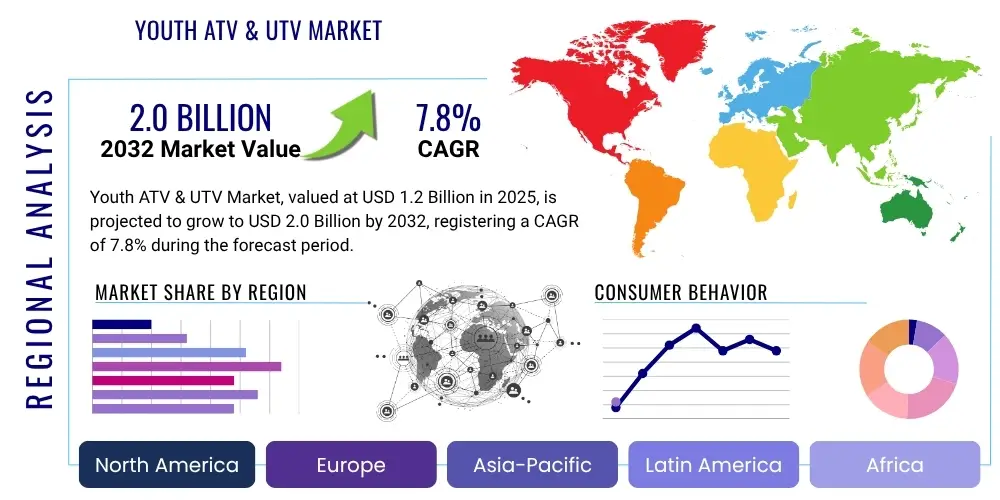

Youth ATV & UTV Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429062 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Youth ATV & UTV Market Size

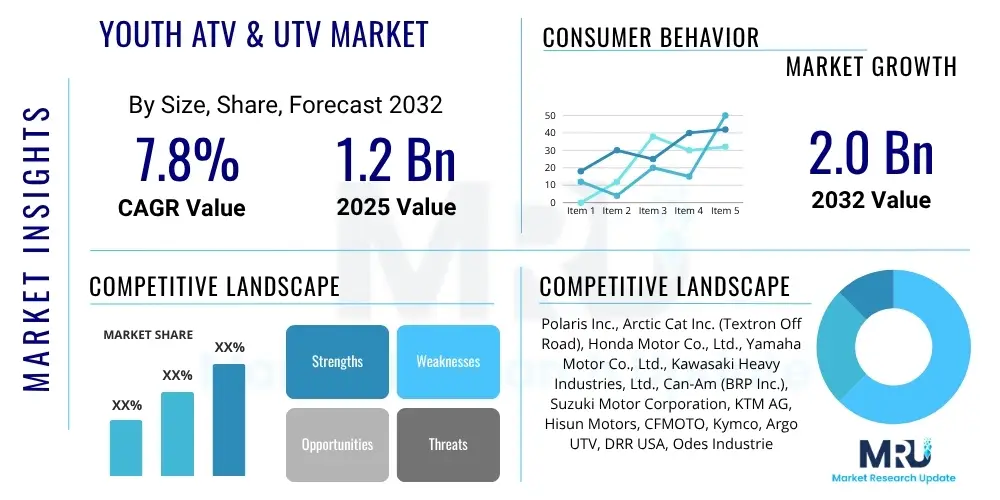

The Youth ATV & UTV Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 1.2 Billion in 2025 and is projected to reach USD 2.0 Billion by the end of the forecast period in 2032.

Youth ATV & UTV Market introduction

The Youth ATV and UTV Market encompasses the segment of All-Terrain Vehicles (ATVs) and Utility Task Vehicles (UTVs) specifically designed and engineered for younger riders. These vehicles typically feature smaller engine displacements, lower top speeds, enhanced safety features, and ergonomic designs tailored to the physical capabilities and developmental stages of children and teenagers. This market caters primarily to recreational pursuits, offering young enthusiasts a gateway to outdoor adventure, off-road exploration, and competitive sports in a controlled and safety-conscious environment. The products within this category are distinguishable by their robust construction, simplified controls, and often include parental control features such as speed limiters and remote engine shut-off mechanisms, ensuring a secure riding experience.

Major applications for youth ATVs and UTVs extend beyond mere recreation, finding utility in various family settings and organized activities. They are frequently used on private properties for light farm chores, property maintenance, and family outings, fostering a sense of responsibility and outdoor engagement among young users. Furthermore, these vehicles play a significant role in developing crucial motor skills, hand-eye coordination, and decision-making abilities in a dynamic setting. The benefits include promoting physical activity, encouraging outdoor exploration away from digital screens, and facilitating family bonding through shared experiences. Their design prioritizes safety, offering a structured learning platform for off-road riding, often under adult supervision and within designated safe areas.

Driving factors for the growth of this market are multifaceted, primarily stemming from increasing parental interest in providing outdoor recreational opportunities for their children, coupled with rising disposable incomes that allow for investment in such leisure equipment. Advancements in vehicle safety technology, including improved braking systems, enhanced stability, and more intuitive controls, have boosted parental confidence in these products. Moreover, the expanding network of off-road parks and trails, along with organized youth riding events and competitions, further stimulates demand by creating accessible and engaging environments for young riders. The perceived value of developing practical skills and an appreciation for the outdoors also significantly contributes to the market's upward trajectory.

Youth ATV & UTV Market Executive Summary

The Youth ATV and UTV Market is experiencing dynamic shifts driven by evolving business trends, distinct regional preferences, and significant segment-specific developments. Key business trends indicate a strong emphasis on product innovation, particularly in enhancing safety features, integrating advanced technology for connectivity and performance monitoring, and offering greater customization options to cater to individual rider preferences. Manufacturers are increasingly focusing on developing electric variants, aligning with global sustainability initiatives and addressing concerns about noise and emissions, which also presents a novel selling proposition for environmentally conscious families. Strategic partnerships between manufacturers and safety organizations, as well as educational institutions, are becoming more common to promote responsible riding and expand market reach, reinforcing the industry's commitment to youth rider safety.

Regionally, the market exhibits diverse growth patterns. North America currently dominates the market, propelled by a well-established culture of outdoor recreation, extensive trail networks, and a strong presence of key manufacturers and dealerships. However, the Asia Pacific region is rapidly emerging as a high-growth market, driven by increasing disposable incomes, a growing middle class, and rising interest in recreational sports and outdoor activities, particularly in countries like China and India. Europe also maintains a significant market share, with strict regulatory frameworks influencing product design and safety standards, fostering a market focused on compliant and high-quality offerings. Latin America and the Middle East & Africa are showing nascent but promising growth, as economic development and infrastructure improvements facilitate greater access to recreational vehicles.

Segmentation trends reveal substantial evolution across various product types and end-user categories. The segment for electric youth ATVs and UTVs is projected to witness the highest growth, driven by technological advancements, environmental considerations, and quieter operation, which is appealing to residential areas and noise-sensitive environments. Smaller engine displacement categories remain popular for younger children, while larger youth models cater to teenagers seeking more challenging experiences. The emphasis on safety accessories and protective gear as integral components of the purchase decision continues to strengthen, reflecting a heightened awareness among parents. Furthermore, the market is seeing a rise in demand for multi-purpose youth UTVs that blend recreational capabilities with light utility functions, appealing to families residing in rural or semi-rural areas, thereby diversifying product offerings and expanding the overall market reach.

AI Impact Analysis on Youth ATV & UTV Market

User inquiries concerning AI's influence on the Youth ATV & UTV Market primarily revolve around enhancing rider safety, improving vehicle diagnostics, and creating more engaging and personalized riding experiences. Users frequently question how AI can prevent accidents, especially for inexperienced young riders, and whether it can assist in training or skill development. Concerns about data privacy and the ethical implications of AI monitoring youth riders are also prominent. The overarching expectation is that AI will make these vehicles safer, smarter, and more appealing to both parents and children, while also streamlining maintenance and operational aspects. The summary of key themes suggests a strong desire for AI-driven predictive safety, intelligent rider assistance, and personalized learning environments, balanced with a need for transparency and control over data.

- AI-powered predictive analytics for proactive maintenance, identifying potential mechanical failures before they occur.

- Integrated AI-driven safety systems, including collision avoidance, stability control, and geo-fencing for restricted riding zones.

- Smart rider monitoring via sensors and cameras to detect fatigue, improper riding posture, or dangerous maneuvers, alerting parents or supervisors.

- Personalized training programs and virtual reality simulations, utilizing AI to adapt difficulty based on individual rider skill progression.

- Voice-activated controls and intelligent infotainment systems for hands-free operation and enhanced rider engagement.

- Advanced telematics with AI algorithms to track riding patterns, speed, and location, offering detailed reports for parental oversight.

- Enhanced diagnostics and troubleshooting through AI, providing real-time vehicle health status and facilitating easier repairs.

- Autonomous or semi-autonomous features for guided learning paths or return-to-base functions, improving accessibility and safety.

DRO & Impact Forces Of Youth ATV & UTV Market

The Youth ATV & UTV Market is propelled by a robust set of drivers, balanced by significant restraints, and presents numerous opportunities, all shaped by various impact forces. A primary driver is the increasing emphasis parents place on providing structured outdoor recreational activities for their children, recognizing the physical and developmental benefits of such engagement. Rising disposable incomes in many regions allow families to invest in leisure vehicles, viewing them as valuable assets for skill development and family bonding. Furthermore, continuous advancements in safety technology, including improved braking, stability, and parental control features, significantly boost consumer confidence and mitigate safety concerns, making these vehicles more appealing to a broader audience. The growing number of dedicated youth riding programs and events also creates a supportive ecosystem, encouraging participation and ownership.

Conversely, the market faces several notable restraints. The relatively high initial purchase cost of youth ATVs and UTVs, coupled with ongoing maintenance expenses, can be a significant barrier for many potential buyers. Stringent and evolving regulatory frameworks in various regions, particularly concerning age restrictions, engine displacement limits, and mandatory safety equipment, can complicate market entry and product offerings for manufacturers, while also imposing compliance burdens on consumers. Persistent safety concerns, despite technological advancements, remain a critical restraint, often influenced by negative media portrayals of accidents involving youth riders, leading to parental apprehension. Environmental considerations, such as noise pollution and emissions from gasoline-powered models, also present challenges, particularly in urban-adjacent recreational areas.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The burgeoning demand for electric youth ATVs and UTVs presents a significant growth avenue, aligning with global sustainability trends and offering quieter, emission-free alternatives that appeal to a wider range of environments. Customization and personalization options, allowing young riders to tailor their vehicles, can enhance product appeal and foster brand loyalty. Integration with smart technologies, such as GPS tracking, telematics, and rider monitoring systems, offers advanced safety and diagnostic capabilities, transforming the user experience. Emerging markets in Asia Pacific and Latin America, characterized by expanding economies and a growing interest in Western recreational pursuits, represent untapped potential for market penetration. Additionally, the development of comprehensive safety training and certification programs can further instill confidence and responsible riding practices.

Segmentation Analysis

The Youth ATV & UTV market is intricately segmented across various dimensions, allowing for a detailed understanding of consumer preferences, product characteristics, and market dynamics. This comprehensive segmentation provides manufacturers with critical insights for product development, marketing strategies, and regional expansion. The primary segmentation criteria include product type, engine size, age group suitability, application, power source, and distribution channel, each revealing distinct market behaviors and growth prospects. Analyzing these segments helps stakeholders identify niche markets and tailor offerings to specific customer needs, thereby maximizing market penetration and profitability. The diverse nature of these segments reflects the wide range of requirements and expectations from the youth off-road vehicle community.

- By Product Type:

- Youth All-Terrain Vehicles (ATVs): Designed for single riders, often featuring handlebar steering and saddle seating.

- Youth Utility Task Vehicles (UTVs): Typically multi-passenger, with steering wheel, foot pedals, and bucket/bench seating.

- By Engine Size:

- Under 50cc: Primarily for very young children, focus on low speed and high safety.

- 50cc to 90cc: For intermediate young riders, offering a balance of performance and control.

- 90cc to 125cc: For older youth and teenagers, providing more power and capability.

- Over 125cc: Limited youth models, often for experienced teens under strict supervision.

- By Age Group:

- 6-10 Years: Entry-level models with maximum safety features and speed restrictions.

- 10-14 Years: Intermediate models, often with progressive power and advanced features.

- 14-16 Years: More powerful models, resembling adult ATVs/UTVs but with youth-specific safety considerations.

- By Application:

- Recreational: Dominant segment for trail riding, leisure, and casual outdoor fun.

- Utility/Farm: Used for light chores on private properties, appealing to rural families.

- Sports/Competition: For organized racing and competitive events, demanding higher performance.

- Training/Educational: Used in riding schools and safety training programs.

- By Power Source:

- Gasoline-powered: Traditional ICE engines, offering longer range and quick refueling.

- Electric-powered: Emerging segment, offering quiet operation, zero emissions, and reduced maintenance.

- By Distribution Channel:

- Dealerships: Authorized retailers offering sales, service, and parts.

- Online Retailers: E-commerce platforms providing convenience and wider product selection.

- Specialty Stores: Focused on outdoor recreation and powersports equipment.

Value Chain Analysis For Youth ATV & UTV Market

The value chain for the Youth ATV & UTV Market is a complex network of activities that spans from raw material sourcing to the final sale and post-purchase services, ensuring the efficient flow of products and value creation. At the upstream end, the chain begins with the procurement of various raw materials such as steel, aluminum, plastics, rubber, and specialized composites. These materials are then supplied to component manufacturers who produce critical parts like engines, transmissions, tires, suspension systems, electrical components, and braking systems. This stage is crucial as the quality and performance of these individual components directly impact the overall safety and reliability of the final youth vehicle, requiring strong supplier relationships and stringent quality control.

The manufacturing phase involves the assembly of these components into finished youth ATVs and UTVs, along with the integration of specialized safety features unique to youth models, such as adjustable speed limiters, parental control mechanisms, and reinforced chassis designs. Once manufactured, the vehicles move into the downstream segment of the value chain, which encompasses warehousing, logistics, and distribution. Distribution channels are varied and typically include authorized dealerships, which serve as primary points of sale, offering not only new vehicle sales but also parts, accessories, and maintenance services. Alongside traditional dealerships, the rise of online retail platforms and specialty outdoor sports stores provides alternative avenues for reaching consumers, especially for accessories and smaller models, broadening market accessibility.

Direct and indirect distribution channels play significant roles in market penetration. Direct sales, though less common for complete vehicles, can occur through manufacturer-owned stores or factory events, offering a direct link to the consumer and immediate feedback. More predominantly, an indirect channel through a network of independent dealerships allows manufacturers to leverage established sales and service infrastructure, providing extensive geographical reach and localized customer support. These dealerships often provide test rides, financing options, and crucial after-sales support, which is vital for building customer loyalty and ensuring vehicle longevity. Furthermore, rental services and specialized youth riding academies also form part of the downstream value chain, providing access to vehicles for short-term use and contributing to rider education and market growth, ultimately enhancing the overall market ecosystem.

Youth ATV & UTV Market Potential Customers

The primary potential customers and end-users for Youth ATVs and UTVs are diverse, ranging from individual families seeking recreational outdoor activities to organized groups and commercial entities focused on youth development and entertainment. At the core, parents are the key decision-makers and purchasers, driven by a desire to provide their children with engaging outdoor experiences, develop motor skills, and foster an appreciation for nature. These parents often come from middle to high-income households with disposable income available for leisure investments, valuing products that blend fun with safety and developmental benefits. Their purchasing decisions are heavily influenced by safety features, brand reputation, regulatory compliance, and the overall value proposition of the vehicle in terms of durability and resale value.

Beyond individual family purchases, a significant segment of potential customers includes farm families and those residing in rural or semi-rural areas. For these buyers, youth ATVs and UTVs can serve a dual purpose: recreational fun for children and light utility tasks on private property, such as hauling small loads or assisting with property maintenance. This practical application adds another layer of value, making the investment more justifiable. The growing trend of agritourism and outdoor recreation on private lands further supports this customer segment, as these vehicles become an integral part of their lifestyle and activities, offering both entertainment and utility for younger family members under supervision.

Furthermore, the market extends to organized groups and businesses such as youth sports academies, particularly those focused on off-road racing or adventure sports, and outdoor recreational parks or rental facilities. These entities purchase youth ATVs and UTVs in fleets to support training programs, guided tours, or provide supervised riding experiences to their younger clientele. Educational institutions and community programs that promote outdoor skills and safety also represent potential customers, utilizing these vehicles as tools for practical learning and structured adventure. This breadth of end-users highlights the versatile appeal of youth ATVs and UTVs, catering to a wide spectrum of needs from purely recreational to instructional and light-duty commercial applications, all centered around providing safe and engaging experiences for young people.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2032 | USD 2.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Polaris Inc., Arctic Cat Inc. (Textron Off Road), Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Can-Am (BRP Inc.), Suzuki Motor Corporation, KTM AG, Hisun Motors, CFMOTO, Kymco, Argo UTV, DRR USA, Odes Industries, Hammerhead Off-Road, PitsterPro, TrailMaster, Massimo Motor, Tao Motor, Redcat Racing |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Youth ATV & UTV Market Key Technology Landscape

The Youth ATV & UTV Market is increasingly characterized by the integration of advanced technologies aimed at enhancing safety, performance, and the overall rider experience. A crucial aspect of this technological evolution is the adoption of sophisticated engine management systems that optimize fuel efficiency and power delivery while adhering to emissions standards, especially for gasoline-powered models. Electric powertrains are rapidly gaining traction, featuring advanced battery technology for extended range and faster charging, alongside powerful electric motors that offer instant torque and quieter operation. These electric systems are often paired with regenerative braking, further enhancing efficiency and safety by providing controlled deceleration and extending battery life, appealing to environmentally conscious consumers and urban-proximate recreational areas.

Safety technology forms a cornerstone of innovation in this market segment. Manufacturers are incorporating advanced braking systems, including hydraulic disc brakes on all four wheels for superior stopping power, often complemented by anti-lock braking systems (ABS) in higher-end models. Stability control systems and advanced suspension designs, such as independent rear suspension (IRS), improve handling and ride comfort across varied terrains, reducing the risk of rollovers. Telematics and GPS tracking are becoming standard features, allowing parents to monitor vehicle location, speed, and geofenced operating zones remotely, providing an invaluable layer of supervision and control. Remote engine shut-off capabilities, often operated via a smartphone app or dedicated fob, offer immediate safety intervention.

Furthermore, connectivity and smart features are transforming the user interface and overall experience. Digital instrument clusters provide clear, concise information to young riders, while some models integrate with smartphone applications to offer detailed ride statistics, maintenance reminders, and personalized riding modes. IoT sensors are being utilized for real-time vehicle diagnostics, monitoring tire pressure, engine temperature, and other critical parameters to prevent potential issues and ensure optimal performance. Helmet-integrated communication systems and smart displays mounted on the handlebars are emerging to provide navigation, communication, and performance data directly to the rider, enhancing both safety and engagement in a highly intuitive manner, thereby shaping the future of youth off-road vehicle design and functionality.

Regional Highlights

- North America: This region stands as the largest market for Youth ATVs and UTVs, driven by a deeply ingrained culture of outdoor recreation, extensive off-road trail systems, and a high disposable income. The presence of major manufacturers and a well-established dealership network also contributes to its dominance. Countries like the United States and Canada lead in sales, with a strong consumer base prioritizing family outdoor activities and powersports.

- Europe: The European market, while significant, is characterized by stringent safety regulations and environmental standards that influence product design and sales. Countries such as Germany, the UK, and France show steady demand, with a growing interest in electric variants due to increasing environmental awareness and urban noise restrictions. Recreational parks and agricultural use are key applications.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, fueled by rapidly increasing disposable incomes, a burgeoning middle class, and a rising interest in leisure and adventure sports, particularly in emerging economies like China, India, and Southeast Asian countries. Urbanization and the development of new recreational facilities are also driving demand.

- Latin America: This region presents a growing market opportunity, albeit from a smaller base. Economic development and increasing infrastructure for tourism and outdoor activities are stimulating demand for youth off-road vehicles. Brazil and Mexico are key markets, with recreational and utility applications gaining traction among families and landowners.

- Middle East and Africa (MEA): The MEA market is still nascent but shows promising growth potential, particularly in the Middle Eastern countries where high disposable incomes and a penchant for recreational activities are prevalent. Desert riding and organized events contribute to demand, while in Africa, utility applications in rural areas may drive future growth for UTVs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Youth ATV & UTV Market.- Polaris Inc.

- Arctic Cat Inc. (Textron Off Road)

- Honda Motor Co., Ltd.

- Yamaha Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Can-Am (BRP Inc.)

- Suzuki Motor Corporation

- KTM AG

- Hisun Motors

- CFMOTO

- Kymco

- Argo UTV

- DRR USA

- Odes Industries

- Hammerhead Off-Road

- PitsterPro

- TrailMaster

- Massimo Motor

- Tao Motor

- Redcat Racing

Frequently Asked Questions

What age is appropriate for youth ATVs and UTVs?

Youth ATVs and UTVs are typically designed for riders aged 6 to 16, with specific models catering to different age brackets based on engine size, speed limits, and safety features. Parental supervision and adherence to manufacturer guidelines are crucial for safe operation.

What are the key safety features on youth off-road vehicles?

Key safety features include adjustable speed limiters, remote engine shut-off controls, sturdy roll cages for UTVs, parental control systems, disc brakes, protective enclosures, and clear warning labels. Many models also offer stability control and educational safety videos.

Are electric youth ATVs and UTVs a viable alternative to gasoline models?

Yes, electric youth ATVs and UTVs are increasingly viable, offering benefits like quieter operation, zero emissions, lower maintenance, and consistent torque. Advancements in battery technology provide competitive range and performance, making them an attractive eco-friendly option.

What regulations apply to youth ATVs and UTVs?

Regulations vary significantly by region and country, often covering minimum age requirements, engine displacement limits, mandatory safety equipment (like helmets), and permissible riding areas. It is essential for consumers to check local laws and manufacturer recommendations.

Where can I find reliable safety training for youth ATV and UTV riders?

Reliable safety training is often available through certified organizations such as the ATV Safety Institute (ASI) or similar national powersports associations. Many manufacturers and dealerships also offer or recommend accredited training programs to promote responsible riding practices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager