Novel Tobacco Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435835 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Novel Tobacco Products Market Size

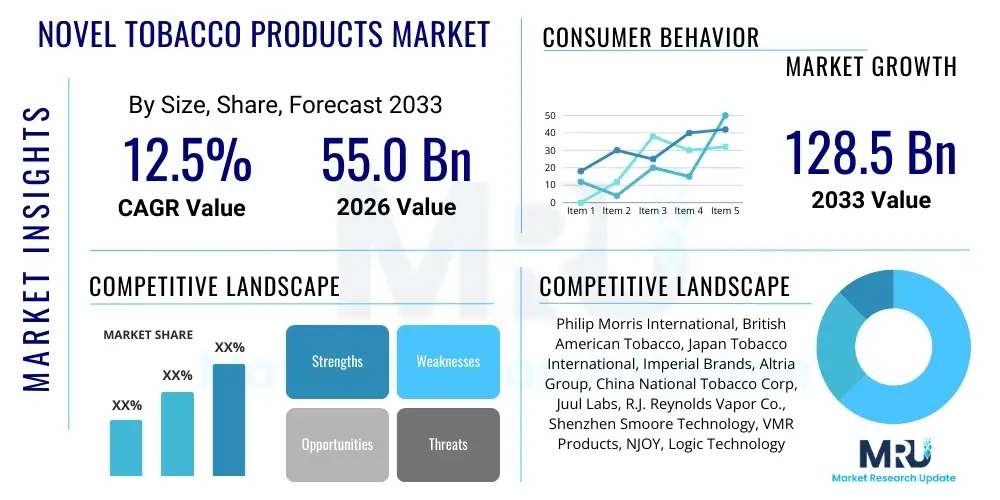

The Novel Tobacco Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 55.0 Billion in 2026 and is projected to reach USD 128.5 Billion by the end of the forecast period in 2033.

Novel Tobacco Products Market introduction

The Novel Tobacco Products Market encompasses innovative nicotine delivery systems designed as alternatives to traditional combustible cigarettes. This expansive category primarily includes Electronic Nicotine Delivery Systems (ENDS), commonly known as e-cigarettes or vaping devices, Heated Tobacco Products (HTPs), and modern oral nicotine pouches and lozenges. These products are fundamentally defined by their potential to reduce harmful chemical exposure compared to smoking, although their long-term health impact remains a subject of ongoing scientific and regulatory debate. The primary objective driving the market expansion is the global public health focus on harm reduction, coupled with shifting consumer preferences toward less harmful or more socially acceptable nicotine consumption methods.

E-cigarettes deliver nicotine through heating a liquid (e-liquid) into an aerosol, while HTPs heat processed tobacco sticks to generate an inhalable aerosol without combustion. Oral nicotine products, conversely, offer a smoke-free, discreet alternative. Major applications of these novel products include recreational nicotine use, smoking cessation or reduction aids, and adult consumer transitions from traditional smoking habits. The demographic shift, particularly the uptake among younger adult smokers and the desire for convenient, indoor-friendly usage, accelerates market adoption across developed economies.

Driving factors for this market are stringent government regulations on traditional tobacco advertising and sales, advancements in battery technology and flavor delivery systems, and aggressive marketing and R&D investments by major tobacco companies (Big Tobacco) pivoting their portfolios toward "smoke-free" futures. The core benefit these products offer is the elimination of combustion, which significantly reduces the levels of harmful and potentially harmful constituents (HPHCs) found in cigarette smoke, thereby positioning them as integral components of global tobacco harm reduction strategies, despite facing escalating regulatory scrutiny regarding youth access and flavor bans in key regions.

Novel Tobacco Products Market Executive Summary

The Novel Tobacco Products Market is experiencing robust acceleration, fueled by intense technological competition and a profound shift in consumer behavior away from traditional cigarettes toward reduced-risk alternatives. Current business trends indicate a critical strategic pivot among established tobacco giants, allocating significant capital expenditures towards product innovation, particularly in closed-system vaping devices and sophisticated HTP technology, aiming for rapid consumer migration. This pivot is often necessitated by tightening regulatory environments that seek to balance public health objectives (harm reduction) with concerns regarding potential youth initiation. The market dynamic is characterized by frequent mergers, acquisitions, and strategic partnerships, particularly between large multinational corporations and specialized technology providers, focused on securing intellectual property related to heating methods and nicotine formulation stability.

Regionally, Asia Pacific (APAC), led by markets like Japan and South Korea where HTPs are highly successful, and North America, dominated by the e-cigarette segment, remain the primary growth engines. Europe shows strong segmentation, with countries like the UK embracing harm reduction policies, fostering the uptake of open and closed vaping systems, while certain EU member states impose stricter flavor restrictions. Emerging markets in Latin America and the Middle East are beginning to show significant potential, driven by urbanization and improved disposable income, although these regions often contend with fragmented or uncertain regulatory landscapes, creating both barriers and opportunities for early market entry and expansion.

Segment trends demonstrate a clear movement toward sophisticated, next-generation devices emphasizing user experience, longevity, and connectivity. HTPs are gaining ground due to their perceived closer sensory resemblance to smoking, while oral nicotine products are witnessing exponential growth driven by their highly discreet nature and 100% smoke-free guarantee, making them highly attractive to consumers seeking alternatives in smoke-restricted environments. The distribution segment is witnessing diversification, with online sales channels increasing in importance for specialized, regulated sales, although convenience stores and specialty vape shops remain critical touchpoints for immediate access and consumer consultation.

AI Impact Analysis on Novel Tobacco Products Market

Common user and industry inquiries regarding AI's impact on the Novel Tobacco Products Market center on how artificial intelligence can optimize product development, enhance supply chain efficiency under stringent regulation, and personalize marketing responsibly. Users frequently ask about AI's role in clinical research, particularly in analyzing real-world usage patterns and assessing potential health risks associated with different aerosol compositions. There is significant interest in using predictive AI models to forecast regulatory changes and subsequent consumer responses, allowing companies to rapidly adjust product portfolios. Key concerns revolve around ethical AI use in targeted advertising, ensuring compliance with age restrictions, and the potential for AI-driven personalization to increase dependency or youth attraction, necessitating robust governance frameworks for data utilization within this highly sensitive industry.

- AI-driven optimization of battery longevity and heating element efficiency in HTPs and vaping devices.

- Predictive modeling for assessing the toxicity profiles of novel e-liquid formulations before extensive clinical trials.

- Automation and optimization of complex supply chain logistics, ensuring compliance with regional import/export restrictions and taxation.

- Personalized dosage and flavor recommendations based on consumer usage data analyzed via machine learning.

- Enhanced age verification and compliance monitoring systems for online sales, reducing the risk of youth access.

- Utilization of natural language processing (NLP) to monitor public sentiment and regulatory debates across global jurisdictions in real-time.

- Robotics and AI employed in high-precision manufacturing processes for complex components like ceramic heating blades and mesh coils.

- Forecasting shifts in consumer demand between open, closed, HTP, and oral products based on socio-economic indicators.

- Development of personalized nicotine delivery schedules to assist smokers in transitioning or reducing nicotine dependence.

- Advanced quality control using computer vision for detecting micro-defects in assembled devices and consumables.

DRO & Impact Forces Of Novel Tobacco Products Market

The Novel Tobacco Products Market is primarily driven by the imperative for public health harm reduction strategies and robust corporate investment in smoke-free alternatives, yet it is simultaneously restrained by escalating global regulatory uncertainty and persistent public skepticism regarding the long-term safety profile of these products. Opportunities arise significantly from the untapped potential in emerging economies where smoking rates remain high and from the advancement of discreet, highly efficient oral nicotine delivery systems that avoid inhalation risks entirely. The interplay of these factors creates significant impact forces where technological innovation often precedes regulatory framework establishment, leading to market volatility and high barriers to entry for companies unable to navigate complex legislative requirements and capital-intensive R&D cycles. Success in this market is critically dependent on achieving regulatory approval and establishing strong scientific evidence supporting reduced risk claims.

Drivers include the widespread recognition of the harms of combustion, encouraging millions of smokers globally to seek alternatives. The rapid development of sophisticated hardware, better flavor systems, and higher-quality nicotine salts has improved the user experience significantly, accelerating the transition. Furthermore, the supportive stance taken by certain governmental and public health bodies, such as in the UK and New Zealand, which view these products as valuable cessation tools, provides significant market momentum. Restraints, conversely, are severe, centered around the risk of youth initiation, which has triggered widespread bans on flavored products, restrictive marketing rules, and pre-market authorization requirements (like the FDA's PMTA process in the US). These regulatory hurdles require enormous investment and time, often slowing innovation and favoring incumbent players with deep pockets.

The core opportunity lies in developing truly differentiated products that offer validated health improvements and complete consumer satisfaction, thus maximizing switching rates. Specifically, research into non-tobacco derived nicotine and advanced pharmaceutical delivery mechanisms presents a future growth trajectory distinct from traditional tobacco dependence. However, the most significant impact force remains the delicate balance between innovation (which often involves attractive flavors) and public health ethics (preventing youth uptake). This force mandates that market participants invest heavily not just in product R&D, but also in rigorous scientific substantiation and robust, verifiable age-gating mechanisms across all sales channels, making regulatory compliance a competitive advantage.

Segmentation Analysis

The Novel Tobacco Products Market segmentation is crucial for understanding the varied adoption rates and regulatory challenges across different product forms and consumption methodologies. The market is primarily categorized based on the mechanism of nicotine delivery—inhalation (e-cigarettes and HTPs) versus non-inhalation (oral products). Further divisions consider device technology (open versus closed systems), flavor profiles that drive consumer loyalty, and the complex web of distribution channels utilized to reach the adult consumer base while strictly adhering to age verification mandates. These segments reflect the industry's attempt to cater to diverse consumer preferences, ranging from heavy smokers seeking a near-combustible experience to younger adult users prioritizing discretion and variety.

- Product Type

- E-cigarettes/Vaping Devices (Vaporizers)

- Heated Tobacco Products (HTPs)

- Oral Tobacco/Nicotine Products (Pouches, Lozenges, Gums)

- Other Novel Products (e.g., Nicotine Inhalers)

- Distribution Channel

- Online Sales (E-commerce Platforms, Brand Websites)

- Offline Retail

- Convenience Stores and Gas Stations

- Specialty Vape and Smoke Shops

- Supermarkets and Hypermarkets

- Pharmacies (in certain regulated markets)

- Flavor Type

- Menthol and Mint

- Tobacco Flavor

- Fruity and Sweet Flavors

- Dessert and Beverage Flavors

- Unflavored Nicotine Products

- Technology

- Closed System (Pre-filled Pods/Cartridges)

- Open System (Refillable Tanks)

- Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Novel Tobacco Products Market

The value chain for the Novel Tobacco Products Market is highly concentrated and complex, starting with the upstream sourcing of key raw materials like high-ppurity pharmaceutical-grade nicotine, propylene glycol (PG), vegetable glycerin (VG), and specialized flavorings, alongside critical electronic components such as lithium-ion batteries and microprocessors. Upstream analysis highlights significant dependencies on Asian manufacturing hubs, particularly in China (Shenzhen) for electronic components and device assembly, leading to vulnerabilities related to geopolitical trade tensions and supply chain interruptions. Quality control and regulatory compliance begin at this stage, with suppliers needing to meet stringent purity and safety standards for all chemical inputs, especially nicotine sourcing and extraction, which is often vertically integrated within major tobacco corporations.

Midstream activities involve sophisticated product design, flavor development (which requires substantial R&D to stabilize complex chemical mixtures), and high-precision manufacturing and assembly of the hardware. This stage is dominated by intellectual property protection, particularly regarding the heating technologies (induction vs. conduction) and proprietary battery management systems that ensure user safety and consistent nicotine delivery. Downstream analysis focuses on distribution and sales. The distribution channels are bifurcated into direct sales (brand-owned websites) and indirect channels (retailers, wholesalers). Direct distribution allows for better control over age verification and consumer data capture, crucial for targeted marketing and regulatory reporting. Indirect channels, particularly convenience stores, provide widespread accessibility and account for the majority of immediate, impulse purchases, demanding robust retailer education and compliance programs.

The increasing digitalization of the purchasing process, even through indirect channels, is redefining customer interaction, with e-commerce platforms and brand-specific apps becoming central to loyalty programs and new product launches. The complexity of the value chain is amplified by varying excise taxes, flavor restrictions, and packaging mandates across different jurisdictions, requiring highly localized packaging and logistics operations. Direct distribution is becoming increasingly favored by large multinational companies (MNCs) to ensure strict adherence to Minimum Legal Sales Age (MLSA) requirements, mitigate illicit trade risks, and control pricing strategies, while smaller independent players often rely exclusively on indirect B2B wholesale channels and specialty retail outlets for market penetration.

Novel Tobacco Products Market Potential Customers

The primary target demographic and potential customers for the Novel Tobacco Products Market are adult smokers seeking viable alternatives to traditional combustible cigarettes, driven by health concerns, social pressures, or convenience. This demographic is further segmented into established smokers looking for cessation aids (transition users) and long-term switchers who intend to replace traditional smoking entirely with reduced-risk products. A crucial subset includes existing vapers or HTP users who are highly receptive to next-generation hardware upgrades, improved flavor stability, and enhanced battery life. The appeal is particularly strong among urban populations aged 25 to 55 who are generally more technologically literate and socially conscious regarding the impacts of smoking on themselves and those around them.

Secondary customer groups include adult users seeking discreet nicotine consumption methods, which primarily drive the rapid uptake of oral nicotine pouches in environments where smoking or vaping is strictly prohibited, such as workplaces, public transport, or indoor venues. These consumers prioritize ease of use, zero emissions, and convenience over the traditional sensory experience. While the industry strictly prohibits targeting minors, regulatory scrutiny often focuses on preventing "cross-over" attraction to traditional non-nicotine consumers, mandating that marketing efforts strictly adhere to adult-only verification and messaging focused on switching from established combustible habits.

The end-users are largely motivated by the perception of harm reduction, flavor variety (where permitted), cost efficiency in the long run compared to traditional cigarettes, and the convenience afforded by smoke-free operation. Successful market penetration relies on providing differentiated products for heavy smokers (high nicotine delivery, robust hardware) and light smokers (discreet, low-dose options), ensuring that the range of products captures the full spectrum of adult nicotine consumption needs globally, while always emphasizing the "for adult smokers only" messaging to maintain regulatory compliance and consumer trust.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 55.0 Billion |

| Market Forecast in 2033 | USD 128.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Philip Morris International, British American Tobacco, Japan Tobacco International, Imperial Brands, Altria Group, China National Tobacco Corp, Juul Labs, R.J. Reynolds Vapor Co., Shenzhen Smoore Technology, VMR Products, NJOY, Logic Technology Development, Fontem Ventures, KT&G, Turning Point Brands, Swedish Match, Chillax, Myblu, BIDI Vapor, Nicoventures |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Novel Tobacco Products Market Key Technology Landscape

The technological landscape of the Novel Tobacco Products Market is intensely competitive, primarily focused on enhancing nicotine delivery efficiency, ensuring product safety, and improving user experience to maximize adult smoker migration. In the E-cigarette sector, the key technological advancements center around improved atomizer design, transitioning from traditional coiled wicks to ceramic heating elements and mesh coils, which offer larger surface areas for more consistent and flavorful vapor production while reducing the risk of 'dry hits.' Furthermore, the widespread adoption of nicotine salts over freebase nicotine has revolutionized the market, allowing for higher, more satisfying nicotine concentrations to be delivered with less harshness, closely mimicking the rapid satisfaction profile of a combustible cigarette and driving the success of closed pod systems.

Heated Tobacco Products (HTPs) are defined by proprietary heating technology, primarily differentiating between internal blade heaters (conduction) and induction heating systems. Induction heating represents a significant leap forward, eliminating direct contact with the tobacco stick, which reduces cleaning requirements and potentially offers greater temperature control for minimizing harmful constituent formation. Innovations also include sophisticated temperature regulation algorithms powered by microprocessors, which prevent overheating and ensure a uniform heating curve, thereby providing a consistent and repeatable experience across uses. Battery technology is critical across all novel products, with research heavily focused on energy density, rapid charging, and miniaturization to meet consumer demands for sleek, portable devices with extended usage times, often incorporating smart features like Bluetooth connectivity for usage monitoring.

The overarching technological trend is the convergence of hardware efficiency with chemical stability. Companies are investing heavily in material science for safer chassis construction and pharmaceutical formulation expertise to stabilize e-liquids and oral nicotine products against degradation, ensuring a reliable shelf life and dose accuracy. Regulatory technology, often referred to as "RegTech," is also a key landscape feature, utilizing advanced data analytics and IoT capabilities embedded in devices to track usage patterns for submission to regulatory bodies (like the FDA) to substantiate public health claims and secure market authorization, cementing compliance as a technological necessity rather than a mere administrative burden.

- Nicotine Salt Technology: Facilitates high-concentration nicotine delivery with reduced throat irritation, crucial for closed pod systems.

- Induction Heating Systems: Advanced method for HTPs, utilizing electromagnetic fields to heat tobacco without direct contact, improving efficiency and cleanliness.

- Ceramic and Mesh Coils: Modern atomizer design offering superior surface area, faster ramp-up time, and enhanced flavor clarity in vaping devices.

- Integrated Smart Chipsets: Microprocessors managing temperature control, preventing overheating, and supporting features like puff count, battery optimization, and child lock mechanisms.

- Proprietary Battery Management Systems (BMS): Focused on maximizing lithium-ion battery safety, longevity, and fast-charging capabilities crucial for portable devices.

- Aerosol Chemistry Analysis Platforms: Specialized lab technologies used to accurately measure and identify harmful and potentially harmful constituents (HPHCs) in the generated aerosol for regulatory submission.

- Child-Resistant Packaging and Age Verification Technology: Mandatory features in hardware and packaging design, often including NFC or QR codes linked to verification systems for retail compliance.

- Non-Tobacco Nicotine (NTN) Sourcing: Synthesized nicotine creation to bypass certain regulatory classifications applied specifically to tobacco-derived products, broadening the raw material supply chain.

Regional Highlights

North America, particularly the United States, represents a highly lucrative yet intensely regulated segment of the Novel Tobacco Products Market. The region is characterized by substantial consumer adoption of e-cigarettes and vaping products, particularly closed pod systems, although the market is facing increasing consolidation due to the stringent Pre-Market Tobacco Application (PMTA) requirements imposed by the Food and Drug Administration (FDA). This regulatory environment necessitates significant financial investment in clinical data and product substantiation, favoring multinational corporations. Despite flavor bans in several states and localities aimed at reducing youth usage, consumer demand for approved tobacco-flavored products and the burgeoning oral nicotine segment (pouches) ensures continued robust market expansion, driven by the massive adult smoking population transitioning away from combustibles.

Europe presents a fragmented but structurally supportive market landscape, largely governed by the European Union’s Tobacco Products Directive (TPD). The UK stands out with its highly supportive public health approach towards vaping as a harm reduction tool, leading to high adoption rates of both open and closed systems. Conversely, many continental European nations maintain moderate regulation, focusing primarily on nicotine strength limits and tank sizes, while the growth of HTPs is noticeable in Eastern and Southern Europe. The primary trend in Europe is the rapid expansion of the oral nicotine category, particularly in Scandinavia (driven by traditional snus markets like Sweden) and spreading into Central Europe, where it is marketed successfully as a discreet, smoke-free alternative compliant with increasing indoor air restrictions.

Asia Pacific (APAC) is arguably the fastest-growing and most complex market due to the coexistence of highly liberal (e.g., Japan, South Korea) and highly restrictive (e.g., India, Thailand, Australia) jurisdictions. Japan is the global leader for Heated Tobacco Products (HTPs), dominating the segment due to an early regulatory framework that effectively banned e-liquids containing nicotine, forcing manufacturers to focus heavily on HTP technology, resulting in massive consumer switching rates. China, despite being the world's largest producer of vaping hardware, maintains strict, evolving regulations on domestic sales. The overall regional growth is powered by enormous populations of smokers in countries like Indonesia and the Philippines, where novel products are slowly gaining acceptance, provided companies can navigate diverse tax regimes and often ambiguous product classifications across borders.

- North America (US and Canada): Market characterized by strict FDA regulatory oversight (PMTA), favoring closed-system vaping and rapid growth of oral nicotine pouches. High levels of R&D investment are required for market access and sustained presence.

- Europe (UK, Germany, France): Segmentation influenced by the TPD; the UK is a major advocate for vaping in harm reduction; strong growth in oral nicotine throughout Scandinavia and Central Europe.

- Asia Pacific (Japan, South Korea, China): HTP dominance in Japan and South Korea driven by favorable early regulation; China acts as the global manufacturing hub but imposes increasingly strict domestic sales rules; significant future potential in Southeast Asia.

- Latin America (Brazil, Mexico): Emerging market facing widespread regulatory uncertainty and bans on e-cigarettes and HTPs in key economies like Brazil, limiting expansion and fostering illicit market activity; high potential if regulation evolves favorably.

- Middle East and Africa (MEA): Nascent market with strong demand in urban centers (UAE, Saudi Arabia, South Africa); growth driven by high disposable incomes and a desire for premium, less socially intrusive nicotine alternatives, often reliant on regulatory legalization of imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Novel Tobacco Products Market.- Philip Morris International (PMI)

- British American Tobacco (BAT)

- Japan Tobacco International (JTI)

- Imperial Brands PLC

- Altria Group, Inc.

- China National Tobacco Corporation (CNTC)

- Juul Labs, Inc.

- R.J. Reynolds Vapor Company (Subsidiary of BAT)

- Shenzhen Smoore Technology Limited (Vaporesso, FEELM)

- VMR Products LLC

- NJOY Holdings, Inc.

- Logic Technology Development LLC

- Fontem Ventures B.V. (Subsidiary of Imperial Brands)

- KT&G Corporation

- Turning Point Brands, Inc.

- Swedish Match AB (Now part of PMI)

- Chillax Technology Co., Ltd.

- Myblu (Subsidiary of Imperial Brands)

- BIDI Vapor, LLC

- Nicoventures Trading Ltd. (Subsidiary of BAT)

Frequently Asked Questions

Analyze common user questions about the Novel Tobacco Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between Heated Tobacco Products (HTPs) and E-cigarettes (Vaping)?

HTPs, such as IQOS, heat real tobacco sticks to produce an aerosol without combustion, aiming for a sensory experience closer to traditional smoking. E-cigarettes, conversely, heat a liquid solution (e-liquid) containing nicotine, flavorings, PG, and VG, generating a vapor that is inhaled, offering greater flavor variety and technological flexibility.

What is driving the substantial growth in the oral nicotine products segment?

The primary driver is the demand for highly discreet, 100% smoke-free, and spit-free nicotine consumption methods that are usable in environments where smoking or vaping is banned. Oral pouches appeal to adult consumers seeking convenience and a product perceived as less risky than inhalation products, enabling consumption indoors or on public transport.

How is regulatory uncertainty impacting innovation in the Novel Tobacco Products Market?

Regulatory uncertainty, particularly the implementation of strict pre-market authorization processes (like the FDA's PMTA) and widespread flavor bans, is creating high barriers to entry. This forces companies to prioritize huge investments in regulatory science and compliance over rapid flavor innovation, slowing the pace of product diversification and favoring established firms with extensive resources.

Which geographical region holds the largest market share for Novel Tobacco Products and why?

Asia Pacific (APAC), primarily driven by the massive consumer acceptance and market size of Heated Tobacco Products (HTPs) in markets like Japan and South Korea, currently holds the largest share. High population density, robust consumer switching rates from traditional smoking, and supportive early HTP regulation in these key markets contribute significantly to regional dominance.

Are Novel Tobacco Products considered effective tools for smoking cessation?

While many users utilize novel tobacco products to quit or reduce traditional smoking, they are generally classified as harm reduction tools rather than officially approved cessation devices. Public health bodies like Public Health England support vaping as an aid, but their efficacy depends heavily on the individual user's motivation and the sustained transition away from combustible cigarettes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager