Wet Flue Gas Desulfurization System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429965 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Wet Flue Gas Desulfurization System Market Size

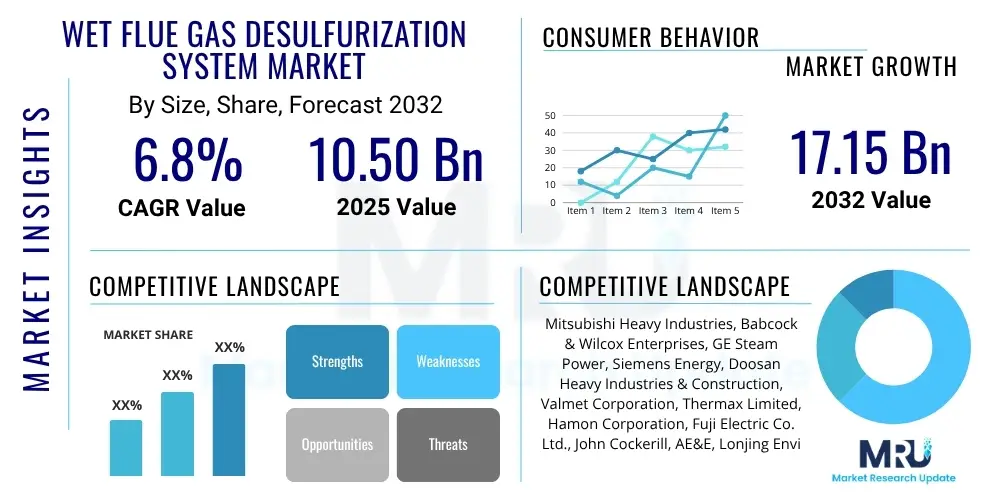

The Wet Flue Gas Desulfurization System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 10.50 Billion in 2025 and is projected to reach USD 17.15 Billion by the end of the forecast period in 2032.

Wet Flue Gas Desulfurization System Market introduction

Wet Flue Gas Desulfurization (WFGD) systems are critical environmental control technologies designed to remove sulfur dioxide (SO2) from the exhaust flue gases of fossil fuel power plants and other industrial facilities. These systems primarily utilize an alkaline slurry, typically limestone or lime, to chemically react with and absorb SO2, converting it into a stable byproduct, often gypsum. The process ensures compliance with stringent air quality regulations, mitigating acid rain, respiratory illnesses, and other environmental and public health concerns associated with SO2 emissions. The global imperative for cleaner air and sustainable industrial practices underpins the increasing adoption and technological evolution of WFGD systems across various sectors.

The core product in this market involves a complex interplay of scrubbers, absorbers, mist eliminators, and associated pumps, pipes, and control systems. The efficiency and reliability of WFGD systems are paramount for continuous operation of large-scale industrial plants. Major applications span across thermal power generation, particularly coal-fired and oil-fired power plants, cement manufacturing facilities, metal smelting operations, and waste incineration plants. The versatility of WFGD technology allows it to be tailored to specific emission limits and fuel compositions, making it a cornerstone of modern industrial pollution control strategies.

The tangible benefits of deploying WFGD systems include significant reductions in SO2 emissions, leading to improved air quality and adherence to national and international environmental standards. This contributes to enhanced public health outcomes and ecological preservation. Key driving factors for market growth encompass the tightening of environmental regulations worldwide, particularly in rapidly industrializing economies, coupled with a steady demand for electricity, often met by fossil fuel-based generation. Furthermore, ongoing advancements in WFGD technology, focused on efficiency, reduced operational costs, and multi-pollutant removal capabilities, continue to propel market expansion and foster innovation in emissions control.

Wet Flue Gas Desulfurization System Market Executive Summary

The Wet Flue Gas Desulfurization System market is experiencing dynamic shifts, driven by evolving global energy landscapes and an unwavering commitment to environmental sustainability. Business trends indicate a focus on consolidation among leading players, enhancing their capabilities in engineering, procurement, and construction (EPC) services, as well as long-term operational and maintenance contracts. There is an increasing emphasis on optimizing system performance through digital integration, predictive analytics, and advanced materials science to improve corrosion resistance and reduce downtime. Furthermore, companies are exploring modular WFGD solutions to cater to smaller industrial applications and facilitate faster deployment, catering to a broader spectrum of customer needs.

Regionally, Asia Pacific stands out as the predominant growth engine for the WFGD market. This surge is primarily fueled by rapid industrialization, extensive investments in new coal-fired power plants, and the progressive implementation of more stringent environmental regulations in countries like China and India. While mature markets in North America and Europe exhibit stable demand, growth is primarily attributed to retrofitting aging infrastructure, upgrading existing systems to meet revised emission standards, and transitioning towards more efficient and less resource-intensive operations. Latin America and the Middle East and Africa represent emerging opportunities, characterized by developing industrial bases and increasing awareness of air pollution control.

From a segmentation perspective, the power generation sector continues to be the largest end-user, accounting for a significant share of WFGD installations due to its high volume of flue gas emissions. However, the industrial sector, including cement, chemical, and metallurgy, is demonstrating robust growth as these industries face escalating pressure to reduce their environmental footprint. The market is also segmented by absorbent type, with limestone-based systems dominating due to their cost-effectiveness and widespread availability. Moreover, the demand is split between new installations and retrofit projects, with retrofit opportunities expanding significantly as older plants seek to extend their operational lifespans while complying with modern environmental mandates. These intertwined trends collectively shape a resilient and continually innovating market for WFGD systems.

AI Impact Analysis on Wet Flue Gas Desulfurization System Market

Common user questions regarding AI's impact on Wet Flue Gas Desulfurization (WFGD) systems revolve around how artificial intelligence can enhance operational efficiency, reduce costs, improve environmental compliance, and extend equipment lifespan. Users are keen to understand the practical applications of AI in real-time monitoring, predictive maintenance, and process optimization for these complex systems. Key concerns include the initial investment in AI integration, data security, the need for specialized personnel, and the reliability of AI algorithms in dynamic operating environments. There is a clear expectation that AI will transform WFGD systems into more autonomous, adaptive, and economically viable solutions, providing significant benefits over traditional control methods.

- AI-driven predictive maintenance significantly reduces unplanned downtime by analyzing sensor data to anticipate equipment failures, enabling proactive repairs and optimizing maintenance schedules.

- Real-time process optimization through AI algorithms allows WFGD systems to dynamically adjust operating parameters, such as absorbent flow rates and pH levels, to maximize SO2 removal efficiency while minimizing reagent consumption and energy usage.

- Enhanced emissions monitoring and reporting capabilities are achieved by AI, which can process vast amounts of continuous emission monitoring system (CEMS) data to detect anomalies, ensure regulatory compliance, and generate automated, auditable reports.

- Improved energy efficiency is a direct outcome of AI optimization, as the technology can fine-tune fan speeds, pump operations, and other energy-intensive components based on actual load and flue gas characteristics, leading to substantial operational cost savings.

- AI facilitates advanced fault detection and diagnosis by identifying subtle patterns in operational data that might indicate impending issues, allowing operators to address problems before they escalate into major disruptions.

DRO & Impact Forces Of Wet Flue Gas Desulfurization System Market

The Wet Flue Gas Desulfurization (WFGD) System market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the core Impact Forces. A primary driver is the global escalation of stringent environmental regulations aimed at mitigating air pollution, particularly SO2 emissions from industrial sources and power generation. Governments and international bodies are continuously tightening emission limits, compelling industries to adopt or upgrade WFGD technologies to ensure compliance. This regulatory pressure is especially pronounced in rapidly industrializing nations, where a surge in fossil fuel consumption necessitates robust pollution control infrastructure. Furthermore, a growing global awareness of climate change and public health impacts from air pollution is increasing societal demand for cleaner energy production and industrial processes, thereby accelerating WFGD adoption.

However, the market also faces significant restraints. The substantial capital expenditure required for the initial installation of WFGD systems can be a considerable barrier for potential adopters, especially for smaller enterprises or in regions with limited financial resources. High operational and maintenance costs, including the continuous supply of absorbents like limestone, energy consumption for pumps and fans, and waste disposal, further add to the economic burden. The emergence and increasing adoption of alternative desulfurization technologies, such as dry and semi-dry FGD systems, which may offer lower capital costs or simpler operation for certain applications, also pose a competitive challenge. Moreover, the global shift towards renewable energy sources and the decommissioning of coal-fired power plants in developed economies could temper the long-term growth trajectory for new WFGD installations.

Despite these challenges, numerous opportunities exist to propel the WFGD market forward. The vast number of existing coal-fired and industrial plants worldwide that either lack modern desulfurization systems or require upgrades to meet stricter new standards presents a substantial retrofit market. Developing economies in Asia Pacific, Latin America, and Africa are experiencing significant industrial expansion and energy demand, leading to opportunities for new WFGD installations. Furthermore, technological advancements focused on enhancing efficiency, reducing costs, and improving the environmental performance of WFGD systems, such as advanced absorbents, multi-pollutant removal capabilities, and integration with smart digital technologies, offer promising avenues for market expansion. The potential for WFGD systems to be integrated with carbon capture utilization and storage (CCUS) technologies also represents a long-term opportunity as industries seek comprehensive solutions for climate change mitigation, positioning WFGD as a foundational component of future clean industrial complexes.

Segmentation Analysis

The Wet Flue Gas Desulfurization System market is comprehensively segmented to provide a detailed understanding of its varied facets, enabling stakeholders to identify specific niches and growth avenues. This segmentation typically dissects the market based on system type, application, absorbent used, and the nature of the installation (new versus retrofit). Each segment reflects distinct technological preferences, operational requirements, and market dynamics, driven by diverse industrial needs and regional regulatory landscapes. Understanding these segments is crucial for strategic planning, product development, and market entry strategies, allowing companies to tailor their offerings to specific end-user demands and technological specifications within the broader WFGD ecosystem.

- By Type

- Sea Water FGD: Utilizes seawater as the absorbent, suitable for coastal power plants due to easy availability and disposal of treated water into the sea.

- Wet Limestone FGD: The most common type, employing limestone slurry to react with SO2, producing gypsum as a byproduct. Known for its high efficiency and cost-effectiveness.

- Wet Lime FGD: Uses lime slurry as the absorbent, offering similar efficiency to limestone systems but with higher reagent costs; often used where limestone is less accessible.

- Others: Includes systems utilizing sodium alkali (e.g., sodium carbonate or sodium sulfite) or ammonia, typically for specific industrial applications or smaller scale plants.

- By Application

- Power Generation: Dominant segment, primarily for coal-fired and oil-fired power plants due to large volumes of flue gas and stringent emission regulations.

- Chemical Industry: Used in chemical processing plants to control SO2 emissions from various reactions and combustion processes.

- Cement Industry: Applied to reduce SO2 emissions from cement kilns, which burn fossil fuels and can release sulfur from raw materials.

- Metal Smelting: Critical for controlling SO2 emissions from smelters processing sulfur-containing ores (e.g., copper, nickel), a major source of atmospheric SO2.

- Others: Encompasses waste incinerators, pulp and paper mills, refineries, and other industrial facilities with significant SO2 emissions.

- By Absorbent

- Limestone: Widely preferred due to its abundance, low cost, and high reactivity, producing valuable gypsum byproduct.

- Lime: Used as an alternative when limestone is unavailable or when specific process conditions favor lime; generally more reactive but costlier.

- Seawater: Environmentally benign and cost-effective for coastal installations, requiring no chemical reagents beyond the natural alkalinity of seawater.

- Sodium Carbonate: Used in certain industrial applications, often in smaller or specialized systems, offering good solubility and reactivity.

- By End-Use

- New Installations: Demand driven by construction of new power plants and industrial facilities, especially in developing regions.

- Retrofits: Significant market segment involving the upgrade or addition of WFGD systems to existing, older plants to meet contemporary emission standards and extend operational life.

Value Chain Analysis For Wet Flue Gas Desulfurization System Market

The value chain for the Wet Flue Gas Desulfurization (WFGD) System market is a complex network involving multiple stakeholders, from raw material suppliers to end-users, each contributing to the creation and delivery of these critical environmental control systems. At the upstream end, the chain begins with the procurement of essential raw materials and components. This includes suppliers of bulk chemicals like limestone, lime, and other reagents necessary for the desulfurization process, as well as manufacturers of specialized components such as pumps, fans, absorbers, mist eliminators, heat exchangers, instrumentation, and corrosion-resistant alloys. Engineering firms and technology licensors also play a crucial upstream role by developing and providing the proprietary designs and intellectual property for efficient WFGD system operation, forming the foundational technological backbone of the market.

Moving downstream, the value chain encompasses the engineering, procurement, and construction (EPC) contractors who integrate these components and designs into a complete operational system for end-users. These EPC firms are responsible for project management, civil construction, equipment installation, and commissioning, ensuring that the WFGD system meets performance specifications and regulatory requirements. Beyond the initial installation, the downstream activities extend to operation and maintenance (O&M) services, which are critical for the long-term efficiency and reliability of WFGD systems. This segment includes providers of spare parts, regular inspections, technical support, performance optimization, and sometimes full-service contracts to manage the entire desulfurization process for the plant owner. The effective management of byproducts, such as gypsum, also falls within the downstream scope, often involving partnerships for its sale or disposal, thus closing the loop on material flow.

Distribution channels within the WFGD market are predominantly direct, especially for large-scale projects like power plants or major industrial facilities, where manufacturers or EPC contractors engage directly with end-user clients. This direct approach facilitates bespoke solutions, detailed engineering, and long-term service agreements. However, indirect channels also exist, particularly for smaller projects or through system integrators and regional distributors who may bundle WFGD solutions with other pollution control equipment or provide localized support. Sales and technical support teams from WFGD system providers play a vital role in educating potential customers, addressing technical queries, and negotiating contracts. The robustness of this value chain, from reliable raw material sourcing to expert post-installation services, is instrumental in ensuring the effective deployment and sustained performance of WFGD systems globally, driving environmental compliance and operational efficiency for industrial emitters.

Wet Flue Gas Desulfurization System Market Potential Customers

The primary potential customers for Wet Flue Gas Desulfurization (WFGD) systems are industries characterized by significant emissions of sulfur dioxide (SO2) from their combustion processes. At the forefront are thermal power generation plants, particularly those fueled by coal and heavy oil. These facilities, globally, represent the largest segment of end-users due to the sheer volume of flue gases they produce and the high sulfur content in their fuel sources. As environmental regulations tighten, both new power plant constructions and existing operational facilities seeking to extend their lifespans must invest in or upgrade their WFGD systems to remain compliant. The economic necessity of these plants, coupled with increasing environmental scrutiny, ensures a steady demand from the power sector, driving technological adoption and retrofit projects across various regions.

Beyond the power sector, a diverse range of heavy industrial facilities constitutes a substantial customer base. The cement manufacturing industry, for instance, produces significant SO2 emissions from the combustion of fuels in kilns and from the raw materials themselves; thus, cement producers are increasingly integrating WFGD solutions. Similarly, the metal smelting industry, particularly operations dealing with sulfur-rich ores (e.g., copper, nickel), is a critical market segment due to the high SO2 concentrations typically found in their process gases. Chemical manufacturing plants, waste incineration facilities, and even large commercial boilers also represent important potential customers. These industries, driven by a combination of regulatory compliance, corporate social responsibility, and a desire to improve operational sustainability, consistently seek efficient and reliable WFGD solutions.

Moreover, the potential customer landscape extends to government agencies and public sector entities involved in infrastructure development and environmental protection. These bodies often mandate the installation of WFGD systems in state-owned enterprises or approve projects that require such pollution control technologies. Investment banks and financial institutions, while not direct end-users, are also indirect potential customers as they finance large-scale industrial projects that necessitate WFGD installations, thus influencing procurement decisions. The continuous need for these industries to balance economic operations with environmental stewardship ensures a sustained and expanding demand for WFGD systems, making them indispensable components of modern industrial infrastructure and positioning the service providers at the heart of global environmental efforts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 10.50 Billion |

| Market Forecast in 2032 | USD 17.15 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitsubishi Heavy Industries, Babcock & Wilcox Enterprises, GE Steam Power, Siemens Energy, Doosan Heavy Industries & Construction, Valmet Corporation, Thermax Limited, Hamon Corporation, Fuji Electric Co. Ltd., John Cockerill, AE&E, Lonjing Environment Technology Co. Ltd., Clyde Bergemann Power Group, KC Cottrell, CMI Group, Ducon Infratechnologies, Marsulex Environmental Technologies, Chiyoda Corporation, FlSmidth, Elex AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wet Flue Gas Desulfurization System Market Key Technology Landscape

The Wet Flue Gas Desulfurization (WFGD) System market is characterized by a dynamic and evolving technological landscape, continuously driven by the imperative for enhanced efficiency, reduced operational costs, and improved environmental performance. A cornerstone of this landscape is the advancement in absorber tower design, which focuses on optimizing gas-liquid contact to maximize SO2 removal efficiency with minimal pressure drop. Innovations include advanced tray designs, spray nozzle configurations, and structured packing materials that improve mass transfer kinetics. Furthermore, the development of corrosion-resistant materials, such as specialized alloys and polymer linings, is crucial for extending the lifespan of WFGD components, which operate in highly acidic and abrasive environments, thereby reducing maintenance frequency and costs. These material science breakthroughs contribute significantly to the reliability and durability of WFGD infrastructure.

Another significant aspect of the technology landscape is the optimization of slurry management systems. This involves sophisticated control strategies for reagent feed rates, pH control, and the management of solids content to ensure optimal desulfurization while minimizing reagent consumption and byproduct handling challenges. The development of advanced analytical instrumentation for real-time monitoring of flue gas composition and slurry properties has enabled more precise control and quicker responses to process variations. Additionally, research into more efficient and environmentally friendly absorbents, as well as processes for enhancing gypsum quality to make it a marketable byproduct (e.g., for wallboard manufacturing), continues to shape the technological trajectory. This focus on resource efficiency and byproduct valorization aligns with broader sustainability goals within the industry.

Moreover, the integration of digital technologies, particularly artificial intelligence (AI), machine learning (ML), and the Industrial Internet of Things (IIoT), is rapidly transforming the operational paradigm of WFGD systems. These technologies enable predictive maintenance, real-time performance optimization, and autonomous control, leading to significant improvements in reliability, energy consumption, and overall operational efficiency. Smart sensors deployed throughout the system provide continuous data streams that AI algorithms process to identify anomalies, predict equipment failures, and suggest optimal operating parameters. Beyond SO2 removal, technological advancements are also exploring the potential for WFGD systems to simultaneously remove other pollutants, such as mercury and fine particulate matter, positioning them as multi-pollutant control solutions. These integrated, intelligent, and materials-advanced WFGD systems represent the cutting edge of air pollution control technology, designed to meet the complex demands of modern industrial operations and stringent environmental standards.

Regional Highlights

- North America: This region represents a mature market for WFGD systems, characterized by stringent environmental regulations, particularly from the Environmental Protection Agency (EPA). The demand is largely driven by retrofitting existing coal-fired power plants and industrial facilities to comply with updated emission standards, as well as for routine maintenance and upgrades of installed systems. Investment in advanced monitoring and control technologies for WFGD operations is also prominent.

- Europe: Similar to North America, Europe is a mature market influenced by comprehensive European Union directives on industrial emissions. While there is a strong policy push towards renewable energy sources, WFGD systems remain crucial for existing conventional power plants and heavy industries to meet strict air quality targets. The focus is on maximizing efficiency and minimizing the environmental footprint of these systems, often incorporating multi-pollutant removal capabilities.

- Asia Pacific (APAC): The APAC region is the fastest-growing and largest market for WFGD systems globally. Rapid industrialization, substantial investments in new coal-fired power plants to meet escalating energy demand, and increasingly stringent environmental regulations in countries like China, India, and Southeast Asian nations are the primary drivers. The region offers significant opportunities for both new installations and the expansion of existing pollution control infrastructure.

- Latin America: This region is an emerging market for WFGD systems, witnessing increasing industrial activity and growing awareness of air pollution control. Countries such as Brazil, Mexico, and Chile are implementing stricter environmental policies, which is expected to fuel demand for WFGD installations in their power generation and industrial sectors. The market here is poised for gradual but steady growth.

- Middle East and Africa (MEA): The MEA region presents considerable growth potential due, in part, to ongoing infrastructural development, expansion of energy-intensive industries, and a nascent but growing emphasis on environmental protection. As economies in this region diversify and industrialize, the adoption of WFGD systems will become increasingly important for managing industrial emissions and meeting evolving international environmental standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wet Flue Gas Desulfurization System Market.- Mitsubishi Heavy Industries

- Babcock & Wilcox Enterprises

- GE Steam Power

- Siemens Energy

- Doosan Heavy Industries & Construction

- Valmet Corporation

- Thermax Limited

- Hamon Corporation

- Fuji Electric Co. Ltd.

- John Cockerill

- AE&E

- Lonjing Environment Technology Co. Ltd.

- Clyde Bergemann Power Group

- KC Cottrell

- CMI Group

- Ducon Infratechnologies

- Marsulex Environmental Technologies

- Chiyoda Corporation

- FlSmidth

- Elex AG

Frequently Asked Questions

Analyze common user questions about the Wet Flue Gas Desulfurization System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Wet Flue Gas Desulfurization system?

A Wet Flue Gas Desulfurization (WFGD) system is an advanced air pollution control technology that removes sulfur dioxide (SO2) from the exhaust gases of industrial facilities, primarily power plants. It operates by contacting the flue gas with an alkaline slurry, typically made from limestone or lime, which chemically absorbs and neutralizes the SO2, often producing gypsum as a byproduct.

Why are WFGD systems important for industries?

WFGD systems are crucial for industries to comply with stringent environmental regulations on SO2 emissions, which contribute to acid rain, smog, and respiratory diseases. By significantly reducing these harmful emissions, WFGD systems help industries operate more sustainably, protect public health, and avoid substantial regulatory fines and environmental penalties.

What are the primary types of WFGD systems available?

The primary types of WFGD systems include Wet Limestone FGD, which uses limestone slurry to produce gypsum; Wet Lime FGD, employing lime slurry; and Sea Water FGD, which utilizes the natural alkalinity of seawater as an absorbent, typically for coastal installations. Other types use sodium-based or ammonia-based absorbents for specialized applications.

What are the main challenges faced by the WFGD market?

Key challenges include the high upfront capital investment for system installation, substantial operational and maintenance costs (reagent consumption, energy, waste disposal), and competition from alternative desulfurization technologies. Additionally, the global shift towards renewable energy sources and the decommissioning of some fossil fuel plants in developed regions pose long-term market restraints.

How is Artificial Intelligence impacting WFGD system operations?

AI is transforming WFGD operations by enabling predictive maintenance, optimizing process parameters in real-time for maximum SO2 removal efficiency, and improving energy consumption. AI-driven analytics also enhance emissions monitoring, fault detection, and overall system reliability, leading to cost savings and improved environmental compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager