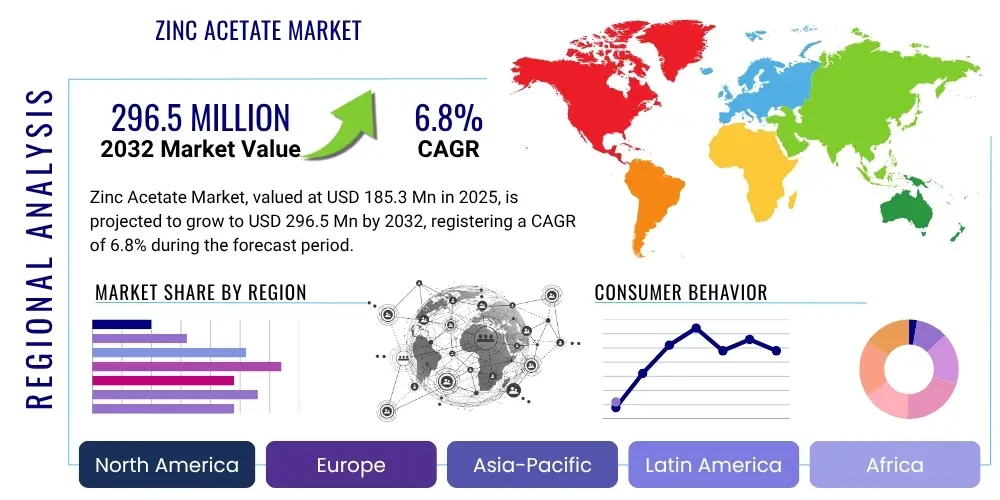

Zinc Acetate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430557 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Zinc Acetate Market Size

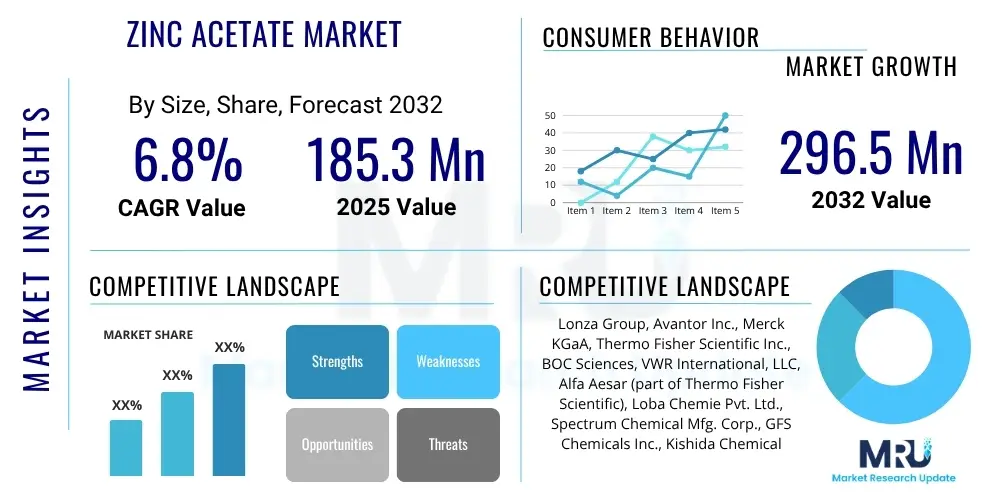

The Zinc Acetate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $185.3 Million in 2025 and is projected to reach $296.5 Million by the end of the forecast period in 2032.

Zinc Acetate Market introduction

Zinc acetate is a chemical compound with the formula Zn(CH3COO)2, commonly available as a dihydrate, Zn(CH3COO)2(H2O)2. It presents as a white, crystalline solid, highly soluble in water and alcohol. This versatile compound serves as an essential zinc source and finds extensive application across various industries due to its unique properties, including its role as an antimicrobial agent, a dietary supplement, and a catalyst in organic synthesis. Its broad utility underscores its significance in modern industrial and health-related sectors.

The product is characterized by its high purity and bioavailability, making it suitable for pharmaceutical formulations and nutritional supplements where zinc deficiency is addressed. In the agricultural sector, it functions as a micronutrient fertilizer, promoting crop health and yield. Industrially, it is leveraged in wood preservation, textile dyeing, and as a precursor for other zinc compounds. The increasing awareness regarding zinc's health benefits and its industrial efficacy are primary drivers for market expansion.

The market for zinc acetate is influenced by its diverse application portfolio and the continuous demand from health-conscious consumers and industrial enterprises seeking efficient and cost-effective solutions. Key driving factors include the rising prevalence of zinc deficiency globally, stringent regulations promoting food fortification, and technological advancements enhancing its production and application methods. The market benefits from its proven track record in therapeutic uses and its growing adoption in sustainable agricultural practices.

Zinc Acetate Market Executive Summary

The Zinc Acetate Market is experiencing robust growth, driven by escalating demand in the pharmaceutical, agricultural, and food and beverage sectors. Business trends indicate a focus on expanding production capacities and investing in research and development to discover novel applications and optimize existing formulations. Companies are increasingly adopting sustainable manufacturing processes and exploring strategic partnerships to enhance market penetration and address diverse consumer needs, particularly for high-purity grades required in medical applications. The market structure remains competitive, with key players focusing on product differentiation and supply chain resilience.

Regionally, the Asia Pacific market is poised for significant expansion, fueled by rapid industrialization, growing populations, and increasing awareness of health and nutrition. North America and Europe, while mature, demonstrate steady demand, supported by well-established pharmaceutical and agricultural industries and strict regulatory frameworks that ensure product quality and safety. Latin America and the Middle East and Africa represent emerging markets with considerable growth potential as economic development and healthcare infrastructure improve, driving the adoption of zinc acetate in various applications.

Segmentation trends highlight the pharmaceutical segment as a dominant force, primarily due to zinc acetate's use in dietary supplements and medications for common cold treatment and wound healing. The agricultural segment is also a substantial contributor, propelled by the need for micronutrient fertilizers to combat soil deficiencies and improve crop yields. Additionally, its application in food and beverage fortification and as a chemical intermediate continues to show consistent growth. The market's resilience is attributed to the non-substitutable nature of zinc in many of its critical applications.

AI Impact Analysis on Zinc Acetate Market

User inquiries concerning AI's influence on the Zinc Acetate Market frequently center on themes of operational efficiency, cost reduction, product innovation, and supply chain optimization. Common questions revolve around how AI can streamline manufacturing processes, predict raw material price fluctuations, identify new therapeutic applications through data analysis, and improve inventory management. Users express expectations that AI will lead to enhanced product quality, reduced waste, and faster R&D cycles, ultimately impacting market competitiveness and profitability. There is also interest in AI's role in compliance and sustainability reporting within the chemical industry.

- AI driven process optimization enhances production efficiency and reduces manufacturing costs for zinc acetate.

- Predictive analytics powered by AI assists in forecasting demand and managing raw material procurement, mitigating supply chain risks.

- AI algorithms accelerate research and development for new zinc acetate applications, especially in pharmaceuticals and agriculture, by analyzing vast datasets.

- Quality control can be significantly improved through AI-enabled systems for real-time monitoring and anomaly detection during production.

- AI facilitates the development of sustainable production methods, including optimizing energy consumption and waste reduction processes.

- Market trend analysis and competitive intelligence benefit from AI's ability to process and interpret complex market data rapidly.

DRO & Impact Forces Of Zinc Acetate Market

The Zinc Acetate Market is significantly shaped by a confluence of drivers, restraints, opportunities, and broader impact forces. Key drivers include the increasing global awareness of zinc deficiency, which propels demand for zinc acetate in pharmaceutical and nutraceutical applications. Its role as a crucial micronutrient in agriculture to enhance crop yield and quality further stimulates market growth. Additionally, the compound's antimicrobial properties make it valuable in various industrial processes, including wood preservation and textile manufacturing, solidifying its market position. These factors collectively contribute to a robust and expanding demand landscape across multiple end-use sectors.

Conversely, the market faces several restraints. The volatility in the prices of raw materials, particularly zinc metal, directly impacts the production costs of zinc acetate, potentially affecting profit margins and market stability. Stringent environmental regulations concerning chemical production and waste disposal pose compliance challenges for manufacturers, necessitating significant investment in sustainable practices and technologies. Furthermore, the availability of substitute compounds for specific applications, though limited in core uses, introduces competitive pressure, requiring continuous innovation and product differentiation from zinc acetate producers.

Opportunities for market expansion arise from ongoing research and development into novel therapeutic applications, such as advanced wound care and new drug formulations utilizing zinc acetate. The growing trend towards organic farming and sustainable agriculture practices creates avenues for zinc acetate as an eco-friendly micronutrient source. Furthermore, emerging economies, particularly in Asia Pacific and Latin America, present untapped potential due to their expanding healthcare infrastructure and increasing industrial activities, offering new markets for product penetration. Strategic collaborations and technological advancements in synthesis can unlock further growth.

Impact forces within the market structure play a crucial role. The bargaining power of buyers is moderate, driven by the availability of multiple suppliers and the standardized nature of the product, although specialized high-purity grades command higher prices. The bargaining power of suppliers, primarily zinc metal producers, is significant due to commodity price fluctuations. The threat of new entrants is relatively low due to capital-intensive production processes and regulatory hurdles. The threat of substitutes is also moderate, as zinc acetate possesses unique properties for its primary applications. Industry rivalry remains intense, with established players competing on price, quality, and distribution network efficiency.

Segmentation Analysis

The Zinc Acetate Market is comprehensively segmented by various criteria to provide a detailed understanding of its dynamics and potential growth areas. These segmentations allow for a granular analysis of market trends, consumer preferences, and regional contributions, enabling stakeholders to identify key growth opportunities and challenges within specific categories. The market is primarily divided by type, application, and end-user, reflecting the diverse forms and uses of zinc acetate across industries. Each segment's performance is influenced by unique drivers and restraints, contributing to the overall market trajectory.

Further segmentation by geographic region provides insights into the localized demand and supply patterns, regulatory environments, and economic conditions that impact market growth. This multi-dimensional segmentation facilitates strategic planning for market entry, product development, and resource allocation. Understanding these segments is crucial for businesses aiming to tailor their offerings to specific market needs and optimize their competitive strategies, ensuring comprehensive market coverage and sustained growth.

- By Type

- Dihydrate

- Anhydrous

- By Application

- Pharmaceuticals

- Agriculture

- Food & Beverages

- Chemicals

- Wood Preservation

- Others (e.g., Textile Industry, Environmental Remediation)

- By End-User

- Human Health (Supplements, Medicine)

- Animal Nutrition

- Crop Protection & Fertilizers

- Industrial Processing

- Environmental Remediation

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Zinc Acetate Market

The value chain for the Zinc Acetate Market begins with the upstream sourcing of raw materials, primarily zinc metal and acetic acid. Zinc ore is mined and then processed to produce zinc metal, which forms the fundamental component. Acetic acid is generally derived from petrochemical processes or fermentation. These raw materials are then supplied to manufacturers of zinc acetate. The quality and purity of these initial inputs are critical as they directly influence the final product's quality, particularly for pharmaceutical and food-grade applications, necessitating robust supplier relationships and quality control measures at this initial stage of the value chain.

Following the manufacturing process, which involves chemical reactions and purification steps, the zinc acetate product moves into downstream analysis and distribution. Manufacturers often conduct in-house quality assurance and control, including elemental analysis and impurity profiling, to ensure compliance with industry standards and regulatory requirements. This stage is crucial for maintaining product integrity and safety. The distribution channel then facilitates the movement of the finished product to various end-use industries, including pharmaceutical companies, agricultural enterprises, food and beverage manufacturers, and other industrial clients, often involving extensive logistics and inventory management.

Distribution channels for zinc acetate typically involve both direct and indirect approaches. Direct sales involve manufacturers selling directly to large industrial consumers or specialized pharmaceutical firms, often through long-term contracts and dedicated sales teams. This method allows for customized solutions, technical support, and stronger client relationships. Indirect channels leverage a network of distributors, wholesalers, and chemical suppliers who purchase in bulk from manufacturers and then distribute to smaller businesses or a wider array of end-users. These intermediaries provide market reach, local presence, and specialized logistical services, effectively bridging the gap between producers and diverse customer bases, ensuring efficient market penetration across various geographic regions.

Zinc Acetate Market Potential Customers

The primary potential customers for zinc acetate span a diverse range of industries, driven by the compound's versatile properties and essential role as a zinc source. Pharmaceutical companies represent a significant end-user segment, utilizing zinc acetate in the formulation of dietary supplements to address zinc deficiencies, over-the-counter cold remedies, and specialized medications for conditions like Wilson's disease. The demand from this sector is consistently high due to increasing global health awareness and the recognized importance of zinc for immune function and overall well-being. Quality and purity are paramount for these buyers, often necessitating pharmaceutical-grade zinc acetate.

Another substantial customer base is the agricultural sector, where zinc acetate is employed as a micronutrient fertilizer. Farmers and agrochemical manufacturers use it to correct zinc deficiencies in soil, thereby improving crop health, increasing yields, and enhancing the nutritional quality of produce. This application is particularly critical in regions with zinc-deficient soils, contributing to global food security. Demand from this segment is often influenced by crop cycles, agricultural policies, and prevailing environmental conditions.

Furthermore, the food and beverage industry constitutes a growing segment of potential customers, using zinc acetate for food fortification in products like cereals, infant formula, and various beverages to boost their nutritional content. Chemical industries also act as buyers, where zinc acetate serves as a catalyst in organic synthesis reactions, a mordant in textile dyeing, and an ingredient in various chemical formulations. Wood treatment and preservation industries also utilize zinc acetate for its antifungal and antimicrobial properties, protecting timber from decay. These diverse applications underscore the broad spectrum of potential buyers, making the market highly multi-faceted.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $185.3 Million |

| Market Forecast in 2032 | $296.5 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lonza Group, Avantor Inc., Merck KGaA, Thermo Fisher Scientific Inc., BOC Sciences, VWR International, LLC, Alfa Aesar (part of Thermo Fisher Scientific), Loba Chemie Pvt. Ltd., Spectrum Chemical Mfg. Corp., GFS Chemicals Inc., Kishida Chemical Co., Ltd., Finoric LLC, Shepherd Chemical Company, Parchem Fine & Specialty Chemicals, American Elements, Nippon Chemical Industrial Co., Ltd., Global Calcium Pvt. Ltd., Samaritan Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Zinc Acetate Market Key Technology Landscape

The technology landscape for the Zinc Acetate Market primarily revolves around efficient and scalable synthesis methods, advanced purification techniques, and sophisticated analytical methodologies to ensure product quality and purity. The predominant production methods involve the reaction of zinc oxide or zinc carbonate with acetic acid, followed by crystallization. Innovations focus on optimizing reaction conditions, such as temperature, pressure, and catalyst use, to maximize yield and minimize energy consumption. Continuous flow reactors and microreactor technologies are being explored to enhance reaction efficiency and safety, moving away from traditional batch processes towards more automated and sustainable production. The goal is to reduce operational costs and environmental footprint while maintaining high product integrity, especially for pharmaceutical and food-grade applications which demand ultra-high purity.

Purification technologies are paramount in achieving the required purity levels for various applications. Techniques like recrystallization, solvent extraction, and membrane filtration are commonly employed to remove impurities and unwanted by-products. Advances in these areas include the development of highly selective membranes and more environmentally friendly solvents, aligning with green chemistry principles. The ability to produce zinc acetate with precise specifications, such as specific particle sizes or anhydrous forms, also represents a technological advancement that broadens its application scope and caters to specialized industrial demands. This includes techniques for controlled crystallization and drying processes.

Furthermore, analytical technologies play a crucial role in the quality assurance and control of zinc acetate. High-performance liquid chromatography (HPLC), atomic absorption spectroscopy (AAS), inductively coupled plasma mass spectrometry (ICP-MS), and X-ray diffraction (XRD) are standard tools used for identifying and quantifying impurities, determining elemental composition, and characterizing crystalline structures. Recent advancements in real-time online monitoring systems integrate these analytical techniques directly into the production line, enabling immediate detection of deviations and ensuring consistent product quality. This integration of analytical precision throughout the manufacturing process underscores the technological sophistication required to meet stringent regulatory and market demands.

Regional Highlights

- North America: This region represents a mature yet stable market for zinc acetate, driven by a well-established pharmaceutical industry and advanced agricultural practices. The United States and Canada are key contributors, with steady demand for dietary supplements and micronutrient fertilizers. Stringent regulatory frameworks for pharmaceuticals and food additives ensure high-quality product requirements.

- Europe: The European market demonstrates consistent demand, influenced by robust healthcare sectors and a focus on sustainable agriculture. Germany, the UK, France, and Italy are significant consumers. Innovations in chemical synthesis and growing awareness of environmental concerns are shaping market trends, with an emphasis on eco-friendly production methods.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to rapid industrialization, expanding healthcare infrastructure, and large agricultural economies, particularly in China, India, and Southeast Asia. Increasing disposable incomes and rising health awareness are fueling the demand for pharmaceutical-grade zinc acetate and agricultural applications.

- Latin America: This emerging market shows considerable growth potential, primarily driven by expanding agricultural sectors in Brazil and Argentina, which require micronutrient fertilizers. Developing pharmaceutical and food processing industries are also contributing to the increasing consumption of zinc acetate in the region.

- Middle East and Africa (MEA): The MEA market is gradually developing, supported by increasing investments in healthcare infrastructure and growing agricultural activities in countries like Saudi Arabia and South Africa. The region presents long-term growth opportunities as economic diversification efforts continue and awareness regarding nutritional supplements rises.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Zinc Acetate Market.- Lonza Group

- Avantor Inc.

- Merck KGaA

- Thermo Fisher Scientific Inc.

- BOC Sciences

- VWR International, LLC

- Alfa Aesar (part of Thermo Fisher Scientific)

- Loba Chemie Pvt. Ltd.

- Spectrum Chemical Mfg. Corp.

- GFS Chemicals Inc.

- Kishida Chemical Co., Ltd.

- Finoric LLC

- Shepherd Chemical Company

- Parchem Fine & Specialty Chemicals

- American Elements

- Nippon Chemical Industrial Co., Ltd.

- Global Calcium Pvt. Ltd.

- Samaritan Chemical Co., Ltd.

Frequently Asked Questions

What are the primary applications of Zinc Acetate?

Zinc acetate is primarily used in pharmaceuticals as a dietary supplement for zinc deficiency and in cold remedies, in agriculture as a micronutrient fertilizer, and in the food industry for fortification. It also serves as a catalyst in chemical synthesis and in wood preservation.

Is Zinc Acetate safe for human consumption?

Yes, when used in appropriate dosages and purity grades, zinc acetate is safe for human consumption as a dietary supplement and medication. It is regulated by health authorities to ensure safety and efficacy.

How is Zinc Acetate produced?

Zinc acetate is typically produced by reacting zinc oxide or zinc carbonate with acetic acid. The resulting solution is then crystallized to obtain the solid zinc acetate, often in its dihydrate form, followed by purification.

What factors are driving the growth of the Zinc Acetate market?

Key drivers include increasing global awareness of zinc deficiency and its health benefits, rising demand for fortified foods, the need for micronutrients in agriculture, and its utility in various industrial applications like wood preservation and chemical synthesis.

What are the emerging opportunities in the Zinc Acetate market?

Emerging opportunities include research into new therapeutic applications such as advanced wound care, growing demand for organic farming practices, and market expansion in developing economies with increasing healthcare and agricultural investments. Innovations in sustainable production also present significant avenues for growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager