Web3 Payment Solutions Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429681 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Web3 Payment Solutions Market Size

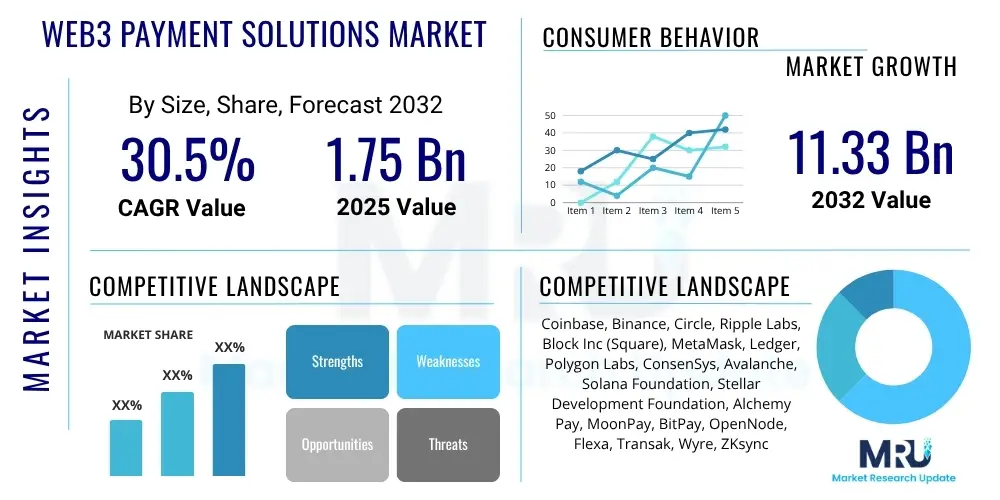

The Web3 Payment Solutions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 30.5% between 2025 and 2032. The market is estimated at USD 1.75 Billion in 2025 and is projected to reach USD 11.33 Billion by the end of the forecast period in 2032.

Web3 Payment Solutions Market introduction

The Web3 Payment Solutions Market represents a paradigm shift in financial transactions, leveraging decentralized technologies such as blockchain, smart contracts, and cryptocurrencies to enable peer-to-peer and transparent value exchange. Unlike traditional payment systems that rely on intermediaries like banks or credit card companies, Web3 payments operate on a distributed ledger, offering enhanced security, immutability, and often lower transaction costs. These solutions are fundamentally designed to empower users with greater control over their assets and data, fostering a more open and inclusive financial ecosystem.

The core product in this market encompasses a range of decentralized applications (dApps), protocols, and infrastructure that facilitate digital asset transactions. This includes cryptocurrency wallets, decentralized exchanges (DEXs), payment gateways built on blockchain, and smart contract-enabled payment escrows. Major applications span across various sectors, from decentralized finance (DeFi) and non-fungible token (NFT) marketplaces to online gaming, metaverse economies, cross-border remittances, and even conventional e-commerce, where businesses are exploring the integration of crypto payments.

Key benefits of Web3 payment solutions include increased transaction speed, reduced settlement times, lower fees due to the absence of intermediaries, enhanced transparency, and robust cryptographic security. The driving factors behind the market's growth are multifaceted, primarily fueled by the increasing adoption of blockchain technology, a global demand for financial decentralization, the rising popularity of digital assets, and the need for more efficient and equitable global payment systems. The push for greater financial inclusion, particularly in underserved regions, also plays a significant role in accelerating the embrace of these innovative payment methods.

Web3 Payment Solutions Market Executive Summary

The Web3 Payment Solutions Market is experiencing robust growth driven by accelerating blockchain adoption, increasing interest in decentralized finance, and the ongoing demand for efficient and transparent payment systems. Businesses are increasingly recognizing the potential of Web3 to reduce transaction costs, enhance security, and facilitate instantaneous global settlements, leading to a surge in development and deployment of innovative payment protocols and platforms. This market is characterized by a dynamic landscape where technological advancements, evolving regulatory frameworks, and shifting consumer preferences continuously shape its trajectory.

From a business trends perspective, there is a clear movement towards integrating stablecoins for everyday transactions, mitigating the volatility associated with other cryptocurrencies. Furthermore, institutional interest in Web3 payment rails is escalating, with traditional financial entities exploring partnerships and developing their own blockchain-based solutions. Regional trends indicate that Asia Pacific is a significant hub for Web3 payment adoption, particularly in emerging economies where digital asset usage is high for remittances and financial inclusion. North America continues to lead in innovation and venture capital investment, while Europe is establishing a clearer regulatory landscape, such as with MiCA, which could foster more widespread adoption.

Segmentation trends highlight the increasing diversification of Web3 payment applications. While retail and e-commerce remain strong use cases, the gaming and metaverse sectors are emerging as critical drivers, requiring seamless in-game and virtual economy transactions. Cross-border payments are also seeing substantial traction due to the inherent efficiencies of blockchain. The market is witnessing a blend of direct consumer-to-merchant payments and sophisticated B2B solutions, indicating a maturing ecosystem that caters to a broad spectrum of financial needs and operational scales. The overall market sentiment suggests a strong positive outlook, albeit with challenges related to scalability and regulatory clarity.

AI Impact Analysis on Web3 Payment Solutions Market

Users frequently inquire about how Artificial Intelligence will integrate with and enhance the Web3 Payment Solutions Market, focusing on aspects such as security, efficiency, and user experience. Common concerns revolve around AI's role in detecting fraudulent activities within decentralized systems, optimizing transaction routing, and personalizing financial services, while also raising questions about potential vulnerabilities if AI models become centralized or are compromised. There is a strong expectation that AI will address some of the current limitations of Web3 payments, particularly regarding scalability and user-friendliness, by providing intelligent automation and predictive capabilities.

- Enhanced fraud detection and prevention through advanced pattern recognition on blockchain data.

- Optimized transaction routing and gas fee prediction to improve efficiency and reduce costs.

- Personalized user experiences and financial recommendations based on on-chain behavior.

- Automated compliance checks and regulatory reporting for evolving Web3 landscapes.

- Improved smart contract auditing and vulnerability detection before deployment.

- Risk assessment and credit scoring models for decentralized lending and borrowing.

- Intelligent automation of backend processes, such as reconciliation and settlement.

DRO & Impact Forces Of Web3 Payment Solutions Market

The Web3 Payment Solutions Market is shaped by a confluence of powerful drivers, significant restraints, and abundant opportunities, all subject to various impact forces. The primary drivers include the escalating global adoption of blockchain technology, the inherent demand for increased transparency and security in financial transactions, and the compelling benefits of lower transaction costs and faster settlement times compared to traditional systems. Furthermore, the growing trend towards financial inclusion for the unbanked and underbanked populations, particularly in emerging economies, is a substantial catalyst for the proliferation of Web3 payment solutions, offering access to digital financial services without relying on conventional banking infrastructure. The rapid proliferation of digital assets and cryptocurrencies also acts as a foundational driver, creating a natural demand for robust and decentralized payment mechanisms.

Despite this positive momentum, several restraints pose challenges to the market's widespread adoption. Regulatory uncertainty remains a significant hurdle, as governments worldwide grapple with how to classify and oversee decentralized finance and digital assets, leading to a fragmented and often unpredictable legal landscape. Scalability issues with some foundational blockchain networks can limit transaction throughput, affecting the ability of Web3 solutions to handle high volumes of payments at peak times. The volatility of many cryptocurrencies also acts as a deterrent for everyday use, though the increasing prevalence of stablecoins aims to address this. Additionally, user education and the complexity of interacting with decentralized applications represent barriers to entry for less tech-savvy individuals, alongside persistent concerns about the security of smart contracts and potential exploits.

However, these challenges are counterbalanced by numerous opportunities. The burgeoning metaverse and gaming industries present vast ecosystems ripe for Web3 payment integration, enabling seamless in-game purchases and ownership of digital assets. Cross-border payments and international remittances stand to be revolutionized by Web3, offering faster and cheaper alternatives to traditional SWIFT-based systems. The continued expansion of the Decentralized Finance (DeFi) sector provides a fertile ground for integrated payment solutions, fostering greater liquidity and innovation. Institutional adoption of digital assets and blockchain technology is also opening new avenues for B2B Web3 payment solutions. The impact forces at play include rapid technological advancements in blockchain and cryptography, evolving regulatory frameworks globally, macroeconomic shifts influencing digital asset investment, and the competitive intensity among existing financial institutions and new Web3 innovators, all contributing to a highly dynamic and transformative market.

Segmentation Analysis

The Web3 Payment Solutions market is segmented to provide a granular view of its diverse components and applications, enabling stakeholders to understand market dynamics and growth opportunities more effectively. This segmentation considers various aspects, including the underlying technology, the types of digital assets processed, the applications they serve, and the end-users leveraging these solutions. This detailed breakdown helps in identifying specific niches and areas of high growth within the broader Web3 ecosystem, reflecting the market's evolving maturity and specialization.

The market can be broadly categorized by component, distinguishing between foundational platforms and the services built upon them. Further refinement occurs through asset type, acknowledging the different roles of volatile cryptocurrencies versus stablecoins and the emerging use of NFTs and central bank digital currencies (CBDCs) in payment contexts. Application-based segmentation highlights the sectors driving demand, ranging from direct consumer-facing retail to complex enterprise-level B2B transactions. Finally, end-user segmentation differentiates between individual consumers, businesses of varying sizes, and developers who are building the next generation of decentralized applications. These segments are crucial for market players to tailor their strategies and product offerings to specific needs and regulatory environments.

- By Component

- Platforms (Blockchain Networks, Payment Protocols)

- Services (Consulting, Integration, Maintenance & Support)

- By Type

- Cryptocurrency Payments (Bitcoin, Ethereum, Solana, etc.)

- Stablecoin Payments (USDT, USDC, DAI, etc.)

- NFT-based Payments

- Central Bank Digital Currencies (CBDCs)

- By Application

- Retail & E-commerce

- Gaming & Metaverse

- Cross-Border Payments & Remittances

- Decentralized Finance (DeFi) & DApps

- B2B Payments & Supply Chain Finance

- Content Creation & Creator Economy

- By End-User

- Individuals/Consumers

- Small & Medium-sized Enterprises (SMEs)

- Large Enterprises

- Developers & Blockchain Projects

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Web3 Payment Solutions Market

The value chain for Web3 Payment Solutions is characterized by a decentralized and interconnected ecosystem, diverging significantly from traditional payment processing structures. At the upstream end, the value chain begins with core infrastructure providers, encompassing blockchain protocol developers who create the underlying distributed ledger technologies (e.g., Ethereum, Solana, Polygon) and layer-2 scaling solutions that enhance transaction speed and reduce costs. This segment also includes node operators, validators, and decentralized oracle networks that provide crucial off-chain data to smart contracts, ensuring the reliability and functionality of payment processes. Wallet providers and key management services also form a foundational part, securing users' digital assets and enabling interaction with decentralized applications.

Moving downstream, the value chain extends to application-layer developers who build user-facing platforms such as decentralized exchanges (DEXs), NFT marketplaces, metaverse platforms, and e-commerce dApps that integrate Web3 payment functionalities. Payment gateways and aggregators specifically designed for Web3 payments bridge the gap between these decentralized applications and broader merchant adoption. These intermediaries streamline the process for businesses to accept various cryptocurrencies and stablecoins, often providing conversion services and enhanced user interfaces. Content creators, gamers, and various digital businesses also sit downstream, as they are the direct beneficiaries and primary integrators of these payment solutions for their economic activities.

The distribution channels for Web3 payment solutions are predominantly digital and multi-faceted. Direct distribution often occurs through peer-to-peer (P2P) transfers facilitated by self-custodial wallets, giving users full control over their funds. Indirect channels involve various platforms, including centralized cryptocurrency exchanges (CEXs) that offer simplified payment experiences, decentralized exchanges (DEXs) for direct asset swaps, and specialized Web3 payment processors that integrate directly with merchant websites or dApps. Additionally, developer communities and open-source contributions play a critical role in the dissemination and evolution of these solutions, fostering innovation and interoperability across the ecosystem. This interconnected structure ensures that value is created and distributed efficiently across all participants, from infrastructure providers to end-users.

Web3 Payment Solutions Market Potential Customers

The potential customer base for Web3 Payment Solutions is expansive and diverse, encompassing individuals, businesses, and developers seeking more efficient, transparent, and secure financial transactions. Individual end-users, particularly those who are crypto-native or early adopters of blockchain technology, represent a significant segment. This includes individuals engaged in decentralized finance (DeFi), participants in the growing non-fungible token (NFT) market, and users active in metaverse and online gaming ecosystems, all of whom require seamless digital asset payments. Furthermore, individuals in regions with unstable fiat currencies or high remittance costs are increasingly turning to Web3 payments for cross-border transfers and as a hedge against inflation.

Businesses, ranging from small and medium-sized enterprises (SMEs) to large enterprises, constitute another crucial customer segment. E-commerce platforms are exploring Web3 payments to reduce processing fees, mitigate chargeback risks, and tap into a global customer base that prefers digital asset transactions. Gaming companies and metaverse projects are integrating these solutions for in-game economies, digital asset ownership, and virtual land sales, offering players true ownership and interoperability. Additionally, businesses involved in international trade and supply chain finance are finding value in Web3 payments for faster, more transparent, and auditable B2B transactions, improving cash flow and reducing operational complexities. Decentralized Autonomous Organizations (DAOs) and other blockchain-native organizations also rely entirely on Web3 payment infrastructure for their operational finances.

Developers and blockchain projects themselves form a specialized but vital customer group, as they leverage existing Web3 payment protocols and tools to build new decentralized applications and services. These innovators require robust, scalable, and secure payment infrastructures to power their dApps, token ecosystems, and smart contract functionalities. Ultimately, anyone seeking alternatives to traditional financial intermediaries, desiring greater control over their funds, or operating within digital-first economies, is a potential buyer or end-user of Web3 payment solutions, driving the continuous expansion and refinement of this innovative market segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.75 Billion |

| Market Forecast in 2032 | USD 11.33 Billion |

| Growth Rate | 30.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coinbase, Binance, Circle, Ripple Labs, Block Inc (Square), MetaMask, Ledger, Polygon Labs, ConsenSys, Avalanche, Solana Foundation, Stellar Development Foundation, Alchemy Pay, MoonPay, BitPay, OpenNode, Flexa, Transak, Wyre, ZKsync |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Web3 Payment Solutions Market Key Technology Landscape

The Web3 Payment Solutions market is built upon a sophisticated and evolving technological landscape, with blockchain technology forming its foundational layer. Various blockchain protocols, such as Ethereum, Solana, Polygon, Avalanche, and Stellar, serve as the underlying ledgers that record and validate transactions in a decentralized and immutable manner. These protocols offer different trade-offs in terms of scalability, transaction speed, security, and decentralization, influencing the choice of network for specific payment applications. Smart contracts, self-executing agreements whose terms are directly written into code, are integral to automating payment logic, escrow services, and programmatic money flows without the need for intermediaries, thereby enhancing efficiency and reducing counterparty risk.

Cryptography plays a critical role in securing Web3 payments, utilizing techniques like public-key cryptography for secure digital signatures and zero-knowledge proofs (ZKPs) for privacy-preserving transactions, allowing verification of information without revealing the underlying data. Layer 2 scaling solutions, including rollups (optimistic and zero-knowledge) and sidechains, are crucial for overcoming the scalability limitations of mainnet blockchains, enabling faster and cheaper transactions necessary for widespread commercial adoption. Decentralized Identifiers (DIDs) and Verifiable Credentials (VCs) are emerging technologies that enhance identity management and authentication within Web3 payment flows, promoting trust and compliance in a privacy-centric manner.

Interoperability protocols, such as cross-chain bridges and atomic swaps, are also vital for enabling seamless value transfer between different blockchain networks, addressing the fragmentation of the Web3 ecosystem. Furthermore, decentralized oracle networks provide reliable external data to smart contracts, which is essential for payment solutions that rely on real-world events or market conditions, such as dynamic pricing or conditional payments. The continuous advancement and integration of these diverse technologies are paramount to the growth and widespread acceptance of Web3 payment solutions, driving innovation in transaction efficiency, security, and user experience across various industries.

Regional Highlights

- North America: This region is a global leader in Web3 innovation and investment, characterized by a high concentration of blockchain startups, venture capital funding, and technological development. It is a key market for the development of enterprise-grade Web3 payment solutions and sophisticated DeFi protocols. Regulatory discussions are ongoing, with efforts to balance innovation with consumer protection and financial stability.

- Europe: Europe is rapidly advancing in regulatory clarity with initiatives like the Markets in Crypto-Assets (MiCA) regulation, which is expected to provide a unified framework for digital assets across the EU. This clarity could significantly boost institutional and retail adoption of Web3 payments. The region shows strong interest in CBDC exploration and cross-border payment efficiency.

- Asia Pacific (APAC): APAC is a dominant region for cryptocurrency adoption and Web3 payment usage, particularly in emerging economies where digital assets are widely used for remittances and as a hedge against inflation. Countries like Vietnam, the Philippines, and India exhibit high retail crypto ownership and engagement. The region is also a hotspot for blockchain gaming and metaverse development, driving demand for in-platform Web3 payment solutions.

- Latin America: This region is experiencing significant growth in Web3 payment adoption, often driven by economic instability and the need for alternative financial systems. Bitcoin and other cryptocurrencies are increasingly used for remittances and everyday transactions in countries like El Salvador (where Bitcoin is legal tender) and Argentina, highlighting the practical utility of decentralized payments for financial inclusion.

- Middle East and Africa (MEA): The MEA region is witnessing growing interest from governments and financial institutions in blockchain and digital assets. Countries in the UAE and Saudi Arabia are investing heavily in blockchain infrastructure and regulatory sandboxes. In Africa, Web3 payments offer a viable solution for improving remittance channels and extending financial services to underserved populations, leveraging mobile penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Web3 Payment Solutions Market.- Coinbase

- Binance

- Circle

- Ripple Labs

- Block Inc (Square)

- MetaMask (ConsenSys)

- Ledger

- Polygon Labs

- Avalanche (Ava Labs)

- Solana Foundation

- Stellar Development Foundation

- Alchemy Pay

- MoonPay

- BitPay

- OpenNode

- Flexa

- Transak

- Wyre

- ZKsync

- Stripe (exploring Web3 integrations)

Frequently Asked Questions

What are Web3 Payment Solutions?

Web3 Payment Solutions leverage decentralized technologies like blockchain and cryptocurrencies to enable peer-to-peer transactions without intermediaries, offering enhanced security, transparency, and efficiency compared to traditional payment systems.

How do Web3 Payments differ from traditional payments?

Web3 Payments operate on decentralized networks, removing the need for banks or payment processors. They often involve lower fees, faster settlement times, and greater user control over funds, contrasting with the centralized, intermediary-dependent nature of traditional payments.

What are the main benefits of using Web3 Payment Solutions?

Key benefits include reduced transaction costs, faster global settlements, enhanced security through cryptography, increased transparency via public ledgers, and greater financial inclusion for unbanked populations.

What challenges does the Web3 Payment Solutions market face?

Major challenges include regulatory uncertainty across different jurisdictions, scalability issues of underlying blockchain networks, volatility of certain cryptocurrencies, and the need for greater user education and robust security measures against exploits.

What is the projected growth of the Web3 Payment Solutions Market?

The Web3 Payment Solutions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 30.5% from 2025 to 2032, reaching an estimated value of USD 11.33 Billion by the end of the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager