Two-Wheeler in Logistics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430615 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Two-Wheeler in Logistics Market Size

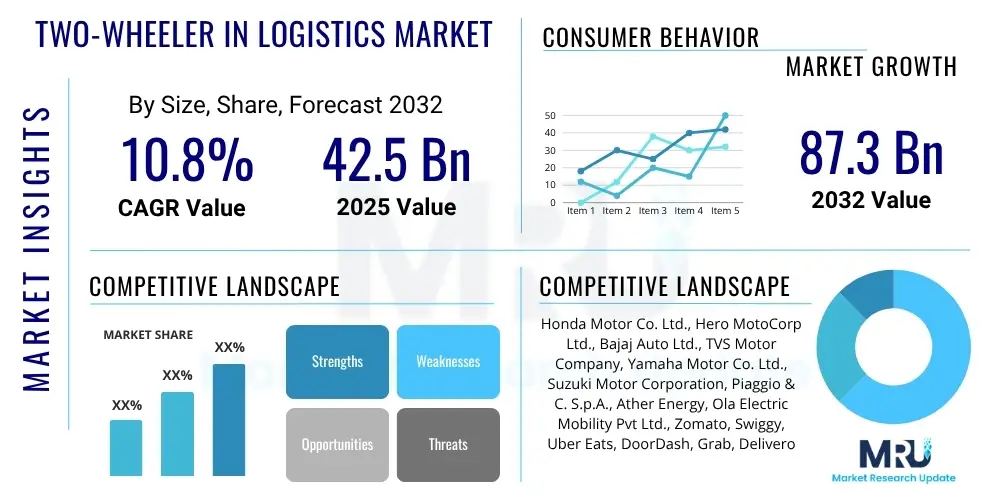

The Two-Wheeler in Logistics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2025 and 2032. The market is estimated at USD 42.5 Billion in 2025 and is projected to reach USD 87.3 Billion by the end of the forecast period in 2032.

Two-Wheeler in Logistics Market introduction

The Two-Wheeler in Logistics Market encompasses the utilization of motorcycles, scooters, and electric two-wheelers for various commercial delivery and logistics operations. This dynamic sector plays a critical role in addressing the surging demand for swift, efficient, and cost-effective last-mile delivery services, particularly in urban and semi-urban environments. The core product offering includes a diverse range of two-wheelers optimized for carrying goods, often featuring specialized cargo compartments and enhanced durability for continuous operation.

Major applications for two-wheelers in logistics span a broad spectrum, including food delivery, e-commerce parcel delivery, grocery delivery, pharmaceutical distribution, and field service technician support. The inherent agility of two-wheelers allows them to navigate congested city streets and narrow alleys more effectively than larger vehicles, significantly reducing delivery times and improving operational efficiency. This speed and maneuverability are primary benefits, enabling businesses to meet increasingly stringent customer expectations for rapid fulfillment.

Driving factors for the market's robust growth include the unprecedented expansion of the e-commerce industry, particularly accelerated by global digital adoption trends and consumer preferences for online shopping. Rapid urbanization, leading to denser populations and increased traffic congestion, further underscores the necessity for agile delivery solutions. The burgeoning gig economy, which heavily relies on independent riders for delivery services, also acts as a significant catalyst, contributing to both the supply of labor and the demand for efficient delivery vehicles.

Two-Wheeler in Logistics Market Executive Summary

The Two-Wheeler in Logistics Market is experiencing transformative growth, driven by key business, regional, and segment trends. Business trends are characterized by a strong emphasis on technology integration, including advanced fleet management systems, route optimization software, and the increasing adoption of electric two-wheelers for sustainable operations. Companies are investing in data analytics to enhance operational efficiency, reduce delivery costs, and improve overall customer satisfaction, signaling a shift towards smart logistics solutions. The competitive landscape is intensifying with the entry of new players and strategic partnerships aimed at expanding geographical reach and service offerings.

Regional trends indicate Asia-Pacific as the dominant market, propelled by its vast population, burgeoning e-commerce sectors, and the widespread existing use of two-wheelers for personal transport, which translates seamlessly into commercial applications. Emerging economies in Latin America, the Middle East, and Africa are also exhibiting significant growth potential, driven by urbanization and expanding digital economies that foster last-mile delivery demands. In contrast, developed regions like Europe and North America are seeing increased adoption of electric two-wheelers, aligning with stricter environmental regulations and a focus on sustainable urban logistics.

Segment trends highlight the rapid expansion of the food delivery and e-commerce logistics sectors as primary growth engines. Electric two-wheelers are emerging as a pivotal sub-segment, driven by environmental concerns, supportive government policies, and advancements in battery technology that enhance range and performance. The growing preference for quick commerce, promising deliveries in under an hour, further bolsters the demand for agile two-wheeler fleets. Additionally, there is a noticeable trend towards specialized two-wheelers equipped with advanced features tailored for specific delivery needs, such as temperature-controlled compartments for groceries or pharmaceuticals, indicating market maturation and diversification.

AI Impact Analysis on Two-Wheeler in Logistics Market

User questions regarding the impact of AI on the Two-Wheeler in Logistics Market frequently center on themes of efficiency enhancement, operational cost reduction, and the potential for autonomous delivery. Users are keen to understand how AI can optimize delivery routes to bypass congestion, improve predictive maintenance for fleet longevity, and enhance rider safety through intelligent monitoring. There is also significant interest in AI's role in demand forecasting, inventory management for hyperlocal hubs, and the development of more personalized and adaptive delivery services. Concerns sometimes emerge around data privacy, the initial investment required for AI integration, and the potential displacement of human delivery personnel as AI-powered autonomous solutions advance.

- AI-powered route optimization significantly reduces delivery times and fuel consumption, improving efficiency.

- Predictive maintenance analytics for two-wheeler fleets minimizes downtime and extends vehicle lifespan.

- Demand forecasting models optimize fleet size and resource allocation, reducing operational costs.

- AI-driven rider behavior analysis enhances safety protocols and provides personalized training.

- Autonomous last-mile delivery solutions using two-wheelers are in pilot phases, promising future scalability and reduced labor costs.

- Intelligent inventory management for micro-fulfillment centers improves stock accuracy and order preparation.

- Dynamic pricing and delivery slot optimization using AI algorithms enhances profitability and customer satisfaction.

DRO & Impact Forces Of Two-Wheeler in Logistics Market

The Two-Wheeler in Logistics Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, alongside significant impact forces. Key drivers include the exponential growth of e-commerce and online retail, which necessitates robust last-mile delivery infrastructure to meet consumer expectations for speed and convenience. Rapid urbanization, leading to increased traffic congestion and a demand for agile delivery solutions in dense cityscapes, further propels market expansion. The expanding gig economy model provides a flexible and readily available workforce, lowering operational overheads for delivery service providers, while technological advancements in vehicle design and fleet management software contribute to greater efficiency and reliability.

However, the market also faces considerable restraints. Traffic congestion, while a driver for agility, simultaneously poses operational challenges such as increased accident risks and delays, impacting overall delivery efficiency. The limited carrying capacity of two-wheelers restricts their use for bulkier or larger volume deliveries, forcing businesses to utilize mixed fleets. Safety concerns for riders, particularly in adverse weather conditions or high-traffic areas, remain a critical challenge requiring significant investment in training and safety gear. Furthermore, evolving regulatory landscapes concerning vehicle emissions, operational permits, and rider employment conditions can create hurdles for market players.

Opportunities within this sector are abundant and promising. The accelerating shift towards electric two-wheelers presents a significant avenue for sustainable growth, driven by environmental mandates and improving battery technologies that offer greater range and faster charging. The integration of advanced technologies such as IoT, telematics, and sophisticated fleet management systems offers enhanced tracking, security, and operational intelligence. Expansion into rural and semi-urban logistics, where traditional delivery infrastructure may be lacking, represents an untapped market potential. Moreover, the development of specialized two-wheelers for specific cargo needs, such as insulated compartments for food or medical supplies, opens new niche markets and premium service offerings.

Segmentation Analysis

The Two-Wheeler in Logistics Market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation allows for precise market analysis, identifying key growth areas and niche opportunities across various vehicle types, application areas, and end-user categories. Each segment exhibits unique characteristics and growth drivers, reflecting the evolving needs of the logistics and delivery ecosystem.

- By Vehicle Type

- Motorcycles

- Scooters

- Electric Two-Wheelers

- Mopeds

- By Application

- Food Delivery

- E-commerce Logistics

- Courier and Parcel Delivery

- Pharmaceutical Delivery

- Grocery Delivery

- Field Service and Utilities

- Others

- By End-User

- Restaurants and Food Service Providers

- Retailers and E-commerce Companies

- Courier and Logistics Companies

- Pharmaceutical Distributors

- Local Businesses and SMEs

- Government and Public Services

- By Range

- Short Range (Urban Last-Mile)

- Medium Range (Inter-City)

- By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric

Value Chain Analysis For Two-Wheeler in Logistics Market

The value chain for the Two-Wheeler in Logistics Market is a multi-faceted process involving several key stages, from raw material procurement to final delivery of goods. At the upstream level, the chain begins with the sourcing of various components and raw materials crucial for two-wheeler manufacturing. This includes suppliers of steel, aluminum, plastics, rubber, and electronic components for engines, chassis, tires, batteries, and advanced telematics systems. Research and development activities also form a significant part of the upstream segment, focusing on innovation in vehicle design, fuel efficiency, electric powertrain development, and cargo-carrying solutions, ensuring manufacturers have access to cutting-edge technology and materials for producing high-performance and reliable logistics vehicles.

Moving downstream, the value chain encompasses the manufacturing, assembly, and distribution of two-wheelers, followed by their integration into logistics operations. Two-wheeler manufacturers, both conventional and electric, produce a range of vehicles specifically designed or adapted for commercial use. These vehicles are then distributed through various channels, including direct sales to large fleet operators, dealerships for smaller businesses and independent contractors, and increasingly, through online platforms. Once acquired, these two-wheelers are utilized by a diverse set of logistics and delivery companies, e-commerce giants, food service providers, and local businesses, forming the core of the last-mile delivery ecosystem. Technology providers offering fleet management software, route optimization algorithms, and telematics services are integral to enhancing the operational efficiency of these downstream users.

The distribution channel for two-wheelers in logistics is characterized by both direct and indirect approaches. Direct sales involve manufacturers or their authorized distributors selling directly to large corporate clients, logistics companies, or government entities that require significant fleets. This often includes customized solutions, bulk discounts, and dedicated after-sales support. Indirect channels involve a network of dealerships and retailers that cater to individual contractors, small and medium-sized enterprises (SMEs), and smaller fleet operators. The rise of online marketplaces and leasing models is also increasingly influencing the distribution landscape, offering flexible acquisition options. The entire value chain is supported by an intricate network of after-sales services, including maintenance, repairs, parts supply, and financing options, ensuring the longevity and continuous operation of these critical assets within the logistics industry.

Two-Wheeler in Logistics Market Potential Customers

The Two-Wheeler in Logistics Market caters to a broad and diverse range of end-users and buyers, all seeking efficient and agile last-mile delivery solutions. These potential customers span across various industries, from global e-commerce giants requiring rapid parcel delivery to local businesses needing quick customer fulfillment. The critical factor for these buyers is the ability of two-wheelers to navigate urban congestion, access challenging delivery points, and provide cost-effective transport for smaller parcels and time-sensitive goods. The growth of digital economies and changing consumer expectations for instant gratification continue to expand this customer base significantly.

Key segments of potential customers include established players and emerging enterprises alike. E-commerce companies and online retailers represent a primary customer group, utilizing two-wheelers extensively for last-mile delivery of products purchased through their platforms. Food delivery service providers, including aggregators and individual restaurants, depend heavily on two-wheelers for fast and fresh food delivery. Courier and parcel delivery companies, both international and domestic, integrate two-wheelers into their fleets to enhance speed and efficiency in urban centers. Additionally, pharmaceutical companies and healthcare providers leverage these vehicles for urgent medical supply and prescription deliveries, ensuring timely access to critical items.

Beyond these prominent sectors, a myriad of other end-users contribute to the market's demand. Grocery delivery services, both standalone and supermarket-affiliated, find two-wheelers indispensable for hyperlocal fulfillment. Field service organizations, such as utility companies or technicians, use two-wheelers for quick dispatch and access to customer locations. Small and medium-sized enterprises (SMEs) across various sectors, from florists to electronics repair shops, increasingly adopt two-wheelers for local deliveries to maintain competitiveness. Even government and public services, like postal departments, often incorporate two-wheeler fleets for efficient mail and document distribution, highlighting the ubiquitous utility of these versatile logistics assets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 42.5 Billion |

| Market Forecast in 2032 | USD 87.3 Billion |

| Growth Rate | 10.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honda Motor Co. Ltd., Hero MotoCorp Ltd., Bajaj Auto Ltd., TVS Motor Company, Yamaha Motor Co. Ltd., Suzuki Motor Corporation, Piaggio & C. S.p.A., Ather Energy, Ola Electric Mobility Pvt Ltd., Zomato, Swiggy, Uber Eats, DoorDash, Grab, Deliveroo, Bluedart Express Ltd., Delhivery Pvt Ltd., Amazon Logistics, FedEx Corporation, DHL Express. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Two-Wheeler in Logistics Market Key Technology Landscape

The Two-Wheeler in Logistics Market is increasingly defined by a sophisticated technology landscape that enhances efficiency, safety, and sustainability. Central to this landscape are advanced GPS and telematics systems, which provide real-time tracking, geo-fencing capabilities, and detailed route history, allowing logistics companies to monitor their fleets effectively and ensure timely deliveries. Integrated Internet of Things (IoT) sensors are deployed across vehicles to collect vital data on performance, fuel consumption, and operational parameters, which is then fed into centralized fleet management platforms for comprehensive analysis and decision-making. These technologies are foundational for optimizing delivery operations and managing assets across large and geographically dispersed fleets.

Furthermore, the market heavily relies on sophisticated software solutions such as route optimization algorithms and intelligent dispatch systems. These AI-powered tools analyze numerous variables including traffic conditions, weather patterns, delivery windows, and rider availability to generate the most efficient delivery paths, significantly reducing travel time and operational costs. The proliferation of electric two-wheelers has also brought advancements in battery technology, focusing on increased energy density for extended range, faster charging capabilities, and improved battery management systems for enhanced longevity. Connectivity solutions, including 4G/5G networks, ensure seamless communication between riders, dispatch centers, and customers, facilitating dynamic adjustments to delivery schedules and providing real-time updates.

Safety and security technologies are also gaining prominence, driven by increasing awareness and regulatory requirements. This includes features like anti-lock braking systems (ABS), traction control, and advanced rider assistance systems (ARAS) designed to prevent accidents and improve rider confidence. Moreover, specialized cargo solutions, such as temperature-controlled delivery boxes for perishable goods and secure locking mechanisms for valuable items, integrate smart technology to maintain product integrity and prevent theft. The continuous evolution of these technologies is not only improving the operational capabilities of two-wheelers in logistics but also contributing to a safer, more sustainable, and highly responsive delivery ecosystem, meeting the complex demands of modern urban logistics.

Regional Highlights

- Asia Pacific: Dominates the global market due to high population density, rapid e-commerce expansion, and established two-wheeler culture. Countries like India, China, Indonesia, and Vietnam are major growth hubs, driven by affordable last-mile solutions and burgeoning online consumer bases. Government support for electric mobility further accelerates adoption.

- Europe: Focuses on sustainable urban logistics, with increasing adoption of electric two-wheelers. Strict emission regulations and smart city initiatives in countries such as the UK, Germany, France, and the Netherlands drive innovation in green delivery solutions and efficient route planning for congested city centers.

- North America: Experiencing significant growth, especially in metropolitan areas, fueled by the expansion of the gig economy and the demand for rapid food and grocery delivery. Companies are investing in electric two-wheeler fleets to enhance urban mobility and reduce operational costs, with increasing penetration in last-mile parcel delivery.

- Latin America: An emerging market with strong potential, propelled by urbanization, developing e-commerce infrastructure, and the need for cost-effective delivery solutions. Brazil and Mexico are leading the charge, adapting two-wheeler logistics to navigate diverse geographical challenges and serve expanding urban populations.

- Middle East and Africa (MEA): Showing nascent but promising growth, primarily driven by investments in logistics infrastructure and the rise of online retail. Countries in the GCC region and South Africa are witnessing increased adoption for food and parcel delivery, with a focus on integrating modern fleet management technologies to overcome logistical hurdles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Two-Wheeler in Logistics Market.- Honda Motor Co. Ltd.

- Hero MotoCorp Ltd.

- Bajaj Auto Ltd.

- TVS Motor Company

- Yamaha Motor Co. Ltd.

- Suzuki Motor Corporation

- Piaggio & C. S.p.A.

- Ather Energy

- Ola Electric Mobility Pvt Ltd.

- Zomato

- Swiggy

- Uber Eats

- DoorDash

- Grab

- Deliveroo

- Bluedart Express Ltd.

- Delhivery Pvt Ltd.

- Amazon Logistics

- FedEx Corporation

- DHL Express

Frequently Asked Questions

What are the primary drivers of growth for the Two-Wheeler in Logistics Market?

The market's growth is primarily driven by the exponential expansion of e-commerce, rapid urbanization leading to increased demand for last-mile delivery, and the burgeoning gig economy which provides a flexible workforce for delivery services. These factors collectively push for agile, cost-effective, and swift delivery solutions.

What challenges does the Two-Wheeler in Logistics Market face?

Key challenges include limited carrying capacity for larger or bulkier items, persistent traffic congestion that can affect delivery schedules, safety concerns for riders operating in dense urban environments, and evolving regulatory landscapes concerning vehicle emissions and rider employment conditions.

What is the role of electric two-wheelers in this market?

Electric two-wheelers are playing an increasingly pivotal role, driven by environmental mandates, supportive government policies, and advancements in battery technology. They offer a sustainable, quiet, and often more cost-effective solution for urban last-mile delivery, aligning with global efforts to reduce carbon emissions and improve air quality.

How is AI impacting the Two-Wheeler in Logistics Market?

AI is transforming the market through route optimization, predictive maintenance, demand forecasting, and intelligent dispatch systems. These AI applications enhance operational efficiency, reduce delivery times and costs, improve rider safety, and are paving the way for future autonomous delivery solutions.

Which regions are leading the adoption of two-wheelers in logistics?

Asia-Pacific is the leading region, characterized by its vast population, robust e-commerce growth, and widespread two-wheeler usage. Emerging markets in Latin America, the Middle East, and Africa are also showing significant growth, while Europe and North America focus on sustainable, electric-powered last-mile solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager