Waveguide Components and Assemblies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428620 | Date : Oct, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Waveguide Components and Assemblies Market Size

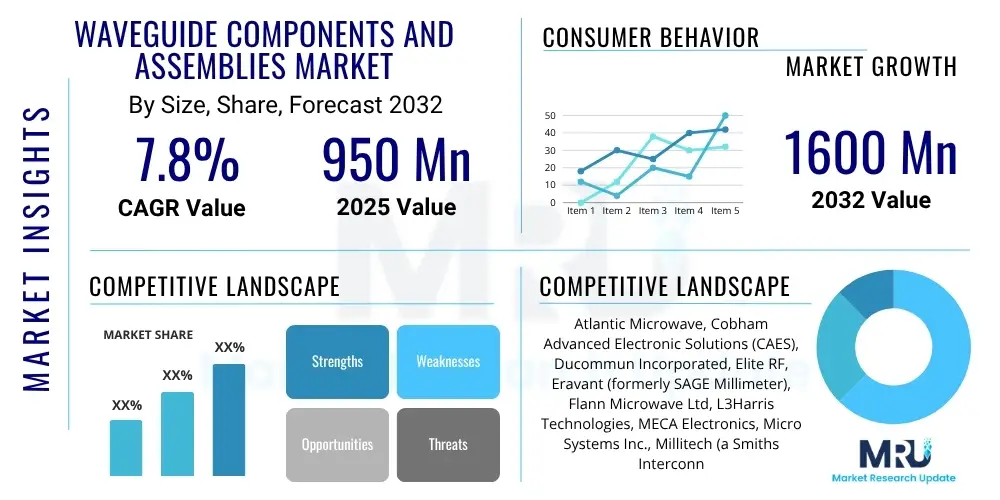

The Waveguide Components and Assemblies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at $950 million in 2025 and is projected to reach $1600 million by the end of the forecast period in 2032.

Waveguide Components and Assemblies Market introduction

The Waveguide Components and Assemblies Market encompasses a critical segment of the high-frequency communication and sensing ecosystem, providing essential infrastructure for transmitting electromagnetic waves with minimal loss and distortion. These components, ranging from rigid and flexible waveguides to specialized adapters, couplers, and filters, are engineered to guide microwave and millimeter-wave signals efficiently. Their primary function involves enabling the precise and robust transmission of high-frequency energy in applications where traditional coaxial cables would incur prohibitive signal degradation. The market's growth is predominantly driven by the escalating demand for advanced communication systems, sophisticated radar technologies, and high-performance satellite applications, all of which rely heavily on the superior electrical performance and mechanical integrity offered by waveguide solutions.

The products within this market are typically manufactured from conductive metals such as aluminum, copper, and brass, and are designed for specific frequency bands, ensuring optimal performance for applications like 5G wireless networks, defense radar systems, and space-borne communication links. Key benefits of waveguide components include their exceptional power handling capabilities, very low insertion loss, high isolation, and inherent shielding against electromagnetic interference. These characteristics make them indispensable in environments requiring high reliability and performance, such as aerospace, military, and telecommunications infrastructure. The continuous evolution of these industries, particularly the global rollout of 5G and the increasing investment in defense modernization, acts as significant driving forces propelling the waveguide components and assemblies market forward, fostering innovation in materials, manufacturing processes, and design for higher frequency and greater efficiency.

Waveguide Components and Assemblies Market Executive Summary

The Waveguide Components and Assemblies Market is experiencing robust expansion, propelled by significant business trends including the global rollout of 5G technology, increasing investments in defense and aerospace sectors, and the proliferation of satellite internet services. Companies are focusing on innovation in manufacturing techniques, such as additive manufacturing, to produce lighter and more complex waveguide structures, alongside the development of components for increasingly higher frequency bands like millimeter-wave. Regional trends indicate strong growth in the Asia-Pacific due to rapid telecommunications infrastructure development and defense modernization initiatives, while North America and Europe maintain significant market shares driven by advanced research, military spending, and space programs. The market is also witnessing a trend towards miniaturization and integration of components, aimed at reducing system size and weight, which is particularly critical for mobile and aerial platforms.

Segment-wise, the market is seeing elevated demand for flexible waveguides due to their versatility and ease of installation in confined spaces, especially in aerospace and radar applications. Furthermore, the push for higher data rates and greater bandwidth is fueling the demand for millimeter-wave components, including those operating in Ka-band, V-band, and W-band, which are crucial for 5G backhaul and advanced sensing applications. The competitive landscape is characterized by both established industry giants and specialized niche players, all striving to differentiate through technological advancements, superior product performance, and tailored solutions. Strategic partnerships and mergers and acquisitions are also common strategies employed to expand market reach and enhance technological capabilities. Overall, the market remains dynamic, driven by technological imperatives and expanding application areas across various high-growth industries.

AI Impact Analysis on Waveguide Components and Assemblies Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is poised to significantly transform the Waveguide Components and Assemblies Market, addressing common user questions about enhancing design efficiency, optimizing manufacturing processes, and enabling predictive maintenance. Users are keenly interested in how AI can accelerate the complex design cycle for high-frequency components, especially given the stringent performance requirements and intricate geometries of waveguides. There is a strong expectation that AI will lead to more innovative and efficient designs, reduce development costs, and improve the overall performance characteristics of waveguide products. Furthermore, inquiries often revolve around AI's potential to streamline production, ensure higher quality control, and minimize waste through intelligent automation, making manufacturing more cost-effective and responsive to market demands. The prospect of using AI for real-time monitoring and predictive failure analysis in operational waveguide systems is also a key area of interest, promising increased reliability and reduced downtime for critical applications.

AI's influence is expected to extend beyond design and manufacturing into broader market dynamics, including supply chain optimization and the identification of new application opportunities. Users are exploring how AI can analyze vast datasets from market trends, customer feedback, and material science to forecast demand more accurately, manage inventory efficiently, and identify emerging technological needs for waveguide solutions. This analytical capability can inform strategic decisions, guiding manufacturers in developing products that are precisely aligned with future market requirements. The overarching themes reflect a desire for AI to not only automate and optimize existing processes but also to catalyze innovation, leading to a new generation of smarter, more resilient, and highly specialized waveguide components that can meet the escalating demands of advanced communication, sensing, and defense systems. This shift could redefine competitive advantages and accelerate the market's trajectory towards more integrated and intelligent RF solutions.

- AI-powered design optimization for complex waveguide geometries, reducing prototyping cycles.

- Enhanced manufacturing processes through AI-driven automation and quality control, leading to higher precision and reduced defects.

- Predictive maintenance for waveguide systems, utilizing AI algorithms to monitor performance and anticipate failures, increasing reliability and uptime.

- Improved material selection and characterization through AI analysis, leading to waveguides with superior electrical and thermal properties.

- Optimized supply chain and inventory management using AI for demand forecasting and logistics, ensuring timely component availability.

- New applications and functionalities for waveguides in smart environments and AI-driven systems.

- Reduced design iterations and cost savings through advanced AI simulation and modeling.

- Personalized waveguide solutions based on AI analysis of specific application requirements.

DRO & Impact Forces Of Waveguide Components and Assemblies Market

The Waveguide Components and Assemblies Market is shaped by a complex interplay of drivers, restraints, and opportunities, influenced by various impact forces. Key drivers include the global expansion of 5G and future 6G networks demanding high-frequency components, escalating defense budgets focused on advanced radar and electronic warfare systems, and the proliferation of satellite communication and internet services. The increasing complexity and performance requirements of aerospace applications, alongside the growing adoption of IoT and autonomous vehicles necessitating robust communication links, further fuel market expansion. However, significant restraints challenge market growth, such as the high manufacturing costs associated with precision engineering and specialized materials, the intricate design complexities required for millimeter-wave operation, and a persistent shortage of skilled engineers and technicians. Additionally, the emergence of alternative technologies like optical fiber in certain applications, while not a direct substitute, presents competitive pressure, and the inherent bulkiness of some waveguide solutions can be a limitation in miniaturized systems. Opportunities abound in emerging applications such as quantum computing, advanced medical imaging, and space exploration, alongside the potential for new material sciences and additive manufacturing techniques to revolutionize production.

Impact forces within the market further define its landscape. The bargaining power of buyers is moderate to high, as large telecom operators and defense contractors can exert significant influence due to their purchasing volumes and project specifics, often demanding custom solutions. Conversely, the bargaining power of suppliers is also moderate, driven by the specialized nature of materials and manufacturing processes, requiring specific expertise and infrastructure. The threat of new entrants is relatively low due to the high capital investment, technical barriers, and stringent regulatory and quality certifications required to operate in this precision-driven market. However, the threat of substitutes, while currently limited for core high-frequency, high-power applications, could increase with advancements in alternative transmission media. Competitive rivalry among existing players is intense, with companies constantly innovating and differentiating through performance, cost-efficiency, and customer service to secure market share in a highly specialized and technically demanding industry. These forces collectively dictate the strategic decisions and growth trajectories of companies within the waveguide components and assemblies sector.

Segmentation Analysis

The Waveguide Components and Assemblies Market is meticulously segmented to provide a comprehensive understanding of its diverse landscape, reflecting variations in product type, material composition, operational frequency, and end-use applications. This detailed segmentation allows market participants to identify niche opportunities, understand competitive dynamics within specific sub-markets, and tailor their product development and marketing strategies. The market's structure is largely dictated by the technical requirements of high-frequency signal transmission, where specific component characteristics are critical for optimal system performance. Analyzing these segments reveals shifting demand patterns driven by technological advancements, evolving industry standards, and the unique needs of various high-tech sectors, ranging from telecommunications to defense and scientific research. The increasing demand for solutions across a broader spectrum of frequencies and in more challenging operational environments underpins the complexity and richness of this market's segmentation.

- By Component Type:

- Rigid Waveguides

- Flexible Waveguides

- Adapters

- Couplers (Directional, Hybrid)

- Isolators and Circulators

- Attenuators (Fixed, Variable)

- Filters (Bandpass, Lowpass, Highpass)

- Terminations/Loads

- Antennas (Horn, Slotted, Phased Array Feed)

- Waveguide Switches

- Pressure Windows

- By Material:

- Aluminum

- Copper

- Brass

- Silver

- Nickel

- Stainless Steel

- Composite Materials

- By Frequency Band:

- L-Band

- S-Band

- C-Band

- X-Band

- Ku-Band

- K-Band

- Ka-Band

- V-Band

- W-Band

- Millimeter-Wave (beyond W-Band)

- By Application:

- Telecommunications (5G Infrastructure, Satellite Communication, Broadcast)

- Radar & Defense (Aerospace Radar, Ground-Based Radar, Naval Radar, Electronic Warfare)

- Aerospace (Aircraft, UAVs, Spacecraft)

- Test & Measurement (Laboratory Equipment, Industrial Testing)

- Industrial (High-Power Heating, Drying, Plasma Generation)

- Medical (MRI Systems, Oncology Devices)

- Scientific Research

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Aftermarket (Maintenance, Repair, and Overhaul - MRO)

- System Integrators

- Research Institutions

Value Chain Analysis For Waveguide Components and Assemblies Market

The value chain for the Waveguide Components and Assemblies Market is characterized by a series of specialized stages, beginning with the meticulous sourcing of raw materials and culminating in the delivery and integration of sophisticated components into complex systems. Upstream activities involve suppliers of high-grade conductive metals such as aluminum, copper, and brass, along with providers of specialized coatings and plating materials crucial for performance and durability. These raw material providers must adhere to stringent quality standards to ensure the precise electrical and mechanical properties required for waveguide fabrication. Component manufacturers then engage in highly specialized processes including CNC machining, brazing, electroforming, and potentially additive manufacturing, demanding significant investment in advanced machinery and skilled labor. This stage is critical for achieving the tight tolerances and complex geometries inherent in waveguide design.

Downstream in the value chain, system integrators play a pivotal role, combining individual waveguide components with other RF and microwave subsystems to create complete operational units for end-users. These integrators work closely with component manufacturers to ensure seamless compatibility and optimal system performance. The distribution channels for waveguide components are typically a mix of direct and indirect sales. Direct sales are prevalent for large volume orders, custom solutions, or strategic partnerships with major aerospace, defense, or telecommunication clients, allowing for direct technical support and tailored service. Indirect channels involve a network of specialized distributors and value-added resellers who provide regional market access, localized support, and smaller volume sales to a broader customer base, including research institutions and smaller enterprises. The efficiency of this value chain relies heavily on strong collaboration between each stage, from material science innovation to final system integration, to meet the demanding performance and reliability expectations of high-frequency applications.

Waveguide Components and Assemblies Market Potential Customers

The primary end-users and buyers of waveguide components and assemblies span a diverse range of high-technology industries, each requiring precise and reliable high-frequency signal transmission for their critical operations. Telecommunication equipment manufacturers constitute a significant customer base, procuring these components for 5G base stations, microwave backhaul links, and satellite communication terminals where high bandwidth and low loss are paramount. Aerospace and defense contractors are another cornerstone, integrating waveguides into advanced radar systems for surveillance, missile guidance, electronic warfare platforms, and onboard aircraft communication systems, demanding extreme robustness and performance in harsh environments. Satellite operators and manufacturers are increasingly reliant on waveguides for both ground stations and space-borne payloads, facilitating global communication and data transmission.

Beyond these major sectors, research institutions and universities frequently acquire waveguide components for experimental setups, advanced physics studies, and development of next-generation communication and sensing technologies. Test and measurement laboratories utilize these assemblies for calibrating RF equipment, conducting performance evaluations, and ensuring compliance with industry standards across various applications. Furthermore, industrial sectors, particularly those involved in high-power microwave heating, drying processes, and plasma generation, also represent a niche but growing customer segment. The stringent technical specifications, high reliability requirements, and specialized nature of these applications mean that potential customers prioritize product quality, performance, and supplier expertise when making purchasing decisions in this highly specialized market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $950 million |

| Market Forecast in 2032 | $1600 million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlantic Microwave, Cobham Advanced Electronic Solutions (CAES), Ducommun Incorporated, Elite RF, Eravant (formerly SAGE Millimeter), Flann Microwave Ltd, L3Harris Technologies, MECA Electronics, Micro Systems Inc., Millitech (a Smiths Interconnect Company), Narda STS (a L3Harris Company), Pasternack Enterprises Inc., Quinstar Technology Inc., SAGE Millimeter Inc., Space Machine & Engineering Corp. (SME), Waveline Inc., Wavetronix, WR Components, VTT Technical Research Centre of Finland, RPG Radiometer Physics GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Waveguide Components and Assemblies Market Key Technology Landscape

The Waveguide Components and Assemblies Market is underpinned by a sophisticated array of technologies that enable the precise fabrication and reliable operation of high-frequency components. Central to manufacturing is advanced Computer Numerical Control (CNC) machining, which allows for the creation of intricate waveguide geometries with extremely tight tolerances, critical for achieving optimal electrical performance at millimeter-wave frequencies. Precision brazing and soldering techniques are also vital for joining different sections of waveguides and integrating other passive components, ensuring robust electrical continuity and mechanical integrity. Furthermore, electroforming technology is employed to produce complex internal structures and high-purity internal surfaces, particularly for components requiring exceptional performance and minimal signal loss. These traditional methods are continually being refined to meet ever-increasing demands for precision and reduced manufacturing costs.

Innovations in materials science are playing a crucial role, with research focusing on lighter, stronger, and more thermally stable alloys that can perform reliably in extreme environments such as space or high-power defense applications. The development of specialized conductive coatings and surface treatments further enhances the electrical characteristics and environmental resilience of waveguide components. Alongside traditional manufacturing, additive manufacturing (3D printing) is emerging as a disruptive technology, offering the potential to create highly complex, integrated waveguide structures with reduced weight and novel functionalities that are impossible with conventional methods. This technology facilitates rapid prototyping and enables the production of custom components on demand. Moreover, sophisticated microwave circuit design software and electromagnetic simulation tools are indispensable for designing, optimizing, and verifying waveguide performance before physical fabrication, significantly shortening development cycles and improving first-pass design success. Advanced testing and measurement equipment, including Vector Network Analyzers (VNAs) and anechoic chambers, are also foundational technologies ensuring the rigorous validation of component and assembly performance against stringent industry standards.

Regional Highlights

- North America: This region dominates the Waveguide Components and Assemblies Market, largely due to robust defense and aerospace expenditures, significant investments in advanced radar systems, and the pioneering development of 5G and satellite communication technologies. The presence of major defense contractors, aerospace giants, and leading telecommunications companies, coupled with strong government funding for research and development, fuels continuous innovation and demand. The United States, in particular, is a key market, characterized by cutting-edge technological advancements and a well-established manufacturing base for high-frequency components.

- Europe: The European market demonstrates steady growth, driven by investments in space programs (e.g., ESA initiatives), automotive radar development, and continued modernization of military communication systems across countries like Germany, France, and the UK. Strong emphasis on industrial automation and a vibrant research ecosystem also contribute to the demand for high-performance waveguide solutions. The region benefits from a strong base of specialized manufacturers and a focus on high-quality engineering.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, primarily propelled by aggressive 5G infrastructure deployment in countries like China, India, Japan, and South Korea. Rapid expansion of telecommunications networks, increasing defense spending, and a booming satellite communication sector are key drivers. The region's vast industrial base and burgeoning consumer electronics market also contribute to the demand for waveguide components. Investment in local manufacturing capabilities and R&D is accelerating.

- Latin America: This region is an emerging market for waveguide components and assemblies, driven by improving telecommunication infrastructure, particularly the expansion of wireless broadband and upcoming 5G deployments. Growing investments in defense modernization and resource exploration (e.g., oil and gas) also contribute to the demand, albeit at a slower pace compared to other regions. Brazil and Mexico are leading markets within Latin America.

- Middle East and Africa (MEA): The MEA region is witnessing growth spurred by significant investments in satellite communication services, particularly for remote areas and defense applications. Expanding telecommunications networks, driven by government initiatives and increasing connectivity needs, along with rising defense budgets, are fostering demand for reliable high-frequency components. Countries like Saudi Arabia, UAE, and South Africa are key contributors to this growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Waveguide Components and Assemblies Market.- Atlantic Microwave

- Cobham Advanced Electronic Solutions (CAES)

- Ducommun Incorporated

- Elite RF

- Eravant (formerly SAGE Millimeter)

- Flann Microwave Ltd

- L3Harris Technologies

- MECA Electronics

- Micro Systems Inc.

- Millitech (a Smiths Interconnect Company)

- Narda STS (a L3Harris Company)

- Pasternack Enterprises Inc.

- Quinstar Technology Inc.

- SAGE Millimeter Inc.

- Space Machine & Engineering Corp. (SME)

- Waveline Inc.

- Wavetronix

- WR Components

- VTT Technical Research Centre of Finland

- RPG Radiometer Physics GmbH

Frequently Asked Questions

What are waveguide components and assemblies primarily used for?

Waveguide components and assemblies are primarily used for efficiently transmitting high-frequency electromagnetic waves, particularly in microwave and millimeter-wave applications, across various sectors such as telecommunications, radar, aerospace, and satellite communication, where low loss and high power handling are critical.

What factors are driving the growth of the Waveguide Components and Assemblies Market?

The market's growth is largely driven by the global rollout of 5G and future 6G networks, increasing investments in defense and aerospace technologies, the expansion of satellite communication services, and the growing demand for advanced radar systems and high-frequency test and measurement equipment.

What are the main challenges faced by the Waveguide Components and Assemblies Market?

Key challenges include high manufacturing costs due to precision engineering, the complexity of designing components for increasingly higher frequency bands, a shortage of skilled labor, and competition from alternative transmission technologies like coaxial cables and optical fibers in specific applications.

How is 5G technology impacting the demand for waveguide components?

5G technology is significantly boosting demand for waveguide components, especially those operating in millimeter-wave bands, as they are essential for achieving the high bandwidth, low latency, and increased capacity required for 5G backhaul, base stations, and other infrastructure.

What key innovations are shaping the future of waveguide technology?

Key innovations include the adoption of additive manufacturing (3D printing) for complex geometries, advancements in lightweight and high-performance materials, development of highly integrated and miniaturized components, and the use of AI and machine learning for design optimization and predictive maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager