Whiplash Protection System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429641 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Whiplash Protection System Market Size

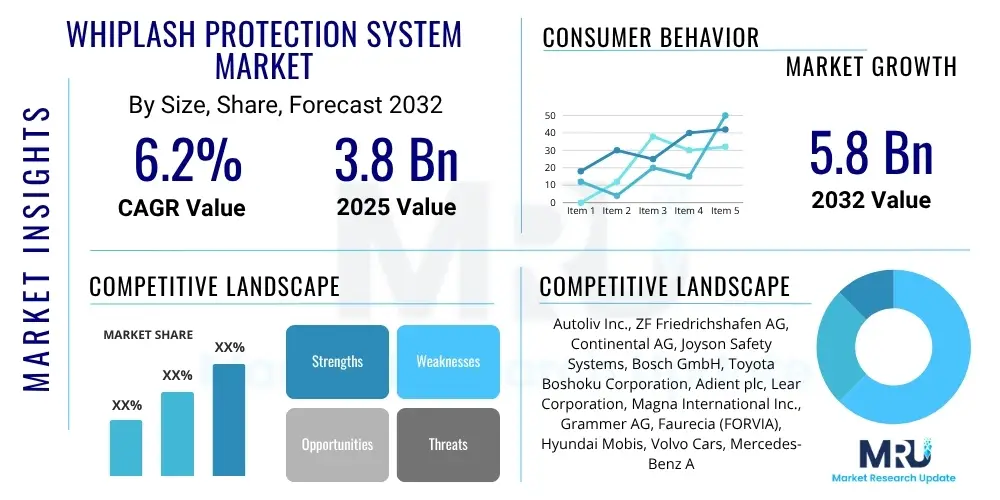

The Whiplash Protection System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2032. The market is estimated at $3.8 Billion in 2025 and is projected to reach $5.8 Billion by the end of the forecast period in 2032.

Whiplash Protection System Market introduction

The Whiplash Protection System (WPS) market encompasses a range of automotive safety technologies designed to mitigate the severity of whiplash injuries, primarily sustained during rear-end collisions. These systems typically integrate active or passive headrests, advanced seatback designs, and sometimes pre-tensioning seatbelts, all engineered to support the occupant's head and torso effectively during impact, thus minimizing sudden neck hyperextension or hyperflexion. Major applications are predominantly found in passenger vehicles, including sedans, SUVs, and compact cars, with an increasing presence in commercial vehicles where occupant safety is also paramount. The primary benefit of these systems is a significant reduction in the risk and severity of whiplash-associated disorders, leading to improved occupant safety and reduced healthcare costs.

Driving factors for the Whiplash Protection System market include increasingly stringent global automotive safety regulations, which mandate advanced occupant protection features in new vehicles. Growing consumer awareness regarding vehicle safety ratings and the long-term health implications of whiplash injuries also fuels demand. Furthermore, the continuous advancements in sensor technology, materials science, and integrated vehicle safety architectures are enabling more sophisticated and effective WPS solutions. These combined forces ensure that the Whiplash Protection System remains a critical and evolving segment within the broader automotive safety market, pushing manufacturers to innovate and adopt these essential technologies more widely.

Whiplash Protection System Market Executive Summary

The Whiplash Protection System market is characterized by robust growth driven by evolving automotive safety standards, increasing consumer demand for safer vehicles, and technological advancements. Business trends indicate a strong focus on OEM integration of advanced active whiplash protection systems, moving beyond basic passive headrests to more sophisticated sensor-based and adaptive solutions. Manufacturers are increasingly incorporating WPS into standard safety packages, signaling a shift towards holistic occupant protection strategies. Collaborations between technology providers and automotive OEMs are also a notable trend, accelerating the development and deployment of next-generation systems.

Regional trends reveal that mature automotive markets in North America and Europe continue to lead in adoption due to stringent safety regulations and high consumer awareness. However, the Asia Pacific region is emerging as a significant growth hub, propelled by rapidly expanding automotive production, rising disposable incomes, and the gradual implementation of stricter safety norms. Segments trends highlight a growing preference for active whiplash protection systems over passive ones, as active systems offer dynamic response capabilities that adapt to collision severity and occupant posture. There is also an increasing emphasis on integrating WPS with other advanced driver-assistance systems (ADAS) to create a more comprehensive and proactive safety ecosystem within vehicles.

AI Impact Analysis on Whiplash Protection System Market

Common user questions regarding AI's impact on Whiplash Protection Systems often revolve around how AI can enhance their effectiveness, whether it can predict and prevent whiplash injuries more intelligently, and what the ethical implications or technical challenges might be. Users are keen to understand if AI can move WPS beyond reactive measures to proactive or predictive safety, integrating with other vehicle systems. Key themes emerging from these inquiries include the potential for personalized protection based on occupant characteristics, real-time adaptive responses to varying collision scenarios, and the role of AI in improving overall accident mitigation strategies. There is a clear expectation that AI will lead to more sophisticated, data-driven, and highly responsive whiplash protection solutions.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is poised to revolutionize the Whiplash Protection System market by introducing a new layer of intelligence and adaptability. AI algorithms can process vast amounts of data from various vehicle sensors, including radar, cameras, and accelerometers, to anticipate potential collisions and optimize WPS deployment. This predictive capability allows systems to prepare occupants for impact by adjusting headrest positions, seatbelt tension, and seatback angles milliseconds before a collision occurs, significantly enhancing protective efficacy. Furthermore, AI can personalize protection based on occupant size, posture, and even real-time biometric data, offering a tailored response rather than a generic one.

Beyond immediate pre-collision actions, AI can also contribute to the continuous improvement of WPS designs. By analyzing post-collision data and injury outcomes, AI models can identify patterns and suggest design modifications or algorithmic enhancements to future systems. This iterative learning process ensures that Whiplash Protection Systems become progressively smarter and more effective over time. The integration of AI also facilitates seamless communication with other advanced safety features like autonomous emergency braking (AEB) and lane-keeping assist, creating a more cohesive and comprehensive vehicle safety network that works proactively to prevent accidents and minimize injury severity when impacts are unavoidable.

- Predictive sensing and pre-emptive activation of WPS components.

- Adaptive protection tailored to occupant size, posture, and collision dynamics.

- Integration with advanced driver-assistance systems (ADAS) for holistic safety.

- Real-time data analysis for continuous system optimization and learning.

- Development of smart seats that automatically adjust for optimal whiplash protection.

DRO & Impact Forces Of Whiplash Protection System Market

The Whiplash Protection System market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, alongside various impact forces that shape its competitive landscape and growth trajectory. A primary driver is the global increase in road accidents, which underscores the critical need for advanced occupant safety features. This is compounded by increasingly stringent automotive safety regulations worldwide, mandating the inclusion of robust whiplash protection in new vehicle models. Growing consumer awareness regarding the severe and long-term health consequences of whiplash injuries also compels vehicle manufacturers to integrate superior WPS solutions. Furthermore, continuous technological advancements, particularly in sensor technology, smart materials, and AI-driven predictive systems, are enhancing the effectiveness and appeal of these protection systems.

However, the market also faces notable restraints. The high cost associated with developing and integrating advanced whiplash protection systems, especially active ones, can be a barrier for some manufacturers, particularly in budget segments. The complexity of integrating these sophisticated systems with existing vehicle architectures and electronics also poses a technical challenge, requiring extensive research and development. Additionally, a lack of universal standardization across different regions regarding testing protocols and performance requirements can create fragmentation and hinder widespread adoption. These factors necessitate careful balancing by market participants to ensure viability and competitiveness.

Despite these restraints, significant opportunities abound for the Whiplash Protection System market. Emerging automotive markets in developing economies present substantial growth potential as vehicle penetration increases and safety awareness improves. The ongoing evolution towards autonomous and semi-autonomous vehicles offers a unique opportunity for integrating WPS into sophisticated, holistic safety platforms, where pre-crash sensing can optimize protection even further. Innovation in lightweight yet strong materials and modular system designs can help address cost and integration challenges. The competitive impact forces, such as the bargaining power of buyers (OEMs demanding cost-effective yet high-performance systems) and suppliers (specialized component providers), along with the threat of new entrants and substitutes (alternative injury prevention methods), continuously shape market dynamics, driving innovation and efficiency among existing players and influencing market share.

Segmentation Analysis

The Whiplash Protection System market is comprehensively segmented to provide a detailed understanding of its structure, growth drivers, and diverse applications. This segmentation allows for targeted analysis of consumer preferences, technological trends, and regional dynamics, which are crucial for strategic planning and market development. The market is primarily categorized by the type of system employed, the specific vehicle applications, the key components utilized, and the distribution channels through which these systems reach end-users. This multi-faceted approach ensures that all significant facets of the market are covered, offering granular insights into the various sub-markets and their respective growth trajectories.

Understanding these segments helps manufacturers tailor their products to specific demands and market niches. For instance, the distinction between active and passive systems highlights the technological evolution and performance differences, while the application split between passenger and commercial vehicles reflects varied safety priorities and design constraints. Similarly, component-based segmentation provides insights into the supply chain and technological innovation at a granular level, and the sales channel analysis differentiates between direct OEM integration and aftermarket opportunities. Each segment carries unique growth potential and competitive dynamics, making this analysis vital for stakeholders navigating the Whiplash Protection System landscape.

- By Type

- Active Whiplash Protection System

- Passive Whiplash Protection System

- By Application

- Passenger Cars

- Commercial Vehicles

- By Component

- Headrests

- Seatbacks

- Sensors

- Control Units

- Actuators

- By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Whiplash Protection System Market

The value chain for the Whiplash Protection System market begins with upstream activities involving raw material suppliers and component manufacturers. This includes suppliers of metals (steel, aluminum), plastics (polymers for seat frames and covers), fabrics (for upholstery), and critical electronic components such as sensors, microcontrollers, and actuators. These suppliers play a crucial role in providing the foundational materials and sophisticated electronic sub-assemblies that are essential for the functionality and performance of both active and passive WPS. Quality, cost, and consistent supply from these upstream players directly impact the final product and its competitiveness.

Moving downstream, the value chain progresses to the core manufacturing and integration phase, where automotive OEMs and Tier 1 suppliers design, assemble, and integrate the Whiplash Protection Systems into complete vehicle architectures. This stage involves complex engineering, testing, and validation processes to ensure the systems meet stringent safety standards and performance criteria. The distribution channels for these systems are primarily direct, with OEMs integrating the WPS into new vehicles at the point of manufacture. Indirect channels also exist through the aftermarket, where specialized suppliers and distributors offer replacement parts or upgrade kits, although this segment is generally smaller for core safety systems like WPS.

Finally, the value chain culminates with the end-users – vehicle owners and fleet operators – who benefit from enhanced occupant safety. The effectiveness of the distribution channel, whether direct or indirect, is crucial for market penetration and customer satisfaction. The direct channel ensures seamless integration and warranty support, while the indirect channel serves the replacement and upgrade market, albeit with varying degrees of complexity regarding installation and compatibility. The efficiency and reliability across all stages of this value chain are paramount for the overall success and continued growth of the Whiplash Protection System market.

Whiplash Protection System Market Potential Customers

The primary potential customers and end-users of Whiplash Protection Systems are broadly categorized into automotive Original Equipment Manufacturers (OEMs), who integrate these systems into newly produced vehicles, and subsequently, the individual vehicle owners who purchase these equipped cars. OEMs are crucial buyers as they seek advanced safety technologies to meet regulatory requirements, enhance their brand's safety reputation, and attract safety-conscious consumers. Their purchasing decisions are driven by factors such as cost-effectiveness, system reliability, integration complexity, and compliance with global safety standards like Euro NCAP and IIHS.

Beyond the direct OEM procurement, fleet operators represent another significant segment of potential customers. Companies managing large fleets of vehicles, such as rental car agencies, ride-sharing services, and corporate fleets, prioritize vehicle safety to protect their drivers and passengers, minimize liability, and reduce downtime associated with accidents. For these buyers, the durability, long-term effectiveness, and maintenance requirements of WPS are important considerations. While most WPS are factory-installed, there is also a nascent demand from individual consumers and aftermarket workshops for potential upgrades or replacements, though this largely depends on system complexity and vehicle compatibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $3.8 Billion |

| Market Forecast in 2032 | $5.8 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Autoliv Inc., ZF Friedrichshafen AG, Continental AG, Joyson Safety Systems, Bosch GmbH, Toyota Boshoku Corporation, Adient plc, Lear Corporation, Magna International Inc., Grammer AG, Faurecia (FORVIA), Hyundai Mobis, Volvo Cars, Mercedes-Benz AG, SAIC General Motors, Honda Motor Co. Ltd., Tesla Inc., Stellantis N.V., Volkswagen AG, General Motors |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Whiplash Protection System Market Key Technology Landscape

The Whiplash Protection System market is characterized by a rapidly evolving technological landscape focused on enhancing occupant safety through sophisticated engineering and digital integration. Key technologies driving innovation include advanced sensor fusion, which combines data from various sources like radar, camera, and lidar systems to achieve a more accurate and comprehensive understanding of imminent collision scenarios. This allows for precise timing and optimization of pre-tensioning seatbelts and adaptive headrest movements. Furthermore, the development of smart seatbelt systems with active retractors and load limiters plays a crucial role in managing occupant kinematics during impact, working in tandem with the headrest and seatback.

Another significant technological advancement is the integration of predictive algorithms, often powered by Artificial Intelligence and Machine Learning, which analyze real-time vehicle dynamics and environmental data to anticipate potential collisions. These algorithms enable WPS to activate pre-emptively, adjusting seat and headrest positions to an optimal protective posture milliseconds before impact. Materials science also contributes significantly, with ongoing research into lightweight yet high-strength materials for seat structures and energy-absorbing foams for headrests, improving both safety performance and vehicle efficiency. The convergence of these technologies, along with increasingly sophisticated control units, is leading to highly responsive, adaptive, and effective whiplash protection systems that offer personalized safety for vehicle occupants.

Regional Highlights

- North America: This region is a mature market driven by stringent safety regulations imposed by organizations like NHTSA and IIHS. High consumer awareness regarding safety features and the presence of major automotive OEMs and Tier 1 suppliers contribute to consistent demand and technological advancements. The U.S. and Canada lead in adopting advanced active whiplash protection systems.

- Europe: Europe is another key region, characterized by proactive safety standards from Euro NCAP, which strongly influence the integration of advanced WPS. Countries like Germany, Sweden, and the UK are at the forefront of automotive safety innovation, with a strong emphasis on research and development for both passive and active systems. Consumer preference for premium and safe vehicles further fuels market growth.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to the rapid expansion of automotive manufacturing bases, increasing disposable incomes, and evolving safety regulations in countries like China, India, Japan, and South Korea. The rising production of passenger cars and the growing demand for technologically advanced safety features are significant drivers.

- Latin America: This region is witnessing gradual adoption of WPS, primarily driven by increasing vehicle sales and improving safety awareness. Regulatory bodies are slowly aligning with global safety standards, pushing OEMs to incorporate more advanced protection systems, particularly in countries like Brazil and Mexico.

- Middle East and Africa (MEA): The MEA region is an emerging market for Whiplash Protection Systems. Growth is primarily linked to increasing vehicle imports, investments in local automotive assembly, and a rising focus on road safety initiatives. Economic development and infrastructure improvements are expected to drive future adoption, though at a slower pace compared to other regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Whiplash Protection System Market.- Autoliv Inc.

- ZF Friedrichshafen AG

- Continental AG

- Joyson Safety Systems

- Bosch GmbH

- Toyota Boshoku Corporation

- Adient plc

- Lear Corporation

- Magna International Inc.

- Grammer AG

- Faurecia (FORVIA)

- Hyundai Mobis

- Volvo Cars

- Mercedes-Benz AG

- SAIC General Motors

- Honda Motor Co. Ltd.

- Tesla Inc.

- Stellantis N.V.

- Volkswagen AG

- General Motors

Frequently Asked Questions

What is a Whiplash Protection System (WPS)?

A Whiplash Protection System (WPS) is an automotive safety feature designed to mitigate neck injuries, specifically whiplash, during rear-end collisions. It typically involves specialized headrests and seat designs that move to support the occupant's head and torso upon impact, preventing extreme hyperextension or hyperflexion of the neck.

How do active whiplash protection systems differ from passive ones?

Passive whiplash protection systems rely on the occupant's inertia during a collision to push the headrest forward. Active systems, conversely, use sensors to detect an imminent rear impact and automatically adjust the headrest and seatback position milliseconds before the collision, offering a more dynamic and potentially more effective response.

What types of vehicles are equipped with Whiplash Protection Systems?

Whiplash Protection Systems are predominantly found in modern passenger cars, including sedans, SUVs, and luxury vehicles, often as standard equipment due to stringent safety regulations and high consumer demand for safety. They are also increasingly being integrated into commercial vehicles, particularly in regions with evolving safety standards.

What are the key benefits of having a Whiplash Protection System in a vehicle?

The primary benefit of a WPS is significantly reducing the risk and severity of whiplash injuries, which can lead to chronic pain and long-term disability. It enhances overall occupant safety, contributes to higher vehicle safety ratings, and can help reduce medical costs and insurance claims associated with whiplash-related incidents.

How is AI impacting the future development of Whiplash Protection Systems?

AI is set to revolutionize WPS by enabling predictive and adaptive capabilities. AI algorithms can analyze sensor data to anticipate collisions, optimize headrest and seat adjustments pre-impact, and personalize protection based on occupant characteristics, leading to more intelligent, proactive, and effective safety solutions integrated with broader ADAS features.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager