Transportation Management System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431092 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Transportation Management System Market Size

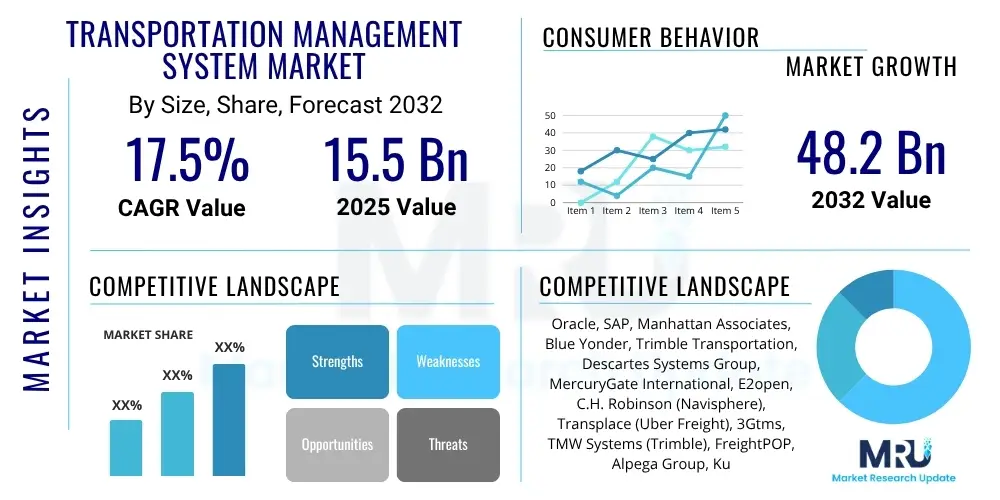

The Transportation Management System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.5% between 2025 and 2032. The market is estimated at USD 15.5 Billion in 2025 and is projected to reach USD 48.2 Billion by the end of the forecast period in 2032.

Transportation Management System Market introduction

The Transportation Management System (TMS) market encompasses software solutions designed to manage and optimize the physical movement of goods, both incoming and outgoing, and the associated information flow. A TMS typically helps businesses plan, execute, and monitor the transportation of freight, offering functionalities like freight booking, carrier management, route optimization, load planning, and audit and payment processing. These systems are crucial for modern supply chains, enabling companies to enhance efficiency, reduce costs, improve customer service, and gain real-time visibility into their logistics operations. The product's core aim is to streamline the complex processes involved in transportation logistics, whether for raw materials, finished goods, or parcels.

Major applications of TMS span across diverse industries, including manufacturing, retail, e-commerce, third-party logistics (3PLs), and the food and beverage sector. Its benefits are manifold, ranging from significant cost savings through optimized routes and carrier selection to enhanced operational efficiency by automating manual tasks. Real-time tracking and visibility provided by TMS solutions improve decision-making and customer satisfaction, while compliance features help businesses navigate complex regulatory landscapes. The market's robust growth is primarily driven by the exponential expansion of e-commerce, increasing supply chain complexities, the growing need for logistical efficiency and cost optimization, and the rising demand for real-time visibility across global supply networks. Additionally, the push for sustainable logistics and reduced carbon footprints also contributes to TMS adoption.

Transportation Management System Market Executive Summary

The Transportation Management System market is experiencing significant expansion, driven by widespread digitalization and the increasing complexity of global supply chains. Key business trends include the accelerated adoption of cloud-based TMS solutions, enabling greater scalability and accessibility for businesses of all sizes. There is a growing emphasis on integrating advanced technologies such as Artificial intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) to enhance predictive analytics, automation, and real-time visibility within transportation operations. Sustainability initiatives and the demand for eco-friendly logistics practices are also shaping market developments, pushing for TMS solutions that optimize routes for reduced fuel consumption and emissions. This strategic shift towards more intelligent and environmentally conscious logistics is a defining characteristic of the current market landscape.

From a regional perspective, North America and Europe continue to dominate the TMS market due to their advanced technological infrastructure, high adoption rates of logistics solutions, and a strong presence of key market players. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapid industrialization, burgeoning e-commerce sectors, and increasing investments in logistics infrastructure, particularly in countries like China and India. Latin America, the Middle East, and Africa are also witnessing steady growth, albeit from a smaller base, as businesses in these regions seek to modernize their supply chains to compete globally. These regional dynamics highlight a global recognition of the strategic importance of optimized transportation management for economic development and competitive advantage.

Segmentation trends indicate a strong preference for cloud-deployed TMS solutions, offering flexibility and lower upfront costs compared to traditional on-premise systems. The software component segment continues to hold the largest market share, but the services segment, including implementation, consulting, and support, is growing rapidly as organizations require specialized expertise to maximize their TMS investments. By enterprise size, large enterprises are major adopters, but Small and Medium-sized Enterprises (SMEs) are increasingly investing in TMS, often through more affordable cloud-based or modular solutions, to streamline their logistics. Furthermore, the market is diversifying across transportation modes, with solutions tailored for road, rail, ocean, and air freight gaining traction, reflecting the multifaceted nature of global trade and logistics requirements.

AI Impact Analysis on Transportation Management System Market

Users frequently inquire about how Artificial Intelligence (AI) will revolutionize logistics and transportation management, focusing on themes such as enhanced operational efficiency, predictive capabilities, and the potential for greater automation. Common questions revolve around AI's ability to optimize routing, forecast demand, and manage inventory more effectively, as well as its role in mitigating risks and improving decision-making processes. Concerns often include the complexity of AI integration, the need for robust data infrastructure, data privacy issues, and the impact on human jobs within the logistics sector. Expectations are high for AI to deliver significant cost reductions, improved delivery times, and more resilient supply chains, transforming traditional approaches to transportation planning and execution.

- AI-driven route optimization significantly reduces fuel consumption and transit times by analyzing real-time traffic, weather, and road conditions.

- Predictive analytics powered by AI enables accurate demand forecasting and proactive management of potential disruptions, such as vehicle breakdowns or port delays.

- Automated load planning and freight matching improve capacity utilization and minimize empty mileage through intelligent allocation algorithms.

- AI enhances real-time visibility and tracking by processing vast amounts of telematics and sensor data, providing precise location and status updates.

- Dynamic pricing and negotiation strategies with carriers become more effective using AI to analyze market rates and historical performance data.

- Improved risk management through AI identifies potential issues in the supply chain, such as customs delays or natural disasters, allowing for pre-emptive actions.

- Enhanced customer experience through AI-powered chatbots and predictive estimated times of arrival (ETAs) that keep clients informed.

- AI contributes to sustainability by optimizing routes and loads, leading to reduced carbon emissions and more environmentally friendly logistics operations.

- Autonomous vehicles and drones, underpinned by AI, hold the potential to transform last-mile delivery and long-haul transportation, addressing labor shortages and efficiency.

- AI-based anomaly detection systems identify fraudulent activities or deviations from planned routes, enhancing security and operational integrity.

DRO & Impact Forces Of Transportation Management System Market

The Transportation Management System (TMS) market is profoundly shaped by a confluence of powerful drivers, persistent restraints, significant opportunities, and overarching impact forces. Key drivers propelling the market forward include the unprecedented surge in global e-commerce, necessitating sophisticated logistics solutions for efficient last-mile delivery and inventory management. The increasing complexity of global supply chains, characterized by distributed manufacturing, diverse supplier networks, and fluctuating consumer demands, mandates robust TMS solutions for effective coordination. Furthermore, the relentless pursuit of cost efficiency and operational optimization across industries compels businesses to adopt TMS to reduce transportation expenses, streamline processes, and minimize delays. The growing demand for real-time visibility and transparency across the entire supply chain, coupled with stringent regulatory compliance requirements for freight movements, also acts as a powerful catalyst for market growth, pushing businesses to invest in advanced tracking and reporting functionalities. These drivers collectively create a compelling business case for TMS adoption, fostering innovation and expansion within the market.

Despite the strong growth drivers, the TMS market faces several notable restraints. The high initial investment cost associated with implementing a comprehensive TMS can be a significant barrier, particularly for Small and Medium-sized Enterprises (SMEs) with limited capital budgets. Integrating TMS with existing legacy Enterprise Resource Planning (ERP) systems, warehouse management systems (WMS), and other supply chain software often presents considerable technical complexities and can be time-consuming and expensive. Additionally, the shortage of skilled personnel required to operate, maintain, and optimize advanced TMS platforms poses a challenge, as organizations struggle to find experts proficient in logistics, IT, and data analytics. Resistance to change within organizations, along with concerns about data security and privacy when migrating sensitive logistics information to cloud-based systems, also acts as a restraining factor. These challenges require strategic planning and investment in training and infrastructure to overcome, influencing the pace and scale of TMS adoption.

Opportunities for growth in the TMS market are abundant and diverse. The rapid proliferation of cloud-based TMS solutions offers scalability, flexibility, and lower total cost of ownership, making advanced logistics capabilities accessible to a broader range of businesses, including SMEs. The increasing integration of cutting-edge technologies like Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and Blockchain within TMS platforms presents significant avenues for innovation, enabling predictive analytics, enhanced automation, and improved data security. The expansion into emerging markets, particularly in Asia Pacific, Latin America, and the Middle East and Africa, driven by their burgeoning economies and developing logistics infrastructures, offers substantial untapped potential. Furthermore, the growing focus on optimizing last-mile delivery in urban areas and the demand for sustainable logistics practices create new specialized TMS solution opportunities. Overarching impact forces include global economic shifts, geopolitical instabilities affecting trade routes, fluctuating fuel prices, and evolving environmental regulations that collectively influence transportation strategies and the demand for resilient, adaptable TMS solutions. These opportunities highlight a dynamic market poised for continued innovation and strategic expansion.

Segmentation Analysis

The Transportation Management System (TMS) market is comprehensively segmented to address the diverse needs of various industries and operational requirements. This segmentation allows for a detailed analysis of market dynamics, identifying key growth areas and niche opportunities within the broader logistics and supply chain landscape. The primary segmentation criteria include the components of the TMS solution, the deployment model utilized, the specific modes of transportation managed, the industry verticals served, and the size of the enterprises adopting these systems. Each segment reflects unique characteristics and demands, influencing product development, market strategies, and competitive positioning among TMS providers.

- By Component

- Software (On-premise, Cloud-based)

- Services (Consulting, Implementation, Support & Maintenance)

- By Deployment Model

- On-premise

- Cloud-based

- Hybrid

- By Transportation Mode

- Roadways

- Railways

- Waterways (Ocean/Inland)

- Airways

- By Industry Vertical

- Retail & E-commerce

- Manufacturing

- Logistics & 3PL

- Food & Beverage

- Healthcare & Pharmaceuticals

- Automotive

- Chemicals

- Government

- Others

- By Enterprise Size

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

Value Chain Analysis For Transportation Management System Market

The value chain of the Transportation Management System market begins with upstream activities focused on the development and provision of core technological components and foundational services. This segment primarily involves software developers and vendors who design and build the TMS platforms, including specialized modules for planning, execution, and optimization. Hardware providers contribute infrastructure like servers, networking equipment, and IoT devices for data collection, while data providers offer critical information such as mapping data, traffic updates, and freight market intelligence. Research and development teams are pivotal here, continuously innovating to integrate advanced functionalities like AI, Machine Learning, and blockchain, ensuring the TMS solutions remain competitive and responsive to evolving logistics demands. The quality and sophistication of these upstream inputs directly impact the capabilities and effectiveness of the final TMS product, laying the groundwork for downstream applications.

Moving downstream, the value chain extends to the distribution, implementation, and utilization of TMS solutions by various end-users. Distribution channels are diverse, encompassing direct sales teams from TMS vendors, a network of third-party integrators, and value-added resellers (VARs) who provide localized support and customized implementations. Indirect channels often involve strategic partnerships with consulting firms and technology platforms that bundle TMS within broader supply chain offerings. Once acquired, the TMS is implemented by logistics service providers, manufacturers, retailers, and e-commerce companies to manage their freight operations. These end-users leverage the system to plan optimal routes, select carriers, track shipments in real-time, manage freight costs, and ensure compliance. Post-implementation, ongoing support, maintenance, and updates are crucial for maximizing the system's longevity and performance, often provided by the original vendor or specialized service partners. This downstream activity focuses on delivering the tangible benefits of enhanced efficiency, cost savings, and improved visibility to the ultimate buyers, thereby completing the value creation cycle within the TMS ecosystem.

Transportation Management System Market Potential Customers

The potential customer base for the Transportation Management System (TMS) market is broad and diverse, encompassing any organization involved in the movement of goods, regardless of industry or size. Manufacturers, particularly those with complex supply chains spanning multiple geographies, are key buyers seeking to optimize inbound raw material logistics and outbound finished product distribution. Retailers, especially those operating extensive e-commerce platforms, rely heavily on TMS to manage vast volumes of parcel shipments, orchestrate last-mile deliveries, and ensure timely product availability for their customers. The rapid growth of online shopping has significantly expanded this segment, creating a continuous demand for sophisticated and scalable TMS solutions.

Third-Party Logistics (3PL) providers and other dedicated logistics companies represent a significant portion of the TMS market. These entities manage transportation for multiple clients and require robust, multi-tenant TMS solutions to handle diverse freight requirements, optimize asset utilization, and provide superior service levels. Beyond these core segments, industries such as food and beverage, healthcare and pharmaceuticals, and automotive also exhibit high potential for TMS adoption. These sectors often deal with specific challenges like cold chain logistics, regulatory compliance, and just-in-time delivery, making advanced TMS capabilities indispensable. Government agencies involved in public works or defense logistics, as well as distributors managing vast networks of warehouses and delivery routes, also stand as vital end-users, underscoring the universal applicability of transportation management solutions in today's interconnected global economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.5 Billion |

| Market Forecast in 2032 | USD 48.2 Billion |

| Growth Rate | 17.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces | >|

| Segments Covered | >|

| Key Companies Covered | Oracle, SAP, Manhattan Associates, Blue Yonder, Trimble Transportation, Descartes Systems Group, MercuryGate International, E2open, C.H. Robinson (Navisphere), Transplace (Uber Freight), 3Gtms, TMW Systems (Trimble), FreightPOP, Alpega Group, Kuebix (Trimble), PTV Group, CTSI Global, Omnitracs (Solera), Freightos, WiseTech Global |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Transportation Management System Market Key Technology Landscape

The Transportation Management System (TMS) market is undergoing a significant technological transformation, driven by advancements that enhance efficiency, visibility, and decision-making capabilities. Cloud computing remains a foundational technology, offering scalable, flexible, and cost-effective deployment models for TMS solutions, facilitating widespread adoption across enterprises of all sizes. The shift from on-premise to cloud-based platforms enables real-time collaboration, easier integration with other supply chain systems, and continuous updates. This paradigm allows businesses to access advanced TMS functionalities without the heavy upfront investment in IT infrastructure, making sophisticated logistics management more accessible. Furthermore, the proliferation of cloud services supports the rapid deployment and scaling of TMS, catering to dynamic business needs and seasonal fluctuations in transportation volumes.

Beyond cloud infrastructure, the integration of Artificial Intelligence (AI) and Machine Learning (ML) is profoundly impacting TMS functionalities. AI algorithms power predictive analytics for demand forecasting, dynamic route optimization, and proactive risk management, anticipating potential disruptions before they occur. ML models analyze vast datasets of historical and real-time transportation data to identify patterns, improve carrier selection, and optimize freight spend, leading to smarter and more efficient operations. The Internet of Things (IoT) plays a crucial role by enabling real-time asset tracking through sensors embedded in vehicles, containers, and cargo, providing unparalleled visibility into shipment location, condition, and security. Big Data Analytics complements these technologies by processing and interpreting the massive volumes of data generated, offering actionable insights for strategic planning and continuous operational improvement, thereby enhancing the overall intelligence and responsiveness of TMS solutions.

Emerging technologies like Blockchain and advanced Telematics are also gaining traction within the TMS landscape. Blockchain offers enhanced transparency, security, and traceability for supply chain transactions, creating immutable records of shipments, contracts, and payments, which can streamline audit processes and reduce disputes. Telematics, through GPS tracking and vehicle diagnostics, provides detailed data on driver behavior, vehicle performance, and fuel consumption, enabling fleet managers to optimize routes, ensure compliance, and improve safety. These technologies, when integrated into TMS platforms, contribute to creating a more robust, secure, and intelligent transportation ecosystem, addressing modern logistics challenges such as fraud prevention, sustainability, and complex regulatory adherence. The continuous evolution and adoption of these advanced technologies are key to the future development and competitive differentiation of TMS offerings.

Regional Highlights

North America continues to be a dominant force in the Transportation Management System (TMS) market, characterized by early adoption of advanced logistics technologies, a mature e-commerce sector, and a strong emphasis on supply chain efficiency. The region benefits from a robust infrastructure and a significant presence of leading TMS vendors and technology innovators. Companies across the United States and Canada are heavily investing in TMS to manage complex cross-border logistics, optimize freight movements, and navigate stringent regulatory environments. The high operational costs associated with transportation in North America also drive businesses to seek solutions that promise significant cost savings and efficiency gains. Furthermore, the push for enhanced customer experience, particularly in last-mile delivery, fuels demand for sophisticated, real-time tracking and optimization capabilities offered by modern TMS platforms.

Europe also holds a substantial share of the TMS market, driven by its well-established manufacturing industries, intricate intra-European trade networks, and a strong focus on sustainability and regulatory compliance. Countries such as Germany, the UK, France, and the Netherlands are at the forefront of TMS adoption, integrating solutions to manage diverse transportation modes, optimize cross-border shipping, and adhere to strict environmental standards. The region's emphasis on integrated logistics and smart cities initiatives further encourages the deployment of advanced TMS solutions that support multimodal transportation and efficient urban delivery. The increasing volume of e-commerce transactions and the need for seamless international trade within the European Union bolster the demand for comprehensive TMS platforms capable of handling complex customs procedures and varied logistical requirements across multiple countries.

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate in the TMS market during the forecast period. This rapid expansion is primarily attributed to the explosive growth of e-commerce in countries like China, India, and Southeast Asian nations, coupled with rapid industrialization and significant investments in logistics infrastructure development. As businesses in APAC scale their operations and aim to compete on a global stage, the need for efficient and transparent transportation management becomes paramount. Government initiatives promoting digitalization and trade facilitation also contribute to increased TMS adoption. While North America and Europe lead in market size, the immense untapped potential and economic development across APAC present significant opportunities for TMS providers, driven by a burgeoning middle class, expanding manufacturing capabilities, and a rising demand for sophisticated supply chain solutions to manage burgeoning trade volumes.

- North America: Dominant market share due to mature e-commerce, extensive infrastructure, and early technology adoption. Strong focus on cost efficiency and real-time visibility.

- Europe: Significant market, driven by manufacturing, intra-regional trade, and strong emphasis on sustainability and complex regulatory compliance.

- Asia Pacific (APAC): Fastest-growing region, fueled by booming e-commerce, rapid industrialization, and infrastructure investments, particularly in China and India.

- Latin America: Emerging market with increasing adoption due to growing trade activities, logistics modernization efforts, and demand for efficiency.

- Middle East & Africa (MEA): Steady growth propelled by infrastructure development, diversification of economies from oil, and investment in logistics hubs and trade corridors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Transportation Management System Market.- Oracle

- SAP

- Manhattan Associates

- Blue Yonder

- Trimble Transportation

- Descartes Systems Group

- MercuryGate International

- E2open

- C.H. Robinson (Navisphere)

- Transplace (Uber Freight)

- 3Gtms

- TMW Systems (Trimble)

- FreightPOP

- Alpega Group

- Kuebix (Trimble)

- PTV Group

- CTSI Global

- Omnitracs (Solera)

- Freightos

- WiseTech Global

Frequently Asked Questions

What is a Transportation Management System (TMS) and why is it important?

A Transportation Management System (TMS) is a software solution designed to help businesses manage and optimize their transportation operations. It is crucial for enhancing efficiency, reducing costs, improving shipment visibility, ensuring regulatory compliance, and boosting customer satisfaction by streamlining freight planning, execution, and monitoring.

What are the primary benefits of implementing a TMS?

Implementing a TMS offers numerous benefits, including significant reductions in freight costs through optimized routing and carrier selection, improved operational efficiency through automation, enhanced real-time visibility of shipments, better on-time delivery performance, and stronger compliance with transportation regulations, all contributing to a more resilient supply chain.

How is AI impacting the Transportation Management System market?

AI is profoundly impacting the TMS market by enabling predictive analytics for demand forecasting and risk management, optimizing routes in real-time based on dynamic conditions, automating load planning and freight matching, and enhancing overall operational efficiency. AI integration leads to smarter decision-making and more resilient, cost-effective transportation operations.

What are the key challenges in TMS adoption and implementation?

Key challenges in TMS adoption include high initial investment costs, complexity in integrating with existing legacy systems, a shortage of skilled personnel to manage and optimize the software, and internal resistance to organizational change. Addressing these requires careful planning, investment in training, and robust technical support.

Which industries are the primary adopters of Transportation Management Systems?

The primary industries adopting Transportation Management Systems include retail and e-commerce, manufacturing, third-party logistics (3PL) providers, food and beverage, and healthcare and pharmaceuticals. These sectors heavily rely on efficient freight movement for their core operations and supply chain effectiveness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Intelligent Transportation Management System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Smart Supply Chain Solution Market Statistics 2025 Analysis By Application (Retail, IT and Telecommunication, Manufacturing, BFSI, Energy and Utility, Healthcare, Other), By Type (Transportation Management System (TMS), Warehouse Management System (WMS)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Transportation Management System (TMS) Solution Market Statistics 2025 Analysis By Application (Retail, Healthcare and Pharmaceutical, Manufacturing, Transportation and Logistics, Energy and Utilities, Government), By Type (Planning and Execution, Order Managment, Audit, Payment and Claims, Reporting and Analytics, Routing and Tracking), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Freight Transportation Management System Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Solution, Services), By Application (Rail Freight, Road Freight, Ocean Freight, Air Freight), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager