Urethane Surface Coatings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429686 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Urethane Surface Coatings Market Size

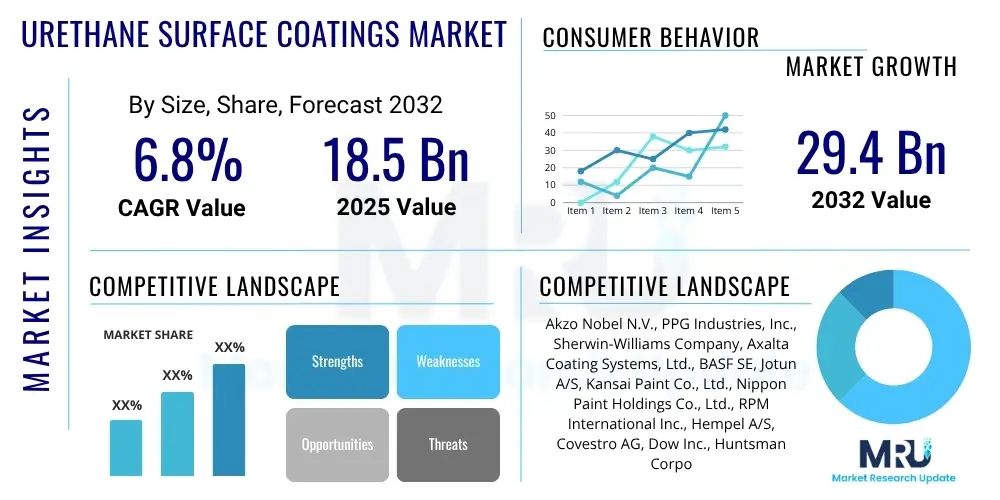

The Urethane Surface Coatings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $18.5 Billion in 2025 and is projected to reach $29.4 Billion by the end of the forecast period in 2032.

Urethane Surface Coatings Market introduction

Urethane surface coatings represent a sophisticated class of polymeric materials highly valued for their exceptional performance characteristics, encompassing superior durability, robust chemical resistance, excellent abrasion resistance, and remarkable aesthetic appeal. These high-performance coatings are fundamentally derived from a precise chemical reaction involving isocyanates and polyols, which collectively form a resilient and versatile polyurethane layer. The versatile nature of urethane coatings allows for their formulation into various types, including solvent-borne, water-borne, high-solids, and powder coatings, each engineered to offer specific advantages tailored to distinct application requirements and in compliance with evolving environmental regulations. This inherent adaptability makes them an indispensable solution across a multitude of industries where stringent demands for protection, extended longevity, and visual integrity are paramount.

The major applications of urethane coatings are extensive and diverse, spanning critical sectors such as the automotive industry, where they are widely utilized for premium clear coats, primers, and protective finishes, significantly enhancing vehicle aesthetics and resistance to environmental damage. In the construction industry, these coatings are essential for durable flooring systems, resilient roofing membranes, protective architectural finishes, and structural coatings, contributing to the longevity and safety of buildings and infrastructure. Furthermore, industrial machinery and equipment benefit immensely from urethane coatings, which provide superior corrosion protection, impact resistance, and chemical stability in demanding operational environments. The wood and furniture industry also relies on these coatings to impart enhanced durability, scratch resistance, and an attractive finish to a wide array of products.

The core benefits associated with urethane coatings are multifaceted and provide substantial value proposition to end-users. These include their superior hardness, ensuring resistance to physical damage, coupled with significant flexibility, preventing cracking and chipping under stress. Their exceptional impact resistance and weatherability contribute to the extended lifespan of coated substrates, thereby substantially reducing long-term maintenance and replacement costs. Moreover, the ability of urethane coatings to deliver a high-gloss finish, specific tactile properties, or a matte appearance, along with customized color options, adds significant aesthetic and functional value to products. The market's growth is predominantly propelled by the expanding global automotive production, escalating construction activities, particularly evident in rapidly developing economies, and the surging demand for robust protective coatings across various industrial applications, all contributing to a sustained upward trajectory for the market.

Urethane Surface Coatings Market Executive Summary

The global urethane surface coatings market is currently experiencing a period of robust and sustained growth, driven by a confluence of dynamic business trends and significant shifts in regional economic landscapes. A primary business trend observed across the industry is the intensified focus on pioneering research and development initiatives aimed at innovating both high-performance and environmentally sustainable coating solutions. This strategic thrust involves the accelerated development of advanced bio-based polyurethanes, the introduction of smart coatings endowed with sophisticated functionalities such as self-healing or enhanced anti-corrosion properties, and the refinement of advanced application techniques that bolster efficiency and minimize material waste. Industry consolidation, frequently manifested through strategic mergers and acquisitions, represents another prominent trend, as leading companies endeavor to broaden their product portfolios, extend their geographical footprint, and augment their technological capabilities, all with the overarching goal of securing a larger market share and strengthening their competitive positioning. The increasing integration of automation within coating application processes is also profoundly transforming manufacturing efficiency and ensuring consistent product quality across various production lines.

From a regional perspective, the Asia Pacific region maintains its undisputed dominance in the global urethane surface coatings market. This leadership is primarily attributed to its rapid pace of industrialization, the burgeoning growth of its construction sectors, and the significant escalation in automotive production, particularly in economic powerhouses such as China, India, and other Southeast Asian nations. The region further benefits from a rapidly expanding middle class, which fuels increasing demand for consumer goods and drives extensive infrastructure development projects, all of which necessitate advanced protective coatings. In contrast, North America and Europe, while representing more mature market landscapes, are nevertheless experiencing notable growth, largely stimulated by stringent environmental regulations that actively promote the adoption of high-solids and water-borne coating technologies. Additionally, robust investments in renovating existing infrastructure and upgrading advanced manufacturing facilities further contribute to market expansion in these regions. Latin America, the Middle East, and Africa collectively present emerging opportunities, characterized by substantial infrastructure development initiatives and increasing foreign investment in their respective manufacturing sectors, although their current market penetration levels remain comparatively lower.

An analysis of segmentation trends within the market reveals a persistent, albeit evolving, demand for solvent-borne coatings, particularly in specialized industrial applications where peak performance and cost-effectiveness are paramount considerations. Simultaneously, water-borne and high-solids technologies are rapidly gaining significant traction, primarily propelled by increasingly rigorous environmental mandates and growing industry preference for sustainable solutions. The automotive and construction segments consistently remain the largest consumers of urethane coatings, with substantial innovation efforts directed towards enhancing vehicle aesthetics, improving overall durability, and extending the structural integrity of buildings. The industrial coatings segment is undergoing considerable diversification, driven by an escalating demand for highly specialized coatings capable of offering superior resistance to harsh chemicals, extreme temperatures, and intense mechanical stress. Furthermore, the demand for functional coatings, which include properties such as antimicrobial or anti-graffiti capabilities, is experiencing a notable upsurge, reflecting a broader market trend towards value-added product offerings across nearly all end-use sectors, indicating a sophisticated evolution in product expectations.

AI Impact Analysis on Urethane Surface Coatings Market

Common user inquiries regarding the profound influence of Artificial Intelligence (AI) on the urethane surface coatings market frequently center on its transformative potential to optimize intricate chemical formulations, significantly streamline manufacturing processes, and elevate the overall quality and consistency of finished products. Users are keenly interested in understanding how AI can drastically reduce the traditionally iterative, time-consuming, and resource-intensive trial-and-error approach prevalent in research and development, predict material performance with greater accuracy under a myriad of diverse operating conditions, and facilitate a far more efficient utilization of critical resources. There is also substantial interest in AI's pivotal role in implementing predictive maintenance strategies for sophisticated coating application equipment, thereby minimizing downtime and extending asset lifecycles. Furthermore, AI's capacity to optimize complex supply chain logistics for essential raw materials and its ability to astutely identify emerging market trends and evolving customer preferences are also key areas of focus. These AI-driven insights are expected to inform strategic product development and market positioning, with the overarching expectation that AI will catalyze significant advancements in product innovation, operational efficiency, and the widespread adoption of sustainable practices across the entire industry value chain.

- AI-driven formulation optimization: Accelerating research and development cycles by employing machine learning algorithms to predict optimal material combinations, synthesize novel compounds, and precisely tailor coating properties for specific applications, significantly reducing experimental costs and timelines.

- Enhanced manufacturing efficiency and process control: Utilizing AI for real-time monitoring and predictive maintenance of sophisticated production machinery, dynamically optimizing critical operational parameters such as temperature, pressure, and mixing speeds, thereby minimizing energy consumption, reducing material waste, and maximizing throughput.

- Improved quality assurance and defect detection: Implementing advanced AI-powered vision systems and sensor networks for automated, high-precision defect detection on coated surfaces, ensuring unparalleled consistency in coating application, and maintaining stringent quality standards throughout the entire manufacturing process, leading to fewer product recalls.

- Optimized supply chain management and logistics: Leveraging AI algorithms for highly accurate demand forecasting, intelligent inventory management across global supply networks, and efficient routing of raw materials and finished products, resulting in substantial cost savings, reduced lead times, and enhanced material availability, mitigating supply chain disruptions.

- Personalized product development and market responsiveness: Analyzing vast datasets of market intelligence, customer feedback, and performance data with AI to identify highly specific unmet needs and rapidly tailor coating solutions more precisely to individual client requirements or emerging market niches, accelerating time-to-market for innovative products.

- Predictive performance analysis and material degradation modeling: Employing AI to simulate and accurately predict coating behavior under various environmental stressors, including UV exposure, chemical attack, and mechanical wear, enabling the development of inherently more durable, reliable, and longer-lasting products designed for extreme conditions.

- Accelerated sustainability initiatives: AI assisting in the identification, characterization, and seamless integration of bio-based raw materials, optimizing solvent reduction strategies, and refining manufacturing processes to minimize Volatile Organic Compound (VOC) emissions and overall waste generation, supporting a greener and more environmentally responsible industry.

DRO & Impact Forces Of Urethane Surface Coatings Market

The urethane surface coatings market is intricately shaped by a complex interplay of influential drivers, inherent restraints, promising opportunities, and broader impact forces that collectively dictate its growth trajectory and competitive landscape. Key drivers underpinning market expansion include the escalating and consistent demand from pivotal end-use industries, notably the automotive, construction, and general industrial sectors, all of which are increasingly reliant on these high-performance coatings for both superior protection and enhanced aesthetic appeal. Moreover, continuous technological advancements, particularly those leading to the successful development of high-performance and environmentally compliant formulations such as innovative water-borne and high-solids systems, actively stimulate further market growth by offering solutions that meet modern industrial challenges. Additionally, a growing awareness among consumers and industries regarding the significant long-term benefits of employing protective coatings, including enhanced durability, superior corrosion resistance, and substantially reduced maintenance costs over time, contributes significantly to the sustained market demand across a diverse array of applications.

Conversely, the market also contends with several considerable restraints that can impede its full growth potential. A primary challenge is the inherent volatility and often unpredictable upward fluctuation in the prices of critical raw materials, specifically for essential precursors like isocyanates and polyols. These price instabilities directly impact manufacturing costs, compress profit margins for producers, and can create supply chain uncertainties. Furthermore, the increasingly stringent environmental regulations enacted by governmental bodies globally, primarily aimed at substantially reducing Volatile Organic Compound (VOC) emissions and other hazardous air pollutants, necessitate significant and continuous research and development investments for compliance. This adds considerable operational expenses and complexity to manufacturing processes. The substantial capital expenditure required for establishing and maintaining advanced manufacturing facilities, coupled with the complex and often lengthy regulatory approval processes for new product formulations, can act as significant deterrents for new market entrants and pose ongoing challenges for established players, limiting rapid innovation cycles.

Despite these challenges, abundant opportunities exist for sustained market growth, particularly within rapidly developing economies where industrialization, urbanization, and infrastructure development are progressing at an accelerated pace, opening up new demand frontiers. A significant and burgeoning opportunity lies in the increasing trend towards sustainable and green coatings, encompassing bio-based and recyclable urethane systems, which presents a fertile ground for both technological innovation and extensive market penetration. The continuous development of smart coatings that offer advanced functionalities such as self-healing properties, antimicrobial efficacy, or integrated sensing capabilities also provides highly lucrative growth prospects by adding significant value and differentiating products in competitive markets. Broader impact forces, such as the considerable bargaining power of buyers (large end-use manufacturers often demand competitive pricing, customized solutions, and just-in-time delivery) and the influence of suppliers (a relatively concentrated group of raw material producers can dictate input costs and availability), significantly shape market dynamics. This is further intensified by fierce competitive rivalry among established market leaders and the persistent threat posed by substitute coating technologies, necessitating continuous innovation and strategic positioning to maintain market share and profitability.

Segmentation Analysis

The urethane surface coatings market is comprehensively segmented to meticulously address the diverse and evolving needs of various industries and specialized applications, providing a detailed framework for categorizing products based on their fundamental chemical composition, the applied manufacturing technology, their intended functional application, and the specific end-use sector they serve. This granular and multi-faceted segmentation offers invaluable insights into the complex market dynamics, empowering manufacturers to strategically tailor their product offerings, refine their marketing strategies, and optimize their distribution channels more effectively to reach target customers. A thorough understanding of these distinct segments is absolutely crucial for identifying specific growth pockets within the market, adapting swiftly to evolving industrial requirements, and proactively responding to ever-changing regulatory landscapes that govern the coatings industry. The primary segmentation criteria consistently highlight the ongoing technological shifts towards more sustainable and high-performance options, underscore the remarkable functional versatility inherent in urethanes, and emphasize their critical, pervasive role across multiple major economic sectors globally, showcasing their indispensable nature.

- By Resin Type

- Polyurethane

- Acrylic Urethane

- Epoxy Urethane

- Polyester Urethane

- Alkyd Urethane

- Others (e.g., Urethane Acrylate)

- By Technology

- Solvent-borne Coatings: Traditional systems offering robust performance, widely used where VOC regulations are less stringent or specific properties are required.

- Water-borne Coatings: Environmentally friendly alternatives with lower VOCs, gaining traction due to strict regulations and performance improvements.

- High-solids Coatings: Formulations with higher resin content and reduced solvent, offering improved efficiency and lower environmental impact.

- Powder Coatings: Solvent-free technology, applied as a dry powder and cured with heat, known for durability and environmental benefits.

- Radiation Curable Coatings (UV/EB): Systems cured instantly by ultraviolet or electron beam radiation, offering rapid processing, energy efficiency, and high performance.

- By Application

- Protective Coatings: Designed primarily for asset protection against corrosion, abrasion, chemicals, and weathering, ensuring longevity and safety.

- Decorative Coatings: Focused on aesthetic enhancement, providing superior gloss, color retention, and a smooth finish for visual appeal.

- Functional Coatings: Specialized coatings offering advanced properties such as self-healing, antimicrobial, anti-graffiti, anti-fouling, or thermal insulation capabilities.

- By End-Use Industry

- Automotive & Transportation

- OEM (Original Equipment Manufacturer): Factory-applied coatings for new vehicle production, including primers, basecoats, and clearcoats.

- Refinish: Coatings used for vehicle repair and repainting in aftermarket workshops.

- Commercial Vehicles: Coatings for trucks, buses, and other heavy-duty transport.

- Aerospace: High-performance coatings for aircraft exteriors and interiors, requiring specialized resistance.

- Building & Construction

- Flooring: Durable coatings for concrete, wood, and other floor surfaces in residential, commercial, and industrial settings.

- Roofing: Weather-resistant coatings for roofs, providing waterproofing and UV protection.

- Wall Coatings: Protective and decorative finishes for interior and exterior walls.

- Infrastructure: Coatings for bridges, pipelines, marine structures, and other civil engineering projects.

- Industrial

- Heavy Duty Equipment: Coatings for construction, agricultural, and mining machinery.

- General Industrial: Coatings for various manufactured goods, machinery, and components.

- Storage Tanks & Pipelines: Protective coatings for industrial tanks, vessels, and pipelines in sectors like oil and gas, chemical processing.

- Wood & Furniture: Coatings for cabinetry, flooring, outdoor furniture, and other wood products, offering durability and aesthetic appeal.

- Marine: Anti-corrosive and anti-fouling coatings for ships, offshore platforms, and other marine vessels, designed for harsh sea environments.

- Packaging: Protective and decorative coatings for various packaging materials, enhancing product integrity and branding.

- Electronics: Specialized coatings for electronic components and devices, providing insulation, protection, and aesthetic finishes.

- Others (Textiles, Medical Devices, Consumer Goods, Sporting Goods): Broad category covering niche applications requiring specific urethane properties.

Value Chain Analysis For Urethane Surface Coatings Market

The intricate value chain within the urethane surface coatings market meticulously outlines a sequence of interconnected activities, commencing with the fundamental sourcing of raw materials, progressing through sophisticated manufacturing and precise formulation processes, and ultimately culminating in the strategic distribution and expert application of the final products to a diverse array of end-users. The upstream segment of this value chain is predominantly characterized by a relatively concentrated group of large chemical manufacturers who are responsible for supplying critical precursors. These essential components include a variety of isocyanates, such as Toluene Diisocyanate (TDI), Methylene Diphenyl Diisocyanate (MDI), and Hexamethylene Diisocyanate (HDI), alongside a wide range of polyols, including polyester polyols, polyether polyols, and acrylic polyols. Additionally, this stage involves the provision of crucial additives like catalysts, pigments, fillers, and solvents. The quality, consistency, and reliable availability of these foundational raw materials profoundly influence the overall cost structure, the performance characteristics, and the environmental profile of the finished coating products, making this segment a critical determinant of market dynamics.

Midstream activities represent the core manufacturing and highly specialized formulation processes executed by coating producers. Companies operating in this segment are tasked with the procurement of raw materials, engage in extensive and continuous research and development to engineer novel formulations, meticulously manufacture the coatings to exacting specifications, and conduct rigorous, multi-stage quality control testing to ensure product integrity and performance. This pivotal stage necessitates significant capital investment in advanced chemical processing plants, a deep reservoir of technical expertise, and an unwavering adherence to a complex web of industry standards and environmental regulations. The capacity to innovate consistently, coupled with the ability to offer highly customized solutions that meet specific client demands, serves as a paramount differentiator in this intensely competitive segment, allowing companies to carve out niche markets and build strong brand loyalty.

Downstream activities are primarily focused on the efficient distribution, strategic sales, and expert application of urethane coatings to reach the final consumer. Products are delivered to end-users through a multifaceted network of distribution channels, which typically include direct sales to large industrial clients requiring bulk orders and specialized service, a broad network of specialized distributors catering to smaller businesses and regional markets, and an increasingly utilized presence on online platforms for enhanced accessibility and reach. Indirect channels often involve wholesalers and retailers who further extend market penetration. The final and critical stage involves application services, which may be provided by highly specialized contractors possessing specific expertise in coating application, or managed by in-house departments of large end-user companies. This stage is where the urethane coatings are professionally applied to various substrates, ultimately delivering their promised protective, functional, and aesthetic benefits. The overall efficiency and robustness of the distribution network, combined with the provision of comprehensive technical support and training to applicators, are absolutely crucial for achieving market success, ensuring customer satisfaction, and building a strong reputation within the industry.

Urethane Surface Coatings Market Potential Customers

The potential customer base for urethane surface coatings is exceptionally broad and remarkably diverse, primarily encompassing a wide array of end-user industries that exhibit a consistent and critical need for high-performance protective and aesthetically pleasing finishes for their manufactured products, valuable assets, or vital infrastructure. These customers are typically large-scale industrial manufacturers, prominent construction firms, and extensive industrial operators who place paramount importance on the durability, superior corrosion resistance, chemical stability, and visual appeal of the coatings they utilize. Their purchasing decisions are invariably driven by a combination of specific and often stringent performance requirements, mandatory regulatory compliance, considerations for long-term cost-effectiveness, and the indispensable need to significantly extend the operational lifespan and reduce the maintenance burden of their substantial investments, making urethane coatings an attractive proposition due to their proven longevity and resilience.

Key segments within this extensive customer base include global automotive manufacturers, encompassing both Original Equipment Manufacturers (OEMs) for new vehicle production and aftermarket refinishers for repair and restoration. These clients actively seek advanced urethane coatings for vehicle bodies, critical components, and interior parts, demanding finishes that offer superior gloss retention, exceptional scratch resistance, and robust protection against environmental factors like UV radiation and road debris. The building and construction sector represents another significantly large and consistently growing customer group. This segment includes general contractors, property developers, infrastructure project managers, and facility maintenance professionals who extensively employ urethanes for highly durable flooring systems, resilient roofing membranes, robust protective coatings for concrete and steel structures, and sophisticated architectural finishes that necessitate excellent weatherability, long-term color stability, and overall structural longevity, particularly in challenging environments.

Furthermore, a vast range of industrial manufacturers across diverse sub-sectors, such as heavy machinery producers, aerospace component manufacturers, marine vessel constructors, critical oil and gas infrastructure operators, and precision electronics manufacturers, collectively constitute a substantial and specialized customer segment. These industrial clients demand highly specialized urethane coatings that are engineered to effectively withstand extremely harsh operating environments, exposure to aggressive chemicals, and intense mechanical abrasion. Simultaneously, the wood and furniture manufacturing industry maintains a consistent and robust customer base, relying heavily on urethane coatings to provide durable, attractive, and long-lasting finishes for both consumer and commercial wood products, enhancing their appeal and extending their service life. The escalating global emphasis on sustainability and environmental stewardship also means that potential customers across all these sectors are increasingly and actively seeking innovative low-VOC (Volatile Organic Compound) and bio-based urethane solutions, reflecting a growing consciousness and preference for eco-friendly product options that align with corporate responsibility goals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $18.5 Billion |

| Market Forecast in 2032 | $29.4 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Akzo Nobel N.V., PPG Industries, Inc., Sherwin-Williams Company, Axalta Coating Systems, Ltd., BASF SE, Jotun A/S, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., RPM International Inc., Hempel A/S, Covestro AG, Dow Inc., Huntsman Corporation, DIC Corporation, Eastman Chemical Company, Arkema S.A., Wanhua Chemical Group Co., Ltd., Mitsui Chemicals, Inc., Trelleborg AB, Sika AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Urethane Surface Coatings Market Key Technology Landscape

The urethane surface coatings market is characterized by a dynamic and continually evolving technological landscape, driven by significant advancements in material science and innovative application techniques. These innovations are primarily aimed at simultaneously enhancing performance characteristics, bolstering sustainability credentials, and improving overall manufacturing and application efficiency. One of the most prominent and impactful technological shifts involves the widespread adoption and continuous refinement of water-borne and high-solids urethane formulations. These advanced technologies are critically important for achieving substantial reductions in volatile organic compound (VOC) emissions, which directly addresses increasingly stringent global environmental regulations and improves worker safety standards, all while delivering robust protective properties and maintaining excellent aesthetic appeal, making them a preferred choice in many segments.

Further innovation is distinctly observable in the realm of radiation-curable urethanes, particularly the rapid growth and sophistication of UV-curable and electron beam (EB) curable systems. These cutting-edge technologies offer nearly instantaneous curing times, which translates directly into significantly faster production rates, substantial energy savings compared to traditional thermal curing methods, and superior performance characteristics such as exceptional abrasion resistance, chemical inertness, and durability. This combination of benefits makes them extraordinarily attractive for high-speed, high-performance applications in diverse sectors including wood finishing, automotive headlamp coatings, and protective layers for sensitive electronics. Moreover, the progressive integration of nanotechnology into urethane coating formulations represents a burgeoning and transformative area, enabling the development of coatings with dramatically enhanced properties such as superior scratch resistance, advanced self-cleaning capabilities, heightened UV protection, and even innovative self-healing functionalities, achieved by embedding specially engineered nanoparticles that respond dynamically to damage or environmental stimuli.

In addition to these advancements, the industry is witnessing a concerted and growing emphasis on the development and commercialization of smart coatings and innovative bio-based solutions. Smart coatings are designed to incorporate sophisticated functionalities such as integrated temperature indication, early-stage corrosion detection, or potent antimicrobial action, thereby adding significant value and specialized utility in highly niche and demanding applications. Concurrently, the overarching global imperative for sustainability has vigorously spurred extensive research and development into bio-based polyols and isocyanates, which are increasingly derived from renewable agricultural resources. This strategic shift aims to significantly reduce the industry's historical reliance on petrochemicals and substantially lower the carbon footprint associated with coating product manufacturing. These multifaceted technological advancements collectively aim to meet the escalating and complex demands for high-performance, environmentally responsible, and functionally advanced coating solutions across an incredibly diverse spectrum of industrial, commercial, and consumer applications globally.

Regional Highlights

- Asia Pacific (APAC): The Asia Pacific region stands as the undisputed leader in the global urethane surface coatings market, commanding the largest share. This dominance is primarily driven by rapid and extensive industrialization, burgeoning construction activities, and the significant expansion of automotive manufacturing bases in economic powerhouses such as China, India, Japan, and South Korea. Strong and sustained economic growth, coupled with increasing urbanization rates and substantial ongoing infrastructure development projects, are collectively fueling a surging demand for both protective and decorative urethane coatings across a highly diverse array of critical economic sectors, including manufacturing, automotive OEM and refinish, and residential and commercial construction. The region's vibrant manufacturing landscape and rising disposable incomes continue to propel market expansion significantly.

- North America: North America represents a mature yet highly innovative market characterized by a profound emphasis on continuous technological advancement and strict adherence to increasingly stringent environmental regulations. Market growth in this region is primarily propelled by the robust automotive refinish segment, consistent activity in residential and commercial construction, and essential maintenance and upgrade initiatives within the expansive industrial sector. A prevailing trend is the escalating demand for sustainable, low-VOC (Volatile Organic Compound), and ultra-high-performance coatings, reflecting a conscious shift towards eco-friendly and more efficient solutions driven by both regulatory pressures and end-user preferences. The region also benefits from a strong R&D infrastructure supporting advanced material development.

- Europe: Europe constitutes a significant and highly competitive market, distinguished by its intensive focus on advanced research and development, a strong commitment to sustainability principles, and the implementation of rigorous environmental policies that actively promote the widespread adoption of water-borne and high-solids coating technologies. Key drivers for the European market include sustained automotive production, a thriving architectural coatings sector, and diverse industrial applications requiring specialized protective finishes. Major contributing countries such as Germany, France, and the United Kingdom are experiencing increasing demand for highly specialized functional coatings, driven by innovative applications in renewable energy, aerospace, and advanced manufacturing sectors.

- Latin America: Latin America is an emerging market that exhibits considerable growth potential, primarily bolstered by extensive infrastructure development projects, increasing foreign direct investments in industrial sectors, and expanding automotive industries, particularly in economically influential countries such as Brazil and Mexico. Periods of greater economic stabilization, coupled with a rising middle class and increasing disposable incomes, are collectively contributing to a growing demand for urethane coatings in both the construction and consumer goods sectors. The region's abundant natural resources and developing manufacturing capabilities also support market expansion, attracting international players.

- Middle East and Africa (MEA): The Middle East and Africa region is projected to experience steady and consistent growth in the urethane surface coatings market. This growth is strongly supported by ambitious large-scale construction projects, significant strategic investments in crucial oil and gas infrastructure, and ongoing efforts to diversify economies beyond traditional oil revenues, particularly evident in the Gulf Cooperation Council (GCC) countries. The demand for highly robust protective coatings designed to perform effectively in the region's harsh environmental conditions (e.g., extreme heat, sand abrasion, salinity) and for building resilient infrastructure is a major and consistent driving factor, alongside growing urbanization and industrialization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Urethane Surface Coatings Market.- Akzo Nobel N.V.

- PPG Industries, Inc.

- Sherwin-Williams Company

- Axalta Coating Systems, Ltd.

- BASF SE

- Jotun A/S

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- RPM International Inc.

- Hempel A/S

- Covestro AG

- Dow Inc.

- Huntsman Corporation

- DIC Corporation

- Eastman Chemical Company

- Arkema S.A.

- Wanhua Chemical Group Co., Ltd.

- Mitsui Chemicals, Inc.

- Trelleborg AB

- Sika AG

Frequently Asked Questions

What are urethane surface coatings and their primary benefits?

Urethane surface coatings are durable polymeric finishes formed by reacting isocyanates and polyols, offering exceptional resistance to abrasion, chemicals, and weathering. Their primary benefits include superior protection, enhanced longevity of coated substrates, improved aesthetics, remarkable flexibility, and excellent adhesion, making them ideal for high-performance applications across various demanding industries.

Which major industries utilize urethane surface coatings most frequently and why?

Urethane surface coatings are extensively used in the automotive and transportation sector for vehicle finishes due to their gloss and scratch resistance, the building and construction industry for durable flooring, roofing, and structural protection, and various industrial applications for heavy machinery and infrastructure requiring high chemical and corrosion resistance. They are also vital in wood and furniture, marine, and aerospace sectors due to their protective and aesthetic properties.

What are the key drivers propelling the growth of the urethane surface coatings market globally?

The market's growth is primarily driven by increasing demand from the expanding automotive, construction, and industrial sectors, alongside continuous technological advancements leading to high-performance and environmentally compliant formulations. Rising global awareness of the long-term protective benefits, enhanced durability, and aesthetic appeal of these coatings also significantly contributes to sustained market expansion and adoption.

How do environmental regulations specifically impact the urethane surface coatings market?

Environmental regulations, particularly those targeting Volatile Organic Compound (VOC) emissions, significantly influence the market by compelling manufacturers to invest heavily in research and development for eco-friendly alternatives. This drives the adoption and innovation of water-borne, high-solids, and powder urethane coating technologies, which offer lower environmental impact and improved worker safety, affecting production processes and product portfolios.

What emerging technologies are actively influencing the future development of urethane coatings?

Emerging technologies include advanced water-borne and high-solids formulations for reduced environmental impact, rapid-curing UV/EB systems for increased efficiency, and the integration of nanotechnology for enhanced properties like self-healing, superior scratch resistance, and improved UV protection. The development of smart coatings with functional indicators and bio-based raw materials for improved sustainability are also key trends shaping the market's innovative future.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager