Workflow Automation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427873 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Workflow Automation Market Size

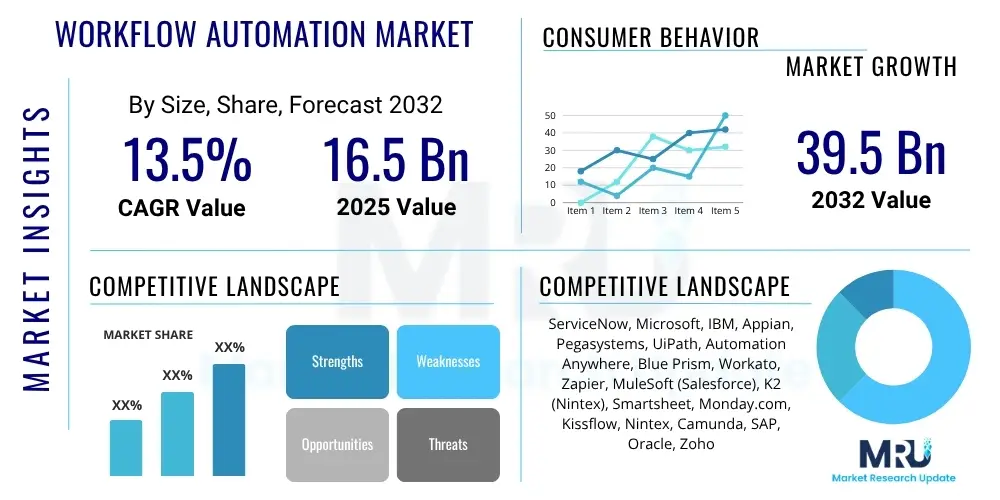

The Workflow Automation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2025 and 2032. The market is estimated at USD 16.5 Billion in 2025 and is projected to reach USD 39.5 Billion by the end of the forecast period in 2032.

Workflow Automation Market introduction

The Workflow Automation Market is experiencing robust expansion, driven by an urgent global need for operational efficiency, cost reduction, and enhanced productivity across diverse industries. Workflow automation refers to the design, execution, and automation of processes based on a set of procedural rules, without the need for manual intervention. This technology streamlines tasks, optimizes resource allocation, and minimizes human error, making business operations more agile and responsive to market demands. Products within this market encompass a wide array of software solutions, including Business Process Management (BPM) suites, Robotic Process Automation (RPA) tools, integration platforms as a service (iPaaS), and low-code/no-code development platforms, all designed to automate repetitive, rule-based tasks and complex cross-functional processes.

Major applications of workflow automation span virtually every department within an organization. In IT, it automates incident management, service requests, and infrastructure provisioning. Human Resources leverages it for onboarding, payroll processing, and performance management. Finance and Accounting utilize automation for invoice processing, expense approvals, and financial reporting. Sales and Marketing benefit from automated lead nurturing, campaign management, and customer relationship management. The primary benefits include significant time savings, improved data accuracy, enhanced compliance, better resource utilization, and a superior customer and employee experience. These solutions liberate employees from mundane tasks, allowing them to focus on strategic initiatives that drive innovation and growth. The overall impact is a fundamental transformation in how businesses operate, making them more competitive and resilient in an increasingly complex global landscape.

Several driving factors are propelling the adoption of workflow automation. The escalating demand for digital transformation initiatives, accelerated by the recent global shift towards remote and hybrid work models, is a primary catalyst. Organizations are recognizing that manual processes are bottlenecks that hinder agility and scalability. Furthermore, the imperative to reduce operational costs while simultaneously improving service delivery quality is pushing businesses to invest in automation technologies. The rise of cloud computing and Software-as-a-Service (SaaS) models has made workflow automation solutions more accessible and affordable for a wider range of businesses, including small and medium-sized enterprises (SMEs). Additionally, the increasing complexity of regulatory compliance and the need for greater transparency in business operations are further fueling the demand for automated, auditable workflows. These combined forces create a powerful impetus for continuous growth in the workflow automation market.

Workflow Automation Market Executive Summary

The workflow automation market is experiencing dynamic shifts, characterized by several prevailing business trends, distinct regional developments, and evolving segment performances. Globally, organizations are aggressively pursuing digital transformation, a trend significantly accelerated by the increased adoption of remote and hybrid work models, which necessitates seamless, automated processes to maintain operational continuity and efficiency. The market is witnessing a strong move towards hyperautomation, integrating technologies like Robotic Process Automation (RPA), Artificial Intelligence (AI), Machine Learning (ML), and Business Process Management (BPM) into comprehensive platforms. This convergence allows for the automation of a wider spectrum of tasks, from simple data entry to complex decision-making processes, driving greater value and scalability for enterprises. There is also a growing emphasis on low-code/no-code platforms, democratizing access to automation tools and empowering citizen developers to create solutions without extensive programming knowledge, thereby reducing reliance on specialized IT teams and accelerating deployment cycles.

Regional trends reveal varied adoption rates and focus areas. North America, particularly the United States, remains a dominant market due driven by early technology adoption, significant R&D investments, and a large presence of key solution providers. The region benefits from a mature IT infrastructure and a strong focus on enhancing productivity and reducing operational expenditures across sectors like BFSI, healthcare, and IT. Europe is also a significant market, propelled by stringent regulatory requirements that necessitate auditable and compliant processes, as well as a strong push for digital transformation in manufacturing and public administration. The Asia Pacific region is emerging as the fastest-growing market, primarily due to rapid industrialization, increasing digitalization initiatives in developing economies like China and India, and a burgeoning SME sector eager to leverage automation for competitive advantage. Latin America, the Middle East, and Africa are showing nascent but accelerating growth, spurred by government digitalization efforts and investments in cloud infrastructure.

Segmentation trends highlight the increasing importance of cloud-based deployment models, favored for their flexibility, scalability, and lower upfront costs, especially among small and medium-sized enterprises. Large enterprises continue to invest heavily in robust, integrated workflow automation suites, often opting for a hybrid deployment approach that balances on-premises control with cloud agility. In terms of business functions, IT operations, Human Resources, and Finance & Accounting remain the frontrunners in automation adoption due to the high volume of repetitive tasks in these areas. However, other functions like Sales & Marketing, Customer Service, and Supply Chain Management are rapidly catching up, recognizing the immense potential for efficiency gains and improved stakeholder experiences. The BFSI, IT & Telecom, and Healthcare sectors are leading the industry vertical adoption, driven by stringent compliance needs, complex operational structures, and a continuous push for service optimization. The market also sees a rising demand for automation services, including consulting, implementation, and support, as organizations seek expert guidance to navigate complex integration and deployment challenges.

AI Impact Analysis on Workflow Automation Market

Common user questions regarding the impact of AI on the Workflow Automation Market frequently revolve around the fundamental transformation of operational processes, the potential for augmented intelligence, and the challenges associated with implementation. Users are keen to understand how AI can move automation beyond simple rule-based tasks to encompass more cognitive capabilities, such as natural language processing for customer service or predictive analytics for supply chain optimization. Key themes include concerns about job displacement versus job augmentation, the necessity of new skill sets for the workforce, the ethical implications of AI-driven decisions, and the complexities of integrating AI with existing legacy systems. There is also significant interest in the measurable ROI of AI integration, data privacy concerns with AI processing sensitive information, and the accessibility of advanced AI tools for businesses of varying sizes, specifically asking if these sophisticated technologies are within reach for small and medium-sized enterprises. The overarching expectation is that AI will unlock unprecedented levels of efficiency and insight, but users also seek clarity on the practical steps and potential pitfalls of adopting such transformative technologies.

- AI enhances predictive capabilities, allowing automation systems to anticipate issues and proactively trigger workflows.

- It enables intelligent document processing, extracting and understanding unstructured data from various sources.

- AI facilitates natural language processing (NLP) for automating customer service interactions and content generation.

- Machine Learning (ML) algorithms optimize workflow routing and resource allocation based on real-time data and historical patterns.

- Cognitive automation, powered by AI, extends beyond rule-based tasks to handle more complex, unstructured processes.

- AI contributes to hyperautomation strategies, orchestrating multiple technologies for end-to-end process automation.

- It supports better decision-making by analyzing vast datasets and recommending optimal workflow paths.

- AI-driven automation systems can continuously learn and adapt, improving performance over time without constant human reprogramming.

- It transforms business intelligence, providing deeper insights into operational bottlenecks and opportunities for further automation.

- AI helps in identifying and eliminating redundant or inefficient steps within existing workflows.

- It plays a critical role in anomaly detection, flagging unusual activities or potential security threats within automated processes.

- AI augments human capabilities by taking over mundane cognitive tasks, freeing up employees for strategic work.

- It enables personalized automation experiences, tailoring workflows to individual user needs or preferences.

DRO & Impact Forces Of Workflow Automation Market

The Workflow Automation Market is propelled by a confluence of powerful drivers that are fundamentally reshaping business operations globally. A primary driver is the pervasive demand for operational efficiency and the continuous pursuit of cost reduction. Businesses across all sectors are under immense pressure to do more with less, and workflow automation offers a direct pathway to achieving these goals by streamlining repetitive tasks, minimizing human error, and optimizing resource allocation. The accelerating pace of digital transformation initiatives, particularly post-pandemic, has further cemented the necessity of automation. Organizations are recognizing that manual processes are no longer sustainable in a digitally-driven world, prompting significant investments in automated solutions to enhance agility and responsiveness. The rise of cloud-based automation platforms, offering flexibility, scalability, and reduced infrastructure costs, has made these technologies more accessible to a broader range of businesses. Furthermore, the increasing adoption of Robotic Process Automation (RPA) as a foundational component for automating routine, rule-based tasks acts as a significant catalyst, often serving as an entry point for organizations to explore broader workflow automation strategies. These drivers collectively create a compelling business case for the widespread adoption and continuous evolution of workflow automation technologies.

Despite the strong growth trajectory, the Workflow Automation Market faces several significant restraints that can impede its full potential. High initial investment costs, particularly for comprehensive enterprise-wide solutions and their associated integration efforts, can be a deterrent for small and medium-sized enterprises (SMEs) with limited budgets. Data security and privacy concerns also present a formidable challenge, especially as automation solutions increasingly handle sensitive corporate and customer information. Organizations are wary of potential breaches and the regulatory penalties associated with them, leading to cautious adoption. Another critical restraint is the lack of skilled professionals capable of implementing, managing, and optimizing complex automation workflows. The demand for expertise in areas like BPM, RPA, and AI integration often outstrips the available talent pool. Moreover, resistance to change within organizations, stemming from employee fears of job displacement or discomfort with new technologies, can slow down adoption and hinder successful implementation. Finally, the complexities involved in integrating new automation solutions with diverse legacy systems pose technical and operational challenges, requiring significant resources and planning, which can be a barrier for many established businesses.

The Workflow Automation Market is ripe with numerous opportunities that promise to drive future growth and innovation. The continued integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities into workflow automation platforms represents a massive opportunity. AI can elevate automation from rule-based to cognitive processes, enabling solutions to handle unstructured data, make predictive decisions, and continuously learn and adapt, thereby unlocking hyperautomation. The expansion of workflow automation into new, underserved industries, such as healthcare, government, and education, where manual processes are still prevalent, offers substantial market potential. As these sectors undergo digital transformation, their demand for efficient and compliant automated workflows will surge. The proliferation of low-code/no-code platforms is a game-changer, democratizing automation by allowing business users to develop and deploy solutions with minimal IT intervention, significantly reducing development time and costs. Furthermore, the global shift towards remote and hybrid work models has permanently increased the need for robust, cloud-based workflow automation to maintain productivity and collaboration across geographically dispersed teams. The increasing complexity of regulatory environments also presents an opportunity, as automated workflows can ensure compliance, auditability, and transparency, transforming a compliance burden into an operational advantage. These opportunities, when effectively leveraged, will fuel substantial market expansion and innovation.

Segmentation Analysis

The Workflow Automation Market is broadly segmented based on various critical parameters including component, deployment model, organization size, business function, and industry vertical, each providing a unique lens into the market dynamics and adoption patterns. This granular segmentation allows market participants to understand specific demand drivers, competitive landscapes, and growth opportunities within distinct niches. Each segment plays a crucial role in shaping the overall market, reflecting differing technological preferences, operational requirements, and budget considerations across a diverse user base. The evolution of these segments is influenced by technological advancements, economic shifts, and changing business priorities, making a detailed analysis essential for strategic planning and market penetration.

- Component

- Software: Includes standalone applications, BPM suites, RPA platforms, iPaaS, and low-code/no-code tools.

- Services: Comprises consulting, implementation, training, support, and maintenance services.

- Deployment Model

- Cloud: Solutions hosted on remote servers and accessed via the internet (SaaS, PaaS).

- On-premises: Software installed and operated from an organization's internal infrastructure.

- Hybrid: A combination of cloud and on-premises deployment, balancing flexibility with control.

- Organization Size

- Large Enterprises: Organizations with extensive resources and complex operational structures.

- Small & Medium-sized Enterprises (SMEs): Businesses with limited resources, often seeking cost-effective and scalable solutions.

- Business Function

- IT Operations: Automating service requests, incident management, infrastructure provisioning.

- Human Resources (HR): Streamlining onboarding, payroll, performance management, leave requests.

- Finance & Accounting: Automating invoice processing, expense approvals, financial reporting, budgeting.

- Sales & Marketing: Enhancing lead nurturing, CRM integration, campaign management, proposal generation.

- Customer Service: Automating ticket routing, query resolution, feedback collection.

- Supply Chain Management: Optimizing procurement, inventory management, logistics.

- Operations: General business process automation across core operational areas.

- Industry Vertical

- BFSI (Banking, Financial Services, and Insurance): Driven by regulatory compliance, fraud detection, customer service.

- IT & Telecom: For network management, service orchestration, IT service management.

- Healthcare: Automating patient intake, claims processing, appointment scheduling, record management.

- Retail & E-commerce: For order fulfillment, inventory management, customer support, marketing automation.

- Manufacturing: Optimizing production processes, supply chain, quality control.

- Government & Public Sector: Streamlining citizen services, permit applications, internal administration.

- Education: Automating student enrollment, grading, administrative tasks.

- Media & Entertainment: For content creation workflows, distribution, rights management.

- Others: Includes transportation, energy, utilities, and other niche sectors.

Value Chain Analysis For Workflow Automation Market

A comprehensive value chain analysis for the Workflow Automation Market reveals a complex interplay of activities, starting from core technology development and extending through deployment, distribution, and ongoing support, ultimately delivering automated solutions to end-users. The upstream segment of the value chain is dominated by technology providers focused on research and development. This includes companies specializing in artificial intelligence and machine learning algorithms, cloud infrastructure services, database management systems, and core software development kits (SDKs) and frameworks. These entities provide the foundational components that enable the creation of sophisticated workflow automation platforms. Investment in innovation at this stage is critical, as it directly influences the capabilities and scalability of downstream solutions. Key activities here involve intellectual property creation, platform architecture design, and the development of robust, secure, and interoperable core technologies. Strong upstream players ensure the availability of advanced tools and components, which are then leveraged by solution developers.

Moving downstream, the value chain involves a significant focus on solution development, integration, and service delivery. This segment is occupied by a diverse array of companies, including independent software vendors (ISVs) that build proprietary workflow automation platforms (e.g., BPM suites, RPA software, iPaaS), system integrators (SIs) that specialize in customizing and deploying these solutions within complex enterprise environments, and consulting firms that advise businesses on their automation strategies. Solution developers acquire core technologies from upstream providers, combining them to create user-friendly and industry-specific applications. Integrators then ensure that these solutions seamlessly connect with an organization's existing IT infrastructure, including legacy systems, enterprise resource planning (ERP) platforms, and customer relationship management (CRM) systems. Service providers offer ongoing support, maintenance, training, and optimization services, ensuring the long-term effectiveness and evolution of automated workflows. The downstream activities are crucial for translating technological capabilities into tangible business value for end-users, addressing specific organizational challenges and opportunities.

Distribution channels for workflow automation solutions are diverse, encompassing both direct and indirect models. Direct sales channels involve solution providers engaging directly with enterprise clients through their own sales teams, often for large, customized, or complex implementations. This approach allows for direct communication, tailored solutions, and stronger relationship building. Indirect channels, however, are increasingly prevalent and critical for market penetration, especially for cloud-based or standardized solutions. These include a vast network of resellers, value-added resellers (VARs), managed service providers (MSPs), and independent software vendors (ISVs) who bundle workflow automation software with their own offerings or services. Cloud marketplaces and application stores also serve as significant indirect distribution avenues, particularly for low-code/no-code platforms and SaaS-based solutions, providing easy access and subscription-based models for a broad customer base. Strategic partnerships with technology consultancies and global system integrators also play a vital role, extending market reach and providing specialized expertise. The choice of distribution channel often depends on the solution's complexity, target market, and the vendor's strategic objectives, with many companies employing a hybrid approach to maximize their market presence.

Workflow Automation Market Potential Customers

The Workflow Automation Market caters to a vast and continuously expanding base of potential customers, encompassing virtually every industry and organization size that seeks to optimize operations, reduce costs, and enhance efficiency. At a macro level, the primary buyers of workflow automation solutions are enterprises across all industry verticals, ranging from established multinational corporations to agile small and medium-sized enterprises (SMEs). These organizations are driven by the universal need to streamline repetitive and rule-based tasks, accelerate decision-making processes, and improve overall business agility in an increasingly competitive global landscape. Potential customers can be broadly categorized by their operational challenges, digital maturity, and strategic objectives, but the fundamental appeal of automation – to achieve more with less – resonates across the entire spectrum. This broad appeal ensures a continuous demand for innovative and scalable automation solutions, making nearly any operational business a potential target.

More specifically, key end-users and buyers of workflow automation solutions typically include decision-makers in IT departments, such as CIOs and IT managers, who are tasked with digital transformation, system integration, and infrastructure optimization. Business unit heads and functional leaders, including HR directors, CFOs, heads of operations, sales and marketing VPs, and customer service managers, are also significant buyers. These functional leaders are directly impacted by inefficient manual processes and are keen to leverage automation to achieve departmental KPIs, improve employee satisfaction, and enhance customer experience. For instance, HR departments invest in automation to streamline onboarding, payroll, and talent management, while finance departments seek to automate invoice processing, expense management, and financial reporting. Customer service divisions utilize automation for ticket routing, query resolution, and personalized support. The driving force for these buyers is the tangible ROI derived from automation, including reduced operational costs, increased productivity, improved compliance, and enhanced data accuracy, which collectively contribute to achieving strategic business objectives and gaining a competitive edge.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 16.5 Billion |

| Market Forecast in 2032 | USD 39.5 Billion |

| Growth Rate | 13.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ServiceNow, Microsoft, IBM, Appian, Pegasystems, UiPath, Automation Anywhere, Blue Prism, Workato, Zapier, MuleSoft (Salesforce), K2 (Nintex), Smartsheet, Monday.com, Kissflow, Nintex, Camunda, SAP, Oracle, Zoho |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Workflow Automation Market Key Technology Landscape

The Workflow Automation Market is fundamentally shaped by a dynamic and evolving technology landscape, where several innovative platforms and tools converge to deliver comprehensive automation solutions. At its core, the technology stack for workflow automation includes Business Process Management (BPM) suites, which provide frameworks for designing, executing, monitoring, and optimizing business processes. These suites often come with visual modeling tools, rule engines, and collaboration features, enabling organizations to manage complex, end-to-end workflows. Robotic Process Automation (RPA) is another cornerstone technology, focused on automating repetitive, rule-based digital tasks by mimicking human interactions with software applications. RPA bots can interact with various systems, extract data, and perform actions without human intervention, acting as digital workers that boost efficiency and accuracy. The synergy between BPM for process orchestration and RPA for task automation is a key trend, creating robust hyperautomation capabilities.

Beyond BPM and RPA, the market heavily leverages cloud computing infrastructure, particularly Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) models. Cloud deployment offers scalability, flexibility, reduced infrastructure costs, and easier accessibility, making advanced automation solutions available to a wider range of businesses. Integration Platform as a Service (iPaaS) solutions are critical for connecting disparate applications and data sources, enabling seamless data flow and process orchestration across an enterprise's diverse IT ecosystem. These platforms provide pre-built connectors and APIs, simplifying the complex task of integrating various systems, from legacy on-premises applications to modern cloud services. Furthermore, Artificial Intelligence (AI) and Machine Learning (ML) are increasingly embedded into workflow automation tools, transcending traditional rule-based automation. AI-powered capabilities include natural language processing (NLP) for understanding unstructured data, intelligent document processing (IDP) for extracting insights from documents, and predictive analytics for optimizing workflows and decision-making, moving automation towards more cognitive and adaptive processes.

The rise of low-code/no-code development platforms also represents a transformative technological shift in the workflow automation landscape. These platforms empower business users, or "citizen developers," to build and deploy automation applications and workflows using intuitive drag-and-drop interfaces and visual models, significantly reducing the reliance on specialized IT developers. This democratization of development accelerates automation initiatives, fosters innovation across business units, and reduces time-to-market for new automated processes. Additionally, advanced analytics and data visualization tools are integral, providing real-time insights into workflow performance, identifying bottlenecks, and enabling continuous process improvement. Mobile access and responsive design are also crucial technologies, ensuring that employees can interact with and manage workflows from anywhere, on any device. The convergence of these technologies – BPM, RPA, Cloud, iPaaS, AI/ML, and low-code/no-code – defines the current state of the art in workflow automation, driving unprecedented levels of efficiency, agility, and intelligence in business operations.

Regional Highlights

- North America: This region is a dominant market for workflow automation, driven by early adoption of advanced technologies, substantial investments in digital transformation initiatives, and the presence of numerous key market players. The United States and Canada lead in implementing sophisticated automation solutions across BFSI, IT & Telecom, and healthcare sectors, primarily focusing on improving operational efficiency, enhancing customer experience, and ensuring regulatory compliance. The mature IT infrastructure and high spending capacity of enterprises further fuel market growth.

- Europe: The European market shows strong growth, stimulated by stringent data protection regulations (like GDPR) that necessitate auditable and compliant processes, alongside significant governmental and private sector investments in digitalization. Countries such as the UK, Germany, France, and the Nordics are at the forefront, with a particular emphasis on automating public administration, manufacturing, and financial services to boost productivity and foster innovation.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, characterized by rapid industrialization, burgeoning digital transformation projects in emerging economies like China, India, and Southeast Asian countries, and a growing number of small and medium-sized enterprises (SMEs) embracing automation. The region's growth is propelled by increasing internet penetration, a rising young workforce, and government initiatives promoting smart cities and digital economies, leading to significant adoption in IT, manufacturing, and retail.

- Latin America: The workflow automation market in Latin America is in an earlier growth stage but is accelerating steadily. Factors such as increasing foreign investments, government efforts to modernize public services, and the growing awareness among businesses about the benefits of automation for competitive advantage are driving adoption. Brazil and Mexico are leading the charge, with particular interest from the financial services and telecommunications sectors.

- Middle East and Africa (MEA): This region exhibits emerging growth, primarily fueled by extensive government-led digital transformation programs, particularly in GCC countries (e.g., UAE, Saudi Arabia) aiming to diversify their economies and build smart infrastructure. Investments in cloud computing and smart city initiatives are paving the way for increased adoption of workflow automation across various sectors, including oil and gas, finance, and public services, as organizations seek to optimize operations and reduce reliance on manual labor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Workflow Automation Market.- ServiceNow

- Microsoft

- IBM

- Appian

- Pegasystems

- UiPath

- Automation Anywhere

- Blue Prism

- Workato

- Zapier

- MuleSoft (Salesforce)

- K2 (Nintex)

- Smartsheet

- Monday.com

- Kissflow

- Nintex

- Camunda

- SAP

- Oracle

- Zoho

Frequently Asked Questions

What is workflow automation?

Workflow automation refers to the design, execution, and automation of a sequence of tasks or processes based on a set of defined rules, without the need for manual intervention. It streamlines operations, reduces human error, and improves efficiency across various business functions.

How does AI impact workflow automation?

AI significantly enhances workflow automation by enabling cognitive capabilities beyond rule-based tasks. It allows for intelligent document processing, predictive analytics, natural language understanding, and continuous learning, leading to more adaptive and intelligent automated workflows.

What are the primary benefits of implementing workflow automation?

The primary benefits include increased operational efficiency, significant cost reduction, improved data accuracy, enhanced compliance and auditability, faster task completion, better resource utilization, and an overall improved customer and employee experience.

Which industries are adopting workflow automation most rapidly?

Industries rapidly adopting workflow automation include Banking, Financial Services, and Insurance (BFSI), IT & Telecom, Healthcare, Retail & E-commerce, and Manufacturing, driven by complex processes, regulatory demands, and the need for high efficiency.

What are the key challenges in adopting workflow automation?

Key challenges include high initial investment costs, data security and privacy concerns, the scarcity of skilled professionals, organizational resistance to change, and the complexities involved in integrating new automation solutions with existing legacy systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Construction Workflow Automation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Enterprise Workflow Automation Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (On-Premise, Cloud-Based), By Application (Small Business, Medium-sized Business, Large Business), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Central Fill Pharmacy Automation System Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Automated Medication Dispensing System, Integrated Workflow Automation Systems, Automated Packaging and Labeling Systems, Automated Table Top Counters, Automated Medication Compounding Systems, Automated Storage and Retrieval Systems, Other Automated Systems), By Application (Inpatient Pharmacy, Outpatient Pharmacy, Retail Pharmacy, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Workflow Automation and Optimization Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (On-premise, Cloud, Others), By Application (Transportation & Logistics, Banking, Healthcare, Education, Financial Services & Insurance, Telecommunications & IT, Manufacturing, Retail), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager