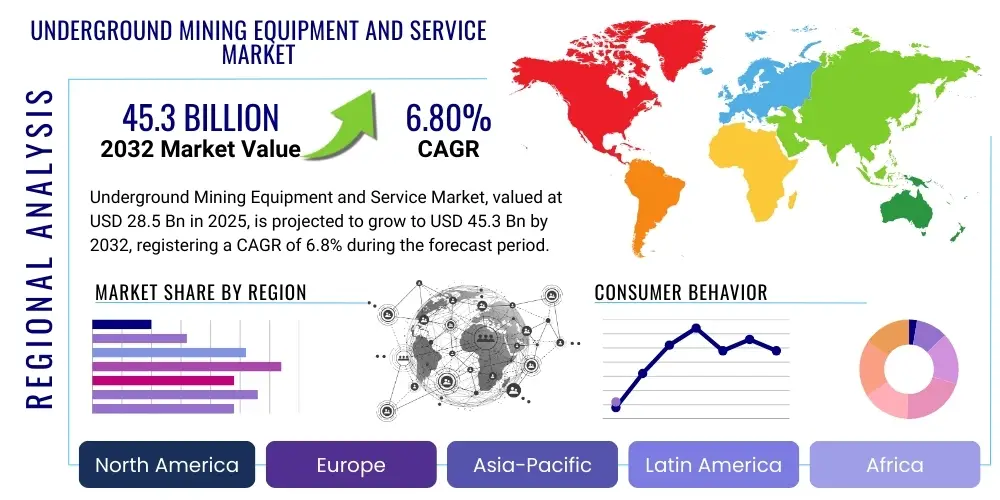

Underground Mining Equipment and Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427830 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Underground Mining Equipment and Service Market Size

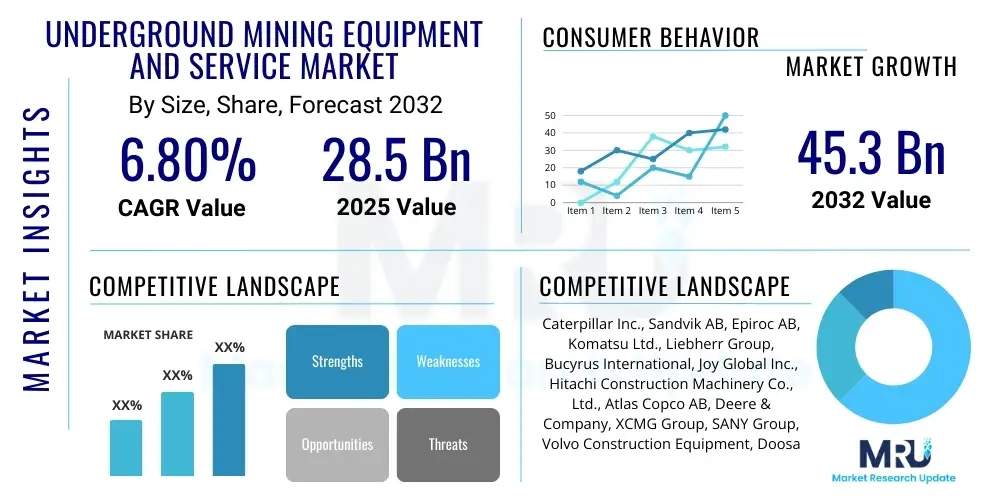

The Underground Mining Equipment and Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 28.5 billion in 2025 and is projected to reach USD 45.3 billion by the end of the forecast period in 2032.

Underground Mining Equipment and Service Market introduction

The Underground Mining Equipment and Service Market encompasses a diverse range of machinery, tools, and support systems critical for extracting valuable minerals and materials from subterranean deposits. This sector includes heavy machinery such as drills, loaders, haul trucks, continuous miners, longwall shearers, and ground support equipment, alongside specialized ventilation, pumping, and communication systems designed for the unique challenges of underground operations. The essential nature of these products lies in their ability to facilitate efficient, safe, and productive mining activities beneath the Earths surface.

Major applications for underground mining equipment and services span the extraction of various commodities, including precious metals like gold and silver, base metals such as copper and nickel, industrial minerals, and coal. These technologies are integral to modern mining practices, enabling access to deeper and more complex ore bodies that are economically unviable or environmentally sensitive for open-pit methods. The primary benefits derived from these advanced solutions include enhanced operational safety through automation and remote control, increased productivity via higher extraction rates and reduced downtime, and improved cost efficiency through optimized resource utilization and predictive maintenance capabilities.

The markets expansion is fundamentally driven by several powerful factors, including the surging global demand for minerals and metals, fueled by industrialization, urbanization, and the widespread adoption of electrification and renewable energy technologies which are highly mineral-intensive. Furthermore, stringent safety regulations enacted by governments worldwide compel mining companies to invest in safer, more advanced equipment and services, pushing innovation in areas like ventilation, fire suppression, and autonomous operations. Technological advancements, particularly in automation, digitalization, and electrification, are also pivotal drivers, promising greater efficiency, lower operational costs, and reduced environmental impact, thereby making underground mining a more attractive and sustainable option for resource extraction.

Underground Mining Equipment and Service Market Executive Summary

The Underground Mining Equipment and Service Market is experiencing robust growth, propelled by a confluence of evolving business trends, significant regional developments, and dynamic segment shifts. Business trends indicate a strong industry focus on sustainability, digital transformation, and the integration of advanced technologies like AI and automation to enhance operational efficiency, safety, and environmental stewardship. Mining companies are increasingly adopting remote operation centers and predictive maintenance solutions, driven by a desire to optimize asset utilization and minimize human exposure to hazardous underground environments, while also grappling with challenges such as skilled labor shortages and escalating capital expenditure requirements for new projects and advanced machinery. Strategic partnerships and mergers among equipment manufacturers and technology providers are becoming prevalent, aiming to offer integrated solutions and expand market reach, further consolidating the competitive landscape.

From a regional perspective, the Asia-Pacific region stands out as a dominant and rapidly expanding market, primarily due to significant mining activities in China, India, and Australia, coupled with increasing infrastructure development and industrialization. North America and Europe, while mature markets, are leading in the adoption of cutting-edge technologies like autonomous mining systems and electrification, driven by stringent environmental regulations and a focus on innovation and efficiency. Latin America and Africa offer substantial growth opportunities, characterized by rich mineral reserves and ongoing investments in modernizing mining operations, although political stability and infrastructure development remain key considerations for market penetration and expansion in these areas. Each region presents unique demand characteristics shaped by the prevalent types of minerals mined, regulatory frameworks, and economic development levels.

Segmentation trends highlight a noticeable shift towards services, with maintenance, repair, and operational support gaining prominence as mining companies seek to extend equipment lifespans and ensure operational continuity. Equipment segments are witnessing significant innovation, particularly in drilling and excavation machinery designed for greater precision and power, and in loading and hauling solutions emphasizing higher payloads and energy efficiency. Automation and remote-controlled equipment are rapidly becoming standard, driving demand for intelligent systems that can operate autonomously and integrate seamlessly into digital ecosystems. Furthermore, the market is seeing a rising preference for electric and battery-powered machinery to reduce emissions and improve underground air quality, marking a significant transition away from traditional diesel-powered alternatives, aligning with global sustainability goals and regulatory pressures for cleaner mining operations.

AI Impact Analysis on Underground Mining Equipment and Service Market

The integration of Artificial Intelligence (AI) into the Underground Mining Equipment and Service Market is rapidly transforming traditional mining practices, addressing long-standing challenges related to safety, efficiency, and resource optimization. Users frequently question how AI can enhance worker safety, improve equipment uptime, optimize mineral extraction, and reduce operational costs within the complex and often hazardous underground environment. There is a strong interest in AIs role in predictive maintenance to prevent costly breakdowns, its capacity to enable autonomous operations to minimize human risk exposure, and its potential to analyze vast datasets for better decision-making in real-time. Concerns often revolve around the initial investment costs, the need for specialized skills to manage AI systems, and the reliability of these technologies in harsh operating conditions, yet the overarching expectation is that AI will be a cornerstone for the future of sustainable and productive underground mining.

- AI-powered predictive maintenance reduces downtime by forecasting equipment failures, optimizing maintenance schedules, and extending asset lifespan.

- Autonomous mining systems, guided by AI, enhance worker safety by removing personnel from high-risk areas, minimizing human error, and improving operational consistency.

- Real-time data analytics, facilitated by AI, optimizes drilling patterns, blasting strategies, and material handling, leading to more efficient ore extraction and reduced waste.

- AI-driven ventilation and environmental control systems enhance worker health and compliance by dynamically adjusting airflow and monitoring air quality in response to real-time conditions.

- AI algorithms improve resource identification and geological modeling by processing vast amounts of seismic and sensor data, leading to more accurate mine planning and increased recovery rates.

- Enhanced operational efficiency through AI-optimized fleet management and traffic control within underground networks, reducing bottlenecks and energy consumption.

- AI facilitates advanced training simulations for operators, allowing them to practice complex scenarios in a safe, virtual environment, improving skill development and preparedness.

DRO & Impact Forces Of Underground Mining Equipment and Service Market

The Underground Mining Equipment and Service Market is shaped by a complex interplay of drivers, restraints, opportunities, and powerful impact forces that influence its growth trajectory and competitive landscape. Key drivers include the escalating global demand for critical minerals and metals, essential for industrial development, infrastructure projects, and the rapidly expanding electric vehicle and renewable energy sectors. Coupled with this is the increasing depth and complexity of accessible ore bodies, which necessitates more sophisticated and robust underground mining solutions. Furthermore, stringent global safety regulations are compelling mining companies to invest in advanced, safer, and often automated equipment and services, aiming to mitigate risks to human operators and improve overall mine safety statistics. Technological advancements in automation, digitalization, and electrification are also powerful accelerators, offering improvements in efficiency, productivity, and environmental performance, thus making underground mining more attractive and sustainable.

However, the market also faces significant restraints. The substantial capital expenditure required for acquiring and maintaining advanced underground mining equipment, coupled with the high operational costs associated with energy consumption and specialized labor, presents a considerable barrier to entry and expansion, particularly for smaller mining companies. The availability of skilled labor capable of operating and maintaining sophisticated modern machinery is a persistent challenge, necessitating significant investment in training and development. Additionally, volatile commodity prices introduce market uncertainty, impacting investment decisions and project timelines, while stringent environmental regulations, though driving innovation in some areas, can also impose additional costs and operational restrictions, particularly concerning waste management, water usage, and carbon emissions. Geopolitical instability in key mining regions and the lengthy approval processes for new mining projects also add layers of complexity and risk to market development.

Opportunities for growth are abundant, particularly in the widespread adoption of automation and remote-control technologies, which promise enhanced safety, efficiency, and continuous operation in hazardous environments. The increasing focus on sustainability and decarbonization across the mining industry opens avenues for electric and battery-powered equipment, reducing emissions and improving underground air quality. Emerging markets, especially in parts of Asia, Africa, and Latin America, with their rich untapped mineral resources and growing industrialization, represent significant potential for new projects and modernization of existing mines. Furthermore, the development of innovative service models, such as equipment-as-a-service or predictive maintenance subscriptions, allows mining companies to reduce upfront capital costs and benefit from continuous technological upgrades and expert support, fostering long-term relationships and creating new revenue streams for service providers.

The impact forces influencing the market, often analyzed through frameworks like Porters Five Forces, are significant. The bargaining power of buyers, primarily large mining corporations, is substantial due to their purchasing volume and demand for highly customized and reliable solutions, leading to competitive pricing pressures on equipment manufacturers. The bargaining power of suppliers, especially for specialized components and advanced technologies, can be moderate to high, as niche expertise and proprietary innovations are critical. The threat of new entrants is relatively low due to the enormous capital investment, technological expertise, and established supply chains required to compete effectively in this highly specialized market. The threat of substitute products or services is minimal, as underground mining equipment and services are uniquely tailored for subterranean extraction and lack direct, viable alternatives. Finally, competitive rivalry among existing players is intense, driven by continuous innovation, service differentiation, and global expansion strategies, with major manufacturers vying for market share through technological leadership, strategic partnerships, and comprehensive after-sales support, constantly pushing the boundaries of what is possible in underground mining.

Segmentation Analysis

The Underground Mining Equipment and Service Market is comprehensively segmented to provide granular insights into its diverse components and dynamics. This segmentation facilitates a detailed understanding of varying demands across different equipment types, service offerings, mining methods, and end-use applications, enabling stakeholders to identify specific growth areas and tailor strategies effectively. The market can be categorized by the nature of equipment, the specific services provided, the type of minerals being extracted, and the geographical regions involved. This multi-faceted approach ensures that all aspects of the value chain, from machinery procurement to operational support, are thoroughly analyzed, highlighting trends and opportunities in each distinct segment for both suppliers and mining operators.

- By Equipment Type: This segment includes a range of machinery essential for underground operations.

- Drilling & Bolting Equipment: Face drills, rock drills, bolters, jumbos.

- Loading & Hauling Equipment: LHDs (Load-Haul-Dump machines), underground trucks, shuttle cars, conveyors.

- Excavation Equipment: Continuous miners, longwall shearers, roadheaders.

- Ground Support Equipment: Shotcrete machines, roof support systems.

- Ventilation Systems: Main fans, auxiliary fans, ducting, air coolers.

- Pumping & Dewatering Equipment: Submersible pumps, centrifugal pumps, mine dewatering systems.

- Other Equipment: Communication systems, lighting, power distribution units.

- By Service Type: This segment covers the crucial support functions that ensure operational efficiency and longevity.

- Maintenance & Repair: Preventive maintenance, corrective maintenance, spare parts supply.

- Installation & Commissioning: Setup and testing of new equipment.

- Training & Consulting: Operator training, safety training, operational optimization consulting.

- Leasing & Rental: Equipment rental services for short-term or project-specific needs.

- Digital Solutions & Software: Mine planning software, remote monitoring, data analytics, automation solutions.

- By Mining Method: The market is also segmented by the specific techniques used for mineral extraction.

- Room & Pillar Mining: Employed for relatively flat-lying deposits, common in coal and some industrial minerals.

- Longwall Mining: Primarily used for coal extraction, involving a long wall of coal extracted in a single pass.

- Block Caving: Mass mining method used for large, low-grade ore bodies.

- Cut & Fill Mining: Versatile method for irregular ore bodies.

- Sublevel Caving & Stoping: Used for steeply dipping or massive ore bodies.

- By End-Use Industry: This segment categorizes demand based on the type of minerals extracted.

- Metal Mining: Gold, copper, nickel, zinc, lead, iron ore, silver, platinum group metals.

- Coal Mining: Thermal coal, coking coal.

- Mineral Mining: Potash, salt, gypsum, aggregates, industrial minerals.

Underground Mining Equipment and Service Market Value Chain Analysis

The value chain for the Underground Mining Equipment and Service Market is intricate, involving multiple stages from raw material sourcing to end-user support, highlighting the collaborative and interdependent nature of the industry. The upstream analysis begins with the procurement of raw materials such as steel, specialized alloys, hydraulic components, advanced electronics, and various composite materials. These are sourced from a global network of suppliers, often requiring specific metallurgical properties and high-performance characteristics to withstand the harsh conditions of underground mining. Component manufacturers then transform these raw materials into critical parts like engines, transmissions, hydraulic cylinders, electrical systems, and cutting tools, which are essential for the assembly of complex mining machinery. The quality and reliability of these upstream inputs directly influence the performance and durability of the final equipment, making supplier relationships and quality control paramount.

The core of the value chain lies in the manufacturing and assembly of the diverse range of underground mining equipment, where specialized engineering, design, and fabrication processes are employed. Major equipment manufacturers leverage advanced manufacturing techniques, including robotics, precision machining, and rigorous testing, to produce machinery that meets stringent industry standards for safety, efficiency, and environmental compliance. Following manufacturing, the downstream analysis focuses on the distribution, sales, and comprehensive after-sales services. Distribution channels can be direct, where manufacturers sell and service equipment directly to large mining corporations, or indirect, involving a network of authorized dealers, distributors, and agents who provide localized sales, technical support, and spare parts. These channels are crucial for market penetration, customer relationship management, and ensuring timely delivery and responsive service.

Direct distribution often involves dedicated sales teams and service centers strategically located near major mining regions, offering a personalized approach and in-depth technical expertise. This model is favored by large manufacturers for high-value equipment and long-term contracts, enabling direct feedback from customers for product innovation and continuous improvement. Indirect distribution, through a network of independent distributors and dealers, is vital for reaching a broader customer base, especially in diverse geographical locations where local presence and understanding of regional nuances are critical. These intermediaries provide essential services such as equipment installation, commissioning, preventative maintenance, emergency repairs, and supply of genuine spare parts, playing a critical role in minimizing equipment downtime and ensuring operational continuity for mining clients. The effectiveness of both direct and indirect channels is paramount for sustained market success, as comprehensive service and support are often as important as the equipment itself in the highly demanding underground mining environment, emphasizing the importance of a robust and responsive value chain.

Underground Mining Equipment and Service Market Potential Customers

The potential customers for the Underground Mining Equipment and Service Market are primarily diverse mining companies operating across the globe, ranging from multinational giants to mid-tier and junior exploration firms. These end-users are engaged in the extraction of a wide array of minerals and metals, each requiring specific types of equipment and specialized services tailored to their geological conditions, mining methods, and operational scales. Major mining corporations, with their extensive portfolios of active mines and long-term investment strategies, represent the largest customer segment, consistently seeking advanced, high-capacity, and technologically integrated solutions to maximize productivity, enhance safety, and meet rigorous environmental standards across their vast operations. Their demand often extends to complete fleet solutions, comprehensive service contracts, and cutting-edge automation technologies to maintain their competitive edge and operational efficiency.

Mid-tier mining companies, while having fewer operations than the majors, also constitute a significant customer base, often focusing on optimizing existing assets and exploring opportunities for expansion. They frequently seek cost-effective yet reliable equipment, along with robust maintenance and support services, to ensure consistent output and achieve their production targets within tighter budgetary constraints. These companies may be particularly interested in leasing options or flexible service agreements that allow them to manage capital expenditure more efficiently. Their purchasing decisions are often driven by a strong emphasis on return on investment and solutions that can be scaled or adapted to specific project requirements without excessive overhead.

Junior mining companies, typically involved in early-stage exploration and development projects, also form a segment of potential customers, albeit with different needs. Their focus is often on acquiring essential, reliable, and sometimes more compact equipment for initial mine development, often relying on rental or used equipment options to conserve capital. They also require specialized consulting services for mine planning, geological assessment, and project management. Additionally, governmental mining agencies and state-owned enterprises in various countries represent another category of end-users, especially in regions rich in mineral resources, where they play a significant role in resource extraction and require modern equipment and expert services to support national mining objectives and ensure sustainable development. Equipment and service providers must therefore develop differentiated offerings and flexible engagement models to cater to the diverse needs and financial capacities of this wide spectrum of mining clientele.

Underground Mining Equipment and Service Market Key Technology Landscape

The Underground Mining Equipment and Service Market is undergoing a profound technological transformation, driven by an imperative for enhanced safety, improved efficiency, and reduced environmental impact. Key advancements center around automation and remote control, enabling operators to manage complex machinery from a safe distance, often thousands of kilometers away in dedicated control centers. This not only mitigates risks associated with hazardous underground environments but also allows for continuous operation, leading to increased productivity and optimized resource utilization. Technologies such as autonomous haulage systems, remote-controlled drills, and automated loaders are becoming increasingly sophisticated, incorporating advanced sensors, precise navigation systems, and real-time data analytics to operate with minimal human intervention, thereby revolutionizing the operational paradigm of underground mining.

Another pivotal technological trend is the widespread adoption of electrification and battery-powered equipment. Moving away from traditional diesel-powered machinery significantly reduces greenhouse gas emissions, improves underground air quality by eliminating diesel particulate matter, and lowers noise pollution, contributing to a healthier and safer working environment for miners. Battery-electric vehicles (BEVs) and equipment offer benefits such as reduced ventilation requirements, lower energy costs due to regenerative braking, and simplified maintenance, despite initial higher capital costs and the need for robust charging infrastructure. This shift aligns strongly with global sustainability goals and regulatory pressures for cleaner industrial operations, positioning electric solutions as a cornerstone for future underground mining development and fostering innovation in battery technology, power management, and charging solutions tailored for demanding mining applications.

Furthermore, the integration of the Internet of Things (IoT), advanced data analytics, and Artificial Intelligence (AI) is transforming mine management and operational intelligence. IoT sensors embedded in equipment collect vast amounts of real-time data on machinery performance, environmental conditions, and production metrics, which are then processed by AI algorithms to provide actionable insights. This enables predictive maintenance, allowing mining companies to anticipate equipment failures before they occur, optimize maintenance schedules, and significantly reduce unplanned downtime. AI and machine learning are also enhancing geological modeling, ore body identification, and mine planning, leading to more accurate resource estimation and efficient extraction strategies. Digital twins, which are virtual replicas of physical assets and systems, are also emerging as powerful tools for simulation, optimization, and scenario planning, offering a comprehensive overview of mine operations and enabling proactive decision-making across the entire value chain of underground mining. These convergent technologies are creating a more intelligent, interconnected, and efficient mining ecosystem.

Regional Highlights

- Asia-Pacific: This region is a dominant force in the underground mining equipment and service market, primarily driven by large-scale mining operations in countries such as China, Australia, and India. The increasing demand for base metals, coal, and critical minerals, coupled with ongoing industrialization and infrastructure development, fuels significant investment in modernizing existing mines and developing new underground projects. Australia, in particular, is a leader in adopting advanced technologies, including automation and remote operations, due to its deep and complex ore bodies and high labor costs. The region benefits from a large consumer base and a continuous push towards technological integration to enhance safety and efficiency, making it a critical hub for market growth and innovation.

- North America: A mature yet highly innovative market, North America, encompassing the United States, Canada, and Mexico, is characterized by its focus on advanced technology adoption, stringent safety regulations, and a growing emphasis on environmental sustainability. Miners here are early adopters of autonomous mining systems, electrification, and digital solutions aimed at improving productivity and reducing operational risks. High-value mineral extraction, particularly for gold, copper, and industrial minerals, sustains demand for sophisticated equipment and services. The region also benefits from significant research and development investments aimed at pioneering next-generation mining technologies and achieving zero-emission operations.

- Europe: Despite a decline in traditional coal mining, Europe remains a significant market for specialized underground mining equipment and services, driven by base metal and industrial mineral extraction in countries like Sweden, Finland, and Poland. The region is a hub for manufacturing advanced mining machinery and is at the forefront of implementing stringent environmental and safety standards, which propels demand for eco-efficient and highly automated solutions. European companies often lead in developing and exporting innovative technologies for deep mining, remote operations, and battery-electric vehicles, influencing global market trends.

- Latin America: This region presents substantial growth opportunities due to its vast and rich mineral reserves, especially for copper, gold, iron ore, and silver, found in countries such as Chile, Peru, Brazil, and Mexico. While historically relying on traditional methods, there is a growing trend towards modernizing mining operations and adopting advanced underground equipment and services to improve efficiency, safety, and environmental compliance. Investment in infrastructure and the drive to exploit deeper ore bodies are key drivers. The regions market dynamics are often influenced by commodity price fluctuations and the need for solutions tailored to diverse geological conditions and operational scales.

- Africa: Africa is a promising market with immense untapped mineral wealth, particularly for gold, platinum group metals, diamonds, and various critical minerals. Countries like South Africa, the Democratic Republic of Congo, and Ghana are major players. The market is characterized by a mix of established, large-scale operations and numerous developing projects. There is increasing investment in modernizing aging infrastructure and adopting new technologies to enhance safety, productivity, and sustainability. Challenges include political instability, infrastructure deficits, and skills gaps, yet the long-term potential for growth in underground mining equipment and services remains significant as mining companies seek to unlock the continents vast resources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Underground Mining Equipment and Service Market.- Caterpillar Inc.

- Sandvik AB

- Epiroc AB

- Komatsu Ltd.

- Liebherr Group

- Bucyrus International (now part of Caterpillar)

- Joy Global Inc. (now Komatsu Mining Corp.)

- Hitachi Construction Machinery Co., Ltd.

- Atlas Copco AB (Epiroc was spun off from Atlas Copco)

- Deere & Company (John Deere)

- XCMG Group

- SANY Group

- Volvo Construction Equipment

- Doosan Bobcat Inc.

- J.H. Fletcher & Co., Inc.

- Normet Oy

- MacLean Engineering

- Boart Longyear Ltd.

- DSI Underground (now a segment of Sandvik)

- Jennmar Corp.

Frequently Asked Questions

What is the primary driver of growth in the Underground Mining Equipment and Service Market?

The surging global demand for critical minerals and metals, fueled by industrialization, urbanization, and the widespread adoption of electrification and renewable energy technologies, is the primary driver of growth in the Underground Mining Equipment and Service Market.

How is AI impacting safety in underground mining operations?

AI significantly enhances safety by enabling autonomous mining systems and remote-controlled equipment, removing personnel from hazardous environments. It also supports predictive maintenance, minimizing unexpected equipment failures that could pose risks.

What are the main types of equipment used in underground mining?

Key equipment types include drilling and bolting machinery, loading and hauling equipment (LHDs, trucks), excavation tools (continuous miners, longwall shearers), ground support systems, and essential ventilation and pumping equipment.

Which geographical region holds the largest market share for underground mining equipment and services?

The Asia-Pacific region currently holds the largest market share, driven by extensive mining activities in countries like China, Australia, and India, coupled with ongoing industrial growth and significant infrastructure development.

What are the key opportunities for innovation in this market?

Key opportunities for innovation lie in the further development and adoption of automation and remote-control technologies, the transition to electrification and battery-powered equipment for sustainable operations, and the integration of IoT, AI, and data analytics for predictive maintenance and optimized mine planning.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager