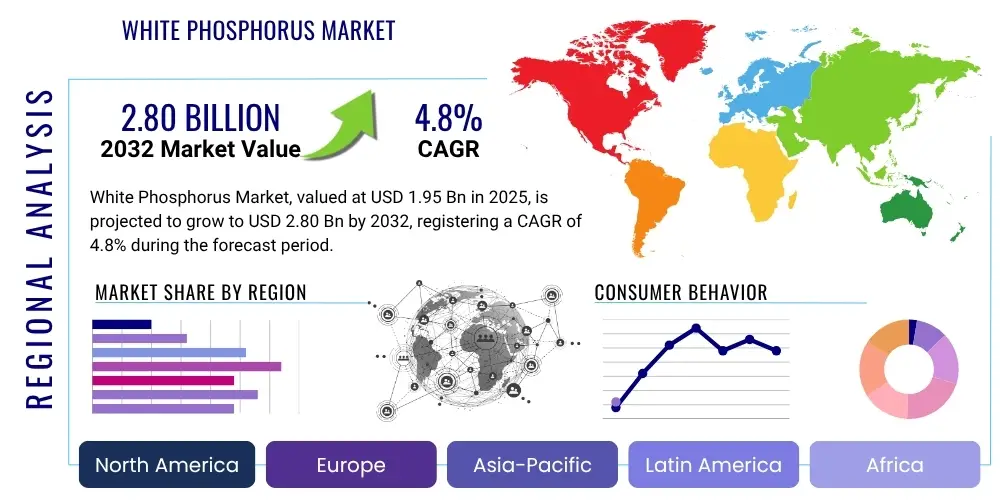

White Phosphorus Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431251 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

White Phosphorus Market Size

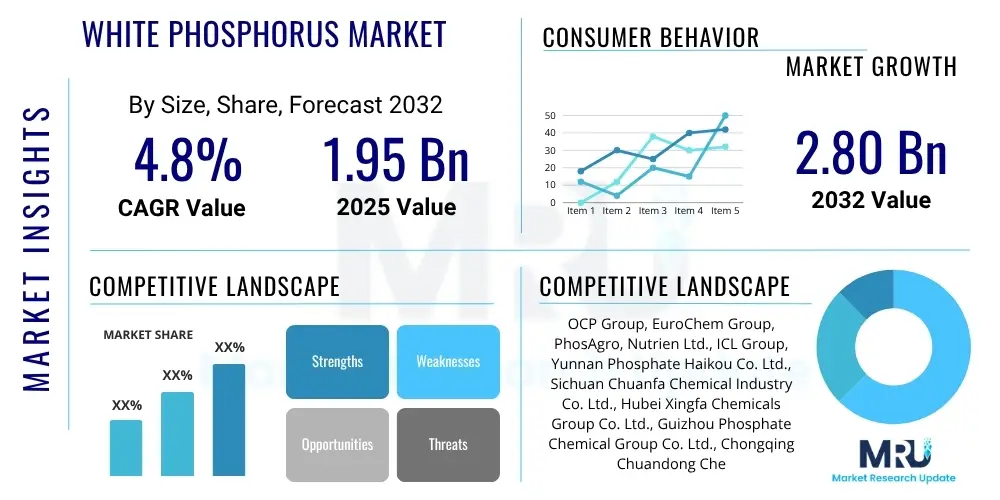

The White Phosphorus Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at USD 1.95 Billion in 2025 and is projected to reach USD 2.80 Billion by the end of the forecast period in 2032.

White Phosphorus Market introduction

The White Phosphorus Market encompasses the production, distribution, and consumption of white phosphorus, a highly reactive allotrope of phosphorus with the chemical formula P4. This elemental phosphorus is characterized by its waxy texture, garlic-like odor, and extreme pyrophoric nature, igniting spontaneously in air at relatively low temperatures. Its unique properties make it indispensable in a variety of industrial and specialized applications, despite its inherent hazards and stringent regulatory controls. The market's dynamics are heavily influenced by global geopolitical stability, industrial demand for its derivatives, and advancements in handling and manufacturing safety protocols.

White phosphorus serves as a critical intermediate in the chemical industry, particularly in the production of various phosphorus compounds. These derivatives find extensive use in diverse sectors, ranging from agriculture and pharmaceuticals to electronics and detergents. Its role as a key precursor for red phosphorus, phosphorus pentoxide, phosphoric acid, and organophosphorus compounds underscores its foundational importance. Beyond its chemical applications, white phosphorus is also utilized in specific military applications due to its intense incendiary and smoke-generating properties, contributing to both tactical and signaling purposes, though these uses are increasingly scrutinized under international conventions.

The primary benefits of white phosphorus stem from its high reactivity and versatility as a chemical building block. It enables the synthesis of a broad spectrum of compounds vital for modern industries. Driving factors for market growth include sustained demand for phosphate-based fertilizers and pesticides in agriculture, the expansion of the electronics industry requiring high-purity phosphorus compounds, and ongoing innovation in pharmaceutical and specialty chemical sectors that rely on phosphorus chemistry. However, the market faces challenges related to its hazardous nature, strict environmental regulations, and the pursuit of safer alternative materials, which together shape its future trajectory and investment landscape.

White Phosphorus Market Executive Summary

The White Phosphorus Market is navigating a complex landscape defined by robust demand from key industrial sectors alongside increasing regulatory scrutiny and environmental consciousness. Business trends indicate a focus on optimizing production processes for greater efficiency and safety, with significant investments in research and development aimed at improving handling, storage, and waste management. Companies are also exploring diversification into higher-value phosphorus derivatives, moving beyond basic commodity production to mitigate risks associated with volatile raw material prices and shifting geopolitical dynamics affecting military applications. Supply chain resilience is a paramount concern, driving efforts to secure raw material access and establish multiple sourcing options to ensure continuous operation amidst global disruptions.

Regional trends reveal a bifurcated market with significant production capabilities concentrated in Asia Pacific, particularly China and India, driven by lower production costs and substantial domestic demand from burgeoning agricultural and chemical industries. North America and Europe, while having stricter environmental regulations and higher production costs, maintain strong demand for specialty phosphorus compounds and military applications. Emerging economies in Latin America and the Middle East and Africa are showing nascent growth, spurred by agricultural expansion and increasing industrialization. The balance between domestic production capacities and import dependency varies significantly across these regions, influencing pricing strategies and market accessibility.

Segmentation trends highlight the dominance of the chemical intermediate segment, where white phosphorus is converted into a wide array of useful compounds, including phosphoric acid, phosphorus pentasulfide, and various organophosphorus chemicals. The agricultural sector remains a crucial end-use for fertilizers and pesticides derived from phosphorus. Military applications, while highly sensitive and subject to international conventions, continue to represent a stable, albeit niche, demand segment. There is a growing emphasis on high-purity white phosphorus for semiconductor manufacturing, reflecting technological advancements and the increasing complexity of electronic devices, which represents a high-growth, high-value segment within the overall market.

AI Impact Analysis on White Phosphorus Market

User questions related to AI's impact on the White Phosphorus Market frequently revolve around how artificial intelligence can enhance safety, optimize production efficiency, and improve supply chain management given the hazardous nature of the material. There is significant interest in AI's potential to predict and prevent incidents, streamline complex manufacturing processes, and provide real-time insights into market dynamics and raw material availability. Concerns also touch upon the ethical implications of AI in military applications involving white phosphorus and the challenges of integrating advanced AI systems into highly specialized and regulated chemical environments. Users seek to understand how AI can transform the industry from a safety, operational, and strategic perspective, balancing innovation with stringent risk management.

- AI can significantly enhance safety protocols by predicting equipment failures, detecting abnormal process conditions, and automating emergency response systems in production facilities.

- Predictive analytics driven by AI can optimize raw material procurement, inventory management, and logistics, ensuring a more stable and cost-effective supply chain for white phosphorus.

- AI algorithms can analyze complex chemical reaction data to optimize synthesis routes, improve yield, and reduce energy consumption in the manufacturing of white phosphorus and its derivatives.

- Quality control can be revolutionized through AI-powered vision systems and analytical tools, ensuring high purity levels essential for sensitive applications like electronics and pharmaceuticals.

- Market forecasting and demand prediction can be made more accurate with AI, enabling producers to better align production schedules with market needs and reduce waste.

- AI could assist in the development of novel, less hazardous synthesis methods or alternative materials, although this is a longer-term research endeavor.

- Regulatory compliance monitoring can be automated, with AI systems flagging potential deviations from environmental and safety standards, thus reducing legal and operational risks.

DRO & Impact Forces Of White Phosphorus Market

The White Phosphorus Market is shaped by a confluence of powerful drivers, inherent restraints, and emerging opportunities, all interacting to create a dynamic impact force on its trajectory. Key drivers include the consistent demand from the agricultural sector for phosphate fertilizers and pesticides, which rely on phosphorus derivatives for enhanced crop yield and protection. The chemical industry's need for white phosphorus as a versatile precursor for a wide range of specialty chemicals, flame retardants, and food additives further fuels its consumption. Additionally, the defense sector provides a steady, albeit sensitive, demand for its incendiary and smoke-producing capabilities, particularly for signaling and illumination. These factors collectively create a foundational demand base that underpins market stability and growth, driving innovation in efficient production and application technologies.

However, the market faces significant restraints primarily due to the hazardous nature of white phosphorus. Its pyrophoric properties, toxicity, and severe environmental impact in case of accidental release necessitate extremely stringent handling, storage, and transportation regulations, leading to high operational costs and limited market participants. Public perception and strong environmental advocacy groups also exert pressure, particularly concerning its military applications and potential ecological damage, pushing for safer alternatives and stricter controls. Furthermore, the limited availability of high-quality phosphate rock, the primary raw material, coupled with geopolitical factors affecting mining operations, can introduce supply chain vulnerabilities and price volatility, impacting overall market stability and growth potential.

Opportunities in the White Phosphorus Market arise from ongoing research into novel applications and the development of more sustainable production methods. The expansion of the electronics industry, particularly in semiconductor manufacturing requiring ultra-high purity phosphorus, presents a growing niche for value-added products. Innovations in recycling phosphorus from waste streams and exploring alternative, environmentally friendlier synthesis routes could mitigate some of the current restraints and open new avenues for market players. Furthermore, advancements in safety technologies and contained manufacturing processes could enhance efficiency and reduce risks, potentially expanding the market by making production more viable in new regions. The interaction of these drivers, restraints, and opportunities creates a complex set of impact forces that continuously redefine the market's boundaries and investment appeal, necessitating strategic foresight and adaptive business models from industry participants.

Segmentation Analysis

The White Phosphorus Market is comprehensively segmented to provide a detailed understanding of its diverse applications, end-use industries, and forms. This segmentation allows for precise market analysis, identifying key growth areas, demand patterns, and competitive landscapes within specific niches. The market is primarily segmented by application, which delineates its various uses across different sectors, and by end-use industry, categorizing the ultimate consumers of white phosphorus and its derivatives. Additionally, the market can be segmented by product form, although white phosphorus is predominantly traded in its elemental P4 form, the subsequent derivatives often dictate the market's value chain. Analyzing these segments helps stakeholders pinpoint strategic entry points, investment opportunities, and areas for product innovation, contributing to a holistic market perspective.

- By Application:

- Chemical Intermediates:

- Phosphoric Acid Production

- Phosphorus Pentoxide Production

- Phosphorus Pentasulfide Production

- Organophosphorus Compounds

- Other Phosphorus Chemicals (e.g., phosphorus chlorides, phosphines)

- Military Applications:

- Incendiary Ammunition

- Smoke Screens and Grenades

- Tracer Ammunition

- Illumination Flares

- Agriculture (indirectly, via derivatives):

- Fertilizers (e.g., ammonium phosphates)

- Pesticides and Herbicides (e.g., organophosphate pesticides)

- Electronics:

- Semiconductor Doping

- LED Manufacturing

- Photovoltaics

- Food Additives (indirectly, via derivatives):

- Preservatives

- Emulsifiers

- Flame Retardants

- Detergents and Cleaning Agents

- Pharmaceutical Intermediates

- Chemical Intermediates:

- By End-Use Industry:

- Chemical Industry

- Defense Sector

- Agriculture Industry

- Electronics Industry

- Food & Beverage Industry

- Pharmaceutical Industry

- Mining & Metallurgy

- Water Treatment

- By Form:

- Elemental White Phosphorus (P4)

- Derivatives (e.g., Phosphoric Acid, Phosphorus Pentasulfide) - primarily traded as derivatives in the market, but elemental P4 is the base.

Value Chain Analysis For White Phosphorus Market

The value chain for the White Phosphorus Market is intricate, beginning with the upstream extraction of phosphate rock and extending through complex chemical processing to its diverse downstream applications. Upstream activities involve the mining of phosphate rock, which is a naturally occurring mineral containing phosphorus. Key considerations at this stage include the quality and phosphorus content of the ore, the efficiency of mining operations, and the environmental impact of extraction. Subsequent beneficiation processes are employed to concentrate the phosphate content, preparing it for further chemical conversion. The availability and cost of phosphate rock, along with energy prices (especially for electricity used in electric arc furnaces), are critical determinants of the final cost of white phosphorus, heavily influencing profitability margins throughout the chain.

Midstream activities primarily encompass the energy-intensive production of elemental white phosphorus using the electric arc furnace method. This process involves reducing phosphate rock with coke and silica at high temperatures, yielding gaseous white phosphorus that is then condensed and collected under water to prevent spontaneous combustion. Producers at this stage face significant challenges related to energy consumption, capital expenditure for specialized equipment, and stringent environmental regulations concerning emissions and waste management. The purity of the produced white phosphorus is crucial for downstream applications, especially in the electronics and pharmaceutical sectors, requiring sophisticated refining processes. Efficient operation and adherence to safety protocols are paramount due to the hazardous nature of the product.

Downstream analysis focuses on the transformation of white phosphorus into a myriad of useful derivatives and its ultimate consumption by various end-use industries. White phosphorus serves as a fundamental building block for manufacturing phosphoric acid, phosphorus pentoxide, phosphorus chlorides, and various organophosphorus compounds. These derivatives are then supplied to sectors such as agriculture (for fertilizers and pesticides), electronics (for semiconductors), detergents, food additives, and flame retardants. The distribution channel for white phosphorus is highly specialized, predominantly involving direct sales to large industrial consumers or through a limited number of specialized chemical distributors equipped to handle hazardous materials. Both direct and indirect distribution strategies are employed, with direct sales being common for major industrial clients requiring bulk quantities, while indirect channels cater to smaller users or those needing specific derivatives, ensuring strict adherence to safety and regulatory compliance at every point of transfer.

White Phosphorus Market Potential Customers

The potential customers for white phosphorus, or more commonly its derivatives, span a wide array of industrial sectors due to its versatility as a chemical precursor. The largest cohort of end-users is within the chemical manufacturing industry, where white phosphorus is directly used to produce a vast range of intermediate and finished phosphorus compounds. These include essential chemicals like phosphoric acid, which is a cornerstone for phosphate fertilizers, and phosphorus pentoxide, vital for dehydrating agents and other chemical syntheses. Manufacturers of organophosphorus compounds, phosphorus chlorides, and other specialty phosphorus chemicals are also key direct and indirect consumers, leveraging its reactivity for their diverse product portfolios. This segment values reliable supply, consistent purity, and adherence to stringent safety and quality standards in sourcing raw materials.

Beyond the primary chemical producers, the agricultural sector represents a massive end-user base, primarily through its demand for fertilizers and pesticides derived from white phosphorus. Farmers and agricultural cooperatives rely heavily on phosphate-based fertilizers to enrich soil and enhance crop yields, while organophosphate pesticides are critical for crop protection against pests. Although these users do not directly purchase white phosphorus, their sustained demand significantly drives the market for its derivatives, making them crucial indirect customers. The growth of the global population and the increasing need for food security ensure a continuous, robust demand from this sector, influencing long-term market trends for white phosphorus production.

Other significant potential customers include the defense sector, which utilizes white phosphorus in specific military applications such as incendiary devices, smoke-generating munitions, and tracer rounds for illumination and signaling. While this is a highly regulated and sensitive market, it represents a stable and high-value segment. The electronics industry is another growing customer segment, requiring high-purity phosphorus for doping semiconductors and manufacturing advanced electronic components. Additionally, the pharmaceutical industry uses phosphorus derivatives as intermediates in drug synthesis, and the food and beverage industry utilizes them as additives for preservation and texture enhancement. These diverse end-users collectively define the demand landscape for white phosphorus, each with unique requirements for product specification, purity, and supply chain reliability, further highlighting the compound's broad industrial importance despite its hazardous properties.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.95 Billion |

| Market Forecast in 2032 | USD 2.80 Billion |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OCP Group, EuroChem Group, PhosAgro, Nutrien Ltd., ICL Group, Yunnan Phosphate Haikou Co. Ltd., Sichuan Chuanfa Chemical Industry Co. Ltd., Hubei Xingfa Chemicals Group Co. Ltd., Guizhou Phosphate Chemical Group Co. Ltd., Chongqing Chuandong Chemical Co. Ltd., Nippon Chemical Industrial Co. Ltd., Arkema S.A., Lanxess AG, Solvay S.A., Chemtura Corporation (now part of Lanxess), BASF SE, Dow Chemical Company, Celanese Corporation, Mitsubishi Chemical Corporation, Sumitomo Chemical Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

White Phosphorus Market Key Technology Landscape

The primary technology employed for the industrial production of white phosphorus remains the electric arc furnace (EAF) method, which has been the cornerstone of the industry for over a century. This process involves the carbothermic reduction of phosphate rock in the presence of silica at extremely high temperatures, typically between 1200 and 1500 degrees Celsius. The EAF technology is characterized by its high energy consumption, which directly influences production costs and environmental footprint, making energy efficiency a critical area of focus for manufacturers. Continuous improvements in furnace design, electrode technology, and off-gas recovery systems are being implemented to enhance process efficiency, reduce emissions, and optimize raw material utilization, ensuring the long-term viability of this established production route.

Beyond the core EAF process, the technology landscape for the white phosphorus market also encompasses advanced safety and handling solutions, which are paramount due to the highly reactive and toxic nature of the material. Innovations in inert atmosphere storage, specialized transportation containers, and automated transfer systems are crucial for minimizing risks of accidental ignition or exposure. Real-time monitoring systems, integrating sensors and predictive analytics, are increasingly being adopted in production facilities to detect and mitigate potential hazards proactively. These safety technologies are not just about compliance but are fundamental to operational reliability and social license to operate, driving continuous investment in hazard control and emergency response capabilities.

Emerging technological trends are focused on sustainability and the development of alternative, potentially less energy-intensive or environmentally impactful, synthesis routes for phosphorus compounds. While direct alternatives to large-scale white phosphorus production are still in early research stages, significant efforts are directed towards phosphorus recycling from waste streams, such as sewage sludge and industrial by-products. Technologies for extracting and recovering phosphate from these sources aim to reduce reliance on virgin phosphate rock and create a more circular economy for phosphorus. Furthermore, advancements in catalytic processes and precision chemistry are explored to create phosphorus derivatives more efficiently, potentially bypassing some hazardous intermediate steps, thereby reshaping the broader phosphorus value chain and impacting the long-term demand dynamics for elemental white phosphorus itself.

Regional Highlights

- Asia Pacific (APAC): This region dominates the white phosphorus market in terms of both production and consumption, driven primarily by China and India. Abundant raw material reserves, lower operating costs, and strong domestic demand from the agriculture, chemical, and electronics industries fuel its growth. China is the largest producer and consumer, making regional regulatory shifts and economic policies highly influential on global supply.

- North America: A mature market characterized by stringent environmental regulations and high safety standards. Demand is steady from the chemical industry for specialty phosphorus compounds and a consistent, albeit specialized, need from the defense sector. The region focuses on high-value derivatives and process optimization rather than bulk production.

- Europe: Similar to North America, Europe maintains a strong regulatory framework and emphasizes sustainability. Key demand segments include industrial chemicals, specialty additives, and some military applications. There is a growing focus on phosphorus recycling technologies to reduce dependency on imported phosphate rock and promote a circular economy.

- Latin America: This region exhibits growing demand, predominantly from its expanding agricultural sector for fertilizers and pesticides. While production capacities are limited, there is potential for market growth as industrialization progresses and food security concerns drive increased agricultural output. Import reliance is significant for white phosphorus and its derivatives.

- Middle East and Africa (MEA): Rich in phosphate rock reserves, particularly in North Africa, this region holds a strategic position in the upstream value chain. Production of white phosphorus is emerging, especially in countries looking to leverage their raw material advantages for downstream chemical industries. Demand is increasing from agricultural and industrial development projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the White Phosphorus Market.- OCP Group

- EuroChem Group

- PhosAgro

- Nutrien Ltd.

- ICL Group

- Yunnan Phosphate Haikou Co. Ltd.

- Sichuan Chuanfa Chemical Industry Co. Ltd.

- Hubei Xingfa Chemicals Group Co. Ltd.

- Guizhou Phosphate Chemical Group Co. Ltd.

- Chongqing Chuandong Chemical Co. Ltd.

- Nippon Chemical Industrial Co. Ltd.

- Arkema S.A.

- Lanxess AG

- Solvay S.A.

- BASF SE

- Dow Chemical Company

- Celanese Corporation

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co. Ltd.

- Koppers Inc.

Frequently Asked Questions

What are the primary industrial applications of white phosphorus?

White phosphorus is primarily used as a vital chemical intermediate in the production of various phosphorus compounds. These include phosphoric acid for fertilizers and food additives, phosphorus pentoxide for dehydrating agents, and a wide array of organophosphorus compounds critical for pesticides, flame retardants, and specialty chemicals in diverse industries.

How is white phosphorus typically manufactured on an industrial scale?

Industrial production of white phosphorus predominantly relies on the electric arc furnace (EAF) method. This highly energy-intensive process involves reducing phosphate rock with coke and silica at elevated temperatures, yielding gaseous white phosphorus that is then condensed and collected under water to prevent spontaneous ignition due to its pyrophoric nature.

What are the major environmental and safety concerns associated with white phosphorus?

The primary concerns with white phosphorus include its extreme toxicity and pyrophoric nature, leading to severe burns upon skin contact and spontaneous ignition in air. Environmentally, its potential release can lead to significant contamination of water bodies and soil, posing risks to ecosystems and human health. Strict regulations and advanced safety protocols are essential to mitigate these hazards throughout its lifecycle.

Which geographical regions are key players in the global white phosphorus market?

Asia Pacific, particularly China and India, holds a dominant position in the global white phosphorus market due to vast raw material reserves and significant demand from its rapidly expanding agricultural and chemical sectors. North America and Europe also maintain substantial market shares, focusing on high-value derivatives and advanced safety practices, while the Middle East and Africa are emerging players due to their phosphate rock endowments.

Are there any significant alternatives or substitutes for white phosphorus in its key applications?

While direct elemental white phosphorus has limited direct substitutes for its role as a chemical intermediate, the market for its derivatives often sees competition. For instance, in agriculture, various sources of phosphorus for fertilizers exist, and non-organophosphate pesticides are continually developed. In military applications, efforts are ongoing to develop less harmful smoke and incendiary agents, but complete, functionally equivalent non-phosphorus alternatives are often application-specific and still under active research and development.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager