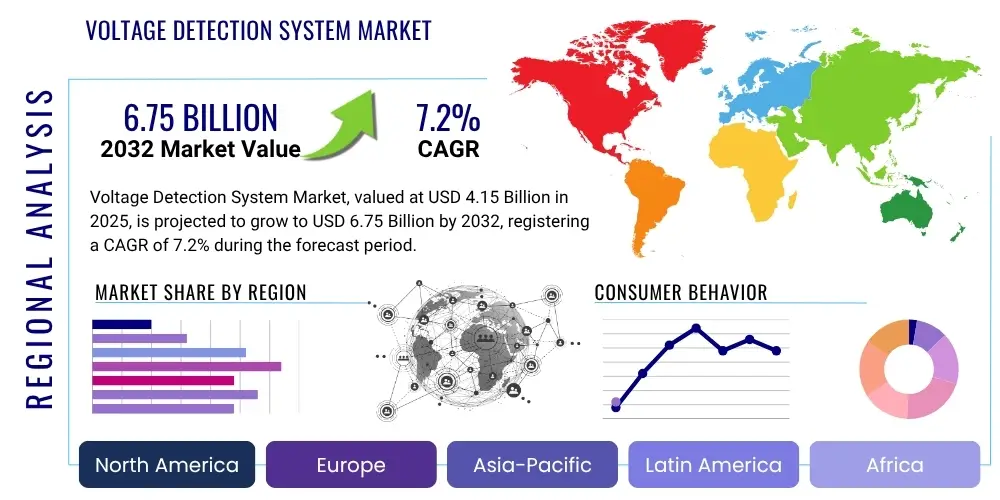

Voltage Detection System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428679 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Voltage Detection System Market Size

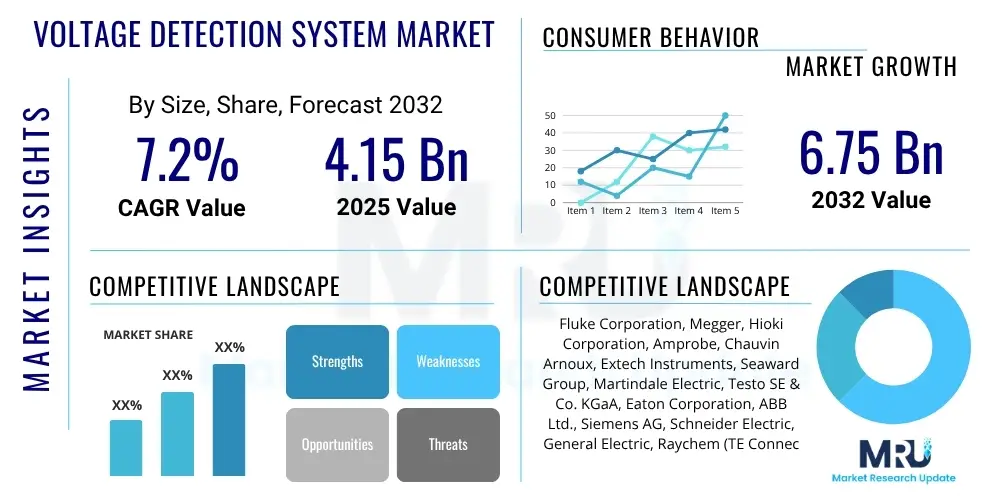

The Voltage Detection System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032. The market is estimated at $4.15 Billion in 2025 and is projected to reach $6.75 Billion by the end of the forecast period in 2032.

Voltage Detection System Market introduction

The Voltage Detection System (VDS) market encompasses a range of devices and technologies designed to identify the presence or absence of electrical voltage in circuits, equipment, and power lines. These systems are crucial for ensuring the safety of personnel, preventing electrical accidents, and maintaining the integrity of electrical infrastructure across diverse applications. They provide a vital safety mechanism by alerting users to energized circuits before maintenance or operational activities commence, thereby mitigating risks of electrocution and equipment damage.

Products within this market range from simple handheld non-contact voltage testers to complex integrated systems with advanced sensing capabilities. Major applications span industrial manufacturing, power generation and distribution, residential and commercial buildings, and the automotive sector. Key benefits of these systems include enhanced worker safety, increased operational efficiency through proactive fault detection, compliance with stringent electrical safety regulations, and improved reliability of electrical grids and machinery. The demand for VDS is significantly driven by a global emphasis on occupational safety standards, rapid industrialization, expansion of smart grid initiatives, and the increasing complexity of electrical networks.

Voltage Detection System Market Executive Summary

The Voltage Detection System market is experiencing dynamic shifts driven by technological advancements and evolving safety paradigms. Key business trends include the miniaturization of VDS devices, integration with IoT platforms for remote monitoring, and the development of intelligent, self-calibrating systems. Manufacturers are increasingly focusing on creating user-friendly interfaces and incorporating robust environmental shielding to enhance device durability and performance in harsh operating conditions. Strategic partnerships and mergers are also prevalent as companies seek to consolidate market share and expand their technological portfolios, particularly in areas involving predictive maintenance and smart sensor networks.

Regionally, Asia Pacific is anticipated to demonstrate the highest growth, fueled by rapid industrialization, significant investments in power infrastructure, and increasing adoption of stringent safety regulations in emerging economies like China and India. North America and Europe continue to be strong markets, driven by the modernization of existing grids, strict occupational safety standards, and a high uptake of advanced VDS solutions in industrial and utility sectors. Segment-wise, the market sees robust growth in non-contact detection technologies due to their inherent safety advantages, while the industrial and utility end-user segments are projected to maintain dominant market shares owing to the critical need for continuous voltage monitoring and safety compliance in these environments.

AI Impact Analysis on Voltage Detection System Market

Users frequently inquire about how Artificial Intelligence (AI) can transcend traditional voltage detection, moving beyond simple presence/absence indications to more predictive and analytical capabilities. Common questions revolve around AI's role in enhancing system reliability, enabling predictive maintenance, improving fault localization, and automating safety responses. There is a strong interest in understanding how AI can process vast amounts of sensor data to identify anomalous patterns, forecast potential equipment failures, and optimize maintenance schedules, thereby transforming reactive safety measures into proactive strategies. Concerns often include data security, the complexity of integrating AI into existing infrastructure, and the potential for false positives.

- Predictive Maintenance: AI algorithms analyze historical voltage data, environmental conditions, and equipment performance to predict potential failures, enabling proactive maintenance and reducing unexpected downtime.

- Enhanced Fault Localization: AI can process data from multiple sensors across a network to rapidly and precisely pinpoint the location of electrical faults, significantly speeding up repair times and minimizing outage durations.

- Smart Grid Integration: AI-powered VDS contributes to smarter grid operations by providing real-time, intelligent insights into grid stability and potential vulnerabilities, optimizing power distribution and enhancing resilience.

- Autonomous Safety Responses: In advanced systems, AI can trigger automated safety protocols, such as immediate power disconnections or rerouting, in response to detected voltage anomalies, thereby preventing accidents with minimal human intervention.

- Optimized Resource Management: AI helps in optimizing the deployment and scheduling of maintenance crews by identifying critical areas requiring immediate attention, leading to more efficient resource utilization and cost savings.

- Anomaly Detection: AI algorithms can detect subtle deviations from normal voltage patterns that might indicate developing issues, allowing for early intervention before critical failures occur.

- Self-Calibration and Diagnostics: Future AI-integrated VDS may feature self-calibration capabilities and advanced diagnostics, reducing the need for manual checks and improving measurement accuracy over time.

DRO & Impact Forces Of Voltage Detection System Market

The Voltage Detection System market is propelled by a confluence of critical drivers, notably the escalating global emphasis on industrial safety standards and occupational health regulations. Governments and regulatory bodies worldwide are implementing stricter mandates for worker safety in environments with electrical hazards, compelling industries to adopt advanced VDS solutions. Furthermore, significant investments in infrastructure development, including smart grid initiatives, expansion of renewable energy sources, and modernization of existing power networks, create substantial demand for reliable and efficient voltage detection technologies to ensure operational integrity and prevent costly outages. The continuous push for automation across various industries also necessitates sophisticated VDS integration for safeguarding automated machinery and personnel working alongside them.

However, the market faces several restraints, including the relatively high initial capital expenditure required for advanced VDS installations, particularly for comprehensive, integrated systems. The technical complexities associated with integrating these systems into diverse legacy infrastructures, coupled with a lack of universal standardization across different voltage detection technologies and communication protocols, can hinder widespread adoption. Maintenance and calibration costs for sophisticated VDS devices can also be a deterrent for smaller enterprises. Despite these challenges, significant opportunities exist in emerging markets, where rapid industrialization and infrastructure growth are creating new demand. The ongoing innovation in wireless and non-contact VDS, coupled with the integration of AI and IoT, presents avenues for developing more intelligent, efficient, and cost-effective solutions. Furthermore, increasing demand for customized solutions tailored to specific industry requirements offers growth prospects.

Segmentation Analysis

The Voltage Detection System market is comprehensively segmented based on various attributes to provide a detailed understanding of its dynamics and potential growth areas. These segmentations allow for a granular analysis of product types, technologies, voltage ranges, applications, end-users, and portability, revealing specific trends and consumer preferences across different operational contexts. Understanding these segments is crucial for manufacturers to tailor their product offerings, for service providers to identify niche markets, and for investors to make informed decisions regarding market entry and expansion strategies.

- By Type

- Contact Voltage Detection Systems

- Non-Contact Voltage Detection Systems

- By Technology

- Capacitive Detection Systems

- Resistive Detection Systems

- Inductive Detection Systems

- Optoelectronic Detection Systems

- Electromagnetic Field Detection Systems

- By Voltage Range

- Low Voltage Detection Systems (Up to 1 kV)

- Medium Voltage Detection Systems (1 kV to 36 kV)

- High Voltage Detection Systems (Above 36 kV)

- By Application

- Power Generation

- Power Transmission and Distribution

- Industrial Manufacturing

- Construction

- Residential and Commercial Buildings

- Mining

- Oil and Gas

- Automotive

- Telecommunications

- By End-User

- Utilities

- Manufacturing Industries

- Commercial Enterprises

- Residential Users

- Government and Public Sector

- By Portability

- Portable Devices

- Fixed/Installed Systems

Value Chain Analysis For Voltage Detection System Market

The value chain for the Voltage Detection System market begins with upstream activities involving the procurement of raw materials and specialized components. This phase includes suppliers of semiconductors, integrated circuits, microcontrollers, sensors (e.g., capacitive, resistive, optical), high-quality plastics, metals, and insulating materials crucial for manufacturing robust and accurate VDS devices. Key players in this stage focus on innovation in sensor technology and material science to improve detection accuracy, durability, and miniaturization of components. Strategic partnerships with these suppliers are vital for manufacturers to ensure consistent quality and cost-effectiveness of their products, supporting the development of advanced detection capabilities.

Further along the value chain, the manufacturing stage involves the assembly, calibration, and testing of these components into finished VDS products. This includes the integration of firmware and software that enable advanced functionalities such as data logging, wireless communication, and self-diagnostics. The downstream activities focus on the distribution, sales, and post-sales support of Voltage Detection Systems. Distribution channels are varied, encompassing direct sales to large industrial clients and utilities, indirect sales through specialized distributors, electrical wholesalers, and online retail platforms catering to smaller businesses and individual users. The choice of distribution channel often depends on the product's complexity and target customer base, with direct channels typically employed for high-voltage, custom industrial systems and indirect channels for standard, off-the-shelf devices.

Voltage Detection System Market Potential Customers

Potential customers for Voltage Detection Systems are incredibly diverse, spanning across nearly every sector that interacts with electricity, emphasizing the universal need for electrical safety. Electric utilities, including power generation companies, transmission system operators, and distribution companies, represent a primary customer segment due to their extensive network of high, medium, and low voltage infrastructure. These entities require VDS for routine maintenance, fault detection, and ensuring the safety of their field personnel during grid operations and upgrades. The robust and reliable nature of these systems is critical for minimizing downtime and preventing catastrophic failures within the national power grids.

Beyond utilities, industrial manufacturing facilities are significant end-users, requiring VDS for protecting workers from energized machinery, performing lock-out/tag-out procedures, and maintaining complex production lines. Sectors such as oil and gas, mining, and construction industries also represent substantial markets, where harsh operating environments and high-risk electrical installations necessitate robust and reliable voltage detection. Commercial buildings, including offices, shopping malls, and data centers, along with residential consumers, utilize VDS for electrical troubleshooting and ensuring home safety. The automotive industry, particularly with the rise of electric vehicles, is emerging as a growing segment for specialized high-voltage detection systems. Government agencies and public infrastructure projects also consistently invest in VDS for various applications, underscoring the broad applicability and critical demand across a multitude of end-user/buyer categories.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.15 Billion |

| Market Forecast in 2032 | $6.75 Billion |

| Growth Rate | CAGR 7.2% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fluke Corporation, Megger, Hioki Corporation, Amprobe, Chauvin Arnoux, Extech Instruments, Seaward Group, Martindale Electric, Testo SE & Co. KGaA, Eaton Corporation, ABB Ltd., Siemens AG, Schneider Electric, General Electric, Raychem (TE Connectivity), WIKA Group, Keysight Technologies, DILO Company Inc., Qualitrol Company LLC, Vanguard Instruments |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Voltage Detection System Market Key Technology Landscape

The Voltage Detection System market is continuously evolving with significant advancements in its underlying technological landscape, moving towards greater accuracy, safety, and integration. A prominent trend is the widespread adoption of non-contact detection methods, which utilize electromagnetic field sensing or capacitive coupling to detect voltage without direct physical contact, significantly enhancing operator safety. Wireless communication technologies, particularly Wi-Fi, Bluetooth, and cellular IoT, are increasingly integrated into VDS devices, enabling remote monitoring, data logging, and real-time alerts. This connectivity facilitates predictive maintenance strategies and allows for more efficient management of extensive electrical networks by providing access to critical information from a safe distance.

Another crucial technological development involves the incorporation of advanced sensor fusion techniques, combining data from multiple sensor types to improve the reliability and precision of voltage detection, especially in complex environments with electromagnetic interference. Artificial Intelligence (AI) and Machine Learning (ML) algorithms are also becoming integral, enabling VDS to perform intelligent anomaly detection, predict equipment failures, and optimize operational efficiency through data analytics. Furthermore, the use of advanced materials, such as those with improved dielectric properties and environmental resilience, contributes to the development of more durable and robust VDS units capable of withstanding harsh industrial conditions. Digital signal processing (DSP) and miniaturization technologies are leading to more compact, portable, and versatile voltage detection tools that can be easily integrated into personal protective equipment or complex grid infrastructure, ensuring compliance with evolving industry standards.

Regional Highlights

- North America: This region stands as a mature market for Voltage Detection Systems, driven by stringent occupational safety regulations, significant investments in smart grid infrastructure modernization, and a robust industrial sector. The U.S. and Canada are leading adopters of advanced VDS technologies, with a strong focus on worker safety and reliability of power transmission and distribution networks. Demand is further boosted by the increasing integration of renewable energy sources and the need for sophisticated monitoring solutions.

- Europe: Similar to North America, Europe exhibits a high demand for VDS due to strict safety standards (e.g., EU directives), an aging electrical infrastructure requiring continuous monitoring, and the ongoing transition to Industry 4.0. Countries like Germany, the UK, and France are at the forefront of adopting innovative VDS solutions, particularly those offering enhanced safety features, predictive capabilities, and compliance with environmental regulations. The focus on energy efficiency and grid stability further fuels market growth.

- Asia Pacific (APAC): Positioned as the fastest-growing market, APAC is characterized by rapid industrialization, massive infrastructure development projects, and expanding power generation and distribution capacities in countries such as China, India, and Japan. The rising awareness of industrial safety, coupled with increasing government investments in smart cities and grid modernization, is driving substantial demand for VDS. The emergence of local manufacturers and competitive pricing strategies also contribute to the region's dynamic growth.

- Latin America: This region presents significant growth potential, primarily due to ongoing economic development, urbanization, and increasing investments in power sector reforms and renewable energy projects. Countries like Brazil and Mexico are witnessing an uptake in VDS adoption as they strive to modernize their electrical infrastructure and improve safety standards across industrial and commercial sectors. Challenges related to infrastructure development and regulatory frameworks are gradually being addressed, paving the way for market expansion.

- Middle East and Africa (MEA): The MEA region is experiencing steady growth in the VDS market, fueled by large-scale construction projects, rapid urbanization, and substantial investments in oil and gas, and energy infrastructure. Countries in the GCC region are particularly prominent, driven by ambitious diversification plans and the development of smart cities. The increasing emphasis on industrial safety and the expansion of utilities across Africa also contribute to the rising demand for voltage detection solutions, albeit at a slower pace compared to APAC.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Voltage Detection System Market.- Fluke Corporation

- Megger

- Hioki Corporation

- Amprobe

- Chauvin Arnoux

- Extech Instruments

- Seaward Group

- Martindale Electric

- Testo SE & Co. KGaA

- Eaton Corporation

- ABB Ltd.

- Siemens AG

- Schneider Electric

- General Electric

- Raychem (TE Connectivity)

- WIKA Group

- Keysight Technologies

- DILO Company Inc.

- Qualitrol Company LLC

- Vanguard Instruments

Frequently Asked Questions

What is a Voltage Detection System (VDS)?

A Voltage Detection System is a device or integrated technology designed to detect the presence or absence of electrical voltage in a circuit, conductor, or equipment, crucial for ensuring safety and operational integrity.

Why are Voltage Detection Systems important in industrial settings?

VDS are critical in industrial settings for preventing electrical accidents, protecting workers during maintenance, ensuring compliance with safety regulations, and minimizing equipment damage and costly downtime by identifying live circuits.

How does AI enhance Voltage Detection Systems?

AI enhances VDS by enabling predictive maintenance, improving fault localization, integrating with smart grids for optimized operations, facilitating autonomous safety responses, and detecting subtle anomalies for proactive intervention.

What are the key types of Voltage Detection Systems available?

Key types include contact voltage detectors (requiring direct contact) and non-contact voltage detectors (sensing electromagnetic fields), categorized further by technology like capacitive, resistive, inductive, and optoelectronic methods.

What factors primarily drive the growth of the Voltage Detection System market?

The market is primarily driven by increasing global emphasis on industrial safety regulations, significant investments in power infrastructure development (including smart grids), rising automation across industries, and the continuous need for reliable electrical network monitoring.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager