Two Winding Power Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429462 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Two Winding Power Transformer Market Size

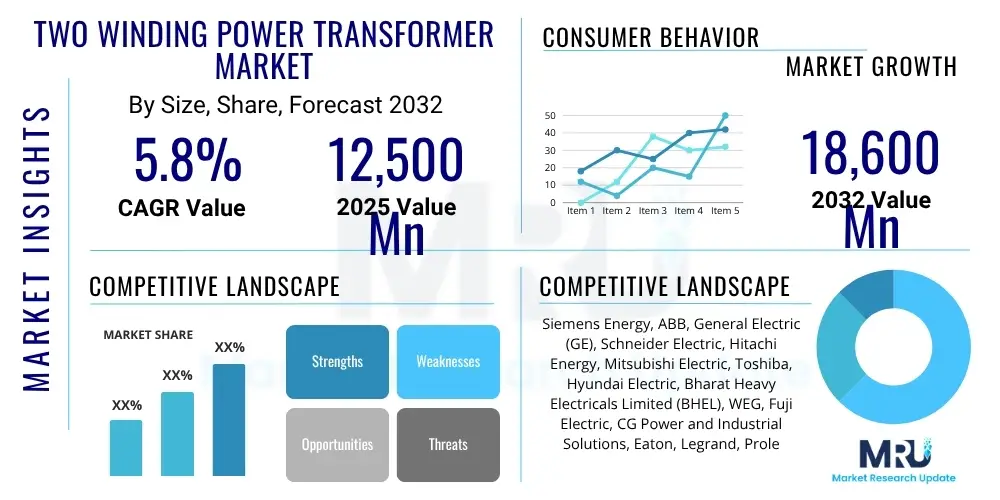

The Two Winding Power Transformer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 12,500 Million in 2025 and is projected to reach USD 18,600 Million by the end of the forecast period in 2032.

Two Winding Power Transformer Market introduction

The Two Winding Power Transformer Market is a critical segment within the electrical equipment industry, instrumental in the efficient transmission and distribution of electrical energy across grids worldwide. These transformers are fundamental components designed to either step up or step down voltage levels, ensuring power can be transported over long distances with minimal loss and then safely delivered to end-users at appropriate voltage. The increasing global demand for electricity, driven by industrialization, urbanization, and the expanding integration of renewable energy sources, underpins the sustained growth and importance of this market.

A two winding power transformer typically consists of a primary winding and a secondary winding, electromagnetically coupled but electrically isolated, around a laminated core. This design allows for the efficient conversion of electrical energy from one voltage level to another, making them indispensable in power generation plants, substations, and large industrial facilities. The robust design and high efficiency of these transformers contribute significantly to grid stability and operational effectiveness. Their ability to handle high power ratings and withstand rigorous operational conditions makes them a preferred choice for large-scale power infrastructure projects globally.

Major applications for two winding power transformers span across electric utilities for grid infrastructure, industrial sectors such as manufacturing, mining, and oil and gas for operational power, and the rapidly expanding renewable energy sector for integrating wind and solar farms into the national grid. The primary benefits include enhanced transmission efficiency, improved voltage regulation, increased grid reliability, and the ability to adapt power systems to diverse load requirements. Key driving factors for market expansion include significant investments in grid modernization initiatives, the escalating demand for electricity in developing economies, and the global push towards sustainable energy sources requiring extensive grid integration infrastructure.

Two Winding Power Transformer Market Executive Summary

The Two Winding Power Transformer Market is undergoing dynamic shifts characterized by robust business trends focused on smart grid integration, digitalization, and sustainability. Manufacturers are increasingly investing in research and development to produce more energy-efficient and environmentally friendly transformers, driven by stringent regulatory frameworks and the global imperative to reduce carbon footprints. Consolidation through mergers and acquisitions is also a prominent trend, as larger players seek to expand their technological capabilities, market reach, and product portfolios to better serve a diverse customer base and gain competitive advantage in a highly competitive landscape. The emphasis on advanced materials and predictive maintenance solutions is reshaping business models across the industry.

Regionally, the Asia Pacific market stands out as a dominant force, fueled by rapid industrialization, extensive urbanization, and substantial investments in new power generation and transmission infrastructure, particularly in countries like China and India. North America and Europe are focusing on grid modernization, replacing aging infrastructure, and integrating a higher proportion of renewable energy sources, which necessitates specialized and high-efficiency transformers. Latin America, the Middle East, and Africa are also witnessing growth, albeit at varying paces, driven by electrification projects, industrial expansion, and the development of new energy resources, indicating a diversified global demand pattern that requires region-specific strategies.

Segment trends within the market highlight a growing demand for liquid-immersed transformers due to their cost-effectiveness and high power ratings, alongside an increasing preference for dry-type transformers in sensitive or indoor applications where fire safety and environmental concerns are paramount. There is also a notable shift towards higher voltage and ultra-high voltage (UHV) transformers to minimize transmission losses over long distances, particularly in large-scale renewable energy projects and inter-regional grid connections. The burgeoning data center industry and electrified transportation initiatives further contribute to specialized transformer requirements, creating new niches and opportunities for product innovation and market penetration across various power rating categories.

AI Impact Analysis on Two Winding Power Transformer Market

Common user inquiries about AI's influence on the Two Winding Power Transformer Market often revolve around how artificial intelligence can enhance operational efficiency, extend asset lifespan through predictive maintenance, optimize energy management, and contribute to the development of smarter, more resilient grids. Users express expectations for AI to minimize downtime, improve fault detection capabilities, and facilitate better resource allocation. There is also significant interest in AI's role in the design and manufacturing processes, potentially leading to more efficient and customized transformer solutions. The overarching theme is the anticipation of AI transforming traditional power infrastructure into intelligent, self-optimizing systems, thereby ensuring greater reliability and sustainability in power delivery.

- AI-driven predictive maintenance systems analyze operational data from transformers to forecast potential failures, enabling proactive repairs and significantly reducing unplanned downtime.

- Optimized operational efficiency through AI algorithms that monitor load conditions, temperature, and other parameters, dynamically adjusting transformer performance for maximum energy savings.

- Enhanced design and manufacturing processes leverage AI for simulating transformer performance under various conditions, optimizing material usage, and streamlining production workflows.

- Improved grid integration by utilizing AI for real-time monitoring and control, allowing transformers to adapt to fluctuating renewable energy inputs and maintain grid stability.

- Advanced cybersecurity for intelligent transformers, where AI detects anomalies and potential threats, safeguarding critical infrastructure from cyberattacks and ensuring secure operations.

DRO & Impact Forces Of Two Winding Power Transformer Market

The Two Winding Power Transformer Market is significantly propelled by several key drivers, primarily the global imperative for grid modernization and expansion. Aging power infrastructure in developed nations necessitates substantial investments in replacements and upgrades, while rapidly developing economies require new installations to support increasing electricity demand and industrial growth. The widespread integration of renewable energy sources, such as solar and wind power, into existing grids demands robust and efficient transformers capable of handling intermittent generation and bidirectional power flow. Furthermore, growing urbanization and the proliferation of large-scale industrial projects globally are consistently driving the demand for reliable and high-capacity power transformers to support new load centers.

Conversely, the market faces notable restraints, including the high initial capital expenditure associated with purchasing and installing large power transformers, which can be a significant barrier for some utilities and industrial clients. Volatility in raw material prices, particularly for copper, electrical steel, and insulating oil, directly impacts manufacturing costs and profit margins, creating uncertainty for market players. Additionally, increasing environmental concerns regarding the use of mineral oil in liquid-immersed transformers, due to its flammability and potential for leakage, are driving demand for more eco-friendly, albeit often more expensive, alternatives like ester-based fluids, presenting a cost-benefit dilemma for adoption.

Opportunities within the market are abundant, especially with the ongoing development of smart grid technologies that integrate advanced monitoring, control, and communication capabilities with transformers, promising enhanced operational efficiency and reliability. The global push for High Voltage Direct Current (HVDC) transmission projects, particularly for long-distance power transfer and interconnecting asynchronous grids, creates specialized demand for HVDC converter transformers. Moreover, the vast installed base of aging transformers presents a substantial opportunity for retrofitting and maintenance services, extending their lifespan and improving performance. Emerging economies, with their continuous infrastructural development and electrification initiatives, offer new frontiers for market expansion and technological deployment.

Segmentation Analysis

The Two Winding Power Transformer Market is broadly segmented based on various attributes, including the insulation type, power rating, application area, and specific design configurations. This granular segmentation helps in understanding the diverse demands and technological preferences across different end-user industries and geographical regions. Each segment caters to unique operational requirements and environmental considerations, thereby influencing product development, market strategies, and competitive positioning among manufacturers. Analyzing these segments provides a comprehensive view of market dynamics and potential growth trajectories for various product categories.

- By Insulation Type

- Liquid-Immersed Transformers: Typically utilize mineral oil or ester fluids for cooling and insulation, widely used in utility and large industrial applications due to their superior cooling capacity and cost-effectiveness.

- Dry-Type Transformers: Employ air or solid insulating materials, suitable for indoor installations or sensitive environments where fire safety and environmental impact are critical concerns.

- By Power Rating

- Small Power Transformers: Generally rated up to 60 MVA, used in distribution networks and smaller industrial facilities.

- Medium Power Transformers: Range from 61 MVA to 200 MVA, common in substations and larger industrial plants.

- Large Power Transformers: Above 200 MVA, critical for bulk power transmission in utility grids and major generation stations.

- By Application

- Utility: Encompasses power generation, transmission, and distribution networks managed by electricity companies.

- Industrial: Includes manufacturing plants, mining operations, oil and gas facilities, and other heavy industries.

- Commercial: Covers large commercial buildings, data centers, and infrastructure projects requiring dedicated power solutions.

- Renewable Energy: For integrating wind farms, solar power plants, and other sustainable energy sources into the grid.

- By Voltage Class

- Low Voltage (LV)

- Medium Voltage (MV)

- High Voltage (HV)

- Extra High Voltage (EHV)

- Ultra High Voltage (UHV)

Value Chain Analysis For Two Winding Power Transformer Market

The value chain for the Two Winding Power Transformer Market is intricate, beginning with the upstream supply of critical raw materials. This segment involves sourcing high-quality electrical steel for cores, copper or aluminum for windings, various insulating materials such as paper, porcelain, and composite polymers, as well as mineral or ester-based insulating oils. The performance and longevity of a transformer are heavily dependent on the quality and consistency of these raw materials, making robust supplier relationships and quality control paramount for manufacturers. Fluctuations in commodity prices directly impact manufacturing costs and, consequently, the final market price of transformers, necessitating effective procurement strategies to mitigate risks.

Further along the value chain, the manufacturing and assembly phase involves complex engineering, precision fabrication, and rigorous testing processes. Manufacturers design and produce transformers tailored to specific voltage requirements, power ratings, and environmental conditions. This phase includes core assembly, winding, tanking, insulation, and final testing. Downstream analysis reveals the distribution and installation of these transformers. Key end-users include national and regional electric utilities, which are the largest consumers, alongside various industrial sectors such as manufacturing, heavy industries, oil and gas, and the rapidly growing renewable energy sector. Engineering, Procurement, and Construction (EPC) firms also play a crucial role in managing large-scale infrastructure projects that incorporate these transformers.

The distribution channels for two winding power transformers can be categorized as direct and indirect. Direct sales are common for large, high-value transformers where manufacturers engage directly with major utility companies or large industrial clients, often involving custom-engineered solutions and long-term contracts. This direct engagement allows for close collaboration, technical support, and tailored services. Indirect channels involve distributors, agents, or system integrators, especially for smaller or standard transformers, facilitating wider market reach and localized support. Post-sales services, including installation, commissioning, maintenance, repair, and eventual decommissioning, constitute a significant portion of the value chain, ensuring the operational lifespan and reliability of these critical assets throughout their entire life cycle.

Two Winding Power Transformer Market Potential Customers

Potential customers for two winding power transformers primarily comprise entities involved in the generation, transmission, and distribution of electrical power. Electric utilities, encompassing both publicly and privately owned companies, represent the largest segment of end-users. These organizations consistently invest in transformers for substations, power plants, and grid expansion or modernization projects to meet growing demand, replace aging infrastructure, and enhance grid reliability. Their procurement decisions are often influenced by factors such as transformer efficiency, reliability, longevity, and adherence to stringent industry standards and environmental regulations, making them highly discerning buyers with long-term purchasing cycles.

Beyond traditional utilities, a broad spectrum of industrial facilities constitutes a significant customer base. This includes heavy industries such as manufacturing plants, metallurgy, mining operations, and the oil and gas sector, which require robust power transformers to run their machinery and maintain operational continuity. Data centers, with their immense and continuous power consumption needs, are also emerging as key customers, demanding highly efficient and reliable transformers to ensure uninterrupted power supply for their critical IT infrastructure. These industrial buyers prioritize performance, durability, and minimal downtime, as any power disruption can lead to substantial financial losses and operational inefficiencies.

Furthermore, the rapidly expanding renewable energy sector, including large-scale solar farms, wind power plants, and hydroelectric facilities, requires specialized two winding power transformers to step up generated voltage for efficient transmission to the grid. Commercial establishments, such as large shopping complexes, hospitals, airports, and urban development projects, also act as end-users, requiring transformers for their local power distribution systems. Engineering, Procurement, and Construction (EPC) companies, acting on behalf of these diverse end-users, play a crucial role in the procurement process, often seeking comprehensive solutions that include transformer supply, installation, and commissioning as part of broader infrastructure development projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 12,500 Million |

| Market Forecast in 2032 | USD 18,600 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy, ABB, General Electric (GE), Schneider Electric, Hitachi Energy, Mitsubishi Electric, Toshiba, Hyundai Electric, Bharat Heavy Electricals Limited (BHEL), WEG, Fuji Electric, CG Power and Industrial Solutions, Eaton, Legrand, Prolec GE, TBEA, XD Group, Jinle Electrical, Shanghai Electric. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Two Winding Power Transformer Market Key Technology Landscape

The technological landscape of the Two Winding Power Transformer Market is continually evolving, driven by the demand for higher efficiency, enhanced reliability, reduced environmental impact, and seamless integration with modern smart grids. Innovations in core materials, such as amorphous metal cores, are gaining traction due to their ability to significantly reduce no-load losses, leading to improved energy efficiency and lower operational costs over the transformer's lifespan. These advanced materials offer superior magnetic properties compared to traditional silicon steel, aligning with global energy conservation efforts and stricter efficiency standards imposed by regulatory bodies worldwide, making them a key area of research and development for leading manufacturers.

Another significant technological advancement is the integration of advanced monitoring and diagnostic systems. These smart technologies employ sensors, IoT devices, and data analytics to provide real-time insights into a transformer's operational health, including temperature, oil levels, gas analysis, and vibration. Such condition monitoring enables predictive maintenance strategies, allowing utilities and industrial operators to identify potential issues before they escalate into costly failures, thereby extending asset life, reducing downtime, and optimizing maintenance schedules. This shift from time-based to condition-based maintenance is a pivotal change enhancing overall grid resilience and operational expenditure management.

Furthermore, the development of eco-friendly and high-performance insulating fluids, particularly natural and synthetic esters, is transforming the market. These fluids offer higher fire safety due to their elevated flash points and are biodegradable, addressing environmental concerns associated with traditional mineral oil. The research into High-Temperature Superconducting (HTS) transformers, while still largely in the developmental and niche application phase, holds immense promise for creating compact, lighter, and virtually loss-free transformers, which could revolutionize urban grid infrastructure. Moreover, the focus on modular and standardized transformer designs, along with advanced manufacturing techniques, aims to reduce production lead times and facilitate quicker deployment in rapidly expanding or upgrading grid infrastructures across the globe.

Regional Highlights

- Asia Pacific (APAC): This region is a powerhouse in the global two winding power transformer market, primarily driven by rapid industrialization, extensive urbanization, and massive investments in power generation and transmission infrastructure. Countries like China and India are leading the charge with ambitious grid expansion projects and the integration of large-scale renewable energy capacities, creating immense demand for all types of power transformers. Government initiatives supporting manufacturing growth and electrification further solidify APAC's dominance and projected high growth rate.

- North America: The market in North America is characterized by significant investments in modernizing and upgrading aging grid infrastructure, ensuring enhanced reliability and resilience. The strong emphasis on integrating renewable energy sources, such as wind and solar, alongside the expansion of smart grid technologies, drives the demand for advanced and efficient two winding power transformers. Regulatory mandates and incentives for energy efficiency also play a crucial role in shaping market trends and technological adoption.

- Europe: Europe exhibits a mature yet evolving market, focused on decarbonization targets, cross-border grid interconnections, and the increasing penetration of offshore wind power and other renewables. The region is a leader in adopting High Voltage Direct Current (HVDC) transmission systems, which necessitates specialized transformers, further contributing to market growth. Stringent environmental regulations and a strong commitment to energy efficiency are key factors influencing product development and market dynamics in European countries.

- Latin America: This region is experiencing steady growth in the two winding power transformer market, primarily due to ongoing electrification projects aimed at improving energy access in remote areas and supporting industrial expansion. Investments in new power generation capacities, particularly from hydroelectric and other renewable sources, as well as the need to upgrade existing transmission and distribution networks, contribute to a stable demand for transformers across the continent. Economic stability and governmental support for infrastructure development are crucial for continued market progression.

- Middle East and Africa (MEA): The MEA region presents significant growth opportunities, largely fueled by large-scale infrastructure projects, rapid industrial development, and initiatives to diversify energy sources. Countries in the Middle East are investing heavily in new power plants and grid extensions to meet rising energy demands from booming urban centers and industrial zones. In Africa, electrification programs and the development of new energy resources, including renewables, are driving substantial demand for reliable power transmission and distribution equipment, including two winding power transformers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Two Winding Power Transformer Market.- Siemens Energy

- ABB

- General Electric (GE)

- Schneider Electric

- Hitachi Energy

- Mitsubishi Electric

- Toshiba

- Hyundai Electric

- Bharat Heavy Electricals Limited (BHEL)

- WEG

- Fuji Electric

- CG Power and Industrial Solutions

- Eaton

- Legrand

- Prolec GE

- TBEA

- XD Group

- Jinle Electrical

- Shanghai Electric

- Power Partners

Frequently Asked Questions

What are the primary drivers for the Two Winding Power Transformer Market growth?

The market is predominantly driven by global grid modernization initiatives, substantial industrial expansion across various sectors, the increasing integration of renewable energy sources into national grids, and rapid urbanization demanding new power infrastructure.

What is the difference between liquid-immersed and dry-type two winding power transformers?

Liquid-immersed transformers use mineral oil or ester fluids for cooling and insulation, ideal for high power ratings and outdoor use, while dry-type transformers use air or solid insulation, preferred for indoor or environmentally sensitive applications due to enhanced fire safety.

How is Artificial Intelligence impacting the Two Winding Power Transformer Market?

AI significantly impacts the market by enabling predictive maintenance, optimizing transformer operations for efficiency, enhancing design and manufacturing processes, improving smart grid integration for stability, and bolstering cybersecurity for critical infrastructure.

What key challenges does the Two Winding Power Transformer Market face?

Key challenges include high initial capital expenditures for new installations, volatility in raw material prices (such as copper and electrical steel), and growing environmental concerns associated with traditional mineral oil-filled transformers, which push for costlier eco-friendly alternatives.

Which region is expected to lead the Two Winding Power Transformer Market during the forecast period?

The Asia Pacific region is anticipated to lead the market, driven by extensive investments in new power generation and transmission infrastructure, rapid industrialization, and significant urbanization in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager