Ultra-Wideband Anchor and Tags Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428685 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Ultra-Wideband Anchor and Tags Market Size

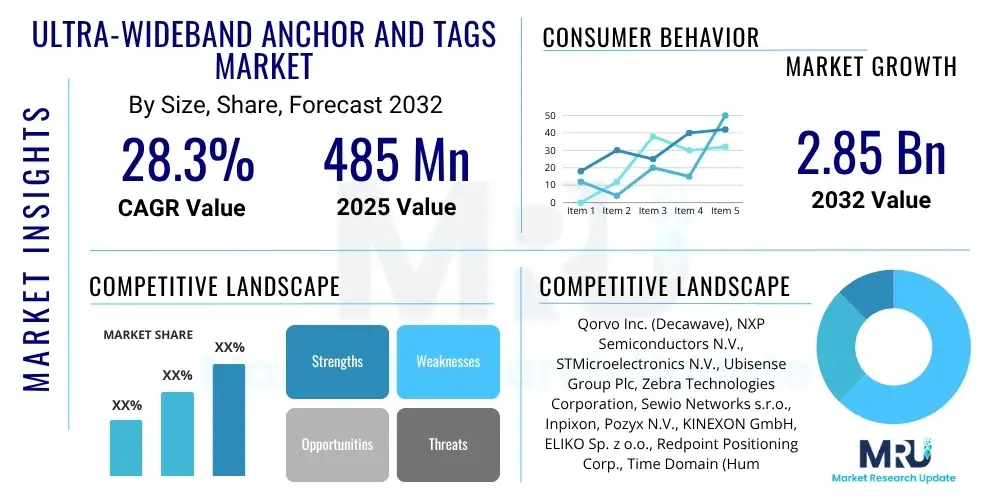

The Ultra-Wideband Anchor and Tags Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.3% between 2025 and 2032. The market is estimated at $485 Million in 2025 and is projected to reach $2.85 Billion by the end of the forecast period in 2032.

Ultra-Wideband Anchor and Tags Market introduction

The Ultra-Wideband (UWB) Anchor and Tags Market encompasses the advanced ecosystem dedicated to delivering highly precise real-time location services (RTLS) and robust short-range communication through UWB technology. This market includes the design, manufacturing, and deployment of specialized UWB hardware components, such as stationary anchors that act as reference points, and mobile tags attached to assets or personnel for tracking. UWB technology distinguishes itself by employing a broad spectrum of frequencies to transmit short, low-power pulses, enabling centimeter-level accuracy even in complex indoor and cluttered outdoor environments where traditional GPS systems are often ineffective. This inherent precision and reliability position UWB as a critical enabler for a wide array of mission-critical applications across various industrial and commercial sectors seeking unparalleled operational visibility and control.

The core products within this market, UWB anchors and tags, are engineered to offer distinct benefits that drive their adoption. UWB anchors are strategically positioned throughout a facility or designated area to establish a robust localization grid. These anchors continuously listen for signals from UWB tags, which are compact, battery-powered devices affixed to the objects or individuals requiring tracking. The high-resolution time-of-flight measurements between tags and multiple anchors allow for highly accurate triangulation or multilateration, pinpointing locations with exceptional granularity. This capability is paramount for applications demanding precise positioning, such as real-time asset tracking in warehouses, ensuring worker safety in hazardous industrial zones, and enhancing operational efficiency in smart manufacturing facilities. The low power consumption of UWB tags also ensures extended battery life, reducing maintenance overhead and increasing the overall cost-effectiveness of deployments.

Several pivotal driving factors are propelling the expansion of the Ultra-Wideband Anchor and Tags Market. The global surge in demand for digital transformation, particularly within the context of Industry 4.0, is accelerating the need for advanced RTLS solutions that can provide actionable insights into operational workflows. Industries are increasingly recognizing the strategic value of real-time location data to optimize supply chain management, automate inventory processes, and improve the utilization of high-value equipment. Furthermore, the growing emphasis on enhancing worker safety and security in complex environments, coupled with the imperative to comply with stringent regulatory standards, is compelling businesses to invest in reliable UWB-based personnel tracking systems. As enterprises strive for greater efficiency, precision, and safety across their operations, UWB technology stands out as a superior solution, poised for continued market growth and broader integration into intelligent infrastructure.

Ultra-Wideband Anchor and Tags Market Executive Summary

The Ultra-Wideband Anchor and Tags market is experiencing robust growth, primarily driven by transformative business trends that emphasize operational intelligence, automation, and enhanced safety across diverse industrial and commercial sectors. Enterprises are increasingly investing in UWB solutions to achieve unprecedented levels of accuracy in asset tracking, personnel management, and process optimization. The ongoing global shift towards digitalization and the pervasive adoption of Internet of Things (IoT) technologies are creating a fertile ground for UWB, as businesses seek reliable, high-precision location data to fuel their smart factory initiatives, optimize intricate supply chain logistics, and improve overall resource management. This trend underscores a broader industry move towards data-driven decision-making, where real-time spatial information becomes a critical competitive differentiator.

Regional trends indicate a dynamic landscape, with North America and Europe currently leading in market penetration due to established technological infrastructures, significant early adoption of industrial IoT, and stringent safety regulations that necessitate advanced tracking systems. These regions benefit from robust R&D ecosystems and a high concentration of sophisticated manufacturing and logistics operations willing to invest in cutting-edge solutions. The Asia Pacific (APAC) region, however, is projected to exhibit the most rapid growth, propelled by accelerated industrialization, large-scale smart city developments, and substantial government investments in technological infrastructure in countries such as China, India, and Japan. Latin America, the Middle East, and Africa are also gradually increasing their adoption, particularly in sectors such as mining, energy, and retail, as they modernize their operational capabilities and seek to enhance efficiency and security.

Segmentation trends within the market highlight the dominance of asset tracking and personnel safety applications, which continue to represent the largest and most actively developing segments. The demand for UWB tags is diversifying, with innovations in form factors to suit various deployment scenarios, including wearable badges, industrial-grade attachments, and embedded modules for original equipment manufacturing. Furthermore, there is a significant trend towards the integration of UWB systems with advanced software platforms that incorporate artificial intelligence and machine learning capabilities. These integrations enable sophisticated data analytics, predictive maintenance, and highly adaptive location services, transforming raw UWB data into actionable business intelligence. This evolution from basic positioning to comprehensive, intelligent RTLS ecosystems underscores the market's maturity and its potential for sustained expansion across an ever-widening array of vertical markets.

AI Impact Analysis on Ultra-Wideband Anchor and Tags Market

The integration of Artificial Intelligence (AI) is fundamentally transforming the Ultra-Wideband Anchor and Tags Market, addressing critical user questions regarding enhanced accuracy, operational efficiency, and the derivation of actionable intelligence from vast location datasets. Users frequently inquire about how AI can refine UWB system performance, minimize deployment complexities, extend battery life for tags, and enable more sophisticated, autonomous applications. The prevailing user expectations center on leveraging AI to move beyond mere static positioning, seeking dynamic, predictive, and context-aware capabilities. This fusion of UWB’s precise data capture with AI’s analytical prowess promises to deliver a new generation of intelligent real-time location services, fulfilling the demand for systems that are not only accurate but also smart, adaptable, and proactive in their insights.

AI algorithms are being extensively deployed to significantly improve UWB localization accuracy, particularly in challenging environments prone to signal interference and multipath propagation. By analyzing historical data and real-time signal characteristics, AI can adaptively recalibrate UWB networks, compensate for environmental anomalies, and filter out noise, thereby achieving superior positioning precision. Beyond raw accuracy, AI enables UWB systems to learn complex patterns of movement, predict future locations of assets or personnel, and identify deviations from normal behavior. This predictive capability is invaluable for applications such as proactive equipment maintenance, optimizing material flow on a factory floor, or detecting potential safety breaches. Furthermore, AI contributes to optimizing power consumption in UWB tags by intelligently managing transmission intervals based on contextual relevance and movement patterns, significantly extending battery life and reducing operational costs for large-scale deployments.

Moreover, AI-driven analytics platforms are essential for transforming the enormous volumes of raw UWB location data into meaningful, actionable business intelligence. These platforms can identify bottlenecks in production lines, optimize traffic flow in warehouses, or analyze interaction patterns in retail environments, providing insights that would be impossible to discern through manual analysis. The synergy between UWB's granular data and AI's capacity for complex pattern recognition and automated decision-making is creating highly integrated solutions for inventory optimization, supply chain visibility, and enhanced worker safety. This intelligent interpretation of location data allows organizations to make strategic decisions, leading to profound improvements in efficiency, security, and overall operational performance, thereby maximizing the return on investment for UWB technology across various industry verticals and solidifying its role as a cornerstone of smart infrastructure.

- Enhanced localization accuracy through sophisticated signal processing and adaptive calibration algorithms.

- Predictive analytics for asset movement, equipment maintenance, and potential operational bottlenecks.

- Optimized UWB network deployment and dynamic environmental adaptation, reducing manual calibration needs.

- Automated anomaly detection and alerts for improved security, safety compliance, and theft prevention.

- Smarter energy management and communication scheduling for UWB tags, significantly extending battery life.

- Development of context-aware location services for personalized experiences and automated task execution.

- Integration with machine learning models for continuous self-improvement of RTLS performance over time.

- Advanced data visualization and actionable insights derived from complex UWB datasets for strategic decision-making.

DRO & Impact Forces Of Ultra-Wideband Anchor and Tags Market

The Ultra-Wideband Anchor and Tags Market operates within a complex framework influenced by various Drivers, Restraints, and Opportunities, which are further shaped by broader Impact Forces. A primary driver is the accelerating demand for highly accurate, real-time location systems (RTLS) across virtually all industrial and commercial sectors. The advent of Industry 4.0 and the pervasive integration of IoT devices necessitate granular visibility into assets, personnel, and workflows to achieve peak operational efficiency and informed decision-making. UWB's unique ability to provide centimeter-level precision in both indoor and challenging outdoor environments, coupled with its robust performance against multipath interference, makes it a superior choice over less accurate technologies like Wi-Fi or Bluetooth Low Energy for critical applications where precise positioning is non-negotiable for safety, productivity, and compliance.

Despite its compelling advantages, the market also faces notable restraints that can impede its growth. One significant hurdle is the relatively higher initial capital expenditure required for deploying a comprehensive UWB infrastructure, encompassing a dense network of anchors, compared to some alternative RTLS solutions. This upfront cost can be a deterrent for smaller enterprises or those with limited budgets. Furthermore, while UWB's low power spectral density minimizes interference with other wireless systems, integrating it into existing, often crowded, radio frequency environments can still present technical challenges and require careful frequency planning. Regulatory complexities and varying spectrum allocation policies across different geographical regions also pose obstacles, potentially slowing down widespread global standardization and adoption. The specialized technical expertise required for optimal system design, installation, calibration, and ongoing maintenance adds to operational complexities and cost, creating a barrier for organizations lacking in-house capabilities.

Conversely, significant opportunities exist for market expansion and innovation, poised to overcome current restraints. Continuous advancements in UWB chipset miniaturization and manufacturing processes are progressively driving down the cost of both anchors and tags, making the technology more accessible and economically viable for a broader range of applications. The synergistic integration of UWB with emerging technologies such as Artificial Intelligence (AI), Machine Learning (ML), and cloud computing is unlocking new capabilities, enabling more intelligent analytics, predictive maintenance, and adaptive location services. Moreover, the expansion of UWB into novel application areas, including augmented reality (AR) and virtual reality (VR) for immersive experiences, secure contactless payment systems, and smart home ecosystems, represents vast untapped growth potential. Furthermore, the increasing global focus on enhancing worker safety in hazardous industrial environments and meeting stringent regulatory compliance provides a strong impetus for UWB adoption, driving both technological advancements and market penetration across critical sectors.

Segmentation Analysis

The Ultra-Wideband Anchor and Tags Market is meticulously segmented to provide a detailed and granular understanding of its components, technological underpinnings, diverse applications, and the various end-use industries it serves. This comprehensive segmentation is instrumental for market players, investors, and analysts to identify specific growth drivers, understand competitive dynamics, and strategically position products and services. Analyzing these distinct segments reveals the current landscape and future trajectories, highlighting areas of high growth potential and emerging demands across the global market. Each segment contributes uniquely to the overall market value and adoption patterns, reflecting the versatile utility of UWB technology in addressing complex operational challenges.

- By Component: This segment analyzes the distinct hardware and software elements that constitute a UWB solution, as well as the essential services required for deployment and maintenance.

- Hardware (UWB Anchors, UWB Tags, UWB Modules, Antennas, Development Kits)

- Software (Location Engines, Analytics Platforms, API Integration Tools, Middleware)

- Services (Consulting Services, System Integration Services, Maintenance & Support Services, Managed Services)

- By Technology: This segment differentiates UWB based on the underlying radio transmission methodologies, each with specific characteristics regarding data rate and complexity.

- Impulse Radio Ultra-Wideband (IR-UWB)

- Orthogonal Frequency Division Multiplexing Ultra-Wideband (OFDM-UWB)

- By Application: This segment categorizes the market based on the primary functions and use cases that UWB technology addresses across various operational environments.

- Asset Tracking and Management (e.g., equipment, tools, vehicles)

- Personnel Tracking and Safety (e.g., worker safety, contact tracing)

- Inventory Management and Optimization (e.g., warehouse stock, retail items)

- Proximity Sensing and Awareness (e.g., collision avoidance, zone control)

- Access Control and Security (e.g., secure entry, geofencing)

- Indoor Navigation and Positioning (e.g., smart buildings, airports)

- Sports Analytics and Performance Tracking (e.g., athlete monitoring, ball tracking)

- Payment and Transactions (e.g., secure contactless payments)

- Augmented and Virtual Reality (AR/VR) for immersive experiences

- By End-Use Industry: This segment delineates the diverse vertical markets that are adopting UWB solutions to solve specific industry challenges and enhance their operational models.

- Manufacturing and Industrial Automation (e.g., smart factories, logistics, automotive production)

- Logistics and Warehousing (e.g., supply chain optimization, inventory visibility)

- Healthcare (e.g., hospitals, clinics, elderly care, patient and equipment tracking)

- Retail and E-commerce (e.g., in-store analytics, asset protection, fulfillment centers)

- Sports and Entertainment (e.g., venue management, fan engagement)

- Automotive and Transportation (e.g., autonomous vehicles, factory logistics)

- Government and Public Safety (e.g., emergency services, critical infrastructure)

- Mining and Construction (e.g., underground safety, heavy equipment tracking)

- Aerospace and Defense (e.g., secure communications, high-value asset tracking)

- Residential and Smart Home (e.g., device control, presence detection)

Value Chain Analysis For Ultra-Wideband Anchor and Tags Market

The value chain for the Ultra-Wideband Anchor and Tags Market is a sophisticated and highly integrated ecosystem, beginning with fundamental technology development and extending through to end-user deployment and ongoing support, showcasing the collaborative efforts required to deliver these advanced real-time location solutions. The upstream segment is critical, dominated by specialized semiconductor manufacturers and component suppliers who are responsible for the intricate design and production of core UWB chipsets, radio frequency (RF) modules, and advanced antenna solutions. These components form the technological foundation of both UWB anchors and tags, requiring significant investment in research and development to achieve desired levels of accuracy, low power consumption, and miniaturization. Key players at this initial stage innovate to provide highly integrated solutions that are both cost-effective and high-performing, setting the standard for subsequent stages in the value chain.

Further along the value chain, original equipment manufacturers (OEMs) and hardware developers integrate these core UWB components into finished products, such as various types of UWB anchors designed for specific mounting environments and diverse UWB tags customized for different assets or personnel. This stage often involves industrial design, enclosure manufacturing, and quality assurance to ensure product robustness and reliability. Following hardware production, system integrators play an indispensable role by combining UWB hardware with proprietary or third-party software platforms, which include sophisticated location engines, data analytics tools, and application programming interfaces (APIs). These integrators are responsible for comprehensive solution deployment, including site surveys, network planning, installation, precise system calibration, and ensuring seamless integration with existing enterprise resource planning (ERP) or warehouse management systems (WMS) to deliver a fully functional RTLS solution tailored to the client's specific operational needs.

The downstream segment of the value chain focuses on distribution, sales, and post-deployment services. Distribution channels are varied, encompassing direct sales teams that manage large, complex enterprise accounts requiring bespoke solutions and extensive support, as well as a robust network of specialized distributors and value-added resellers (VARs). VARs are particularly crucial for extending market reach, providing localized expertise, and offering customized packages that cater to the specific requirements of small and medium-sized enterprises (SMEs) across different geographic regions. Finally, post-sales services, including ongoing maintenance, technical support, software updates, and performance optimization, are vital for ensuring the long-term effectiveness, reliability, and security of UWB systems. This interconnected value chain underscores the intricate collaboration from silicon to solution, ensuring the delivery of high-performance UWB systems to meet the exacting demands of modern industrial and commercial applications.

Ultra-Wideband Anchor and Tags Market Potential Customers

The Ultra-Wideband Anchor and Tags Market targets an expansive and diverse range of potential customers across virtually every major industry, all unified by a critical need for highly accurate, real-time location intelligence. These end-users and buyers span from large-scale multinational corporations managing vast production facilities and complex global supply chains to specialized service providers in healthcare, retail, and sports, each seeking to leverage precise spatial data for operational excellence. Any organization where knowing the exact location of assets, personnel, or critical goods can lead to significant improvements in efficiency, safety, security, or customer experience represents a prime candidate for UWB technology adoption. The demand is particularly pronounced in environments where traditional global positioning systems (GPS) are unavailable or unreliable, making UWB an indispensable solution for indoor and localized outdoor positioning challenges.

Key sectors driving adoption include manufacturing and industrial automation, where customers such as automotive manufacturers, electronics assembly plants, and heavy machinery producers utilize UWB to optimize production flows, track work-in-progress, manage tools, and enhance worker safety on dynamic factory floors. Logistics and warehousing companies, ranging from global freight forwarders to regional distribution centers, are significant buyers, deploying UWB for granular inventory management, optimizing forklift routes, streamlining picking processes, and preventing misplaced goods. In the healthcare sector, hospitals, clinics, and eldercare facilities are increasingly adopting UWB to track high-value medical equipment, monitor patient movements for safety, manage staff deployment, and facilitate emergency response, thereby enhancing patient care and operational workflows within complex medical environments.

Beyond these core industries, a growing array of other sectors represent substantial potential for UWB market expansion. Retail establishments, particularly large format stores and e-commerce fulfillment centers, employ UWB for inventory protection, enhancing customer navigation, and optimizing employee task assignments and efficiency. Governmental agencies and public safety organizations are exploring UWB for emergency responder tracking in hazardous situations, secure access control for restricted areas, and critical infrastructure monitoring. The construction industry benefits from UWB for tracking tools, materials, and personnel across expansive, dynamic job sites, while the mining sector uses it for underground safety monitoring and asset management. Sports and entertainment venues are also emerging as significant customers, leveraging UWB for athlete performance analytics, spectator navigation, and optimizing event logistics, underscoring the broad applicability of UWB technology in providing unparalleled visibility and control over physical assets and human resources for data-driven strategic decision-making.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $485 Million |

| Market Forecast in 2032 | $2.85 Billion |

| Growth Rate | 28.3% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Qorvo Inc. (Decawave), NXP Semiconductors N.V., STMicroelectronics N.V., Ubisense Group Plc, Zebra Technologies Corporation, Sewio Networks s.r.o., Inpixon, Pozyx N.V., KINEXON GmbH, ELIKO Sp. z o.o., Redpoint Positioning Corp., Time Domain (Humatics), Wipelot, Cofely Besix Facility Management (Engie), Uwinloc, AccuRate.io, Estimote Inc., Litum RTLS, Tracktio, Albis Technologies AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultra-Wideband Anchor and Tags Market Key Technology Landscape

The Ultra-Wideband Anchor and Tags Market is characterized by a sophisticated and rapidly evolving technological landscape designed to push the boundaries of precision location and robust wireless communication. At its fundamental level, UWB technology utilizes extremely short duration radio pulses spread across a very broad spectrum of frequencies, typically ranging from 3.1 GHz to 10.6 GHz, for accurate distance measurement and low-power data transmission. The primary technical approaches include Impulse Radio Ultra-Wideband (IR-UWB), which relies on discrete, sub-nanosecond pulses, and Orthogonal Frequency Division Multiplexing Ultra-Wideband (OFDM-UWB), which offers higher data rates and improved spectral efficiency. These methodologies enable exceptionally precise Time of Flight (ToF) measurements between a UWB tag and multiple stationary UWB anchors, facilitating centimeter-level localization accuracy in diverse and challenging environments, including those with significant metallic interference or multipath propagation.

Ongoing technological advancements are significantly impacting the UWB market, primarily focusing on miniaturization, enhanced power efficiency, and improved signal processing capabilities. UWB chipsets are continuously shrinking in size while simultaneously becoming more energy-efficient, allowing for their seamless integration into a wider array of compact and lightweight tags suitable for various applications, from wearable safety devices to embedded modules for integration into other products. Advanced antenna designs are crucial for optimizing signal propagation characteristics, maximizing range, and further reducing power consumption, thereby extending the operational life of battery-powered tags. Furthermore, sophisticated algorithms for ranging, triangulation, multilateration, and advanced filtering techniques are under constant development. These algorithms are designed to enhance localization accuracy, mitigate the effects of noise and interference, and provide exceptionally robust performance even in highly dynamic and complex industrial or commercial settings.

The key technology landscape also extends beyond core hardware to encompass the vital software and infrastructure components that complete a UWB solution. This includes highly optimized location engines capable of processing raw UWB signal data into precise spatial coordinates and movement trajectories in real-time. Complementary analytical platforms are developed to derive actionable business intelligence from the vast datasets generated by UWB systems, providing insights into operational bottlenecks, asset utilization, and safety compliance. Robust Application Programming Interfaces (APIs) are essential for enabling seamless integration of UWB data with existing enterprise resource planning (ERP) systems, warehouse management systems (WMS), and other industrial IoT platforms. Crucially, the development of standardized protocols (such. as IEEE 802.15.4z) and coexistence mechanisms is a vital part of the technology, ensuring that UWB devices can operate effectively alongside other wireless technologies like Wi-Fi, Bluetooth, and cellular networks without causing

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager