Traction Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428883 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Traction Transformer Market Size

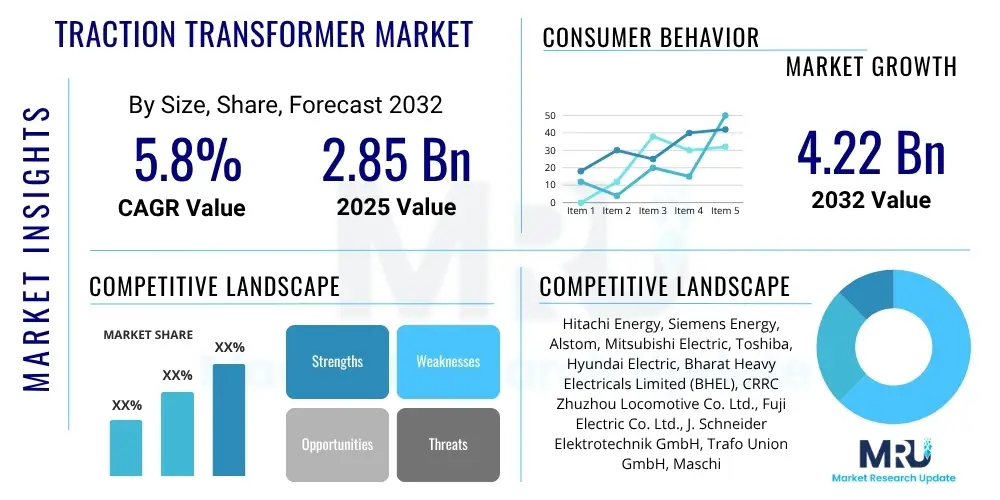

The Traction Transformer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 2.85 billion in 2025 and is projected to reach USD 4.22 billion by the end of the forecast period in 2032.

Traction Transformer Market introduction

The Traction Transformer Market encompasses the design, manufacturing, and supply of specialized transformers essential for the operation of electric rail vehicles and electrified railway networks. These transformers are crucial components that convert high-voltage power from overhead lines or third rails to a suitable voltage and current level required by the traction motors and auxiliary systems of locomotives, electric multiple units (EMUs), metro trains, and trams. Their primary function is to ensure efficient and reliable power delivery, facilitating the propulsion and various onboard electrical needs of modern rail transport systems. The robust construction and specialized insulation of traction transformers enable them to withstand the harsh operating conditions characterized by vibrations, temperature fluctuations, and electromagnetic interference inherent in railway environments.

Product descriptions typically highlight their compact design, lightweight construction, and enhanced thermal management capabilities, which are vital for integration into space-constrained rolling stock. Major applications span across high-speed rail, suburban commuter trains, urban metro systems, and freight locomotives, underpinning the global transition towards more sustainable and efficient public and freight transportation. The core benefits derived from advanced traction transformers include improved energy efficiency, reduced maintenance costs, enhanced operational reliability, and a significant contribution to lowering carbon emissions by enabling electric propulsion. These systems are instrumental in supporting the increasing demand for faster, cleaner, and more widespread rail networks globally.

The market is primarily driven by escalating global investments in railway infrastructure, particularly the expansion of high-speed rail networks and urban mass transit systems in developing economies, coupled with modernization initiatives in mature markets. Environmental concerns and government mandates promoting electric mobility also play a pivotal role, pushing railway operators to adopt more energy-efficient and low-emission solutions. The continuous evolution of power electronics and material science is also fostering innovation, leading to more compact, lighter, and higher-performing traction transformers that meet stringent operational and environmental standards.

Traction Transformer Market Executive Summary

The Traction Transformer Market is experiencing dynamic growth, propelled by robust global investments in railway infrastructure and a pronounced shift towards sustainable transportation solutions. Business trends indicate a strong focus on research and development to achieve lighter, more compact, and energy-efficient transformer designs, often incorporating advanced cooling technologies and digital monitoring capabilities. Strategic partnerships and mergers among key players are common, aiming to leverage synergistic technologies and expand geographic reach, particularly in emerging markets where new rail projects are abundant. Furthermore, manufacturers are increasingly emphasizing customized solutions to meet diverse operational requirements across different railway systems, ranging from high-speed trains to urban metros, leading to a highly competitive yet innovative landscape.

Regional trends reveal Asia Pacific as the dominant market, primarily due to extensive railway network expansion projects, particularly in China and India, alongside significant investments in high-speed rail. Europe continues to be a substantial market, driven by modernization efforts, the upgrade of existing infrastructure, and the deployment of advanced signaling and electrification systems across various countries. North America is also exhibiting steady growth, spurred by freight rail electrification initiatives and investments in passenger rail system enhancements. Latin America, the Middle East, and Africa are emerging as promising markets with increasing urbanization and economic development fostering new railway projects and public transport upgrades.

Segment trends highlight strong growth in the onboard traction transformer segment, especially for high-speed trains and electric multiple units, reflecting the global preference for electric rolling stock. Demand for compact and liquid-cooled transformers is particularly high, driven by space constraints and the need for efficient thermal management in modern vehicles. The market also sees a rising preference for transformers integrated with advanced control and diagnostic systems, enhancing operational reliability and facilitating predictive maintenance. These trends collectively underscore a market characterized by continuous innovation and adaptation to evolving railway industry needs, focusing on efficiency, sustainability, and operational excellence.

AI Impact Analysis on Traction Transformer Market

Common user questions related to the impact of AI on the Traction Transformer Market frequently revolve around how artificial intelligence can enhance efficiency, reduce operational costs, and improve the reliability and lifespan of these critical components. Users are particularly interested in AI's role in predictive maintenance, smart diagnostics, optimized design processes, and energy management within complex railway networks. There is a clear expectation that AI will contribute significantly to minimizing downtime, anticipating failures before they occur, and making railway operations more resilient and cost-effective. Users also seek to understand the integration of AI with existing digital infrastructure and its potential to revolutionize the decision-making processes for maintenance schedules and asset management strategies.

AI's influence is poised to transform several facets of the traction transformer lifecycle, from initial design to end-of-life management. By leveraging vast datasets collected from operational transformers, AI algorithms can identify patterns indicative of impending failures, optimize performance parameters, and suggest proactive interventions. This shift from reactive to predictive maintenance holds substantial economic and operational advantages for railway operators. Moreover, AI can aid in the development of next-generation transformers by simulating performance under various conditions, thereby accelerating R&D cycles and leading to more robust and efficient designs. The integration of AI also facilitates better communication and data exchange within smart grid railway systems, allowing for dynamic adjustments in power supply and demand.

The overarching themes users emphasize are enhanced reliability, cost savings through optimized maintenance, and improved energy efficiency across the entire rail network. They also look for insights into how AI can help address the challenges of aging infrastructure and the increasing complexity of modern railway systems. The ability of AI to process and analyze real-time operational data is seen as a key enabler for smarter, more autonomous railway operations, ultimately leading to safer and more sustainable public transportation. As the market progresses, AI is expected to become an indispensable tool for manufacturers and operators alike, driving innovation and operational excellence.

- Predictive maintenance and fault diagnosis through sensor data analysis.

- Optimized design and simulation for enhanced efficiency and reduced material usage.

- Real-time performance monitoring and anomaly detection.

- Energy management optimization within railway power grids.

- Automated inspection and quality control during manufacturing.

- Enhanced operational decision-making for maintenance scheduling.

- Development of self-healing and adaptive transformer systems.

DRO & Impact Forces Of Traction Transformer Market

The Traction Transformer Market is profoundly shaped by a combination of key drivers, restraints, opportunities, and impactful external forces. Driving factors predominantly include rapid global urbanization leading to increased demand for efficient public transport systems, significant investments in the expansion and modernization of railway infrastructure, particularly in developing economies, and the growing emphasis on high-speed rail projects as a sustainable mode of intercity travel. Furthermore, stringent environmental regulations pushing for the decarbonization of the transport sector, coupled with governmental support for electric mobility, are accelerating the adoption of electric locomotives and EMUs, thereby boosting the demand for traction transformers. The continuous technological advancements focused on developing more efficient, compact, and lightweight transformers also serve as a crucial market driver, enhancing the viability and performance of modern rail systems.

However, the market faces several restraining factors that could impede its growth. The high initial capital expenditure associated with the installation and maintenance of railway electrification systems and traction transformers represents a significant barrier, especially for countries with limited budgets. The extended operational lifespan of traction transformers, often spanning several decades, results in infrequent replacement cycles, which can moderate market growth in established regions. Additionally, the complex and highly specialized manufacturing processes, coupled with the reliance on specific raw materials, can lead to supply chain vulnerabilities and increased production costs. Geopolitical instabilities and economic downturns can further delay or halt large-scale railway projects, impacting market demand. The need for robust, standardized infrastructure and interoperability across different national rail networks also presents a challenge.

Opportunities within this market are abundant, primarily driven by the modernization of aging railway infrastructure in developed nations, which necessitates the replacement of older, less efficient transformers with advanced units. The development of smart rail initiatives and digitalized railway networks creates avenues for integrating smart traction transformers equipped with advanced monitoring and communication capabilities. The emerging demand for lightweight and compact transformer solutions, particularly for high-speed and urban rail vehicles where space and weight are critical, offers significant growth potential for manufacturers investing in innovative materials and designs. Expanding railway networks in emerging markets across Asia Pacific, Latin America, and Africa also present substantial long-term growth prospects as these regions invest heavily in new rail lines and public transport systems. The increasing focus on renewable energy integration into railway power grids further opens up new possibilities for specialized transformer solutions.

The market is also influenced by broader impact forces. Economic growth directly correlates with investment capabilities in infrastructure projects. Technological advancements in power electronics, materials science, and digital intelligence continually reshape product development and operational efficiencies. Regulatory landscapes, including safety standards, environmental policies, and electrification mandates, dictate market requirements and drive innovation. Lastly, environmental concerns, specifically the imperative to reduce greenhouse gas emissions, exert a strong influence, pushing for greener railway solutions and thereby increasing the demand for efficient electric traction systems. These forces collectively define the market's trajectory and competitive dynamics.

Segmentation Analysis

The Traction Transformer Market is extensively segmented to reflect the diverse applications, operational requirements, and technological variations inherent in global railway systems. This segmentation allows for a granular understanding of market dynamics, growth drivers within specific niches, and the varying preferences of end-users. Analyzing these segments helps stakeholders identify key growth areas, tailor product offerings, and devise effective market entry and expansion strategies. The primary segmentation criteria include the type of mounting, the application of the transformer, the specific cooling system employed, and the voltage level it handles, all of which are critical design and performance parameters for traction transformers.

- By Type:

- Onboard Transformers (Locomotive, EMU/DMU)

- Trackside/Ground Transformers

- By Application:

- High-Speed Rail

- Metro & Tram

- Freight Locomotives

- Passenger Locomotives (excluding high-speed)

- By Cooling System:

- Air-Cooled

- Oil-Cooled (Natural, Forced)

- Ester-Cooled

- Other Liquid-Cooled (e.g., Silicone)

- By Mounting:

- Underframe Mounted

- Roof Mounted

- Machine Room Mounted

- By Voltage:

- Low Voltage

- Medium Voltage

- High Voltage

Value Chain Analysis For Traction Transformer Market

The value chain for the Traction Transformer Market begins with the upstream suppliers of critical raw materials and components. This stage involves the procurement of high-grade electrical steel for transformer cores, copper or aluminum for windings, various insulating materials (paper, oil, ester fluids, epoxy resins), and specialized components such as bushings, tap changers, and cooling systems. The quality and availability of these raw materials significantly impact the cost and performance of the final product. Manufacturers often engage in long-term relationships with reputable suppliers to ensure consistent quality and mitigate supply chain risks, with a growing emphasis on sourcing sustainable and environmentally friendly materials where possible. Research and development activities, including material science advancements and design optimization, are also crucial at this initial stage.

Moving downstream, the value chain encompasses the manufacturing and assembly of traction transformers, followed by testing and certification processes to meet stringent international railway standards. Manufacturers typically sell these transformers directly to locomotive and rolling stock Original Equipment Manufacturers (OEMs), who integrate them into electric trains, or to national railway authorities and metro operators for trackside applications. The distribution channel is predominantly direct, especially for large-scale projects, allowing for close collaboration between the manufacturer and the end-user for customized solutions and technical support. Indirect channels might involve sales through large system integrators or engineering, procurement, and construction (EPC) contractors who manage entire railway electrification projects. After-sales services, including installation support, maintenance, spare parts supply, and refurbishment, form a critical part of the downstream value chain, ensuring the long-term operational reliability of the transformers.

The direct interaction between traction transformer manufacturers and their primary customers—railway OEMs and operators—is characteristic of this market due to the specialized nature of the product and the need for tailored specifications. This direct engagement ensures that transformers are designed and built to precisely meet the demanding performance, safety, and environmental requirements of specific railway applications. Indirect distribution typically occurs when the traction transformer is part of a larger subsystem or an overall electrification project managed by a main contractor, where the transformer manufacturer acts as a sub-supplier. Both direct and indirect channels necessitate strong technical expertise, robust project management capabilities, and a deep understanding of the railway industry's unique operational challenges and regulatory landscape. The entire value chain is driven by innovation, quality assurance, and the ultimate goal of providing reliable and efficient power conversion solutions for modern electric rail transport.

Traction Transformer Market Potential Customers

The potential customers for traction transformers are diverse, primarily comprising entities involved in the development, operation, and maintenance of electrified railway systems globally. The principal end-users are national railway authorities and state-owned railway corporations responsible for managing and expanding extensive rail networks, including high-speed lines, passenger, and freight corridors. These large-scale operators are constantly investing in new rolling stock and infrastructure upgrades, creating consistent demand for advanced traction transformers to power their fleets and trackside installations. Their procurement decisions are often influenced by national infrastructure development plans, long-term sustainability goals, and the need for reliable, energy-efficient equipment.

Another significant customer segment includes private railway operators and urban transport authorities, particularly those managing metro, tram, and light rail systems in metropolitan areas. With ongoing urbanization and the expansion of public transit networks worldwide, these entities are key buyers for compact, efficient, and robust traction transformers suitable for high-density urban environments. Their purchasing criteria often prioritize space-saving designs, reduced noise levels, and advanced monitoring capabilities to ensure continuous service and minimal disruption. Additionally, rolling stock manufacturers and locomotive builders, such as Alstom, Siemens, CRRC, and Stadler Rail, represent a crucial customer base, as they integrate traction transformers as core components into their electric multiple units (EMUs), electric locomotives, and high-speed trains. These OEMs require custom-designed transformers that meet specific performance, weight, and dimensional specifications for their vehicles.

Furthermore, engineering, procurement, and construction (EPC) contractors specializing in railway electrification projects often act as intermediaries or direct purchasers of traction transformers. They oversee the design, supply, and installation of entire rail infrastructure systems, sourcing components from various manufacturers. Consulting firms and system integrators focused on railway solutions also influence purchasing decisions by recommending specific technologies and suppliers to their clients. The collective focus of these diverse customers is on acquiring highly reliable, efficient, and technologically advanced traction transformers that contribute to the overall safety, performance, and sustainability of modern electric railway transportation systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.85 billion |

| Market Forecast in 2032 | USD 4.22 billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Energy, Siemens Energy, Alstom, Mitsubishi Electric, Toshiba, Hyundai Electric, Bharat Heavy Electricals Limited (BHEL), CRRC Zhuzhou Locomotive Co. Ltd., Fuji Electric Co. Ltd., J. Schneider Elektrotechnik GmbH, Trafo Union GmbH, Maschinenelektro GmbH, Transfesa Logistics, VEM Group, Celme S.r.l. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Traction Transformer Market Key Technology Landscape

The Traction Transformer Market is continuously evolving with significant technological advancements aimed at enhancing performance, efficiency, and reliability while reducing size and weight. A primary area of innovation involves the development of advanced cooling systems, moving beyond traditional oil-based cooling to ester-based fluids, which offer higher flash points, better biodegradability, and improved environmental profiles. This shift allows for safer operations and contributes to the greening of railway infrastructure. Furthermore, sophisticated forced-cooling mechanisms are being integrated to manage heat dissipation more effectively in compact designs, crucial for high-power applications and confined spaces within rolling stock. The use of innovative insulation materials and techniques, such as vacuum impregnation and specialized composite materials, is also central to improving dielectric strength and thermal endurance.

Another critical technological trend is the adoption of lightweight and compact designs. Manufacturers are increasingly utilizing aluminum windings instead of copper, and employing advanced core materials with lower losses, to significantly reduce the overall weight of transformers. This is particularly vital for high-speed trains and metro systems where weight reduction directly translates to improved energy efficiency and reduced track wear. The integration of power electronics within the transformer architecture is also gaining traction, enabling smarter control, more flexible power conversion, and improved grid interaction. This includes the development of multi-voltage and multi-frequency transformers that can adapt to different railway electrification standards across regions, simplifying international operations and reducing the need for costly vehicle changes at borders.

Furthermore, digital technologies are playing an increasingly important role in the key technology landscape. Smart traction transformers are equipped with integrated sensors and advanced monitoring systems that provide real-time data on temperature, vibration, voltage, and current levels. This data is then utilized for predictive maintenance, fault diagnosis, and operational optimization, often facilitated by AI and machine learning algorithms. Such digital integration enhances operational reliability, minimizes downtime, and extends the service life of transformers. The focus on noise reduction technologies, incorporating advanced dampening materials and optimized winding arrangements, is also becoming paramount, especially for urban rail applications where noise pollution is a significant concern. These technological innovations collectively drive the market towards more efficient, sustainable, and intelligent rail transport solutions.

Regional Highlights

- North America: The market in North America is characterized by steady investments in upgrading aging freight rail infrastructure and expanding urban passenger rail systems. Key drivers include government initiatives for electrification, particularly in high-traffic corridors, and the increasing demand for sustainable transport solutions. Modernization of existing locomotives and rolling stock, along with the adoption of positive train control (PTC) systems, further drives demand for reliable traction transformers.

- Europe: Europe represents a mature but highly innovative market. Growth is fueled by extensive high-speed rail networks, ambitious decarbonization targets, and the ongoing modernization of conventional railway lines. European Union directives for interoperability and cross-border rail traffic necessitate advanced, multi-standard traction transformers. Countries like Germany, France, and the UK are leading in technological adoption and infrastructure development, focusing on energy efficiency and smart grid integration.

- Asia Pacific (APAC): APAC is the leading market for traction transformers, driven by massive investments in new railway projects, particularly in China, India, and Southeast Asian nations. Rapid urbanization, the expansion of high-speed rail, and the development of extensive metro networks are primary growth engines. Governments in the region are heavily prioritizing infrastructure development to support economic growth and accommodate large populations, leading to significant demand for both onboard and trackside transformers.

- Latin America: The Latin American market is experiencing gradual growth, primarily spurred by urban rail transit projects and some long-distance freight line expansions. Countries like Brazil, Mexico, and Argentina are investing in public transportation infrastructure to alleviate traffic congestion and facilitate economic connectivity. While smaller in scale compared to APAC or Europe, the region presents emerging opportunities for specialized traction transformer solutions.

- Middle East and Africa (MEA): The MEA region is witnessing increasing investment in new railway networks, particularly for freight and high-speed passenger connections, as part of national development visions. Gulf Cooperation Council (GCC) countries are prominent, with ambitious projects like the GCC Railway Network. African nations are also gradually investing in rail infrastructure to enhance connectivity and economic development. This region offers significant long-term growth potential as these projects materialize.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Traction Transformer Market.- Hitachi Energy

- Siemens Energy

- Alstom

- Mitsubishi Electric

- Toshiba Corporation

- Hyundai Electric Co. Ltd.

- Bharat Heavy Electricals Limited (BHEL)

- CRRC Zhuzhou Locomotive Co. Ltd.

- Fuji Electric Co. Ltd.

- J. Schneider Elektrotechnik GmbH

- Trafo Union GmbH

- Maschinenelektro GmbH

- Transfesa Logistics S.A.

- VEM Group

- Celme S.r.l.

Frequently Asked Questions

What is a traction transformer?

A traction transformer is a specialized electrical transformer designed to convert high-voltage power from railway overhead lines or third rails into the appropriate voltage and current required by a train's traction motors and auxiliary systems. It is essential for the operation of electric locomotives, EMUs, metro trains, and trams.

What drives the growth of the traction transformer market?

Market growth is primarily driven by global railway infrastructure expansion, including high-speed rail and urban mass transit, increased government investments in public transport, growing environmental concerns favoring electric mobility, and technological advancements leading to more efficient and compact designs.

What are the main types of traction transformers?

The main types include onboard transformers, which are integrated into the rolling stock (e.g., locomotives, EMUs), and trackside or ground transformers, which are part of the stationary railway electrification infrastructure, providing power to the overhead lines or third rails.

How does AI impact traction transformer maintenance?

AI significantly impacts maintenance by enabl

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager