Vacuum Interrupter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428152 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Vacuum Interrupter Market Size

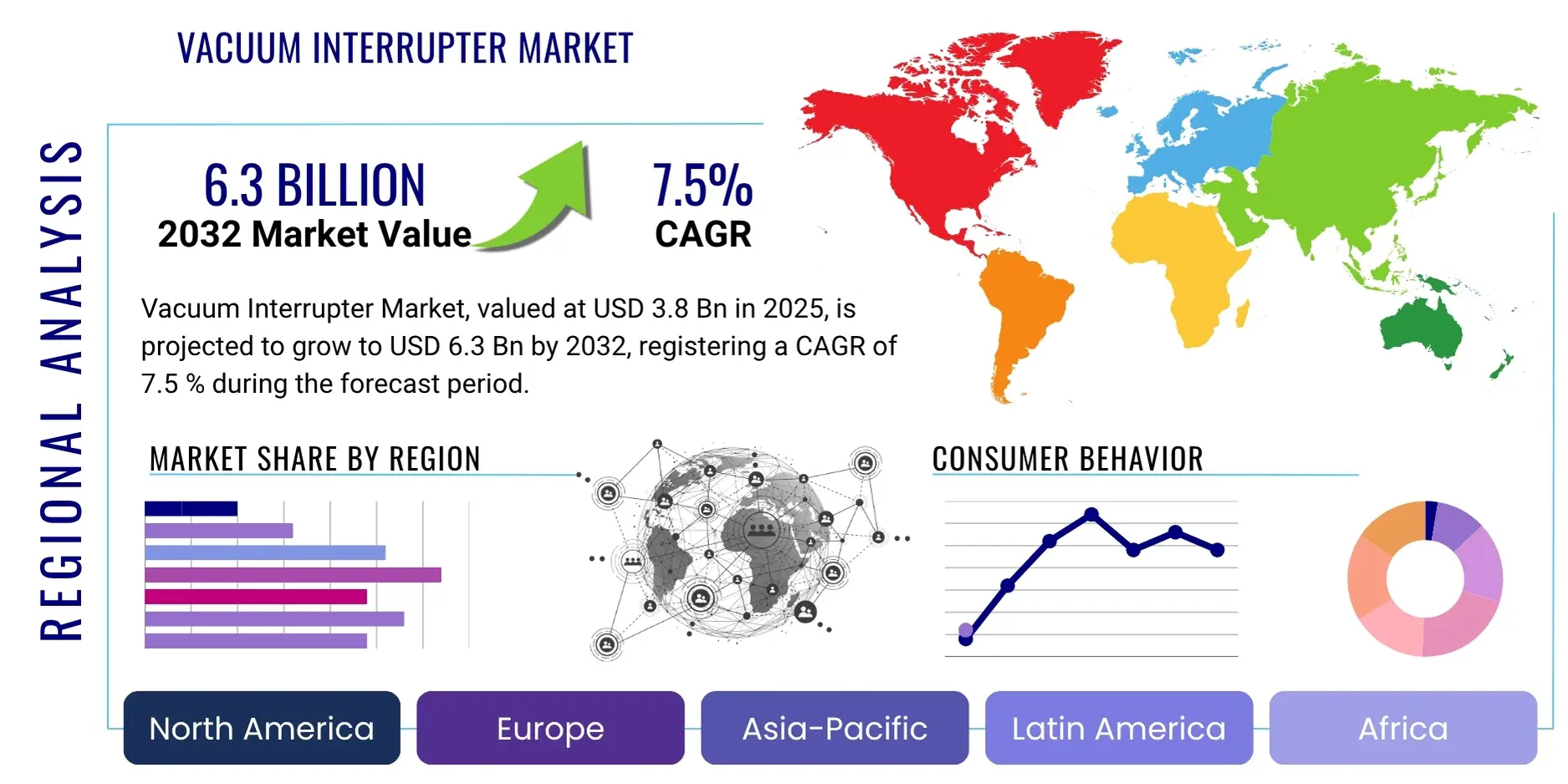

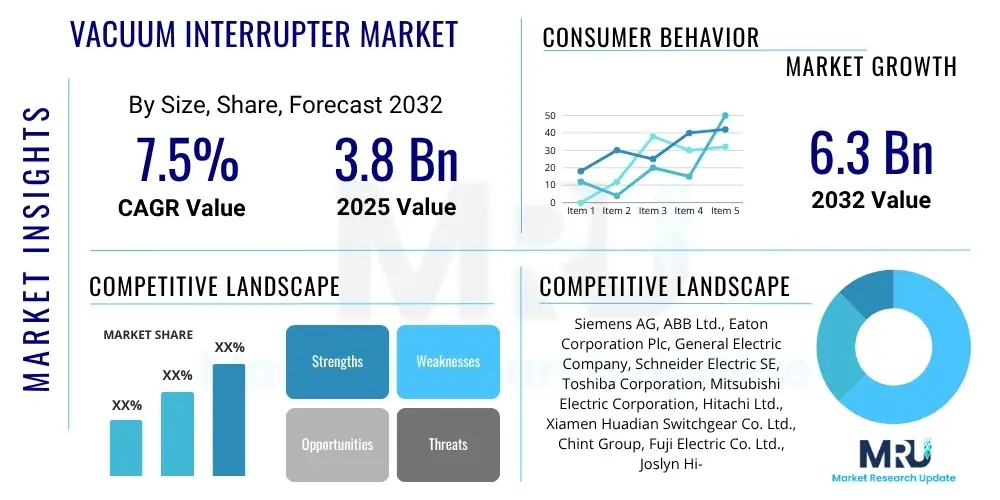

The Vacuum Interrupter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2032. The market is estimated at USD 3.8 Billion in 2025 and is projected to reach USD 6.3 Billion by the end of the forecast period in 2032.

Vacuum Interrupter Market introduction

The Vacuum Interrupter Market constitutes a pivotal and increasingly vital segment within the global electrical power infrastructure, critical for ensuring the secure, efficient, and reliable operation of diverse electrical systems across various voltage levels. Vacuum interrupters are sophisticated switching devices specifically engineered to extinguish electrical arcs with exceptional rapidity within a meticulously controlled high-vacuum environment. This unique arc-quenching mechanism is fundamental to interrupting current flow and safeguarding sensitive electrical equipment from the damaging effects of overcurrents and short circuits. Compared to traditional arc interruption technologies, vacuum interrupters offer profound advantages, including significantly enhanced safety for operators, a superior operational lifespan, drastically reduced maintenance requirements, and crucial environmental benefits due to the complete elimination of hazardous insulating gases such as sulfur hexafluoride (SF6), which is a potent greenhouse gas. Their inherent robustness, compact design, and unparalleled performance characteristics render them indispensable components in contemporary power grids, advanced industrial facilities, and a growing array of high-voltage and specialized electrical applications.

The core functionality of vacuum interrupters positions them as essential building blocks within various switchgear assemblies, particularly in circuit breakers, contactors, and reclosers. Each vacuum interrupter unit typically comprises a hermetically sealed ceramic or glass envelope that encases a set of fixed and moving electrical contacts within a meticulously maintained high-vacuum chamber. When these contacts separate during a fault or switching operation, the absence of air within the vacuum ensures that the electrical arc extinguishes almost instantaneously without the need for external arc-quenching media, preventing ionization and current flow. Their major applications are broad and critical, spanning across national and regional power transmission and distribution networks, where they are vital for maintaining grid stability, ensuring fault protection, and enabling smart grid functionalities. Furthermore, their extensive utilization in diverse industrial settings—ranging from large-scale manufacturing plants, intricate mining operations, and expansive data centers to process industries—serves to protect motors, transformers, generators, and other heavy electrical equipment from operational disturbances and potential damage. The accelerating global integration of distributed and utility-scale renewable energy sources, such as solar photovoltaic farms and wind power plants, further amplifies their demand, as vacuum interrupters are crucial for connecting, isolating, and protecting these variable power generation units reliably within the grid infrastructure.

The key benefits derived from the deployment of vacuum interrupters are multifaceted and contribute significantly to modern electrical system design and operation. These advantages include their inherently compact size, which allows for more space-efficient switchgear designs, high dielectric strength providing superior insulation capabilities, exceptionally fast interruption speed facilitating rapid fault clearance, and a minimal environmental footprint consistent with global sustainability initiatives. Collectively, these attributes translate into tangible economic and operational advantages for end-users, manifesting as lower operational costs due to reduced maintenance, substantially improved system reliability and uptime, and significantly enhanced safety protocols for personnel operating the electrical infrastructure. The driving factors propelling the growth of this market are numerous and powerful. These include the escalating global imperative for comprehensive grid modernization and the aggressive implementation of smart grid technologies that demand more intelligent and responsive switching devices. Concurrently, the burgeoning global electricity demand, spurred by industrial growth and urbanization, necessitates expanded and more resilient power networks. Moreover, substantial global investments in renewable energy infrastructure, coupled with the critical need for advanced and reliable power protection solutions in rapidly industrializing emerging economies, serve as powerful market accelerators. The ongoing need for replacement and upgrade of aging electrical infrastructure, particularly prevalent in developed regions, further fuels a consistent demand for efficient, environmentally sustainable, and technologically advanced vacuum interrupter components for next-generation electrical networks.

Vacuum Interrupter Market Executive Summary

The Vacuum Interrupter Market is strategically positioned for robust growth throughout the forecast period, primarily propelled by an accelerating global energy transition towards decarbonization and substantial, sustained investments in modernizing and expanding power infrastructure worldwide. Current business trends within the market underscore a pronounced emphasis on the development and integration of smart grid technologies, coupled with advanced digital solutions within associated switchgear. This integration aims to significantly enhance operational efficiency, enable sophisticated predictive maintenance capabilities for improved asset management, and facilitate real-time diagnostics of electrical systems. Manufacturers are increasingly channeling their research and development efforts towards engineering more compact, higher-performance vacuum interrupters that can effectively handle elevated voltage levels and endure more frequent switching cycles. This innovation directly addresses the dynamic and complex demands arising from the pervasive integration of intermittent renewable energy sources into the grid and the widespread adoption of industrial automation. The competitive landscape is intensely dynamic, characterized by continuous innovation in materials science, particularly in developing advanced contact alloys and ceramic envelopes, and refining manufacturing processes to achieve superior durability, efficiency, and cost-effectiveness. Furthermore, strategic collaborations, joint ventures, and mergers and acquisitions are frequently observed, as leading companies seek to broaden their product portfolios, expand their technological expertise, and extend their geographical footprint to capitalize on nascent market opportunities and consolidate their competitive positions.

From a regional perspective, the Asia Pacific region is anticipated to maintain its formidable dominance in the Vacuum Interrupter Market, driven by an unparalleled confluence of rapid urbanization, large-scale industrialization, and massive infrastructure development projects, especially prominent in economic powerhouses such like China, India, and various Southeast Asian nations. These countries are experiencing significant increases in electricity demand and investing heavily in expanding and upgrading their power grids. North America and Europe are projected to exhibit steady and consistent growth, primarily fueled by extensive grid modernization initiatives, the systematic replacement of their aging and legacy electrical infrastructure, and increasingly stringent environmental regulations that actively favor the adoption of vacuum technology over less sustainable SF6-based alternatives. Emerging markets in Latin America, the Middle East, and Africa are collectively demonstrating promising growth potential, buoyed by escalating investments in power generation, transmission, and distribution capacities aimed at fulfilling rapidly growing energy demands and supporting robust economic expansion. Each distinct region presents a unique set of market drivers, challenges, and opportunities, influenced by a complex interplay of local regulatory frameworks, the pace of technological adoption, specific economic growth trajectories, and geopolitical factors impacting infrastructure development.

Segment-wise, the medium-voltage applications segment is expected to continue holding the largest share of the market, reflecting its pervasive utilization in critical distribution networks, extensive industrial facilities, and commercial buildings globally. However, the high-voltage segment is distinctly projected to experience the most accelerated growth rate throughout the forecast period. This rapid expansion is primarily driven by the increasing deployment of long-distance transmission lines necessary for integrating remote renewable energy projects, the expansion of ultra-high voltage (UHV) grids, and the escalating demand for highly reliable power flow in large-scale energy infrastructure. Concurrently, within the end-use industry segmentation, the power transmission and distribution sector remains the unequivocally largest consumer of vacuum interrupters. Nevertheless, the renewable energy sector and the industrial automation segment are demonstrating exceptionally robust expansion, benefiting from global sustainability mandates and the relentless drive towards operational efficiency. The widespread emphasis on developing and implementing sustainable energy solutions, coupled with the continuous automation and digitalization of industrial processes, are critical overarching factors shaping these segment trends, leading to ongoing innovation and significant product differentiation across a myriad of applications within the evolving vacuum interrupter market ecosystem.

AI Impact Analysis on Vacuum Interrupter Market

User inquiries and market discourse concerning the impact of Artificial Intelligence (AI) on the Vacuum Interrupter Market predominantly revolve around its transformative potential in areas such as predictive maintenance, advanced fault detection, and optimizing overall grid operations. Users are intensely curious about how AI algorithms and machine learning models can significantly enhance the inherent reliability and extend the operational lifespan of vacuum interrupters, thereby drastically reducing unscheduled downtime and contributing to the development of a smarter, more resilient, and self-healing power grid. There is substantial interest in AI's capability to process and analyze vast quantities of real-time operational data streaming from sophisticated sensors embedded within modern switchgear—sensors monitoring parameters such as temperature, vibration, partial discharge, and contact wear. This analytical prowess enables early anomaly detection and facilitates proactive intervention before potential failures escalate. Expectations are high for AI-driven insights that will lead to dramatically improved asset management strategies, substantial reductions in operational and maintenance costs, and the eventual development of next-generation intelligent vacuum interrupter systems that can autonomously adapt to dynamic grid conditions and self-diagnose potential issues. While the potential benefits are clear, concerns often focus on the complexities of data security, the significant challenges associated with integrating AI solutions into existing legacy infrastructure, and the critical need for a workforce equipped with specialized skills to effectively manage and leverage these AI-augmented systems.

- AI-powered predictive maintenance models precisely forecast potential failures, drastically reducing unscheduled downtime and significantly extending the lifespan of vacuum interrupters by enabling proactive component replacement and maintenance scheduling.

- Enhanced fault detection and isolation capabilities, driven by AI, rapidly pinpoint and isolate grid anomalies, improving overall grid reliability, minimizing outages, and accelerating recovery times through automated responses.

- Optimization of switching operations using AI algorithms minimizes mechanical wear and electrical erosion on vacuum contacts, prolonging device life and improving energy efficiency by choosing optimal switching points.

- AI analytics facilitate sophisticated real-time performance monitoring of vacuum interrupters and associated switchgear, providing deep insights into operational parameters and enabling immediate detection of subtle deviations from normal behavior.

- Development of smart vacuum interrupters with integrated AI capabilities allows for autonomous decision-making in response to grid conditions, leading to more adaptive and resilient power distribution systems.

- Improved efficiency in resource allocation and spare parts management is achieved through AI-driven data analysis, optimizing inventory levels and ensuring critical components are available precisely when needed.

- Integration of advanced cybersecurity measures within connected vacuum interrupter systems is crucial, with AI playing a role in detecting and mitigating cyber threats to maintain grid integrity and data privacy.

- AI facilitates the analysis of historical fault data to identify patterns and root causes, leading to continuous improvements in vacuum interrupter design and operational strategies.

DRO & Impact Forces Of Vacuum Interrupter Market

The Vacuum Interrupter Market is intrinsically shaped by a dynamic interplay of compelling driving factors, persistent restrictive challenges, and expansive opportunities, all operating under the influence of various internal and external impact forces. Foremost among the key drivers is the global imperative for extensive grid modernization, particularly the widespread adoption and integration of advanced smart grid technologies that inherently demand more reliable, efficient, and intelligent switching solutions. The unprecedented rapid expansion of renewable energy generation capacity, encompassing utility-scale solar photovoltaic arrays and sprawling wind farms, necessitates exceptionally robust and high-performance interrupters for seamless connection, reliable protection, and efficient integration into national grids, thereby significantly boosting demand. Furthermore, accelerating industrialization and relentless urbanization trends across emerging economies worldwide translate into escalating electricity consumption and an urgent need for stable, resilient power infrastructure, acting as powerful and consistent market stimulants. Crucially, stringent environmental regulatory mandates, particularly those advocating for the phase-out of SF6 gas in switchgear due to its severe greenhouse gas potency, strongly favor the adoption of environmentally benign vacuum technology, compelling its widespread implementation across utility companies and diverse industrial sectors globally.

Conversely, several formidable restraints continue to impede the unbridled growth of the market. The high initial capital investment required for deploying modern vacuum switchgear, especially in regions with constrained budgetary resources or developing infrastructure, can represent a significant barrier to entry and adoption. The inherently complex and highly specialized manufacturing processes involved in producing consistently high-quality vacuum interrupters—requiring advanced material science, ultra-high vacuum technology, and precision engineering facilities—contribute substantially to elevated production costs and can potentially lead to limitations in the global supply chain. Intense price competition, exacerbated by the presence of numerous established manufacturers and an influx of new entrants, particularly from cost-competitive Asian markets, can exert significant downward pressure on profit margins across the value chain. Moreover, the remarkably long operational lifespan of existing traditional switchgear infrastructure means that asset replacement cycles can be considerably extended, thereby slowing down the natural adoption rate of newer, more advanced vacuum technologies in some legacy systems. Technical challenges associated with developing and implementing vacuum interrupters for ultra-high voltage (UHV) applications, while continuously being addressed through dedicated research and development, still present a notable technical barrier.

Despite these aforementioned restraints, the Vacuum Interrupter Market is replete with substantial and compelling opportunities for growth and innovation. The burgeoning global development of electric vehicle (EV) charging infrastructure, encompassing both public fast-charging networks and large-scale fleet charging depots, represents a new and rapidly expanding application area for vacuum interrupters, which are essential for protecting the high-power electrical circuits involved. Significant investments in smart city initiatives, aiming to create interconnected and efficient urban environments, and the exponential proliferation of hyperscale data centers, which demand exceptionally high reliability and continuous power distribution, further open novel and lucrative avenues for market expansion. Moreover, ongoing and continuous technological advancements in vacuum interrupter design, including innovative contact materials, advanced arc-quenching techniques, and refined manufacturing processes, consistently promise to enhance performance, reduce overall costs, and broaden their applicability across an even wider range of voltage levels and specific applications. The pervasive and ongoing replacement of outdated electrical infrastructure in many developed nations with more advanced, efficient, and sustainable solutions provides a stable and consistent demand base, while the greenfield development prospects in rapidly industrializing emerging economies offer substantial long-term growth potential for vacuum interrupter manufacturers.

A variety of significant impact forces continuously influence the dynamics and trajectory of the Vacuum Interrupter Market. The accelerating pace of technological innovation stands as a paramount force, constantly redefining product capabilities, pushing the boundaries of performance, and driving improvements in manufacturing efficiency. Shifting global and regional regulatory landscapes, particularly those pertaining to environmental protection, energy efficiency standards, and grid reliability benchmarks, directly influence market demand, dictate product specifications, and can either stimulate or constrain market growth. Global supply chain dynamics, encompassing the availability and pricing of critical raw materials (e.g., copper, chromium, specialized ceramics), geopolitical tensions impacting international trade routes, and the resilience of manufacturing networks, can profoundly affect production costs, delivery timelines, and market accessibility. Furthermore, macroeconomic factors such as overall economic stability, governmental policies related to infrastructure spending, and strategic investments in energy transition initiatives play a crucial role in shaping aggregate market demand and influencing investment patterns across the electrical equipment sector. The inherent competitive intensity within the broader electrical equipment sector further acts as a powerful driver for continuous innovation, aggressive pricing strategies, and strategic differentiation among market participants.

Segmentation Analysis

The Vacuum Interrupter Market is meticulously segmented across multiple dimensions to offer comprehensive and granular insights into its diverse applications, varied voltage requirements, and underlying technological variations. This detailed segmentation is instrumental in facilitating a deeper understanding of the intricate market dynamics, enabling the identification of specific high-growth areas, and empowering market stakeholders to formulate highly targeted and effective strategies for distinct product niches and geographical regions. The primary segmentation categories generally include classification by the inherent design type of the vacuum interrupter, such as axial magnetic field and radial magnetic field designs, which dictate the specific mechanisms employed for controlling and extinguishing the electrical arc during operation, thereby impacting performance characteristics. Further critical divisions are made by voltage level, encompassing low voltage (up to 1 kV), medium voltage (1 kV to 36 kV), and high voltage (above 36 kV), accurately reflecting the broad spectrum of applications across the entire power system infrastructure.

Beyond these foundational classifications, the market is also segmented by specific application areas, which include their integration into core products like circuit breakers, contactors, reclosers, and load break switches, each serving distinct protection, switching, and control functions within electrical networks. This segmentation highlights the functional diversity and versatility of vacuum interrupter technology across various types of electrical switchgear. Lastly, the segmentation by end-use industry provides a critical lens into the major consuming sectors. This category includes power transmission and distribution utilities (T&D), a broad industrial segment (comprising manufacturing, mining, oil & gas, and process industries), the burgeoning renewable energy sector (e.g., solar, wind, battery storage), the railway and transportation sector, and specialized applications such as data centers and IT infrastructure. Each of these segments presents unique demands and growth trajectories, driven by specific operational requirements, regulatory environments, and investment cycles, collectively painting a holistic picture of the market structure and underlying demand drivers.

- By Type:

- Axial Magnetic Field Vacuum Interrupters (AMF): Utilize an axial magnetic field to diffuse the arc uniformly over the contact surface, suitable for high short-circuit currents.

- Radial Magnetic Field Vacuum Interrupters (RMF): Employ a radial magnetic field to drive the arc circularly, typically for lower current ratings but still effective.

- By Voltage:

- Low Voltage (up to 1 kV): Primarily used in industrial motor control centers and low-voltage distribution panels.

- Medium Voltage (1 kV to 36 kV): Dominant segment, widely adopted in utility distribution networks, industrial facilities, and commercial building switchgear.

- High Voltage (above 36 kV): Growing segment for power transmission lines, utility substations, and large-scale renewable energy project connections.

- By Application:

- Circuit Breakers: Main application for fault current interruption in power systems.

- Contactors: Used for frequent switching of loads, such as large motors or capacitor banks.

- Load Break Switches: Designed to interrupt normal load currents, but not fault currents.

- Reclosers: Automatic circuit breakers for overhead distribution lines, restoring power after transient faults.

- Others (e.g., tap changers in transformers, capacitor banks, traction applications): Niche applications requiring specialized switching.

- By End-Use Industry:

- Power Transmission & Distribution (T&D): Utilities and grid operators for substations, feeders, and grid modernization.

- Industrial (Manufacturing, Mining, Oil & Gas, Chemicals): Protection of heavy machinery, motors, and process control systems.

- Renewable Energy (Solar, Wind, Hydro, Battery Storage): Integration and protection of generation and storage assets.

- Railway & Transportation: Traction power systems, railway substations, and high-speed rail networks.

- Data Centers & IT Infrastructure: Ensures uninterrupted power supply and protection for critical IT loads.

- Utilities: Broader utility applications beyond just T&D, including power generation plants.

Value Chain Analysis For Vacuum Interrupter Market

The comprehensive value chain for the Vacuum Interrupter Market encompasses a meticulously structured series of interconnected activities, commencing from the foundational sourcing and processing of specialized raw materials and extending seamlessly through to the final deployment by end-users, alongside crucial post-sales support and lifecycle management. An in-depth upstream analysis reveals critical dependencies on a specialized ecosystem of suppliers providing ultra-high purity ceramic or glass envelopes, which are essential for maintaining the vacuum integrity; high-grade copper and tungsten alloys for contact materials, optimized for arc resistance and electrical conductivity; and advanced metal alloys for the structural components and bellows that enable contact movement. The unwavering quality, consistent availability, and price stability of these highly specialized raw materials directly and significantly impact the overall performance, reliability, and cost-effectiveness of the final vacuum interrupter product. Concurrently, extensive research and development (R&D) activities, spanning sophisticated material science, advanced vacuum technology, and cutting-edge electrical engineering, form an absolutely crucial component of this upstream segment, continuously driving innovation to achieve enhanced product efficiency, superior breaking capacity, and prolonged durability, ensuring the market remains at the forefront of electrical protection technology.

Midstream activities primarily encompass the highly specialized manufacturing, assembly, and rigorous testing of the vacuum interrupters. This phase is often undertaken by dedicated vacuum interrupter component manufacturers who possess proprietary technologies and expertise. These sophisticated components are then supplied to Original Equipment Manufacturers (OEMs) and switchgear manufacturers globally. These manufacturers subsequently integrate the vacuum interrupters into complete and functional electrical products, such as sophisticated medium-voltage switchgear, high-voltage circuit breakers, automatic reclosers, and industrial contactors. The manufacturing process itself is characterized by extreme precision engineering, including advanced vacuum brazing techniques to ensure hermetic sealing, meticulous contact fabrication, and assembly within cleanroom environments to prevent contamination. Rigorous quality control protocols and extensive testing, encompassing dielectric withstand tests, mechanical endurance tests, and short-circuit interruption tests, are absolutely paramount at each stage to guarantee the unparalleled reliability, safety, and conformity of the final electrical equipment to international standards. The distribution channel then plays a vital role in effectively connecting these manufacturers with the diverse array of end-users across the globe. Direct distribution channels typically involve sales directly to large power utilities or major industrial clients through dedicated, technically proficient sales forces, offering bespoke solutions, project management, and specialized technical support for complex installations. Conversely, indirect channels leverage an expansive network of authorized distributors, wholesalers, system integrators, and electrical contractors who possess local market knowledge and reach a broader base of smaller industrial clients, commercial enterprises, and other OEMs, providing localized inventory, installation services, and essential after-sales support.

Downstream analysis meticulously focuses on the crucial phases of installation, operational deployment, and long-term maintenance of the vacuum interrupter-equipped switchgear and electrical apparatus. The primary end-users in this segment include major national and regional power utilities, a wide spectrum of industrial facilities (e.g., manufacturing, mining, petrochemicals), large commercial establishments, and developers of renewable energy projects. Post-sales services, which are critical for customer satisfaction and product longevity, encompass comprehensive technical support, efficient supply of spare parts, regular preventative maintenance contracts, and specialized training programs, all designed to ensure the sustained long-term performance, reliability, and safety of the installed base throughout its operational life. Furthermore, the feedback loop originating from these end-users—reporting on real-world performance metrics, observed failure modes, emerging functional requirements, and desired technological improvements—serves as an invaluable input that often directly informs and drives upstream R&D initiatives. This iterative and dynamic flow of information and products across the entire value chain ensures continuous improvement, fosters innovation, and directly influences the market's overall sustainability, competitiveness, and responsiveness to evolving industry demands. The efficiency and interconnectedness of this entire chain, from the responsible sourcing of raw materials to effective end-of-life considerations, are paramount for the vacuum interrupter market's continued success.

Vacuum Interrupter Market Potential Customers

The demographic of potential customers for vacuum interrupters is exceptionally broad and diverse, spanning across virtually every sector that maintains a critical reliance on robust, efficient, and highly reliable electrical power management, distribution, and protection systems. The single largest and most significant segment of buyers comprises governmental and privately-owned power transmission and distribution utilities across the globe. These entities utilize vacuum interrupters extensively within their complex substation architectures, across extensive feeder lines, and in myriad grid modernization and expansion projects, all with the paramount objective of ensuring a stable, uninterrupted, and reliable supply of electricity to consumers and industries alike. Alongside utilities, a vast array of industrial end-users forms another substantial and growing customer base. This industrial segment includes large-scale manufacturing plants, intensive mining operations, critical oil and gas facilities, sophisticated chemical processing units, and high-tech semiconductor fabrication plants. These industries require unparalleled circuit protection for their heavy machinery, large motors, transformers, and other critical infrastructure to prevent costly operational downtime, protect valuable assets, and ensure the utmost safety for personnel and processes, where even momentary power interruptions can have severe financial and safety repercussions.

Beyond these traditional industrial and utility sectors, the burgeoning global renewable energy industry represents an increasingly vital and rapidly expanding customer segment. This includes developers and operators of utility-scale solar power plants, vast onshore and offshore wind farms, hydroelectric facilities, and advanced battery energy storage systems. Vacuum interrupters are absolutely essential for seamlessly connecting these often-intermittent and variable generation sources to the main grid, as well as for protecting their intricate electrical components from faults and ensuring stable power output. Furthermore, the extensive railway and public transportation sector constitutes a significant user base, employing vacuum interrupters in critical traction power systems, railway substations, and high-speed rail networks to manage vast amounts of electrical power and ensure operational safety. The escalating demand for exceptionally high reliability and continuous, uninterrupted power supply in the rapidly proliferating data centers and mission-critical IT infrastructure also positions these facilities as crucial and growing end-users. Lastly, original equipment manufacturers (OEMs) who design and integrate vacuum interrupters as core components i

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 3.8 Billion |

| Market Forecast in 2032 | USD 6.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, ABB Ltd., Eaton Corporation Plc, General Electric Company, Schneider Electric SE, Toshiba Corporation, Mitsubishi Electric Corporation, Hitachi Ltd., Xiamen Huadian Switchgear Co. Ltd., Chint Group, Fuji Electric Co. Ltd., Joslyn Hi-Voltage, Tavrida Electric Group, Wuhan Huachen Vacuum Electric Co., Ltd., Actom (Pty) Ltd., CG Power and Industrial Solutions Limited, Myers Power Products, Inc., Mersen Corporate, Meidensha Corporation, Powell Industries, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vacuum Interrupter Market Key Technology Landscape

The technology landscape of the Vacuum Interrupter Market is in a state of continuous evolution, driven by relentless innovation aimed at significantly enhancing performance characteristics, bolstering intrinsic reliability, and ensuring greater environmental sustainability across the entire product lifecycle. A foundational and core technological aspect is the sophisticated design of the vacuum interrupter bottle itself, which incorporates ongoing advancements in contact materials. These include specialized copper-chromium (CuCr) alloys, often augmented with proprietary additives, meticulously engineered to optimize arc quenching capabilities, minimize contact erosion during repeated operations, and substantially extend the overall operational lifespan of the device. Parallel developments in contact geometry, such as the widely adopted axial magnetic field (AMF) and radial magnetic field (RMF) designs, are absolutely crucial for effectively controlling and diffusing the electric arc during the interruption process. These designs improve the breaking capacity, reduce the energy dissipated during arcing, and minimize contact bounce, all of which contribute to superior performance and longevity. Furthermore, the ceramic or glass envelope materials encapsulating the vacuum chamber are under continuous refinement, focusing on achieving higher dielectric strength, superior mechanical robustness, and thermal stability to reliably withstand increasingly demanding operating conditions across a broader temperature range and vibration profiles.

Beyond the fundamental interrupter design and material science, the market is profoundly shaped by the adoption of advanced manufacturing techniques and precision engineering processes. These include ultra-high vacuum processing protocols, which are critical for achieving and maintaining the extreme vacuum levels required for optimal arc quenching, and sophisticated precision brazing techniques that ensure the hermetic sealing and structural integrity of the vacuum chamber, preventing contamination and leakage over decades of operation. Innovations in actuation mechanisms, encompassing both highly responsive magnetic actuators and robust spring-operated systems, are equally vital for achieving exceptionally rapid and consistent contact separation and closure times, which are paramount for fast fault clearance and reliable switching. Moreover, a transformative trend involves the pervasive integration of intelligent sensors and advanced digital communication interfaces directly within vacuum interrupter-equipped switchgear. These "smart" technologies enable granular real-time monitoring of critical operational parameters (e.g., contact wear, temperature, pressure), advanced diagnostic capabilities, and sophisticated predictive maintenance algorithms. This integration fundamentally transforms asset management, allowing for proactive intervention and alignment with the broader strategic objectives of smart grid development, Industry 4.0 initiatives, and the increasing demand for data-driven operational intelligence. Ongoing research into novel insulating materials, composite structures, and advancements towards DC vacuum interrupters for future high-voltage direct current (HVDC) applications further contributes to making vacuum interrupters more compact, energy-efficient, and cost-effective across an ever-expanding array of voltage applications and challenging environments.

Regional Highlights

- Asia Pacific: This region stands as the undisputed leader in the Vacuum Interrupter Market, propelled by an unprecedented pace of industrialization, rapid urbanization, and monumental investments in power infrastructure expansion. Countries like China and India are at the forefront, driving massive projects in power generation, transmission, and distribution, fueled by escalating electricity demand and government initiatives to modernize grids. The region's focus on renewable energy integration and smart grid adoption further cements its dominant position and growth trajectory.

- North America: Experiencing consistent and substantial growth, North America's market is primarily driven by extensive grid modernization programs aimed at enhancing reliability and resilience. The region is heavily investing in integrating large-scale renewable energy sources and systematically replacing its aging electrical infrastructure. Stringent reliability standards, a strong emphasis on advanced power management solutions, and the integration of digital technologies into switchgear contribute significantly to market expansion.

- Europe: The European market is characterized by robust growth, largely influenced by some of the world's most stringent environmental regulations, particularly those promoting the phase-out of SF6 gas from switchgear. This regulatory push has led to a high adoption rate of vacuum interrupter technology as a sustainable alternative. Market growth is further sustained by significant investments in smart grid technologies, ambitious offshore wind projects, and the strengthening of cross-border grid interconnections, aiming for a more integrated and resilient European energy network.

- Latin America: As an emerging market, Latin America presents promising growth prospects driven by increasing investments in power infrastructure and new energy projects designed to address its growing energy demand and support economic development. Urbanization trends and the need for reliable electrical protection in expanding industrial sectors across countries like Brazil and Mexico are key factors stimulating market uptake.

- Middle East & Africa (MEA): This region demonstrates significant growth potential, fueled by substantial investments in critical oil & gas infrastructure, rapid urbanization across key cities, and highly ambitious renewable energy projects, particularly in solar power. Demand for vacuum interrupters is notably boosted by ongoing large-scale power grid expansion initiatives and robust industrial development across economically significant nations such as Saudi Arabia, the UAE, and South Africa, all striving for enhanced energy security and diversified power generation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vacuum Interrupter Market.- Siemens AG

- ABB Ltd.

- Eaton Corporation Plc

- General Electric Company

- Schneider Electric SE

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Hitachi Ltd.

- Xiamen Huadian Switchgear Co. Ltd.

- Chint Group

- Fuji Electric Co. Ltd.

- Joslyn Hi-Voltage

- Tavrida Electric Group

- Wuhan Huachen Vacuum Electric Co., Ltd.

- Actom (Pty) Ltd.

- CG Power and Industrial Solutions Limited

- Myers Power Products, Inc.

- Mersen Corporate

- Meidensha Corporation

- Powell Industries, Inc.

Frequently Asked Questions

What is a vacuum interrupter and what is its primary function in electrical systems?

A vacuum interrupter is a highly efficient electrical switchgear component designed to interrupt current flow by rapidly extinguishing electrical arcs in a high-vacuum environment. Its primary function is to protect electrical systems, equipment, and personnel from damage caused by overcurrents, short circuits, and other faults, ensuring stable and safe power distribution and transmission.

What are the key advantages of using vacuum interrupters compared to older arc-quenching technologies?

Vacuum interrupters offer significant advantages over traditional technologies (like oil or SF6 gas), including superior safety, extended operational lifespan, minimal maintenance requirements, and environmental friendliness due to the absence of harmful gases. They also provide faster interruption speeds, higher reliability, and a more compact design, leading to lower total cost of ownership.

Which industries and applications are the largest consumers of vacuum interrupters globally?

The power transmission and distribution (T&D) sector is the largest consumer, utilizing vacuum interrupters in substations and grid modernization. Other major applications include industrial facilities (manufacturing, mining), renewable energy installations (solar, wind farms), railway systems, and data centers, all requiring reliable power protection and switching solutions.

How is technological advancement, particularly AI, influencing the Vacuum Interrupter Market?

Technological advancements, especially AI and smart sensors, are profoundly influencing the market by enabling predictive maintenance, real-time performance monitoring, and enhanced fault detection. AI algorithms analyze operational data to anticipate failures, optimize switching cycles, and improve grid resilience, leading to more intelligent and reliable vacuum interrupter systems.

What are the main drivers and restraints impacting the growth of the Vacuum Interrupter Market?

Key drivers include global grid modernization, increasing renewable energy integration, and stringent environmental regulations favoring SF6-free solutions. Restraints encompass high initial investment costs, complex manufacturing processes, and intense price competition. Opportunities lie in EV charging infrastructure expansion and smart city development.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager