Notebook Shell Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431565 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Notebook Shell Market Size

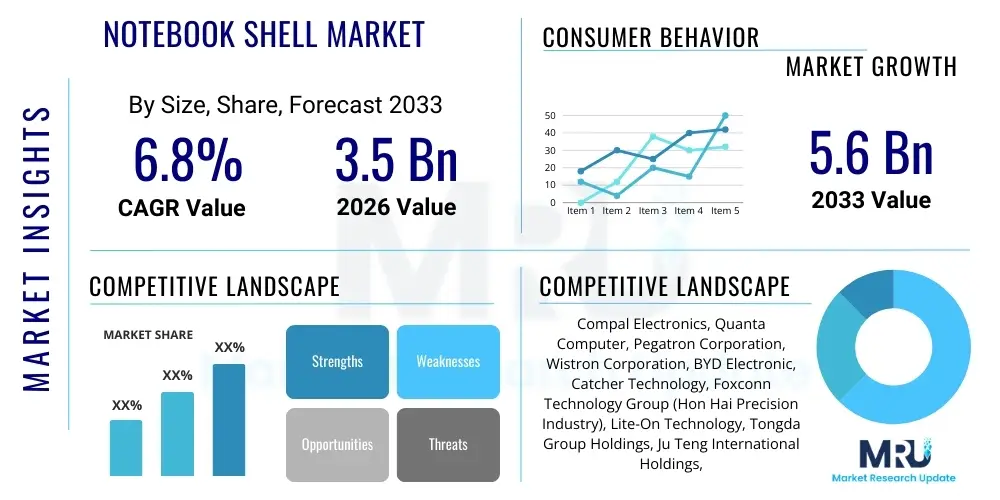

The Notebook Shell Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Notebook Shell Market introduction

The Notebook Shell Market encompasses the global production and distribution of external casings and enclosures designed for portable computing devices, primarily laptops and notebooks. These shells, which form the structural backbone and aesthetic exterior of the device, are critical components responsible for protecting internal electronics, facilitating thermal management, and determining overall device ergonomics and durability. Key materials utilized include various grades of plastics (such as ABS and Polycarbonate), lightweight metals (like Aluminum, Magnesium Alloy), and increasingly, advanced composites (like Carbon Fiber). The primary function extends beyond protection to include dissipating heat generated by CPUs and GPUs, shielding components from electromagnetic interference (EMI), and providing a surface for user interaction and branding.

Product descriptions within this market vary significantly based on the target segment. Premium notebook shells often emphasize precision manufacturing processes, such as Computer Numerical Control (CNC) machining of aerospace-grade aluminum, offering superior rigidity and a high-end finish suitable for ultrabooks and professional workstations. Conversely, mass-market and entry-level models predominantly utilize injection-molded plastics, balancing cost-efficiency with acceptable durability. Major applications span the consumer electronics sector, including standard laptops, gaming notebooks requiring robust cooling solutions, convertible two-in-one devices demanding complex hinge structures, and ruggedized notebooks built for industrial or military use. The ongoing drive for thinner, lighter, and more durable computing devices fundamentally shapes product innovation in this space.

The market growth is primarily driven by the continuous global demand for portable computing, accelerated digital transformation across various industries, and the cyclical replacement needs of both corporate and consumer user bases. Furthermore, benefits associated with advanced shell designs—such as enhanced thermal performance leading to sustained processing power, improved battery life due to reduced weight, and superior aesthetic appeal—are major factors compelling manufacturers to adopt newer materials and production techniques. The rising popularity of high-performance gaming laptops, which necessitate specialized chassis designs for effective heat management, acts as a significant catalyst for market expansion, particularly in the premium material segment.

Notebook Shell Market Executive Summary

The Notebook Shell Market is experiencing a pivotal shift driven by demands for extreme portability, enhanced sustainability, and superior thermal performance. Current business trends indicate a strong move away from conventional plastics towards lightweight metal alloys (such as CNC-machined aluminum and magnesium alloys) in mid-to-high-end segments, reflecting consumer willingness to pay a premium for durability and sleek design. Manufacturers are increasingly focusing on vertical integration and automation to manage complexity associated with sophisticated thermal dissipation features integrated directly into the shell structure. Supply chain resilience, particularly concerning the sourcing of high-purity metals and specialized coatings, remains a key strategic focus for major OEMs, ensuring timely production aligned with accelerated product refresh cycles in the global PC market.

Regional trends highlight Asia Pacific (APAC) as the epicenter of both demand and production, primarily due to the concentration of major original equipment manufacturers (OEMs) and original design manufacturers (ODMs) in countries like China, Taiwan, and South Korea. North America and Europe continue to lead in terms of design innovation and the adoption of high-cost, advanced shell technologies, driven by strong enterprise demand for high-performance laptops. Emerging markets, while still dominated by plastic shells due to cost sensitivities, are rapidly increasing their consumption rates, presenting future expansion opportunities, particularly for standardized shell designs optimized for cost-effective manufacturing.

Segment trends reveal that the Material Type segment is critical, with plastic shells maintaining volume dominance but metal shells capturing significant revenue growth due to higher Average Selling Prices (ASPs). By Application, the Gaming segment is exerting considerable pressure on shell innovation, requiring larger ventilation areas and specialized internal structures for airflow optimization, contrasting sharply with the Ultrabook segment which prioritizes minimal thickness and maximal structural integrity through advanced unibody construction. The customization and aesthetics sub-segments, including specialized finishes, textures, and embedded logos using sophisticated laser etching, are gaining prominence as differentiation tools in a saturated consumer electronics landscape.

AI Impact Analysis on Notebook Shell Market

User queries regarding the influence of Artificial Intelligence (AI) on the Notebook Shell Market frequently revolve around two core themes: how AI workloads might necessitate new thermal design requirements, and how AI can optimize the shell manufacturing and design process itself. Key concerns focus on whether the increased computational demand of local AI processing (on-device AI) will significantly elevate internal heat generation, potentially rendering current passive cooling shells inadequate and driving the adoption of more complex, integrated liquid cooling or specialized heat pipe structures within the shell framework. Expectations center on AI tools being used for topology optimization, rapidly iterating shell designs to minimize material usage while maximizing structural integrity and thermal dissipation efficiency, thereby accelerating time-to-market for next-generation portable devices.

- AI-driven Thermal Optimization: Utilizing machine learning algorithms to simulate and predict thermal hotspots within the chassis, leading to optimized vent placement and material composition for enhanced heat dissipation without increasing bulk.

- Generative Design for Shells: AI tools creating lightweight, high-performance structures by optimizing material topology based on weight constraints, stress analysis, and cooling requirements, particularly beneficial for magnesium and carbon fiber composite shells.

- Quality Control and Defect Detection: Implementing AI vision systems in manufacturing lines (especially CNC machining and coating) to ensure high aesthetic and structural quality standards, crucial for premium metal unibody designs.

- Material Selection Intelligence: AI assisting in the rapid identification and vetting of sustainable or recycled materials that meet stringent durability and thermal performance metrics, supporting eco-friendly design goals.

- Supply Chain Prediction: AI algorithms forecasting demand fluctuations and material lead times, improving inventory management for specialized shell components (e.g., hinge assemblies, complex metal blocks).

DRO & Impact Forces Of Notebook Shell Market

The dynamics of the Notebook Shell Market are primarily shaped by a trifecta of forces: increasing consumer expectations for premium materials and slim profiles (Drivers), persistent challenges related to complex manufacturing costs and material sourcing volatility (Restraints), and the burgeoning potential offered by advanced composite materials and sustainable manufacturing practices (Opportunities). Key drivers include the relentless pursuit of miniaturization, necessitating highly precise and durable enclosures, and the rising demand for gaming laptops that require large, specialized shells to manage high thermal loads. Restraints often center on the high capital expenditure required for sophisticated manufacturing technologies like 5-axis CNC machining, coupled with the instability in global metal prices (aluminum, magnesium), which directly impacts production costs and profit margins for mid-range devices.

Opportunities are prominently visible in the sphere of sustainable production, where utilizing recycled aluminum and bio-based plastics can cater to environmentally conscious consumers and stringent regulatory demands (e.g., WEEE directives). Furthermore, the integration of smart features directly into the shell structure—such as embedded antennas or conductive surfaces for specialized charging—represents a significant avenue for future market development. The major impact forces driving change include rapid shifts in component technology (e.g., smaller motherboards, increased battery density) which allow for slimmer external designs, competitive intensity among major OEMs (Apple, Dell, HP, Lenovo) requiring constant shell differentiation, and intellectual property protection surrounding innovative shell designs and thermal solutions.

The balancing act between maintaining high structural integrity, achieving minimal thickness, and ensuring effective thermal management defines the current market tension. If drivers related to consumer demand for high-end aesthetics (metal finishes, customized logos) continue to outweigh the restraint of manufacturing complexity, the market will skew further towards premium materials. Conversely, if economic pressures mandate cost reduction, standardized plastic shell designs will maintain significant volume share, particularly in educational and emerging markets. The overarching impact forces compel manufacturers to invest heavily in R&D to find the optimal equilibrium between performance, cost, and aesthetic appeal, often resulting in hybrid shell designs that combine different material benefits.

Segmentation Analysis

The Notebook Shell Market is comprehensively segmented based on material type, manufacturing process, shell structure, and application, providing a granular view of market dynamics and competitive positioning across various end-use sectors. Material type remains the most critical segmentation axis, differentiating products based on cost, durability, weight, and thermal performance attributes. The interplay between these segments reflects technological advancements, evolving consumer preferences, and the diverse performance requirements dictated by device form factor, ranging from ultra-thin clamshell laptops to rugged, convertible 2-in-1 devices.

- By Material Type:

- Plastic (ABS, Polycarbonate)

- Metal (Aluminum Alloy, Magnesium Alloy)

- Composite Materials (Carbon Fiber, Glass Fiber Reinforced Polymers)

- Hybrid Materials

- By Manufacturing Process:

- Injection Molding

- Die Casting

- CNC Machining (Milling)

- Stamping

- By Shell Structure:

- Clamshell

- Unibody

- Convertible (2-in-1)

- Detachable

- By Application:

- Standard/Mainstream Laptops

- Ultrabooks

- Gaming Notebooks

- Commercial/Enterprise Laptops

- Rugged Notebooks

Value Chain Analysis For Notebook Shell Market

The value chain for the Notebook Shell Market begins with upstream activities focusing on raw material procurement, which is highly capital-intensive and geographically concentrated. Upstream analysis involves the sourcing and refinement of specialized resins for plastic shells, and the mining, smelting, and alloying of metals like aluminum and magnesium. Key upstream suppliers include major chemical companies (for plastics and specialized coatings) and metal suppliers (for high-grade alloys). The quality and purity of these raw materials directly influence the structural integrity and aesthetic finish of the final shell. Price volatility and ethical sourcing concerns in the raw material stage significantly impact the overall production cost and lead times for downstream manufacturers.

The core manufacturing stage involves specialized Original Design Manufacturers (ODMs) and high-volume component producers who execute complex processes such as CNC milling, high-pressure die casting, and sophisticated injection molding. This midstream phase adds substantial value through precision engineering, surface treatments (anodizing, painting, electroplating), and integrating secondary components like antenna modules or thermal pads. Direct distribution occurs when major OEM players (e.g., Apple, Microsoft) utilize their internal manufacturing capabilities or tightly controlled supply chains for high-volume, proprietary shell designs. Indirect distribution is more common for standardized or white-label shell components used by smaller assemblers, often involving specialized distributors focusing on electronic components.

The downstream segment encompasses the integration of the shell components (A, B, C, D covers) with the internal electronics (motherboard, display, keyboard, battery) by the Original Equipment Manufacturers (OEMs) and final assembly plants. Distribution channels then move the finished notebooks to market. Direct channels involve manufacturers selling directly to consumers (D2C) or large corporate clients. Indirect channels, which dominate the market, include large IT distributors, specialized electronics retailers, e-commerce platforms, and value-added resellers (VARs) who customize laptops for specific enterprise needs. The end of the value chain is defined by end-user consumption and, increasingly, reverse logistics and recycling efforts, driven by regulatory pressures demanding sustainable material recovery from the shell.

Notebook Shell Market Potential Customers

The primary consumers and buyers in the Notebook Shell Market are global Original Equipment Manufacturers (OEMs) who design and sell branded portable computers. These major technology companies—such as Lenovo, HP, Dell, Apple, Acer, and Asus—constitute the direct demand, purchasing shells from specialized ODMs or producing them in-house. Their purchasing decisions are driven not only by cost efficiency and volume capabilities but fundamentally by quality control, material aesthetics, and the ODM's ability to innovate complex designs, particularly concerning thermal architecture and hinge mechanisms essential for modern form factors.

Secondary but significant customers include smaller, niche assemblers and white-label producers who cater to specific geographic markets or specialized sectors, such as ruggedized computing for military and industrial applications. These buyers often prioritize standardization, robustness, and specific certification compliance (e.g., IP ratings for dust and water resistance) over high-end aesthetics. Educational institutions and large governmental procurement agencies also act as influential indirect customers, as their massive volume orders dictate the demand for durable, cost-effective plastic and aluminum blend shells suitable for high-wear environments.

The rising segment of potential customers includes specialized gaming PC builders and modders, although their volume is minor compared to major OEMs. Their demand is hyper-focused on customized, aesthetically aggressive shells featuring transparent panels, specialized lighting integration, and extreme thermal management capabilities. Ultimately, while the notebook shell is a B2B component, its characteristics directly influence the final consumer’s purchasing decision, meaning the end-user preference for thinness, weight, and finish acts as a powerful, indirect driver of purchasing criteria for OEMs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Compal Electronics, Quanta Computer, Pegatron Corporation, Wistron Corporation, BYD Electronic, Catcher Technology, Foxconn Technology Group (Hon Hai Precision Industry), Lite-On Technology, Tongda Group Holdings, Ju Teng International Holdings, Unimicron Technology, Amphenol Corporation, AAC Technologies, ShunSin Technology, Jabil, Luxshare Precision Industry, Inventec Corporation, Shenzhen Kaifa Technology, Hi-P International, TPK Holding. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Notebook Shell Market Key Technology Landscape

The technological landscape of the Notebook Shell Market is rapidly evolving, driven primarily by material science innovations and precision manufacturing advancements aimed at achieving structural integrity in increasingly thin form factors. Currently, key technologies center around advanced material processing. For metal shells, the predominant technology is 5-axis Computer Numerical Control (CNC) machining, which allows for the creation of intricate unibody chassis with extremely tight tolerances, critical for high-end devices like Apple’s MacBooks or premium ultrabooks. Surface treatments, such as micro-arc oxidation (MAO) and specialized anodizing, are crucial for achieving desired aesthetic finishes, corrosion resistance, and scratch hardness without adding significant weight.

In the composite and plastic segments, multi-shot injection molding and thin-walled injection molding technologies are paramount. These processes enable the creation of complex geometries and internal reinforcement structures necessary for thermal channeling and electromagnetic shielding, all while minimizing material use and cycle times. The adoption of carbon fiber reinforced polymers (CFRP) is a significant technological trend, utilizing advanced layup and compression molding techniques to achieve superior strength-to-weight ratios compared to traditional metal alloys, although often at a higher cost. Furthermore, integrating conductive coatings for antennae (LDS technology) directly onto the plastic or composite shell eliminates the need for external antenna housing, contributing to sleeker designs.

The future technology trajectory focuses heavily on sustainability and integrated functionality. This includes widespread adoption of recycled plastics and near-net-shape manufacturing techniques like Thixomolding (for magnesium alloys) to reduce waste and energy consumption. Another frontier is the development of chassis-integrated cooling systems, moving beyond simple heat sink mounts to incorporating micro-channels or vapor chambers directly into the shell’s internal geometry, often achieved through additive manufacturing (3D printing) of complex internal structures for specialized, high-performance gaming notebooks. This continuous push for seamless integration of thermal, structural, and aesthetic requirements defines the cutting edge of shell manufacturing technology.

Regional Highlights

Regional analysis reveals a heavily asymmetrical market structure, dictated by manufacturing hubs and consumption power. Asia Pacific (APAC) holds the dominant market share, accounting for the vast majority of global notebook shell production. This dominance is attributable to the presence of large contract manufacturers and ODMs in Greater China (mainland China, Taiwan), who possess the necessary scaled infrastructure for advanced processes like high-volume CNC machining and sophisticated plastic molding. APAC also serves as a massive consumer market, driven by rapidly growing middle-class populations in India, Southeast Asia, and China, generating strong demand for both entry-level and premium devices.

North America and Europe represent key regions for high-value consumption and design innovation. The demand in these areas is heavily skewed towards premium segments, specifically ultrabooks and enterprise-grade laptops, driving the adoption of high-cost materials (aluminum, carbon fiber) and advanced unibody structures. OEMs operating in these regions often focus on integrating sustainable and recycled materials to meet local regulatory standards and consumer preferences for eco-friendly electronics. Although production volumes are lower than in APAC, the high Average Selling Prices (ASPs) of notebooks sold here ensure significant revenue contribution to the shell market.

Latin America (LATAM) and the Middle East & Africa (MEA) are characterized by rising urbanization and increasing digital adoption, leading to substantial volume growth, primarily in the plastic and lower-cost aluminum segments. Price sensitivity is a major factor, favoring standardized, durable shell designs. While these regions do not contribute significantly to global manufacturing output, they represent critical growth opportunities for manufacturers targeting mainstream and educational markets. Market penetration efforts in MEA and LATAM often rely on regional distribution partnerships and adapting designs to local environmental conditions, such as requirements for enhanced dust resistance or extreme temperature tolerance.

- Asia Pacific (APAC): Dominates manufacturing and volume consumption; driven by major ODMs (Taiwan, China) and massive local consumer markets (China, India). Focuses on efficient mass production and complex supply chain management.

- North America: High revenue share, emphasizing premium materials (CNC Aluminum) and high-end ultrabooks; strong driver of sustainable material adoption and cutting-edge design for enterprise use.

- Europe: Mature market with strict environmental regulations; high demand for aesthetically refined and durable shells; substantial focus on security and certified materials for commercial segments.

- Latin America (LATAM): Emerging high-growth market, primarily driven by consumer demand for affordable and standard plastic shells; growth potential tied to digital education initiatives.

- Middle East & Africa (MEA): High growth potential fueled by increasing internet penetration; market favors cost-effectiveness and robustness to handle diverse environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Notebook Shell Market.- Compal Electronics

- Quanta Computer

- Pegatron Corporation

- Wistron Corporation

- BYD Electronic (International) Co. Ltd.

- Catcher Technology Co., Ltd.

- Foxconn Technology Group (Hon Hai Precision Industry)

- Lite-On Technology Corporation

- Tongda Group Holdings Limited

- Ju Teng International Holdings Limited

- Unimicron Technology Corporation

- Amphenol Corporation

- AAC Technologies Holdings Inc.

- ShunSin Technology Holdings Limited

- Jabil Inc.

- Luxshare Precision Industry Co., Ltd.

- Inventec Corporation

- Shenzhen Kaifa Technology Co., Ltd.

- Hi-P International Limited

- TPK Holding Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Notebook Shell market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the shift from plastic to metal notebook shells?

The primary driver is consumer preference for lightweight durability, premium aesthetics, and enhanced thermal performance. Metal shells, especially aluminum and magnesium alloys produced via CNC machining, offer superior rigidity and heat dissipation crucial for modern, powerful, yet slim ultrabooks.

How does the type of shell material impact a notebook's thermal management?

Metal shells, particularly aluminum and magnesium, are significantly more effective at conducting and dissipating heat away from internal components compared to plastic shells. This superior thermal conductivity is vital for high-performance laptops, such as gaming models, to prevent throttling and maintain peak processing speeds.

Which manufacturing process is dominant for high-end, thin-and-light notebook shells?

For premium, thin-and-light devices, Computer Numerical Control (CNC) machining of solid metal blocks is the dominant manufacturing process. CNC allows for the creation of intricate unibody chassis with extremely precise dimensions and aesthetically flawless finishes necessary for high-value products.

What role do environmental regulations play in the Notebook Shell Market?

Environmental regulations, particularly in Europe and North America, mandate increased use of sustainable and recycled materials (like post-consumer recycled plastic and recycled aluminum). This pushes manufacturers to innovate in material science and production processes to ensure compliance without compromising structural integrity or aesthetic quality.

Is the market for composite material notebook shells, such as carbon fiber, expected to grow?

Yes, the market for composite shells (e.g., carbon fiber) is expected to grow, particularly in the high-performance and business segments. Carbon fiber offers an exceptional strength-to-weight ratio, addressing the simultaneous market demand for reduced weight and superior mechanical strength, often utilized in aerospace-grade professional laptops.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager