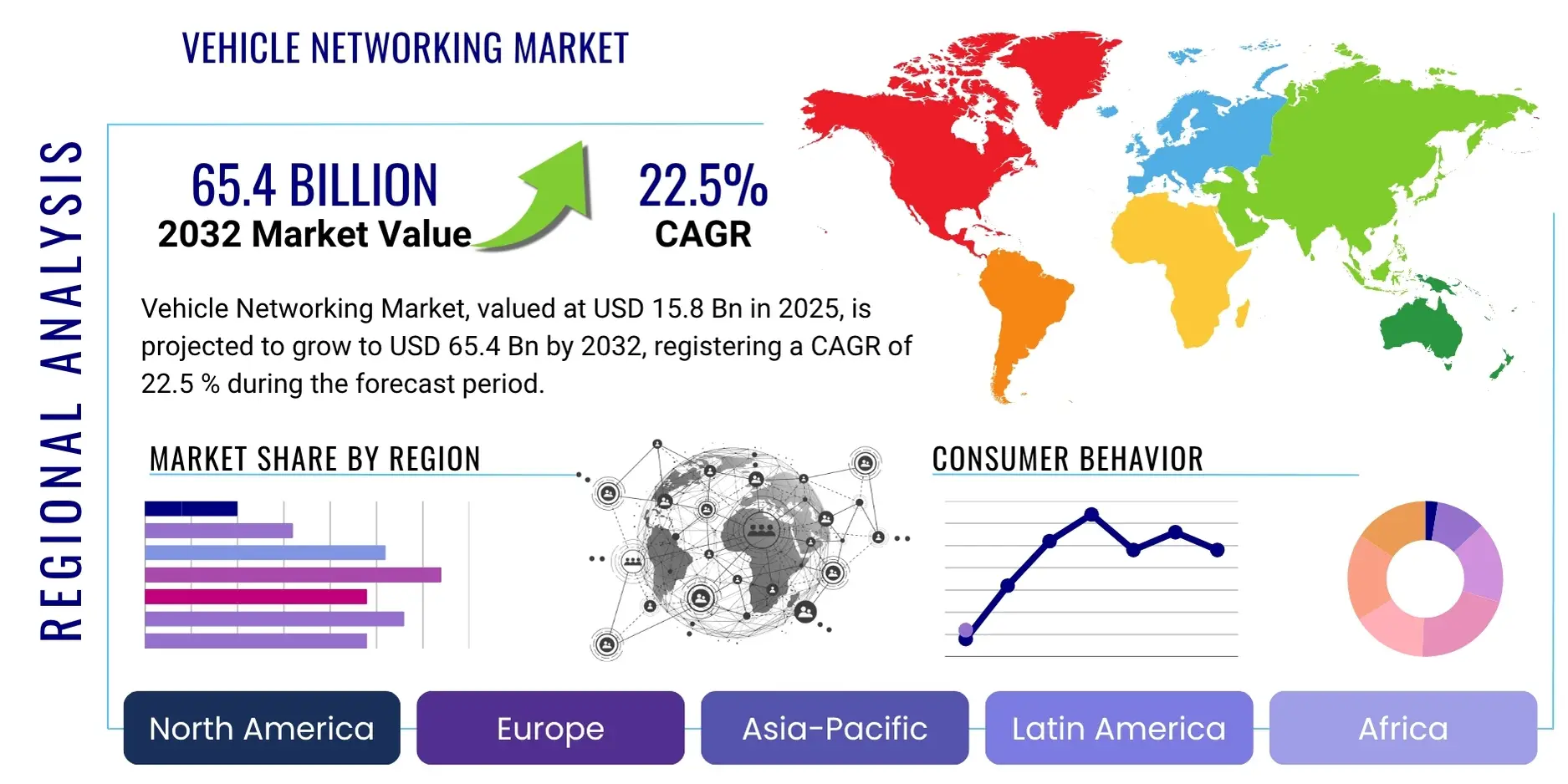

Vehicle Networking Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428249 | Date : Oct, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Vehicle Networking Market Size

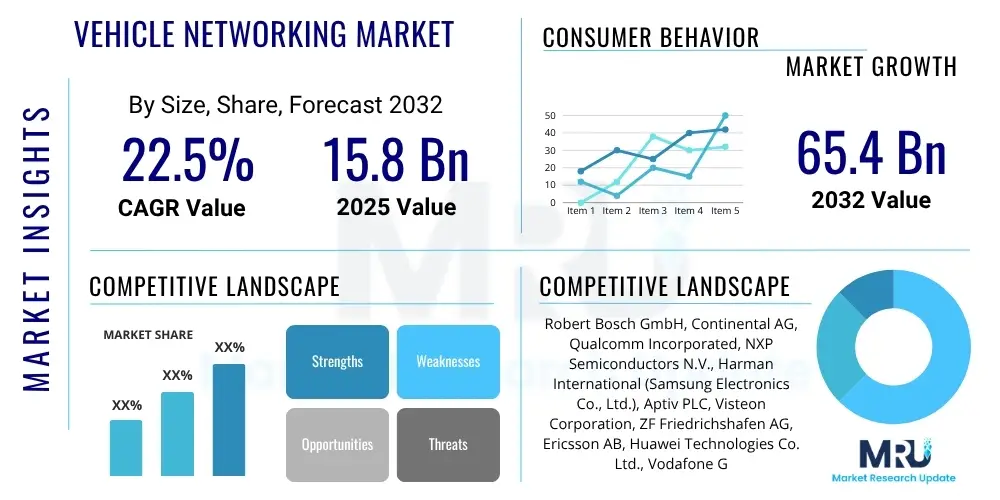

The Vehicle Networking Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.5% between 2025 and 2032. The market is estimated at USD 15.8 billion in 2025 and is projected to reach USD 65.4 billion by the end of the forecast period in 2032.

Vehicle Networking Market introduction

Vehicle networking refers to the intricate communication systems that enable vehicles to connect with other vehicles (V2V), infrastructure (V2I), pedestrians (V2P), network (V2N), and the cloud (V2C), collectively known as V2X communication. This complex ecosystem facilitates the exchange of critical data, enhancing various aspects of automotive functionality from safety and efficiency to convenience and entertainment. The core technologies underpinning vehicle networking include high-speed automotive Ethernet, CAN bus, FlexRay, and wireless technologies such as 4G/5G, Wi-Fi, and Bluetooth, forming a robust communication backbone within and outside the vehicle.

Major applications of vehicle networking span across several domains. In the realm of safety, it supports Advanced Driver-Assistance Systems (ADAS) like collision avoidance, automatic emergency braking, and lane-keeping assist, eventually paving the way for fully autonomous driving capabilities. For convenience and entertainment, it powers sophisticated infotainment systems, real-time navigation, remote diagnostics, and over-the-air (OTA) updates, transforming the in-car experience. Furthermore, vehicle networking is crucial for fleet management, smart city integration, and optimizing traffic flow by providing real-time data on road conditions and vehicle positions.

The benefits derived from advanced vehicle networking are substantial, including significantly improved road safety through reduced accidents, enhanced traffic management leading to decreased congestion and fuel consumption, and a more personalized and engaging user experience for occupants. Key driving factors propelling market growth include the escalating demand for connected car features, stringent government regulations mandating advanced safety systems, rapid advancements in autonomous driving technology, the proliferation of electric vehicles, and the continuous evolution of 5G infrastructure. These elements collectively foster an environment ripe for innovation and widespread adoption of networked vehicle solutions globally.

Vehicle Networking Market Executive Summary

The global Vehicle Networking Market is experiencing dynamic shifts, driven by transformative business trends, evolving regional landscapes, and rapid advancements across key segments. A prominent business trend is the increasing convergence of automotive manufacturers with technology and telecommunication companies, fostering collaborative innovation in software-defined vehicles and robust connectivity solutions. There is a strong focus on cybersecurity integration from the design phase, addressing the inherent vulnerabilities of highly connected systems. Furthermore, the market is witnessing a move towards subscription-based services and data monetization models, unlocking new revenue streams for OEMs and service providers. This strategic realignment is essential for navigating the complex interplay between hardware, software, and services in the connected car ecosystem.

Regionally, Asia Pacific continues to dominate the market, primarily fueled by rapid economic growth, burgeoning automotive production in countries like China, Japan, and South Korea, and strong government support for smart transportation initiatives and 5G deployment. Europe and North America are also exhibiting significant growth, characterized by stringent regulatory mandates for vehicle safety and emissions, high consumer demand for advanced driver-assistance systems, and substantial investments in autonomous vehicle research and development. Emerging markets in Latin America and the Middle East & Africa are gradually adopting vehicle networking solutions, driven by increasing urbanization and the desire for modern transportation infrastructure, though adoption rates are varied and often dependent on localized technological readiness and economic factors.

Segment-wise, the market is primarily propelled by the burgeoning demand for telematics and infotainment applications, which enhance both vehicle management and passenger experience. The Advanced Driver-Assistance Systems (ADAS) and autonomous driving segment is poised for exponential growth, with networking serving as the critical enabler for real-time sensor data processing, decision-making, and communication among autonomous vehicles. Innovations in high-bandwidth automotive Ethernet and low-latency 5G connectivity are particularly crucial for these segments. The integration of vehicle networking into powertrain and chassis control systems is also gaining traction, optimizing vehicle performance and fuel efficiency, while enhancing overall vehicular safety and control through sophisticated data exchange.

AI Impact Analysis on Vehicle Networking Market

Artificial Intelligence (AI) is fundamentally transforming the Vehicle Networking Market by addressing critical challenges and unlocking new capabilities, particularly concerning data processing, autonomous decision-making, and user experience. Common questions users often pose relate to how AI enhances autonomous driving safety, the implications for cybersecurity in a connected car, how AI can optimize traffic flow and vehicle efficiency, and the potential for personalized in-car experiences. There is also considerable interest in the ethical considerations surrounding AI in autonomous systems and its role in predictive maintenance to reduce vehicle downtime. Users expect AI to move beyond basic automation, enabling truly intelligent and adaptive vehicle behaviors, while also demanding robust solutions to safeguard privacy and security in a data-rich environment.

The key themes emerging from user expectations center on AI's ability to interpret vast amounts of real-time sensor data from cameras, lidar, and radar, making instantaneous and accurate decisions crucial for autonomous navigation. Concerns frequently revolve around the reliability of AI algorithms in unforeseen scenarios, the potential for adversarial attacks on AI systems within vehicle networks, and the transparency of AI decision-making processes. Furthermore, users anticipate AI-driven personalization that adapts to individual preferences, from climate control and entertainment to driving style. The overarching expectation is for AI to deliver safer, more efficient, and highly intuitive mobility solutions, mitigating human error and maximizing operational effectiveness within complex networked environments.

- Enhanced Autonomous Driving: AI processes vast sensor data for real-time perception, decision-making, and path planning, enabling safer and more reliable autonomous functions.

- Predictive Maintenance: AI algorithms analyze vehicle performance data to predict potential component failures, optimizing maintenance schedules and reducing downtime.

- Optimized Traffic Flow: AI-powered V2X communication enables vehicles to share real-time traffic information, allowing for dynamic route optimization and reduced congestion.

- Personalized User Experience: AI learns driver and passenger preferences, customizing infotainment, climate control, seating, and driving profiles for enhanced comfort and convenience.

- Advanced Cybersecurity: AI-driven intrusion detection systems monitor network traffic for anomalies, identifying and neutralizing cyber threats in real time.

- Natural Language Processing (NLP): AI enables intuitive voice control for vehicle functions, navigation, and infotainment, improving human-machine interaction.

- Edge Computing Optimization: AI algorithms running on edge devices in vehicles enable faster data processing locally, reducing latency for critical functions.

DRO & Impact Forces Of Vehicle Networking Market

The Vehicle Networking Market is shaped by a confluence of Drivers, Restraints, and Opportunities, along with significant Impact Forces that dictate its trajectory. A primary driver is the accelerating demand for advanced connectivity features in modern vehicles, propelled by consumer expectations for seamless digital experiences, safety enhancements, and efficient mobility solutions. The rapid progress in autonomous driving technologies inherently relies on robust vehicle networking for real-time data exchange and collaborative decision-making, further fueling market expansion. Regulatory mandates for enhanced vehicle safety, such as eCall systems and upcoming requirements for V2X communication, also serve as powerful catalysts. Moreover, the global shift towards electric vehicles necessitates sophisticated networking for battery management, charging infrastructure communication, and range optimization.

Conversely, several restraints impede the market's full potential. Cybersecurity concerns represent a formidable challenge, as connected vehicles become attractive targets for malicious attacks, demanding continuous innovation in protective measures. The high initial development and implementation costs for advanced networking hardware and software can be a barrier for some manufacturers and consumers. Furthermore, the lack of universally accepted standardization across diverse technologies and communication protocols creates integration complexities and interoperability issues. Data privacy concerns, particularly regarding the collection and utilization of vast amounts of personal and vehicular data, also pose significant ethical and regulatory hurdles that require careful navigation to build consumer trust.

Despite these challenges, substantial opportunities exist for growth and innovation. The widespread rollout of 5G infrastructure is set to revolutionize vehicle networking by providing ultra-low latency and high-bandwidth capabilities, critical for V2X communication and autonomous driving. The emergence of software-defined vehicles (SDVs) opens new avenues for flexible, upgradable, and personalized automotive functionalities, driving demand for advanced networking architectures. New business models centered around connected services, data monetization, and mobility-as-a-service (MaaS) are poised to unlock significant value. Moreover, the increasing integration of vehicles into smart city ecosystems offers opportunities for optimizing urban mobility and resource management. The impact forces influencing the market are primarily technological advancements, rapidly evolving regulatory landscapes, shifting consumer preferences towards digitally integrated lifestyles, global economic conditions affecting automotive sales, and intense competitive pressures among established players and new entrants.

Segmentation Analysis

The Vehicle Networking Market is comprehensively segmented across various dimensions to provide a detailed understanding of its complex landscape and growth drivers. These segmentations allow for a granular analysis of market dynamics, identifying key areas of investment, innovation, and competitive advantage. Understanding the market through these lenses is crucial for stakeholders to tailor their strategies, develop targeted products, and address the specific needs of different end-users and applications, thereby maximizing market penetration and revenue growth.

- By Component:

- Hardware: Processors, Sensors, Communication Modules, Antennas, Cables & Connectors

- Software: Operating Systems, Middleware, Application Software, Cybersecurity Software

- By Connectivity:

- Wireless: 4G/LTE, 5G, Wi-Fi, Bluetooth, NFC, Satellite

- Wired: Ethernet, CAN, FlexRay, LIN, MOST

- By Application:

- Telematics: eCall, BCall, Roadside Assistance, Navigation, Remote Diagnostics, Stolen Vehicle Tracking, Fleet Management

- Infotainment: Content Streaming, Human-Machine Interface (HMI), In-vehicle Wi-Fi Hotspot, App Integration

- Advanced Driver-Assistance Systems (ADAS) & Autonomous Driving: Adaptive Cruise Control, Lane Keeping Assist, Automatic Emergency Braking, Parking Assist, Traffic Jam Assist, Driver Monitoring

- Powertrain & Chassis Control: Engine Management, Transmission Control, Suspension Control, Braking Systems

- Body & Comfort Electronics: Climate Control, Lighting, Door & Window Control, Seat Adjustment

- By Vehicle Type:

- Passenger Cars: Sedans, SUVs, Hatchbacks, Luxury Vehicles, Electric Passenger Vehicles

- Commercial Vehicles: Trucks, Buses, Vans, Light Commercial Vehicles, Electric Commercial Vehicles

- Off-Highway Vehicles, Recreational Vehicles (RVs)

Value Chain Analysis For Vehicle Networking Market

A comprehensive value chain analysis for the Vehicle Networking Market elucidates the intricate journey of components, software, and services from their inception to final consumption, highlighting critical stakeholders at each stage. The upstream segment of the value chain is dominated by semiconductor manufacturers, who supply the essential microcontrollers, processors, and communication chips that form the brain of vehicle networking systems. These are complemented by sensor providers, offering a vast array of sensors (radar, lidar, camera, ultrasonic) crucial for data acquisition in ADAS and autonomous driving. Additionally, specialized software developers contribute foundational operating systems, middleware, and cybersecurity solutions, forming the intelligent layer of the networking architecture. Collaboration and strategic partnerships at this stage are paramount for integrating diverse technologies and ensuring interoperability.

Moving downstream, the value chain involves Tier 1 automotive suppliers who integrate these upstream components and software into modular systems, such as communication control units, infotainment platforms, and ADAS modules, supplying them to vehicle manufacturers. Automotive Original Equipment Manufacturers (OEMs) then integrate these complex networking systems into their vehicles, often customizing software and developing proprietary user interfaces. Beyond manufacturing, telecommunication service providers play a pivotal role, offering the network infrastructure (4G, 5G) necessary for V2X communication and connected services. Data analytics companies also emerge as significant players, extracting valuable insights from the vast data generated by networked vehicles, which can be used for various applications from predictive maintenance to urban planning.

The distribution channels for vehicle networking solutions are multifaceted, primarily involving direct sales and integration by OEMs into new vehicles at the point of manufacture. This direct approach ensures seamless integration and compatibility. Indirect channels include aftermarket service providers who offer upgrades or additional connected features, and specialized telematics providers who cater to fleet operators. The interplay between these direct and indirect channels is evolving, with software-defined vehicles enabling new business models where features can be activated or subscribed to post-purchase, blurring the traditional lines of distribution. Effective collaboration across the entire value chain, from chip designers to end-service providers, is essential for accelerating innovation, reducing costs, and ensuring a robust and secure vehicle networking ecosystem.

Vehicle Networking Market Potential Customers

The Vehicle Networking Market caters to a diverse range of potential customers and end-users, each with distinct needs and motivations for adopting these advanced technologies. Automotive Original Equipment Manufacturers (OEMs) stand as the primary customers, integrating vehicle networking solutions into their new vehicle models to meet consumer demand for connectivity, enhance safety features, and enable autonomous capabilities. They are driven by the need to differentiate their products in a competitive market, comply with evolving regulatory standards, and lay the groundwork for future mobility services. Tier 1 suppliers also represent a significant customer segment, as they procure networking components and software to develop integrated modules for OEMs, acting as crucial intermediaries in the automotive supply chain.

Beyond traditional automotive manufacturing, fleet operators, including logistics companies, ride-sharing services, and public transportation agencies, are increasingly adopting vehicle networking to optimize their operations. For these customers, real-time vehicle tracking, remote diagnostics, predictive maintenance, and efficient route planning are critical for reducing operational costs, improving service delivery, and enhancing overall fleet safety and security. The ability to monitor vehicle health and driver behavior remotely offers substantial economic and logistical advantages, making connected solutions indispensable for modern fleet management.

Furthermore, government bodies and municipal authorities are emerging as key customers, particularly in the context of smart city initiatives. They leverage vehicle networking data and V2X communication to manage traffic flow, enhance public safety, optimize emergency response, and develop intelligent transportation systems. Telecommunication companies and internet service providers also play a dual role, acting both as suppliers of network infrastructure and as potential customers for solutions that enhance their service offerings or enable new data-driven services. Lastly, individual vehicle owners are the ultimate beneficiaries and indirect customers, whose increasing demand for safer, more connected, and convenient driving experiences directly drives the adoption of vehicle networking technologies by all other stakeholders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.8 Billion |

| Market Forecast in 2032 | USD 65.4 Billion |

| Growth Rate | 22.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Qualcomm Incorporated, NXP Semiconductors N.V., Harman International (Samsung Electronics Co., Ltd.), Aptiv PLC, Visteon Corporation, ZF Friedrichshafen AG, Ericsson AB, Huawei Technologies Co. Ltd., Vodafone Group Plc, Verizon Communications Inc., AT&T Inc., Intel Corporation, NVIDIA Corporation, Marvell Technology Inc., Renesas Electronics Corporation, STMicroelectronics N.V., Panasonic Corporation, Denso Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicle Networking Market Key Technology Landscape

The technological landscape of the Vehicle Networking Market is characterized by a blend of established in-vehicle communication protocols and cutting-edge wireless connectivity solutions, all aimed at fostering a highly integrated and intelligent mobility ecosystem. Traditional wired technologies like the Controller Area Network (CAN) bus remain foundational for robust, real-time communication between electronic control units (ECUs) within a vehicle, supporting critical functions such as engine management and braking. However, with the increasing data demands of ADAS and infotainment systems, high-bandwidth solutions such as Automotive Ethernet and FlexRay are gaining prominence, enabling faster and more complex data transfer within the vehicle architecture. These wired networks provide the low-latency and reliability required for safety-critical applications, forming the backbone of the in-vehicle network.

In parallel, wireless communication technologies are rapidly evolving to connect vehicles with the outside world. The rollout of 5G cellular networks is a significant game-changer, offering ultra-low latency, massive connectivity, and high bandwidth essential for real-time V2X communication, cloud-based services, and complex autonomous driving data exchange. Alongside 5G, Wi-Fi and Bluetooth continue to serve localized connectivity needs for infotainment, device pairing, and short-range vehicle-to-device (V2D) interactions. Dedicated Short Range Communication (DSRC) and Cellular V2X (C-V2X) are crucial for direct V2V, V2I, and V2P communication, enabling immediate safety warnings and cooperative driving scenarios without relying on cellular towers, though C-V2X is increasingly favored for its broader capabilities and integration with 5G.

Beyond connectivity, several other technologies are integral to the vehicle networking ecosystem. Over-the-Air (OTA) update capabilities allow manufacturers to remotely update vehicle software, introducing new features, fixing bugs, and improving performance throughout the vehicle's lifecycle. Cloud connectivity and edge computing are vital for processing, storing, and analyzing the massive amounts of data generated by networked vehicles, enabling applications like predictive maintenance, personalized services, and traffic optimization. Robust cybersecurity protocols and encryption techniques are non-negotiable, protecting vehicle networks from unauthorized access and malicious attacks. Furthermore, advancements in sensor technology (radar, lidar, cameras) and artificial intelligence (AI) are inextricably linked to vehicle networking, as these enable data collection and intelligent processing, making the entire system smarter and more responsive.

Regional Highlights

- North America: This region stands out for its early adoption of advanced automotive technologies and significant investment in autonomous driving research and development. Strong consumer demand for connected car features, coupled with government initiatives promoting vehicle safety and intelligent transportation systems, propels market growth. The presence of major tech companies and automotive OEMs fosters innovation in telematics, ADAS, and cloud-connected services.

- Europe: Europe is characterized by stringent safety and environmental regulations, driving the integration of vehicle networking for features like eCall emergency services and efficient powertrain management. A robust automotive manufacturing base and ongoing trials for V2X communication, particularly in Germany and the Nordic countries, contribute significantly to market expansion. Emphasis on data privacy and cybersecurity also shapes regional developments.

- Asia Pacific (APAC): The APAC region holds the largest market share, driven by high automotive production volumes, rapid urbanization, and escalating consumer demand for connectivity, especially in countries like China, Japan, and South Korea. Strong government support for 5G deployment, smart city initiatives, and autonomous vehicle pilots in these nations accelerate the adoption of advanced vehicle networking solutions. India and Southeast Asian countries are also emerging as key growth markets.

- Latin America: The market in Latin America is in an earlier stage of development but is experiencing steady growth due to increasing new vehicle sales, expanding smartphone penetration, and a rising interest in connected car services. Regulatory frameworks are gradually evolving to support telematics and safety features, with countries like Brazil and Mexico leading the adoption curve for vehicle networking solutions.

- Middle East and Africa (MEA): This region is witnessing nascent but promising growth, primarily driven by smart city projects in the UAE and Saudi Arabia, alongside increasing demand for commercial vehicle fleet management solutions. Investment in modern infrastructure and a growing affluent population are fostering the adoption of advanced automotive technologies, though challenges related to regulatory harmonization and infrastructure development persist.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicle Networking Market.- Robert Bosch GmbH

- Continental AG

- Qualcomm Incorporated

- NXP Semiconductors N.V.

- Harman International (Samsung Electronics Co., Ltd.)

- Aptiv PLC

- Visteon Corporation

- ZF Friedrichshafen AG

- Ericsson AB

- Huawei Technologies Co. Ltd.

- Vodafone Group Plc

- Verizon Communications Inc.

- AT&T Inc.

- Intel Corporation

- NVIDIA Corporation

- Marvell Technology Inc.

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Panasonic Corporation

- Denso Corporation

Frequently Asked Questions

What is vehicle networking?

Vehicle networking refers to the system of communication technologies that enable data exchange between a vehicle and other entities, including other vehicles (V2V), infrastructure (V2I), pedestrians (V2P), and cloud services (V2C), collectively known as V2X. It facilitates functions from infotainment to autonomous driving, enhancing safety, efficiency, and convenience.

How does 5G impact vehicle networking?

5G significantly enhances vehicle networking by providing ultra-low latency, high bandwidth, and massive connectivity. These capabilities are crucial for real-time V2X communication, supporting complex ADAS, autonomous driving, and high-definition content streaming, enabling faster decision-making and seamless data exchange for safer and more efficient mobility.

What are the primary challenges in the Vehicle Networking Market?

Key challenges include ensuring robust cybersecurity against increasing threats, achieving universal standardization for interoperability across diverse technologies, managing the high costs associated with development and deployment, and addressing data privacy concerns related to the vast amount of sensitive information collected and transmitted by connected vehicles.

What are V2X communications and why are they important?

V2X (Vehicle-to-Everything) communications enable vehicles to communicate with various elements in their environment. This is critical for enhancing road safety by providing real-time hazard warnings, optimizing traffic flow, improving fuel efficiency, and facilitating the development of fully autonomous driving systems by sharing crucial information instantly.

How does vehicle networking enhance vehicle safety?

Vehicle networking significantly enhances safety by enabling real-time data exchange that powers Advanced Driver-Assistance Systems (ADAS) such as collision avoidance, automatic emergency braking, and lane-keeping assist. It also facilitates emergency services (eCall) and provides drivers with timely warnings about road conditions, traffic, and potential hazards, thereby reducing accident risks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Next Generation In-Vehicle Networking (IVN) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (LIN, CAN, FlexRay, MOST), By Application (Introduction, Infotainment, Climate Control, Navigation, Driver Assistance Systems (DAS)), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- In-Vehicle Networking Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Powertrain, Safety, Body Electronics, Chassis, Infotainment), By Application (Passenger Cars, LCVs, HCVs, AGVs), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager