Utility Scale Synchronous Condenser Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430440 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Utility Scale Synchronous Condenser Market Size

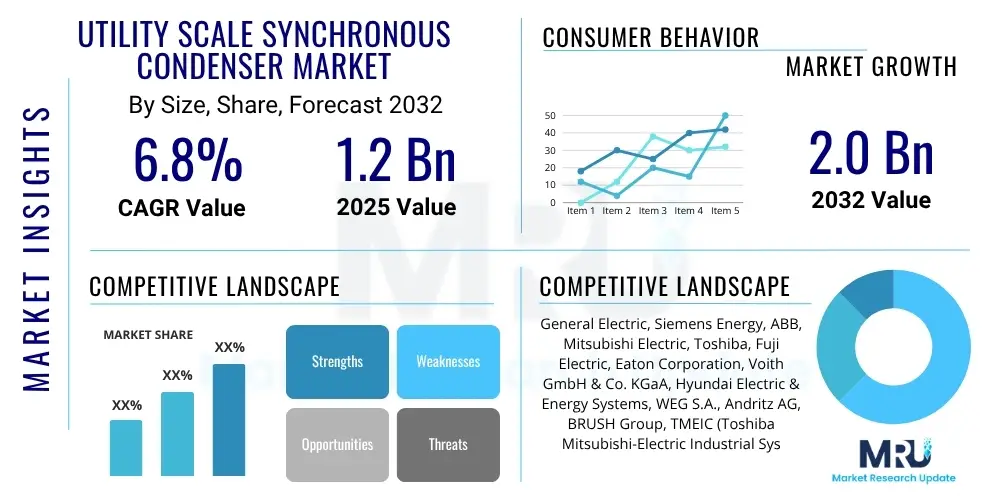

The Utility Scale Synchronous Condenser Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 1.2 Billion in 2025 and is projected to reach USD 2.0 Billion by the end of the forecast period in 2032.

Utility Scale Synchronous Condenser Market introduction

The Utility Scale Synchronous Condenser Market is undergoing significant transformation, driven by the global energy transition and the increasing integration of intermittent renewable energy sources into national grids. A synchronous condenser, also known as a synchronous compensator or synchronous capacitor, is essentially a synchronous motor operating without mechanical load, specifically designed to provide or absorb reactive power to stabilize grid voltage. These critical machines play a pivotal role in maintaining the stability, reliability, and power quality of modern electricity networks, especially in an era marked by distributed generation and the phase-out of traditional fossil fuel-based power plants that historically provided inherent grid inertia.

The core product within this market encompasses large-scale rotating electrical machines that are connected to the power grid, contributing to its overall health by providing reactive power support, voltage regulation, and crucial system inertia. Unlike static compensators such as STATCOMs, synchronous condensers offer the unique advantage of contributing short-circuit current and mechanical inertia, which are vital for mitigating frequency deviations and maintaining grid robustness during fault conditions. Major applications span from supporting long transmission lines and industrial loads to enhancing the operational resilience of renewable energy parks, particularly large offshore wind farms and expansive solar arrays that lack intrinsic inertia.

The primary benefits of deploying utility scale synchronous condensers include enhanced grid stability, improved power quality, increased transmission capacity, and the provision of system strength. They are instrumental in absorbing or injecting reactive power to control voltage levels, which is crucial for efficient power transfer and preventing widespread outages. Driving factors for market expansion include the aggressive global push towards decarbonization, leading to a surge in renewable energy installations, the need to modernize aging grid infrastructure, and increasingly stringent grid codes that mandate minimum levels of system inertia and reactive power capability. These factors collectively underscore the indispensable role of synchronous condensers in securing the future of electricity grids worldwide.

Utility Scale Synchronous Condenser Market Executive Summary

The Utility Scale Synchronous Condenser Market is poised for substantial growth, primarily fueled by the accelerating global transition to renewable energy sources and the associated challenges in maintaining grid stability. Key business trends indicate a strong focus on innovation, with manufacturers developing more compact, efficient, and technologically advanced synchronous condensers capable of seamless integration into complex modern grids. There is a discernible shift towards offering integrated solutions that combine synchronous condensers with advanced control systems and digital monitoring capabilities, providing comprehensive grid support rather than standalone hardware. Furthermore, strategic partnerships between equipment manufacturers, EPC contractors, and utility companies are becoming more prevalent, aimed at delivering turn-key solutions and accelerating project deployment.

Regionally, the market exhibits diverse growth patterns influenced by varying levels of renewable energy penetration and grid modernization initiatives. Asia Pacific is emerging as a dominant region, driven by massive investments in renewable energy infrastructure, rapid industrialization, and expanding transmission networks in countries like China, India, and Australia. Europe, with its advanced grid infrastructure and ambitious decarbonization targets, continues to be a crucial market, focusing on enhancing grid resilience to accommodate high levels of wind and solar power. North America is also experiencing significant growth, primarily due to aging grid infrastructure replacement programs, the integration of large-scale renewable projects, and the imperative to improve grid stability across vast geographical areas. Latin America and the Middle East and Africa are showing promising potential as they embark on their own journeys of grid modernization and renewable energy adoption.

In terms of segment trends, the market is observing a rising demand for high-power rating synchronous condensers, especially for applications involving offshore wind farms and major transmission corridors. The need for advanced cooling technologies, such as hydrogen-cooled systems, is growing for these larger units to maximize efficiency and reduce footprint. Furthermore, there is an increasing emphasis on flexible and modular designs that can be tailored to specific grid requirements, offering utilities greater adaptability. The application segment for renewable energy integration is anticipated to demonstrate the most robust growth, reflecting the global energy paradigm shift, while conventional grid stability applications will continue to form a foundational demand base. The emphasis is on future-proofing grids, and synchronous condensers are critical components in achieving this objective by providing essential services traditionally offered by conventional thermal generators.

AI Impact Analysis on Utility Scale Synchronous Condenser Market

User inquiries concerning AI's influence on the Utility Scale Synchronous Condenser Market frequently revolve around optimizing operational efficiency, enhancing predictive maintenance capabilities, and integrating these traditional assets into smarter, more dynamic grids. Common questions explore how AI can improve the control and response times of synchronous condensers, extend their operational lifespan, and whether AI-driven grid management systems will diminish or augment the need for physical inertia providers. Users are keen to understand the extent to which AI can facilitate the seamless integration of synchronous condensers with other grid assets, such as STATCOMs and energy storage systems, for holistic grid stability solutions. The core theme is leveraging AI to make synchronous condensers not only more efficient and reliable but also more adaptive and responsive components within a highly complex, interconnected grid infrastructure, ensuring optimal performance and proactive issue resolution.

- AI-powered predictive maintenance: Utilizes machine learning algorithms to analyze operational data from synchronous condensers, predicting potential failures, optimizing maintenance schedules, and significantly reducing unplanned downtime, thereby extending asset lifespan and improving availability.

- Optimized control and dispatch: AI can process vast amounts of real-time grid data to dynamically control the reactive power output and operational mode of synchronous condensers, ensuring optimal voltage support and inertia provision in response to fluctuating grid conditions and renewable energy intermittency.

- Enhanced grid integration: AI algorithms facilitate the seamless coordination of synchronous condensers with other Flexible AC Transmission System (FACTS) devices, battery energy storage systems, and renewable power plants, creating a more cohesive and resilient smart grid infrastructure.

- Digital twin creation for performance simulation: AI contributes to developing highly accurate digital twins of synchronous condensers, enabling precise simulations of their performance under various grid scenarios, optimizing design parameters, and facilitating operator training.

- Fault detection and isolation: AI-driven analytics can quickly identify and localize grid disturbances or internal equipment faults, allowing for faster response times and minimizing the impact on grid stability.

DRO & Impact Forces Of Utility Scale Synchronous Condenser Market

The Utility Scale Synchronous Condenser Market is primarily driven by the escalating integration of intermittent renewable energy sources, such as wind and solar power, which inherently lack the rotational inertia provided by conventional generators. This absence of inertia necessitates compensatory technologies to maintain grid frequency and voltage stability, a role perfectly suited for synchronous condensers. The global push for grid modernization and the replacement of aging infrastructure also serves as a significant driver, as older grids were not designed to handle the dynamic challenges posed by decentralized generation. Furthermore, increasingly stringent grid codes and regulatory frameworks worldwide are mandating higher standards for reactive power support, voltage control, and system strength, compelling utilities to invest in robust solutions like synchronous condensers. These forces combine to create a compelling demand for the technology, ensuring its vital role in the energy transition.

Despite strong drivers, the market faces certain restraints, most notably the high upfront capital expenditure associated with the installation of large-scale synchronous condensers. These are substantial pieces of rotating machinery requiring significant civil works, specialized transportation, and complex installation procedures, which can deter potential investors. The availability of alternative technologies, such as Static Synchronous Compensators (STATCOMs) and other power electronics-based solutions, which offer faster response times and smaller footprints, presents a competitive challenge, particularly in scenarios where inertia is not the primary concern. Moreover, the extensive planning and long lead times required for synchronous condenser projects can pose a barrier to rapid deployment, especially in rapidly evolving energy landscapes. These factors necessitate careful economic and technical evaluation by grid operators before committing to synchronous condenser investments.

Significant opportunities exist in the development of hybrid solutions that combine the inertia benefits of synchronous condensers with the fast reactive power response of STATCOMs, offering a comprehensive grid stabilization package. Emerging markets, particularly in Asia Pacific, Latin America, and Africa, present substantial growth avenues as these regions heavily invest in new power generation and transmission infrastructure, often prioritizing renewable energy integration. The increasing adoption of offshore wind power, which often requires robust grid connection solutions due far from grid connection points, also provides a niche but growing opportunity for large synchronous condenser installations. Impact forces such as evolving government policies supporting grid resilience and renewable integration, continuous technological advancements leading to more efficient and compact designs, and global economic trends influencing investment in critical infrastructure will significantly shape the market trajectory. The transition from a centralized to a distributed generation model fundamentally alters grid dynamics, creating an urgent need for solutions that can replicate or enhance the stability services traditionally provided by large fossil fuel plants, positioning synchronous condensers as a key enabler for future energy systems.

Segmentation Analysis

The Utility Scale Synchronous Condenser market is meticulously segmented to provide a granular understanding of its diverse components and applications, enabling stakeholders to identify specific growth areas and strategic opportunities. This segmentation typically dissects the market based on distinct characteristics such as the type of cooling employed, the power rating of the unit, the primary application for which it is utilized, and the end-user industry that deploys these critical assets. Such a detailed analysis allows for a comprehensive assessment of demand drivers and competitive landscapes across various market niches. Understanding these segments is crucial for manufacturers to tailor their product offerings, for utilities to make informed procurement decisions, and for investors to gauge market potential.

- By Cooling Type

- Hydrogen-cooled Synchronous Condensers: Employ hydrogen gas as a cooling medium, typically used for larger units due to its superior thermal conductivity and efficiency, enabling higher power density.

- Air-cooled Synchronous Condensers: Utilize ambient air for cooling, often preferred for smaller to medium-sized units due to lower complexity and maintenance requirements, suitable for various environmental conditions.

- By Power Rating

- Below 100 MVAR: Smaller capacity units often deployed for localized voltage support or in less demanding grid environments.

- 100-200 MVAR: Mid-range capacity, frequently used for medium-sized renewable energy integration projects or regional grid stabilization.

- Above 200 MVAR: High-capacity units, critical for large-scale grid stabilization, long-distance transmission line support, and major renewable energy hubs like offshore wind farms.

- By Application

- Renewable Energy Integration: Essential for maintaining grid stability and voltage control in grids with high penetration of intermittent wind and solar power.

- Grid Stability and Reliability: Provides reactive power compensation, short-circuit contribution, and inertia to prevent voltage collapses and frequency deviations across the general transmission network.

- Industrial Applications: Used in large industrial complexes with fluctuating loads that require robust power quality and voltage support to ensure uninterrupted operations.

- By End-User

- Utilities: National and regional transmission system operators (TSOs) and distribution system operators (DSOs) are the primary purchasers for grid-wide stability.

- Independent Power Producers (IPPs): Developers of large renewable energy projects who need to meet grid code compliance for connection to the transmission network.

- Heavy Industries: Companies in sectors like mining, metals, and chemicals that operate large, variable loads and require localized grid reinforcement.

Value Chain Analysis For Utility Scale Synchronous Condenser Market

The value chain for the Utility Scale Synchronous Condenser Market begins with upstream activities involving the sourcing and processing of critical raw materials. This segment includes suppliers of high-grade electrical steel for stator cores, copper for windings, specialized insulation materials, and bearing components. Manufacturers of these fundamental parts play a crucial role in determining the quality and performance of the final product. The robustness and efficiency of the synchronous condenser are highly dependent on the integrity of these foundational components, necessitating strong relationships with reliable and quality-focused suppliers. Ensuring a stable supply chain for these specialized materials is paramount for consistent production and managing manufacturing costs effectively. This initial stage sets the technical specifications and cost base for the subsequent manufacturing processes, highlighting its foundational importance to the entire product lifecycle.

Moving downstream, the value chain encompasses the sophisticated manufacturing, assembly, and testing of synchronous condensers by original equipment manufacturers (OEMs). These companies integrate all the procured components, apply advanced engineering expertise, and conduct rigorous factory acceptance tests to ensure the units meet stringent performance and safety standards. Following manufacturing, the product moves through complex distribution channels, which often involve specialized logistics due to the enormous size and weight of these machines. Installation is a critical step, frequently managed by Engineering, Procurement, and Construction (EPC) firms that oversee project planning, site preparation, civil works, and commissioning. Post-installation, long-term operations and maintenance (O&M) services, including predictive maintenance and spare parts supply, become essential to ensure the continuous and reliable functioning of the synchronous condensers throughout their operational life. This downstream segment is characterized by high levels of technical expertise and project management capabilities.

The distribution channels for utility scale synchronous condensers are predominantly direct, involving direct sales from the OEM to large national or regional utilities and independent power producers (IPPs). This direct engagement facilitates close collaboration on technical specifications, project timelines, and customized solutions, given the strategic importance and high capital investment of these assets. Indirect distribution channels, while less common for the largest units, can involve partnerships with global EPC contractors who integrate synchronous condensers into broader grid expansion or renewable energy projects. These EPCs act as intermediaries, procuring the equipment on behalf of the ultimate end-users and providing comprehensive project delivery. Both direct and indirect models emphasize the need for strong technical support and long-term service agreements, reflecting the critical nature of synchronous condensers in maintaining grid stability and the highly specialized requirements of their deployment and operation. The complexity and bespoke nature of these products mean that sales cycles are typically long, requiring extensive pre-sales consultation and post-sales support.

Utility Scale Synchronous Condenser Market Potential Customers

The primary end-users and buyers of utility scale synchronous condensers are predominantly national and regional Transmission System Operators (TSOs) and Distribution System Operators (DSOs). These entities are responsible for managing the stability, reliability, and security of the electricity grid, making them critically dependent on technologies that provide reactive power support, voltage control, and system inertia. As grids evolve with higher penetrations of renewable energy, TSOs and DSOs face increasing challenges in maintaining these fundamental grid services, driving their demand for synchronous condensers. Their procurement decisions are heavily influenced by regulatory mandates, grid codes, and the imperative to ensure uninterrupted power supply to their service territories. The long-term investment horizon and strategic importance of these assets mean that TSOs and DSOs typically engage in extensive technical evaluations and long-term planning before procurement.

Another significant segment of potential customers includes Independent Power Producers (IPPs), particularly those involved in developing large-scale renewable energy projects such as vast onshore and offshore wind farms, and utility-scale solar installations. These developers are often mandated by grid operators to ensure their projects meet specific grid code requirements for connection, which frequently includes provisions for reactive power compensation and inertia contribution. Synchronous condensers allow IPPs to comply with these stringent grid connection requirements, thereby enabling the successful integration of their intermittent generation assets into the wider transmission network. The need for stable and compliant grid connections directly translates into demand for synchronous condensers from these renewable project developers, especially in regions with high renewable energy targets and robust grid integration policies.

Furthermore, large industrial operators, particularly those in heavy industries such as mining, petrochemicals, and metals, also represent potential customers. These industries often feature massive, fluctuating electrical loads that can introduce significant disturbances to local grid stability and power quality. By deploying synchronous condensers, these industrial facilities can ensure localized voltage support, improve power factor, and mitigate the impact of their operations on the broader grid, thereby enhancing their operational reliability and potentially reducing utility penalties. While typically smaller in scale than utility-owned units, these industrial applications still represent a valuable niche market for synchronous condenser manufacturers, driven by the need for robust internal grid management and operational continuity. The diversity of these end-users underscores the broad applicability and critical function of synchronous condensers across various segments of the energy ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2032 | USD 2.0 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Electric, Siemens Energy, ABB, Mitsubishi Electric, Toshiba, Fuji Electric, Eaton Corporation, Voith GmbH & Co. KGaA, Hyundai Electric & Energy Systems, WEG S.A., Andritz AG, BRUSH Group, TMEIC (Toshiba Mitsubishi-Electric Industrial Systems Corporation), Nidec Corporation, Bharat Heavy Electricals Limited (BHEL), Harbin Electric Corporation, Shanghai Electric Group Co. Ltd., Ansaldo Energia S.p.A., Hitachi Energy, JSW Energy Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Utility Scale Synchronous Condenser Market Key Technology Landscape

The key technology landscape of the Utility Scale Synchronous Condenser Market is continuously evolving, driven by the increasing demands for grid flexibility, efficiency, and reliability in a renewable-heavy energy system. Advanced control systems form the backbone of modern synchronous condensers, utilizing sophisticated algorithms and real-time data analytics to optimize reactive power output, voltage regulation, and inertia contribution. These intelligent control platforms enable precise and dynamic response to rapidly changing grid conditions, ensuring seamless integration with other grid assets and maximizing the operational benefits of the condenser. Furthermore, the development of robust and high-performance bearing technologies, including magnetic bearings, is crucial for reducing mechanical losses, extending operational lifespan, and lowering maintenance requirements, which significantly contributes to the overall efficiency and cost-effectiveness of these large rotating machines.

Innovations in cooling technologies also play a pivotal role, with hydrogen cooling remaining a dominant feature for high-power rating units due to its superior thermal conductivity, allowing for more compact designs and higher power density. However, ongoing research aims to improve air-cooled designs for smaller units, making them more efficient and suitable for a broader range of applications. The integration of synchronous condensers with Flexible AC Transmission System (FACTS) devices, such as STATCOMs, is another significant technological trend. These hybrid solutions leverage the complementary strengths of both technologies: the inertia and short-circuit contribution of synchronous condensers combined with the fast, precise reactive power compensation of STATCOMs, offering a comprehensive and highly responsive grid stabilization package. This synergistic approach ensures optimal grid performance under diverse operating scenarios, addressing both dynamic and static stability challenges effectively.

The advent of digitalization and the Industrial Internet of Things (IIoT) are further transforming the market. Remote monitoring and diagnostics systems, powered by advanced sensors and data communication networks, enable real-time performance tracking, predictive maintenance, and remote troubleshooting of synchronous condensers. This capability enhances operational reliability, minimizes downtime, and optimizes maintenance scheduling, leading to significant cost savings for operators. The creation of digital twins for synchronous condensers allows for virtual modeling and simulation of their behavior under various grid conditions, facilitating optimization of control strategies and asset management. These technological advancements collectively enhance the efficiency, reliability, and cost-effectiveness of synchronous condensers, solidifying their role as indispensable components in the future of utility-scale power grids and reinforcing their position within the modern energy infrastructure.

Regional Highlights

- North America: The market in North America is driven by extensive grid modernization initiatives, particularly in the United States and Canada, aimed at enhancing resilience and accommodating the growing influx of renewable energy, especially large-scale wind and solar projects. Aging infrastructure replacement also plays a significant role, as utilities upgrade their systems to meet new reliability standards and integrate distributed energy resources more effectively across vast transmission networks.

- Europe: Europe represents a mature but dynamically growing market, characterized by very high renewable energy penetration and ambitious decarbonization targets. Countries across the continent are heavily investing in synchronous condensers to manage grid stability challenges arising from the intermittency of wind and solar power, particularly in regions with significant offshore wind development, where grid codes demand robust reactive power and inertia support.

- Asia Pacific (APAC): This region is projected to be the fastest-growing market, propelled by rapid industrialization, burgeoning energy demand, and substantial government investments in renewable energy infrastructure, notably in China, India, and Australia. The expansion of transmission networks to serve growing populations and industrial complexes, coupled with the integration of large-scale hydro, wind, and solar projects, creates immense demand for grid stabilization technologies.

- Latin America: The market in Latin America is witnessing steady growth as countries develop their power generation and transmission infrastructure. The region's rich hydropower resources and increasing investment in new renewable energy projects, particularly wind and solar, necessitate enhanced grid stability solutions. Economic development and the need for reliable energy access are key drivers for synchronous condenser adoption in this region.

- Middle East and Africa (MEA): The MEA region is emerging as a promising market due to significant investments in new power generation capacity, including both conventional and large-scale renewable energy projects, coupled with ambitious grid expansion plans. The need for robust grid infrastructure to support economic diversification and growing energy demands, particularly for urban centers and industrial zones, drives the demand for utility scale synchronous condensers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Utility Scale Synchronous Condenser Market.- General Electric

- Siemens Energy

- ABB Ltd.

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Fuji Electric Co., Ltd.

- Eaton Corporation plc

- Voith GmbH & Co. KGaA

- Hyundai Electric & Energy Systems Co., Ltd.

- WEG S.A.

- Andritz AG

- BRUSH Group

- TMEIC (Toshiba Mitsubishi-Electric Industrial Systems Corporation)

- Nidec Corporation

- Bharat Heavy Electricals Limited (BHEL)

- Harbin Electric Corporation

- Shanghai Electric Group Co. Ltd.

- Ansaldo Energia S.p.A.

- Hitachi Energy

- JSW Energy Limited

Frequently Asked Questions

What is a utility scale synchronous condenser and why is it essential?

A utility scale synchronous condenser is a rotating electrical machine designed to absorb or provide reactive power to the grid, crucial for maintaining voltage stability and providing essential system inertia. It is essential because it supports grid resilience, especially with the integration of intermittent renewable energy sources that lack natural inertia, preventing voltage collapses and frequency deviations across the power network.

How does the growth of renewable energy impact the synchronous condenser market?

The increasing deployment of renewable energy sources like wind and solar, which are inherently intermittent and lack rotational inertia, significantly drives the demand for synchronous condensers. These devices fill the gap by providing the necessary reactive power, voltage support, and system strength to stabilize grids increasingly reliant on decentralized, variable generation, ensuring reliable power delivery.

What are the key technological advancements in synchronous condensers?

Key advancements include sophisticated AI-powered control systems for optimized reactive power management, improved bearing technologies for enhanced efficiency and lifespan, and the development of hybrid solutions combining synchronous condensers with STATCOMs. Digitalization, including remote monitoring and digital twin creation, also plays a crucial role in improving operational reliability and predictive maintenance.

How do synchronous condensers compare to STATCOMs, and when is each preferred?

Synchronous condensers provide both reactive power and crucial mechanical inertia, contributing to short-circuit strength and frequency stability. STATCOMs (Static Synchronous Compensators) offer faster, more precise electronic reactive power compensation but do not provide inertia. Synchronous condensers are preferred when inertia and short-circuit contribution are critical, especially for large-scale renewable integration; STATCOMs are chosen for rapid dynamic voltage support without the need for inertia.

Which regions are leading the market for utility scale synchronous condensers?

Asia Pacific is expected to lead in market growth due to massive investments in renewable energy and grid expansion, particularly in China and India. Europe also remains a strong market with high renewable penetration and stringent grid stability requirements. North America is experiencing significant demand driven by grid modernization and large-scale renewable energy project integration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager