Whole Genome Sequencing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430670 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Whole Genome Sequencing Market Size

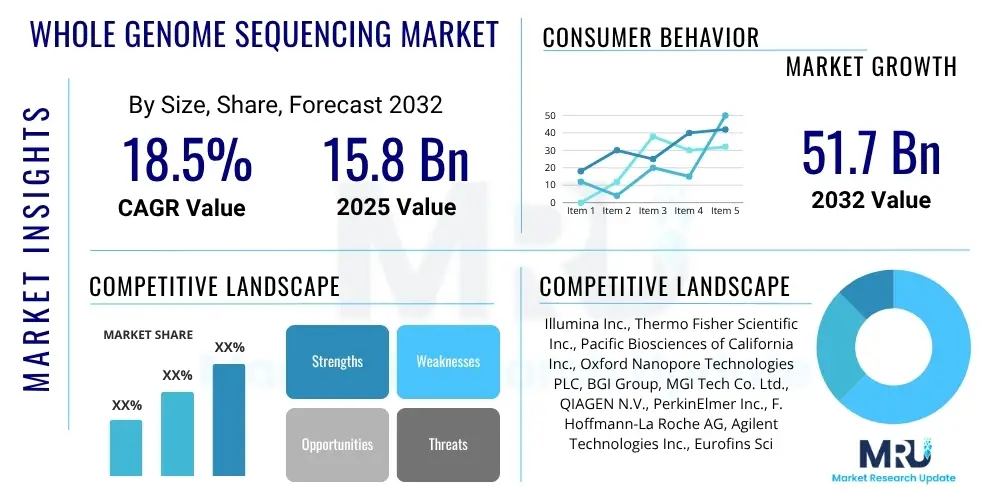

The Whole Genome Sequencing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at $15.8 billion in 2025 and is projected to reach $51.7 billion by the end of the forecast period in 2032.

Whole Genome Sequencing Market introduction

The Whole Genome Sequencing (WGS) market encompasses the technologies, products, and services dedicated to determining the complete DNA sequence of an organism's genome at a single time. This advanced genomic technique offers an unparalleled, comprehensive view of an individual's genetic makeup, extending beyond targeted gene panels or exome sequencing to include non-coding regions and structural variants, which are increasingly recognized for their roles in health and disease. WGS provides a foundational understanding for personalized medicine by identifying genetic predispositions, diagnosing rare diseases, understanding disease progression, and guiding therapeutic strategies. The product offerings in this market include high-throughput sequencing instruments, a vast array of specialized kits and reagents for sample preparation and library construction, and sophisticated bioinformatics software and services for data analysis and interpretation.

Major applications of Whole Genome Sequencing span across clinical diagnostics, academic and research initiatives, drug discovery and development, and even agriculture and animal research. In clinical settings, WGS is revolutionizing the diagnosis of complex genetic disorders, often providing answers where traditional methods fail, thereby enabling earlier intervention and more precise patient management. For researchers, it serves as an indispensable tool for uncovering novel genetic variants associated with diseases, studying population genetics, and advancing our fundamental understanding of biological processes. The benefits are profound: a single WGS test can replace multiple targeted tests, offering a holistic genetic profile that can inform preventative care, optimize drug selection, and enhance disease surveillance.

The market's robust growth is primarily driven by several key factors. Significant advancements in sequencing technologies have dramatically reduced the cost and increase the speed of genomic analysis, making WGS more accessible for both research and clinical applications. There is a growing global emphasis on precision medicine initiatives, which leverage genomic information to tailor medical treatments to individual patients, inherently boosting the demand for comprehensive genomic profiling. Furthermore, the increasing prevalence of genetic and chronic diseases, coupled with a deeper understanding of their genetic underpinnings, is compelling healthcare providers and researchers to adopt WGS for enhanced diagnostic capabilities and therapeutic development. Finally, the continuous innovation in bioinformatics tools and computational power is improving the efficiency and accuracy of interpreting the immense datasets generated by WGS, further solidifying its utility and expanding its adoption.

Whole Genome Sequencing Market Executive Summary

The Whole Genome Sequencing (WGS) market is experiencing dynamic growth, propelled by rapid technological advancements, declining sequencing costs, and an expanding array of clinical and research applications. Business trends indicate a strong focus on strategic collaborations and partnerships between technology providers, pharmaceutical companies, and academic institutions to accelerate research and clinical translation. Companies are increasingly investing in developing integrated solutions that combine hardware, reagents, and advanced bioinformatics platforms to offer comprehensive, end-to-end WGS workflows. Mergers and acquisitions are also prevalent as key players seek to expand their technological portfolios, market reach, and competitive edge, particularly in data analytics and interpretation services. This emphasis on holistic solutions aims to simplify the WGS process for end-users and address the complex challenges associated with large-scale genomic data management and analysis.

Regionally, North America continues to dominate the WGS market due to significant research funding, the presence of major genomics companies, and early adoption of advanced healthcare technologies. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, driven by increasing healthcare expenditure, rising awareness about personalized medicine, a large and diverse patient pool, and government initiatives aimed at establishing national genomic sequencing programs. Europe also represents a substantial market share, supported by robust academic research and growing investments in precision medicine. These regional trends highlight a global shift towards integrating genomic information into healthcare systems, with emerging economies rapidly catching up in infrastructure development and technological adoption.

In terms of segmentation, the services segment, particularly bioinformatics and data interpretation services, is expected to hold a significant market share and witness substantial growth. This is attributed to the complexity of WGS data and the need for specialized expertise to derive meaningful insights. Application-wise, clinical diagnostics and personalized medicine are rapidly expanding as WGS proves invaluable for diagnosing rare diseases, guiding cancer treatment, and assessing pharmacogenomic responses. Technologically, innovations in long-read sequencing and advancements in next-generation sequencing platforms are continually enhancing the accuracy, speed, and cost-effectiveness of WGS, further driving its adoption across various end-user segments including academic and research institutions, hospitals and clinics, and pharmaceutical and biotechnology companies. The convergence of these trends underscores a market poised for sustained expansion and transformative impact on healthcare and life sciences.

AI Impact Analysis on Whole Genome Sequencing Market

Users frequently inquire about artificial intelligence's transformative potential in managing and interpreting the vast datasets generated by Whole Genome Sequencing, seeking to understand how AI can streamline complex analyses, accelerate disease diagnosis, and enhance personalized treatment strategies. Common questions revolve around AI's ability to identify subtle genetic variations, predict disease susceptibility, and personalize drug responses more accurately than traditional methods. There is significant interest in how AI tools improve the efficiency of bioinformatics, reduce manual intervention, and overcome the computational bottlenecks associated with genomic data. Concerns also emerge regarding data privacy, the reliability of AI algorithms in clinical decision-making, and the potential for algorithmic bias in diverse populations. Users expect AI to make WGS more accessible, cost-effective, and actionable, transforming it from a purely research tool into a routine clinical application.

- Enhanced data analysis and interpretation of complex genomic datasets.

- Improved variant calling and identification of pathogenic mutations.

- Accelerated diagnosis of rare and undiagnosed genetic diseases.

- Advanced prediction of disease susceptibility and prognosis.

- Personalized medicine development through AI-driven drug discovery and pharmacogenomics.

- Automated bioinformatics workflows, reducing turnaround time and human error.

- Development of predictive models for treatment response and patient stratification.

- Facilitation of large-scale population genomics studies and biomarker discovery.

DRO & Impact Forces Of Whole Genome Sequencing Market

The Whole Genome Sequencing market is profoundly shaped by a complex interplay of drivers, restraints, and opportunities that constitute its impact forces. Key drivers propelling market expansion include the substantial decline in sequencing costs over the past decade, making WGS increasingly affordable for broader adoption in both research and clinical settings. Continuous technological advancements, particularly in high-throughput sequencing platforms and automation, further enhance the speed, accuracy, and efficiency of genomic analysis. The escalating global emphasis on personalized medicine and precision oncology, where WGS offers critical insights into individual patient profiles for tailored treatments, significantly fuels demand. Additionally, the rising prevalence of genetic disorders, infectious diseases, and various cancers, coupled with increasing government and private funding for genomic research, creates a fertile ground for market growth. These drivers collectively foster an environment of innovation and expanded application of WGS technologies across diverse healthcare and scientific domains.

Conversely, the market faces several notable restraints. The substantial initial capital investment required for sequencing instruments and the high operational costs associated with reagents and skilled personnel can be prohibitive for smaller institutions or those in developing regions. Ethical considerations surrounding genomic data, including informed consent, data privacy, and the potential for discrimination, present significant challenges that necessitate robust regulatory frameworks. The immense complexity of interpreting the vast amount of data generated by WGS, requiring highly specialized bioinformatics expertise, remains a bottleneck. Furthermore, regulatory hurdles and the lack of standardized guidelines for clinical WGS applications can impede widespread adoption, creating uncertainty among healthcare providers and payers regarding reimbursement policies and clinical utility. Addressing these restraints is crucial for unlocking the full potential of WGS.

Despite these challenges, numerous opportunities exist for market participants. The emergence of WGS in non-invasive prenatal testing (NIPT), agricultural genomics for crop improvement, and veterinary genomics signifies new avenues for application and commercial growth. The ongoing development of more user-friendly, integrated bioinformatics solutions powered by artificial intelligence and machine learning is poised to democratize data analysis, making WGS insights more accessible to a wider range of users. Furthermore, increasing partnerships between technology providers and pharmaceutical companies for drug discovery and development, particularly in rare disease therapeutics, present substantial growth prospects. The expansion of direct-to-consumer (DTC) genomics services, focusing on health and ancestry, also represents a growing segment, albeit one requiring careful navigation of regulatory and ethical landscapes. These opportunities highlight the diverse potential for WGS to transform various sectors beyond traditional human health applications, offering significant avenues for market diversification and expansion.

Segmentation Analysis

The Whole Genome Sequencing market is comprehensively segmented across various dimensions to provide a detailed understanding of its dynamics, adoption patterns, and growth opportunities. These segmentations typically include categorization by product type, technology utilized, specific applications, and the end-user base. Each segment reflects distinct market characteristics, driving forces, and competitive landscapes, offering insights into where innovation and demand are most concentrated. Analyzing these segments helps in identifying niche markets, understanding consumer preferences, and predicting future trends, allowing stakeholders to strategically position their offerings within the evolving genomic landscape.

- By Product:

- Kits and Reagents

- Instruments

- Services

- Sequencing Services

- Bioinformatics Services

- Data Analysis Services

- By Technology:

- Sequencing by Synthesis (SBS)

- Nanopore Sequencing

- Single Molecule Real-Time (SMRT) Sequencing

- Others (e.g., Combinatorial Probe-Anchor Ligation, Chain Termination)

- By Application:

- Clinical Diagnostics

- Rare Disease Diagnosis

- Cancer Diagnostics

- Infectious Disease Diagnostics

- Genetic Screening

- Drug Discovery and Development

- Personalized Medicine

- Agriculture and Animal Research

- Academic Research

- Others

- Clinical Diagnostics

- By End User:

- Academic and Research Institutions

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

- Forensic Laboratories

- Direct-to-Consumer (DTC) Genomics Companies

Value Chain Analysis For Whole Genome Sequencing Market

The value chain for the Whole Genome Sequencing market is intricate, involving multiple specialized stages from raw material sourcing to the final delivery of genomic insights to end-users. The upstream segment of the value chain primarily involves suppliers of essential raw materials such as specialized chemicals, enzymes, and reagents crucial for nucleic acid extraction, library preparation, and the sequencing reactions themselves. This segment also includes manufacturers of sophisticated sequencing instruments, robotic systems for automation, and developers of proprietary software integral for instrument operation. Key players in this stage focus on innovation in chemistries, improving hardware efficiency, and developing robust, scalable platforms to meet the growing demand for high-throughput sequencing. Their ability to provide reliable, cost-effective, and high-quality components directly influences the efficiency and affordability of the entire WGS process.

Moving downstream, the value chain encompasses service providers and end-users who convert raw genomic data into actionable insights. This involves genomic sequencing service providers, bioinformatics companies, and data analysis specialists who process, align, call variants, and interpret the massive datasets generated. Diagnostic laboratories, academic and research institutions, pharmaceutical and biotechnology companies, and increasingly, direct-to-consumer genomics companies represent the primary end-users. These entities leverage WGS data for diverse applications ranging from disease diagnosis and biomarker discovery to drug development and personalized treatment strategies. The downstream segment is characterized by a strong emphasis on data security, analytical precision, and the translation of complex genomic information into clinically relevant or commercially viable outcomes, often requiring advanced computational infrastructure and specialized human capital.

Distribution channels in the Whole Genome Sequencing market are multifaceted, typically involving both direct and indirect approaches. Direct sales are common for high-value instruments and large-scale service contracts, where manufacturers and service providers engage directly with major academic centers, large hospitals, and pharmaceutical companies. This direct approach allows for customized solutions, technical support, and stronger client relationships. Indirect channels involve distributors and resellers who help broaden market reach, especially for reagents, kits, and smaller instruments, particularly in geographically dispersed or emerging markets. Online platforms and specialized genomics marketplaces are also gaining traction, offering a more streamlined procurement process for certain products and services. Effective distribution, whether direct or indirect, is critical for ensuring timely access to necessary components and expertise, thereby enabling the widespread adoption and utilization of Whole Genome Sequencing technologies.

Whole Genome Sequencing Market Potential Customers

The Whole Genome Sequencing market serves a diverse array of potential customers, each with unique needs and applications for comprehensive genomic data. Academic and research institutions represent a foundational customer segment, constantly seeking advanced WGS capabilities for basic scientific discovery, population genetics studies, evolutionary biology research, and understanding disease mechanisms. Their demand is driven by the need for high-resolution genomic data to support grant-funded projects, publish groundbreaking research, and educate future generations of scientists. These institutions often require access to the latest sequencing technologies, bioinformatics tools, and expert support to manage and interpret vast datasets, driving innovation in both technology and methodology.

Hospitals and clinics constitute another rapidly growing customer base, increasingly integrating WGS into clinical diagnostics and patient management. This includes specialized genetic testing labs, oncology centers, and rare disease clinics that leverage WGS for accurate diagnosis of complex genetic conditions, guiding personalized treatment plans for cancer patients, and identifying inherited disease risks. The utility of WGS in clinical settings extends to infectious disease surveillance, pharmacogenomics for optimizing drug dosages, and non-invasive prenatal screening. For these customers, key considerations include diagnostic accuracy, turnaround time, regulatory compliance, and the ability to integrate genomic insights seamlessly into existing healthcare workflows and electronic health records.

Pharmaceutical and biotechnology companies are significant consumers of Whole Genome Sequencing, utilizing it extensively in drug discovery, development, and clinical trials. WGS aids in identifying novel drug targets, understanding disease pathophysiology, stratifying patient populations for clinical trials, and developing companion diagnostics. This segment's demand is focused on high-throughput, reliable sequencing solutions that can accelerate the drug development pipeline, reduce attrition rates, and bring more effective, personalized therapies to market. Additionally, forensic laboratories, direct-to-consumer genomics companies, and agricultural research organizations also represent expanding customer segments, each applying WGS to specific domains such as criminal investigations, ancestry and health insights, and crop or livestock improvement, respectively, showcasing the broad applicability and transformative potential of genomic data across numerous industries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $15.8 billion |

| Market Forecast in 2032 | $51.7 billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Illumina Inc., Thermo Fisher Scientific Inc., Pacific Biosciences of California Inc., Oxford Nanopore Technologies PLC, BGI Group, MGI Tech Co. Ltd., QIAGEN N.V., PerkinElmer Inc., F. Hoffmann-La Roche AG, Agilent Technologies Inc., Eurofins Scientific SE, Macrogen Inc., Novogene Co. Ltd., GENEWIZ (Azenta Life Sciences), Psomagen Inc., Sengenics International, DNAnexus Inc., Congenica Ltd., PierianDx, GenapSys Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Whole Genome Sequencing Market Key Technology Landscape

The Whole Genome Sequencing market is underpinned by a rapidly evolving and sophisticated technology landscape, primarily driven by advancements in next-generation sequencing (NGS) platforms. Sequencing by Synthesis (SBS), notably championed by Illumina, remains a dominant force, offering high accuracy and throughput suitable for large-scale genome projects and clinical diagnostics. However, newer long-read sequencing technologies from players like Pacific Biosciences (SMRT Sequencing) and Oxford Nanopore Technologies (Nanopore Sequencing) are gaining significant traction. These platforms excel at resolving complex genomic regions, structural variants, and epigenetic modifications that short-read technologies struggle with, thereby expanding the applications of WGS into areas like de novo assembly and detection of challenging mutations.

Beyond the core sequencing instruments, the technology landscape encompasses critical components for sample preparation, data generation, and bioinformatics. Automation systems, including liquid handling robots, are increasingly integrated into WGS workflows to reduce manual errors, increase throughput, and ensure reproducibility. Advances in library preparation kits are making it possible to sequence from increasingly challenging or limited sample types, further democratizing access to WGS. The burgeoning field of bioinformatics is indispensable, with sophisticated software and algorithms required for raw data processing, sequence alignment, variant calling, and functional interpretation. Cloud computing platforms play a vital role in storing and analyzing the immense datasets, offering scalable and secure solutions for genomic data management.

The convergence of these technologies, coupled with ongoing research and development, continues to enhance the efficiency, cost-effectiveness, and diagnostic power of WGS. Innovations in single-cell sequencing, spatial genomics, and multi-omics integration are pushing the boundaries of what WGS can achieve, providing unprecedented insights into cellular heterogeneity and complex biological systems. Furthermore, the increasing integration of artificial intelligence and machine learning tools within bioinformatics is revolutionizing data interpretation, enabling faster, more accurate identification of disease-causing variants and predictive biomarkers. This dynamic technological environment ensures that the WGS market remains at the forefront of biological and medical discovery, continuously expanding its utility and impact.

Regional Highlights

- North America: This region holds the largest market share in the Whole Genome Sequencing market, primarily driven by substantial investments in genomic research, the presence of major key players, and a well-established healthcare infrastructure. High adoption rates of advanced diagnostic technologies, coupled with significant funding from government and private organizations for precision medicine initiatives, contribute to its dominance.

- Europe: Europe represents a significant market, characterized by strong academic research contributions, increasing government support for genomic projects, and the growing implementation of personalized medicine programs across various countries. Collaborative research efforts and a focus on rare disease diagnosis further stimulate market growth in this region.

- Asia Pacific (APAC): Expected to exhibit the highest CAGR during the forecast period, the APAC region's growth is fueled by increasing healthcare expenditure, a large and diverse patient population, rising awareness regarding genetic disorders, and improving access to advanced diagnostic technologies. Government initiatives in countries like China, India, and Japan to establish national genomic sequencing projects are key growth drivers.

- Latin America: This region is an emerging market, showing increasing investment in healthcare infrastructure and rising awareness about genomic medicine. While still nascent compared to other regions, opportunities for market expansion are driven by improving economic conditions and a growing focus on diagnostic capabilities.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth, primarily due to increasing government spending on healthcare, rising incidence of chronic and genetic diseases, and a growing recognition of the benefits of WGS. Strategic partnerships and international collaborations are helping to overcome infrastructural challenges and expand market access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Whole Genome Sequencing Market.- Illumina Inc.

- Thermo Fisher Scientific Inc.

- Pacific Biosciences of California Inc.

- Oxford Nanopore Technologies PLC

- BGI Group

- MGI Tech Co. Ltd.

- QIAGEN N.V.

- PerkinElmer Inc.

- F. Hoffmann-La Roche AG

- Agilent Technologies Inc.

- Eurofins Scientific SE

- Macrogen Inc.

- Novogene Co. Ltd.

- GENEWIZ (Azenta Life Sciences)

- Psomagen Inc.

- Sengenics International

- DNAnexus Inc.

- Congenica Ltd.

- PierianDx

- GenapSys Inc.

Frequently Asked Questions

What is Whole Genome Sequencing (WGS) and how does it differ from other genetic tests?

Whole Genome Sequencing (WGS) is a comprehensive laboratory process that determines the entire DNA sequence of an organism's genome at once. Unlike targeted genetic tests or exome sequencing, which only analyze specific genes or protein-coding regions, WGS captures both coding and non-coding regions, providing the most complete picture of an individual's genetic makeup. This comprehensive scope allows for the identification of a broader range of genetic variations, including single nucleotide polymorphisms, structural variants, and copy number variations, which may be missed by less extensive methods, leading to more accurate diagnoses and deeper insights into disease etiology and personalized treatment options.

What are the primary applications of Whole Genome Sequencing in clinical diagnostics?

The primary applications of Whole Genome Sequencing in clinical diagnostics are extensive and rapidly expanding. WGS is crucial for diagnosing rare and undiagnosed genetic diseases, where it can identify novel disease-causing mutations that might be overlooked by conventional testing. It is increasingly utilized in precision oncology to guide cancer treatment by identifying somatic and germline mutations that inform targeted therapies and predict drug response. Furthermore, WGS plays a significant role in identifying genetic predispositions to common diseases, aiding in pharmacogenomics to optimize drug dosages, and in infectious disease surveillance for rapid pathogen identification and tracking. Its comprehensive nature makes it an invaluable tool for understanding complex disorders and tailoring patient care.

How have costs for Whole Genome Sequencing changed, and what are the future trends?

Costs for Whole Genome Sequencing have dramatically decreased over the past decade, plummeting from millions of dollars per genome to under $1,000 for sequencing alone in some research settings. This significant reduction is primarily due to technological advancements, increased automation, and competitive market dynamics. Future trends indicate a continued decline in sequencing costs, potentially reaching a few hundred dollars per genome, making WGS more accessible for routine clinical use and large-scale population health initiatives. Beyond sequencing, the cost burden is shifting towards bioinformatics analysis and data interpretation, areas where AI and machine learning are expected to drive efficiencies and further reduce overall costs, enhancing the affordability and scalability of WGS for broader adoption.

What ethical considerations are associated with Whole Genome Sequencing data?

Whole Genome Sequencing data raises several significant ethical considerations due to its comprehensive and highly personal nature. Key concerns include data privacy and security, as genomic information can reveal sensitive details about an individual's health, ancestry, and predisposition to diseases, necessitating robust protection against unauthorized access or misuse. The issue of informed consent is paramount, ensuring individuals fully understand the implications of having their entire genome sequenced, including potential future uses of their data. Furthermore, there are ethical dilemmas surrounding the reporting of incidental findings, the potential for genetic discrimination in employment or insurance, and equitable access to WGS technologies and their benefits across diverse populations. Addressing these ethical challenges requires careful policy development, transparent communication, and ongoing public discourse to ensure responsible and beneficial use of genomic insights.

What role does bioinformatics play in Whole Genome Sequencing?

Bioinformatics plays an indispensable and central role in Whole Genome Sequencing, as it is the critical discipline for managing, processing, and interpreting the immense datasets generated by sequencing instruments. After raw sequence reads are produced, bioinformatics tools are used for quality control, alignment of reads to a reference genome, identification of genetic variants (such as SNPs, indels, and structural variations), and annotation of these variants to determine their potential functional impact. Advanced bioinformatics platforms leverage computational algorithms, statistical methods, and databases to filter noise, pinpoint disease-causing mutations, and integrate genomic data with clinical information. This analytical pipeline is essential for transforming complex genomic data into actionable insights for research, diagnostics, and personalized medicine, making bioinformatics capabilities as crucial as the sequencing technology itself.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager