Used Cooking Oil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428651 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Used Cooking Oil Market Size

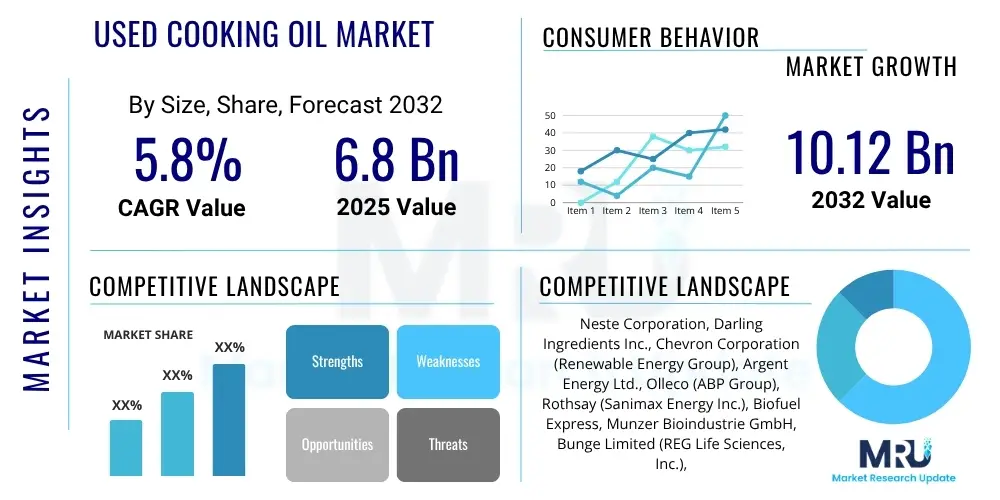

The Used Cooking Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 6.8 billion in 2025 and is projected to reach USD 10.12 billion by the end of the forecast period in 2032.

Used Cooking Oil Market introduction

The Used Cooking Oil (UCO) market encompasses the global ecosystem involved in the collection, processing, and repurposing of residual oils generated from various cooking activities. This critical sector transforms a significant waste stream, produced by households, commercial food service establishments, and industrial food processing units, into valuable raw materials. Historically, UCO was often disposed of improperly, leading to environmental contamination and waste management challenges. However, with increasing global emphasis on sustainability, resource recovery, and the circular economy, UCO has emerged as a highly sought-after commodity for its diverse industrial applications and environmental benefits. The market's evolution reflects a broader societal shift towards valuing waste as a resource.

As a product, UCO is characterized by its fatty acid composition, which retains considerable energy value despite prior heating. While its exact properties can vary based on the original oil type and cooking conditions, it typically consists of triglycerides, free fatty acids, and small amounts of impurities. The primary benefit of utilizing UCO lies in its environmental credentials. By diverting UCO from landfills or drainage systems, it prevents soil and water pollution. More significantly, its conversion into biofuels like biodiesel, hydrotreated vegetable oil (HVO), and sustainable aviation fuel (SAF) offers a potent strategy for reducing greenhouse gas emissions compared to fossil fuels, thus mitigating climate change impacts and promoting a lower carbon footprint across various sectors, particularly transportation.

Major applications of UCO are predominantly in the renewable energy sector, where it serves as a crucial feedstock for advanced biofuels. Beyond this, UCO finds utility in the oleochemical industry, contributing to the production of eco-friendly soaps, detergents, bio-lubricants, and other chemicals, thereby reducing reliance on petroleum-derived inputs. Furthermore, after rigorous purification and treatment, UCO can be incorporated into animal feed formulations as an energy source. The driving factors behind the market's robust expansion include stringent environmental regulations promoting waste valorization and renewable energy adoption, escalating global demand for sustainable products, and economic incentives such as biofuel blending mandates and carbon credit schemes. Technological advancements in UCO collection, purification, and conversion processes further enhance its market viability and expand its range of applications, positioning UCO at the forefront of the bio-based economy.

Used Cooking Oil Market Executive Summary

The Used Cooking Oil (UCO) market is currently undergoing a period of significant expansion, underpinned by a global paradigm shift towards sustainable resource management and renewable energy generation. Business trends indicate a strong move towards integrated supply chains, where specialized collection companies collaborate closely with large-scale biorefineries to ensure a consistent and high-quality feedstock supply. Consolidation among market players, driven by the need for economies of scale and enhanced processing capabilities, is a notable feature. Furthermore, there is an increasing investment in digital solutions and advanced analytics to optimize UCO collection logistics, improve quality control, and streamline trade, reflecting a sophisticated approach to managing this valuable waste stream. The emergence of new players focused on specific high-value applications, such as Sustainable Aviation Fuel (SAF) production, also signals a dynamic and innovative market environment.

From a regional perspective, the market dynamics are diverse yet converge on themes of growth and increasing strategic importance. Asia Pacific continues to dominate in terms of UCO generation volume, with countries like China and India seeing rapid growth in collection infrastructure and processing capacity, driven by both domestic environmental concerns and export opportunities to regions with high biofuel demand. Europe remains a frontrunner in UCO valorization, characterized by stringent regulatory frameworks and well-established biofuel industries that highly value UCO as a preferred feedstock under the Renewable Energy Directive (RED II). North America is experiencing accelerated growth, particularly in the production of renewable diesel and SAF, bolstered by substantial government incentives and corporate sustainability commitments aimed at decarbonizing transportation sectors. Emerging markets in Latin America and the Middle East and Africa are beginning to develop their UCO collection and processing capabilities, aligning with broader national goals for waste reduction and energy diversification.

Segmentation trends highlight the enduring dominance of biofuel production as the primary application for UCO, with a discernible shift towards higher-value advanced biofuels. While biodiesel remains a cornerstone, the demand for Hydrotreated Vegetable Oil (HVO), also known as renewable diesel, and especially Sustainable Aviation Fuel (SAF), is witnessing exponential growth. This pivot is driven by the fact that UCO is a key approved feedstock for these advanced fuels, offering significant greenhouse gas emission reductions and meeting stringent technical specifications. Concurrently, the oleochemical sector continues to be a stable consumer, seeking UCO for environmentally friendly ingredient formulations, and the animal feed industry provides a consistent, albeit heavily regulated, outlet for treated UCO. The diversification of UCO applications across these segments underscores its versatility and strategic importance as a multi-purpose bio-resource.

AI Impact Analysis on Used Cooking Oil Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Used Cooking Oil (UCO) market frequently center on its potential to revolutionize logistical efficiencies, enhance the economic viability of UCO collection, and improve the quality and consistency of processed feedstock. Stakeholders are keen to understand how AI can address prevalent challenges such as the fragmented nature of UCO supply, the inherent variability in raw UCO quality, and the high operational costs associated with traditional collection methods. Expectations are high that AI can introduce a new paradigm of data-driven decision-making and automation, transforming UCO management from a reactive, labor-intensive process into a proactive, optimized, and more sustainable value chain, ultimately boosting the industry's capacity and environmental contribution.

AI and machine learning technologies possess a transformative capacity across the entire Used Cooking Oil value chain, starting from the point of generation. In the collection phase, AI-powered predictive analytics can analyze historical data, weather patterns, and real-time inputs from restaurants and food processing facilities to forecast UCO generation volumes and optimize collection routes. This dynamic route planning minimizes fuel consumption, reduces vehicle emissions, and lowers operational costs for collection companies. Furthermore, the integration of Internet of Things (IoT) sensors into UCO collection bins allows for real-time monitoring of fill levels. These smart bins can automatically trigger pickup requests when nearing capacity, eliminating unnecessary trips and ensuring timely collection, thereby enhancing the overall efficiency and responsiveness of the supply chain.

Beyond collection, AI significantly enhances quality control and processing efficiency. Machine vision systems, coupled with advanced machine learning algorithms, can be deployed at intake facilities to rapidly and accurately assess the quality of incoming UCO. These systems can detect contaminants such as water, food particles, and non-cooking oils, ensuring only compliant feedstock enters the refining process. This automated quality assurance is critical for maintaining the stringent standards required for biofuel production, particularly for advanced fuels like SAF, where impurities can severely impact final product quality and processing equipment. In biorefineries, AI algorithms can optimize complex processing parameters, such as reaction temperatures, catalyst dosage, and flow rates, leading to improved conversion yields, reduced energy consumption, and consistent output quality, making the UCO refining process more efficient and cost-effective.

- Enhanced logistical efficiency and route optimization for UCO collection fleets using predictive AI models, reducing fuel consumption and operational overhead.

- Real-time monitoring of UCO collection bins via IoT sensors and AI algorithms to enable demand-driven pickups, minimizing idle time and maximizing collection rates.

- Automated quality assessment and contaminant detection at UCO intake points utilizing machine vision and deep learning, ensuring superior feedstock quality for downstream processing.

- Optimization of UCO refining and conversion processes through AI-driven process control, leading to higher biofuel yields, lower energy usage, and consistent product specifications.

- Advanced market forecasting and supply-demand prediction models, powered by machine learning, to better manage inventory, pricing strategies, and procurement decisions.

- Development of transparent and traceable UCO supply chains through blockchain integration with AI analytics, enhancing accountability and mitigating fraud.

- Data-driven insights for strategic investment in new collection infrastructure and processing technologies, informed by AI analysis of market trends and geographical potential.

DRO & Impact Forces Of Used Cooking Oil Market

The Used Cooking Oil market's trajectory is shaped by a confluence of compelling drivers, inherent challenges acting as restraints, and significant opportunities that can be leveraged, all subject to various overarching impact forces. The foundational drivers are deeply rooted in global environmental mandates and the urgent need for sustainable resource management, propelling UCO from a mere waste product to a pivotal feedstock in the bioeconomy. Conversely, the market grapples with a fragmented supply chain, quality inconsistencies, and competitive pressures from alternative feedstocks, which present notable restraints. However, a dynamic landscape of technological advancements and expanding end-use applications offers substantial avenues for growth and diversification, while external impact forces such as regulatory shifts and geopolitical factors continuously influence its evolution.

The primary drivers sustaining the Used Cooking Oil market's growth are unequivocally linked to the escalating global demand for renewable energy and the imperative of decarbonization. Stringent government regulations and policies across North America, Europe, and Asia Pacific, including biofuel blending mandates, carbon pricing mechanisms, and subsidies for renewable fuel production, create a robust economic incentive for UCO valorization. These legislative frameworks not only stimulate demand but also foster investment in collection infrastructure and advanced processing technologies. Furthermore, increasing corporate sustainability commitments and heightened consumer awareness regarding waste reduction and climate change contribute significantly. The volatility and high cost of crude oil also bolster the economic attractiveness of UCO-derived biofuels, positioning them as viable and often more stable alternatives. The finite nature of fossil fuels and the push for energy independence further solidify UCO’s strategic importance.

Despite these powerful drivers, the market faces several significant restraints. The highly dispersed nature of UCO generation, emanating from millions of individual households and a vast network of commercial food establishments, presents formidable logistical challenges for efficient and cost-effective collection and aggregation. This fragmentation results in high collection costs and often limits the scalability of supply. Another critical restraint is the inherent variability and potential for contamination in collected UCO, which can contain water, food particles, cleaning agents, and non-cooking oils. These impurities necessitate extensive and costly pre-treatment processes to ensure the feedstock meets the stringent quality specifications required for high-value applications like advanced biofuels, adding a significant operational burden. Competition from other biofuel feedstocks, such as virgin vegetable oils, animal fats, and purpose-grown energy crops, can also influence UCO pricing and availability. The substantial capital expenditure required to establish and operate large-scale UCO processing facilities further acts as a barrier to market entry and expansion.

Nevertheless, the Used Cooking Oil market is rich with opportunities. The most prominent opportunity lies in the burgeoning demand for Sustainable Aviation Fuel (SAF), where UCO is a highly favored and readily available feedstock, crucial for the aviation industry's ambitious decarbonization targets. As global airlines commit to increasing SAF usage, the market for UCO-derived SAF is poised for exponential growth. Additionally, the expansion into novel oleochemical applications, such as the production of bio-based plastics, lubricants, and high-performance biochemicals, offers diversification beyond the fuel sector, unlocking new revenue streams and higher-value product categories. Geographic expansion of UCO collection networks, particularly in developing economies with rapidly growing food service sectors and improving waste management infrastructure, represents a substantial untapped supply potential. Continuous innovation in UCO refining and conversion technologies, including enzymatic processes and catalytic advancements, further enhance its versatility and economic viability.

Various external impact forces continuously shape the Used Cooking Oil market. Evolving international and national regulatory frameworks are paramount; changes in biofuel mandates, carbon intensity scoring, and waste management policies can dramatically alter market demand and supply dynamics. Technological advancements, from smart collection systems to advanced biorefining techniques, directly influence the efficiency and profitability of UCO processing, making new applications feasible. Global energy prices, particularly crude oil, dictate the competitiveness of UCO-derived fuels, affecting investment decisions and market sentiment. Geopolitical events and trade policies can impact the international flow of UCO and its derivatives, creating supply chain disruptions or new market access opportunities. Finally, increasing public and corporate awareness of environmental issues and the circular economy exerts sustained pressure on industries to adopt and prioritize sustainable feedstocks like UCO.

Segmentation Analysis

The Used Cooking Oil market is systematically segmented to provide a granular and comprehensive understanding of its intricate structure, enabling stakeholders to discern specific trends, identify lucrative niches, and formulate targeted strategies across the value chain. This segmentation is typically articulated along key dimensions such as the source from which the UCO is collected, the diverse applications into which it is converted, and the specific end-use industries that ultimately consume the refined products. A detailed analysis of these segments is indispensable for effective market sizing, strategic planning, resource allocation, and ensuring that UCO is optimally channeled towards its most economically and environmentally beneficial uses while addressing the unique characteristics of each market segment.

Segmentation by Source is critical as it delineates the origins of UCO, directly influencing collection logistics, quality consistency, and supply volumes. UCO generated by households, while collectively substantial, is often dispersed and may contain varied impurities, making its collection logistically challenging and costly, often relying on municipal recycling programs or community drop-off points. In contrast, commercial sources, primarily restaurants, hotels, and catering services, offer more concentrated and predictable volumes, making them prime targets for specialized collection companies that establish regular pickup schedules. Industrial food processing facilities, such as snack food manufacturers or large-scale frying operations, typically yield the largest and most consistent volumes of UCO, often of higher quality due to controlled cooking environments, simplifying bulk collection and transport. Understanding the proportional contribution and characteristics of each source segment is vital for designing efficient and scalable collection networks.

In terms of applications, the Used Cooking Oil market exhibits significant diversity, reflecting UCO's versatility as a bio-resource. The largest and most impactful application segment remains biofuel production, which includes the conversion of UCO into traditional biodiesel through transesterification, advanced renewable diesel (Hydrotreated Vegetable Oil or HVO) via hydrotreatment, and increasingly, Sustainable Aviation Fuel (SAF). This segment is driven by global decarbonization mandates and the urgent need for lower-carbon transportation fuels. Beyond biofuels, the oleochemical sector represents another significant application, where UCO serves as a sustainable feedstock for manufacturing fatty acids, glycerol, and various derivatives used in the production of bio-based soaps, detergents, lubricants, and bioplastics, aligning with the shift away from petrochemicals. Lastly, the animal feed industry utilizes purified UCO as an energy-rich fat supplement for livestock and poultry, providing a cost-effective and nutritious ingredient, although this application is subject to stringent quality and safety regulations to prevent contamination.

- By Source

- Households: Smaller, dispersed volumes; logistical challenges; often collected via municipal programs.

- Restaurants and Food Service Establishments: Consistent, moderate-to-large volumes; primary target for commercial collection; key supply for biofuel producers.

- Industrial Food Processing: Large, consistent volumes; higher quality potential; ideal for bulk processing; critical for large-scale biorefineries.

- By Application

- Biofuel Production: Dominant segment; driven by decarbonization; includes:

- Biodiesel: Conventional FAME-based biofuel.

- Renewable Diesel (HVO): Chemically identical to fossil diesel, higher value.

- Sustainable Aviation Fuel (SAF): High growth potential, critical for aviation decarbonization.

- Oleochemicals: Sustainable raw material for bio-based products; includes fatty acids, glycerol, surfactants, and lubricants.

- Animal Feed: Used as an energy supplement; requires rigorous purification and safety checks.

- Power Generation: Direct burning for energy in specific industrial settings; typically lower-grade UCO.

- Others (e.g., bio-lubricants, soaps): Niche applications driven by specific bio-based product demands.

- Biofuel Production: Dominant segment; driven by decarbonization; includes:

- By End-Use Industry

- Fuel Industry: Major consumer for road transport, aviation, and marine fuels.

- Chemicals Industry: Utilizes UCO for various bio-based chemicals and materials.

- Animal Feed Industry: Integrates treated UCO into feed formulations.

- Power & Energy Industry: Direct use in industrial boilers or power plants.

- Others: Includes manufacturers of specialty products like waxes, cosmetics components.

Value Chain Analysis For Used Cooking Oil Market

The value chain for the Used Cooking Oil market is a complex, multi-tiered process that systematically transforms a waste product into a valuable feedstock, underpinning a circular economy model. It commences with the initial generation and collection of UCO, progresses through various stages of aggregation and pre-treatment, moves into advanced processing and refining, and culminates in the distribution of UCO-derived products to diverse end-users. A thorough analysis of this chain is paramount for identifying critical bottlenecks, enhancing operational efficiencies, optimizing resource recovery, and maximizing the economic and environmental value generated from UCO, influencing investment decisions and market competitiveness across all stages.

Upstream activities in the UCO value chain are centered around the crucial tasks of generation, collection, and initial aggregation. This phase begins with the myriad sources of UCO, including millions of individual households, thousands of commercial establishments like restaurants and hotels, and numerous industrial food processing facilities. Specialized UCO collection companies, often operating regionally or nationally, engage in scheduled pickups from these sources. Following collection, the raw UCO is typically transported to local aggregation centers or intermediary storage facilities. At this preliminary stage, basic pre-treatment often occurs, which may involve initial coarse filtration to remove larger food particles and decantation to separate water, aiming to consolidate smaller volumes into larger batches and improve handling for subsequent stages. This initial phase is highly labor-intensive and logistically challenging due to the dispersed nature of UCO generation.

Downstream activities involve the sophisticated transformation of aggregated UCO into marketable products. Once collected and aggregated, the UCO is transported to larger processing and refining plants. Here, it undergoes a series of advanced purification steps, including degumming, neutralization, bleaching, and deodorization, to remove remaining impurities such as phospholipids, free fatty acids, color bodies, and odor compounds. This rigorous refining process is essential to meet the stringent quality specifications required by various end-use industries. The purified UCO is then converted into final products, predominantly biofuels (biodiesel, renewable diesel, Sustainable Aviation Fuel), but also oleochemicals and animal feed components, using specialized conversion technologies such as transesterification, hydrotreatment, or enzymatic processes. This stage adds significant value and requires substantial capital investment in advanced biorefining infrastructure.

The distribution channels for Used Cooking Oil, both raw and processed, are multifaceted and critical for market efficiency. Direct distribution involves large-scale UCO collectors or aggregators selling directly to major UCO processing plants or end-users through established contracts, ensuring a consistent and reliable supply. This direct engagement often fosters long-term partnerships, providing stability in feedstock procurement. Indirect distribution channels incorporate brokers, traders, and other intermediaries who facilitate transactions between smaller collection entities and larger processors, helping to consolidate fragmented supplies and manage logistics. The entire distribution network relies heavily on specialized logistics, including dedicated tankers, storage tanks, and transportation fleets capable of handling UCO effectively and safely. Furthermore, the final refined products are distributed through established fuel supply chains, chemical distributors, and animal feed suppliers to reach their respective end markets.

Used Cooking Oil Market Potential Customers

The Used Cooking Oil market caters to a diverse array of potential customers, all seeking sustainable and economically viable alternatives to conventional raw materials. These end-users are primarily driven by regulatory pressures to reduce carbon footprints, corporate sustainability goals, and the pursuit of cost efficiencies through waste valorization. The versatility of UCO, transformable into various high-value products, means its customer base extends across critical industrial sectors, making it a pivotal component in the global shift towards bio-based economies and circular resource management strategies. Understanding these diverse customer segments is essential for producers and suppliers to tailor product offerings and marketing efforts effectively.

The most substantial segment of potential customers for Used Cooking Oil comprises biofuel manufacturers, encompassing producers of biodiesel, Hydrotreated Vegetable Oil (HVO), often referred to as renewable diesel, and Sustainable Aviation Fuel (SAF). These companies are at the forefront of the renewable energy transition, relying heavily on UCO as a preferred feedstock due to its classification as an advanced biofuel raw material and its significantly lower carbon intensity compared to virgin vegetable oils. The aviation industry, in particular, with major airlines and fuel distributors, is an increasingly crucial customer for UCO-derived SAF, as it seeks to meet ambitious decarbonization targets and regulatory blending mandates. The demand from this sector is projected to grow exponentially, solidifying UCO’s strategic importance for future fuel production.

Beyond the energy sector, the oleochemical industry represents another significant customer base. Manufacturers specializing in fatty acids, glycerol, surfactants, soaps, detergents, bio-lubricants, and various bio-based plastics are increasingly turning to UCO as a sustainable and cost-effective substitute for petroleum-derived or virgin vegetable oil feedstocks. This shift is motivated by consumer demand for eco-friendly products and corporate initiatives to reduce reliance on fossil resources. Furthermore, the animal feed industry constitutes a consistent market for treated UCO, where it is incorporated as an energy-dense fat supplement in feed formulations for livestock and poultry. For this application, stringent purification and safety regulations are paramount to ensure the absence of contaminants and safeguard animal health, making quality assurance a critical factor for UCO suppliers targeting this segment. Some industrial facilities also act as customers by utilizing lower-grade UCO directly as a fuel for industrial boilers or power generation, offering a localized and immediate energy source, although this typically represents a smaller portion of the overall high-quality UCO market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 6.8 Billion |

| Market Forecast in 2032 | USD 10.12 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Neste Corporation, Darling Ingredients Inc., Chevron Corporation (Renewable Energy Group), Argent Energy Ltd., Olleco (ABP Group), Rothsay (Sanimax Energy Inc.), Biofuel Express, Munzer Bioindustrie GmbH, Bunge Limited (REG Life Sciences, Inc.), Crimson Renewable Energy, LP, Baker Commodities Inc., Ag Processing Inc., TerraVia Holdings, Inc. (Corbion N.V.), Novozymes A/S, China Energy Group, Biowanze, Biodiesel Belgium, Ensyn Corporation, EcoMotion Recycling, Shell Plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |