Wireless Video Surveillance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429994 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Wireless Video Surveillance Market Size

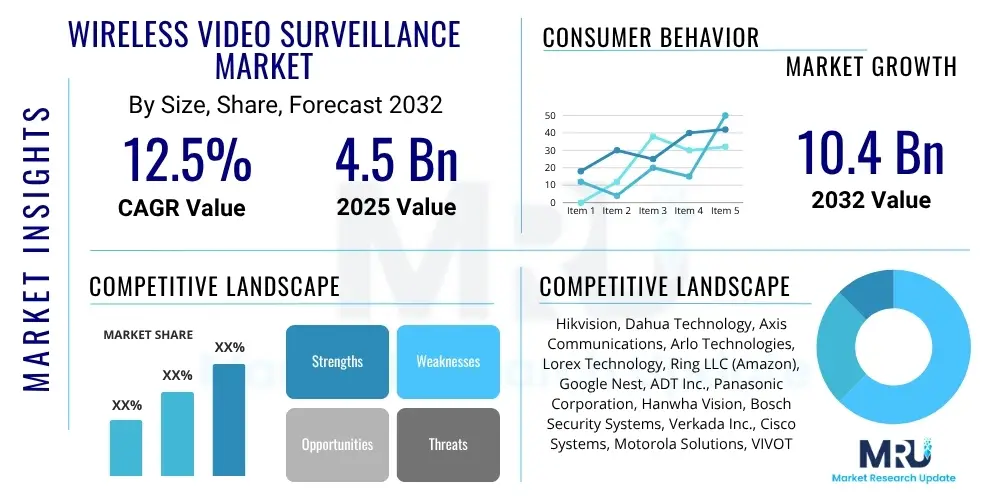

The Wireless Video Surveillance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 4.5 Billion in 2025 and is projected to reach USD 10.4 Billion by the end of the forecast period in 2032.

Wireless Video Surveillance Market introduction

The Wireless Video Surveillance Market encompasses a broad range of security systems that utilize wireless technologies for transmitting video and audio signals, eliminating the need for extensive cabling infrastructure. These systems are designed for real-time monitoring, recording, and playback of surveillance footage, offering unparalleled flexibility and ease of installation compared to traditional wired setups. Products typically include wireless cameras, network video recorders (NVRs) or digital video recorders (DVRs) with wireless capabilities, cloud storage solutions, and advanced analytics software.

Major applications for wireless video surveillance span across various sectors, including residential security, commercial monitoring, industrial oversight, and public safety initiatives. Benefits include simplified installation processes, reduced deployment costs in certain scenarios, enhanced mobility for cameras, and improved aesthetics due to the absence of visible wires. The primary driving factors for this market's expansion are increasing global security concerns, the proliferation of smart home and smart city technologies, advancements in wireless communication standards like 5G and Wi-Fi 6, and the growing demand for remote monitoring capabilities facilitated by cloud integration and mobile access.

Wireless Video Surveillance Market Executive Summary

The Wireless Video Surveillance Market is currently experiencing robust growth, propelled by evolving business trends that emphasize remote management, cloud integration, and intelligent analytics. Businesses are increasingly adopting wireless solutions for streamlined security operations, inventory management, and operational oversight, driven by the desire for cost-effective, scalable, and adaptable surveillance infrastructure. The integration of artificial intelligence (AI) and machine learning (ML) is transforming business applications, enabling proactive threat detection, automated anomaly recognition, and predictive security measures, thereby reducing false alarms and optimizing human resource allocation.

Regional trends indicate significant expansion in Asia Pacific, fueled by rapid urbanization, smart city initiatives, and heightened security spending in developing economies. North America and Europe continue to be mature markets, characterized by high adoption rates of advanced technologies and a strong emphasis on data privacy and regulatory compliance, fostering innovation in secure wireless communication. Latin America, the Middle East, and Africa are emerging as high-potential markets, driven by increasing awareness of security needs and growing investment in infrastructure development, albeit with varying paces of technological adoption and market maturity across countries within these regions.

Segment trends highlight a strong shift towards IP-based wireless cameras offering superior image quality and advanced functionalities. The market is witnessing a surge in demand for DIY (Do-It-Yourself) wireless systems for residential use, while enterprise and public sector applications are gravitating towards comprehensive, scalable solutions integrated with centralized management platforms. Cloud-based video surveillance-as-a-service (VSaaS) models are gaining traction across all segments, promising lower upfront costs, enhanced accessibility, and simplified maintenance, further bolstering the market's growth trajectory and redefining traditional ownership models.

AI Impact Analysis on Wireless Video Surveillance Market

User inquiries regarding AI's impact on the Wireless Video Surveillance Market frequently center on its ability to enhance existing functionalities, address common pain points like false alarms, and navigate evolving ethical and privacy concerns. Key themes emerging from these questions include the extent to which AI improves detection accuracy, its role in automating surveillance tasks, the implications for data storage and processing, and the potential for predictive analysis to prevent incidents. Users are keen to understand how AI can make systems "smarter" and more efficient, reduce manual monitoring efforts, and what challenges, such as data privacy and algorithmic bias, might arise with its widespread adoption.

The integration of AI into wireless video surveillance systems is fundamentally transforming their capabilities, moving beyond mere recording to intelligent interpretation of visual data. AI-powered analytics enable advanced features like facial recognition, object detection, behavioral analysis, and license plate recognition, significantly enhancing the effectiveness of surveillance. This shift allows systems to filter out irrelevant information, identify genuine threats more accurately, and provide actionable insights, thereby revolutionizing how security is managed and perceived in both commercial and residential environments. The technology facilitates a proactive rather than reactive approach to security, paving the way for more sophisticated and autonomous surveillance operations.

- Enhanced object detection and classification, distinguishing humans, vehicles, and animals.

- Reduced false alarms through intelligent motion detection and environmental noise filtering.

- Automated behavioral analysis, identifying suspicious activities or patterns.

- Facial recognition and license plate recognition for access control and identification.

- Predictive analytics to anticipate potential security breaches based on historical data.

- Improved search capabilities, allowing rapid retrieval of specific events from vast footage.

- Optimized bandwidth usage and storage efficiency through intelligent video summarization.

- Integration with other smart systems for coordinated responses and smart automation.

- Edge AI processing for faster analysis and reduced reliance on cloud bandwidth.

- Real-time alert generation for immediate incident response.

DRO & Impact Forces Of Wireless Video Surveillance Market

The Wireless Video Surveillance Market is profoundly influenced by a complex interplay of driving forces, inherent restraints, and burgeoning opportunities that collectively shape its trajectory and impact its overall growth. Key drivers include a rising global demand for enhanced security measures across residential, commercial, and public sectors, spurred by increasing crime rates and geopolitical instabilities. The proliferation of smart homes and smart cities projects, which inherently integrate extensive surveillance networks, further fuels market expansion. Technological advancements such in wireless communication (e.g., 5G, Wi-Fi 6), miniaturization of cameras, and improved battery technologies significantly enhance the functionality and appeal of wireless systems, alongside the growing demand for remote monitoring and cloud-based solutions offering greater accessibility and scalability.

However, the market faces several notable restraints. High initial investment costs for advanced wireless systems, particularly those with sophisticated AI capabilities or long-range connectivity, can be a barrier for some consumers and small businesses. Cybersecurity vulnerabilities pose a significant threat, as wireless networks are susceptible to hacking and data breaches, leading to privacy concerns and potential misuse of surveillance data. Limitations in wireless range, susceptibility to interference, and reliance on battery power for completely untethered cameras can also hinder performance and reliability in certain environments. Data privacy regulations, such as GDPR and CCPA, introduce compliance complexities and increase operational costs for manufacturers and users alike, particularly concerning the storage and processing of personal identifiable information (PII) captured by surveillance systems.

Despite these challenges, substantial opportunities exist for market players. The continuous integration of AI and machine learning promises to unlock new capabilities, such as advanced predictive analytics and autonomous threat detection, creating higher value propositions. The expansion of cloud-based Video Surveillance-as-a-Service (VSaaS) models offers recurring revenue streams and lowers barriers to entry for end-users, promoting wider adoption. Furthermore, emerging markets in Asia Pacific, Latin America, and Africa present untapped potential due to their rapid urbanization and increasing focus on public safety infrastructure. Strategic partnerships between hardware manufacturers, software developers, and telecommunication providers are also creating integrated solutions that can address specific market needs and overcome existing technological limitations, fostering a robust ecosystem for future growth.

Segmentation Analysis

The Wireless Video Surveillance Market is meticulously segmented across various dimensions to provide a comprehensive understanding of its structure and dynamics. These segmentations allow for a granular analysis of market trends, consumer preferences, and technological adoption patterns, enabling businesses to tailor their strategies effectively. The market can be broadly categorized by component, type, application, end-user, and connectivity, each offering unique insights into the diverse landscape of wireless surveillance solutions.

- By Component:

- Hardware (Cameras, NVR/DVR, Storage Devices)

- Software (Video Management Software, Video Analytics Software)

- Services (Installation, Maintenance, Cloud Storage, Managed Services)

- By Type:

- IP Cameras

- Analog Cameras (with wireless transmitters)

- By Application:

- Indoor Surveillance

- Outdoor Surveillance

- By End-User:

- Commercial (Retail, Offices, Healthcare, Hospitality)

- Residential (Smart Homes, Apartments)

- Industrial (Manufacturing Plants, Warehouses)

- Government and Public Infrastructure (Smart Cities, Transportation)

- Defense and Border Security

- By Connectivity:

- Wi-Fi

- Cellular (4G, 5G)

- Bluetooth

- Radio Frequency (RF)

- Other Wireless Technologies (e.g., LoRaWAN)

Value Chain Analysis For Wireless Video Surveillance Market

The value chain for the Wireless Video Surveillance Market is intricate, involving multiple stages from raw material sourcing to end-user deployment and ongoing services, each contributing significantly to the final product's value. The upstream segment involves the procurement of critical components such as image sensors, chipsets, lenses, communication modules (Wi-Fi, 4G/5G), and storage solutions from specialized manufacturers. These suppliers form the foundational layer, providing the core technologies that enable the functionality of wireless surveillance devices. Innovation at this stage, particularly in sensor technology and AI-enabled chipsets, directly impacts the performance and capabilities of the final product, influencing factors like image quality, battery life, and processing power.

Midstream activities primarily encompass the manufacturing, assembly, and integration of these components into complete wireless camera systems, network video recorders, and associated software platforms. This stage involves significant research and development efforts to optimize wireless protocols, enhance cybersecurity features, and develop user-friendly interfaces. Manufacturers often specialize in different product tiers, catering to distinct segments such as DIY residential users, SMBs, or large-scale enterprise deployments. Quality control, testing, and compliance with various international standards are crucial at this juncture to ensure product reliability and market acceptance.

The downstream segment focuses on distribution, sales, installation, and post-sales support, connecting the manufactured products to the end-users. Distribution channels are varied, including direct sales to large enterprises or government bodies, partnerships with system integrators and security solution providers, and indirect sales through retail channels, e-commerce platforms, and specialized distributors. System integrators play a vital role in designing, installing, and configuring complex wireless surveillance networks tailored to specific client needs, often integrating these systems with other security or building management platforms. Post-sales services, including maintenance, software updates, and cloud-based storage subscriptions, represent a growing and increasingly important part of the value chain, ensuring long-term customer satisfaction and generating recurring revenue streams for market participants.

Wireless Video Surveillance Market Potential Customers

The Wireless Video Surveillance Market serves a diverse array of potential customers, spanning across various sectors and demographics, all united by a fundamental need for enhanced security, monitoring, and operational efficiency. End-users typically prioritize convenience, scalability, and ease of deployment, which wireless systems inherently provide. Residential homeowners and renters represent a significant customer base, seeking simple, cost-effective solutions for home security, property monitoring, and parental oversight, often opting for DIY-friendly smart cameras integrated with home automation ecosystems. Small and Medium-sized Businesses (SMBs) are another key segment, utilizing wireless surveillance for loss prevention, employee monitoring, and asset protection without the complexities and costs associated with extensive wired installations.

Large enterprises, including corporate offices, retail chains, and manufacturing facilities, constitute a substantial portion of the market, requiring robust, scalable, and interconnected wireless systems for comprehensive site security, operational surveillance, and regulatory compliance. These customers often demand advanced features such as AI-powered analytics, cloud integration, and seamless integration with existing IT infrastructure. Public sector entities, encompassing government buildings, smart city initiatives, transportation hubs, and educational institutions, are increasingly adopting wireless surveillance for public safety, traffic management, and infrastructure monitoring, driven by the need for flexible deployment in challenging environments and rapid response capabilities. The healthcare sector, with its strict privacy requirements, also represents a growing customer segment, using wireless cameras for patient monitoring, facility security, and emergency response in a discreet and adaptable manner.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.5 Billion |

| Market Forecast in 2032 | USD 10.4 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hikvision, Dahua Technology, Axis Communications, Arlo Technologies, Lorex Technology, Ring LLC (Amazon), Google Nest, ADT Inc., Panasonic Corporation, Hanwha Vision, Bosch Security Systems, Verkada Inc., Cisco Systems, Motorola Solutions, VIVOTEK Inc., D-Link Corporation, TP-Link, Samsung Techwin, Swann Communications, Reolink Digital |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wireless Video Surveillance Market Key Technology Landscape

The Wireless Video Surveillance Market is underpinned by a dynamic and continuously evolving technology landscape, characterized by innovations that enhance connectivity, video quality, data processing, and overall system intelligence. Central to this evolution are advanced wireless communication protocols such as Wi-Fi 6, 5G, and proprietary low-power wide-area network (LPWAN) technologies like LoRaWAN, which offer improved bandwidth, reduced latency, extended range, and greater power efficiency. These advancements enable more reliable and flexible deployment of wireless cameras, supporting high-resolution video streams and real-time data transmission even in challenging environments. The miniaturization of components and improvements in battery technology are also critical, allowing for smaller, more discreet, and truly wire-free camera designs with longer operational periods.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) stands as a pivotal technological trend, transforming raw video data into actionable intelligence. AI-powered analytics, often executed at the edge (on the camera itself) or via cloud platforms, enable features like intelligent motion detection, object classification, facial recognition, behavioral analysis, and anomaly detection. These capabilities drastically reduce false alarms, automate monitoring tasks, and provide proactive security insights. Cloud computing and Video Surveillance-as-a-Service (VSaaS) platforms are also essential, offering scalable storage, remote access, centralized management, and sophisticated data analytics without the need for extensive on-premise infrastructure. This shift to cloud-based solutions lowers the total cost of ownership and democratizes access to advanced surveillance technologies for a broader range of users.

Furthermore, cybersecurity measures are becoming increasingly sophisticated within the wireless video surveillance landscape. With the growing threat of cyberattacks and data breaches, robust encryption protocols, secure authentication mechanisms, and regular software updates are critical to protecting sensitive video footage and user data. Edge computing, which involves processing data closer to the source (e.g., on the camera), reduces the reliance on constant cloud connectivity, enhances data privacy, and minimizes latency for real-time applications. The interoperability of wireless surveillance systems with other IoT devices and smart home ecosystems is also a key technological focus, facilitating the creation of integrated, intelligent security environments that offer enhanced automation and a more holistic approach to safety and convenience.

Regional Highlights

The Wireless Video Surveillance Market exhibits distinct growth patterns and adoption rates across various global regions, influenced by economic development, security priorities, technological infrastructure, and regulatory frameworks. North America, including the United States and Canada, stands as a mature market with high adoption of advanced wireless surveillance solutions. This region benefits from significant investments in smart home technologies, a strong emphasis on commercial and industrial security, and widespread awareness of cutting-Fi 6, and robust broadband penetration. The demand here is largely driven by smart city initiatives, enterprise-level security upgrades, and strong consumer interest in DIY home security systems.

Europe, encompassing countries like Germany, the United Kingdom, and France, represents another key market with a focus on data privacy regulations and high-quality, reliable solutions. The implementation of stringent data protection laws such as GDPR has driven manufacturers to develop highly secure and compliant wireless surveillance systems. The region shows strong demand from the commercial sector, public spaces, and infrastructure projects, with a growing emphasis on AI-powered analytics and cloud-based services for efficient and intelligent monitoring. Nordic countries, in particular, are at the forefront of adopting advanced smart security solutions due to high technological literacy and early adoption of IoT.

Asia Pacific (APAC), led by countries such as China, India, and Japan, is currently the fastest-growing region in the Wireless Video Surveillance Market. This explosive growth is fueled by rapid urbanization, massive government investments in smart city projects, increasing infrastructure development, and a rising awareness of security threats across both commercial and residential sectors. China, in particular, dominates the manufacturing and deployment of surveillance technologies, with extensive public surveillance networks. India and Southeast Asian nations are also witnessing substantial growth due to expanding middle classes, increased disposable income, and a burgeoning demand for modern security solutions. Latin America, the Middle East, and Africa (MEA) are emerging markets with considerable potential. Increased security concerns, coupled with growing economic development and infrastructure investments, are stimulating demand for wireless surveillance systems in these regions. While adoption rates vary, the flexibility and cost-effectiveness of wireless solutions make them particularly appealing for addressing security challenges in diverse and rapidly developing urban and rural settings.

- North America (USA, Canada): High adoption of smart home security, enterprise upgrades, focus on advanced analytics and cloud solutions.

- Europe (Germany, UK, France): Strong regulatory compliance (GDPR), demand for secure and high-quality systems, public safety initiatives.

- Asia Pacific (China, India, Japan): Rapid urbanization, smart city projects, large-scale infrastructure development, increasing security awareness.

- Latin America: Growing security concerns, economic development, increasing investment in public and private sector security.

- Middle East and Africa (MEA): Infrastructure development, rising security threats, increasing government spending on surveillance technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wireless Video Surveillance Market.- Hikvision

- Dahua Technology

- Axis Communications

- Arlo Technologies

- Lorex Technology

- Ring LLC (Amazon)

- Google Nest

- ADT Inc.

- Panasonic Corporation

- Hanwha Vision

- Bosch Security Systems

- Verkada Inc.

- Cisco Systems

- Motorola Solutions

- VIVOTEK Inc.

- D-Link Corporation

- TP-Link

- Samsung Techwin

- Swann Communications

- Reolink Digital

Frequently Asked Questions

Analyze common user questions about the Wireless Video Surveillance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of wireless video surveillance systems?

Wireless video surveillance systems offer enhanced flexibility, easier installation without extensive cabling, scalability for adding more cameras, and often remote access capabilities, making them ideal for diverse security needs.

How does AI impact the effectiveness of wireless video surveillance?

AI significantly enhances effectiveness by enabling intelligent features like object detection, facial recognition, reduced false alarms, and predictive analytics, transforming surveillance from passive monitoring to proactive security management.

Are wireless surveillance systems secure from hacking and data breaches?

Modern wireless surveillance systems employ strong encryption and cybersecurity protocols to protect data. However, users should ensure strong passwords, regular software updates, and secure network configurations to mitigate risks.

What are the key considerations for installing a wireless video surveillance system?

Key considerations include signal range and interference, power source (battery life vs. wired power), storage options (local vs. cloud), camera resolution, and compliance with local privacy regulations.

What are the emerging trends in the Wireless Video Surveillance Market?

Emerging trends include deeper integration of AI and machine learning, widespread adoption of cloud-based VSaaS, utilization of 5G connectivity for enhanced performance, edge computing for faster processing, and improved interoperability with smart home ecosystems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager