by sensor type, the underlying technology used for measurement, diverse application areas, and the specific industries that serve as end-users. Each segment exhibits unique growth patterns and demand drivers, reflecting the diverse requirements of modern industrial and technological landscapes. This detailed categorization helps in analyzing market trends and forecasting future trajectories with greater precision.

- By Type:

- Rotary Torque Sensors: Designed for measuring torque on rotating shafts, ideal for dynamic applications in motors, drivetrains, and pumps.

- Reaction Torque Sensors: Used to measure static or non-rotating torque, often found in testing and calibration rigs, and for measuring reaction forces on stationary components.

- By Technology:

- Strain Gauge: The most common technology, offering high accuracy and reliability by measuring deformation under stress.

- Surface Acoustic Wave (SAW): Non-contact, wireless technology, suitable for harsh environments and high-speed applications.

- Optical: Utilizes light to measure displacement or strain, offering high resolution and immunity to electromagnetic interference.

- Magnetic: Measures changes in magnetic fields due to torsional stress, known for robustness and non-contact operation.

- Capacitive: Measures changes in capacitance due to deformation, offering good sensitivity.

- Piezoelectric: Generates a charge in response to mechanical stress, suitable for dynamic measurements.

- Others: Includes technologies like magnetoelastic and MEMS (Micro-Electro-Mechanical Systems) based sensors.

- By Application:

- Testing & Measurement: Used in R&D, product validation, and quality control for performance assessment.

- Process Control: Integrated into manufacturing lines for real-time monitoring and adjustment of industrial processes.

- Quality Control: Ensuring products meet specified torque requirements during assembly or inspection.

- Research & Development: Essential tools for material science, mechanical engineering, and product innovation.

- Product Development: Integral for prototyping and refining new mechanical systems.

- Industrial Control: Automated systems requiring precise feedback for motor control, robotics, and machinery.

- Safety Monitoring: Preventing overload and ensuring safe operation of equipment.

- Robotics Control: Providing feedback for precise movement and interaction of robotic arms and end-effectors.

- By Industry:

- Automotive: Critical for powertrain testing, electric power steering (EPS), braking systems, ADAS, and electric vehicle (EV) motor control.

- Industrial Automation: Found in robotics, machine tools, pumps, compressors, conveyors, and assembly lines for precision and efficiency.

- Aerospace & Defense: Utilized for aircraft engine testing, flight control systems, structural testing, and weapon systems.

- Healthcare & Medical: Applied in surgical tools, prosthetics, rehabilitation devices, and medical robotics for precise force feedback.

- Agriculture: Integrated into precision farming equipment, tractors, and harvesting machinery for optimized operation.

- Energy: Employed in wind turbines for blade pitch control, oil & gas drilling equipment, and power generation monitoring.

- Consumer Electronics: Emerging applications in haptic feedback systems, smart tools, and exercise equipment.

- Marine: Used in propulsion systems, winches, and offshore equipment for performance and safety monitoring.

- Others: Includes applications in packaging, textile, and general manufacturing industries.

Value Chain Analysis For Torque Sensor Market

The value chain for the Torque Sensor Market is a multi-tiered structure, encompassing a range of activities from raw material sourcing to end-user deployment, each stage adding value to the final product. At the upstream end, the process begins with the procurement of critical raw materials, including specialized metals for sensor bodies, semiconductor materials for electronic components, and advanced ceramics or composites for protective housings. Key suppliers in this stage provide high-grade steel, aluminum alloys, silicon wafers, and various polymers. Component manufacturers then transform these raw materials into specialized parts such as strain gauges, optical gratings, magnetic materials, and integrated circuits, which form the core sensing elements. This upstream segment is characterized by specialized expertise, stringent quality control, and often high capital investment in manufacturing processes.

Moving downstream, these components are assembled and integrated into complete torque sensor units. Sensor manufacturers, often Original Equipment Manufacturers (OEMs), design, produce, and calibrate these sensors, ensuring they meet specific accuracy, durability, and performance standards. This stage involves sophisticated manufacturing techniques, advanced calibration laboratories, and rigorous testing protocols to certify product integrity. Following production, these sensors are distributed to various market participants. Distribution channels can be broadly categorized into direct and indirect sales. Direct sales involve manufacturers selling directly to large industrial clients, automotive OEMs, or aerospace contractors, often requiring custom solutions, technical support, and long-term relationships. This approach allows for direct feedback and tailored service.

Indirect sales channels involve a network of distributors, value-added resellers, and system integrators. Distributors typically carry a broad range of torque sensor products from multiple manufacturers, catering to a wider customer base, including smaller businesses and research institutions. Value-added resellers integrate torque sensors into larger systems or provide complete measurement solutions, adding specialized software or hardware. System integrators play a crucial role by incorporating torque sensors into complex automation systems, robotics, or test benches, providing a comprehensive solution to end-users. These indirect channels extend market reach, offer localized support, and provide solutions that combine torque sensing with other technologies. The final stage of the value chain involves the end-users, such as automotive manufacturers, industrial automation companies, and aerospace firms, who deploy these sensors in their applications, benefiting from the precise data and control they provide, thereby completing the cycle of value creation and consumption in the torque sensor market.

Torque Sensor Market Potential Customers

The Torque Sensor Market serves a diverse and expanding base of potential customers, reflecting the ubiquitous need for precise torque measurement across various industries. These end-users or buyers leverage torque sensors to enhance product quality, optimize operational efficiency, ensure safety, and facilitate advanced automation. A significant segment of potential customers includes automotive manufacturers, particularly those involved in the production of electric vehicles (EVs) and advanced internal combustion engine (ICE) vehicles. For EVs, torque sensors are critical in motor control, battery management, and drivetrain optimization, while for ICE vehicles, they are essential for engine testing, transmission development, and electric power steering systems. The increasing complexity of modern vehicles, coupled with stringent emission and safety standards, positions automotive companies as primary consumers of torque sensor technology.

Another substantial group of potential customers comes from the industrial automation and robotics sectors. Companies specializing in robotics, machine tools, and manufacturing process equipment are key buyers. Torque sensors enable these businesses to develop robots with precise motion control and force feedback, crucial for collaborative robotics and intricate assembly tasks. In machine tools, these sensors ensure optimal cutting force and prevent overload, extending equipment life and improving machining accuracy. Furthermore, manufacturers of pumps, compressors, and various types of rotating machinery represent significant customers, utilizing torque sensors for performance monitoring, predictive maintenance, and efficiency optimization within their systems. The global push towards Industry 4.0 and smart factories, which rely heavily on interconnected devices and real-time data, further expands this customer base, as more industries seek to automate and optimize their production lines.

Beyond automotive and industrial automation, the aerospace and defense industry represents a critical segment of high-value customers. Aerospace contractors and aircraft manufacturers employ torque sensors for crucial applications such as jet engine testing, flight control surface actuation, and structural integrity monitoring, where precision and reliability are paramount for safety. The medical device industry is also a growing customer base, with torque sensors integrated into surgical tools for haptic feedback, prosthetics for natural movement, and rehabilitation equipment for accurate force measurement. Other notable potential customers include research and development institutions, energy sector companies (e.g., wind turbine manufacturers), agricultural equipment producers focusing on precision farming, and even consumer electronics firms developing haptic devices or smart exercise equipment. This broad spectrum of applications underscores the wide-ranging utility and essential nature of torque sensors across the modern technological landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 3.2 Billion |

| Market Forecast in 2032 | USD 5.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HBM, Kistler Group, Sensata Technologies, Honeywell International Inc., FUTEK Advanced Sensor Technology, Inc., ABB Ltd., TE Connectivity, PCB Piezotronics, Inc., Datum Electronics Ltd., Applied Measurements Ltd., Magtrol Inc., Crane Electronics Ltd., Norbar Torque Tools Ltd., Althen Sensors & Controls, Eilersen Electric Digital Systems A/S, Interface Inc., HBK, Lorenz Messtechnik GmbH, Sensor Technology Ltd., S. Himmelstein and Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Torque Sensor Market Key Technology Landscape

The technological landscape of the Torque Sensor Market is characterized by a continuous drive for enhanced accuracy, durability, miniaturization, and integration capabilities, responding to the evolving demands of various industries. The predominant technology remains strain gauge-based sensors, which leverage the principle that electrical resistance changes with mechanical strain. These sensors are highly versatile, offering excellent precision and robust performance in a wide range of static and dynamic applications. Advances in strain gauge materials and bonding techniques continue to improve their stability and temperature compensation, making them suitable for critical measurement tasks. Despite their widespread use, the need for physical contact for signal transmission can be a limitation in some high-speed or harsh environments, prompting the development of non-contact alternatives.

Non-contact technologies are gaining significant traction, addressing the limitations of traditional strain gauge sensors. Surface Acoustic Wave (SAW) technology, for instance, offers wireless and battery-free operation, making it ideal for rotating applications where power transmission and signal wiring are challenging. SAW sensors measure changes in acoustic wave propagation due to torque-induced strain, providing reliable data in harsh conditions with high rotational speeds. Magnetic torque sensors, another key non-contact technology, detect changes in magnetic fields within a shaft as it twists. These sensors are known for their robustness, insensitivity to contaminants, and often a simpler mechanical design, making them attractive for automotive and heavy industrial applications. Optical torque sensors, utilizing principles like changes in light polarization or reflections, offer exceptional resolution and immunity to electromagnetic interference, catering to niche applications requiring extreme precision.

Emerging technologies and ongoing innovations further shape the market. Micro-Electro-Mechanical Systems (MEMS) based torque sensors are enabling significant miniaturization, opening opportunities in medical devices, wearables, and compact robotics where space is limited. The integration of digital electronics directly into the sensor package is providing smart torque sensors with capabilities for onboard signal processing, self-diagnostics, and digital communication protocols (e.g., CAN bus, EtherCAT). Furthermore, the development of wireless communication modules (Bluetooth, Wi-Fi) and IoT compatibility is transforming torque sensors into interconnected nodes within larger industrial ecosystems, facilitating real-time data streaming, remote monitoring, and seamless integration with cloud-based analytics platforms. These technological advancements collectively aim to enhance the utility, versatility, and intelligence of torque sensors, cementing their role as critical components in the smart industrial age.

Regional Highlights

- North America: This region is a significant market driven by substantial investments in aerospace and defense, advanced manufacturing, and the automotive sector, including strong research and development in electric vehicle technologies. The presence of key technology innovators and stringent quality control regulations contribute to the demand for high-precision torque sensors.

- Europe: A mature market characterized by robust industrial automation, a leading automotive industry, and stringent regulatory frameworks regarding product quality and safety. Countries like Germany are at the forefront of Industry 4.0 adoption, driving demand for integrated and intelligent torque sensing solutions.

- Asia Pacific (APAC): The largest and fastest-growing market, primarily fueled by rapid industrialization, extensive manufacturing activities, and a booming automotive sector, especially in China, Japan, South Korea, and India. Increased adoption of robotics and automation across diverse industries, coupled with significant investments in electric vehicle production, propels market expansion.

- Latin America: An emerging market experiencing growth due to increasing industrialization, investments in infrastructure development, and a gradual shift towards modern manufacturing practices. The automotive sector and mining industries are key contributors to torque sensor demand in this region.

- Middle East and Africa (MEA): This region exhibits nascent growth, primarily driven by investments in infrastructure, oil and gas exploration, and a push towards economic diversification. The adoption of automation in processing industries and manufacturing facilities is slowly gaining momentum, leading to increased demand for torque measurement solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Torque Sensor Market.- HBM

- Kistler Group

- Sensata Technologies

- Honeywell International Inc.

- FUTEK Advanced Sensor Technology, Inc.

- ABB Ltd.

- TE Connectivity

- PCB Piezotronics, Inc.

- Datum Electronics Ltd.

- Applied Measurements Ltd.

- Magtrol Inc.

- Crane Electronics Ltd.

- Norbar Torque Tools Ltd.

- Althen Sensors & Controls

- Eilersen Electric Digital Systems A/S

- Interface Inc.

- HBK

- Lorenz Messtechnik GmbH

- Sensor Technology Ltd.

- S. Himmelstein and Company

Frequently Asked Questions

Analyze common user questions about the Torque Sensor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a torque sensor and how does it work?

A torque sensor is a transducer that measures torsional forces (twisting force or moment) and converts it into an electrical signal. Most commonly, they operate using strain gauges bonded to a shaft, which detect minute deformations caused by torque. These deformations alter the electrical resistance of the gauges, producing a measurable voltage change proportional to the applied torque. Other technologies include optical, magnetic, and SAW (Surface Acoustic Wave) methods, often employed for non-contact measurement.

What are the primary applications of torque sensors?

Torque sensors are crucial in numerous industries. In automotive, they are used for engine testing, drivetrain efficiency, and electric power steering. In industrial automation, they are vital for robotics, machine tools, and process control. Aerospace applications include turbine testing and flight control systems. They are also employed in medical devices, agriculture, and research & development for precision measurement, quality control, and safety monitoring.

What are the main types of torque sensors available in the market?

The primary types are rotary torque sensors and reaction torque sensors. Rotary torque sensors measure torque on rotating shafts, ideal for dynamic applications in motors and transmissions. Reaction torque sensors measure static or non-rotating torque, typically used in testing rigs, calibration, or for measuring reaction forces on fixed components. Each type serves distinct operational requirements and application environments.

What technological advancements are impacting the torque sensor market?

Key technological advancements include the development of non-contact sensing methods (SAW, magnetic, optical) for improved durability and performance in harsh environments. Miniaturization through MEMS technology is expanding applications into smaller devices. Integration with wireless communication and IoT capabilities enables real-time data, remote monitoring, and predictive maintenance, enhancing their role in Industry 4.0 and smart factory ecosystems.

What is the future outlook for the torque sensor market?

The future outlook is robust, driven by the continued growth of electric vehicles, the increasing adoption of automation and robotics across industries, and the expansion of smart manufacturing initiatives globally. Innovations in AI integration, wireless connectivity, and advanced materials will further enhance sensor intelligence, precision, and application versatility. Emerging markets and new applications in consumer electronics and healthcare are also expected to fuel sustained market growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager