Transparent Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429155 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Transparent Packaging Market Size

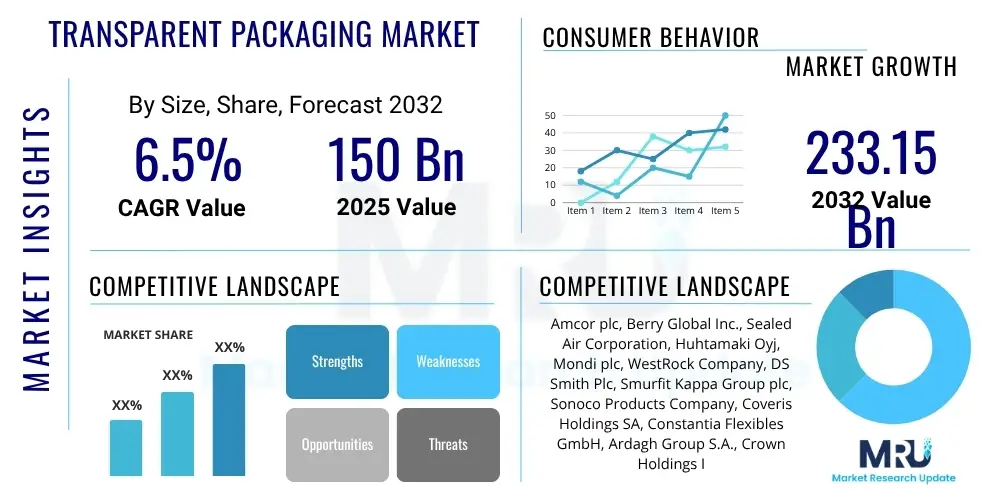

The Transparent Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 150 Billion in 2025 and is projected to reach USD 233.15 Billion by the end of the forecast period in 2032.

Transparent Packaging Market introduction

The Transparent Packaging Market represents a vital and continuously expanding segment within the global packaging industry, dedicated to offering solutions that provide clear visibility of the product contained within. These packaging solutions are strategically designed to leverage the aesthetic and informational advantages of transparency, enabling consumers to directly inspect product quality, verify authenticity, and appreciate the visual attributes of items before purchase. This market encompasses a vast array of materials, including various types of plastics like Polyethylene Terephthalate (PET), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), and Polyethylene (PE), alongside traditional materials such as glass and innovative solutions like cellulose-based films and advanced bio-plastics. The inherent clarity and versatility of these materials make them indispensable across a multitude of sectors, from fast-moving consumer goods to high-value pharmaceuticals.

Products in the transparent packaging sector manifest in diverse forms, ranging from highly flexible packaging formats such as films, wraps, bags, and stand-up pouches, to rigid structures including bottles, jars, containers, blister packs, and clamshells. Each product type is tailored to specific application requirements, balancing factors such as barrier properties, structural integrity, shelf appeal, and cost-efficiency. Major applications for transparent packaging are widespread and critical to numerous industries. These include the food and beverage sector, where transparency is crucial for showcasing freshness and enticing consumers; pharmaceuticals, for visual inspection of products and tamper evidence; cosmetics and personal care, where premium product presentation is paramount; and electronics and other consumer goods, where transparent packaging protects while allowing for direct product viewing without opening the package. The functional benefits extend beyond mere visibility, encompassing protection, preservation, and enhanced marketability.

The market's robust growth trajectory is underpinned by several compelling driving factors. A primary driver is the pervasive consumer preference for product transparency, as buyers increasingly seek assurance regarding the quality and condition of their purchases. The exponential growth of e-commerce platforms globally further amplifies this demand, as transparent packaging significantly aids in digital merchandising, allowing online shoppers a visual experience akin to in-store browsing. Additionally, ongoing technological advancements in material science are continuously improving the performance characteristics of transparent packaging, such as enhanced barrier properties for extended shelf life and greater sustainability through innovations in recyclable and compostable materials. Furthermore, the rising global disposable incomes and rapid urbanization, particularly in emerging markets, are fueling increased consumption of packaged goods, thereby directly stimulating demand for visually appealing and functional transparent packaging solutions. These combined forces ensure the transparent packaging market remains a dynamic and strategically important industry.

Transparent Packaging Market Executive Summary

The global transparent packaging market is poised for significant expansion, propelled by an intricate interplay of evolving consumer demands, technological breakthroughs, and strategic business initiatives. A prominent business trend is the accelerated move towards sustainable packaging solutions, as environmental concerns drive both regulatory bodies and consumers to prioritize recyclable, compostable, and bio-based transparent materials. This shift is reshaping product development and manufacturing processes across the industry. Concurrently, the burgeoning e-commerce sector continues to be a pivotal growth engine, demanding innovative transparent packaging that not only protects goods during transit but also enhances their visual appeal in online retail environments, thereby bolstering brand perception and consumer engagement. Moreover, there is an increasing emphasis on functional packaging, incorporating advanced barrier properties to extend product shelf life and intelligent features for enhanced traceability and anti-counterfeiting measures, especially critical for sensitive products like food and pharmaceuticals.

From a regional perspective, Asia Pacific maintains its position as the dominant market, exhibiting the highest growth rate owing to rapid economic development, increasing urbanization, and a burgeoning middle class across countries like China, India, and Southeast Asian nations. This region benefits from expanding manufacturing capacities and rising consumer spending on packaged goods. North America and Europe, while more mature, are at the forefront of innovation, demonstrating robust adoption of premium, high-performance, and sustainable transparent packaging solutions. Europe, in particular, is shaped by stringent environmental policies and a strong consumer inclination towards eco-friendly products, driving investment in recycling infrastructure and bio-plastic development. Latin America and the Middle East and Africa regions are experiencing steady growth, fueled by improving retail infrastructures, diversifying consumer preferences, and increasing foreign investments in manufacturing and distribution capabilities.

Segmentation analysis reveals the food and beverage industry as the unequivocal leader in the adoption of transparent packaging, leveraging its ability to showcase freshness and quality, thereby driving significant market volumes. Among materials, plastics, especially PET, continue to dominate due to their cost-effectiveness, clarity, and versatility, although glass and advanced bio-plastics are progressively gaining market share, driven by sustainability mandates. In terms of product type, flexible transparent packaging, including films, pouches, and wraps, is witnessing accelerated growth. This is attributed to its lighter weight, material efficiency, convenience, and adaptability, which align well with both sustainability objectives and the logistical demands of e-commerce. Rigid transparent packaging, while mature, continues to be essential for categories requiring robust protection and premium presentation, such as high-end cosmetics and beverages. These trends collectively underscore a dynamic market landscape characterized by innovation, sustainability, and an increasing focus on consumer-centric solutions.

AI Impact Analysis on Transparent Packaging Market

User inquiries concerning the influence of Artificial Intelligence (AI) on the transparent packaging market consistently center on how AI can fundamentally transform operational efficiencies, bolster quality assurance, enable unprecedented levels of personalization, and significantly advance sustainability objectives. Key questions often involve understanding AI's capacity to streamline complex supply chain logistics, predict market demands with greater accuracy, and optimize material usage to minimize environmental footprints. Consumers and industry stakeholders alike express expectations for AI to facilitate smarter packaging solutions that offer real-time product monitoring, enhance anti-counterfeiting measures, and create more interactive and engaging consumer experiences. The overarching themes identified from these queries highlight a collective desire for AI to drive innovation, reduce costs, improve product integrity, and support the industry's transition towards a more eco-conscious and consumer-centric future.

- AI-driven quality inspection: Utilizes computer vision and machine learning algorithms to perform high-speed, accurate visual checks for packaging defects, printing errors, and structural inconsistencies, ensuring superior product quality and reducing waste from faulty units.

- Predictive analytics for demand forecasting: AI models analyze historical sales data, market trends, and external factors to forecast future packaging demand, optimizing production schedules, inventory levels, and raw material procurement, thereby minimizing overproduction and associated environmental impact.

- Smart packaging integration: AI algorithms process data from embedded sensors (e.g., freshness indicators, temperature monitors) in transparent packaging, providing real-time insights on product condition, enhancing food safety, extending shelf life, and offering advanced anti-counterfeiting solutions through unique digital identifiers.

- Automated design and optimization: AI tools assist designers in creating more ergonomic, aesthetically pleasing, and structurally efficient transparent packaging. Generative design algorithms can explore thousands of variations to optimize material usage, reduce weight, and improve protective capabilities while maintaining visual appeal.

- Supply chain optimization: AI enhances end-to-end traceability and logistics by monitoring packaged goods throughout the supply chain. This includes route optimization, warehouse management, and identification of potential disruptions, leading to reduced transportation costs and improved delivery times for transparently packaged products.

- Personalized packaging solutions: AI leverages consumer data and preferences to enable highly customized transparent packaging designs, sizes, and even interactive content. This allows brands to offer unique, tailored product experiences, increasing brand loyalty and market differentiation in competitive landscapes.

- Material optimization and waste reduction: AI analyzes material properties and production processes to recommend optimal material thickness and composition for transparent packaging, minimizing resource consumption. It also identifies opportunities for efficient sorting and recycling, supporting circular economy initiatives.

DRO & Impact Forces Of Transparent Packaging Market

The Transparent Packaging Market is significantly influenced by a powerful confluence of drivers. Paramount among these is the escalating global consumer demand for immediate product visibility, enabling buyers to assess freshness, quality, and authenticity directly, thereby fostering trust and informing purchase decisions. This psychological benefit of transparency is increasingly valued across various retail environments. The exponential expansion of global e-commerce further acts as a critical growth accelerator; visually appealing transparent packaging is indispensable for digital merchandising, allowing products to stand out in online catalogs and providing an essential visual representation for consumers unable to physically inspect items. Moreover, continuous technological advancements in material science are enhancing the performance characteristics of transparent packaging, leading to the development of superior barrier properties for extended shelf life and the introduction of innovative, more sustainable materials, thus broadening market applications and appeal. Finally, the rising disposable incomes and rapid urbanization in emerging economies worldwide contribute to an increased consumption of packaged consumer goods, directly translating into heightened demand for sophisticated and aesthetically pleasing transparent packaging solutions.

Conversely, the market faces several notable restraints that temper its growth potential. Foremost are the increasingly stringent global regulations pertaining to plastic usage and waste management, particularly within regions like the European Union. These regulations often impose limitations on certain plastic types, mandate recycled content, or encourage shifts towards alternative materials, thereby complicating manufacturing processes and increasing compliance costs. The relatively higher cost associated with advanced, high-performance transparent materials, such as those offering exceptional barrier properties or possessing enhanced sustainable attributes (e.g., bio-based or chemically recycled plastics), can act as a significant barrier to widespread adoption, particularly for mass-market products where cost-effectiveness is paramount. Furthermore, persistent environmental concerns surrounding plastic waste and its ecological footprint continue to pose a substantial challenge to the industry's image and operational practices. The inherent complexities in recycling certain multi-layer or mixed-material transparent packaging structures further exacerbate these concerns, making complete material circularity difficult to achieve and limiting the potential for widespread sustainable practices.

Despite these challenges, substantial opportunities exist for growth and innovation within the transparent packaging market. A significant avenue lies in the intensified research and development of biodegradable, compostable, and fully recyclable transparent materials, offering viable and environmentally conscious alternatives to conventional plastics. This focus on material innovation is crucial for addressing both regulatory pressures and evolving consumer preferences for sustainable products. The burgeoning field of smart packaging presents another lucrative opportunity, where transparent formats can integrate advanced functionalities like RFID tags, QR codes, temperature sensors, or freshness indicators, enhancing product traceability, anti-counterfeiting measures, and consumer interaction. Furthermore, the trend towards personalized and customized packaging solutions caters to niche markets and premium brands, allowing transparent packaging to deliver unique aesthetic and functional value. Advancements in barrier technologies that can extend the shelf life of highly sensitive products while maintaining optical clarity will unlock new application areas, particularly within the food and pharmaceutical sectors. The impact forces shaping this market include intense competitive rivalry among a fragmented base of manufacturers, significant bargaining power exerted by large brand owners who dictate design and material specifications, and the constant threat of substitution from opaque or radically different packaging formats, all of which necessitate continuous innovation and strategic agility from market players to maintain and grow their share.

Segmentation Analysis

The transparent packaging market is meticulously segmented to provide a comprehensive understanding of its intricate structure and diverse demands across various industrial applications. This detailed segmentation allows for a precise analysis of market trends, identifying key growth drivers, emerging opportunities, and potential challenges within specific product categories and end-use sectors. The classifications are typically based on the fundamental material composition, the physical product form, the primary application area, and the overarching industry served. This multi-dimensional approach highlights how different segments respond to technological advancements, regulatory pressures, and shifting consumer preferences, enabling market participants to refine their product offerings and strategic planning.

Each segment within the transparent packaging market exhibits unique characteristics and growth potentials. For instance, the material segment delineates the market by the types of raw materials used, with plastics such as PET and PP currently dominating due to their versatility and cost-effectiveness, while glass serves premium and rigid applications. Meanwhile, the product type segmentation distinguishes between flexible formats like films and pouches, which are gaining traction for their convenience and lightweight properties, and rigid formats such as bottles and containers, essential for structural protection. Understanding these distinctions is crucial for manufacturers to align their production capabilities with market needs. Furthermore, the application and end-use industry segments reveal the specific sectors driving demand, from the pervasive use in food and beverages to specialized applications in pharmaceuticals and electronics, each with distinct requirements for barrier protection, shelf appeal, and regulatory compliance. This granular analysis facilitates targeted marketing efforts and product development strategies, ensuring that innovations are aligned with the precise needs of diverse customer bases.

- Material: This segment categorizes transparent packaging based on the primary raw material used in its manufacturing, significantly influencing properties such as clarity, strength, barrier performance, and recyclability.

- Plastic (Polyethylene Terephthalate (PET), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Polyethylene (PE), Polylactic Acid (PLA))

- Glass (Soda-lime glass, Borosilicate glass)

- Paper & Paperboard (Often with transparent windows or coatings)

- Cellulose (Cellophane, Cellulose acetate)

- Others (Bio-based polymers beyond PLA, composite materials)

- Product Type: This segmentation distinguishes packaging based on its physical form and structural characteristics, determining its suitability for different products and handling requirements.

- Flexible Packaging (Films (stretch, shrink, lidding), Bags & Pouches (stand-up, retort, zipper), Wraps)

- Rigid Packaging (Bottles (beverage, personal care), Jars (food, cosmetics), Containers (tubs, bowls), Blisters (pharmaceuticals, consumer electronics), Clamshells (fresh produce, bakery))

- Application: This category defines where the transparent packaging is primarily utilized, reflecting the specific functional and aesthetic demands of various product categories.

- Food & Beverages (Perishables, processed foods, snacks, soft drinks, alcoholic beverages)

- Pharmaceuticals (Blister packs, vials, bottles, sterile medical device packaging)

- Cosmetics & Personal Care (Shampoo bottles, cream jars, makeup compacts, fragrance containers)

- Electronics (Component packaging, consumer gadget blister packs)

- Consumer Goods (Toys, stationery, household items, hardware)

- Others (Automotive parts, textiles, industrial components)

- End-Use Industry: This segment broadly classifies the primary industry or sector that procures and employs transparent packaging solutions for their products, reflecting broader market ecosystems.

- Food Industry (Processors, manufacturers, fresh produce suppliers)

- Beverage Industry (Soft drink companies, breweries, wineries, juice manufacturers)

- Healthcare Industry (Pharmaceuticals, medical devices, hospitals)

- Consumer Electronics Industry (Manufacturers of phones, laptops, accessories)

- Personal Care Industry (Cosmetics, toiletries, beauty products)

- Industrial Industry (Automotive, chemicals, construction materials)

- Others (Retail, e-commerce, logistics)

Value Chain Analysis For Transparent Packaging Market

The value chain of the transparent packaging market is a complex ecosystem beginning with foundational upstream activities centered on the procurement and processing of raw materials. This initial segment is dominated by chemical manufacturers who produce critical resins such as PET, PP, PS, and PE, alongside specialty plastics like PLA, crucial for plastic-based transparent packaging. Concurrently, glass manufacturers supply high-purity glass, and paper mills provide cellulose pulp for cellulose-based films or windowed paperboard solutions. These raw material suppliers are pivotal, as their innovations in material properties, cost structures, and sustainability efforts, particularly in developing recycled content and bio-based alternatives, directly influence the entire value chain. The quality, consistency, and environmental footprint of these foundational materials set the baseline for the performance and market acceptance of the final transparent packaging product. Efficient sourcing and robust supplier relationships are therefore paramount for cost control and material security within the industry.

Further along the value chain, the processed raw materials are transformed into finished transparent packaging products by a diverse array of packaging converters and manufacturers. This midstream segment involves sophisticated manufacturing processes including extrusion, injection molding, blow molding, thermoforming, and lamination, utilized to produce a wide spectrum of packaging formats such as films, pouches, bottles, jars, and blisters. These manufacturers often specialize in specific material types or product forms, employing advanced printing techniques, barrier coating applications, and assembly processes to create functional and aesthetically appealing packaging. The output from these converters is then acquired by brand owners and consumer goods manufacturers across an extensive range of industries, including the food and beverage sector, pharmaceutical companies, cosmetics brands, and electronics manufacturers. These brand owners are the primary users of transparent packaging, integrating it into their product lines not only for protection and preservation but crucially for enhancing product visibility, consumer appeal, and overall brand perception in highly competitive markets.

The final stages of the value chain involve the distribution channels and the ultimate end-consumers. Distribution strategies for transparent packaging can vary significantly; large brand owners often engage in direct procurement from converters, establishing long-term supply agreements. Alternatively, a network of distributors and wholesalers plays a crucial role in supplying smaller businesses, specialized retailers, and regional markets, offering a broader range of packaging solutions and logistical support. The rapid expansion of e-commerce has fundamentally reshaped this distribution landscape, necessitating transparent packaging that is not only visually appealing for online product listings but also robust enough to withstand the rigors of shipping and handling, ensuring product integrity upon arrival. Ultimately, the success of transparent packaging is measured by its ability to meet and exceed consumer expectations regarding product visibility, convenience, safety, and increasingly, sustainability. Feedback from end-consumers, often gathered through market research and sales data, loops back through the value chain, influencing upstream material innovation and midstream manufacturing processes, thereby driving continuous improvement and adaptation within the transparent packaging market.

Transparent Packaging Market Potential Customers

The transparent packaging market serves an exceptionally broad and diverse base of potential customers, spanning multiple industries that place a high premium on product presentation, consumer appeal, and product integrity. Foremost among these are companies within the fast-moving consumer goods (FMCG) sector, particularly those in the expansive food and beverage industry. Food manufacturers, including producers of fresh produce, dairy products, baked goods, snacks, and processed foods, extensively utilize transparent packaging to showcase the freshness, quality, and visual appeal of their offerings. Similarly, beverage companies, ranging from soft drink producers to breweries and wineries, rely on clear bottles and containers to present their products attractively and allow consumers to verify content and color. For these sectors, the ability to visually inspect the product before purchase is a critical differentiator, directly influencing consumer trust and purchasing decisions.

Another significant customer segment comprises pharmaceutical manufacturers and medical device companies. While often requiring specialized barrier and sterile properties, transparent packaging is indispensable for items such as blister packs for pills, clear vials for liquids, and sterile pouches for medical instruments. This allows for easy visual identification of contents, verification of product integrity, and tamper evidence, all crucial for patient safety and regulatory compliance. The cosmetics and personal care industry also represents a substantial customer base, leveraging transparent packaging to convey luxury, highlight product textures, and display vibrant colors of makeup, creams, and fragrances. Premium brands, in particular, use clear bottles, jars, and compacts to create sophisticated visual merchandising, enhancing the perceived value and aesthetic appeal of their products on shelves and in marketing campaigns.

Beyond these core industries, electronics manufacturers are increasingly adopting transparent packaging for components and consumer gadgets, providing essential protection during transit while allowing customers to view the product without compromising security seals or opening the box. The burgeoning e-commerce sector is a rapidly growing customer segment, as online retailers and brand owners require visually attractive yet durable transparent packaging for effective digital presentation and safe, secure delivery to consumers' doorsteps. Furthermore, a wide variety of other consumer goods manufacturers, producing everything from toys and stationery to household items and hardware, utilize transparent packaging to highlight product features, protect goods from damage, and capture consumer attention in highly competitive retail environments. The overarching objective for all these end-users is to enhance consumer engagement, build strong brand loyalty, and ultimately drive sales by presenting their products in the most compelling and trustworthy manner possible through effective transparent packaging solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 150 Billion |

| Market Forecast in 2032 | USD 233.15 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, Berry Global Inc., Sealed Air Corporation, Huhtamaki Oyj, Mondi plc, WestRock Company, DS Smith Plc, Smurfit Kappa Group plc, Sonoco Products Company, Coveris Holdings SA, Constantia Flexibles GmbH, Ardagh Group S.A., Crown Holdings Inc., Gerresheimer AG, Schott AG, Vitro S.A.B. de C.V., Silgan Holdings Inc., AptarGroup Inc., O. Berk Company, Wipak Group, CCL Industries Inc., Alpla Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Transparent Packaging Market Key Technology Landscape

The transparent packaging market is in a constant state of evolution, significantly shaped by ongoing innovations in material science and advanced manufacturing methodologies. A primary technological frontier involves the development and applica

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager