Underwater Acoustic Modem Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427271 | Date : Oct, 2025 | Pages : 239 | Region : Global | Publisher : MRU

Underwater Acoustic Modem Market Size

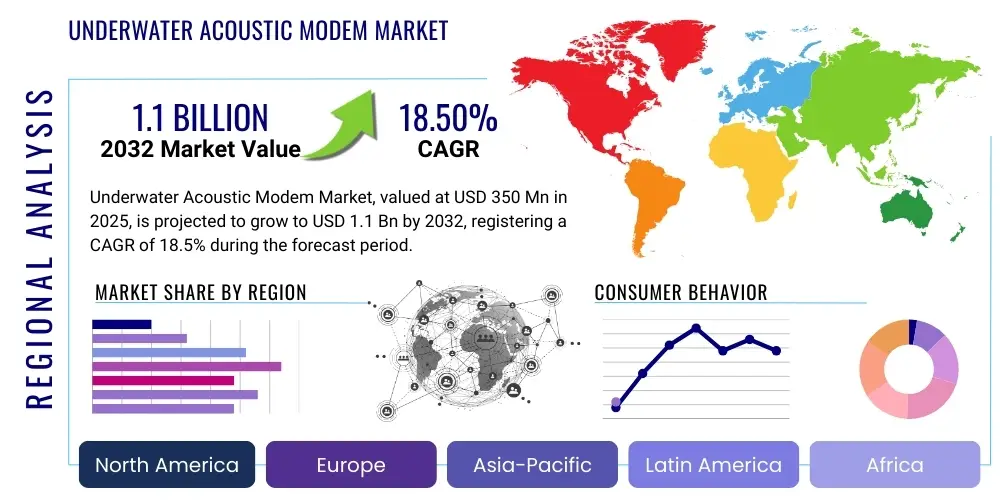

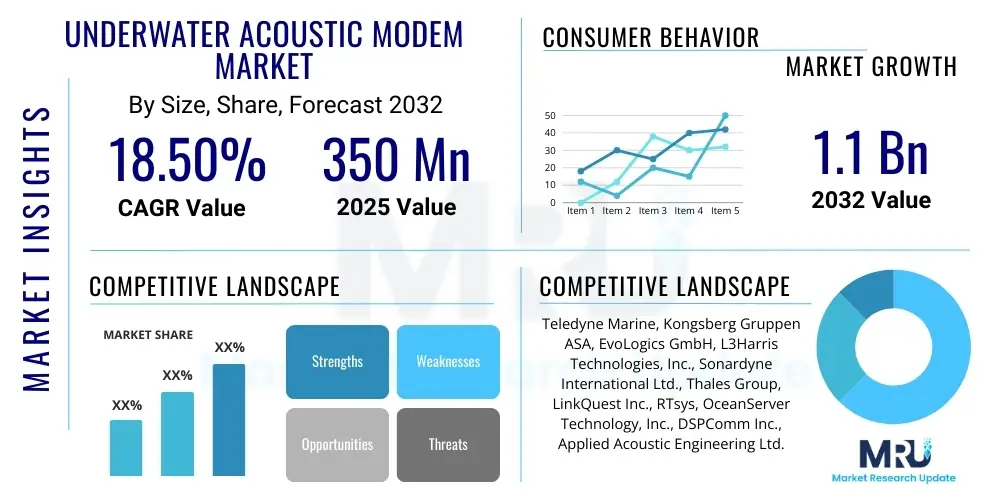

The Underwater Acoustic Modem Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 350 Million in 2025 and is projected to reach USD 1.1 Billion by the end of the forecast period in 2032.

This robust growth trajectory is primarily driven by escalating demand from critical sectors such as offshore oil and gas, defense, oceanographic research, and underwater communication for autonomous underwater vehicles (AUVs). The increasing investment in subsea infrastructure development, coupled with advancements in acoustic technology enhancing data transmission rates and reliability, significantly contributes to market expansion. The long-term outlook for underwater acoustic modems remains highly positive, underpinned by their indispensable role in various subsea operations, from environmental monitoring to military surveillance.

Underwater Acoustic Modem Market introduction

The Underwater Acoustic Modem Market encompasses the design, development, manufacturing, and deployment of devices that facilitate wireless communication underwater using sound waves. These specialized modems convert digital data into acoustic signals for transmission through the water column and then convert received acoustic signals back into digital data. This technology is critical for applications where traditional radio frequency communication is impractical or impossible due to severe attenuation in water. The market is characterized by a continuous drive for higher data rates, increased range, enhanced energy efficiency, and improved robustness in diverse and challenging underwater environments, supporting a wide array of mission-critical operations.

Underwater acoustic modems serve as the backbone for various sophisticated subsea operations, enabling reliable data transfer between submerged assets, surface vessels, and land-based stations. Their primary applications span defense and security, where they are vital for submarine communication, anti-submarine warfare, and underwater surveillance systems. In the offshore oil and gas industry, these modems are essential for monitoring subsea production systems, controlling remotely operated vehicles (ROVs), and supporting seismic surveys. Furthermore, they are indispensable in oceanographic research for collecting data from autonomous underwater sensors, mapping the seafloor, and studying marine ecosystems, providing invaluable insights into the oceans intricate dynamics and vast resources.

The benefits derived from underwater acoustic modems are extensive, including enabling real-time data acquisition from remote subsea locations, facilitating precise navigation for underwater vehicles, and supporting complex collaborative operations involving multiple autonomous platforms. Key driving factors for market growth include the global increase in maritime defense spending, the expansion of deep-sea exploration and exploitation activities, growing awareness and investment in marine environmental monitoring, and the proliferation of AUVs and ROVs requiring sophisticated communication capabilities. As technological advancements continue to address challenges related to multipath propagation, signal attenuation, and Doppler spread, the market for underwater acoustic modems is set to witness sustained innovation and adoption across numerous strategic sectors.

Underwater Acoustic Modem Market Executive Summary

The Underwater Acoustic Modem Market is experiencing dynamic growth, propelled by robust business trends that emphasize automation, data acquisition, and enhanced operational efficiency in subsea environments. Enterprises are increasingly investing in next-generation acoustic communication solutions that offer higher bandwidth, lower latency, and improved network capabilities to support complex underwater IoT networks and autonomous systems. There is a clear industry trend towards integrated solutions that combine communication, navigation, and positioning functionalities, providing comprehensive platforms for subsea asset management and scientific research. Furthermore, the push for miniaturization and energy efficiency is enabling longer mission durations for AUVs and smaller form factors for deployable sensors, broadening the scope of applications and attracting new market entrants focused on specialized niches and advanced software-defined acoustic modem architectures. The market is also seeing a significant trend towards enhanced cybersecurity measures for underwater data transmission, addressing growing concerns regarding data integrity and system vulnerabilities in critical defense and industrial applications.

Regionally, the market exhibits diverse growth patterns influenced by geopolitical priorities, economic development, and marine resource availability. North America, particularly the United States, maintains a dominant position due to substantial defense budgets, extensive offshore energy operations, and a strong presence of key technology developers and research institutions. Europe follows closely, driven by significant investments in renewable offshore energy (e.g., wind farms), advanced marine science initiatives, and naval modernization programs, with countries like Norway, the UK, and France at the forefront. The Asia-Pacific region is emerging as a high-growth market, spurred by increasing maritime security concerns, rapid expansion of naval capabilities in countries like China, India, and South Korea, and escalating offshore oil and gas exploration activities, alongside burgeoning aquaculture and deep-sea mining interests. These regional trends are further amplified by government support for marine technology development and strategic partnerships aimed at fostering innovation and local manufacturing capabilities to serve distinct market demands effectively.

Segmentation trends reveal a clear shift towards advanced communication protocols and hardware designed for specific operational depths and data throughput requirements. The demand for full-duplex communication capabilities is increasing across military and commercial sectors, enabling simultaneous data transmission and reception, which is crucial for real-time control and monitoring. Furthermore, the market for broadband acoustic modems, capable of supporting high-definition video streaming and large data file transfers, is expanding rapidly as the complexity of underwater missions grows. Concurrently, there is a strong emphasis on networkable modems that can form robust ad-hoc underwater networks, facilitating multi-node communication and data relay over large areas. This evolution in segmentation highlights a maturing market that is increasingly tailoring its offerings to meet highly specialized operational demands, from shallow-water coastal monitoring to ultra-deep-sea scientific exploration, ensuring optimal performance and reliability in a wide spectrum of subsea environments, thus maximizing the utility and reach of underwater acoustic communication technology.

AI Impact Analysis on Underwater Acoustic Modem Market

The integration of Artificial Intelligence (AI) is poised to fundamentally transform the Underwater Acoustic Modem Market by addressing traditional limitations and unlocking new capabilities. Users frequently inquire about how AI can enhance data processing, improve signal-to-noise ratios, and enable more autonomous underwater operations. Concerns often revolve around the computational demands of AI algorithms in power-constrained underwater devices and the reliability of AI-driven decision-making in unpredictable marine environments. Expectations include AI-powered adaptive communication protocols, predictive maintenance for subsea assets, and sophisticated data interpretation for environmental monitoring. The core themes center on leveraging AI to move beyond mere data transmission towards intelligent data management and autonomous operational control, significantly improving efficiency, resilience, and actionable insights from underwater networks.

AIs influence is anticipated to manifest across several critical dimensions, including optimizing communication performance by dynamically adjusting transmission parameters based on real-time environmental conditions, thereby reducing errors and increasing throughput. This adaptive intelligence can mitigate the challenges posed by variable salinity, temperature gradients, and unpredictable ocean currents that traditionally degrade acoustic signals. Moreover, AI algorithms can be trained to filter out noise, distinguish between different signal sources, and even predict optimal transmission windows, leading to more robust and reliable underwater communication links, which is particularly vital for applications requiring high data integrity and low latency, such as controlling critical subsea infrastructure or coordinating multiple autonomous underwater vehicles (AUVs) in complex missions.

Furthermore, AI will play a pivotal role in enabling higher levels of autonomy for underwater systems, shifting the paradigm from pre-programmed missions to intelligent, reactive operations. By analyzing vast amounts of sensor data, AI can empower AUVs to make informed decisions autonomously, such as rerouting to avoid obstacles, identifying anomalous events, or optimizing data collection strategies. This capability extends to predictive maintenance for underwater acoustic modems and associated subsea equipment, where AI models can analyze performance data to anticipate potential failures, schedule maintenance proactively, and minimize costly downtime. The overall impact of AI will be a significant leap in the sophistication and efficiency of underwater communication networks, transitioning them from passive data conduits to intelligent, self-optimizing, and highly resilient operational hubs, thereby extending the capabilities of human operators into the previously inaccessible and challenging underwater domain with unprecedented precision.

- AI-driven adaptive signal processing enhances data rates and reliability by compensating for environmental variability.

- Predictive analytics enables proactive maintenance of modems, reducing operational downtime and costs.

- Machine learning algorithms optimize network routing and resource allocation in complex underwater networks.

- AI facilitates autonomous decision-making for AUVs, improving mission efficiency and responsiveness.

- Enhanced data interpretation and anomaly detection for oceanographic research and surveillance applications.

DRO & Impact Forces Of Underwater Acoustic Modem Market

The Underwater Acoustic Modem Market is shaped by a confluence of powerful Drivers, significant Restraints, and promising Opportunities, all interacting to create dynamic Impact Forces. A primary driver is the accelerating demand for high-speed, reliable underwater communication from the defense sector for enhanced submarine-to-submarine and submarine-to-surface vessel communication, as well as for anti-submarine warfare (ASW) and mine countermeasures (MCM). Simultaneously, the burgeoning offshore oil and gas industry requires advanced modems for monitoring subsea infrastructure, controlling remotely operated vehicles (ROVs), and supporting seismic exploration in increasingly deeper and harsher environments. Furthermore, the global emphasis on oceanographic research and environmental monitoring, coupled with the proliferation of Autonomous Underwater Vehicles (AUVs) and underwater sensor networks, substantially boosts market demand for robust acoustic communication solutions capable of real-time data transmission and precise navigation. These factors collectively push for continuous innovation in modem technology.

Despite the strong drivers, several restraints impede faster market growth. The inherent physical limitations of acoustic waves in water, such as limited bandwidth, significant latency over long distances, and susceptibility to multipath propagation and environmental noise, pose persistent challenges to achieving high data rates and long-range communication simultaneously. The high cost associated with research and development, manufacturing, and deployment of advanced underwater acoustic modems, coupled with the need for specialized expertise for installation and maintenance, can deter smaller organizations and projects with limited budgets. Additionally, the power consumption requirements of high-performance modems are a significant concern for battery-operated AUVs and unattended sensor platforms, limiting mission endurance. Regulatory hurdles and the complexity of international frequency allocation for acoustic communication in certain regions also contribute to market friction, creating barriers to widespread adoption and market expansion.

However, these restraints also give rise to significant opportunities. The increasing investment in smart ocean technologies and the concept of an "Underwater Internet of Things" (IoUT) present a vast potential for acoustic modems to form the communication backbone for interconnected subsea assets, enabling unprecedented levels of data collection and remote control. Advances in signal processing techniques, such as spread spectrum and orthogonal frequency-division multiplexing (OFDM), are continuously improving data rates and combating noise, thereby expanding the utility of these devices. Furthermore, the growing focus on renewable offshore energy (e.g., floating wind farms) and the emerging deep-sea mining sector represent new frontiers demanding robust underwater communication solutions. Strategic partnerships between technology developers, defense organizations, and offshore energy companies are fostering innovation and accelerating market penetration, while miniaturization and energy harvesting technologies offer avenues to overcome power constraints. These opportunities underscore the markets long-term potential for sustained growth and technological advancement.

Segmentation Analysis

The Underwater Acoustic Modem Market is intricately segmented based on various critical parameters, including type, application, and end-user, reflecting the diverse operational requirements and technological capabilities within the industry. This segmentation allows for a granular understanding of market dynamics, enabling manufacturers to tailor their products to specific niche demands and providing stakeholders with clear insights into market opportunities. The core segmentation by type often differentiates between shallow-water, medium-water, and deep-water modems, each designed to operate optimally within specific depth ranges, addressing distinct signal propagation characteristics and environmental pressures. Further differentiation occurs based on data rate capabilities, ranging from low-frequency, long-range modems for basic telemetry to high-frequency, short-range modems for broadband data transfer, showcasing the breadth of technological solutions available.

From an application perspective, the market is broadly segmented into defense and security, offshore oil and gas, oceanography and environmental monitoring, and commercial applications such as aquaculture and underwater construction. Each application segment has unique demands for data integrity, latency, range, and robustness, driving specific product developments. For instance, defense applications prioritize secure, stealthy, and robust communication for submarines and unmanned underwater vehicles (UUVs), while oceanography requires reliable data links for distributed sensor networks. The end-user segmentation further refines this, categorizing demand from military forces, oil and gas companies, research institutions, and commercial enterprises. This granular view is crucial for market participants to identify their target audience and develop specialized solutions that offer superior performance and cost-effectiveness for the intended operational environment and user requirements.

The continuous evolution in technology and application scope means that these segmentations are not static; rather, they are constantly refined by emerging trends such as the integration of AI, the development of underwater IoT, and the increasing adoption of hybrid communication systems. The drive for higher data throughput and extended battery life across all segments is a consistent theme, pushing manufacturers to invest heavily in R&D for advanced modulation schemes, power-efficient electronics, and resilient housing materials. As autonomous underwater operations become more prevalent and the need for comprehensive subsea situational awareness intensifies, the market will likely see the emergence of even more specialized segments catering to niche requirements, ensuring that underwater acoustic modems remain at the forefront of subsea communication technology and support the vast array of human activities and scientific endeavors beneath the oceans surface.

- By Type:

- Shallow Water Modems

- Medium Water Modems

- Deep Water Modems

- Long-Range Modems

- Short-Range Modems

- High-Speed Modems

- Low-Power Modems

- By Application:

- Defense and Security (Submarine Communication, Anti-Submarine Warfare, Mine Countermeasures)

- Offshore Oil & Gas (Subsea Production Monitoring, ROV/AUV Control, Seismic Surveys)

- Oceanography and Environmental Monitoring (Scientific Research, Data Collection, Climate Change Studies)

- Commercial (Aquaculture, Underwater Construction, Underwater Tourism)

- By End-User:

- Military and Defense Organizations

- Oil & Gas Companies

- Research and Academic Institutions

- Environmental Agencies

- Commercial Businesses (e.g., Aquaculture Farms, Offshore Construction Firms)

Underwater Acoustic Modem Market Value Chain Analysis

The value chain for the Underwater Acoustic Modem Market is a complex and highly specialized ecosystem, commencing with upstream activities such as fundamental research and development (R&D) of acoustic signal processing algorithms, transducer technologies, and power management solutions. This initial stage involves significant investment in materials science, electronics engineering, and software development, often conducted by specialized research institutions, universities, and dedicated technology firms. Key components like transducers, digital signal processors (DSPs), and microcontrollers are sourced from a global network of advanced electronics suppliers, forming the critical building blocks for the modem units. Manufacturing processes require precision engineering and rigorous quality control to ensure the robustness and reliability of modems in harsh underwater environments, a phase dominated by a relatively small number of highly specialized manufacturers with proprietary expertise and advanced fabrication capabilities.

Midstream activities involve the assembly, integration, and testing of these components into finished acoustic modem products. This stage includes sophisticated calibration procedures, environmental testing, and performance validation to meet stringent industry standards and application-specific requirements. Distribution channels in this market are typically direct, particularly for high-value or customized solutions, where manufacturers directly engage with end-users such as defense organizations, large offshore energy companies, or leading research institutions. This direct approach allows for close collaboration, ensuring the product meets exact specifications and providing opportunities for tailored solutions and comprehensive support services. For more standardized products, a network of specialized distributors and system integrators may be utilized, acting as intermediaries to reach a broader customer base, particularly in commercial sectors or smaller research initiatives where technical support and integration services are crucial.

Downstream activities focus on post-sales support, installation, training, maintenance, and potential upgrades. Due to the highly technical nature of the equipment and the challenging operational environment, ongoing technical support and maintenance services are vital to ensure continuous performance and longevity of the modems. Direct channels facilitate this through dedicated service teams provided by the manufacturers, offering specialized expertise and rapid response to operational issues. Indirect channels, through authorized service partners, extend this support geographically, ensuring that customers in diverse locations receive timely assistance. The overall value chain is characterized by a strong emphasis on R&D, specialized manufacturing, direct customer relationships, and extensive post-sales support, all contributing to the high value and critical nature of underwater acoustic modem technology in enabling essential subsea operations across various strategic sectors globally.

Underwater Acoustic Modem Market Potential Customers

The potential customer base for the Underwater Acoustic Modem Market is broad and diverse, primarily encompassing entities with critical operational requirements for reliable and secure communication in subsea environments. At the forefront are military and defense organizations globally, including navies and coast guards, which utilize these modems for submarine command and control, anti-submarine warfare, underwater surveillance, mine countermeasures, and secure data exfiltration from unmanned underwater vehicles (UUVs). The imperative for advanced maritime security and the modernization of naval fleets drives significant and continuous demand from this sector, prioritizing robust, long-range, and low-probability-of-detection communication capabilities, making them a cornerstone for national defense strategies and regional security operations.

Another major segment comprises companies operating within the offshore oil and gas industry, including exploration firms, production companies, and service providers. These organizations rely heavily on underwater acoustic modems for real-time monitoring and control of subsea infrastructure, such as wellheads, pipelines, and remotely operated vehicles (ROVs). Modems are also essential for conducting seismic surveys, precise positioning of subsea equipment, and ensuring the safety and efficiency of deep-sea drilling and production activities. As the industry ventures into deeper and more challenging waters, the demand for more advanced, reliable, and energy-efficient acoustic communication solutions continues to escalate, providing crucial data links for asset integrity management and operational decision-making in highly demanding environments.

Furthermore, research and academic institutions, environmental monitoring agencies, and commercial entities involved in marine science and various underwater endeavors represent a significant and growing customer segment. These include oceanographic research centers, universities, and governmental bodies focused on studying marine ecosystems, climate change, and geological formations, often deploying autonomous underwater vehicles (AUVs) and extensive sensor networks that require reliable data harvesting. Commercial applications extend to aquaculture for monitoring fish farms, underwater construction and salvage operations requiring precise positioning and communication, and even emerging sectors like deep-sea mining. This broad spectrum of end-users underscores the versatile and indispensable nature of underwater acoustic modems in supporting a wide array of scientific, industrial, and strategic activities beneath the ocean’s surface, enabling humans to explore, understand, and manage the vast resources and intricate dynamics of marine environments.

Underwater Acoustic Modem Market Key Technology Landscape

The Underwater Acoustic Modem Market is characterized by a rapidly evolving technological landscape, driven by the continuous pursuit of higher data rates, extended ranges, enhanced reliability, and greater energy efficiency. Core to this landscape are advancements in transducer design, which dictate the physical properties of sound wave generation and reception, influencing efficiency, bandwidth, and directional capabilities. Alongside this, sophisticated digital signal processing (DSP) algorithms are crucial for mitigating the challenges inherent in underwater acoustic channels, such as multipath interference, Doppler spread, and high attenuation. Technologies like Orthogonal Frequency Division Multiplexing (OFDM), spread spectrum (e.g., Direct Sequence Spread Spectrum - DSSS, Frequency Hopping Spread Spectrum - FHSS), and various adaptive equalization techniques are widely employed to improve signal integrity and achieve robust communication even in noisy or dynamic environments, pushing the boundaries of what is acoustically possible underwater.

Further technological advancements include the development of advanced modulation schemes that allow for more information to be encoded within acoustic signals, significantly increasing data throughput without sacrificing range or reliability. These include phase-shift keying (PSK), frequency-shift keying (FSK), and quadrature amplitude modulation (QAM), each offering different trade-offs in terms of data rate, robustness, and spectral efficiency. The integration of networking protocols, such as those inspired by the Internet Protocol (IP) suite, is crucial for enabling the creation of scalable and robust underwater acoustic networks, often referred to as the "Underwater Internet of Things" (IoUT). These protocols facilitate multi-node communication, data routing, and network management, transforming isolated modems into interconnected communication infrastructures capable of supporting complex autonomous missions and distributed sensor arrays, thereby enabling the seamless flow of data across a vast and dynamic subsea landscape.

Moreover, the incorporation of artificial intelligence (AI) and machine learning (ML) is emerging as a transformative trend, allowing modems to adapt autonomously to changing ocean conditions, optimize transmission parameters in real-time, and perform predictive maintenance. Miniaturization and power management technologies are also pivotal, enabling the development of smaller, lighter, and more energy-efficient modems suitable for small AUVs, gliders, and long-duration sensor deployments. Battery technology improvements and the exploration of underwater energy harvesting solutions further contribute to extending operational endurance. The convergence of these technologies, coupled with ongoing research in quantum acoustics and biomimetic approaches, defines a dynamic and innovative technological landscape that continues to push the performance envelope of underwater acoustic modems, ensuring their indispensable role in future subsea exploration, exploitation, and defense capabilities across the globe.

Regional Highlights

- North America: Dominates the market due to significant defense spending, extensive offshore oil and gas operations, and a robust ecosystem of research institutions and technology developers. The United States leads in naval modernization and deep-sea exploration, driving demand for advanced acoustic modems.

- Europe: A strong market driven by offshore renewable energy projects (especially offshore wind), marine science research, and naval modernization. Countries like Norway, the UK, and France are key players, with substantial investments in marine technology and environmental monitoring.

- Asia-Pacific: Emerging as the fastest-growing region, fueled by increasing maritime security concerns, rapid expansion of naval capabilities (China, India, South Korea), and growing investments in offshore oil & gas, aquaculture, and deep-sea mining. Regional governments are heavily investing in marine technology R&D.

- Latin America: Growth driven by offshore oil and gas exploration in countries like Brazil and Mexico, alongside developing naval capabilities. The region also sees increasing interest in oceanographic research and marine resource management, leading to a steady demand for underwater acoustic communication.

- Middle East & Africa: Characterized by burgeoning offshore oil and gas activities, particularly in the Persian Gulf and off the coast of Africa. Strategic investments in maritime security and coastal surveillance also contribute to market demand for robust underwater communication solutions, albeit at a slower pace.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Underwater Acoustic Modem Market.- Teledyne Marine (USA)

- Kongsberg Gruppen ASA (Norway)

- EvoLogics GmbH (Germany)

- L3Harris Technologies, Inc. (USA)

- Sonardyne International Ltd. (UK)

- Thales Group (France)

- LinkQuest Inc. (USA)

- RTsys (France)

- OceanServer Technology, Inc. (USA)

- DSPComm Inc. (USA)

- Applied Acoustic Engineering Ltd. (UK)

Frequently Asked Questions

What is an underwater acoustic modem and how does it work?

An underwater acoustic modem is a device that enables wireless communication underwater by converting digital data into sound waves for transmission and back again. It utilizes acoustic signals to overcome the limitations of radio frequency waves in water, making it essential for subsea data transfer and control.

What are the primary applications of underwater acoustic modems?

Underwater acoustic modems are primarily used in defense and security for submarine communication, in offshore oil and gas for subsea infrastructure monitoring and ROV control, and in oceanography for scientific data collection and environmental monitoring, along with various commercial subsea operations.

What challenges do underwater acoustic modems face?

Key challenges include limited bandwidth, high latency, susceptibility to multipath propagation and environmental noise, high power consumption for high-performance units, and the inherent physical properties of sound waves in water, which affect range and reliability.

How is AI impacting the Underwater Acoustic Modem Market?

AI is transforming the market by enabling adaptive signal processing for improved data rates, predictive maintenance for devices, optimized network routing, and autonomous decision-making for underwater vehicles, leading to more intelligent and resilient subsea communication systems.

Which regions are leading the growth in the Underwater Acoustic Modem Market?

North America currently leads due to strong defense spending and offshore activities. Europe is also a significant market driven by offshore renewables and marine research. The Asia-Pacific region is experiencing the fastest growth, propelled by naval expansion and increasing offshore resource exploration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager