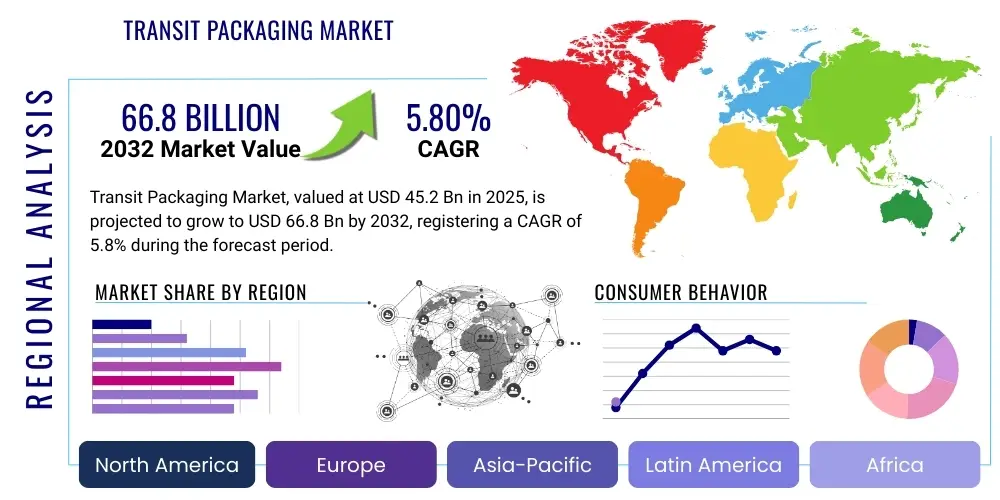

Transit Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427814 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Transit Packaging Market Size

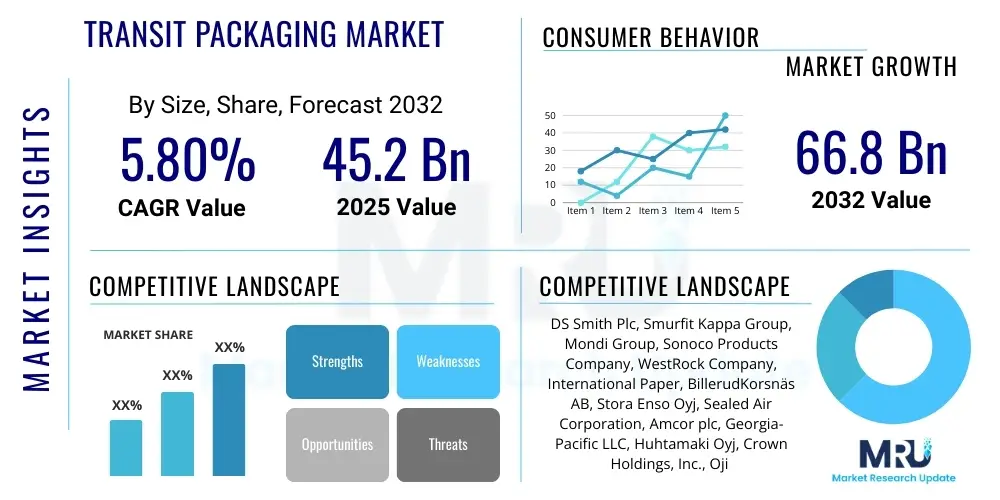

The Transit Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 45.2 billion in 2025 and is projected to reach USD 66.8 billion by the end of the forecast period in 2032. These illustrative figures underscore a robust expansion trajectory, primarily driven by the relentless growth of global e-commerce, increasing industrial output across emerging economies, and persistent demand for enhanced product protection throughout complex supply chains. The markets resilience is further supported by innovations in sustainable materials and packaging technologies, addressing both economic efficiencies and environmental responsibilities.

Transit Packaging Market introduction

Transit packaging, an indispensable component of modern logistics and supply chain management, refers to the secondary and tertiary layers of packaging designed specifically for the protection, handling, and transportation of goods from their origin to their final destination. This critical segment encompasses a diverse range of products, including but not limited to corrugated boxes, plastic films (stretch and shrink wraps), wooden pallets, industrial sacks, protective dunnage, and specialized containers. Its core function is to shield products from physical damage, environmental factors like moisture and temperature fluctuations, and pilferage during storage and transit, thereby ensuring that items arrive in pristine condition, minimizing waste, and preserving the economic value of the shipped goods.

The market for transit packaging is profoundly influenced by several macroeconomic and industry-specific drivers. The unparalleled expansion of global e-commerce, for instance, has generated an immense demand for robust, lightweight, and often custom-sized packaging solutions capable of withstanding multiple handling touchpoints and diverse shipping conditions. Concurrently, the increasing complexity and geographical reach of global supply chains necessitate packaging that can maintain product integrity over extended distances and varied climatic zones. Furthermore, the imperative for operational efficiency, including optimized loading, stacking, and warehousing, continues to drive innovation in packaging design and material science, leading to solutions that enhance logistics processes while reducing overall costs.

Major applications for transit packaging span across a vast spectrum of industries, highlighting its ubiquitous importance. The food and beverage sector relies on it for safe and hygienic delivery of perishable and non-perishable goods, often requiring specialized temperature-controlled or moisture-resistant packaging. Automotive and industrial manufacturing utilize heavy-duty crates and dunnage for transporting delicate components and machinery. The pharmaceutical and healthcare industries demand highly secure, often sterile, and temperature-controlled transit solutions to comply with stringent regulatory standards. Ultimately, the benefits derived from effective transit packaging are multifaceted, including enhanced product safety, reduced shipping damage, improved supply chain efficiency, cost savings through optimized logistics, and a strengthened brand reputation through reliable product delivery, making it a cornerstone of global commerce.

Transit Packaging Market Executive Summary

The Transit Packaging Market is currently navigating a period of significant transformation, characterized by dynamic business trends, evolving regional demands, and segment-specific innovations. From a business perspective, the market is witnessing increased consolidation activities, with major players acquiring specialized firms to broaden their product portfolios and technological capabilities. There is also a pronounced trend towards digital transformation within manufacturing and supply chain operations, leveraging data analytics and IoT for enhanced visibility, predictive maintenance, and operational efficiencies. Companies are increasingly focusing on end-to-end packaging solutions, offering consulting and design services in addition to physical products, to become integral partners in their clients logistics strategies.

Regionally, the market exhibits divergent growth patterns and priorities. Asia-Pacific continues to lead in terms of market size and growth rate, propelled by its expanding manufacturing base, booming e-commerce, and rapid urbanization, particularly in emerging economies like India, Indonesia, and Vietnam. North America and Europe, while representing mature markets, are at the forefront of adopting sustainable and smart packaging technologies, driven by stringent environmental regulations, robust consumer awareness, and significant investments in automation and advanced logistics infrastructure. Emerging markets in Latin America and the Middle East & Africa are demonstrating steady growth, fueled by infrastructure development, rising disposable incomes, and increasing integration into global trade networks, presenting new avenues for market penetration.

Segmentation trends reveal a strong impetus towards sustainable and high-performance materials. The demand for packaging made from recycled plastics, bio-based polymers, and sustainably sourced paper and wood products is escalating rapidly across all end-use sectors. Concurrently, there is a growing emphasis on specialized packaging solutions, such as intelligent packaging with embedded sensors for temperature or shock monitoring, particularly for sensitive goods like pharmaceuticals and high-value electronics. The flexible packaging segment, including stretch films and protective wraps, continues to expand due to its versatility, cost-effectiveness, and adaptability to various product shapes. Furthermore, the customization of packaging to reduce material usage and optimize load efficiency is a growing trend, impacting product design and manufacturing processes significantly.

AI Impact Analysis on Transit Packaging Market

The pervasive integration of Artificial Intelligence (AI) is set to fundamentally reshape the Transit Packaging Market, directly addressing critical user concerns regarding operational efficiency, cost reduction, and product integrity throughout the supply chain. Users are keenly interested in how AI can minimize transit damage, optimize packaging design for material efficiency, and contribute to broader sustainability objectives. Furthermore, questions frequently arise concerning AIs capability to provide predictive insights for logistics, automate complex packaging tasks, and enhance real-time traceability. The overarching expectation is for AI to deliver smarter, more resilient, and environmentally conscious packaging solutions that drive unprecedented levels of performance and cost-effectiveness across the entire value chain.

AIs influence begins in the design and material selection phases, where generative AI algorithms can rapidly iterate through countless design variations to create optimal packaging structures that offer maximum protection with minimal material use, reducing both waste and freight costs. Predictive analytics, powered by machine learning, analyzes vast datasets on shipping routes, environmental conditions, and historical damage incidents to proactively identify and mitigate risks, thereby significantly lowering damage rates. This intelligent foresight allows for dynamic adjustments to packaging specifications or logistical planning before issues arise. Moreover, AI-driven vision systems are revolutionizing quality control on packaging lines, accurately detecting subtle defects in real-time at high speeds, ensuring only flawless packaging enters the supply chain and reinforcing product safety standards.

Further down the value chain, AI is transforming logistics and warehouse management. AI-powered robots and autonomous guided vehicles (AGVs) optimize sorting, packing, and palletizing operations, dramatically improving throughput and reducing labor dependencies. For smart packaging, AI analyzes data streaming from IoT sensors embedded within packages, providing real-time insights into location, temperature, humidity, and shock events. This allows for immediate corrective actions, such as rerouting sensitive shipments or alerting stakeholders to potential spoilage. The capability of AI to forecast demand with greater accuracy also enables more efficient procurement and inventory management of packaging materials, preventing stockouts or overstock. Collectively, these AI applications are creating a more intelligent, adaptive, and sustainable transit packaging ecosystem, capable of meeting the complex demands of modern global commerce.

- Supply Chain Optimization: AI algorithms enhance route planning, load optimization, and warehouse management, reducing transit times and fuel consumption while minimizing empty space.

- Predictive Damage Analytics: AI analyzes historical data and real-time sensor inputs to predict potential damage risks, allowing for reinforced packaging designs or alternative routes and handling protocols.

- Automated Packaging Lines: AI-powered robots and vision systems handle sorting, packing, sealing, and palletizing with high precision and speed, minimizing human error and increasing throughput.

- Smart Inventory Management: AI predicts optimal stock levels for packaging materials and finished goods, reducing waste, storage costs, and ensuring just-in-time availability.

- Real-time Tracking and Monitoring: AI analyzes data from IoT sensors in smart packaging to provide live updates on package location, condition, and environmental parameters throughout transit.

- Quality Control and Defect Detection: AI-powered vision systems identify packaging flaws or damage during production and transit with high accuracy, ensuring consistent product integrity.

- Demand Forecasting: Machine learning models improve accuracy in predicting product demand and packaging material requirements, optimizing procurement and production schedules.

- Sustainable Material Optimization: AI assists in identifying and designing with optimal sustainable materials, such as recycled content and biodegradable alternatives, to reduce environmental footprint.

- Generative Design for Packaging: AI creates innovative and efficient packaging designs that maximize protection while minimizing material usage, reducing design cycle times.

DRO & Impact Forces Of Transit Packaging Market

The Transit Packaging Market is influenced by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces, collectively shaping its growth trajectory and competitive landscape. Key drivers include the exponential expansion of the e-commerce sector globally, necessitating robust and efficient packaging solutions for individual parcel shipments that withstand multiple handling points. Furthermore, the continuous growth of international trade, coupled with increasing industrial output and urbanization in emerging economies, significantly boosts demand for protective packaging across various sectors, from food and beverages to automotive components. The heightened focus on product safety and damage reduction, driven by consumer expectations and regulatory standards, also compels industries to adopt higher-quality and more specialized transit packaging solutions, ensuring goods arrive in pristine condition and reducing post-delivery issues.

Despite these strong growth drivers, the market faces several notable restraints. Volatility in the prices of key raw materials, such as plastics, paper pulp, and timber, directly impacts manufacturing costs and profit margins for packaging producers, leading to potential price fluctuations for end-users. Stringent environmental regulations, particularly regarding single-use plastics and waste management in regions like Europe, pose significant challenges, requiring substantial investment in research and development for sustainable and compliant alternatives. Additionally, the fragmented nature of the market, coupled with a lack of universal standardization in packaging dimensions and materials across diverse industries and geographies, can hinder efficiency and increase operational complexities for global logistics and supply chain operations, demanding customized solutions.

Opportunities within the Transit Packaging Market are abundant, particularly in the realm of sustainability and technological innovation. The growing consumer and corporate demand for eco-friendly solutions presents a massive opportunity for the development and adoption of recycled, recyclable, biodegradable, and bio-based packaging materials. The integration of smart packaging technologies, including RFID tags, QR codes, and IoT sensors, offers enhanced traceability, real-time condition monitoring, and improved supply chain visibility, creating premium value propositions for sensitive and high-value goods. Moreover, the increasing demand for customized, lightweight, and efficient packaging designs that optimize space utilization and reduce freight costs provides avenues for market differentiation. These opportunities are further amplified by overarching impact forces such as rapid advancements in automation and robotics within packaging lines, evolving regulatory frameworks favoring circular economy principles, and a heightened global awareness regarding environmental sustainability, all of which compel continuous innovation and strategic adaptation from market participants.

Segmentation Analysis

The Transit Packaging Market undergoes comprehensive segmentation to provide a granular understanding of its intricate structure and the diverse factors influencing various sub-markets. This analytical approach typically categorizes the market based on several critical parameters: the type of material used, the specific product form of the packaging, the end-use industry it serves, and the primary function it is designed to fulfill. Such segmentation is vital for identifying specific growth drivers, pinpointing emerging trends, and understanding the distinct needs of different customer groups, allowing market players to tailor their product offerings and strategic investments with greater precision and effectiveness.

Understanding these segments allows for a deeper dive into market dynamics. For instance, the material segment highlights the shift towards sustainable options, while the product type segment showcases the evolution of various packaging forms to meet specialized requirements. The end-use industry segment illustrates how sectors like e-commerce or pharmaceuticals have unique demands for packaging performance and compliance. This detailed breakdown facilitates targeted marketing efforts, product development, and strategic partnerships, enabling companies to capitalize on high-growth areas and navigate competitive landscapes with informed decisions. The ongoing innovations in each of these segments underscore the markets adaptability and responsiveness to global economic and environmental pressures.

- By Material:

- Plastics (Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Expanded Polystyrene (EPS) Foams, Stretch & Shrink Wraps, Films, Tapes)

- Paper & Paperboard (Corrugated Boxes, Solid Board Boxes, Paperboard Cartons, Molded Pulp Products, Paper Sacks, Dunnage Paper)

- Wood (Pallets, Crates, Cases, Boxes, Dunnage Wood)

- Metal (Steel Drums, Aluminum Cans, Intermediate Bulk Containers (IBCs) made of metal)

- Others (Glass, Composites, Bio-based materials)

- By Product Type:

- Boxes & Cartons (Corrugated Shipping Boxes, Folding Cartons, Set-up Boxes)

- Crates & Pallets (Wooden Pallets, Plastic Pallets, Metal Pallets, Crate Boxes)

- Bags & Sacks (Flexible Intermediate Bulk Containers (FIBCs), Woven Sacks, Paper Sacks)

- Drums & Barrels (Plastic Drums, Steel Drums, Fiber Drums)

- Protective Films & Wraps (Stretch Film, Shrink Film, Bubble Wrap, Surface Protection Films)

- Dunnage & Void Fill (Air Pillows, Foams, Kraft Paper, Molded Pulp Inserts, Shredded Materials)

- Containers (Intermediate Bulk Containers (IBCs), Collapsible Containers, Bulk Bins)

- By End-Use Industry:

- Food & Beverages (Perishable Goods, Packaged Foods, Beverages)

- E-commerce (General Merchandise, Electronics, Apparel, Home Goods)

- Industrial Manufacturing (Automotive Components, Machinery, Construction Materials)

- Automotive & Transportation (Spare Parts, Vehicle Components, Engines)

- Pharmaceuticals & Healthcare (Drugs, Medical Devices, Vaccines, Diagnostics)

- Consumer Goods (Electronics, Personal Care Products, Home Appliances, Textiles)

- Chemicals & Fertilizers (Industrial Chemicals, Agrochemicals, Petroleum Products)

- Building & Construction (Cement, Tiles, Insulation Materials, Timber)

- Agriculture (Fresh Produce, Grains)

- By Function:

- Protection & Cushioning (Shock Absorption, Vibration Dampening)

- Containment & Unitization (Bundling, Consolidation, Load Stability)

- Handling & Storage (Stackability, Ease of Movement, Warehouse Efficiency)

- Information & Identification (Labeling, Barcoding, Tracking)

- Security & Tamper Evidence (Seals, Locks)

Transit Packaging Market Value Chain Analysis

The value chain for the Transit Packaging Market is a complex ecosystem, starting with the foundational upstream activities and extending through manufacturing, distribution, and ultimately, to the end-user. Upstream analysis critically examines the raw material suppliers who provide the essential inputs for packaging production. This includes pulp and paper mills supplying cellulose fibers for corrugated and paperboard products, petrochemical companies offering polymers (such as PE, PP, PET) for plastic films and rigid containers, and timber companies providing wood for pallets and crates. The quality, cost, and sustainability profile of these raw materials directly impact the entire value chain, making robust supply chain management, ethical sourcing, and investment in sustainable alternatives paramount for packaging manufacturers. Innovation in bio-based and recycled raw materials is a significant focus at this stage.

The midstream segment involves the core manufacturing and conversion processes where raw materials are transformed into finished transit packaging products. This stage encompasses a wide range of activities, including the production of corrugated sheets, plastic extrusion for films, injection molding for containers, and assembly of wooden pallets and crates. Packaging manufacturers invest heavily in advanced machinery, automation technologies, and skilled labor to ensure high-volume, high-quality production. Value addition at this stage often includes specialized treatments (e.g., moisture resistance, anti-static coatings), printing and branding, and the engineering of bespoke designs to meet specific customer requirements. The efficiency, technological capabilities, and design expertise of these manufacturers are critical for producing competitive and functional transit packaging solutions.

Downstream activities focus on the distribution of finished packaging products to a diverse array of end-users and their subsequent integration into clients supply chains. This segment involves a network of logistics providers, wholesalers, distributors, and direct sales channels that deliver packaging to industries such as e-commerce, food and beverages, industrial manufacturing, and pharmaceuticals. Direct distribution typically serves large corporate clients with consistent, high-volume needs, often involving customized solutions and dedicated account management. Indirect channels, through distributors and 3PLs, cater to smaller businesses and a broader range of needs, offering wider product selection and localized support. The efficiency of these distribution networks is crucial for timely delivery, inventory management, and ensuring that end-users have access to the right packaging solutions when and where they need them, optimizing their own operational workflows and product protection strategies.

Transit Packaging Market Potential Customers

The Transit Packaging Market caters to an exceptionally broad and diverse spectrum of potential customers, spanning virtually every industry that produces, processes, or distributes physical goods across local, national, or international supply chains. At the core are industrial manufacturers, including the automotive sector, electronics producers, and heavy machinery fabricators, who require robust and often customized packaging to protect valuable components and finished products from shock, vibration, and environmental damage during assembly and transit. For these customers, factors such as impact resistance, specialized dunnage, and precise fit are crucial to ensure operational continuity and product integrity, driving demand for high-performance and engineered packaging solutions.

The rapid expansion of the e-commerce sector represents another colossal customer base. Online retailers and dedicated fulfillment centers demand packaging that can endure the rigors of individual parcel shipping, often involving multiple sorting and handling points. Key requirements for these customers include lightweight design to minimize shipping costs, ease of opening for the end consumer, and strong branding opportunities, alongside the fundamental need for superior product protection. Similarly, third-party logistics (3PL) providers and warehousing companies, who manage complex supply chains for multiple clients, are significant purchasers of versatile transit packaging that can accommodate a wide array of products and logistical scenarios, prioritizing efficiency, durability, and cost-effectiveness.

Furthermore, industries with highly sensitive or regulated products are critical potential customers. The pharmaceutical and healthcare sectors, for instance, require specialized, often temperature-controlled, sterile, and tamper-evident transit packaging to maintain drug efficacy and comply with stringent health and safety regulations. The food and beverage industry relies on packaging that ensures hygiene, prevents spoilage, and extends shelf life for perishable goods. Even general consumer goods companies, from apparel to home appliances, seek packaging solutions that balance protection with aesthetics, sustainability, and cost efficiency. Essentially, any business involved in the movement of goods, regardless of size or sector, is a potential customer, highlighting the pervasive and indispensable role of transit packaging in global commerce.

Transit Packaging Market Key Technology Landscape

The Transit Packaging Markets technological landscape is characterized by continuous innovation aimed at enhancing product protection, streamlining logistics, and addressing escalating sustainability mandates. A primary area of advancement lies in materials science, with significant research and development efforts focused on creating lightweight yet high-strength materials, such as advanced composite boards, engineered plastics, and specialized foams. These innovations not only improve cushioning and impact resistance but also contribute to reduced material consumption and lower freight costs. Concurrently, there is a pronounced shift towards sustainable material alternatives, including high-recycled content plastics, bio-based polymers (e.g., PLA, PHA), and compostable paperboard, driven by increasing regulatory pressures and strong consumer demand for eco-friendly packaging solutions across global markets.

Another transformative technological trend is the proliferation of smart packaging solutions, which leverage digital and sensing capabilities to provide enhanced supply chain visibility and product intelligence. This includes the integration of RFID (Radio-Frequency Identification) tags, NFC (Near Field Communication) labels, and sophisticated IoT (Internet of Things) sensors directly within or on transit packaging. These technologies enable real-time tracking of package location, precise monitoring of environmental conditions such as temperature, humidity, and shock, and even detection of tampering. The data collected from these smart features allows for proactive intervention in case of deviations, significantly improving product safety, security, and traceability, particularly crucial for sensitive goods like pharmaceuticals, high-value electronics, and perishable food items.

Furthermore, automation and digitalization are fundamentally reshaping packaging operations and supply chain management. Advanced robotics and automated guided vehicles (AGVs) are increasingly deployed in packaging lines for tasks such as precise filling, sealing, labeling, and palletizing, dramatically improving speed, accuracy, and labor efficiency. The adoption of artificial intelligence (AI) and machine learning (ML) algorithms is optimizing everything from demand forecasting for packaging materials to predictive maintenance for machinery, and even generative design for new packaging solutions. Digital platforms and cloud-based systems are facilitating seamless data exchange and collaboration across the entire value chain, from suppliers to end-users, leading to more resilient, responsive, and efficient transit packaging ecosystems that are better equipped to handle the complexities of modern global trade.

Regional Highlights

- Asia Pacific: Leads the global market, fueled by rapid industrialization, booming manufacturing sectors (e.g., electronics, automotive), and the exponential growth of e-commerce. Countries like China, India, Japan, and South Korea are key contributors, driven by expanding consumer bases and significant investments in logistics infrastructure.

- North America: A mature and innovative market, characterized by advanced logistics networks, high adoption of automation, and a strong focus on sustainable and smart packaging solutions. The robust e-commerce sector and stringent regulatory environment in the U.S. and Canada drive demand for high-performance and environmentally compliant transit packaging.

- Europe: A significant market with a strong emphasis on sustainability, circular economy principles, and regulatory compliance (e.g., EUs Packaging and Packaging Waste Directive). Countries like Germany, France, and the UK are pioneers in developing recycled and bio-based materials, alongside advanced protective packaging for intra-European trade and export.

- Latin America: Experiencing consistent growth attributed to expanding manufacturing industries, increasing trade agreements, and the development of organized retail and e-commerce platforms. Brazil and Mexico are prominent markets, with a rising demand for cost-effective and protective packaging as supply chains mature.

- Middle East & Africa: An emerging market propelled by economic diversification efforts, substantial investments in infrastructure development, and growing trade volumes. The regions strategic location facilitates increased demand for robust transit packaging, particularly in sectors like petrochemicals, food, and construction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Transit Packaging Market.- DS Smith Plc

- Smurfit Kappa Group

- Mondi Group

- Sonoco Products Company

- WestRock Company

- International Paper

- BillerudKorsnäs AB

- Stora Enso Oyj

- Sealed Air Corporation

- Amcor plc

- Georgia-Pacific LLC

- Huhtamaki Oyj

- Crown Holdings, Inc.

- Oji Holdings Corporation

- Novolex Holdings LLC

- Greif, Inc.

- Tri-Wall Group

- KapStone Paper and Packaging Corporation

- Universal Packaging Corporation

- Berry Global Group, Inc.

Frequently Asked Questions

What is transit packaging and why is its role critical in modern supply chains?

Transit packaging, often referred to as secondary or tertiary packaging, is specifically designed to protect goods during storage, handling, and transportation from the manufacturer to the end-user. Its critical role lies in preventing physical damage, mitigating environmental risks like moisture and temperature fluctuations, ensuring product integrity, and facilitating efficient logistics operations, thereby minimizing waste, reducing financial losses, and safeguarding brand reputation across complex global supply chains.

What are the primary types of materials used in the transit packaging market?

The primary materials employed in the transit packaging market include a diverse range: paper and paperboard (e.g., corrugated boxes, molded pulp), plastics (e.g., polyethylene films, polypropylene containers, expanded polystyrene foams), wood (e.g., pallets, crates), and metal (e.g., steel drums, aluminum components). Increasingly, the industry is shifting towards sustainable alternatives such as high-recycled content plastics, bio-based polymers, and compostable paper products to align with environmental objectives.

How does the growth of e-commerce significantly impact the transit packaging market?

The exponential growth of e-commerce profoundly impacts the transit packaging market by driving an immense demand for robust, lightweight, and versatile packaging solutions. E-commerce logistics involve more individual package handling points and varied shipping conditions, necessitating packaging that offers superior protection, efficient space utilization, and often includes features for ease of opening and return. This trend accelerates innovation in protective dunnage, optimized box designs, and sustainable materials to meet both operational demands and consumer expectations.

What are the key sustainability trends and innovations shaping transit packaging today?

Key sustainability trends in transit packaging focus on advancing circular economy principles. This involves a strong emphasis on using recycled and recyclable materials, developing biodegradable and compostable alternatives, and implementing packaging designs that minimize material usage (lightweighting) while maximizing protective capabilities. Innovations include bio-based polymers, closed-loop recycling systems, reusable packaging solutions, and digital tools to calculate and reduce packagings environmental footprint.

How is Artificial Intelligence (AI) transforming operations within the transit packaging industry?

AI is revolutionizing the transit packaging industry through multiple avenues. It optimizes supply chain logistics via predictive analytics for routing and demand forecasting, automates packaging processes with AI-powered robots and vision systems for quality control, and enhances product protection by using generative AI for design optimization. Furthermore, AI analyzes real-time data from smart packaging sensors to provide unprecedented visibility into package conditions and locations, leading to more efficient, secure, and responsive packaging solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager