Utility Scale Mineral-Based Electrical Bushing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428541 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Utility Scale Mineral-Based Electrical Bushing Market Size

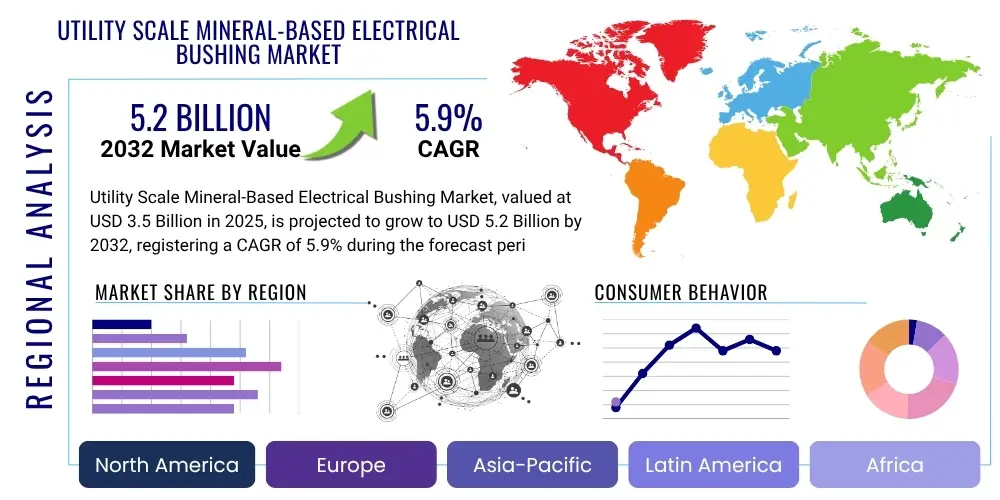

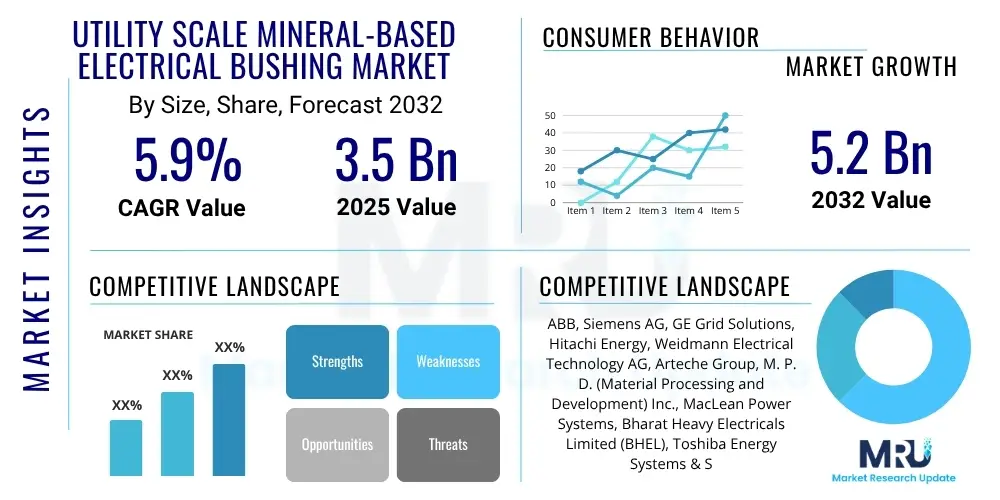

The Utility Scale Mineral-Based Electrical Bushing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.9% between 2025 and 2032. The market is estimated at USD 3.5 Billion in 2025 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2032.

Utility Scale Mineral-Based Electrical Bushing Market introduction

The Utility Scale Mineral-Based Electrical Bushing Market plays a critical role in the global electricity transmission and distribution infrastructure. These bushings are specialized insulating components designed to facilitate the safe passage of electrical conductors through earthed barriers, such as the tanks of transformers or switchgear, or the walls of substations, while maintaining electrical isolation. Primarily, these devices consist of a central conductor surrounded by a mineral oil-impregnated paper (OIP) insulation system, encased within a porcelain or composite outer insulator, making mineral oil a foundational element for their dielectric strength and thermal management capabilities. Their robust design and proven reliability make them indispensable in high voltage and extra high voltage applications within utility-scale power systems.

The product's core function is to ensure reliable electrical insulation and current carrying capacity across various voltage levels, from high voltage (HV) to ultra high voltage (UHV). Major applications for mineral-based electrical bushings include power transformers, circuit breakers, switchgear, and substation installations, where they connect equipment operating at different potential levels. They are crucial for both AC and DC transmission systems, supporting the backbone of national and international power grids. The inherent benefits of mineral-based bushings encompass excellent dielectric strength, superior thermal stability, high mechanical endurance, and a long operational lifespan, which are essential attributes for the demanding conditions of utility-scale power infrastructure.

Driving factors for this market include the global expansion and modernization of electricity grids, particularly in emerging economies with rapidly increasing power demands. The integration of renewable energy sources, such as large-scale wind and solar farms, into existing grids necessitates robust transmission infrastructure components like high-performance bushings. Furthermore, the replacement and upgrade of aging electrical infrastructure in developed regions contribute significantly to market growth, as utilities seek to enhance grid reliability, efficiency, and resilience. The rising industrialization and urbanization across various continents further propel the demand for these foundational electrical components, ensuring stable power delivery to a growing base of consumers and industries.

Utility Scale Mineral-Based Electrical Bushing Market Executive Summary

The Utility Scale Mineral-Based Electrical Bushing Market is currently undergoing significant transformation, driven by a convergence of technological advancements, evolving energy landscapes, and global infrastructure development initiatives. Key business trends indicate a strong focus on enhancing product reliability, extending operational lifespans, and improving the environmental profile of these critical components. Manufacturers are increasingly investing in research and development to optimize insulation designs, explore alternative insulating materials to mineral oil while retaining performance, and integrate smart monitoring capabilities for predictive maintenance. Consolidation among key players and strategic partnerships aimed at expanding geographic reach and technological portfolios are also prominent, fostering a more competitive yet collaborative market environment. The emphasis on higher voltage ratings and modular designs to streamline installation and reduce downtime is shaping product development strategies across the industry.

Regional trends highlight dynamic growth across different geographies. The Asia Pacific region, particularly China and India, continues to be a primary growth engine due to extensive grid expansion projects, rapid industrialization, and urbanization, coupled with significant investments in renewable energy infrastructure. North America and Europe are characterized by substantial investments in grid modernization, replacement of aging assets, and the integration of smart grid technologies, which, while mature markets, still offer consistent demand. Latin America and the Middle East & Africa regions are also witnessing growth, propelled by increasing electricity access initiatives, infrastructure development, and growing energy demands, albeit with varying levels of investment and project execution timelines. Each region presents unique regulatory landscapes and investment priorities that influence market penetration and product specifications.

Segment trends reveal a sustained demand for traditional Oil Impregnated Paper (OIP) bushings due to their proven performance and cost-effectiveness, especially in high voltage applications. However, there is a gradual shift towards Resin Impregnated Paper (RIP) and Solid Composite Insulated Bushings, driven by concerns over environmental impact, fire safety, and maintenance requirements associated with mineral oil. The demand for bushings in Extra High Voltage (EHV) and Ultra High Voltage (UHV) applications is projected to increase significantly, particularly with the proliferation of long-distance transmission lines and inter-regional grid connections. Furthermore, the application segment is diversifying, with robust demand emanating not only from traditional transformers and switchgear but also from dedicated HVDC converter stations, reflecting the growing adoption of high-voltage direct current transmission for efficient bulk power transfer. These evolving segment preferences underscore the market's adaptability and responsiveness to technological and environmental imperatives.

AI Impact Analysis on Utility Scale Mineral-Based Electrical Bushing Market

The integration of Artificial Intelligence (AI) into the Utility Scale Mineral-Based Electrical Bushing Market is poised to revolutionize various aspects, from design and manufacturing to operational maintenance and grid integration. Users are particularly interested in how AI can enhance the reliability and longevity of these crucial components, which are often subjected to extreme environmental stresses and operational demands. Common questions revolve around predictive failure analysis, optimized maintenance schedules, and the ability of AI-driven systems to identify anomalies before they lead to costly outages. There is a strong expectation that AI will significantly reduce operational expenditures and improve the overall resilience of electrical grids by providing actionable insights into bushing performance, thus shifting from reactive to proactive asset management strategies.

Another key theme users are exploring concerns AI's role in the design and manufacturing processes of mineral-based bushings. Stakeholders are keen to understand how AI algorithms can optimize material selection, geometric design, and insulation configurations to achieve superior dielectric performance and thermal dissipation. This includes simulating various operational scenarios to identify potential stress points and refine product specifications more rapidly and accurately than traditional methods. Furthermore, AI's application in quality control during manufacturing, involving automated inspection systems that can detect micro-defects invisible to the human eye, is expected to elevate product consistency and reduce failure rates significantly. This integration would lead to higher quality components with extended service lives, crucial for critical utility infrastructure.

Beyond individual component optimization, the broader impact of AI extends to how mineral-based bushings interact within complex grid ecosystems. Users anticipate that AI will facilitate better integration of sensor data from bushings into wider grid management platforms, enabling real-time condition monitoring and dynamic load management. This holistic approach can contribute to smarter, more efficient power distribution systems, where the health and performance of every critical asset, including bushings, are continuously optimized. The ability of AI to analyze vast datasets from multiple bushings across a grid, identifying patterns and correlations that might indicate systemic weaknesses or impending failures, represents a significant step forward in ensuring the stability and reliability of future energy infrastructures, driving down the total cost of ownership for utilities.

- Enhanced predictive maintenance and failure detection through real-time data analysis.

- Optimized design and material selection for improved dielectric performance and thermal management.

- Automated quality control and inspection in manufacturing, leading to higher product consistency.

- Integration of bushing sensor data into smart grid platforms for holistic asset management.

- Reduction in unplanned outages and operational costs through proactive intervention.

- Improved efficiency and reliability of electrical transmission and distribution systems.

- Development of digital twin models for bushings, enabling virtual testing and performance tracking.

DRO & Impact Forces Of Utility Scale Mineral-Based Electrical Bushing Market

The Utility Scale Mineral-Based Electrical Bushing Market is influenced by a complex interplay of drivers, restraints, and opportunities, shaped by broader economic, technological, and environmental forces. A primary driver is the accelerating global demand for electricity, propelled by rapid industrialization, urbanization, and population growth, particularly in emerging economies. This sustained demand necessitates continuous expansion and modernization of power transmission and distribution networks, requiring a steady supply of high-performance electrical bushings. Furthermore, the global push towards integrating renewable energy sources, such as large-scale wind and solar power plants, into existing grids creates significant demand for robust HV and EHV bushings to connect these new generation facilities to the transmission system. The widespread need to replace and upgrade aging electrical infrastructure in developed countries, where many components have reached or exceeded their design life, also acts as a substantial market driver, ensuring grid reliability and reducing efficiency losses.

Despite strong drivers, the market faces several restraints. The high initial capital investment required for manufacturing and installing utility-scale electrical bushings can be a barrier, especially for smaller market participants or utilities with limited budgets. The complex manufacturing processes, which demand specialized knowledge and stringent quality control, contribute to these high costs. Environmental concerns regarding the use of mineral oil, specifically its flammability and potential for leakage, also pose a significant restraint. This has led to increasing regulatory pressures and a growing preference for alternative, more eco-friendly insulating materials, which, while offering benefits, can be more expensive or less proven in certain long-term applications. Intense competition from alternative bushing technologies, such as those using SF6 gas or solid composite materials, further challenges the dominance of traditional mineral-based solutions by offering perceived advantages in safety, environmental impact, or maintenance.

Opportunities within the market largely stem from the ongoing global transition towards smarter and more resilient grids. The increasing adoption of High Voltage Direct Current (HVDC) transmission systems for long-distance bulk power transfer and inter-regional grid connections presents a lucrative niche for specialized HVDC bushings. Emerging markets in Asia Pacific, Latin America, and Africa offer substantial growth potential due to their nascent grid infrastructure and escalating energy demands, providing fertile ground for new projects. Moreover, continuous research and development in materials science and insulation technology are creating opportunities for manufacturers to develop hybrid solutions that combine the proven reliability of mineral-based designs with the environmental benefits of newer materials, mitigating some of the traditional restraints. Retrofitting existing infrastructure with advanced, digitally enabled bushings that offer condition monitoring capabilities also represents a significant avenue for market expansion, enhancing asset management and extending the lifespan of critical equipment.

Impact forces on the market are multifaceted, encompassing technological advancements that continuously redefine product capabilities and efficiencies, and regulatory shifts that mandate stricter environmental and safety standards. Economic conditions, including global investment cycles in infrastructure and energy projects, directly influence demand. Geopolitical factors can impact supply chains for raw materials and components, affecting production costs and lead times. Furthermore, the increasing focus on climate change and sustainable development exerts pressure on manufacturers to innovate towards greener solutions, influencing product design and market acceptance. These external forces collectively shape the competitive landscape and strategic direction for stakeholders in the Utility Scale Mineral-Based Electrical Bushing Market.

Segmentation Analysis

The Utility Scale Mineral-Based Electrical Bushing Market is comprehensively segmented across various parameters to provide a detailed understanding of its dynamics and target specific market opportunities. These segmentations are critical for market participants to tailor their product offerings, develop effective marketing strategies, and identify areas of high growth or specific technological needs. The market can be broadly analyzed based on voltage level, which directly correlates with the scale and application requirements of the bushings, indicating the complexity and insulation demands. Insulation type forms another crucial segmentation, highlighting the different material compositions and design principles adopted by manufacturers, each with distinct performance characteristics, environmental considerations, and cost implications.

Further segmentation by application provides insights into where these bushings are predominantly utilized within the vast electrical infrastructure. This helps in understanding the demand from specific sectors such as power generation, transmission, or distribution, and whether the demand is driven by new installations or replacement cycles. Each application, such as transformers or switchgear, places unique operational and mechanical stress requirements on the bushings, influencing their design and material specifications. Finally, the market is segmented by end-user, identifying the primary purchasers and operators of these electrical components. This allows for a targeted approach to sales and service, recognizing the distinct purchasing cycles, technical requirements, and long-term strategic goals of different customer groups, from national utilities to private industrial consumers.

Understanding these segmentations enables a granular view of the market, allowing stakeholders to pinpoint underserved areas, evaluate competitive landscapes within specific niches, and forecast future demand patterns more accurately. The interplay between these segments often dictates technological innovation, as manufacturers strive to meet specific needs such as higher voltage capabilities for grid interconnections, environmentally friendly designs for sensitive areas, or enhanced monitoring for critical applications. This detailed breakdown facilitates strategic planning and investment decisions for all entities involved in the utility-scale power sector, from raw material suppliers to original equipment manufacturers and service providers, contributing to the efficient evolution of the global energy grid.

- By Voltage Level:

- High Voltage (HV)

- Extra High Voltage (EHV)

- Ultra High Voltage (UHV)

- By Insulation Type:

- Oil Impregnated Paper (OIP)

- Resin Impregnated Paper (RIP)

- SF6 Gas Insulated Bushings

- Solid Composite Insulated Bushings

- By Application:

- Transformers

- Switchgear

- Substations

- Generators

- HVDC Converters

- By End-User:

- Electric Utilities

- Industrial Sector

- Power Generation Companies

- Renewable Energy Plants

- Data Centers

- Railways and Transportation

Value Chain Analysis For Utility Scale Mineral-Based Electrical Bushing Market

The value chain for the Utility Scale Mineral-Based Electrical Bushing Market is characterized by a series of interconnected stages, beginning with the sourcing of specialized raw materials and extending to the ultimate end-users of these critical electrical components. The upstream segment of the value chain involves a specialized group of suppliers providing essential raw materials such as high-grade insulating paper, mineral oil (or alternative dielectric fluids), porcelain or composite materials for outer insulators, copper or aluminum for conductors, and various epoxy resins and rubber compounds. These suppliers often operate within a niche market, adhering to stringent quality and performance specifications due to the high-stakes nature of electrical grid components. The quality and availability of these raw materials directly impact the manufacturing process, product reliability, and ultimately, the cost efficiency of the final bushing, requiring robust supplier relationships and quality assurance protocols.

Following the raw material procurement, the core manufacturing process involves intricate design, precision engineering, and specialized assembly. This midstream segment is dominated by established electrical equipment manufacturers who possess the necessary expertise in dielectric insulation, mechanical engineering, and high-voltage testing. These manufacturers invest heavily in research and development to innovate bushing designs, improve insulation systems, and develop more environmentally friendly alternatives. The manufacturing process is highly capital-intensive and requires skilled labor, adhering to international standards and certifications to ensure product safety and performance. This stage adds significant value through proprietary technologies, advanced production techniques, and comprehensive quality control measures that define the functional integrity of the bushings.

The downstream segment of the value chain focuses on the distribution, installation, and after-sales support of the electrical bushings. Distribution channels for utility-scale mineral-based bushings are typically direct or through specialized distributors and agents. Large utilities, national grid operators, and major EPC (Engineering, Procurement, and Construction) contractors often procure directly from manufacturers for large-scale projects, benefiting from custom solutions and direct technical support. Indirect channels involve regional distributors who cater to smaller utilities, industrial clients, or provide components for maintenance and replacement. Installation requires specialized engineering knowledge, often provided by the manufacturers or certified service partners, to ensure proper integration and commissioning within the grid infrastructure. After-sales support, including maintenance, repairs, and spare parts, is crucial for extending asset life and ensuring continuous reliable operation, contributing significantly to customer satisfaction and loyalty within this long-lifecycle product market.

Utility Scale Mineral-Based Electrical Bushing Market Potential Customers

The Utility Scale Mineral-Based Electrical Bushing Market serves a diverse yet highly specialized customer base, primarily comprising entities responsible for the generation, transmission, and distribution of electrical power. The primary end-users and buyers are electric utilities, including national grid operators, regional transmission organizations, and local distribution companies. These organizations are continuously investing in expanding, upgrading, and maintaining their vast electrical networks, which necessitates a constant demand for high-performance bushings for their transformers, switchgear, and substation equipment. Their procurement decisions are driven by factors such as product reliability, long operational lifespan, compliance with stringent safety and environmental regulations, and overall cost-efficiency across the asset's lifecycle, often preferring established manufacturers with proven track records.

Beyond traditional utilities, a significant segment of potential customers includes independent power producers (IPPs) and power generation companies. This encompasses operators of conventional power plants (thermal, hydroelectric, nuclear) as well as the rapidly growing sector of renewable energy plants (large-scale wind farms, solar PV parks). As these entities generate electricity, they require robust bushings to connect their generators to step-up transformers and subsequently to the transmission grid. The expansion of renewable energy capacity globally is a particularly strong driver for this customer segment, demanding specialized bushings capable of handling varying load conditions and often operating in remote or challenging environments, requiring durable and reliable components.

Furthermore, heavy industrial sectors, such as metals and mining, oil and gas, petrochemicals, and large manufacturing facilities, represent another key customer segment. These industries often operate their own high-voltage substations and extensive internal electrical distribution systems to power their vast machinery and processes. Their demand for utility-scale bushings is driven by the need for reliable power supply to avoid costly downtime in production. Additionally, emerging end-users like large data centers, which require massive, uninterrupted power supplies, and modern railway systems, which utilize high-voltage traction substations, are increasingly becoming significant buyers. These customers prioritize components that offer maximum uptime, superior safety features, and often, advanced monitoring capabilities to ensure operational continuity and protect critical assets from electrical faults.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 3.5 Billion |

| Market Forecast in 2032 | USD 5.2 Billion |

| Growth Rate | CAGR 5.9% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens AG, GE Grid Solutions, Hitachi Energy, Weidmann Electrical Technology AG, Arteche Group, M. P. D. (Material Processing and Development) Inc., MacLean Power Systems, Bharat Heavy Electricals Limited (BHEL), Toshiba Energy Systems & Solutions Corporation, CG Power and Industrial Solutions Limited, Shandong Taikai Power Electronic Co., Ltd., ZAPAZ Ltd., RITZ Instrument Transformers GmbH, Ensto, Lapp Insulators, TE Connectivity, Dalian North Electrode Co., Ltd., Xi'an XD High Voltage Apparatus Co., Ltd., Nanjing Electric (Group) Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Utility Scale Mineral-Based Electrical Bushing Market Key Technology Landscape

The Utility Scale Mineral-Based Electrical Bushing Market is characterized by a sophisticated technological landscape that continuously evolves to meet the escalating demands for higher voltages, enhanced reliability, and improved environmental performance. The cornerstone technology remains the Oil Impregnated Paper (OIP) insulation system, which has been the industry standard for decades due to its excellent dielectric properties and thermal stability. OIP bushings utilize layers of insulating paper impregnated with mineral oil to provide robust electrical insulation, primarily for AC applications. However, ongoing technological advancements focus on refining OIP designs to improve partial discharge resistance, reduce manufacturing defects, and enhance long-term operational resilience, even as alternative technologies gain traction due to environmental considerations.

Alongside OIP, Resin Impregnated Paper (RIP) and Resin Impregnated Synthetics (RIS) have emerged as significant alternative technologies. RIP bushings replace mineral oil with epoxy resin, offering advantages such as dry-type construction, reduced fire risk, and generally lower maintenance requirements, making them suitable for sensitive installations and environmentally conscious projects. RIS technology further refines this concept by utilizing synthetic materials in conjunction with resin, often resulting in lighter, more compact designs with excellent mechanical properties. Furthermore, the development of solid composite insulated bushings, utilizing materials like silicone rubber or epoxy compounds, provides highly robust, explosion-proof, and maintenance-free solutions, particularly for challenging environmental conditions and high seismic activity areas, presenting a compelling alternative to traditional mineral oil-based designs in specific niches.

Beyond core insulation materials, the technological landscape is increasingly integrating smart features and digital capabilities. Condition monitoring technologies, including partial discharge detection sensors, temperature sensors, and dissolved gas analysis (DGA) systems, are being incorporated into bushings. These intelligent components enable real-time health assessments, predictive maintenance, and early fault detection, significantly enhancing grid reliability and reducing operational costs. Research into SF6 gas alternatives and hybrid insulation systems is also ongoing, aiming to combine the best attributes of various technologies while addressing environmental concerns. The drive towards higher voltage ratings, particularly for UHV AC and HVDC applications, necessitates continuous innovation in insulation design, electrical field management, and mechanical integration to ensure the safe and efficient transfer of bulk power across vast distances, pushing the boundaries of material science and electrical engineering.

Regional Highlights

- North America: Characterized by significant investments in grid modernization and the replacement of aging infrastructure. The region exhibits a consistent demand for reliable, high-performance bushings to enhance grid resilience and accommodate renewable energy integration. Stringent safety and environmental regulations also drive the adoption of advanced insulation technologies.

- Europe: Focus on renewable energy integration, cross-border grid interconnections, and the upgrade of existing transmission and distribution networks. Germany, France,

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager