Veterinary Eye Care Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428159 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Veterinary Eye Care Market Size

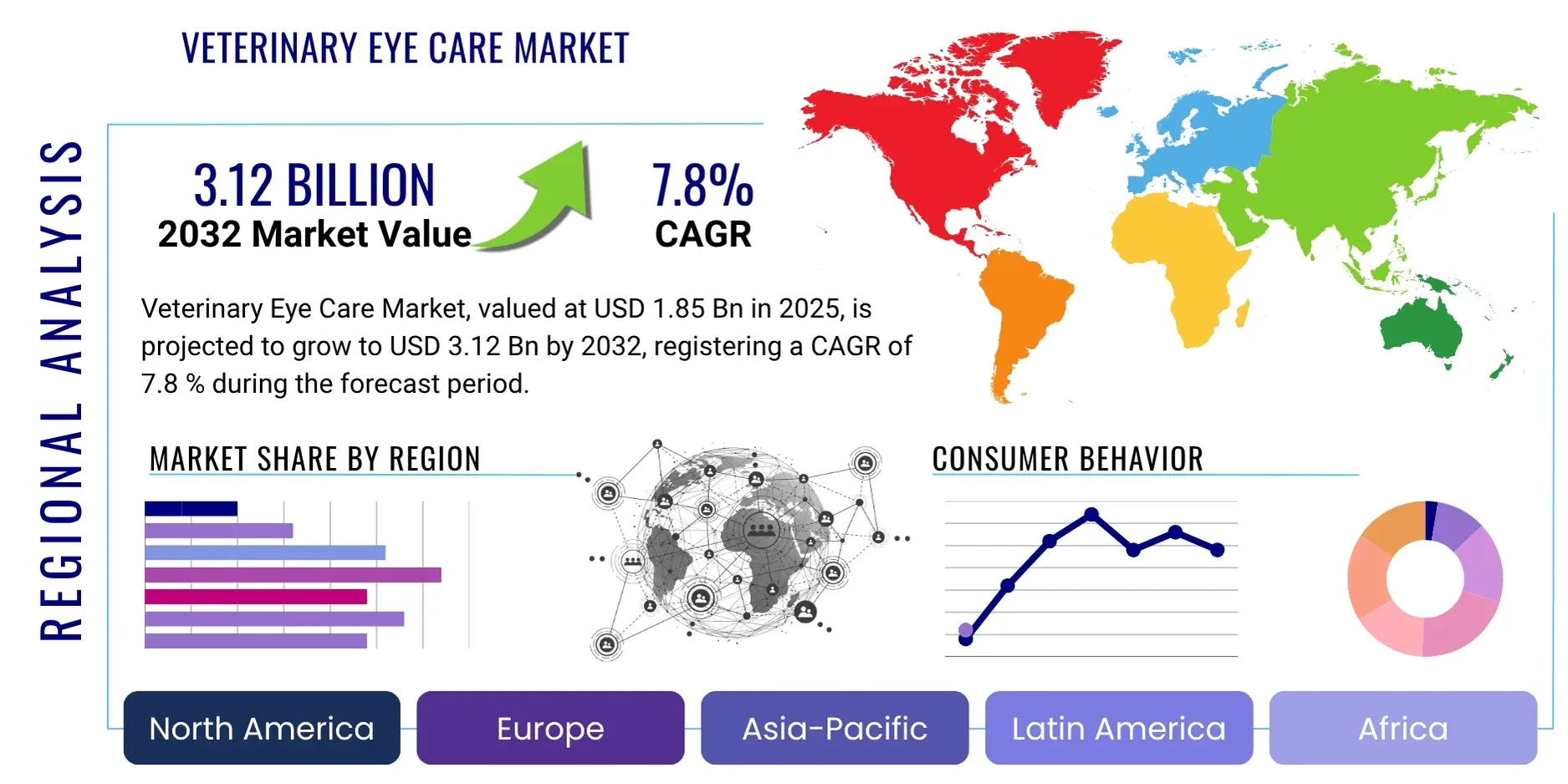

The Veterinary Eye Care Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 1.85 Billion in 2025 and is projected to reach USD 3.12 Billion by the end of the forecast period in 2032.

Veterinary Eye Care Market introduction

The Veterinary Eye Care Market encompasses a broad spectrum of products, services, and technologies dedicated to diagnosing, treating, and preventing ophthalmic conditions in animals. This specialized segment of veterinary medicine addresses a wide array of ocular ailments, from common infections and inflammatory conditions to complex surgical interventions for cataracts, glaucoma, and retinal diseases. The market’s growth is fundamentally driven by the increasing global pet ownership rates and the ongoing humanization of companion animals, leading pet owners to seek advanced medical care comparable to human healthcare standards. This trend fuels demand for sophisticated diagnostic tools, innovative therapeutic agents, and specialized surgical equipment tailored for animal eye health.

Products within this market range from essential ophthalmic solutions like antibiotics, anti-inflammatory drugs, and lubricants to advanced diagnostic instruments such such as tonometers for intraocular pressure measurement, direct and indirect ophthalmoscopes for retinal examination, slit lamps for anterior segment evaluation, and specialized ultrasound for ocular imaging. Surgical offerings include micro-surgical instruments for delicate procedures, phacoemulsification units for cataract removal, and laser systems for various ocular therapies. Major applications extend across companion animals, including dogs, cats, and horses, as well as exotic animals and livestock, although companion animals represent the dominant segment due to closer human interaction and higher willingness to spend on their health.

The benefits derived from a robust veterinary eye care market are profound, ensuring animals can maintain optimal vision, reduce pain, and improve their overall quality of life. Effective eye care also plays a critical role in preventing blindness, which can severely impact an animal's welfare and behavior. Key driving factors include technological advancements in veterinary ophthalmology, greater awareness among pet owners about animal health issues, increased disposable incomes in developed and emerging economies, and the expanding network of specialized veterinary ophthalmologists and clinics. The integration of advanced imaging techniques, minimally invasive surgical procedures, and targeted drug delivery systems continues to propel market innovation and expansion.

Veterinary Eye Care Market Executive Summary

The Veterinary Eye Care Market is experiencing significant momentum, propelled by evolving pet ownership dynamics and technological advancements in animal healthcare. Business trends highlight a strong focus on research and development, leading to the introduction of more effective diagnostic devices and therapeutic agents. Mergers and acquisitions are common as larger animal health companies seek to integrate specialized ophthalmic solutions and expand their product portfolios. There is also a growing emphasis on preventive eye care and early diagnosis, driven by informed pet owners who are increasingly proactive about their pets' health, creating a steady demand for routine examinations and prophylactic treatments. Furthermore, the expansion of veterinary telemedicine services is facilitating easier access to preliminary consultations and follow-up care, reducing geographical barriers for specialized advice.

Regionally, North America and Europe continue to dominate the market due to high pet ownership rates, well-established veterinary infrastructure, and substantial spending on animal healthcare. These regions also benefit from a higher concentration of specialized veterinary ophthalmologists and advanced research facilities. However, the Asia Pacific region is rapidly emerging as a high-growth market, driven by increasing disposable incomes, rising pet adoption in countries like China and India, and a growing awareness of animal welfare. Latin America and the Middle East & Africa also present significant opportunities as their veterinary sectors mature and economic conditions improve, supporting investments in modern animal health services and products. Local manufacturers and distributors are playing an increasingly crucial role in these developing markets, adapting global innovations to local needs.

Segmentation trends indicate that companion animals, particularly dogs and cats, represent the largest segment by animal type, owing to their close bond with humans and the extensive resources allocated to their care. The diagnostic instruments segment is poised for substantial growth due to continuous innovation in imaging and measurement technologies, enabling more accurate and earlier detection of ophthalmic conditions. Within therapeutics, anti-inflammatory and anti-glaucoma drugs are significant contributors, reflecting the prevalence of these conditions. End-user segments show that veterinary hospitals and clinics remain the primary points of care, with a growing trend towards specialized ophthalmic centers that offer advanced surgical and diagnostic capabilities, reflecting the increasing specialization within the veterinary medical field.

AI Impact Analysis on Veterinary Eye Care Market

Common user questions regarding AI's impact on the Veterinary Eye Care Market frequently revolve around its potential to enhance diagnostic accuracy, streamline treatment planning, and improve accessibility to specialized care. Pet owners and veterinary professionals alike inquire about how AI can aid in early disease detection, particularly for subtle or complex conditions that might be missed by the human eye alone. There is considerable interest in AI's role in interpreting diagnostic images, predicting disease progression, and personalizing therapeutic approaches. Concerns often include the reliability of AI algorithms, the ethical implications of autonomous diagnostics, and the potential for AI to displace human expertise rather than augment it. Expectations are high for AI to reduce diagnostic errors, optimize treatment outcomes, and potentially lower the overall cost of advanced eye care by increasing efficiency.

The overarching themes emerging from these inquiries highlight a collective desire for AI to bring greater precision and efficiency to veterinary ophthalmology. Users anticipate AI systems that can analyze complex data sets, such as retinal scans, ocular ultrasounds, and electroretinograms, to provide objective and consistent interpretations. The potential for AI-driven telemedicine platforms to offer remote diagnostic support, especially in underserved areas, is also a significant point of discussion. This includes the ability for general practitioners to leverage AI tools for initial screening and referral decisions, thereby expanding the reach of specialized ophthalmic services. The integration of AI into existing veterinary practice management systems is also a key expectation, aiming to create a seamless workflow from diagnosis to treatment and follow-up.

Furthermore, the discussion extends to how AI might revolutionize drug discovery and personalized medicine in veterinary ophthalmology. There is an expectation that AI could accelerate the identification of novel therapeutic compounds for conditions like glaucoma or dry eye, and even tailor treatment regimens based on an individual animal's genetic profile or disease presentation. The proactive monitoring of chronic eye conditions through AI-powered wearable devices or smart home cameras, which could detect subtle changes in ocular health, represents another anticipated application. While the enthusiasm for these advancements is palpable, there remains a pragmatic demand for robust validation studies and clear regulatory guidelines to ensure the safe and effective deployment of AI technologies in animal health.

- AI-enhanced diagnostic imaging analysis for conditions such as glaucoma, cataracts, and retinal diseases, leading to earlier and more accurate detection.

- Development of AI-powered predictive models for assessing disease progression and treatment efficacy, enabling personalized therapeutic strategies.

- Automation of routine eye health screenings and initial symptom analysis, freeing up veterinary ophthalmologists for complex cases and surgical interventions.

- AI-driven drug discovery and formulation optimization for ophthalmic medications, potentially leading to more targeted and effective treatments.

- Integration of AI into telemedicine platforms for remote consultations, diagnostic support, and monitoring of chronic eye conditions in animals.

- Robotics and AI-assisted surgical systems for enhanced precision in delicate ophthalmic procedures, reducing complications and improving outcomes.

- Educational tools and simulations powered by AI to train veterinary students and practitioners in advanced ophthalmic diagnostics and surgical techniques.

DRO & Impact Forces Of Veterinary Eye Care Market

The Veterinary Eye Care Market is shaped by a confluence of powerful drivers, inherent restraints, and emerging opportunities, all interacting to create dynamic impact forces. Driving factors predominantly include the escalating trend of pet humanization, where animals are increasingly viewed as integral family members, leading to a willingness among owners to invest significantly in their pets' health and well-being. This societal shift is coupled with rising disposable incomes in many regions, directly translating into higher spending on veterinary services, including specialized eye care. Furthermore, continuous advancements in veterinary ophthalmology, encompassing sophisticated diagnostic technologies and innovative treatment modalities, propel market growth by offering more effective solutions for a wider range of ocular conditions. An increasing awareness among pet owners about the importance of regular health check-ups and early intervention for eye problems also acts as a significant driver, encouraging proactive veterinary visits.

However, several restraints temper this growth. The high cost associated with specialized veterinary eye care, including advanced diagnostic procedures, surgical interventions, and long-term medication, can be prohibitive for some pet owners, leading to delayed treatment or opting for less optimal solutions. A significant shortage of board-certified veterinary ophthalmologists globally limits access to specialized care, particularly in rural or underserved areas, creating bottlenecks in service delivery. Regulatory complexities and the stringent approval processes for new animal ophthalmic drugs and devices can also slow down innovation and market entry. Additionally, the fragmented nature of the veterinary healthcare system in some regions can hinder the efficient distribution and adoption of advanced eye care solutions, posing a challenge for market penetration.

Opportunities within the market are abundant and promising. The expansion of telemedicine and telehealth platforms presents a substantial opportunity to bridge geographical gaps, allowing general practitioners to consult with specialists and pet owners to receive initial assessments and follow-up care remotely. Emerging markets in Asia Pacific, Latin America, and the Middle East & Africa, with their rapidly growing pet populations and improving economic conditions, offer untapped potential for market expansion and the establishment of new clinics and services. Investments in research and development for novel therapeutic agents, regenerative medicine approaches, and advanced surgical techniques promise to address currently unmet medical needs and improve treatment outcomes. Moreover, the integration of artificial intelligence and machine learning for enhanced diagnostics and personalized treatment plans represents a transformative opportunity to revolutionize how eye care is delivered to animals, offering unparalleled precision and efficiency. The ongoing emphasis on preventive care and wellness programs also creates a continuous demand for routine ophthalmic examinations and early intervention strategies, thereby bolstering the market's long-term sustainability.

Segmentation Analysis

The Veterinary Eye Care Market is intricately segmented based on various critical parameters, providing a detailed understanding of its constituent components and growth dynamics. These segments help in identifying specific demand patterns, technological preferences, and regional variations in healthcare delivery for animals. The comprehensive segmentation analysis covers animal type, product type, indication, and end-user, each influencing market trends and competitive landscapes differently. This granular approach is essential for stakeholders to develop targeted strategies, optimize resource allocation, and address the specific needs of diverse customer bases within the global veterinary ophthalmic sector.

- By Animal Type:

- Companion Animals

- Dogs

- Cats

- Horses

- Other Companion Animals (e.g., rabbits, ferrets)

- Livestock Animals

- Cattle

- Poultry

- Swine

- Other Livestock

- Companion Animals

- By Product Type:

- Diagnostic Instruments

- Tonometers

- Ophthalmoscopes (Direct & Indirect)

- Slit Lamps

- Retinal Cameras

- Ocular Ultrasounds

- Electroretinography (ERG) Devices

- Other Diagnostic Tools (e.g., tear test strips, fluorescein stain)

- Therapeutics

- Anti-inflammatory Drugs (Steroidal & Non-steroidal)

- Antibiotics

- Antifungal Agents

- Antiviral Agents

- Anti-Glaucoma Drugs

- Lubricants and Tear Replacements

- Immunosuppressants

- Mydriatics & Cycloplegics

- Other Ophthalmic Medications

- Surgical Equipment

- Micro-surgical Instruments

- Phacoemulsification Systems

- Ophthalmic Lasers (e.g., diode lasers)

- Cryosurgery Units

- Surgical Microscopes

- Veterinary Ophthalmic Implants (e.g., intraocular lenses)

- Diagnostic Instruments

- By Indication:

- Cataracts

- Glaucoma

- Conjunctivitis

- Dry Eye Syndrome (Keratoconjunctivitis Sicca)

- Corneal Ulcers and Diseases

- Retinal Diseases

- Uveitis

- Eyelid Disorders

- Orbital Diseases

- Trauma and Injuries

- By End-User:

- Veterinary Hospitals

- Veterinary Clinics

- Specialized Veterinary Ophthalmology Centers

- Research and Academic Institutions

- Animal Shelters and Zoos

Value Chain Analysis For Veterinary Eye Care Market

The value chain for the Veterinary Eye Care Market is a complex ecosystem, beginning with upstream activities focused on research, development, and the sourcing of raw materials. This initial phase involves pharmaceutical companies developing active pharmaceutical ingredients for ophthalmic drugs, medical device manufacturers sourcing specialized optical components, and biotechnology firms investing in innovative gene therapies or regenerative medicine solutions tailored for animal eye health. Collaboration between academic institutions, research organizations, and private sector entities is crucial here for advancing the scientific understanding of animal ocular diseases and translating it into viable products. The quality and availability of these foundational components directly impact the efficacy and safety of the final veterinary eye care products, necessitating rigorous quality control and supply chain management.

Moving downstream, the value chain progresses through the manufacturing, distribution, and ultimately, the delivery of veterinary eye care products and services to end-users. Manufacturers specialize in producing a diverse range of items, including diagnostic instruments like tonometers and ophthalmoscopes, therapeutic agents such as antibiotics and anti-glaucoma drops, and surgical equipment including micro-surgical tools and phacoemulsification systems. After production, these goods are distributed through various channels. Direct distribution involves manufacturers selling directly to large veterinary hospital networks, academic institutions, or government animal health programs, allowing for greater control over pricing and customer relationships. Indirect distribution, which is more prevalent, relies on wholesalers, distributors, and veterinary supply companies that serve a broader network of independent veterinary clinics and pharmacies, extending market reach and providing logistical efficiency.

The final stage of the value chain involves the provision of veterinary eye care services, where products reach their ultimate consumers through veterinary hospitals, specialized ophthalmology clinics, and general veterinary practices. Veterinary professionals, including general practitioners and board-certified ophthalmologists, play a pivotal role in diagnosing conditions, prescribing treatments, and performing surgical procedures. The effectiveness of this downstream segment is heavily influenced by factors such as the availability of skilled personnel, access to advanced equipment, and the overall quality of patient care. Continuous training and education for veterinarians are essential to ensure the proper utilization of new technologies and therapies. The feedback loop from these end-users back to manufacturers and R&D departments is critical for continuous product improvement and the development of solutions that genuinely meet the evolving needs of the animal health community and pet owners.

Veterinary Eye Care Market Potential Customers

The primary potential customers in the Veterinary Eye Care Market are broad and diverse, encompassing various stakeholders deeply invested in animal health and well-being. At the forefront are individual pet owners, who increasingly view their companion animals as family members and are willing to invest substantial resources into their health, including specialized ophthalmic care. This demographic seeks solutions ranging from routine eye check-ups and preventative care to complex surgical interventions for conditions like cataracts or glaucoma. Their decisions are heavily influenced by the advice of veterinarians, the perceived quality of care, and the emotional bond they share with their pets, driving demand for advanced and compassionate veterinary ophthalmology services and products.

Beyond individual pet owners, a significant segment of potential customers includes veterinary hospitals and general veterinary clinics. These institutions are the primary points of contact for animals requiring medical attention, offering a wide array of services from general practice to specialized care. They purchase diagnostic instruments, therapeutic medications, and surgical equipment to provide comprehensive eye care services to their animal patients. For general clinics, the emphasis might be on fundamental diagnostic tools and common medications, while larger veterinary hospitals, especially those with specialty departments, require a broader and more advanced suite of ophthalmic products and technologies to handle complex cases and referrals.

Specialized veterinary ophthalmology centers constitute a highly focused customer segment. These centers are equipped with state-of-the-art diagnostic and surgical equipment and staffed by board-certified veterinary ophthalmologists, catering exclusively to advanced ocular conditions. Their purchasing decisions are driven by the need for cutting-edge technology, highly specialized instruments, and premium therapeutic solutions. Furthermore, academic and research institutions, zoos, wildlife rehabilitation centers, and breeders also represent key potential customers, utilizing veterinary eye care products for research purposes, animal population health management, and maintaining the ocular health of diverse animal species under their care. These entities often require specialized, robust, and often custom solutions to meet their unique requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.85 Billion |

| Market Forecast in 2032 | USD 3.12 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zoetis Inc., Merck Animal Health, Elanco Animal Health, Virbac, Bausch + Lomb (a Bausch Health Company), Akorn Animal Health, Inc., Ocuscience Inc., Animal Eye Care LLC, Clear Eye Inc., Optivet, MedRx, Inc., I-MED Animal Health, Sonomed Escalon, Keeler (a Halma company), Reichert Technologies, Inc., Topcon Corporation, Canon Medical Systems Corporation, IRIS Veterinary Specialists, Vision Pharma, Inc., Regenerative Pet Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Veterinary Eye Care Market Key Technology Landscape

The Veterinary Eye Care Market is characterized by a dynamic and continuously evolving technology landscape, marked by significant innovations aimed at enhancing diagnostic precision, treatment efficacy, and patient outcomes. Advanced imaging techniques form a cornerstone of this technological evolution, with tools such as high-resolution optical coherence tomography (OCT) providing detailed cross-sectional images of the retina and optic nerve, aiding in the early detection and monitoring of conditions like glaucoma and retinal degeneration. Ocular ultrasound continues to improve, offering superior visualization of posterior segment structures, orbital diseases, and intraocular masses, especially when direct visualization is obscured. These imaging modalities allow for non-invasive, precise assessments crucial for tailoring individualized treatment plans.

In the realm of therapeutics and surgical interventions, micro-surgical techniques have become standard, employing specialized instruments and operating microscopes for delicate procedures such as cataract extraction via phacoemulsification, glaucoma shunts, and corneal grafting. Laser therapy, including diode lasers for treating glaucoma and retinal tears, offers minimally invasive options, often reducing recovery times and improving patient comfort. Furthermore, the development of advanced ophthalmic drugs with targeted delivery systems, such as sustained-release implants or nanoparticle formulations, is improving therapeutic outcomes by ensuring consistent drug levels and reducing the frequency of administration, thereby enhancing compliance in animals. Regenerative medicine, encompassing stem cell therapies for corneal repair and retinal regeneration, also represents a cutting-edge area of technological exploration, promising novel treatments for previously incurable conditions.

Beyond clinical instruments and drugs, the integration of digital technologies and artificial intelligence (AI) is rapidly transforming the market. Telemedicine platforms equipped with high-definition cameras and diagnostic peripherals enable remote consultations and specialist referrals, expanding access to expert ophthalmic care. AI and machine learning algorithms are increasingly being deployed to analyze diagnostic images, identify subtle pathologies, and assist in predicting disease progression, augmenting the diagnostic capabilities of veterinary ophthalmologists. Furthermore, the development of specialized electronic health records (EHR) systems with integrated ophthalmic modules is streamlining data management, improving patient tracking, and facilitating research, collectively contributing to a more efficient and data-driven approach to veterinary eye care.

Regional Highlights

- North America: This region stands as the largest and most mature market for veterinary eye care, primarily driven by high pet ownership rates, significant disposable incomes, and a strong culture of pet humanization. The presence of numerous specialized veterinary ophthalmology clinics, advanced research institutions, and a robust animal health infrastructure contributes to its market dominance. Innovation in diagnostic instruments and surgical techniques is readily adopted, supported by substantial R&D investments and favorable reimbursement policies. Key countries include the United States and Canada, which benefit from a high concentration of market players and a well-established regulatory framework for animal health products.

- Europe: Characterized by a strong emphasis on animal welfare and a growing awareness of pet health, Europe represents another significant market. Countries such as the United Kingdom, Germany, France, and Italy contribute substantially to the regional market due to high pet populations and a sophisticated veterinary healthcare system. The adoption of advanced ophthalmic technologies and a willingness among pet owners to spend on specialized care are key drivers. Strict animal health regulations and an increasing number of board-certified veterinary ophthalmologists further bolster market growth.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, fueled by rapidly increasing disposable incomes, rising pet adoption rates, particularly in emerging economies like China and India, and a growing Westernization of pet care practices. While the market is still developing in some areas, significant investments in veterinary infrastructure, increasing awareness campaigns about animal health, and the expansion of global animal health companies into the region are accelerating growth. Countries like Japan, Australia, and South Korea already possess advanced veterinary services, setting a precedent for neighboring developing nations.

- Latin America: This region is experiencing steady growth in the veterinary eye care market, driven by expanding pet populations, urbanization, and an increasing appreciation for companion animal welfare. Economic development in countries like Brazil, Mexico, and Argentina is leading to improved access to veterinary services and a greater willingness among pet owners to seek specialized care. While the adoption of highly advanced technologies may be slower compared to developed regions, there is a strong demand for essential ophthalmic diagnostics and therapeutics, presenting opportunities for market expansion.

- Middle East and Africa (MEA): The MEA region is an emerging market with significant growth potential, although it currently holds a smaller share. The increasing disposable incomes in certain Middle Eastern countries and the rising pet ownership in urban centers are contributing factors. Challenges include less developed veterinary infrastructure and lower awareness levels in some areas. However, government initiatives to improve animal health, growing tourism leading to higher pet populations, and increasing investments by global players are expected to drive future market expansion, particularly in countries like UAE, Saudi Arabia, and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Veterinary Eye Care Market.- Zoetis Inc.

- Merck Animal Health

- Elanco Animal Health

- Virbac

- Bausch + Lomb (a Bausch Health Company)

- Akorn Animal Health, Inc.

- Ocuscience Inc.

- Animal Eye Care LLC

- Clear Eye Inc.

- Optivet

- MedRx, Inc.

- I-MED Animal Health

- Sonomed Escalon

- Keeler (a Halma company)

- Reichert Technologies, Inc.

- Topcon Corporation

- Canon Medical Systems Corporation

- IRIS Veterinary Specialists

- Vision Pharma, Inc.

- Regenerative Pet Solutions

Frequently Asked Questions

Analyze common user questions about the Veterinary Eye Care market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most common eye conditions affecting companion animals?

Common eye conditions in companion animals, particularly dogs and cats, include cataracts, which can lead to blindness; glaucoma, characterized by increased intraocular pressure and optic nerve damage; conjunctivitis, an inflammation of the eye's lining; dry eye syndrome (keratoconjunctivitis sicca), where tear production is inadequate; and corneal ulcers, which are open sores on the surface of the eye. Other prevalent issues involve eyelid abnormalities, retinal diseases, and trauma-induced injuries. Early detection and appropriate veterinary intervention are crucial for managing these conditions and preserving vision.

How much does specialized veterinary eye care typically cost?

The cost of specialized veterinary eye care varies significantly based on the condition, required diagnostics, treatment modality, geographical location, and the specific veterinary clinic. Basic consultations and diagnostic tests like tear production tests or fluorescein staining might range from $100 to $300. More advanced diagnostics, such as ocular ultrasound or electroretinography, can be $300 to $800. Surgical procedures, like cataract removal with phacoemulsification, can range from $2,000 to $6,000 per eye, while glaucoma management with shunts might also be in a similar range. Chronic medication can add ongoing costs, making specialized care a significant financial consideration for pet owners.

What advancements are improving treatment options in veterinary ophthalmology?

Recent advancements in veterinary ophthalmology include refined micro-surgical techniques for conditions like cataracts and glaucoma, utilizing state-of-the-art instruments and laser technology for enhanced precision and reduced invasiveness. New drug formulations, such as sustained-release implants for glaucoma or dry eye, improve compliance and efficacy. Regenerative medicine, including stem cell therapies, is showing promise for corneal repair and retinal conditions. Furthermore, the integration of advanced diagnostic imaging (e.g., OCT, high-resolution ultrasound) and artificial intelligence for disease detection and personalized treatment planning are revolutionizing care, offering more accurate and effective solutions for animal eye health.

How can pet owners proactively prevent common eye problems in their animals?

Proactive prevention of eye problems in pets involves several key strategies. Regular veterinary check-ups, including thorough eye examinations, are essential for early detection of subtle changes. Maintaining good general health through a balanced diet and appropriate exercise supports overall well-being, including ocular health. Owners should regularly inspect their pet's eyes for redness, discharge, cloudiness, or any signs of discomfort and seek veterinary attention promptly if concerns arise. Protecting pets from environmental irritants, ensuring proper grooming around the eyes, and avoiding direct exposure to harmful chemicals can also significantly reduce the risk of ocular issues. For certain breeds predisposed to genetic eye conditions, specialized screening and preventive measures may be recommended by a veterinary ophthalmologist.

When should a pet be referred to a veterinary ophthalmologist?

A pet should be referred to a veterinary ophthalmologist when a general veterinarian identifies a complex or chronic eye condition that requires specialized diagnostic tools or treatment expertise. This includes cases of cataracts, glaucoma, recurrent uveitis, severe corneal ulcers that are unresponsive to initial treatment, retinal detachments, or any condition threatening vision. Referral is also recommended for surgical evaluations, specialized imaging needs, or when a precise diagnosis remains elusive despite general practice efforts. Early referral can often lead to better outcomes, preserving vision and improving the quality of life for the animal.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager