Travel Credit Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431132 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Travel Credit Insurance Market Size

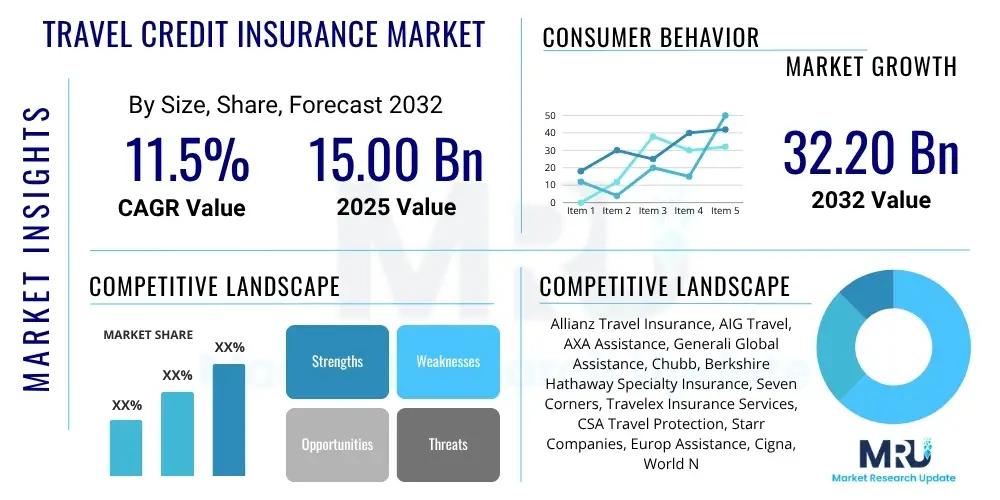

The Travel Credit Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2025 and 2032. The market is estimated at $15.00 Billion in 2025 and is projected to reach $32.20 Billion by the end of the forecast period in 2032.

Travel Credit Insurance Market introduction

The Travel Credit Insurance Market encompasses financial products designed to protect travelers from various unforeseen events that can disrupt their journeys or incur significant financial losses. This insurance, often offered in conjunction with credit cards or as standalone policies, typically covers risks such as trip cancellation, interruption, medical emergencies abroad, lost baggage, and travel delays. Its primary purpose is to provide peace of mind and financial security for individuals undertaking domestic or international travel.

Major applications of travel credit insurance extend across leisure travel, business travel, and educational trips, catering to a diverse demographic including frequent flyers, families, and solo adventurers. Key benefits include mitigating the financial impact of unexpected health issues, protecting investments in non-refundable travel bookings, and offering emergency assistance services globally. Driving factors for market growth include increasing global travel volumes, rising awareness of travel risks, the convenience of digital insurance platforms, and the growing complexity of international travel arrangements requiring comprehensive protection.

Travel Credit Insurance Market Executive Summary

The Travel Credit Insurance Market is currently experiencing robust growth, driven by evolving business trends focused on digital transformation, personalized product offerings, and strategic partnerships with travel providers and financial institutions. Insurers are leveraging data analytics to create tailored policies that better address individual traveler needs, moving away from one-size-fits-all solutions. The shift towards online sales channels and mobile-first applications is significantly enhancing accessibility and customer engagement, streamlining the purchasing and claims processes for a digitally savvy consumer base.

Regionally, North America and Europe continue to represent mature markets with high penetration rates, characterized by established regulatory frameworks and consumer awareness. The Asia Pacific (APAC) region, however, is emerging as a significant growth engine, fueled by increasing disposable incomes, a burgeoning middle class, and a surge in both domestic and outbound tourism, particularly from countries like China and India. Latin America and the Middle East and Africa (MEA) also present considerable opportunities, albeit with varying levels of market maturity and regulatory environments.

Segment trends indicate a strong demand for comprehensive coverage options, including those for adventure travel, pre-existing medical conditions, and specific high-value items. The integration of travel insurance into broader financial products, such as premium credit card benefits, continues to be a crucial distribution strategy. Furthermore, the market is witnessing an emphasis on flexible cancellation policies and enhanced medical coverage in response to global health uncertainties, demonstrating an adaptive and responsive industry landscape.

AI Impact Analysis on Travel Credit Insurance Market

Common user questions regarding AI's impact on the Travel Credit Insurance Market often revolve around how artificial intelligence can make policies more affordable, personalize coverage, expedite claims, and enhance overall customer experience. Users are interested in whether AI can accurately assess individual risk profiles to offer fairer premiums and if it can simplify the often-complex process of filing a claim. There are also queries about AI's role in fraud detection, improving transparency, and providing real-time assistance during travel emergencies, alongside concerns about data privacy and the potential for algorithmic bias in underwriting decisions. The overarching expectation is for AI to deliver more efficient, personalized, and accessible insurance solutions.

- AI-driven personalized policy generation based on traveler behavior and risk profiles.

- Automated underwriting processes for faster policy issuance and dynamic pricing.

- Enhanced fraud detection capabilities through pattern recognition in claims data.

- Streamlined and accelerated claims processing using natural language processing and image recognition.

- Improved customer service via AI-powered chatbots and virtual assistants for instant support.

- Predictive analytics for anticipating potential travel disruptions and proactive communication with policyholders.

- Development of innovative insurance products tailored to specific emerging travel trends.

DRO & Impact Forces Of Travel Credit Insurance Market

The Travel Credit Insurance Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities. Key drivers propelling market expansion include the substantial growth in international and domestic travel, driven by globalization and rising disposable incomes globally. Additionally, increasing consumer awareness regarding the potential financial risks associated with travel, coupled with the convenience and perceived value of integrated credit card benefits, significantly boosts demand. The continued digitalization of insurance services, enabling easier policy comparison and purchase, further acts as a powerful catalyst for growth.

However, the market also faces notable restraints. Intense price competition among providers often leads to downward pressure on premiums, potentially impacting profitability. Complex and evolving regulatory landscapes across different geographies pose challenges for insurers operating internationally, requiring significant compliance efforts. Furthermore, a lingering lack of comprehensive consumer understanding regarding policy terms and conditions, particularly for embedded credit card benefits, can lead to dissatisfaction and dampen market potential. The perceived high cost of some standalone policies also acts as a barrier for budget-conscious travelers.

Opportunities within the market are abundant, particularly in the realm of product innovation and market penetration. The increasing trend of embedded insurance, where coverage is seamlessly integrated at the point of sale for travel bookings or credit card applications, offers a significant avenue for growth. Customization and micro-insurance solutions, catering to specific traveler needs and shorter durations, present opportunities to attract niche segments. Expanding into emerging economies with growing travel sectors and leveraging advanced analytics for hyper-personalization are also key strategic opportunities for market players.

Segmentation Analysis

The Travel Credit Insurance Market is comprehensively segmented to cater to diverse traveler needs and preferences, enabling providers to offer tailored solutions and distribution strategies. This segmentation allows for a granular understanding of market dynamics, identifying specific growth areas and unmet demands. The market can be broadly categorized by coverage type, distribution channel, end-user, and geographic region, each exhibiting unique characteristics and growth trajectories. Analyzing these segments provides critical insights for product development, marketing efforts, and strategic planning within the industry.

- By Coverage Type

- Trip Cancellation and Interruption

- Emergency Medical and Evacuation

- Baggage Loss and Delay

- Travel Delay and Missed Connection

- Accidental Death and Dismemberment

- Rental Car Collision Damage Waiver

- Other Benefits (e.g., identity theft, concierge services)

- By Distribution Channel

- Credit Card Companies (Embedded Benefits)

- Insurance Brokers and Agents

- Online Aggregators and Comparison Websites

- Direct Sales (Insurer Websites)

- Travel Agencies and Tour Operators

- Banks and Financial Institutions

- By End-User

- Leisure Travelers (Individual, Family)

- Business Travelers (Corporate, Individual)

- Students and Educators

- Senior Citizens

- Adventure Travelers

- By Policy Type

- Single Trip Policies

- Multi-Trip/Annual Policies

- Group Policies

Value Chain Analysis For Travel Credit Insurance Market

The value chain for the Travel Credit Insurance Market begins with upstream activities involving reinsurers and technology providers. Reinsurers play a crucial role by absorbing a portion of the risk from primary insurers, thereby enabling them to underwrite larger and more diverse portfolios of travel credit insurance policies. Technology providers supply the essential infrastructure for policy administration, claims processing, data analytics, and digital customer interfaces, forming the backbone of efficient operations. This upstream segment is characterized by specialized expertise and significant capital requirements, influencing the overall cost structure and risk capacity of the market.

Midstream activities primarily encompass the core insurance functions performed by underwriters and policy administrators. Underwriters assess risks, determine appropriate premiums, and design policy terms, ensuring the financial viability of the insurance products. Policy administration involves managing policy issuance, renewals, endorsements, and cancellations, along with maintaining customer records and ensuring regulatory compliance. This stage is critical for maintaining operational efficiency, managing actuarial soundness, and adhering to strict industry standards. Effective claims processing, though often integrated, also forms a crucial part of this core segment, focusing on timely and fair resolution of claims.

Downstream activities focus on the distribution channels that connect insurance providers with end-users. Direct distribution includes sales through insurer websites and mobile applications, allowing for greater control over the customer experience and direct engagement. Indirect distribution is multifaceted, involving credit card companies embedding insurance as a benefit, independent insurance brokers and agents who offer personalized advice, online aggregators and comparison websites that facilitate product comparison, and travel agencies or tour operators who bundle insurance with travel packages. Each channel serves different customer segments and plays a vital role in market penetration and customer acquisition.

Travel Credit Insurance Market Potential Customers

The primary potential customers for travel credit insurance are diverse, encompassing a wide spectrum of individuals and groups undertaking various types of travel. Leisure travelers represent a significant segment, including individuals and families embarking on vacations, cruises, or cultural tours, who seek protection against unforeseen events that could disrupt their plans or lead to financial losses. These customers often prioritize coverage for trip cancellation, medical emergencies, and baggage issues, valuing peace of mind during their leisure pursuits. The convenience of credit card embedded insurance is particularly attractive to this segment.

Business travelers form another crucial customer group, frequently traveling for conferences, meetings, or project assignments. Their priorities often include coverage for travel delays, missed connections, and emergency medical care, as disruptions can have significant professional and financial repercussions. Corporate entities purchasing group policies for their employees also fall into this category, ensuring their workforce is protected during business trips. Students and educators undertaking study abroad programs or research trips also require comprehensive coverage, often extending to longer durations and specific academic-related risks.

Furthermore, adventure travelers engaging in high-risk activities, senior citizens with specific medical coverage needs, and expatriates living abroad represent specialized segments with unique requirements for comprehensive and often customized travel credit insurance policies. Digital nomads and frequent international travelers who embark on multiple trips per year also constitute a growing segment, often opting for annual multi-trip policies to ensure continuous protection. These diverse end-users drive demand for varied product offerings and distribution channels within the travel credit insurance market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $15.00 Billion |

| Market Forecast in 2032 | $32.20 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allianz Travel Insurance, AIG Travel, AXA Assistance, Generali Global Assistance, Chubb, Berkshire Hathaway Specialty Insurance, Seven Corners, Travelex Insurance Services, CSA Travel Protection, Starr Companies, Europ Assistance, Cigna, World Nomads, Travel Guard, Zurich Insurance Group, UnitedHealthcare Global, Liberty Mutual, The Travelers Companies, IMG Global, GeoBlue |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Travel Credit Insurance Market Key Technology Landscape

The Travel Credit Insurance Market is increasingly leveraging advanced technologies to enhance operational efficiency, improve customer experience, and develop innovative products. Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront, employed for predictive analytics to assess risk more accurately, personalize policy recommendations based on individual travel history and preferences, and automate underwriting processes. These technologies significantly reduce manual effort and accelerate decision-making, allowing insurers to offer competitive pricing and faster policy issuance.

Furthermore, Big Data analytics plays a critical role in extracting actionable insights from vast amounts of traveler data, claim histories, and global travel trends. This enables insurers to identify emerging risks, optimize pricing strategies, and refine their product portfolios to meet evolving consumer demands. Cloud computing infrastructure provides the scalability and flexibility required to manage large datasets, support digital distribution channels, and ensure seamless access to services from anywhere in the world, facilitating global operations and collaborations.

Blockchain technology is gaining traction, particularly for its potential to revolutionize claims processing and fraud prevention. By creating immutable and transparent records of policies and claims, blockchain can expedite verification processes, reduce administrative costs, and enhance trust among all parties involved. Additionally, the proliferation of mobile applications and digital platforms is transforming how travel credit insurance is distributed and managed, offering customers convenient access to policy information, emergency assistance, and claims submission tools directly from their smartphones, driving a mobile-first engagement strategy.

Regional Highlights

The global Travel Credit Insurance Market exhibits distinct characteristics and growth patterns across various key regions. North America, driven by high rates of international travel, a robust economy, and sophisticated financial services infrastructure, represents a mature market with high consumer awareness and significant adoption of travel insurance products, often bundled with premium credit cards. The region benefits from strong regulatory oversight and a competitive landscape that encourages continuous product innovation.

Europe mirrors North America in terms of market maturity, with comprehensive regulatory frameworks and a culture of proactive risk management among travelers. Countries within the European Union, in particular, show high penetration rates due to frequent cross-border travel and well-established insurance industries. The Asia Pacific (APAC) region stands out as the fastest-growing market, propelled by expanding middle-class populations, rising disposable incomes, and a surge in both outbound and domestic tourism from economic powerhouses like China, India, and Southeast Asian nations. This region presents significant untapped potential and a dynamic environment for new market entrants and digital innovations.

Latin America and the Middle East and Africa (MEA) are emerging markets for travel credit insurance. While penetration rates are generally lower compared to developed regions, increasing globalization, improving economic conditions, and growing awareness of travel risks are fostering market development. These regions offer opportunities for insurers willing to tailor products to local economic conditions and cultural preferences, particularly through partnerships with local banks and travel operators. Investment in digital infrastructure and consumer education will be key to unlocking their full potential.

- North America: High market maturity, strong consumer awareness, significant penetration of credit card-linked benefits.

- Europe: Established regulatory environment, frequent intra-continental travel, focus on comprehensive coverage.

- Asia Pacific (APAC): Rapid growth, increasing disposable incomes, surge in outbound tourism, digital adoption.

- Latin America: Emerging market, increasing international travel, potential for growth with tailored offerings.

- Middle East and Africa (MEA): Developing market, growing business and leisure travel, opportunities for localized solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Travel Credit Insurance Market.- Allianz Travel Insurance

- AIG Travel

- AXA Assistance

- Generali Global Assistance

- Chubb

- Berkshire Hathaway Specialty Insurance

- Seven Corners

- Travelex Insurance Services

- CSA Travel Protection

- Starr Companies

- Europ Assistance

- Cigna

- World Nomads

- Travel Guard (an AIG company)

- Zurich Insurance Group

- UnitedHealthcare Global

- Liberty Mutual

- The Travelers Companies

- IMG Global

- GeoBlue

Frequently Asked Questions

What does travel credit insurance typically cover?

Travel credit insurance often covers trip cancellation, interruption, emergency medical expenses, baggage loss or delay, and travel delays, providing financial protection against unforeseen events during your journey.

How is travel credit insurance different from standalone travel insurance?

Travel credit insurance is usually offered as a benefit with certain credit cards, providing basic coverage. Standalone policies often offer more comprehensive coverage and higher limits, allowing for customization.

Who are the primary beneficiaries of travel credit insurance?

Primary beneficiaries include leisure travelers, business travelers, families, and individuals seeking financial protection and peace of mind against various travel-related risks.

How can AI impact the future of travel credit insurance?

AI can personalize policies, automate underwriting, enhance fraud detection, expedite claims processing, and improve customer service through intelligent virtual assistants, making insurance more efficient.

What factors are driving the growth of the Travel Credit Insurance Market?

Key drivers include increased global travel, rising awareness of travel risks, the convenience of digital platforms, and the added value of insurance benefits bundled with premium credit cards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager