NTP Time Server Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434537 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

NTP Time Server Market Size

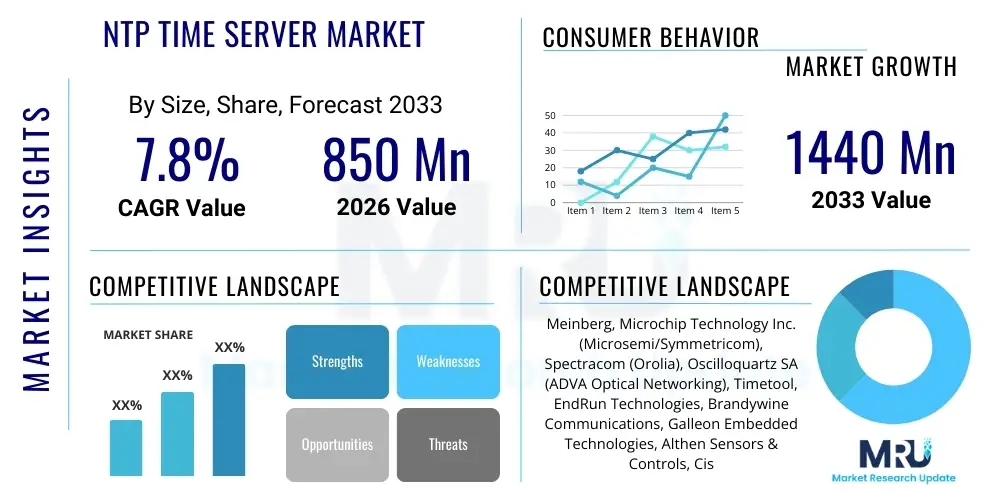

The NTP Time Server Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1440 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for highly accurate, synchronized timing across critical infrastructure sectors such as telecommunications, financial trading, and power utilities, where nanosecond precision is becoming mandatory for regulatory compliance and operational efficiency. The continuous proliferation of networked devices, coupled with the emergence of 5G technology and the Internet of Things (IoT), necessitates robust and reliable Network Time Protocol (NTP) solutions to ensure system coherence globally.

NTP Time Server Market introduction

The NTP Time Server Market encompasses specialized hardware and software solutions designed to accurately synchronize the clocks of computer systems and networked devices using the Network Time Protocol (NTP). These servers typically rely on external, highly precise time sources, such as Global Navigation Satellite Systems (GNSS) like GPS or atomic clocks (e.g., Cesium or Rubidium oscillators), to distribute highly accurate Coordinated Universal Time (UTC) references across local and wide area networks. Product offerings range from rack-mounted, high-security hardware appliances essential for data centers and military applications to virtualized software solutions utilized in cloud environments.

Major applications for NTP Time Servers span critical areas including banking and financial services (for timestamping transactions and ensuring audit trails), telecommunications (for network management, billing, and ensuring call detail record accuracy), and defense/aerospace (for command and control synchronization). Furthermore, industrial automation systems (ICS/SCADA), healthcare facilities, and media broadcasting organizations depend heavily on synchronized timing for flawless operation and data integrity. The fundamental benefit provided by these servers is enhanced operational integrity, improved security through precise log correlation, and compliance with stringent time-sensitive regulations, notably MiFID II in Europe and Sarbanes-Oxley in the US, which mandate verifiable time synchronization.

The market growth is primarily driven by the increasing complexity and scale of global IT infrastructure, the stringent regulatory requirements imposed on financial and healthcare institutions regarding timestamp accuracy, and the imperative need for cybersecurity forensics, where accurate time correlation across numerous devices is crucial for incident response. Technological advancements, particularly in leveraging Precision Time Protocol (PTP/IEEE 1588) alongside traditional NTP, are further pushing market boundaries, enabling microsecond and nanosecond timing accuracy required by modern high-speed trading platforms and advanced telecommunications networks.

NTP Time Server Market Executive Summary

The NTP Time Server Market is witnessing a strong upward trajectory, fueled by global digital transformation initiatives and the transition towards distributed network architectures. Business trends highlight a significant shift towards hybrid solutions, incorporating both hardware-based time appliances for maximum security and resilience, and cloud-based or virtualized NTP services for flexible, scalable deployments, particularly favored by small and medium enterprises (SMEs). Demand is accelerating for enhanced security features, including validated time sources and improved protection against timing-related cyberattacks, such as spoofing and replay attacks. Key industry players are focusing heavily on developing solutions that seamlessly integrate both NTP and PTP protocols, catering to industries demanding ultra-high accuracy timing.

Regionally, North America maintains the largest market share due to the strong presence of major financial trading hubs, stringent regulatory frameworks, and high investment in advanced data center infrastructure. Asia Pacific (APAC), however, is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by rapid infrastructure development, the aggressive rollout of 5G networks in countries like China and India, and increasing governmental investments in smart city projects that require centralized and accurate time synchronization. Europe shows consistent demand, primarily motivated by financial regulation compliance (MiFID II) and the need to modernize legacy industrial control systems.

Segment trends reveal that the hardware appliance segment dominates revenue generation due to its reliability and security, essential for critical infrastructure. However, the software/virtualized segment is growing faster, reflecting the overall IT trend towards virtualization and cloud elasticity. By application, the IT and Telecommunications sector remains the dominant consumer, although the Power and Energy segment is rapidly increasing its market presence, driven by the need for synchronized timing in smart grid operations and power transmission fault analysis. There is a discernible trend towards leveraging multiple time sources (multi-GNSS constellations) to ensure redundancy and higher accuracy in all major deployment types.

AI Impact Analysis on NTP Time Server Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can enhance the management, security, and predictive maintenance of critical timing infrastructure, particularly NTP time servers. Common concerns revolve around whether AI can predict GNSS degradation or timing source anomalies before they impact network operations, how AI models can optimize synchronization accuracy across geographically dispersed networks, and the potential for leveraging AI to detect subtle, malicious timing attacks that evade traditional monitoring systems. Furthermore, users are keen to understand if AI can automate the complex configuration and compliance reporting required in highly regulated environments, thereby reducing human error and operational overhead associated with maintaining high-precision timing.

AI is beginning to play a crucial, albeit indirect, role in the NTP Time Server market by enhancing system monitoring and predictive maintenance capabilities. AI/ML algorithms are employed to analyze vast streams of timing data, identifying subtle deviations, clock drift patterns, and potential infrastructure failures that may compromise synchronization accuracy. This analytical capacity allows network administrators to move beyond reactive error correction to proactive management, ensuring that timing services remain within required compliance thresholds, particularly for PTP deployments where accuracy is measured in nanoseconds. The ability of AI to model network topology and predict latency variations is crucial for optimizing the distribution of time signals across complex, high-variability networks.

Moreover, AI significantly bolsters the security posture of NTP installations. Timing infrastructure is increasingly targeted by sophisticated cyber threats. AI models trained on patterns of normal timing behavior can detect anomalies indicative of spoofing attempts, man-in-the-middle attacks, or compromised time sources with far greater precision and speed than traditional threshold-based systems. By providing real-time, context-aware alerts, AI minimizes the window of vulnerability, ensuring the integrity and authenticity of the distributed time signal, which is foundational for forensic analysis and system auditability. The integration of AI-driven analytics thus positions NTP time servers not just as utility devices but as integral components of the overall network security framework.

- AI enhances predictive maintenance by analyzing clock drift trends and predicting hardware failures in NTP servers, maximizing uptime.

- Machine Learning algorithms improve timing anomaly detection, identifying sophisticated cyberattacks like GNSS spoofing and timing manipulation.

- AI optimizes time distribution algorithms across large, dynamic networks, minimizing latency jitter and ensuring consistent synchronization accuracy.

- Natural Language Processing (NLP) within AI systems can automate complex regulatory reporting and audit trail generation related to time synchronization compliance (e.g., MiFID II).

- AI facilitates resource optimization in virtualized NTP deployments by dynamically allocating processing power based on network synchronization load and required precision levels.

DRO & Impact Forces Of NTP Time Server Market

The NTP Time Server Market dynamics are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and resulting Impact Forces. The primary drivers include the escalating need for nanosecond-level timing accuracy in high-frequency trading (HFT) and 5G networks, coupled with increasingly strict global regulatory mandates requiring verifiable time synchronization logs. Restraints predominantly revolve around the high initial cost of deploying high-precision hardware time servers (such as those incorporating atomic clocks), complexity in maintaining and calibrating PTP systems, and the inherent cybersecurity risks associated with external time sources (GNSS vulnerability). Opportunities arise from the rapid expansion of the IoT landscape, the adoption of smart grid technologies, and the potential for widespread integration of hybrid timing solutions combining resilient hardware with scalable virtualized services. These elements collectively generate strong impact forces pushing organizations towards immediate investment in upgraded, highly secure timing solutions to maintain operational integrity and legal compliance.

Drivers: The fundamental driver is the pervasive digital transformation across all industries, increasing dependence on distributed systems where temporal synchronization is non-negotiable for data integrity and operational efficiency. The continuous expansion of data centers and cloud computing platforms demands resilient and scalable NTP infrastructure. Specifically, the rollout of 5G necessitates extremely precise synchronization for base station coordination and beamforming, pushing demand beyond traditional NTP towards PTP (Precision Time Protocol), requiring more sophisticated time servers. Furthermore, regulatory bodies across the finance, telecom, and healthcare sectors are tightening audit requirements, mandating documented evidence that time synchronization adheres to strict standards, thereby compelling corporations to invest in certified and verifiable time servers.

Restraints: Significant restraints impede market velocity, primarily centered on complexity and cost. High-end NTP/PTP systems, especially those leveraging Rubidium or Cesium oscillators, represent substantial capital expenditures, particularly challenging for smaller enterprises. The technical expertise required to install, manage, and troubleshoot complex timing protocols like PTP (IEEE 1588) often acts as a barrier to widespread adoption, leading organizations to defer upgrades. Moreover, dependency on GNSS signals introduces external vulnerability, including the risk of jamming, spoofing, and signal degradation, which necessitates costly redundant systems (e.g., integrating eLoran or atomic clock backups) to mitigate single-point-of-failure risks.

Opportunities: Emerging opportunities are primarily driven by technological convergence and new application domains. The development of robust, cost-effective hybrid time servers that can utilize multiple external and internal timing sources (multi-GNSS, PTP, internal oscillators) presents a strong growth avenue. The rapidly expanding Industrial Internet of Things (IIoT) and smart manufacturing environments require millions of synchronized endpoints, creating a massive opportunity for scalable, software-defined synchronization solutions. Additionally, the increasing focus on cybersecurity forensics provides a fertile ground, as every security investigation relies on accurately correlated timestamps, positioning high-integrity NTP servers as crucial security tools rather than mere operational utilities.

Impact Forces: The convergence of mandatory regulatory compliance and the increasing vulnerability of high-value targets (like financial exchanges and critical utilities) to timing-related cyberattacks creates a high-impact force. This force compels companies to prioritize resilience and verifiable accuracy above cost considerations. Secondly, the fundamental shift in network requirements, particularly in 5G and high-frequency trading, where timing moves from millisecond to nanosecond precision, acts as a powerful force mandating the replacement of legacy NTP systems with PTP-capable, high-end time servers, thereby guaranteeing continuous market refreshment and technological advancement.

Segmentation Analysis

The NTP Time Server Market is comprehensively segmented based on its component type (hardware vs. software), synchronization source, deployment type, and the critical end-user applications it serves. Analyzing these segments provides a nuanced view of market performance, revealing that while traditional hardware appliances continue to dominate in terms of reliability and revenue for critical infrastructure, the software and virtualized segment is expanding rapidly, aligning with overall cloud migration trends. Furthermore, the segmentation by synchronization source highlights a growing preference for multi-GNSS solutions over single GPS dependency, driven by the imperative for enhanced resilience and uptime in critical applications.

Segmentation is essential for understanding the varying needs across different vertical industries. For example, the financial services sector demands hardware-based servers utilizing high-stability atomic clocks to meet MiFID II nanosecond requirements, falling primarily under the 'Hardware Appliance' and 'Atomic Clock/High Precision' segments. Conversely, large enterprises focusing on standard IT network management often opt for ‘Software/Virtual’ servers using ‘NTP Only’ protocols via GPS sources for cost-effectiveness and ease of scalability. This diverse requirement landscape dictates product development strategies, pushing vendors to offer modular and adaptable solutions that can scale from basic network time services to mission-critical, high-availability time distribution systems utilizing advanced PTP profiles.

- By Component:

- Hardware Appliances (Dominate in high-security environments)

- Software/Virtual Servers (Growing rapidly due to cloud adoption)

- Services (Installation, Maintenance, and Calibration)

- By Synchronization Source:

- GNSS (GPS, GLONASS, Galileo, BeiDou)

- Atomic Clocks (Rubidium, Cesium)

- Radio Signals (e.g., WWVB, DCF77)

- Internal Oscillators (Holdover Capability)

- By Protocol:

- NTP (Network Time Protocol)

- PTP (Precision Time Protocol / IEEE 1588)

- Combined NTP/PTP Solutions

- By End-User Application:

- IT and Telecommunications

- Financial Services and Banking (BFSI)

- Industrial Automation and Critical Manufacturing

- Defense, Aerospace, and Government

- Power, Energy, and Utilities (Smart Grid)

- Healthcare and Medical Systems

Value Chain Analysis For NTP Time Server Market

The value chain for the NTP Time Server Market begins with the highly specialized upstream component providers and extends through complex manufacturing, precise integration, and ultimately, downstream distribution and post-sale maintenance. Upstream activities involve sourcing highly specialized components, primarily high-stability oscillators (such as crystal, oven-controlled crystal, or Rubidium), GNSS receiver modules, and sophisticated networking silicon capable of implementing PTP hardware timestamping. These components are often procured from niche, high-precision electronic manufacturers, forming a critical dependency on supply chain reliability and component quality, directly impacting the server's stability and accuracy metrics. Manufacturers must invest heavily in R&D and calibration laboratories to ensure the final product meets stringent regulatory accuracy requirements.

The midstream phase involves the core server manufacturing, integration of proprietary timing software, and rigorous testing and certification processes (e.g., compliance with specific PTP profiles or regulatory time standards). This stage adds significant value through intellectual property related to jitter reduction, holdover capabilities, and secure management interfaces. Downstream activities are centered on market access and customer support. Distribution channels are typically specialized, relying on expert system integrators, value-added resellers (VARs), and dedicated distributors who possess the technical knowledge necessary to integrate high-precision timing systems into complex network infrastructures, especially in sectors like finance and telecom where customized deployment strategies are mandatory.

Distribution is characterized by both direct sales for large government or military contracts requiring highly secure, bespoke systems, and indirect channels for commercial and enterprise clients. The indirect channel dominates due to the necessity of local installation support and integration expertise provided by VARs. Post-sale services, including annual calibration, maintenance contracts, and firmware updates (particularly security patches), form a crucial and high-margin part of the value chain, ensuring the long-term reliability and compliance of the deployed time servers. The entire chain is heavily regulated, requiring traceability and verification of the time source from the original satellite or atomic clock reference down to the end-user device.

NTP Time Server Market Potential Customers

Potential customers for NTP Time Servers represent any entity operating a distributed IT network where data integrity, system synchronization, and regulatory compliance are paramount, encompassing sectors that require precision timekeeping for operational and legal verification purposes. The largest and most demanding segments include global financial institutions, such as investment banks, stock exchanges, and high-frequency trading firms, which require verifiable sub-microsecond accuracy for transaction logging (driven by regulations like MiFID II and CAT). Telecommunication providers, including fixed-line and mobile operators, represent another core customer base, relying on accurate timing for network operations, synchronization of 5G infrastructure, and reliable billing systems.

Beyond these traditional segments, the burgeoning market for Industrial IoT (IIoT) and smart grid infrastructure is generating a significant new wave of demand. Industrial customers require synchronized time for correlating sensor data, managing real-time manufacturing processes, and ensuring proper sequencing in automated control systems (SCADA). Utility companies use NTP servers for fault monitoring, phase measurement unit (PMU) coordination, and managing decentralized power generation assets. Government and defense organizations are perpetual high-value customers, requiring extremely robust, secure, and often radiation-hardened time servers for secure communications, missile tracking, and command & control systems, often opting for atomic clock-based solutions to ensure absolute resilience against GNSS denial.

Furthermore, cloud service providers (CSPs) and large hyperscale data centers are major consumers, utilizing NTP servers to ensure consistency across millions of virtual machines and storage clusters, which is vital for disaster recovery and distributed database functionality. Even non-critical sectors, such as media broadcasting, utilize high-precision time servers to synchronize production workflows and content delivery networks. Essentially, any enterprise where system logs must be correlated for security auditing, forensic analysis, or regulatory compliance represents a viable, high-potential customer, driving ongoing market growth across all precision tiers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1440 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Meinberg, Microchip Technology Inc. (Microsemi/Symmetricom), Spectracom (Orolia), Oscilloquartz SA (ADVA Optical Networking), Timetool, EndRun Technologies, Brandywine Communications, Galleon Embedded Technologies, Althen Sensors & Controls, Cisco Systems, Juniper Networks, Korus Co., Ltd., Elproma Elektronika, Chronos Technology, ESE, Inc., Masterclock, Inc., Leonardo DRS, Beijing ZGT Technology, Chengdu Spaceon Electronic. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

NTP Time Server Market Key Technology Landscape

The technology landscape of the NTP Time Server market is defined by the continuous quest for higher accuracy, improved resilience, and better security. While Network Time Protocol (NTP) remains the ubiquitous foundation for network synchronization at the millisecond level, the critical sectors are rapidly migrating to the Precision Time Protocol (PTP, or IEEE 1588). PTP offers orders of magnitude greater accuracy, reaching nanosecond and even picosecond levels, achieved through hardware timestamping capabilities embedded in network interface cards and specialized switches. This migration is particularly critical in 5G synchronization, high-frequency stock trading, and advanced industrial automation, necessitating time servers that function as PTP Grandmasters, capable of distributing highly stable time references using specialized hardware profiles.

A second crucial technological area involves the source of the time signal. Traditional reliance on GPS is being superseded by Multi-Global Navigation Satellite System (Multi-GNSS) receivers, which integrate signals from constellations like GLONASS, Galileo, and BeiDou. This multi-source approach dramatically improves resilience against localized signal interference, jamming, or spoofing, ensuring continuous uptime. Furthermore, holdover technology is essential, employing high-stability internal oscillators—such as Oven-Controlled Crystal Oscillators (OCXO), Rubidium, or even compact Cesium atomic clocks—to maintain accuracy when external GNSS signals are temporarily unavailable. The duration and accuracy of this "holdover" capability are key differentiators for high-end NTP server products targeting mission-critical applications.

The emerging technological focus is on security and virtualization. Secure NTP (NTS) is gaining traction, providing cryptographic authentication to prevent time spoofing attacks, a significant cybersecurity threat. For cloud environments, vendors are developing virtualized NTP services and software-based PTP solutions that leverage white-rabbit or similar synchronization techniques for microservice orchestration, demanding highly stable and traceable time within virtual infrastructures. The convergence of time servers with security components, utilizing features like validated firmware and encrypted management interfaces, is becoming a standard expectation across the industry to protect the integrity of the crucial time base.

Regional Highlights

- North America (NA): North America is the leading market for NTP Time Servers, primarily driven by the stringent timing requirements of its massive financial services sector, particularly Wall Street and major exchanges, where regulatory compliance (e.g., FINRA) mandates audited, high-precision timekeeping. The region benefits from high technology adoption rates, extensive infrastructure investment in data centers and cloud services, and a strong defense and aerospace sector demanding ultra-secure and resilient timing solutions. The presence of major technology vendors and early adopters of 5G infrastructure in the US and Canada further solidifies market dominance. Demand is shifting rapidly towards integrated PTP solutions capable of delivering nanosecond accuracy required for low-latency network environments.

- Europe: Europe represents a mature and highly competitive market, characterized by regulatory enforcement, especially the Markets in Financial Instruments Directive (MiFID II), which imposes strict synchronization rules on transaction timestamps. This regulation has driven mandatory upgrades across banking and trading infrastructures, maintaining consistent demand for certified hardware servers with traceable time sources. The rollout of the Galileo GNSS constellation provides a regional boost in time source resilience. Furthermore, Europe's strong focus on industrial automation (Industry 4.0) and smart grid modernization in countries like Germany and the Nordic region fuels the need for synchronized timing in operational technology (OT) networks.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market due to massive investment in digital infrastructure across China, India, Japan, and Southeast Asia. Key growth drivers include the rapid expansion of 5G mobile networks, necessitating large-scale deployment of PTP Grandmasters for precise base station synchronization, and the explosion of hyperscale data centers supporting e-commerce and cloud services. Government initiatives focused on smart cities and critical national infrastructure projects (especially in power transmission and utilities) are significantly increasing the adoption of robust NTP/PTP solutions. Competitive pricing and local manufacturing capabilities are also contributing to the region's accelerated market expansion.

- Latin America (LATAM): The LATAM market is characterized by moderate growth, primarily centered on upgrading telecommunications infrastructure and modernizing financial systems in larger economies like Brazil and Mexico. The adoption rate is slower compared to North America and Europe, often favoring cost-effective software solutions or standard NTP hardware over high-end atomic clock systems. However, increasing foreign investment in regional data centers and the gradual implementation of compliance standards are expected to stimulate demand for more reliable and accurate time synchronization solutions over the forecast period.

- Middle East and Africa (MEA): The MEA region is experiencing increasing demand driven by substantial government-backed infrastructure projects, particularly in the Gulf Cooperation Council (GCC) states (e.g., Saudi Arabia, UAE) focused on developing smart city ecosystems and advanced national networks. The high reliance on critical infrastructure (oil and gas, defense, government) mandates highly resilient timing, often resulting in demand for dual-redundant or atomic clock-based systems to ensure operational security and independence from localized network vulnerabilities. Cybersecurity concerns are also pushing enterprises to adopt NTS-compliant time servers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the NTP Time Server Market.- Meinberg

- Microchip Technology Inc. (Microsemi/Symmetricom)

- Spectracom (Orolia)

- Oscilloquartz SA (ADVA Optical Networking)

- Timetool

- EndRun Technologies

- Brandywine Communications

- Galleon Embedded Technologies

- Althen Sensors & Controls

- Cisco Systems

- Juniper Networks

- Korus Co., Ltd.

- Elproma Elektronika

- Chronos Technology

- ESE, Inc.

- Masterclock, Inc.

- Leonardo DRS

- Beijing ZGT Technology

- Chengdu Spaceon Electronic

- SecureSync

Frequently Asked Questions

Analyze common user questions about the NTP Time Server market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between NTP and PTP Time Servers?

NTP (Network Time Protocol) provides time synchronization typically accurate to the millisecond range, suitable for general IT infrastructure and logging. PTP (Precision Time Protocol, IEEE 1588) offers significantly higher accuracy, down to the nanosecond or picosecond range, by utilizing specialized hardware timestamping. PTP is mandatory for applications requiring ultra-high precision, such as high-frequency trading and 5G network coordination, while NTP serves broader enterprise needs.

How is regulatory compliance impacting the demand for high-precision time servers?

Strict regulations, notably MiFID II in Europe and stringent rules from organizations like FINRA in the US, mandate that financial transactions and critical logs must be timestamped with verifiable, traceable accuracy, often requiring sub-microsecond precision. This regulatory pressure compels financial institutions and critical utilities to invest in high-end, certified time servers, increasing market demand for atomic clock and PTP-enabled solutions.

Which end-user segment is exhibiting the fastest growth rate in the NTP Time Server Market?

The Telecommunications sector, specifically driven by the global rollout of 5G networks, is projected to show the highest growth. 5G infrastructure requires extremely tight synchronization for features like beamforming and inter-cell coordination, accelerating the migration from standard NTP to high-accuracy PTP Grandmaster clocks across both core and access network segments worldwide.

What are the key cybersecurity threats facing NTP Time Servers and how are they mitigated?

The main threats include time source spoofing (falsifying the GNSS signal) and Man-in-the-Middle attacks on the network time distribution. Mitigation strategies involve adopting Multi-GNSS receivers for redundancy, implementing holdover technologies (atomic clocks) to maintain time during signal loss, and deploying Secure NTP (NTS) protocols for cryptographic verification of time packets.

Are virtualized or software-based NTP solutions replacing dedicated hardware appliances?

While virtualized and software-based NTP solutions are rapidly growing due to their scalability and lower cost for non-critical enterprise environments and cloud deployments, they are not fully replacing hardware appliances. Critical infrastructure (defense, finance, utilities) still relies on dedicated hardware appliances with physical security and certified atomic clock synchronization to guarantee the highest level of accuracy, stability, and regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager