Unsecured Business Loans Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429511 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Unsecured Business Loans Market Size

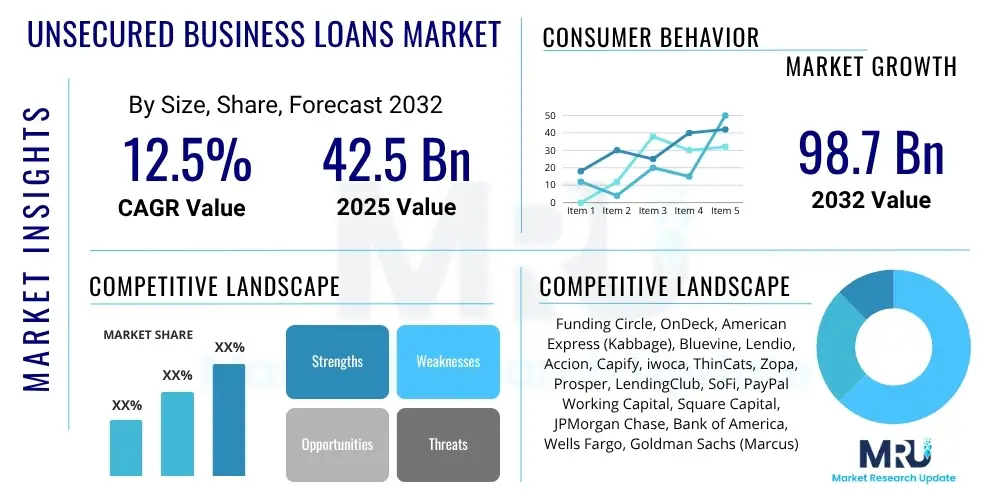

The Unsecured Business Loans Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 42.5 billion in 2025 and is projected to reach USD 98.7 billion by the end of the forecast period in 2032.

Unsecured Business Loans Market introduction

Unsecured business loans represent a cornerstone of modern business finance, particularly for Small and Medium-sized Enterprises (SMEs) and burgeoning startups that often operate without substantial tangible assets to offer as collateral. These financial products are inherently characterized by the absence of a collateral requirement, differentiating them significantly from traditional secured lending options. This structural difference not only enhances accessibility for a broader spectrum of businesses but also reflects a higher perceived risk for lenders, which is typically factored into the interest rates and repayment terms offered. The product's fundamental design caters to the agile and often immediate capital needs of businesses that prioritize speed and flexibility over pledging valuable assets, thus safeguarding their existing equity and operational freedom.

The applications for unsecured business loans are remarkably diverse, spanning critical operational expenditures and strategic growth initiatives. Businesses routinely leverage these funds for managing daily working capital requirements, ensuring smooth cash flow, and covering seasonal fluctuations. They are also instrumental in financing inventory purchases, enabling businesses to meet fluctuating customer demand without draining reserves. Furthermore, these loans are frequently applied to marketing and advertising campaigns, business expansion efforts, technology upgrades, or to bridge temporary shortfalls in revenue, acting as a crucial financial lubricant for sustained growth. The undeniable benefits, including expedited approval processes, versatile fund utilization, and the non-requirement of asset pledges, underscore their increasing appeal across various industry sectors, providing a vital lifeline for businesses at different stages of their lifecycle.

The market's robust expansion is propelled by several potent driving factors. A primary catalyst is the persistent global proliferation of SMEs and the relentless wave of new business formations, each requiring initial and ongoing capital infusion. This inherent demand is amplified by the widespread digital transformation across the financial sector, where advancements in online lending platforms and sophisticated financial technology (fintech) have drastically simplified the application process and accelerated disbursement timelines. The prevailing business preference for streamlined, convenient, and rapid access to funding further solidifies this trend. Moreover, in emerging economies, where traditional banking infrastructure might be less developed or more rigid, unsecured digital lending platforms are playing a transformative role in fostering financial inclusion and stimulating local economic growth by offering accessible capital solutions. This growing reliance on digital channels not only enhances borrower convenience but also empowers lenders to reach previously underserved markets, thereby expanding the overall footprint of the unsecured lending ecosystem.

Unsecured Business Loans Market Executive Summary

The Unsecured Business Loans Market is poised for significant expansion, underpinned by evolving global business trends that emphasize agility, digital integration, and tailored financial solutions for Small and Medium-sized Enterprises (SMEs). A key business trend driving this growth is the pervasive influence of digital lending platforms and advanced fintech innovations, which are systematically reconfiguring the competitive landscape. These technologies facilitate rapid, data-driven loan assessments, offer highly customized loan products, and deliver seamless user experiences, moving away from the often cumbersome processes of traditional banking. The rise of embedded finance, where lending services are integrated directly into business software or e-commerce platforms, is another transformative trend, enhancing convenience and reaching businesses at their point of need, effectively lowering barriers to accessing capital and fueling entrepreneurial activity across diverse sectors. This shift towards seamless, integrated financial solutions is fundamentally altering customer expectations and forcing traditional lenders to innovate rapidly or risk losing market share to agile fintech challengers.

From a regional perspective, the market dynamics vary considerably, reflecting diverse economic conditions, regulatory environments, and levels of technological adoption. North America and Europe, characterized by mature financial infrastructures, exhibit a strong uptake of sophisticated digital lending and advanced data analytics solutions, though they also face heightened regulatory scrutiny regarding data privacy and fair lending practices. In contrast, the Asia Pacific region stands out as a high-growth frontier, fueled by a booming SME segment, rapid urbanization, and an accelerating embrace of digital financial services, particularly in populous economies like India and Southeast Asia. Latin America and the Middle East & Africa are rapidly gaining momentum, driven by increasing smartphone penetration, economic diversification efforts, and governmental initiatives aimed at fostering small business growth, presenting substantial, yet often underserved, market potential for flexible lending products. These regional nuances highlight the importance of localized strategies for market entry and sustained growth for lenders.

Segmentation trends reveal an increasing refinement and specialization of unsecured loan products to precisely match distinct business requirements. There is a discernible focus on serving micro-businesses, freelancers, and rapidly expanding e-commerce ventures, which typically necessitate smaller loan amounts with flexible repayment schedules and streamlined application processes. Lenders are increasingly leveraging sophisticated data analytics, artificial intelligence, and machine learning algorithms to move beyond conventional credit scoring. This enables them to assess a broader spectrum of alternative data points, such as transaction history, online presence, and industry-specific metrics, leading to more granular and accurate risk profiling. This personalized approach to underwriting facilitates the creation of highly targeted and relevant financing solutions for diverse business profiles, enhancing financial inclusion and optimizing the overall lending ecosystem by matching capital more efficiently with demand, thereby fostering a more robust and equitable financial landscape for small businesses worldwide.

AI Impact Analysis on Unsecured Business Loans Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Unsecured Business Loans Market frequently revolve around its transformative capabilities in refining credit assessment methodologies, significantly accelerating loan approval processes, and robustly enhancing fraud detection mechanisms. Users are keenly interested in how AI can contribute to more equitable and efficient lending decisions, potentially reducing inherent biases in traditional underwriting and expanding access to capital for businesses historically underserved by conventional financing models. The dialogue also extends to the potential for AI to facilitate personalized loan offerings, dynamic interest rate adjustments, and superior risk management capabilities for lenders. While expectations for operational streamlining and enhanced customer experience are high, there are also prevalent concerns regarding data privacy, the transparency of algorithmic decision-making, and the ethical implications of AI deployment, highlighting a strong desire for responsible and balanced innovation within this evolving domain. These questions underscore the market's evolving understanding of AI's multifaceted role.

- Expedited Loan Processing: AI-driven platforms can automate the collection and analysis of vast datasets, leading to significantly faster application processing and near-instantaneous loan approval decisions, reducing typical waiting times from days to hours or even minutes, thereby providing critical agility for businesses in need of immediate capital.

- Advanced Credit Risk Assessment: Machine learning algorithms can analyze a wider array of traditional and alternative data points, including transaction histories, social media presence, and even behavioral patterns, to build more comprehensive and accurate credit risk profiles, moving beyond reliance on basic credit scores and enabling access for previously overlooked segments.

- Enhanced Fraud Detection and Prevention: AI systems are highly effective at identifying unusual patterns and anomalies in application data and financial transactions, drastically improving the ability to detect and prevent fraudulent activities, thereby safeguarding lenders' assets and maintaining market integrity by proactively flagging suspicious activities.

- Personalized Loan Product Offerings: AI enables lenders to tailor loan amounts, interest rates, and repayment schedules to individual business needs and risk appetites, creating highly customized financial solutions that optimize value for both the borrower and the lender, moving towards a truly bespoke lending experience.

- Operational Efficiency and Cost Reduction: By automating routine tasks such as data entry, document verification, and initial screening, AI significantly reduces operational overheads for lenders, allowing them to allocate human resources to more complex tasks and enhance overall service quality, leading to leaner and more responsive lending operations.

- Predictive Analytics for Portfolio Management: AI tools provide predictive insights into potential defaults or payment difficulties, allowing lenders to proactively manage their loan portfolios, implement early intervention strategies, and optimize collection processes, thereby minimizing losses and improving overall portfolio health through data-driven foresight.

- Improved Customer Experience: AI-powered chatbots and virtual assistants offer 24/7 support, guiding applicants through the process, answering common questions, and providing personalized recommendations, leading to a more streamlined and satisfactory borrowing experience, thereby boosting customer loyalty and engagement.

- Market Adaptation and Product Innovation: AI's ability to analyze market trends and borrower feedback helps lenders rapidly adapt their products and services to changing economic conditions and emerging business needs, fostering continuous innovation in the unsecured lending space, ensuring offerings remain relevant and competitive.

DRO & Impact Forces Of Unsecured Business Loans Market

The Unsecured Business Loans Market is profoundly shaped by an intricate ecosystem of drivers, restraints, opportunities, and external impact forces that collectively dictate its growth trajectory and competitive dynamics. A primary driver fueling market expansion is the continuous surge in the global population of Small and Medium-sized Enterprises (SMEs), which are perpetually seeking agile and accessible capital solutions to fund their operations, growth, and innovation cycles without the encumbrance of pledging tangible assets. This demand is further amplified by the accelerating pace of digital transformation across all economic sectors, which mandates businesses to invest in technology and infrastructure, often requiring quick, uncollateralized financing. The intrinsic ease of access and the rapid disbursement capabilities offered by modern unsecured lending platforms also significantly contribute to their appeal, satisfying the pressing need for immediate capital among entrepreneurs and small business owners. Moreover, the increasing adoption of cloud-based solutions and API integrations streamlines the borrowing process, making unsecured loans even more attractive.

Conversely, several formidable restraints temper the market's otherwise vigorous growth. The elevated perceived risk associated with lending without collateral inherently translates into higher interest rates for borrowers, which can sometimes render these loans less attractive compared to secured alternatives, or even pose repayment challenges for financially vulnerable businesses. The ever-evolving and often stringent regulatory frameworks across different jurisdictions, particularly concerning consumer protection, data privacy, and anti-money laundering (AML) compliance, impose substantial operational and compliance costs on lenders, potentially slowing innovation and market entry for smaller players. Furthermore, the intensifying competitive landscape, characterized by both established financial institutions and a proliferation of agile fintech startups, exerts downward pressure on profit margins and necessitates continuous differentiation and technological investment. Economic uncertainties, such as inflationary pressures or periods of recession, exacerbate credit risk, leading lenders to adopt more cautious underwriting practices, thereby restricting the availability of unsecured capital for certain segments and increasing the stringency of eligibility criteria.

Amidst these challenges, substantial opportunities exist to propel the market forward. There is immense, largely untapped potential in serving micro-businesses, freelancers, and segments of the SME market that remain underserved by conventional banking systems due to lack of credit history or insufficient collateral. The continuous innovation in specialized fintech platforms, which leverage alternative data and advanced analytics, can create highly tailored and inclusive financial products for these niche segments. The rapid adoption of embedded finance solutions, where lending is seamlessly integrated into point-of-sale systems or business management software, presents a novel distribution channel that reaches businesses at their moment of need, enhancing convenience and increasing uptake. Moreover, the global shift towards online and mobile-first financial services, driven by a technologically savvy generation of entrepreneurs, further solidifies the long-term growth prospects for digital unsecured lending. External impact forces, including macro-economic stability, ongoing advancements in artificial intelligence and big data analytics for superior risk profiling, and supportive governmental policies aimed at fostering SME growth, will play a pivotal role in shaping the market's future resilience and trajectory, encouraging sustainable innovation and broader financial inclusion.

Segmentation Analysis

The Unsecured Business Loans market is meticulously segmented across various dimensions, providing a granular view of market dynamics and enabling lenders to craft highly targeted financial products. This comprehensive segmentation reflects the heterogeneous nature of business financing needs, encompassing differences in capital requirements, organizational structures, industry-specific challenges, and preferred lending channels. By categorizing the market based on key attributes such as loan amount, the legal structure of the borrowing entity, the industry sector, the type of financial provider, and the specific application of funds, stakeholders can gain profound insights into market demand patterns, competitive positioning, and emerging opportunities. This analytical framework is crucial for strategic planning, product development, and effective market penetration, ensuring that diverse business needs are addressed with appropriate and accessible financing solutions.

Each segment within the unsecured business loans market offers unique insights into borrower behavior and lender strategies. For instance, segmenting by loan amount allows providers to design products specifically for micro-enterprises requiring small, frequent injections of capital versus larger SMEs undertaking significant expansion projects. Understanding business types helps in tailoring legal and compliance aspects, while industry-specific segmentation informs risk models and product features, as a retail business might have different needs and risk profiles than a technology startup. The differentiation by provider highlights the competitive landscape between traditional banks, agile fintechs, and peer-to-peer platforms, each with distinct operational models and customer propositions. Finally, segmenting by the intended application of the loan underscores the various pain points businesses seek to address with unsecured capital, from bridging working capital gaps to investing in growth initiatives. This multi-dimensional approach to segmentation allows for a more nuanced understanding of market drivers and inhibitors.

- By Loan Amount: This segmentation categorizes loans based on their principal value, reflecting the varying capital needs of businesses.

- Micro Loans: Typically loans below USD 50,000, designed for very small businesses, startups, and sole proprietors for immediate operational needs or small-scale investments, emphasizing quick turnaround and minimal paperwork.

- Small Loans: Ranging from USD 50,000 to USD 250,000, catering to established small businesses for working capital, inventory, or modest expansion projects, often with flexible repayment terms aligned to business cycles.

- Medium Loans: Loans from USD 250,000 up to USD 1,000,000, often sought by growing SMEs for significant expansion, equipment acquisition, or larger-scale projects, requiring a more detailed financial assessment.

- Large Loans: Loans exceeding USD 1,000,000, typically for more mature SMEs with substantial revenue streams and established operations, though less common in purely unsecured offerings due to higher risk appetite requirements from lenders.

- By Business Type: This segment classifies borrowers based on their legal and operational structure, influencing regulatory requirements and risk assessment methodologies.

- Sole Proprietorships: Individual-owned businesses, often seeking simpler application processes and direct funding, with personal credit history often playing a significant role in approval.

- Partnerships: Businesses owned by two or more individuals, requiring consideration of multiple partners' credit profiles and business agreements, often seeking funds for partnership expansion or operational enhancements.

- Limited Liability Companies (LLCs): Hybrid entities offering liability protection, often with more structured financial records and a clearer separation between personal and business finances, making them a common borrower type.

- Corporations: Larger, more formal entities with complex financial structures, seeking significant capital for growth or specific projects, often with established governance and reporting.

- Freelancers/Gig Economy Workers: A rapidly growing segment often requiring small, flexible loans for project-based needs, equipment upgrades, or managing cash flow between assignments, presenting unique underwriting challenges and opportunities.

- By Industry: Categorizes loans based on the sector in which the borrowing business operates, influencing risk assessment, product features, and typical loan usage patterns.

- Retail & Consumer Goods: Businesses needing capital for inventory, seasonal demand fluctuations, store upgrades, or e-commerce platform enhancements, often requiring fast and flexible financing.

- Services (Consulting, Professional Services, Hospitality): Sectors often asset-light, relying predominantly on human capital and intellectual property, thus making unsecured loans an ideal financing option for working capital or expansion without collateral.

- Manufacturing & Construction: Businesses requiring funds for material purchase, project financing, machinery upgrades, or supply chain optimization, where unsecured loans can complement secured financing or cover short-term gaps.

- Healthcare & Life Sciences: Medical practices, clinics, and small biotech firms needing funds for medical equipment, facility expansion, staffing, or working capital to manage insurance reimbursements, often valuing speed and privacy.

- E-commerce & Technology: Rapidly growing sectors with high innovation and inventory needs, often seeking flexible, scalable financing for product development, marketing, or scaling online operations without traditional collateral.

- Transportation & Logistics: Businesses needing funds for fleet maintenance, fuel costs, regulatory compliance, or operational expansion to meet demand, where quick access to capital is often crucial.

- Others (Agriculture, Education, Non-profits, Creative Arts): Diverse sectors with specific financing requirements not covered elsewhere, often benefiting from tailored unsecured solutions that understand their unique operational models and revenue cycles.

- By Provider: Differentiates the market based on the type of institution offering the loan, highlighting distinct operational models and customer value propositions.

- Banks & Credit Unions: Traditional financial institutions, often offering competitive rates but with stricter eligibility criteria, longer approval times, and a preference for established businesses with robust credit histories.

- Non-Banking Financial Companies (NBFCs): Specialized financial entities offering more flexible products and often catering to segments underserved by traditional banks, with more streamlined processes and bespoke solutions.

- Fintech Lenders: Technology-driven companies leveraging AI/ML for fast, data-driven underwriting, alternative data sources, and digital-first experiences, appealing to businesses seeking speed and convenience.

- Peer-to-Peer (P2P) Lending Platforms: Connect borrowers directly with individual or institutional investors, often offering alternative interest rates and more flexible terms by disintermediating traditional financial institutions.

- Online Lenders: Broad category of digital-first lenders emphasizing speed, convenience, and simplified application processes, often overlapping with fintech and P2P models, providing accessible funding across various business sizes.

- By Application: This segment focuses on the specific purpose for which the business intends to use the borrowed funds, reflecting diverse financial pain points and strategic objectives.

- Working Capital: Funds for daily operational expenses, payroll, utility payments, and maintaining short-term liquidity, crucial for smooth business continuity.

- Equipment Purchase: Financing for acquiring new machinery, tools, software, or technology without using these assets as collateral, enabling businesses to upgrade without tying up existing assets.

- Inventory Financing: Capital to purchase and maintain adequate stock levels, especially critical for seasonal businesses or those experiencing rapid demand growth, ensuring product availability.

- Marketing & Advertising: Funds dedicated to promotional campaigns, brand building, digital advertising, and customer acquisition strategies, driving business growth and market penetration.

- Business Expansion: Capital for opening new locations, entering new markets, hiring additional staff, or scaling existing operations, supporting strategic growth initiatives.

- Debt Consolidation: Combining multiple existing business debts into a single, often more manageable, unsecured loan with a potentially lower overall interest rate or more favorable repayment terms.

- Startup Capital: Initial funding for new businesses to cover launch costs, initial inventory, early operational expenses, or proof-of-concept development, crucial for business inception.

- Technology Upgrades: Investment in new software, hardware, IT infrastructure, or cybersecurity solutions to enhance operational efficiency, competitive edge, or compliance, adapting to a digital economy.

- Crisis Management: Short-term capital to manage unforeseen emergencies, natural disasters, or sudden market downturns, providing a financial safety net.

Value Chain Analysis For Unsecured Business Loans Market

The value chain for the Unsecured Business Loans Market is a complex and highly integrated network of participants and processes, designed to facilitate the flow of capital from originators to borrowing businesses. This chain commences with critical upstream activities, where the foundation for lending decisions is meticulously constructed. Key players in this initial phase include a diverse array of data providers, such as established credit bureaus like Experian, Equifax, and TransUnion, alongside specialized alternative data analytics firms that assess non-traditional metrics like banking transaction data, social media sentiment, or utility payment histories. Technology vendors, supplying robust credit scoring software, identity verification tools, and Know Your Customer (KYC) solutions, are also indispensable at this stage. These upstream components collectively provide lenders with the comprehensive information and analytical capabilities necessary to evaluate borrower creditworthiness, identify potential risks, and ensure regulatory compliance, thereby minimizing fraud and optimizing initial risk assessments before any capital is committed. The quality and breadth of this initial data collection directly impact the accuracy and speed of subsequent lending decisions, forming the bedrock of an efficient unsecured lending process.

The midstream segment of the value chain constitutes the core lending operations, where financial institutions transform raw data into actionable loan products and disburse funds. This segment is populated by a wide spectrum of lenders, including traditional commercial banks and credit unions, agile Non-Banking Financial Companies (NBFCs), innovative fintech lending platforms, and burgeoning peer-to-peer (P2P) lending marketplaces. These entities are responsible for the entire loan origination process, which encompasses product design, aggressive marketing campaigns to attract suitable borrowers, meticulous underwriting leveraging advanced algorithms, and efficient fund disbursement. The efficiency of this stage is increasingly powered by advanced technologies such as Artificial Intelligence (AI) for automated underwriting, Machine Learning (ML) for predictive analytics, and cloud computing for scalable infrastructure. The distribution of these unsecured loans is facilitated through various channels, including direct online applications via lender websites or mobile apps, strategic partnerships with financial advisors and brokers who serve as intermediaries, and increasingly, through embedded finance solutions where lending is seamlessly integrated into other business services or platforms, significantly broadening market reach and enhancing user convenience by meeting borrowers where they already conduct their business operations.

Finally, the downstream activities focus on managing the loan lifecycle post-disbursement, ensuring successful repayment and providing ongoing borrower support. This phase involves rigorous loan monitoring, efficient collection of repayments, and dedicated customer service. Tools for automated payment processing, communication platforms for borrower engagement, and sophisticated portfolio management software are critical components here, enabling lenders to track performance and interact effectively with borrowers. In instances of potential default or delinquency, third-party debt collection agencies and specialized recovery services play a vital role in minimizing financial losses for lenders, employing strategies ranging from amicable settlements to legal actions. The overarching trend across the entire value chain is a continuous drive towards digitization and automation, leveraging technologies to streamline processes, reduce operational costs, enhance decision-making accuracy, and ultimately improve the borrower experience. This holistic approach ensures that unsecured business loans are not only accessible but also efficiently managed throughout their entire lifecycle, fostering a more resilient, transparent, and responsive lending ecosystem that adapts to the evolving needs of both lenders and borrowers.

Unsecured Business Loans Market Potential Customers

The core demographic of potential customers for unsecured business loans comprises a diverse and expansive array of Small and Medium-sized Enterprises (SMEs), budding startups, and ambitious individual entrepreneurs. These segments frequently find themselves in situations where they require immediate or flexible capital for various operational imperatives and strategic growth initiatives, yet they often lack the substantial tangible assets typically mandated by conventional financial institutions as collateral for secured lending. Startups, in particular, represent a significant proportion of this customer base; they frequently rely on unsecured financing to cover crucial initial operational expenses, acquire essential initial equipment without asset pledges, or fund the development of their first products, given their typically limited asset base in their formative stages, making speed and flexibility of funding paramount.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 42.5 Billion |

| Market Forecast in 2032 | USD 98.7 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Funding Circle, OnDeck, American Express (Kabbage), Bluevine, Lendio, Accion, Capify, iwoca, ThinCats, Zopa, Prosper, LendingClub, SoFi, PayPal Working Capital, Square Capital, JPMorgan Chase, Bank of America, Wells Fargo, Goldman Sachs (Marcus), Metro Bank, OakNorth Bank, Credibility Capital, Quicken Loans (Rocket Mortgage), Spotloan, Fundbox, StreetShares, Fast Capital 360, Oportun, Opportunity Fund, WebBank |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Unsecured Business Loans Market Key Technology Landscape

The Unsecured Business Loans Market is being profoundly reshaped by a dynamic confluence of advanced technologies that are fundamentally altering how credit is assessed, loans are processed, and customers are engaged. Central to this technological paradigm shift is the ubiquitous adoption and continuous evolution of Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These intelligent systems enable lenders to move beyond traditional, often rigid, credit scoring models by analyzing vast and diverse datasets, encompassing not only historical financial data but also alternative data points such as real-time banking transactions, social media activity, e-commerce sales performance, and even utility payment records. This sophisticated analytical capability facilitates the generation of more granular, accurate, and predictive credit risk profiles, thereby accelerating the underwriting process, reducing manual errors, and enabling highly personalized loan offers with dynamic interest rates tailored to the unique risk appetite and financial health of each business, significantly enhancing both efficiency and inclusivity in lending decisions.

Regional Highlights

- North America: This region stands as a vanguard in the unsecured business loans market, characterized by its advanced financial infrastructure, high levels of technological adoption, and a deeply embedded culture of entrepreneurship. The United States, in particular, dominates this landscape, driven by a robust economy, a vibrant startup ecosystem, and a strong preference for digital lending solutions among Small and Medium-sized Enterprises (SMEs). Fintech companies and online lenders have achieved significant market penetration, leveraging sophisticated AI and big data analytics for swift and accurate credit assessments. While the market is mature and highly competitive, a well-defined regulatory framework, though constantly evolving, provides a stable environment for financial innovation and consumer protection, encouraging both traditional and challenger banks to compete for market share. Canada also contributes significantly to regional growth, with increasing digitalization in its banking sector and a growing demand for flexible business financing options for its thriving small business community.

- Europe: The European unsecured business loans market is a heterogeneous landscape, profoundly shaped by diverse national economies, varying regulatory approaches, and distinct levels of digital maturity. Western European countries, including the United Kingdom, Germany, and the Netherlands, lead in terms of market size and fintech adoption, with strong government initiatives supporting SME growth and innovation. The implementation of directives like PSD2 (Revised Payment Services Directive) has fostered open banking, stimulating competition and driving innovation in lending solutions. However, the region faces challenges associated with fragmented regulatory frameworks across member states, requiring lenders to navigate complex compliance requirements. Central and Eastern European countries are witnessing accelerated growth, driven by increasing digitalization and a growing appetite for alternative financing options as their economies mature and their SME sectors expand, often leapfrogging traditional banking models. The drive towards a unified digital single market also presents both opportunities and complexities for cross-border lending.

- Asia Pacific (APAC): The APAC region is unequivocally the fastest-growing market for unsecured business loans, propelled by unprecedented economic expansion, rapid urbanization, and a burgeoning SME sector across its diverse economies. Countries such as India, China, and Indonesia are experiencing explosive growth, fueled by vast populations, increasing internet and smartphone penetration, and a significant proportion of unbanked or underbanked businesses seeking accessible capital. Governments are actively promoting digital financial inclusion and supporting startups, creating a fertile ground for fintech lenders who leverage mobile-first strategies and alternative credit scoring models due to limited traditional credit data. The sheer scale of the SME market, coupled with a cultural readiness to adopt digital solutions, positions APAC as a key growth engine, despite challenges posed by diverse regulatory landscapes, infrastructure disparities, and varying levels of financial literacy across the region, which necessitate tailored and adaptable lending strategies.

- Latin America: The Latin American unsecured business loans market is emerging with considerable potential, driven by ongoing economic development, expanding access to digital technologies, and a critical need for flexible financing solutions to support a rapidly growing SME base. Countries like Brazil, Mexico, and Colombia are at the forefront of this growth, experiencing a surge in fintech innovation as traditional banking services often fall short in meeting the needs of small businesses and entrepreneurs. The increasing penetration of smartphones and digital payment systems provides a robust foundation for online lenders to reach wider customer segments, including those in remote areas. However, the region grapples with inherent challenges such as economic volatility, fluctuating exchange rates, varying levels of regulatory maturity, and the presence of large informal economies, necessitating robust and adaptive risk assessment frameworks for lenders to operate successfully and sustainably, often leveraging local data sources and partnerships.

- Middle East and Africa (MEA): The MEA region represents a market with vast, largely untapped potential for unsecured business loans, underpinned by ambitious economic diversification programs and rapid digital transformation initiatives. Particularly in the Gulf Cooperation Council (GCC) countries and key African markets such as South Africa, Kenya, and Nigeria, governments are actively investing in digital infrastructure and promoting policies to foster SME development and entrepreneurship. This creates significant demand for accessible financing solutions in economies looking to reduce reliance on oil and gas. The region is characterized by a young, tech-savvy population and high mobile adoption rates, which are conducive to the growth of mobile-first lending platforms and digital wallets. While challenges exist concerning regulatory evolution, infrastructure development in certain sub-regions, and the need to build robust credit data ecosystems, the strong focus on financial inclusion and leveraging technology to serve previously underserved business segments positions MEA for substantial long-term growth in unsecured lending, with significant opportunities for innovative fintech solutions adapted to local market conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Unsecured Business Loans Market.- Funding Circle

- OnDeck

- American Express (Kabbage)

- Bluevine

- Lendio

- Accion

- Capify

- iwoca

- ThinCats

- Zopa

- Prosper

- LendingClub

- SoFi

- PayPal Working Capital

- Square Capital

- JPMorgan Chase

- Bank of America

- Wells Fargo

- Goldman Sachs (Marcus)

- Metro Bank

- OakNorth Bank

- Credibility Capital

- Quicken Loans (Rocket Mortgage)

- Spotloan

- Fundbox

- StreetShares

- Fast Capital 360

- Oportun

- Opportunity Fund

- WebBank

Frequently Asked Questions

What precisely defines an unsecured business loan and how does it differ from a secured loan?

An unsecured business loan is a type of financial product where the borrower is not required to provide any collateral, such as real estate, inventory, or equipment, to secure the funds. This stands in stark contrast to a secured loan, which mandates specific assets to be pledged as security against the borrowed amount. Lenders offering unsecured loans primarily assess a business's creditworthiness, financial history, cash flow stability, and overall operational health to determine eligibility and loan terms, often making them a more accessible option for startups and businesses with limited tangible assets. The key differentiation lies in the absence of an asset-backed guarantee, which typically results in a faster application process but may involve higher interest rates due to the increased risk for the lender. This flexibility makes it attractive for immediate capital needs without encumbering existing business assets.

What are the key advantages and potential drawbacks for businesses seeking unsecured loans?

The primary advantages of unsecured business loans include rapid access to capital, often with approval and disbursement occurring much faster than secured alternatives, allowing businesses to respond quickly to opportunities or urgent needs. They also offer significant flexibility in how the funds can be utilized across various business operations, without restrictions tied to specific collateral, enabling diverse strategic investments. Furthermore, businesses retain full ownership of all their assets, as nothing is pledged, reducing the risk of asset forfeiture in case of repayment challenges and preserving financial independence. However, potential drawbacks include generally higher interest rates to compensate lenders for the increased risk exposure, and sometimes stricter eligibility criteria concerning credit scores and revenue stability. Loan amounts may also be smaller compared to secured options, and repayment terms can be shorter, requiring efficient cash flow management from the borrower to avoid defaults.

Which specific types of businesses are most likely to utilize unsecured business loans?

Unsecured business loans are particularly well-suited for a broad spectrum of Small and Medium-sized Enterprises (SMEs), including nascent startups, individual entrepreneurs, and businesses operating in service-oriented or e-commerce sectors. Startups frequently leverage these loans to cover initial operational expenses, acquire essential non-collateralized equipment, or fund product development in their early stages when tangible assets are scarce, making speed and flexibility of funding paramount. Service-based businesses, such as consulting firms, marketing agencies, or IT service providers, which typically possess fewer physical assets, find unsecured financing ideal for working capital or expansion without tying up crucial intellectual capital. Additionally, the rapidly expanding e-commerce sector and online retail businesses, characterized by their need for agile financing to scale operations swiftly or manage pronounced seasonal demand fluctuations, increasingly turn to unsecured options for quick, non-collateralized capital injections to maintain their competitive edge and sustain growth in dynamic digital marketplaces.

What key factors do lenders consider when determining eligibility and setting interest rates for unsecured business loans?

Lenders evaluate a multifaceted set of factors to determine eligibility and establish interest rates for unsecured business loans. Primary considerations typically include the business's credit score (both personal and business), its financial history and stability demonstrated through bank statements, revenue consistency, and profitability. The time in business, industry sector, and debt-to-income ratio are also crucial. Increasingly, lenders, especially fintech platforms, leverage advanced analytics, Artificial Intelligence, and Machine Learning to assess alternative data points such as real-time cash flow, online reviews, social media presence, and operational efficiency. This comprehensive approach allows for a more accurate risk assessment, leading to personalized loan offers and dynamically adjusted interest rates that reflect the borrower's unique risk profile and ability to repay, ensuring a more bespoke and fair lending experience for diverse business applicants.

How is Artificial Intelligence (AI) actively transforming the unsecured business loans market?

Artificial Intelligence is profoundly revolutionizing the unsecured business loans market by enhancing efficiency, accuracy, and accessibility across multiple operational facets. AI-powered algorithms enable significantly faster and more precise credit risk assessments, moving beyond traditional metrics by analyzing vast and diverse datasets including alternative data sources. This leads to expedited loan application processing and near-instantaneous approval decisions, greatly benefiting businesses needing rapid capital. AI also plays a critical role in bolstering fraud detection capabilities, identifying suspicious patterns with high accuracy, and thereby protecting lenders from financial losses. Furthermore, it facilitates the creation of highly personalized loan offers and dynamic interest rates tailored to individual business needs and risk profiles, optimizing financial solutions. Overall, AI drives operational efficiency for lenders, improves the customer experience through automated support, and fosters continuous innovation in product development and market responsiveness, making unsecured lending smarter and more inclusive.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager