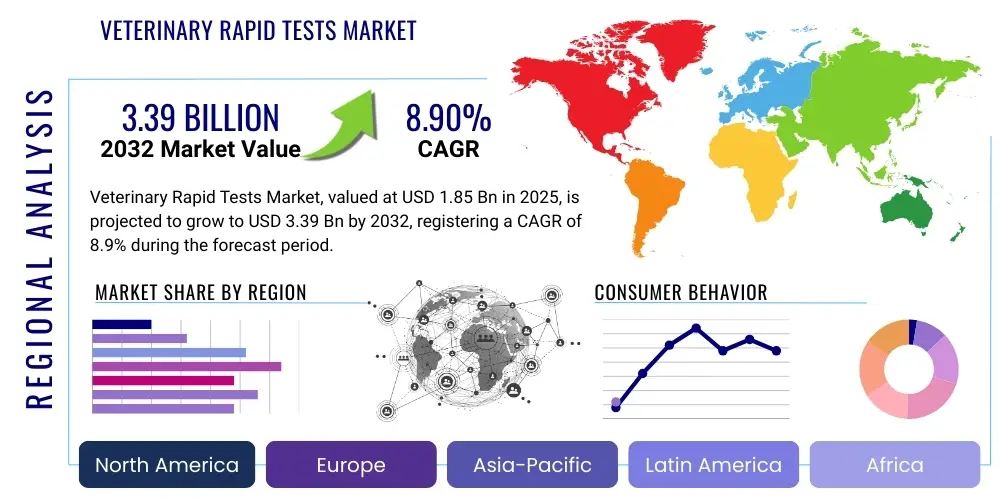

Veterinary Rapid Tests Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427690 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Veterinary Rapid Tests Market Size

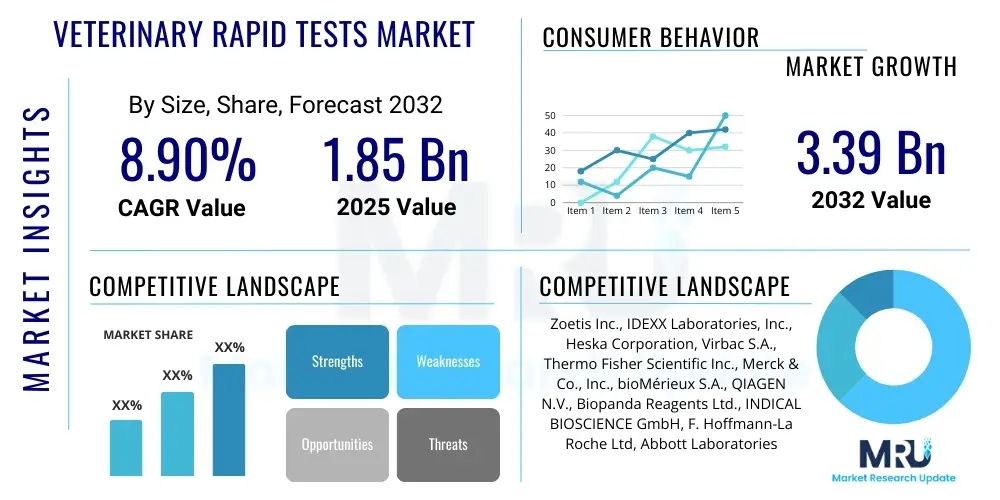

The Veterinary Rapid Tests Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2025 and 2032. The market is estimated at USD 1.85 Billion in 2025 and is projected to reach USD 3.39 Billion by the end of the forecast period in 2032.

Veterinary Rapid Tests Market introduction

The Veterinary Rapid Tests Market encompasses diagnostic tools designed for quick and efficient detection of various diseases and conditions in animals, including infectious agents, parasites, hormones, and other biomarkers. These tests provide timely results, enabling veterinarians to make rapid treatment decisions, implement preventive measures, and manage animal health effectively across diverse settings, from clinics to field operations. The inherent simplicity and portability of these diagnostic solutions make them invaluable for point-of-care (POC) diagnostics, significantly reducing the turnaround time compared to traditional laboratory methods.

Major applications of veterinary rapid tests span a wide array of animal health concerns, including the diagnosis of viral, bacterial, and parasitic infections in companion animals, livestock, and poultry. They are also widely utilized for pregnancy testing, heartworm detection, and monitoring of chronic conditions. The primary benefits of these tests include their ease of use, minimal sample requirements, cost-effectiveness, and the ability to deliver accurate results within minutes, which is critical for preventing disease transmission and ensuring animal welfare. The market’s growth is primarily driven by increasing pet ownership, a rising incidence of zoonotic diseases, and growing awareness among animal owners and farmers regarding the importance of proactive animal health management.

Veterinary Rapid Tests Market Executive Summary

The Veterinary Rapid Tests Market is characterized by robust growth, propelled by evolving business trends centered on convenience, speed, and decentralization of diagnostics. Companies are increasingly investing in research and development to introduce innovative, multi-parameter tests and user-friendly platforms that integrate digital solutions for enhanced data management and interpretation. Consolidation among key players and strategic collaborations with technology providers are common business strategies aimed at expanding product portfolios and market reach. The rising demand for point-of-care testing is reshaping business models, with a focus on delivering accessible and affordable diagnostic tools directly to veterinary practitioners and livestock producers, thereby minimizing reliance on centralized laboratories and optimizing resource utilization.

Regionally, North America and Europe currently dominate the market due to high animal healthcare expenditure, advanced veterinary infrastructure, and high rates of pet adoption. However, the Asia-Pacific region is emerging as a high-growth market, driven by increasing livestock production, rising disposable incomes in developing economies, and a growing awareness of animal health. Latin America and the Middle East & Africa also present significant opportunities, albeit with slower adoption rates, as veterinary healthcare infrastructure continues to develop. Each region exhibits unique epidemiological profiles and regulatory landscapes that influence product demand and market penetration, necessitating tailored commercial strategies from market participants.

Segmentation trends indicate a strong preference for immunochromatographic (lateral flow) assays due to their simplicity and cost-effectiveness, though ELISA-based tests continue to hold a significant share for certain applications requiring higher sensitivity and quantitative results. By animal type, companion animals represent the largest segment, fueled by the humanization of pets and the willingness of owners to invest in their animals’ well-being. The livestock segment is also growing steadily, driven by concerns over food safety, disease outbreaks, and productivity enhancement. The infectious diseases segment remains the largest application area, reflecting the continuous threat posed by pathogens and the critical need for rapid detection to prevent widespread outbreaks and ensure public health.

AI Impact Analysis on Veterinary Rapid Tests Market

The integration of Artificial Intelligence (AI) is poised to significantly transform the Veterinary Rapid Tests Market, addressing common user concerns regarding test accuracy, data interpretation, and early disease detection. Users frequently inquire about AIs potential to enhance the reliability of rapid test results, streamline diagnostic workflows, and provide predictive insights into animal health. There is a strong expectation that AI will move beyond simple result interpretation to offer advanced analytical capabilities, helping veterinarians identify subtle patterns in test data that might indicate an emerging health issue before clinical signs become apparent. This proactive approach is highly valued, particularly in managing herd health and preventing large-scale outbreaks, thereby improving both animal welfare and economic outcomes for producers.

Furthermore, users are keen to understand how AI can reduce the subjectivity often associated with visual interpretation of rapid tests, ensuring consistent and objective results regardless of the operators experience. Questions also arise about AIs role in integrating rapid test data with other clinical information, such as electronic health records and epidemiological data, to create more comprehensive diagnostic profiles. The ultimate goal is to leverage AI for more informed decision-making, optimizing treatment protocols, and enhancing the overall efficiency of veterinary care. The adoption of AI is expected to lead to a new generation of smart rapid diagnostic devices that are not only faster but also more insightful and capable of autonomous learning from vast datasets, continuously improving their diagnostic performance over time.

- Enhanced accuracy in result interpretation through automated image analysis of lateral flow tests.

- Predictive analytics for early disease outbreak detection by correlating rapid test results with environmental and epidemiological data.

- Streamlined workflow automation, from sample processing guidance to automated report generation.

- Integration of rapid test data with electronic veterinary records for comprehensive patient profiles.

- Development of smart diagnostic devices capable of real-time data analysis and decision support.

- Reduced human error and inter-operator variability in test result reading.

- Personalized treatment recommendations based on AI-driven analysis of individual animal test results.

DRO & Impact Forces Of Veterinary Rapid Tests Market

The Veterinary Rapid Tests Market is primarily driven by several critical factors, notably the global increase in pet ownership and the growing humanization of pets, which translates into higher expenditure on animal healthcare and diagnostics. Concurrently, the rising incidence of zoonotic and foodborne diseases, coupled with stringent government regulations for animal health and food safety, mandates widespread and rapid disease surveillance. Technological advancements, leading to more accurate, sensitive, and user-friendly rapid diagnostic platforms, further propel market expansion. The convenience and cost-effectiveness of point-of-care testing, especially in resource-limited settings or for large-scale screenings, are significant drivers enhancing market penetration and adoption rates across various animal segments.

However, the market faces certain restraints, including the relatively high cost of advanced rapid test kits for some specific applications, which can be a barrier to adoption in developing regions. Challenges related to sample collection, storage, and the need for trained personnel to ensure accurate test performance also limit widespread usage, particularly in remote areas. Moreover, the lack of standardized regulatory frameworks across different geographies for veterinary diagnostics can hinder market entry and product commercialization for some manufacturers. Ensuring the specificity and sensitivity of rapid tests to match the performance of traditional laboratory methods remains a continuous challenge that manufacturers must address to build greater confidence among veterinary professionals and end-users.

Opportunities within this market are abundant, particularly in the development of multi-analyte rapid tests that can detect several pathogens or biomarkers simultaneously, improving efficiency and diagnostic breadth. Emerging economies, with their expanding livestock sectors and increasing companion animal populations, present untapped growth potential. The growing trend towards preventive healthcare and routine wellness checks for animals offers avenues for increased adoption of rapid tests for screening purposes. Furthermore, the integration of digital health solutions, such as mobile apps for result interpretation and data management, and the advent of telemedicine for veterinary consultations, are creating new distribution channels and enhancing the accessibility of rapid diagnostic services to a broader customer base, offering significant opportunities for market innovation and expansion.

Segmentation Analysis

The Veterinary Rapid Tests Market is comprehensively segmented based on various critical parameters, including the type of test, animal type, application, and end-user. This granular segmentation allows for a detailed understanding of market dynamics and tailored strategic approaches for different product categories and consumer groups. The diverse needs across companion animals and livestock, coupled with the wide array of diseases and conditions requiring rapid diagnosis, underpin the complexity and growth potential of each segment. The market continues to evolve with the introduction of novel technologies and expanding applications, influencing the share and growth trajectory of these distinct segments, providing targeted insights for stakeholders.

- By Test Type:

- Immunochromatographic Tests (Lateral Flow Assays)

- ELISA Tests

- Agglutination Tests

- Rapid PCR-based Tests (emerging)

- Other Rapid Tests (e.g., direct fluorescent antibody tests)

- By Animal Type:

- Companion Animals (Dogs, Cats, Horses, Birds, Others)

- Livestock Animals (Cattle, Swine, Poultry, Sheep, Goats, Others)

- By Application:

- Infectious Diseases (Bacterial, Viral, Parasitic, Fungal)

- Pregnancy Testing

- Inflammation/Pain

- Toxicology

- Allergy Testing

- Cardiology

- Oncology

- Other Applications

- By End-User:

- Veterinary Hospitals and Clinics

- Diagnostic Laboratories

- Reference Laboratories

- Home Care/Pet Owners (for select basic tests)

- Animal Research Institutes

- Poultry and Livestock Farms

Veterinary Rapid Tests Market Value Chain Analysis

The value chain for the Veterinary Rapid Tests Market begins with upstream activities involving the research and development of novel diagnostic technologies and the procurement of raw materials. This stage includes sourcing specialized reagents, antibodies, antigens, and membrane materials from chemical and biotechnology suppliers. Innovation at this stage focuses on enhancing test sensitivity, specificity, and shelf life, which directly impacts the quality and performance of the final product. Key upstream players include specialized chemical companies and biotechnology firms that provide essential components and foundational scientific expertise required for diagnostic assay development, forming the bedrock of the markets innovation pipeline.

The midstream segment of the value chain involves the manufacturing and assembly of rapid test kits, including formulation, coating, cutting, and packaging. This stage also encompasses stringent quality control processes to ensure consistency and reliability of the finished products. Manufacturers often specialize in certain test types or animal segments, leveraging proprietary technologies and economies of scale. Downstream activities focus on the distribution, sales, and post-sales support of these rapid tests. This includes a complex network of direct sales forces, distributors, wholesalers, and online platforms that connect manufacturers to end-users such as veterinary clinics, hospitals, diagnostic laboratories, and livestock farms. Effective logistics and supply chain management are crucial for ensuring product availability and integrity.

Distribution channels in the Veterinary Rapid Tests Market are multifaceted, encompassing both direct and indirect approaches. Direct sales involve manufacturers selling directly to large veterinary networks, government animal health agencies, or major pharmaceutical distributors. Indirect channels leverage a network of third-party distributors and wholesalers who have established relationships with smaller clinics, independent veterinarians, and pet stores. The choice of channel often depends on the manufacturers scale, product portfolio, and target market. The increasing digitalization of veterinary services also supports online sales and e-commerce platforms as a growing channel for direct consumer access to certain over-the-counter rapid tests, enhancing market reach and convenience for a broader range of end-users.

Veterinary Rapid Tests Market Potential Customers

The primary end-users and buyers in the Veterinary Rapid Tests Market are diverse, encompassing a broad spectrum of entities involved in animal healthcare and management. Veterinary hospitals and clinics represent a significant customer base, relying on rapid tests for everyday diagnostic needs, from routine check-ups to emergency situations. These facilities utilize tests for diagnosing infectious diseases, conducting pre-surgical screenings, and monitoring treatment efficacy in companion animals. Their demand is driven by the need for quick, on-site results that can inform immediate clinical decisions and improve patient outcomes, often integrating these tests into their standard diagnostic protocols.

Diagnostic and reference laboratories constitute another crucial customer segment, particularly for confirming rapid test results, performing complex analyses, and conducting large-volume testing for surveillance programs. While they primarily handle more elaborate laboratory tests, rapid tests serve as valuable pre-screening tools or complementary diagnostics that allow for initial assessments before more extensive laboratory work is initiated. Furthermore, livestock farms and poultry producers are increasingly adopting rapid tests for herd health management, disease surveillance, and to prevent economic losses due to outbreaks. These agricultural entities prioritize tests that are easy to use in the field and provide timely results for large animal populations, contributing significantly to food safety and animal welfare.

Government agencies, including animal health departments and public health organizations, are also key potential customers, utilizing rapid tests for disease monitoring, outbreak investigation, and regulatory compliance, particularly concerning zoonotic diseases that pose a risk to human health. Animal research institutes and academic institutions employ rapid tests for various research purposes, including studying disease pathogenesis and evaluating the efficacy of vaccines or treatments. Lastly, a growing segment includes direct pet owners for certain over-the-counter or home-use rapid tests, primarily for conditions like pregnancy or general wellness, though this segment remains relatively niche and focuses on simpler, non-critical diagnostic applications.

Veterinary Rapid Tests Market Key Technology Landscape

The Veterinary Rapid Tests Market is characterized by a dynamic technological landscape, predominantly driven by advancements in immunodiagnostics and emerging molecular techniques. Lateral flow immunochromatographic assays (LFAs) remain a cornerstone due to their simplicity, speed, and cost-effectiveness. These tests leverage specific antibody-antigen reactions to produce a visually interpretable result, making them ideal for point-of-care diagnostics in various settings. Continuous innovation in LFA technology focuses on improving sensitivity, multiplexing capabilities (detecting multiple analytes in one test), and developing reader devices that provide objective, quantitative results, moving beyond subjective visual interpretation.

Enzyme-linked immunosorbent assays (ELISA) constitute another significant technological platform, offering higher sensitivity and the ability to quantify antibody or antigen levels more precisely. While often requiring laboratory equipment and trained personnel, miniaturized and simplified ELISA formats are being developed for near-patient testing, bridging the gap between traditional lab-based diagnostics and rapid on-site solutions. These advancements aim to deliver the robustness of ELISA with improved workflow efficiency. Furthermore, the market is witnessing the emergence of molecular rapid tests, particularly those based on nucleic acid amplification technologies like loop-mediated isothermal amplification (LAMP) and rapid PCR variants. These tests offer superior sensitivity and specificity for direct pathogen detection, addressing critical needs in infectious disease diagnostics where early and accurate identification of genetic material is paramount for effective disease management and control.

Beyond the core assay technologies, the landscape is also evolving with the integration of digital and connectivity solutions. This includes handheld reader devices equipped with smartphone connectivity, enabling automated result interpretation, data storage, and seamless transmission to electronic health records or cloud-based platforms. These smart devices enhance objectivity, reduce transcription errors, and facilitate epidemiological surveillance by aggregating diagnostic data. Microfluidics and lab-on-a-chip technologies are also gaining traction, promising the development of highly integrated, portable devices capable of performing complex diagnostic panels from minimal sample volumes, further decentralizing advanced veterinary diagnostics and making them more accessible to a wider range of practitioners and animal owners globally.

Regional Highlights

- North America: Dominates the market due to high pet adoption rates, significant animal healthcare expenditure, advanced veterinary infrastructure, and the presence of key market players. Strong regulatory frameworks and extensive research and development activities also contribute to its leading position.

- Europe: A mature market with high awareness of animal health, stringent food safety regulations, and a growing emphasis on preventive care. Countries like Germany, the UK, and France are key contributors, driven by a large companion animal population and a robust livestock industry.

- Asia-Pacific: Expected to be the fastest-growing region, fueled by rising disposable incomes, increasing pet ownership, expanding livestock production, and improving veterinary healthcare infrastructure in countries such as China, India, and Japan. Growing awareness about animal diseases and food safety drives adoption.

- Latin America: Emerging market with increasing awareness of animal health and growing investments in veterinary infrastructure. Brazil and Mexico are key markets due to their significant livestock populations and rising pet ownership, though economic volatility can impact growth.

- Middle East & Africa: A nascent but growing market, primarily driven by increasing government initiatives in animal disease control, growing livestock production, and improving veterinary services. Challenges include limited access to advanced diagnostics and lower animal healthcare expenditure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Veterinary Rapid Tests Market.- Zoetis Inc.

- IDEXX Laboratories, Inc.

- Heska Corporation

- Virbac S.A.

- Thermo Fisher Scientific Inc.

- Merck & Co., Inc. (MSD Animal Health)

- bioMérieux S.A.

- QIAGEN N.V.

- Biopanda Reagents Ltd.

- INDICAL BIOSCIENCE GmbH

- F. Hoffmann-La Roche Ltd (Roche Diagnostics)

- Abbott Laboratories (Abbott Animal Health)

- Bionote Inc.

- Megacor Diagnostik GmbH

- Synbiotics Corporation (part of Zoetis)

- DRG Instruments GmbH

- Creative Diagnostics

- Safeguard Biosystems

- VMRD, Inc.

- Eurofins Scientific SE

Frequently Asked Questions

What are veterinary rapid tests used for?

Veterinary rapid tests are used for the quick and efficient diagnosis of various conditions in animals, including infectious diseases (viral, bacterial, parasitic), pregnancy detection, heartworm screening, and monitoring of chronic health issues. They provide immediate results for timely treatment decisions and disease management at the point of care.

How accurate are veterinary rapid tests compared to traditional lab tests?

Modern veterinary rapid tests are highly accurate, with many offering sensitivity and specificity comparable to traditional laboratory methods for specific applications. Continuous advancements in technology, particularly in immunochromatographic and molecular assays, are further improving their reliability and diagnostic precision, especially when used in conjunction with appropriate clinical evaluation.

What types of animals benefit most from rapid diagnostic tests?

Both companion animals (dogs, cats, horses) and livestock (cattle, swine, poultry) benefit significantly from rapid diagnostic tests. For companion animals, they enable quick diagnosis of common illnesses, while for livestock, they are crucial for herd health management, disease surveillance, and preventing economic losses from widespread outbreaks, contributing to food safety.

How does AI impact the future of veterinary rapid tests?

AI is set to revolutionize veterinary rapid tests by enhancing accuracy through automated result interpretation, enabling predictive analytics for early disease outbreak detection, and integrating data for comprehensive health profiles. AI-powered devices will offer smarter, more objective diagnostics, reducing human error and providing deeper insights for personalized animal care and population health management.

What are the key drivers for the growth of the veterinary rapid tests market?

The primary drivers for market growth include the increasing global pet ownership, rising awareness and expenditure on animal healthcare, and the growing incidence of zoonotic diseases. Additionally, technological advancements leading to more efficient and user-friendly rapid test platforms, coupled with the demand for cost-effective point-of-care diagnostics, are significant growth catalysts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager