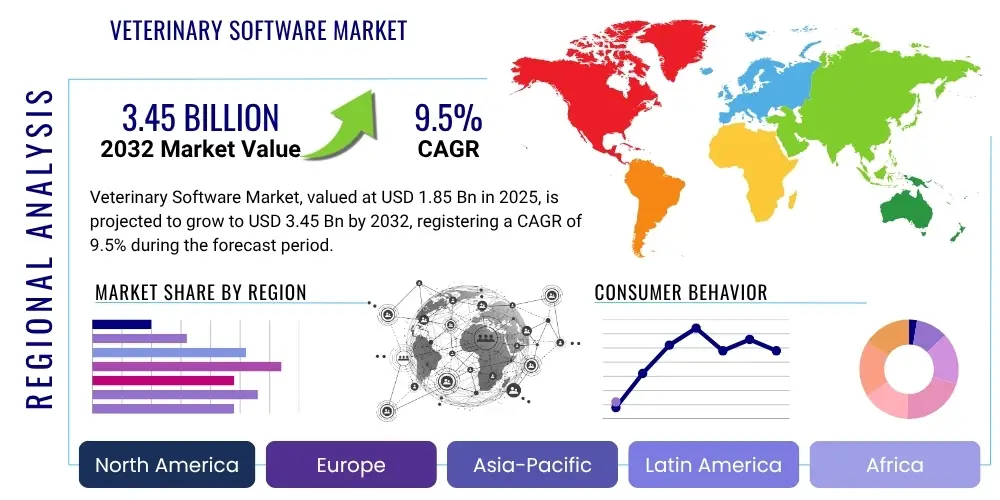

Veterinary Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431108 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Veterinary Software Market Size

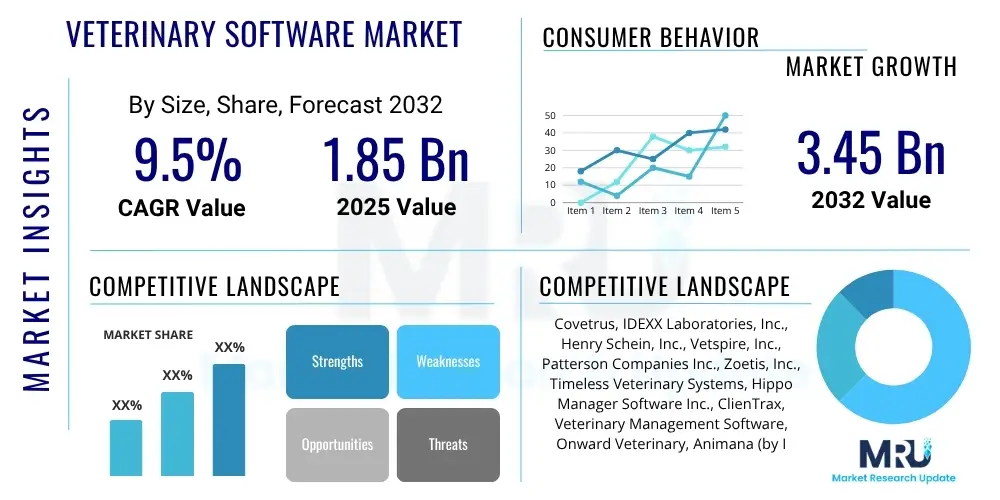

The Veterinary Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at $1.85 billion in 2025 and is projected to reach $3.45 billion by the end of the forecast period in 2032.

Veterinary Software Market introduction

The Veterinary Software Market encompasses a wide array of digital solutions designed to streamline operations and enhance patient care within veterinary practices, hospitals, and related animal health facilities. These solutions range from comprehensive practice management systems that handle appointments, billing, and client communication, to specialized modules for electronic health records (EHR), diagnostic imaging, laboratory information management, and pharmacy management. The core objective of these products is to digitalize and automate the complex administrative and clinical workflows inherent in veterinary medicine, thereby improving efficiency, accuracy, and profitability for veterinary professionals.

Major applications of veterinary software include managing patient medical records, scheduling appointments, processing invoices, inventory control for medications and supplies, managing client communications, and integrating with diagnostic equipment. Key benefits derived from the adoption of such software include enhanced operational efficiency through automation, improved data accuracy and accessibility, better compliance with regulatory standards, optimized financial management, and ultimately, superior patient care outcomes. The driving factors behind the market's robust growth include the increasing global pet ownership, a growing demand for advanced veterinary medical services, the ongoing digital transformation across the healthcare sector, and the critical need for efficient data management and analysis within modern veterinary practices.

Veterinary Software Market Executive Summary

The Veterinary Software Market is experiencing significant expansion, driven by several overarching trends impacting business operations, regional development, and specific market segments. Business trends indicate a strong move towards cloud-based solutions and the integration of telemedicine capabilities, allowing veterinary practices greater flexibility and reach. Consolidation among software providers and strategic partnerships are also shaping the competitive landscape, leading to more integrated and comprehensive offerings. The emphasis on user-friendly interfaces and mobile accessibility continues to be a critical factor in adoption rates, as practices seek to optimize workflow and reduce administrative burden.

Regional trends highlight North America and Europe as mature markets with high adoption rates, propelled by robust pet care expenditures and advanced technological infrastructure. However, the Asia Pacific, Latin America, and Middle East & Africa regions are emerging as high-growth markets, fueled by increasing disposable incomes, rising pet ownership, and developing digital healthcare infrastructures. These regions present substantial untapped potential for veterinary software providers, as more clinics seek to modernize their operations.

Segment trends reveal that practice management software remains the cornerstone of the market, essential for daily operations. However, there is accelerating growth in specialized segments such as Electronic Health Records (EHR) for detailed patient histories, diagnostic imaging software for advanced analysis, and telehealth platforms facilitating remote consultations. Cloud-based deployment is rapidly gaining preference over on-premise solutions due to its scalability, lower upfront costs, and accessibility. The companion animal segment continues to dominate, reflecting the increasing humanization of pets and the willingness of owners to invest in their animals' health, while the livestock segment also sees steady growth driven by farm management and disease prevention needs.

AI Impact Analysis on Veterinary Software Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize veterinary diagnostics, treatment planning, and operational efficiency, along with concerns regarding data privacy and the learning curve for staff. The core themes revolve around AI's potential to augment clinical decision-making, automate repetitive tasks, and provide predictive insights, thereby enhancing the overall quality and accessibility of veterinary care. Expectations include AI-powered tools for faster and more accurate disease detection, personalized treatment protocols, and improved inventory management. Simultaneously, there are questions about the ethical implications of AI, the need for robust cybersecurity measures, and the level of training required for veterinary professionals to effectively utilize these advanced technologies in their daily practice.

AI's integration into veterinary software promises to transform the industry by offering unprecedented capabilities in data analysis and automation. From image recognition algorithms that assist in identifying abnormalities in X-rays and MRIs to predictive analytics that forecast disease outbreaks or optimize appointment scheduling, AI can significantly enhance clinical accuracy and operational efficiency. Furthermore, AI-driven tools can help in analyzing vast amounts of patient data to identify trends, support evidence-based medicine, and personalize treatment plans for individual animals. The ability of AI to process and interpret complex datasets faster than humans can also lead to earlier disease detection and more proactive care, potentially saving lives and improving quality of life for animals.

However, the successful adoption of AI in veterinary software hinges on addressing concerns related to data quality, interoperability with existing systems, and the trust of veterinary professionals in AI-generated recommendations. Robust validation of AI models is crucial to ensure their reliability and accuracy in diverse clinical scenarios. Furthermore, ethical considerations, such as the potential for algorithmic bias and the responsibility for AI-driven decisions, require careful deliberation. As AI technology matures, its seamless integration into veterinary workflows will depend on intuitive user interfaces, comprehensive training programs, and transparent communication about its capabilities and limitations, fostering confidence among practitioners and pet owners alike.

- Enhanced diagnostic accuracy through AI-powered image analysis (radiographs, ultrasounds).

- Predictive analytics for disease outbreak forecasting and personalized treatment plans.

- Automation of administrative tasks, such as scheduling, billing, and inventory management.

- Optimization of drug dosage and treatment protocols based on individual patient data.

- Telemedicine enhancements with AI-assisted symptom triage and remote monitoring.

- Streamlined data entry and electronic health record management through natural language processing.

- Support for evidence-based medicine by analyzing large datasets for clinical insights.

- Improved client communication with AI-driven chatbots for routine inquiries.

DRO & Impact Forces Of Veterinary Software Market

The Veterinary Software Market is significantly shaped by a confluence of driving forces that propel its expansion, alongside inherent restraints that temper growth, and emerging opportunities that promise future avenues for innovation and market penetration. Impact forces, encompassing broader technological, economic, and societal shifts, exert a pervasive influence across these dynamics. Key drivers include the escalating global pet population and the increasing humanization of pets, leading to higher spending on advanced veterinary care and a greater demand for efficient clinic operations. Simultaneously, the imperative for digital transformation across the healthcare sector, coupled with stringent regulatory requirements for data management and patient records, further incentivizes the adoption of sophisticated software solutions. The benefits of improved workflow efficiency, enhanced diagnostic capabilities, and superior patient management provided by these platforms are also strong motivators for veterinary practices.

Conversely, significant restraints pose challenges to the market's accelerated growth. High initial investment costs for comprehensive software systems, coupled with ongoing maintenance and subscription fees, can be prohibitive for smaller veterinary clinics or those in developing regions. Concerns surrounding data security and privacy, particularly with sensitive patient information, necessitate robust cybersecurity measures which can add to operational complexities and costs. Furthermore, a lack of standardization across various software platforms and diagnostic equipment can create integration challenges, hindering seamless data flow. Resistance to change among some veterinary professionals, who may be accustomed to traditional manual processes, also presents an adoption barrier, requiring extensive training and support.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The burgeoning adoption of telemedicine and telehealth services, accelerated by recent global health crises, provides a fertile ground for integrated virtual care modules within veterinary software. Advancements in Artificial Intelligence (AI) and Machine Learning (ML) are opening new frontiers for predictive analytics, enhanced diagnostics, and automated workflows, promising to revolutionize clinical practice. Emerging markets in Asia Pacific and Latin America, characterized by increasing disposable incomes and a growing middle class, represent significant untapped potential for new client acquisition. Additionally, the increasing specialization within veterinary medicine, such as oncology or cardiology, creates demand for highly tailored software solutions that cater to niche requirements, fostering continuous product development and market diversification.

- Drivers:

- Rising global pet ownership and humanization of pets.

- Increasing demand for advanced veterinary medical care.

- Growing need for efficient practice management and operational automation.

- Regulatory compliance and necessity for accurate record-keeping.

- Digital transformation trends in the healthcare industry.

- Restraints:

- High initial investment costs and ongoing maintenance expenses.

- Data security and privacy concerns.

- Lack of standardization and interoperability issues between systems.

- Resistance to change among traditional veterinary professionals.

- Limited awareness and technological infrastructure in developing regions.

- Opportunities:

- Integration of telemedicine and telehealth solutions.

- Advancements in AI and Machine Learning for diagnostics and predictive analytics.

- Expansion into emerging markets with growing pet care expenditures.

- Development of specialized software for niche veterinary services.

- Cloud-based solutions offering scalability and reduced upfront costs.

- Impact Forces:

- Technological advancements driving innovation and feature expansion.

- Economic conditions influencing pet care spending and software investment.

- Regulatory landscape dictating data management and practice standards.

- Societal trends such as pet humanization and preference for digital services.

Segmentation Analysis

The Veterinary Software Market is comprehensively segmented across various dimensions to provide a detailed understanding of its dynamics and growth trajectories. These segmentations are crucial for identifying key market drivers, understanding competitive landscapes, and formulating effective market strategies. The market is primarily analyzed based on the type of software, its deployment model, the end-user base, and the type of animal served, each contributing uniquely to the overall market structure and demand profile. This granular approach allows for a deeper insight into the specific needs and preferences of different veterinary stakeholders, from small independent clinics to large university hospitals, and across various animal species.

Each segment reflects distinct market characteristics and growth potentials. For instance, the practice management software segment, while mature, continues to innovate with cloud integration and enhanced automation features. Electronic Health Records (EHR) and diagnostic imaging software are experiencing rapid growth due to the increasing demand for detailed patient histories and advanced diagnostic capabilities. The preference for cloud-based deployment is becoming more pronounced across all segments, driven by benefits such as scalability, remote accessibility, and reduced infrastructure costs. Understanding these nuanced segment behaviors is vital for stakeholders to effectively target their offerings and address the evolving demands of the global veterinary healthcare ecosystem.

- By Type:

- Practice Management Software (PMS)

- Electronic Health Records (EHR)/Electronic Medical Records (EMR)

- Imaging Software

- Laboratory Information Management System (LIMS)

- Pharmacy Management Software

- Telehealth/Telemedicine Software

- Other Specialty Software (e.g., Anesthesia Monitoring, Dental Software)

- By Deployment:

- On-premise

- Cloud-based

- By End-User:

- Veterinary Hospitals and Clinics

- Specialty and Emergency Veterinary Facilities

- Research Institutes

- Veterinary Reference Laboratories

- Mobile Veterinary Practices

- Universities and Academic Institutions

- By Animal Type:

- Companion Animals (Dogs, Cats, Horses, Other small pets)

- Livestock Animals (Cattle, Swine, Poultry, Aquaculture)

Value Chain Analysis For Veterinary Software Market

The value chain for the Veterinary Software Market is a complex ecosystem involving multiple stages, from initial software development and technological infrastructure provision to the final delivery, implementation, and ongoing support for end-users. The upstream activities are predominantly centered around research and development (R&D) by software developers who innovate and create the core applications. This stage also involves technology providers who supply essential components such as cloud computing services, AI/ML frameworks, database solutions, and cybersecurity tools, forming the foundational technological backbone upon which veterinary software is built. Partnerships with these foundational technology providers are crucial for ensuring scalability, security, and cutting-edge functionality in the final product. Significant investments in human capital, particularly skilled software engineers and veterinary experts, are essential at this phase to ensure the solutions effectively meet clinical and operational needs.

Moving downstream, the value chain focuses on bringing the developed software to market and ensuring its effective utilization by veterinary practices. This phase includes distribution channels, which can be direct or indirect. Direct sales involve software vendors selling and implementing their products directly to large veterinary hospitals, multi-location practices, or academic institutions, often accompanied by comprehensive training and customization services. Indirect channels involve partnerships with resellers, distributors, and integrators who market the software to a broader range of smaller clinics and independent practitioners. These partners often provide localized support and can bundle the software with other veterinary practice solutions. Post-sales services, including technical support, ongoing maintenance, and regular updates, form a critical part of the downstream value chain, ensuring customer satisfaction and long-term retention. Effective communication and collaboration throughout this chain are vital for delivering high-quality, relevant, and well-supported veterinary software solutions to the end-users.

Veterinary Software Market Potential Customers

The potential customers for veterinary software solutions span a diverse range of entities within the animal health industry, all seeking to enhance their operational efficiency, improve patient care, and manage their finances more effectively. These end-users or buyers include small, independent veterinary clinics that require streamlined practice management for daily operations, as well as large, multi-specialty veterinary hospitals that demand sophisticated systems capable of integrating various departmental functions, from internal medicine to surgery and diagnostics. University veterinary teaching hospitals also represent a significant customer segment, needing robust software for both clinical practice and academic research, often with extensive EHR capabilities and complex reporting functionalities. Furthermore, the burgeoning segment of mobile veterinary practices increasingly relies on flexible, cloud-based software that supports remote access and on-the-go data management.

Beyond traditional clinics and hospitals, the customer base extends to specialized veterinary facilities, such as emergency and critical care centers, oncology centers, and dental clinics, each requiring tailored modules within the broader software suite to address their unique workflows. Veterinary reference laboratories, which process diagnostic samples, are also key customers for Laboratory Information Management Systems (LIMS) that integrate seamlessly with clinic software for efficient results reporting. Increasingly, animal shelters and humane societies are adopting software to manage animal intake, adoptions, medical histories, and community outreach programs. Livestock producers and large-scale agricultural operations also represent a growing segment, utilizing specialized veterinary software for herd health management, disease surveillance, and compliance with food safety regulations. Each of these customer groups presents specific requirements that drive product development and market segmentation within the veterinary software industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $1.85 billion |

| Market Forecast in 2032 | $3.45 billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Covetrus, IDEXX Laboratories, Inc., Henry Schein, Inc., Vetspire, Inc., Patterson Companies Inc., Zoetis, Inc., Timeless Veterinary Systems, Hippo Manager Software Inc., ClienTrax, Veterinary Management Software, Onward Veterinary, Animana (by IDEXX), VIA Information Systems, DVMAX Software (by IDEXX), EzyVet, Provet Cloud (by Nordhealth), VETport, Vetlogic, RxWorks, VetVision |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Veterinary Software Market Key Technology Landscape

The Veterinary Software Market is characterized by a dynamic and evolving technological landscape, driven by the broader trends in digital healthcare and enterprise solutions. Central to this landscape is the widespread adoption of cloud computing, which enables veterinary practices to access software and data remotely, scale operations efficiently, and reduce their reliance on expensive on-premise IT infrastructure. Cloud-based platforms offer enhanced data security, automatic updates, and improved collaboration features, making them increasingly attractive to both small clinics and large veterinary hospital networks. Mobile technology integration is another critical component, allowing veterinarians and staff to manage appointments, access patient records, and conduct telemedicine consultations from smartphones and tablets, significantly boosting flexibility and responsiveness in diverse clinical settings.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly emerging as a transformative technology within veterinary software. These advanced capabilities are being applied to various aspects, including diagnostic imaging analysis for faster and more accurate detection of abnormalities, predictive analytics for identifying at-risk patients or forecasting disease outbreaks, and automating routine administrative tasks to free up staff time. Furthermore, data analytics and business intelligence tools are becoming indispensable, enabling practices to glean actionable insights from their operational and clinical data, optimize resource allocation, and enhance financial performance. Cybersecurity measures, including advanced encryption, multi-factor authentication, and robust backup protocols, are also paramount, given the sensitive nature of patient information and the increasing threat of cyberattacks, ensuring the integrity and confidentiality of veterinary data.

Regional Highlights

North America currently dominates the Veterinary Software Market, driven by high pet ownership rates, significant expenditure on pet healthcare, and a technologically advanced veterinary industry. The region benefits from a strong presence of key market players, early adoption of digital solutions, and robust regulatory frameworks that encourage the use of electronic health records. The United States and Canada are at the forefront of this adoption, with veterinary practices actively investing in sophisticated practice management systems, diagnostic imaging software, and telehealth platforms to enhance efficiency and patient outcomes. Continuous innovation and a high awareness among pet owners regarding advanced veterinary care further cement North America's leading position, with a focus on integrated solutions that streamline diverse operational aspects.

Europe represents another substantial market for veterinary software, characterized by a growing pet population and an increasing emphasis on animal welfare. Countries such as the United Kingdom, Germany, France, and the Nordic nations are exhibiting strong growth, supported by national initiatives for digitalizing healthcare and an increasing number of veterinary professionals adopting advanced technological tools. The market here is driven by the need for efficient management of clinical data, compliance with EU regulations on animal health, and the adoption of cloud-based solutions to improve accessibility and reduce operational overhead for clinics of all sizes. The regional landscape also benefits from a mature veterinary healthcare infrastructure and a high willingness among pet owners to invest in quality care for their animals.

The Asia Pacific (APAC) region is projected to be the fastest-growing market for veterinary software, primarily due to rising disposable incomes, rapid urbanization leading to increased pet adoption, and a burgeoning middle class in countries like China, India, and Australia. While the adoption rate has historically been lower compared to Western markets, there is a significant push towards modernizing veterinary practices and improving animal health infrastructure. Government support for digital initiatives, increasing awareness of advanced veterinary care, and the entry of international software providers are catalyzing this growth. The market in APAC is characterized by a strong demand for cost-effective, scalable, and cloud-based solutions that can cater to a diverse range of veterinary practices, from small clinics in rural areas to large urban hospitals. Latin America, the Middle East, and Africa (MEA) are also experiencing steady growth, driven by similar factors of rising pet ownership, improving economic conditions, and the gradual digitalization of healthcare services, presenting significant untapped potential for future market expansion.

- North America: Dominant market share due to high pet ownership, advanced veterinary infrastructure, and strong digital adoption.

- Europe: Significant market size with robust growth, driven by animal welfare initiatives and digital healthcare integration.

- Asia Pacific (APAC): Fastest-growing region, fueled by rising disposable incomes, increasing pet adoption, and modernization of veterinary practices.

- Latin America: Emerging market with growing pet care expenditure and increasing adoption of digital solutions.

- Middle East and Africa (MEA): Gradual growth driven by improving economic conditions and developing veterinary healthcare infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Veterinary Software Market.- Covetrus

- IDEXX Laboratories, Inc.

- Henry Schein, Inc.

- Vetspire, Inc.

- Patterson Companies Inc.

- Zoetis, Inc.

- Timeless Veterinary Systems

- Hippo Manager Software Inc.

- ClienTrax

- Veterinary Management Software

- Onward Veterinary

- Animana (by IDEXX)

- VIA Information Systems

- DVMAX Software (by IDEXX)

- EzyVet

- Provet Cloud (by Nordhealth)

- VETport

- Vetlogic

- RxWorks

- VetVision

Frequently Asked Questions

What is veterinary software?

Veterinary software comprises specialized digital tools and platforms designed to manage and automate various aspects of veterinary practice operations, patient care, and administrative tasks, from scheduling and billing to electronic health records and diagnostic imaging.

What are the primary benefits of using veterinary software?

Key benefits include enhanced operational efficiency, improved accuracy in record-keeping, better client communication, streamlined financial management, optimized patient care through integrated data, and compliance with industry regulations.

How is AI impacting the Veterinary Software Market?

AI is transforming veterinary software by enabling advanced diagnostics through image analysis, predictive analytics for disease trends, automation of administrative workflows, and personalized treatment planning, leading to more efficient and effective animal healthcare.

What are the current key trends in the Veterinary Software Market?

Major trends include the accelerated adoption of cloud-based solutions, integration of telemedicine capabilities, increasing use of AI/ML for diagnostics and automation, and a growing demand for comprehensive, interoperable practice management systems.

Who are the major players in the Veterinary Software Market?

Leading companies in the market include Covetrus, IDEXX Laboratories, Inc., Henry Schein, Inc., Vetspire, Inc., Patterson Companies Inc., Zoetis, Inc., and EzyVet, among others, offering a wide range of solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager