Transplant Diagnostics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430919 | Date : Nov, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Transplant Diagnostics Market Size

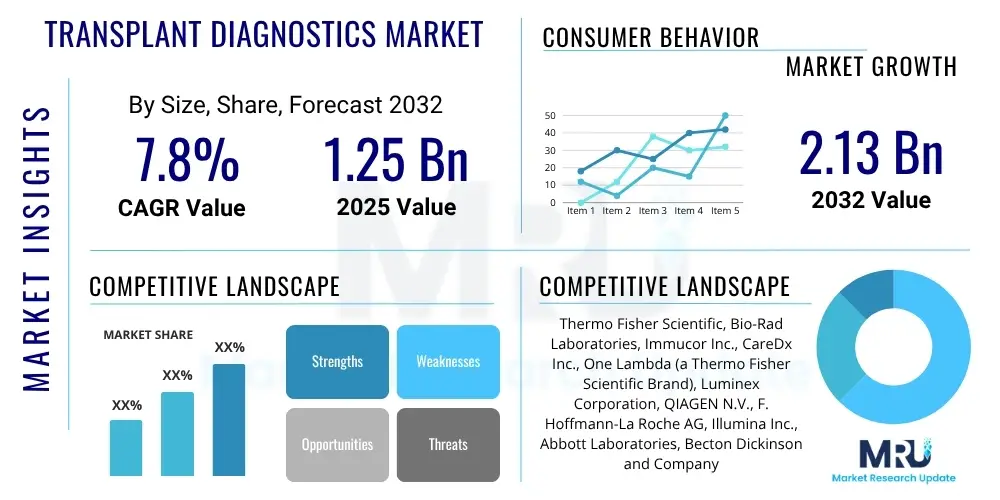

The Transplant Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 1.25 billion in 2025 and is projected to reach USD 2.13 billion by the end of the forecast period in 2032.

Transplant Diagnostics Market introduction

The Transplant Diagnostics Market encompasses a specialized segment within the healthcare industry dedicated to developing and providing diagnostic tools and services essential for successful organ and tissue transplantation. These diagnostics are crucial at various stages, from pre-transplant donor and recipient matching to post-transplant monitoring for rejection. Key product descriptions include sophisticated assays, reagents, and instruments designed to analyze genetic markers, immune responses, and disease pathologies relevant to transplantation, ensuring compatibility and managing complications. Major applications span solid organ transplants, hematopoietic stem cell transplants, and tissue transplants, where precise diagnostic information is paramount for patient safety and graft survival.

The primary benefits of advanced transplant diagnostics include significantly improved patient outcomes through reduced organ rejection rates, enhanced long-term graft survival, and minimized adverse events associated with immunosuppression. These tools facilitate highly accurate Human Leukocyte Antigen (HLA) typing, crossmatching, and antibody detection, which are foundational for identifying suitable donor-recipient pairs. Post-transplant, diagnostics play a vital role in surveillance for signs of rejection or infection, enabling timely intervention and personalized patient management strategies, thereby optimizing treatment efficacy and reducing healthcare costs associated with transplant complications.

Driving factors for market growth are multifaceted and robust. A global increase in chronic diseases such as end-stage renal disease, heart failure, and liver cirrhosis is leading to a greater demand for organ transplantation. Concurrently, advancements in transplant surgery techniques have made transplantation more accessible, further fueling the need for sophisticated diagnostic tools. The rising awareness regarding the benefits of precise diagnostics among clinicians, coupled with continuous technological innovations in molecular diagnostics and genetic sequencing, also significantly contributes to the market expansion. Additionally, a growing geriatric population, often afflicted with multiple comorbidities requiring transplantation, forms a substantial patient pool, thereby sustaining market momentum.

Transplant Diagnostics Market Executive Summary

The Transplant Diagnostics Market is poised for substantial expansion, driven by critical business trends such as increasing investment in research and development by key players, strategic collaborations between diagnostic companies and transplant centers, and a growing emphasis on personalized medicine approaches. Innovations in molecular diagnostic technologies, particularly Next-Generation Sequencing (NGS) and Polymerase Chain Reaction (PCR)-based assays, are enabling more precise and rapid HLA typing and immune monitoring, which in turn are becoming standard practices. Service providers are also expanding their offerings to include comprehensive pre-transplant workups and long-term post-transplant surveillance, reflecting a shift towards integrated diagnostic solutions. The market is also witnessing a trend towards automation and miniaturization of diagnostic platforms, aiming to improve efficiency and reduce turnaround times.

Regional trends indicate North America as the dominant market, largely due to its advanced healthcare infrastructure, high adoption of novel technologies, significant research funding, and a high volume of transplant procedures. Europe follows, characterized by well-established transplant programs and strong regulatory support for diagnostic innovations. The Asia Pacific region is projected to exhibit the highest growth rate, propelled by improving healthcare access, increasing healthcare expenditure, rising awareness about organ donation, and a growing number of transplant centers. Latin America, the Middle East, and Africa are emerging markets, driven by improving economic conditions and developing healthcare systems, although they face challenges such as limited infrastructure and lower organ donation rates. However, increasing efforts to improve healthcare access and quality in these regions present significant opportunities for market penetration.

Segment trends reveal that reagents and kits constitute the largest segment by product type, owing to their frequent use and consumable nature, with molecular assay kits for HLA typing being particularly prominent. Technology-wise, NGS is experiencing rapid adoption due to its ability to provide high-resolution, comprehensive genetic information, positioning it as a future leader. PCR-based methods remain foundational due to their reliability and widespread use. In terms of application, pre-transplant diagnostics dominate, given their critical role in donor-recipient matching, while post-transplant monitoring is a rapidly growing segment. End-user trends show hospitals and transplant centers as primary consumers, driven by the immediate need for diagnostics within their facilities, alongside a growing demand from commercial laboratories offering specialized transplant diagnostic services.

AI Impact Analysis on Transplant Diagnostics Market

Users frequently inquire about artificial intelligence's potential to revolutionize transplant diagnostics, particularly regarding enhancing accuracy, speeding up processes, and personalizing treatment. Common questions focus on whether AI can improve HLA matching, predict organ rejection more effectively, optimize immunosuppression regimens, and integrate vast amounts of patient data. There are expectations for AI to overcome the limitations of traditional diagnostic methods, address organ allocation challenges, and provide insights into complex immune responses. Concerns often revolve around data privacy, the need for robust validation, regulatory hurdles, and the interpretability of AI-driven recommendations. Overall, users anticipate that AI will introduce unprecedented levels of precision and efficiency, fundamentally transforming transplant care through advanced analytical capabilities and predictive modeling, leading to better patient outcomes and optimized resource utilization.

- Enhanced precision in HLA matching by analyzing complex genetic data patterns.

- Predictive analytics for early detection of organ rejection and graft complications.

- Optimization of immunosuppressive drug regimens for personalized patient care.

- Streamlined organ allocation processes through sophisticated matching algorithms.

- Automated analysis of pathology images and molecular data, reducing manual error.

- Improved risk stratification for transplant recipients, aiding clinical decision-making.

- Accelerated research into novel biomarkers for transplant immunology.

- Facilitation of large-scale data integration for comprehensive patient profiles.

DRO & Impact Forces Of Transplant Diagnostics Market

The Transplant Diagnostics Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities. Key drivers include the global increase in the incidence of chronic diseases, such as end-stage organ failure, which necessitates a greater number of organ transplants annually. This demand is further amplified by an aging population, who are often prone to such conditions. Advancements in molecular diagnostic technologies, particularly in gene sequencing and immunology, have made transplant diagnostics more accurate and efficient, directly supporting successful transplant outcomes and encouraging wider adoption. Increased awareness among healthcare professionals and patients about the importance of precise diagnostics in preventing organ rejection and managing post-transplant complications also acts as a strong market impetus.

However, the market faces several significant restraints that could impede its growth trajectory. The high cost associated with advanced transplant diagnostic tests and instruments, especially for technologies like Next-Generation Sequencing (NGS), can be prohibitive for healthcare systems in developing economies or those with budget constraints. Stringent regulatory frameworks and complex reimbursement policies for novel diagnostic tests can delay market entry and widespread adoption. Furthermore, a persistent shortage of skilled professionals capable of performing and interpreting these complex diagnostic procedures, particularly in specialized fields like transplant immunology, poses a considerable challenge. Ethical considerations surrounding organ donation and allocation, though not directly a diagnostic restraint, indirectly affect the volume of procedures and thus the demand for diagnostics.

Despite these restraints, ample opportunities exist for market expansion and innovation. The emergence of personalized medicine offers a vast potential for transplant diagnostics, allowing for tailored immunosuppressive therapies based on individual patient genetic profiles and immune responses. Growth in emerging economies, characterized by improving healthcare infrastructure, increasing disposable incomes, and a rising prevalence of chronic diseases, presents untapped markets for diagnostic companies. The development of non-invasive diagnostic techniques, such as liquid biopsy for monitoring graft health, represents a promising area for future innovation, offering less burdensome and more frequent monitoring options. Strategic collaborations between diagnostic developers, pharmaceutical companies, and research institutions to develop integrated diagnostic and therapeutic solutions also present significant growth avenues.

Segmentation Analysis

The Transplant Diagnostics Market is meticulously segmented across various parameters, allowing for a detailed understanding of its complex landscape and identifying specific areas of growth and investment. These segments typically include product type, technology, application, end user, and organ type, each offering distinct market dynamics and contributing uniquely to the overall market trajectory. A comprehensive segmentation analysis helps stakeholders, from manufacturers to healthcare providers, to pinpoint specific needs, develop targeted strategies, and innovate within niche areas to maximize impact and market share. The continuous evolution in diagnostic methodologies and therapeutic approaches further refines these segmentations, reflecting the market's dynamic nature.

Understanding the interplay between these segments is crucial for strategic planning. For instance, advancements in molecular technologies (a technology segment) directly influence the development of more sophisticated reagents and kits (a product type segment), which are then applied in pre-transplant matching (an application segment) within hospitals and transplant centers (end-user segments). The specific organ type being transplanted also dictates the precise diagnostic protocols required, further highlighting the interconnectedness of these market divisions. This granular view enables companies to tailor their product portfolios, marketing efforts, and distribution networks to better serve the diverse requirements across the transplant diagnostics ecosystem, fostering innovation and market penetration. As the market matures, the precision and depth of these diagnostic tools become increasingly critical for optimizing patient outcomes and managing healthcare costs.

- By Product Type

- Reagents and Kits

- Instruments

- Software & Services

- By Technology

- Molecular Assays

- PCR-based Molecular Assays

- Sanger Sequencing

- Next-Generation Sequencing (NGS)

- Microarray

- Non-Molecular Assays

- Serological Assays (e.g., ELISA, Flow Cytometry)

- Molecular Assays

- By Application

- Diagnostic (Pre-transplant, Post-transplant)

- Research

- By Organ Type

- Kidney Transplants

- Heart Transplants

- Liver Transplants

- Lung Transplants

- Pancreas Transplants

- Bone Marrow Transplants

- Other Organ/Tissue Transplants

- By End User

- Hospitals and Transplant Centers

- Research Laboratories

- Commercial & Reference Laboratories

- Academic & Research Institutes

Value Chain Analysis For Transplant Diagnostics Market

The value chain for the Transplant Diagnostics Market begins with upstream activities involving the research and development of novel diagnostic technologies and the procurement of raw materials. This includes sourcing highly purified reagents, enzymes, antibodies, and specialized biological materials crucial for manufacturing diagnostic kits and instruments. Key players in this phase are often biotechnology companies, chemical suppliers, and academic research institutions that contribute to the foundational scientific discoveries. Strong relationships with reliable suppliers ensure the quality and consistency of raw materials, which is paramount for the accuracy and reliability of the final diagnostic products. Investment in R&D at this stage directly impacts the innovation and competitiveness of diagnostic solutions downstream.

Midstream activities primarily encompass the manufacturing, assembly, and quality control of transplant diagnostic products. This involves the production of reagents and kits, the fabrication of sophisticated diagnostic instruments (such as DNA sequencers or PCR machines), and the development of specialized software for data analysis. Companies in this segment often specialize in molecular biology, immunology, or bioinformatics, ensuring strict adherence to regulatory standards like FDA or CE marking. Robust manufacturing processes, stringent quality assurance protocols, and efficient supply chain management are critical here to produce reliable, high-performing diagnostic tools that meet the rigorous demands of clinical and research settings. Scalability of production and cost-effectiveness are also key considerations.

Downstream activities focus on the distribution, sales, and post-sales support of transplant diagnostic products to end-users. The distribution channel is multifaceted, comprising direct sales forces for major manufacturers, a network of specialized distributors for broader market reach, and online platforms for certain products. Both direct and indirect distribution strategies are employed, depending on the market's geographical reach and the complexity of the product. Direct channels allow for closer customer relationships and immediate feedback, while indirect channels provide wider market penetration through established networks. Post-sales support, including technical assistance, training, and maintenance, is vital due to the complex nature of these instruments and assays, ensuring customer satisfaction and continued product utility. Ultimately, these products reach hospitals, transplant centers, and reference laboratories, where they are utilized for patient care and research.

Transplant Diagnostics Market Potential Customers

The primary end-users and buyers in the Transplant Diagnostics Market are predominantly healthcare institutions and specialized medical facilities. Hospitals, particularly those with active transplant surgery departments, represent a significant customer base. These institutions require a full spectrum of diagnostic tools for pre-transplant evaluations, including comprehensive HLA typing for donor-recipient matching, crossmatching tests to assess antibody compatibility, and infectious disease screening. Post-transplant, they utilize diagnostics for monitoring graft health, detecting early signs of rejection, and managing immunosuppressive drug levels, making them continuous consumers of these specialized products and services. The critical nature of these diagnostics in ensuring successful transplant outcomes underscores their consistent demand within hospital settings.

Transplant centers, often co-located within or affiliated with major hospitals, are another crucial segment of potential customers. These centers are highly specialized units focused entirely on transplantation procedures, demanding the most advanced and high-throughput diagnostic solutions. Their intensive operational needs require not only robust diagnostic kits and instruments but also integrated software solutions for data management and analysis. Furthermore, academic and research institutions engaged in transplant immunology, genetics, and organ preservation also constitute an important customer group. They acquire diagnostic platforms and reagents for scientific inquiry, biomarker discovery, and the development of next-generation transplant diagnostic techniques, contributing to the innovation pipeline of the market.

Beyond these institutional buyers, commercial and reference laboratories play an increasingly vital role. These independent laboratories offer specialized transplant diagnostic services to smaller hospitals, clinics, and even other larger institutions that may not have the capacity or expertise to conduct complex tests in-house. Their ability to provide high-volume testing with rapid turnaround times makes them an attractive option for various healthcare providers. Additionally, a growing segment includes pharmaceutical and biotechnology companies utilizing transplant diagnostics in their clinical trials for new immunosuppressive drugs or therapies, needing precise tools to assess patient eligibility, monitor treatment efficacy, and track immune responses. This diverse customer base highlights the broad applicability and essential nature of transplant diagnostics across the healthcare spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.25 billion |

| Market Forecast in 2032 | USD 2.13 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Bio-Rad Laboratories, Immucor Inc., CareDx Inc., One Lambda (a Thermo Fisher Scientific Brand), Luminex Corporation, QIAGEN N.V., F. Hoffmann-La Roche AG, Illumina Inc., Abbott Laboratories, Becton Dickinson and Company (BD), Siemens Healthineers, GenDx, Transplant Genomics (now part of CareDx), Olerup SSP (a part of QIAGEN), Hologic Inc., Eurofins Scientific, Sebia, Sanofi Genzyme, Natera Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Transplant Diagnostics Market Key Technology Landscape

The Transplant Diagnostics Market is characterized by a rapidly evolving technological landscape, with a strong emphasis on molecular and immunological advancements aimed at improving diagnostic accuracy, speed, and comprehensiveness. Key technologies currently dominating and shaping the market include Next-Generation Sequencing (NGS) and Polymerase Chain Reaction (PCR)-based methods. NGS offers high-resolution Human Leukocyte Antigen (HLA) typing, enabling highly precise donor-recipient matching by sequencing multiple HLA genes simultaneously, thus reducing the risk of rejection. PCR-based assays, including real-time PCR (qPCR), remain fundamental for rapid and sensitive detection of infectious agents, quantification of donor-derived cell-free DNA (dd-cfDNA), and specific HLA allele detection, valued for their reliability and widespread availability in clinical labs.

Beyond gene sequencing, microarrays and flow cytometry are critical components of the technological arsenal. Microarray technology is extensively used for screening a broad panel of HLA antibodies in transplant recipients, identifying antibodies that could cause hyperacute or acute rejection. Flow cytometry is indispensable for crossmatching, a crucial pre-transplant test that determines donor-recipient compatibility by detecting recipient antibodies against donor cells, providing immediate results essential for transplant surgery. These technologies collectively enable a multifaceted approach to transplant diagnostics, offering both genetic and immunological insights that are vital for informed clinical decisions throughout the transplant process.

Emerging technologies are also poised to significantly impact the market. Liquid biopsy, specifically the analysis of donor-derived cell-free DNA (dd-cfDNA) in recipient blood, is gaining traction as a non-invasive method for monitoring graft injury and detecting early signs of rejection. This offers a less burdensome alternative to traditional biopsy, allowing for more frequent monitoring. Bioinformatics and advanced data analytics platforms are becoming increasingly essential for interpreting the vast amount of data generated by NGS and other high-throughput technologies, enabling more sophisticated risk stratification and personalized medicine approaches. The integration of artificial intelligence (AI) and machine learning (ML) is also on the horizon, promising to further enhance predictive capabilities and optimize treatment strategies, thereby driving the next wave of innovation in transplant diagnostics.

Regional Highlights

North America maintains its stronghold as the largest market for transplant diagnostics, primarily due to its robust healthcare infrastructure, high adoption rates of advanced diagnostic technologies, and significant investments in research and development. The presence of numerous leading market players, well-established transplant programs, and a high volume of transplant procedures, particularly kidney and liver transplants, contribute significantly to its dominant share. Favorable reimbursement policies for diagnostic tests and a strong focus on personalized medicine also propel market growth in countries like the United States and Canada, where cutting-edge diagnostic tools are rapidly integrated into clinical practice. This region frequently leads in the introduction of innovative solutions, setting benchmarks for global trends.

Europe represents the second-largest market, characterized by advanced healthcare systems and a high prevalence of chronic diseases leading to a consistent demand for transplantation. Countries such as Germany, the United Kingdom, and France are major contributors, driven by government initiatives to improve organ donation rates, sophisticated research capabilities, and increasing awareness regarding transplant success rates. Strong regulatory support for diagnostic product development and a collaborative environment between academic institutions and industry further foster market growth. While facing challenges related to varied healthcare policies across member states, the region's overall commitment to healthcare innovation and patient care ensures a steady demand for transplant diagnostics.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, presenting immense opportunities for expansion. This growth is attributable to improving healthcare infrastructure, increasing healthcare expenditure, a large and aging population prone to chronic illnesses, and rising awareness about organ donation and transplantation in countries like China, India, Japan, and South Korea. While the number of transplant procedures is increasing, the region still faces challenges such as lower organ donation rates and varying levels of diagnostic technology adoption. However, government initiatives to strengthen healthcare systems, coupled with efforts by international organizations to promote organ donation and transplantation, are expected to significantly boost the transplant diagnostics market in APAC in the coming years, attracting substantial investment from global players.

- North America: Dominant market share driven by advanced healthcare infrastructure, high R&D investments, and rapid adoption of novel technologies.

- Europe: Second-largest market, characterized by well-established transplant programs, strong regulatory support, and a high volume of transplant procedures.

- Asia Pacific (APAC): Fastest-growing market, fueled by improving healthcare access, increasing prevalence of chronic diseases, and rising awareness about transplantation.

- Latin America: Emerging market with growing healthcare expenditure and increasing focus on developing transplant capabilities.

- Middle East and Africa (MEA): Gradually developing market, supported by improvements in healthcare infrastructure and increasing investments in medical services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Transplant Diagnostics Market.- Thermo Fisher Scientific

- Bio-Rad Laboratories

- Immucor Inc.

- CareDx Inc.

- One Lambda (a Thermo Fisher Scientific Brand)

- Luminex Corporation

- QIAGEN N.V.

- F. Hoffmann-La Roche AG

- Illumina Inc.

- Abbott Laboratories

- Becton Dickinson and Company (BD)

- Siemens Healthineers

- GenDx

- Transplant Genomics (now part of CareDx)

- Olerup SSP (a part of QIAGEN)

- Hologic Inc.

- Eurofins Scientific

- Sebia

- Sanofi Genzyme

- Natera Inc.

Frequently Asked Questions

What is the projected growth rate of the Transplant Diagnostics Market?

The Transplant Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032, driven by technological advancements and increasing transplant procedures globally.

Which technologies are primarily used in transplant diagnostics?

Key technologies include Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR)-based assays, microarrays, and flow cytometry for precise HLA typing, crossmatching, and post-transplant monitoring.

What are the main drivers for the Transplant Diagnostics Market?

The market is driven by the rising prevalence of chronic diseases leading to organ failure, continuous technological advancements in diagnostic methods, and an increase in the number of organ transplant procedures worldwide.

How is AI impacting transplant diagnostics?

AI is improving precision in HLA matching, enabling predictive analytics for rejection, optimizing immunosuppression regimens, and streamlining organ allocation, leading to enhanced patient outcomes and efficiency.

Who are the key end-users of transplant diagnostic products?

Primary end-users include hospitals, specialized transplant centers, research laboratories, and commercial reference laboratories, all requiring accurate diagnostics for patient care and scientific inquiry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager