Vibration Sensor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428591 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Vibration Sensor Market Size

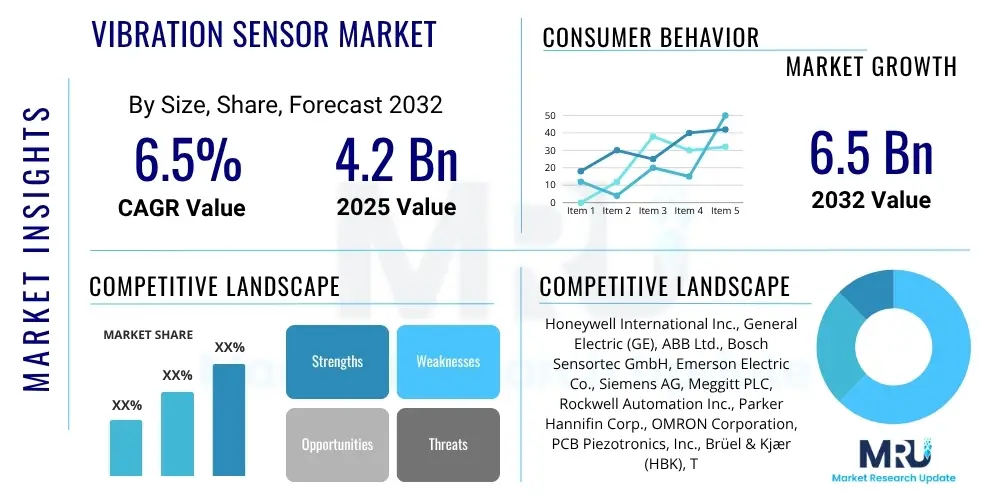

The Vibration Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 4.2 Billion in 2025 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2032.

Vibration Sensor Market introduction

The Vibration Sensor Market is an integral and rapidly evolving segment within the broader industrial and technological landscape, dedicated to the detection, measurement, and analysis of mechanical vibrations. These sophisticated devices play a critical role in condition monitoring and predictive maintenance strategies across numerous industries, serving as the frontline guardians of operational integrity and asset longevity. By converting mechanical vibrations into measurable electrical signals, these sensors enable organizations to preemptively identify potential equipment failures, optimize maintenance schedules, and significantly mitigate the risks associated with unexpected downtime and catastrophic malfunctions. The growing complexity of industrial machinery and the relentless pursuit of operational efficiencies are primary drivers propelling the adoption of advanced vibration sensing solutions globally.

Vibration sensors encompass a diverse range of technologies, including piezoelectric accelerometers, proximity probes, and velocity transducers, each designed to suit specific application requirements and measurement parameters. Piezoelectric sensors, for instance, are widely utilized for their high sensitivity and broad frequency response, making them ideal for monitoring high-frequency vibrations in rotating machinery. Proximity probes, on the other hand, specialize in measuring displacement relative to a target, crucial for analyzing rotor dynamics in large turbines and compressors. The continuous innovation in materials science and micro-electromechanical systems (MEMS) has led to the development of smaller, more robust, and highly accurate sensors, expanding their applicability into previously inaccessible or cost-prohibitive environments. These technological advancements are not only improving sensor performance but also making them more accessible for a wider array of industrial and consumer applications.

The benefits derived from deploying vibration sensors are multifaceted and profound, extending beyond mere fault detection to encompass enhanced safety protocols, reduced operational expenditures, and prolonged asset lifespans. Major applications span industrial manufacturing, automotive, aerospace and defense, oil and gas, power generation, and structural health monitoring. In industrial settings, they are indispensable for monitoring motors, pumps, gearboxes, and fans, ensuring their optimal performance. In the automotive sector, they contribute to vehicle dynamics and comfort analysis, while in aerospace, they monitor engine health and structural integrity. The pervasive drive towards Industry 4.0 and the Internet of Things (IoT) provides significant impetus for market growth, fostering the integration of smart, interconnected vibration sensors that facilitate real-time data acquisition and cloud-based analytics, transforming traditional maintenance paradigms into highly proactive and data-driven strategies.

Vibration Sensor Market Executive Summary

The Vibration Sensor Market is experiencing robust expansion, fundamentally driven by an accelerating global shift towards industrial automation, digitalization, and predictive maintenance strategies. Business trends highlight a significant emphasis on the development of wireless and smart vibration sensors, which offer easier deployment, reduced cabling costs, and seamless integration with IoT platforms. Companies are increasingly investing in sensor fusion technologies, combining vibration data with other parameters such as temperature, pressure, and acoustic emissions to create more comprehensive and accurate diagnostic models. Miniaturization, driven by advancements in MEMS technology, is opening new avenues for applications in consumer electronics and healthcare, while the demand for durable and intrinsically safe sensors is rising within hazardous environments like oil and gas. The competitive landscape is characterized by innovation in data analytics, with vendors offering sophisticated software solutions alongside hardware to provide end-to-end condition monitoring systems.

Regionally, the market exhibits diverse growth patterns and adoption rates. Asia Pacific, spearheaded by manufacturing powerhouses like China, India, Japan, and South Korea, stands out as a dominant force, fueled by rapid industrialization, extensive manufacturing activities, and significant government investments in smart factory initiatives. This region’s high industrial output necessitates widespread deployment of condition monitoring solutions to maintain operational efficiency and competitive advantage. North America and Europe, while more mature markets, demonstrate strong growth in high-value applications, driven by stringent regulatory frameworks for industrial safety, a proactive embrace of advanced technologies, and a concentrated presence of leading aerospace, defense, and automotive industries. These regions are pioneers in integrating AI and machine learning with vibration data for advanced fault diagnostics, ensuring the longevity and efficiency of critical infrastructure and high-tech manufacturing processes. Latin America, the Middle East, and Africa are emerging as promising markets, propelled by nascent industrial growth, significant infrastructure development projects, and increasing awareness regarding asset performance management.

Segmentation trends reveal that accelerometers continue to hold a substantial market share due to their versatility and applicability across a wide spectrum of frequencies and amplitudes, essential for diverse industrial machinery monitoring. The industrial end-use sector, encompassing manufacturing, energy, and process industries, remains the largest consumer of vibration sensors, largely due to the high cost of downtime and the imperative for continuous operational uptime. There is a growing inclination towards advanced technologies such as MEMS and optical sensors, offering enhanced precision and resilience in harsh operating conditions. Wireless vibration sensors are gaining significant traction, particularly in applications where traditional wired installations are impractical or costly. The market for predictive maintenance applications is expanding rapidly, with an increasing number of industries recognizing the long-term cost savings and operational benefits derived from proactive asset management facilitated by real-time vibration data analysis and AI-driven insights.

AI Impact Analysis on Vibration Sensor Market

Users frequently inquire about the transformative potential of Artificial Intelligence (AI) and Machine Learning (ML) in revolutionizing the Vibration Sensor Market, focusing on how these technologies can elevate the capabilities of traditional vibration monitoring from reactive fault detection to highly predictive and prescriptive maintenance. Key themes revolve around AI's ability to process vast quantities of complex vibration data, identify subtle anomalies indicative of incipient failures, and provide actionable insights that often elude human analysis or simpler algorithmic methods. There is a strong expectation that AI integration will lead to more accurate fault diagnosis, significantly reduce false positives, optimize maintenance scheduling, and ultimately extend the operational life of critical assets. Concerns typically address the challenges of data quality and availability for training robust AI models, the computational resources required for advanced analytics, the need for specialized expertise in AI implementation, and ensuring the cybersecurity of AI-driven systems, highlighting a desire for comprehensive, secure, and user-friendly AI-powered solutions.

- Enhanced Anomaly Detection: AI algorithms can analyze complex vibration patterns over time, identifying subtle deviations and anomalies that traditional threshold-based monitoring systems might miss, thereby enabling earlier detection of equipment degradation.

- Advanced Predictive Analytics: Machine learning models can predict remaining useful life (RUL) of machinery components by learning from historical vibration data, allowing for highly optimized and proactive maintenance scheduling, minimizing unplanned downtime.

- Reduced False Positives and Alarms: AI systems can differentiate between normal operational variations and genuine fault conditions more effectively, significantly reducing the occurrence of false alarms that can lead to unnecessary inspections and maintenance costs.

- Automated Fault Diagnosis: AI can automate the complex process of diagnosing specific types of faults (e.g., bearing defects, gear wear, imbalance) by correlating observed vibration signatures with known failure modes, providing more precise recommendations for repair.

- Optimized Maintenance Scheduling: By integrating vibration data with operational parameters and production schedules, AI can recommend the most opportune time for maintenance interventions, balancing asset health with operational efficiency and minimizing disruption.

- Self-Calibrating and Adaptive Systems: AI can enable vibration sensor systems to learn and adapt to changing operational conditions, machine characteristics, and environmental factors, improving the accuracy and relevance of their monitoring over time.

- Sensor Fusion and Data Integration: AI facilitates the integration and analysis of vibration data with other sensor inputs (temperature, pressure, current, acoustic) for a holistic view of machine health, leading to more robust and reliable diagnostic capabilities.

- Remote Monitoring and Cloud-Based Analytics: AI models can be deployed in cloud environments, enabling remote monitoring of assets across geographically dispersed locations and providing real-time insights accessible from anywhere, fostering centralized maintenance management.

DRO & Impact Forces Of Vibration Sensor Market

The Vibration Sensor Market is significantly propelled by several key drivers that underscore its growing importance across various industries. Foremost among these is the widespread adoption of Industry 4.0 and the Internet of Things (IoT), which necessitates real-time data collection and analysis for smart manufacturing processes and interconnected industrial ecosystems. This paradigm shift mandates the integration of advanced sensors, including vibration sensors, to monitor machine health and operational efficiency continuously. Concurrently, the increasing emphasis on predictive maintenance strategies across sectors like manufacturing, oil and gas, and power generation is a substantial driver. Companies are moving away from costly reactive or time-based maintenance towards proactive approaches to minimize downtime, extend asset lifespans, and reduce operational costs, making vibration sensors indispensable tools for these initiatives. Furthermore, stringent safety regulations and environmental compliance standards, particularly in hazardous industries, compel organizations to implement robust condition monitoring systems, further boosting the demand for reliable vibration sensing technologies. The aging industrial infrastructure globally also contributes to this demand, as older machines require more intensive monitoring to prevent failures and ensure continued safe operation.

Despite the robust drivers, the Vibration Sensor Market faces certain restraints that could impede its growth. A significant challenge is the high initial cost associated with the procurement and installation of advanced vibration monitoring systems, which can be a barrier for small and medium-sized enterprises (SMEs) with limited capital budgets. This includes not only the sensors themselves but also the associated data acquisition hardware, software, and integration costs. Moreover, the inherent complexity of data analysis and interpretation poses another restraint. Raw vibration data can be intricate and requires specialized technical expertise to extract meaningful insights, leading to a shortage of skilled personnel capable of effectively deploying, managing, and interpreting these systems. Cybersecurity concerns are also becoming increasingly relevant, as interconnected vibration sensors transmit sensitive operational data, making them potential targets for cyber threats that could compromise industrial control systems or data integrity. The integration challenges with existing legacy systems within older industrial setups further add to the complexity and cost of adoption, requiring significant infrastructure upgrades or custom solutions.

The market is also rife with opportunities that promise significant growth and innovation. The continuous advancements in wireless sensor technologies, offering easier installation, reduced infrastructure costs, and greater flexibility, are opening up new applications and expanding market penetration. The miniaturization of sensors through Micro-Electromechanical Systems (MEMS) technology is creating opportunities for integrating vibration monitoring into smaller devices and new product categories, including consumer electronics and wearable health devices. Moreover, the rapidly evolving field of Artificial Intelligence (AI) and Machine Learning (ML) for advanced data analytics presents a transformative opportunity, enabling more accurate predictive capabilities, automated fault diagnosis, and optimized maintenance scheduling, thereby enhancing the value proposition of vibration sensor solutions. The expansion into emerging markets, particularly in Asia Pacific, Latin America, and the Middle East and Africa, driven by ongoing industrialization and infrastructure development projects, offers vast untapped potential for market players. These regions are increasingly investing in modernizing their industrial bases, creating a fertile ground for the adoption of advanced condition monitoring technologies.

Segmentation Analysis

The Vibration Sensor Market is broadly segmented across several key dimensions, providing a granular view of its diverse applications, technological underpinnings, and end-user adoption patterns. This segmentation helps in understanding the market dynamics, identifying high-growth areas, and tailoring solutions to specific industry needs. The primary categories for segmentation typically include the type of sensor, the underlying technology used, the specific application it serves, and the end-use industry it caters to. Each segment exhibits unique growth trajectories influenced by technological advancements, regulatory mandates, and industry-specific demands for efficiency and safety. The continuous evolution of these segments reflects the market's adaptability and responsiveness to changing industrial requirements and emerging technological capabilities, fostering a robust environment for innovation and specialized product development.

- By Type

- Accelerometers: Dominant segment, highly versatile for general-purpose vibration measurement.

- Proximity Probes: Essential for non-contact measurement of shaft displacement in rotating machinery.

- Velocity Sensors: Used for monitoring lower frequency vibrations and machine speed.

- Other Types: Includes strain gauge-based sensors, fiber optic sensors, and acoustic emission sensors, catering to specialized applications.

- By Technology

- Piezoelectric: Widely used for high-frequency measurements due to their robust design and broad frequency response.

- Piezoresistive: Suitable for measuring static and low-frequency acceleration, often found in shock and impact testing.

- Capacitive: Offer high sensitivity and are often used in MEMS-based accelerometers for consumer electronics.

- MEMS (Micro-Electromechanical Systems): Miniaturized, cost-effective, and low-power sensors, gaining traction in various smart devices and compact industrial applications.

- Optical: Provide immunity to electromagnetic interference and are used in harsh environments or for high-precision measurements.

- Electromagnetic: Primarily used as velocity sensors, generating voltage proportional to vibration velocity.

- By Application

- Condition Monitoring: The largest application, focused on continuous assessment of machine health to prevent failures.

- Predictive Maintenance: Leveraging condition monitoring data to forecast potential failures and schedule maintenance proactively.

- Structural Health Monitoring: Used in civil engineering to assess the integrity of bridges, buildings, and other large structures.

- Process Control: Integrating vibration data into control systems for optimizing industrial processes.

- Noise & Vibration Testing: Utilized in research and development for product design and quality control in automotive and aerospace.

- Research & Development: Supporting innovation in various fields requiring precise vibration analysis.

- By End-Use Industry

- Automotive: For engine diagnostics, vehicle dynamics, and comfort analysis.

- Aerospace & Defense: Monitoring aircraft engines, structural integrity, and defense equipment.

- Industrial (Manufacturing, Robotics, Heavy Machinery): Critical for monitoring motors, pumps, gearboxes, and ensuring uninterrupted production.

- Oil & Gas: Essential for monitoring pipelines, turbines, compressors, and drilling equipment in harsh environments.

- Power Generation: Used in turbines, generators, and cooling systems in conventional and renewable energy plants.

- Healthcare: Applications in medical devices, patient monitoring, and assistive technologies.

- Consumer Electronics: Integrated into smartphones, wearables, and gaming devices for motion sensing.

- Infrastructure: Monitoring the health of bridges, railways, and other critical civil structures.

Value Chain Analysis For Vibration Sensor Market

The value chain for the Vibration Sensor Market is a complex ecosystem involving multiple stages, from raw material sourcing to end-user deployment and ongoing service, each adding significant value to the final product and solution. The upstream segment of the value chain is dominated by raw material suppliers and component manufacturers. This includes providers of specialized materials such as piezoelectric ceramics, silicon wafers for MEMS, high-grade metals for casings, and various electronic components like integrated circuits and microcontrollers. These suppliers are critical for ensuring the quality, reliability, and performance of the sensors. The highly specialized nature of these components often means a limited number of niche suppliers, impacting procurement strategies and fostering strong relationships between sensor manufacturers and their upstream partners. Innovation in material science and component miniaturization at this stage directly influences the capabilities and cost-effectiveness of the final vibration sensor products, making it a competitive and vital part of the value chain.

Moving downstream, the value chain encompasses sensor manufacturers, system integrators, and software developers. Sensor manufacturers design, assemble, and test the vibration sensors, often customizing them for specific applications or industries. They invest heavily in R&D to improve sensor accuracy, durability, and connectivity features, such as wireless capabilities and digital outputs. System integrators play a crucial role by combining vibration sensors with data acquisition systems, communication modules, and analytical software to create comprehensive condition monitoring solutions. These integrators often provide tailored solutions, ensuring seamless integration with existing industrial control systems (ICS) and enterprise resource planning (ERP) platforms. Software developers contribute by creating the analytical tools and platforms, including AI/ML-driven algorithms for predictive maintenance, data visualization dashboards, and reporting functionalities, transforming raw sensor data into actionable insights for end-users. The downstream segment is characterized by increasing collaboration and partnerships to offer integrated, holistic solutions that address complex customer requirements.

The distribution channel for vibration sensors involves both direct and indirect sales approaches. Direct sales are common for large industrial customers and original equipment manufacturers (OEMs) who require customized solutions, technical support, and long-term service agreements. In these instances, sensor manufacturers or system integrators engage directly with the end-users to provide bespoke solutions and build strong relationships. Indirect channels involve a network of distributors, value-added resellers (VARs), and online marketplaces. Distributors, often specialized in industrial equipment or test and measurement tools, play a vital role in reaching a broader customer base, particularly small and medium-sized enterprises (SMEs) that may not have direct access to manufacturers. These channels provide local support, inventory, and faster delivery times. The rise of e-commerce platforms is also creating new avenues for the distribution of standard vibration sensor products, making them more accessible globally. Effective distribution strategies are crucial for market penetration and ensuring widespread availability of these critical industrial components.

Vibration Sensor Market Potential Customers

The potential customers for vibration sensors are incredibly diverse, spanning nearly every industrial sector and extending into consumer and infrastructure domains, driven by the universal need to monitor the health and performance of mechanical assets. At the core, manufacturing plants represent a colossal customer base, encompassing industries such as automotive, aerospace, heavy machinery, and consumer goods production. These facilities rely on vibration sensors to monitor motors, pumps, fans, compressors, and robotics, where unexpected downtime can lead to significant financial losses and production delays. The shift towards lean manufacturing and just-in-time production further amplifies the demand for continuous, real-time machine health monitoring to maintain operational uptime and optimize maintenance schedules. For these customers, the primary benefit lies in enhancing operational efficiency, reducing maintenance costs, and ensuring uninterrupted production workflows.

Beyond traditional manufacturing, significant end-users include the energy sector, specifically oil and gas operators and power generation utilities. In the oil and gas industry, vibration sensors are crucial for monitoring critical assets like pipelines, drilling rigs, offshore platforms, and refinery equipment, often operating in harsh and remote environments where proactive maintenance is paramount for safety and environmental protection. Power generation plants, whether conventional (coal, gas, nuclear) or renewable (wind turbines, hydroelectric), utilize vibration sensors to ensure the integrity and efficiency of turbines, generators, gearboxes, and cooling systems, preventing costly outages and maximizing energy output. Furthermore, the infrastructure management sector, including operators of bridges, railways, and large civil structures, increasingly leverages vibration sensors for structural health monitoring. This application helps detect early signs of structural fatigue or damage, ensuring public safety and extending the lifespan of critical national assets.

Other vital segments of potential customers include research and development institutions, where vibration sensors are used for material testing, product design validation, and experimental analysis across various engineering disciplines. The healthcare sector is an emerging area, with applications in monitoring medical equipment, assistive technologies, and even in some diagnostic tools. Lastly, the integration of miniaturized vibration sensors into consumer electronics, such as smartphones for gesture recognition and activity tracking, and wearables for health monitoring, indicates a burgeoning customer segment with high growth potential, driven by technological advancements and increasing consumer demand for smart, connected devices. These diverse customer groups highlight the pervasive utility and expanding market for vibration sensing solutions, underscoring its foundational role in modern industrial and technological ecosystems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.2 Billion |

| Market Forecast in 2032 | USD 6.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., General Electric (GE), ABB Ltd., Bosch Sensortec GmbH, Emerson Electric Co., Siemens AG, Meggitt PLC, Rockwell Automation Inc., Parker Hannifin Corp., OMRON Corporation, PCB Piezotronics, Inc., Brüel & Kjær (HBK), TE Connectivity Ltd., Kistler Instrumente AG, National Instruments Corp., ifm electronic GmbH, Hansford Sensors Ltd., Metrix Instrument Co., Shinkawa Electric Co., Ltd., DJB Instruments (UK) Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vibration Sensor Market Key Technology Landscape

The Vibration Sensor Market is characterized by a dynamic and continuously evolving technology landscape, driven by the relentless demand for higher accuracy, greater reliability, enhanced connectivity, and reduced cost. Micro-Electro-Mechanical Systems (MEMS) technology stands as a cornerstone of this evolution, enabling the production of miniature, highly integrated, and low-power vibration sensors. MEMS accelerometers, in particular, have revolutionized the market by facilitating their incorporation into a wide array of devices, from consumer electronics like smartphones and wearables to compact industrial monitoring units, where size and power consumption are critical factors. The inherent advantages of MEMS in terms of scalability and cost-effectiveness are expanding the applicability of vibration sensing to new and innovative areas, pushing the boundaries of traditional condition monitoring into more distributed and intelligent systems, leading to a proliferation of smart sensors capable of local data processing.

Wireless sensor networks (WSN) and the integration with the Internet of Things (IoT) represent another significant technological advancement. Wireless vibration sensors eliminate the need for cumbersome and costly cabling, simplifying installation and deployment, especially in remote, hazardous, or rotating equipment environments. These sensors transmit data via various wireless protocols such as Wi-Fi, Bluetooth Low Energy (BLE), Zigbee, or cellular networks to

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager