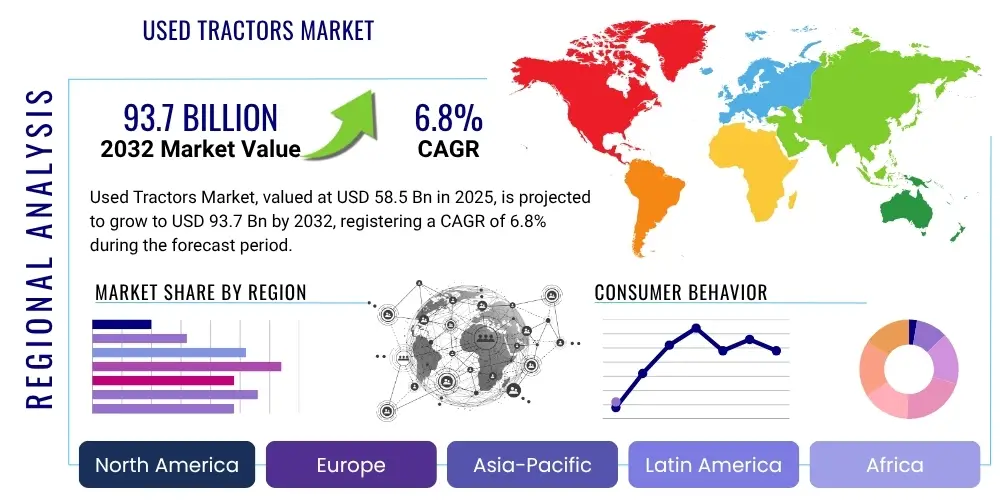

Used Tractors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431250 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Used Tractors Market Size

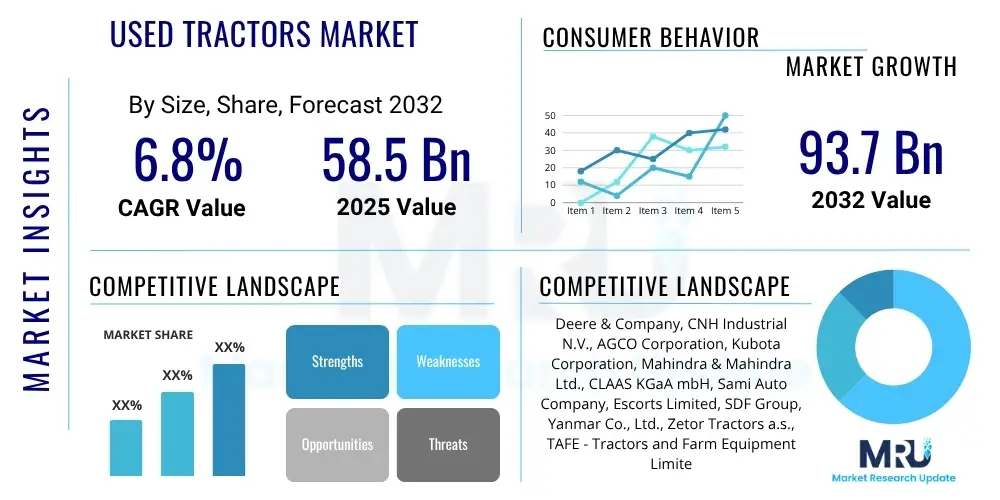

The Used Tractors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $58.5 Billion in 2025 and is projected to reach $93.7 Billion by the end of the forecast period in 2032.

Used Tractors Market introduction

The Used Tractors Market encompasses the sale and purchase of pre-owned agricultural tractors across various horsepower categories and applications. These machines are essential for numerous farming operations, including plowing, tilling, planting, harvesting, and general field maintenance. The market serves as a vital alternative to new equipment, particularly for small and medium-sized farms, offering cost-effective solutions for mechanization needs without the significant capital expenditure associated with new machinery acquisitions.

Products within this market range from compact utility tractors suitable for orchards and small holdings to high-horsepower row-crop and four-wheel-drive tractors designed for large-scale commercial agriculture. Major applications include crop cultivation, livestock farming, horticulture, and forestry, providing versatility to a broad spectrum of agricultural enterprises. The inherent benefits of purchasing used tractors include lower acquisition costs, reduced depreciation, and often immediate availability, allowing farmers to quickly scale their operations or replace equipment without lengthy waiting periods.

Driving factors for the growth of this market include increasing mechanization in developing economies where budgets are constrained, the rising demand for efficient agricultural practices globally, and the consistent need for reliable machinery among farmers. Additionally, the enhanced durability and longevity of modern tractors contribute to a robust secondary market, making used equipment a practical and sustainable choice. Economic uncertainties and fluctuating commodity prices also encourage a shift towards more economical capital investments, further bolstering the appeal of used tractors.

Used Tractors Market Executive Summary

The Used Tractors Market is experiencing robust growth driven by a confluence of economic and operational factors impacting the agricultural sector. Business trends indicate a significant uptick in online sales platforms and certified pre-owned programs offered by original equipment manufacturers (OEMs) and major dealerships, enhancing transparency and trust in transactions. The market is also benefiting from favorable financing options for used equipment, making it more accessible to a wider range of farmers and agricultural businesses. Supply chain efficiencies and improved refurbishment processes are further supporting market expansion, ensuring a steady availability of quality used machinery.

Regionally, developing economies in Asia Pacific, Latin America, and Africa are emerging as key growth drivers, characterized by increasing agricultural output and a growing need for affordable mechanization. North America and Europe continue to represent mature markets, where the emphasis is often on upgrading existing fleets with more advanced used models or acquiring specialized equipment. These regions also benefit from established infrastructure for maintenance and parts, which supports the longevity and resale value of used tractors. Governments and agricultural organizations are increasingly promoting sustainable farming practices, indirectly boosting the used equipment market by emphasizing resource efficiency and circular economy principles.

Segment-wise, high-horsepower used tractors are witnessing strong demand from large commercial farms looking to optimize costs for intensive operations, while compact and medium-horsepower models remain popular among small to medium-sized farms and for utility applications. The market is also seeing differentiation based on application, with specialized used tractors for vineyards, orchards, and livestock operations maintaining consistent demand. The trend towards precision agriculture technologies is slowly permeating the used market, with some newer used models featuring advanced telematics and GPS capabilities, appealing to tech-savvy farmers seeking to enhance productivity and efficiency.

AI Impact Analysis on Used Tractors Market

Common user questions regarding AI's impact on the Used Tractors Market frequently revolve around how artificial intelligence can enhance the assessment of equipment condition, predict maintenance needs, and optimize pricing. Users are concerned about the reliability of AI-driven diagnostics for older models and whether AI will make used tractors more autonomous or integrate precision farming features seamlessly. Expectations are high for AI to provide more accurate valuations, extend the lifespan of machinery through predictive insights, and streamline the buying and selling process by identifying ideal matches between equipment and buyer requirements. There is also interest in how AI could influence the refurbishment process and the certification of used equipment, potentially creating new tiers of quality assurance.

- AI-powered predictive maintenance: Extends lifespan and reduces unplanned downtime for used tractors.

- Automated valuation models: Provides more accurate and transparent pricing for pre-owned equipment.

- Enhanced diagnostics and health monitoring: Improves assessment of tractor condition prior to sale, building buyer confidence.

- Optimized inventory management: Helps dealers manage stock and anticipate demand more effectively.

- Personalized recommendations: Matches buyers with suitable used tractors based on needs and budget.

- Integration of smart farming features: Potential for retrofitting AI-driven precision agriculture capabilities into compatible used models.

- Fraud detection and authenticity verification: AI algorithms can analyze historical data to identify potential discrepancies.

DRO & Impact Forces Of Used Tractors Market

The Used Tractors Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities that collectively shape its trajectory and impact various stakeholders. A primary driver is the cost-effectiveness of used equipment, offering a substantially lower initial investment compared to new tractors, making mechanization accessible to a broader base of farmers, especially in emerging economies and for those operating on tighter budgets. The durability and longevity of modern tractors mean that used units often have considerable operational life remaining, providing excellent value for money. Additionally, the rapid pace of technological advancements in new models means that relatively recent, high-specification tractors can quickly enter the used market at attractive price points, appealing to farmers seeking advanced features without the premium cost.

However, the market faces several restraints that could impede its growth. Concerns regarding the reliability and maintenance costs of used equipment often deter potential buyers, particularly if a comprehensive service history is unavailable or unclear. The lack of standardized warranties and certification programs across all segments of the used market can also create uncertainty and reduce buyer confidence. Furthermore, the availability of spare parts for older or less common models can be challenging, leading to prolonged downtime and increased repair expenses. Economic downturns or adverse agricultural policies can also impact farmers' purchasing power, thereby reducing demand for both new and used equipment.

Despite these challenges, significant opportunities exist for market expansion and innovation. The proliferation of online marketplaces and digital platforms is revolutionizing how used tractors are bought and sold, enhancing transparency, reach, and convenience for both sellers and buyers. The growth of certified pre-owned (CPO) programs by OEMs and authorized dealers is building greater trust and offering extended warranties, thereby mitigating risks associated with used purchases. Moreover, increasing investments in agricultural infrastructure and mechanization in developing regions present a substantial untapped market. The integration of advanced diagnostic tools and telematics in used equipment allows for better condition assessment and predictive maintenance, adding considerable value and potentially attracting a new generation of tech-savvy farmers. These forces combine to create a complex but opportunity-rich environment for the used tractors market.

Segmentation Analysis

The Used Tractors Market is segmented based on various critical attributes, allowing for a detailed understanding of its diverse landscape and consumer preferences. These segments typically include variations by horsepower, application, and distribution channel, each revealing distinct market dynamics and growth opportunities. Analyzing these segments helps stakeholders, including manufacturers, dealers, and financial institutions, to tailor their strategies and product offerings more effectively to meet the specific needs of different agricultural sectors and buyer demographics.

- By Horsepower:

- Below 40 HP

- 40-100 HP

- Above 100 HP

- By Application:

- Agriculture

- Construction

- Industrial

- Other Utility Applications

- By Drive Type:

- Two-Wheel Drive (2WD)

- Four-Wheel Drive (4WD)/Front-Wheel Assist (FWA)

- By Distribution Channel:

- Dealerships

- Online Platforms

- Auctions

- Private Sales

Value Chain Analysis For Used Tractors Market

The value chain for the Used Tractors Market begins with the upstream segment, primarily involving original equipment manufacturers (OEMs) who produce new tractors and the initial consumers who purchase them. Once these new tractors have been used for a certain period, they enter the secondary market. Upstream activities in the used market context also include the initial assessment, acquisition, and basic preparation of these tractors by various intermediaries, such as independent dealers, large agricultural equipment distributors, and sometimes directly by farmers themselves looking to upgrade.

Midstream activities in the value chain are crucial and often involve a network of dealers, specialized refurbishers, and auction houses. This stage focuses on inspection, repair, maintenance, and reconditioning of used tractors to enhance their operational life and market value. Dealers might offer certified pre-owned programs that include thorough inspections and warranties, adding significant value and consumer confidence. The pricing strategies are also formulated at this stage, considering the tractor's age, condition, hours of operation, and market demand. Logistical services for transporting these machines from one point to another are also integral to this segment.

The downstream segment primarily involves the distribution and sale of these reconditioned or inspected used tractors to the ultimate end-users. Distribution channels are varied, encompassing direct sales from farmers, independent dealerships, authorized OEM dealers, online marketplaces, and public or private auctions. Online platforms have emerged as a particularly influential direct and indirect channel, providing extensive reach and transparency. Direct channels allow for more personalized interactions and negotiation, while indirect channels leverage wider networks and often provide additional services like financing and extended support. The end of the value chain focuses on ensuring customer satisfaction through after-sales support, parts availability, and continued maintenance services, which are critical for building long-term relationships and fostering repeat business within the used equipment ecosystem.

Used Tractors Market Potential Customers

The Used Tractors Market caters to a diverse range of end-users and buyers, each with distinct needs, budget constraints, and operational requirements. A significant portion of potential customers comprises small and medium-sized farmers who require reliable agricultural machinery but may lack the capital to invest in new, high-cost equipment. For these farmers, purchasing a used tractor offers an economical entry point into mechanized farming or an affordable way to expand their existing fleet, allowing them to improve efficiency and productivity without incurring substantial debt. This demographic often prioritizes cost-effectiveness, fuel efficiency, and readily available spare parts.

Large commercial farms also represent a crucial segment of potential customers, often seeking used tractors to augment their specialized equipment for specific tasks, or to expand their operations during peak seasons without purchasing brand-new, expensive machinery that might only be used intermittently. These buyers might look for higher horsepower models or specialized used tractors that still offer advanced features like GPS or precision farming compatibility. Their purchasing decisions are often driven by fleet management strategies, aiming to maximize asset utilization and minimize overall operating costs across their extensive agricultural operations.

Beyond traditional farming, the Used Tractors Market attracts a variety of other buyers. Agricultural contractors and machinery rental companies frequently invest in used tractors to build their fleet, as these machines can generate revenue quickly with a lower initial outlay, optimizing their return on investment. Furthermore, hobby farmers, landscapers, groundskeepers, and even small construction companies often purchase used utility tractors for non-agricultural applications like property maintenance, excavation, or material handling. These diverse end-users collectively fuel the demand for used tractors, underscoring the market's broad appeal and versatility in addressing a wide array of functional and financial requirements across multiple sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $58.5 Billion |

| Market Forecast in 2032 | $93.7 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, CNH Industrial N.V., AGCO Corporation, Kubota Corporation, Mahindra & Mahindra Ltd., CLAAS KGaA mbH, Sami Auto Company, Escorts Limited, SDF Group, Yanmar Co., Ltd., Zetor Tractors a.s., TAFE - Tractors and Farm Equipment Limited, Belarus Tractors, Valtra (AGCO Corporation), Fendt (AGCO Corporation), Massey Ferguson (AGCO Corporation), New Holland Agriculture (CNH Industrial), Case IH (CNH Industrial), John Deere Used Equipment, TractorHouse |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Used Tractors Market Key Technology Landscape

The Used Tractors Market is increasingly influenced by advancements in technology, even for pre-owned equipment. While not all used tractors will possess the latest innovations, several key technologies play a crucial role in assessing, maintaining, and enhancing the value of these machines. Diagnostic technologies are paramount, allowing dealers and buyers to accurately evaluate the mechanical and electronic health of a used tractor. This includes onboard diagnostics systems that capture engine hours, fault codes, and performance data, which are vital for understanding the tractor's operational history and potential future maintenance needs. Advanced telematics systems, although more common in newer models, are beginning to appear in a growing number of used tractors. These systems provide real-time data on location, fuel consumption, engine performance, and even operational efficiency, offering valuable insights for fleet management and predictive maintenance.

Furthermore, digital platforms and online marketplaces are foundational technologies transforming the distribution and sales landscape of used tractors. These platforms leverage sophisticated search algorithms, high-resolution imagery, and sometimes virtual reality tours to showcase equipment effectively. They also incorporate secure payment gateways and logistical support, streamlining the transaction process. The integration of artificial intelligence and machine learning is emerging in these platforms for features such as automated valuation models, which analyze vast datasets of historical sales and tractor specifications to provide accurate market prices, and recommendation engines that match buyers with suitable inventory. This technological layer enhances transparency and trust, which are critical for the used equipment market.

Beyond digital tools, material science and engineering innovations in original equipment contribute significantly to the used market's viability. The improved durability and reliability of tractor components mean that machines retain their functionality and structural integrity for longer periods, even after extensive use. Technologies related to precision agriculture, such as GPS guidance systems and auto-steer capabilities, when present in used tractors, add substantial value. Although retrofitting these systems can be complex, their increasing prevalence in newer models means a greater supply of technologically advanced used equipment will enter the market over time, attracting buyers seeking to leverage these efficiencies without the full cost of a new purchase. The confluence of these technologies underpins the robustness and future growth potential of the Used Tractors Market.

Regional Highlights

- North America: A mature market characterized by large commercial farms and a strong demand for high-horsepower used tractors. Robust dealership networks and certified pre-owned programs are prevalent. Emphasis on upgrading to technologically advanced used models and efficient distribution.

- Europe: Diverse market with varying farm sizes and mechanization levels. Western Europe sees demand for specialized used tractors and eco-friendly models, while Eastern Europe focuses on cost-effectiveness for expanding agricultural operations. Strong regulatory frameworks influencing equipment standards.

- Asia Pacific (APAC): Fastest-growing region, driven by increasing mechanization, government support for agriculture, and the proliferation of small and medium-sized farms seeking affordable solutions. India, China, and Southeast Asian countries are key markets with rising disposable incomes. Online platforms gaining significant traction.

- Latin America: Significant growth potential fueled by expanding agricultural lands and the need for efficient farm machinery. Brazil and Argentina are prominent markets, with demand spanning various horsepower categories for diverse crops. Economic stability is a key factor influencing purchasing power.

- Middle East and Africa (MEA): Emerging market with increasing focus on food security and agricultural development. High demand for basic, reliable, and cost-effective used tractors, particularly in sub-Saharan Africa. Challenges include infrastructure limitations and access to financing, creating opportunities for mobile distribution solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Used Tractors Market.- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- CLAAS KGaA mbH

- Sami Auto Company

- Escorts Limited

- SDF Group

- Yanmar Co., Ltd.

- Zetor Tractors a.s.

- TAFE - Tractors and Farm Equipment Limited

- Belarus Tractors

- Valtra (AGCO Corporation)

- Fendt (AGCO Corporation)

- Massey Ferguson (AGCO Corporation)

- New Holland Agriculture (CNH Industrial)

- Case IH (CNH Industrial)

- John Deere Used Equipment

- TractorHouse

Frequently Asked Questions

Analyze common user questions about the Used Tractors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate for the Used Tractors Market?

The Used Tractors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032, reaching $93.7 Billion by 2032.

What are the primary benefits of purchasing a used tractor?

Primary benefits include lower acquisition costs, reduced depreciation, and often immediate availability, offering a cost-effective solution for agricultural mechanization.

How does AI impact the Used Tractors Market?

AI impacts include enhanced diagnostics, predictive maintenance, automated valuation, and optimized inventory management, improving efficiency and transparency in the market.

What are the main segments in the Used Tractors Market?

Key segments include horsepower (Below 40 HP, 40-100 HP, Above 100 HP), application (Agriculture, Construction, Industrial), drive type, and distribution channel.

Which regions are driving the growth of the Used Tractors Market?

Asia Pacific is a key growth driver due to increasing mechanization and government support, while North America and Europe remain mature markets with consistent demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager