Nuclear Grade Resins Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431856 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Nuclear Grade Resins Market Size

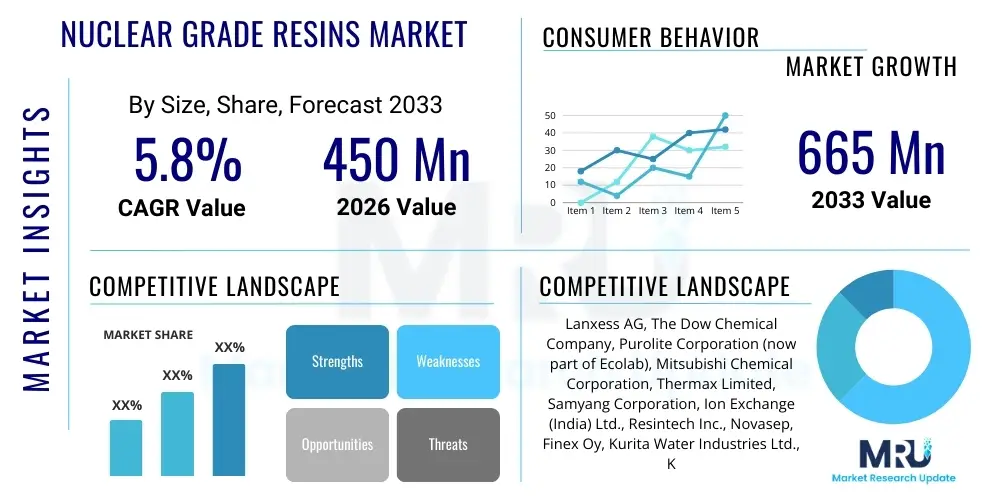

The Nuclear Grade Resins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 665 Million by the end of the forecast period in 2033.

Nuclear Grade Resins Market introduction

The Nuclear Grade Resins Market encompasses highly specialized ion exchange resins designed explicitly for use within nuclear power facilities. These materials are critical components in primary and secondary water circuits, serving essential functions such as maintaining precise water chemistry, controlling corrosion, removing radioactive contaminants (including soluble and colloidal forms), and managing radioactive waste streams. The stringent requirements for purity, stability under extreme radiation and temperature conditions, and specific kinetic properties differentiate nuclear grade resins significantly from standard industrial resins. They must adhere to rigorous regulatory standards set by agencies like the Nuclear Regulatory Commission (NRC) in the US and similar bodies globally, ensuring safe and efficient nuclear plant operation.

These sophisticated resins, primarily based on highly cross-linked polystyrene divinylbenzene matrices functionalized with sulfonic acid (cation) or quaternary amine (anion) groups, are instrumental in minimizing radiation exposure for personnel and extending the operational lifespan of plant components. Major applications include coolant purification in Pressurized Water Reactors (PWRs) and Boiling Water Reactors (BWRs), fuel pool cleanup, condensate polishing, and processing liquid radwaste. The benefits derived from employing high-performance nuclear grade resins include superior effluent quality, enhanced capacity for trace element removal, improved operational flexibility, and substantial reduction in the volume of solid radioactive waste requiring long-term disposal.

The market growth is fundamentally driven by the global resurgence in nuclear power construction, particularly in Asia Pacific economies seeking reliable base-load electricity generation, alongside the increasing need for life extension and maintenance activities in aging reactor fleets across North America and Europe. Furthermore, continuous technological advancements focused on developing radiation-resistant and higher-capacity resins, coupled with heightened regulatory emphasis on minimizing environmental releases of radionuclides, further accelerate the adoption of these specialized purification materials. The demand remains inelastic, governed predominantly by nuclear safety and operational necessity rather than external economic volatility.

Nuclear Grade Resins Market Executive Summary

The Nuclear Grade Resins Market is characterized by a strong interplay between stringent regulatory mandates and critical operational demands within the nuclear energy sector. Business trends indicate a focus on optimizing supply chain resilience, given that only a few specialized manufacturers possess the capability to produce resins meeting nuclear specifications. Strategic initiatives include vertical integration to ensure raw material quality and extensive investment in R&D to develop resins capable of withstanding higher doses of radiation and functioning effectively at elevated temperatures, particularly for advanced reactor designs. Furthermore, digitalization and predictive maintenance protocols in nuclear facilities are driving demand for high-longevity resins that reduce the frequency of change-outs, thereby minimizing personnel exposure and operational downtime, presenting a key competitive differentiator among market participants.

Regional trends are dominated by the significant expansion of nuclear power infrastructure in the Asia Pacific region, notably China, India, and South Korea, which are initiating numerous new reactor projects. This massive capacity addition drives substantial new demand for initial core resin loading and ongoing operational makeup. Conversely, North America and Europe primarily represent mature markets focused on decommissioning and life extension projects, sustaining demand for replacement resins and specialized waste treatment resins. Geopolitical stability and long-term energy policies supporting nuclear power are critical determinants of market growth rates across these regions, influencing procurement cycles and contract volumes for major suppliers.

Segment trends highlight the dominance of the cationic resins segment due to their extensive use in managing primary water chemistry and condensate polishing. However, the specialized mixed-bed resins segment is projected to exhibit the highest growth rate, fueled by the requirement for ultra-high purity water quality in critical systems where simultaneous removal of both cations and anions is essential for corrosion prevention. In application terms, the radioactive waste treatment segment is experiencing accelerated growth as nuclear facilities globally seek more efficient and volume-reducing technologies to comply with stricter waste disposal regulations, propelling demand for specialty macroporous and scavenging resins designed for selective isotope removal.

AI Impact Analysis on Nuclear Grade Resins Market

Common user questions regarding AI's influence often revolve around optimizing resin lifecycle management, predicting resin exhaustion, and enhancing water chemistry control in real-time. Users are keen to understand how AI-driven predictive analytics can minimize unexpected resin bed failures, improve regeneration efficiency, and ultimately reduce the volume of radioactive waste generated. The overarching theme is the expectation that AI and machine learning (ML) algorithms, integrated with sensor data from reactor cooling systems, will transform resin procurement from a scheduled maintenance activity into a data-driven, optimized process, ensuring peak performance and regulatory compliance while potentially accelerating the development time for novel, high-performance nuclear media.

- AI enables predictive modeling of resin exhaustion rates based on real-time water chemistry and flow dynamics, minimizing unnecessary resin change-outs.

- Machine Learning algorithms optimize regeneration cycles, reducing chemical consumption and improving the overall efficiency of water purification loops.

- AI-enhanced sensor data analysis detects subtle anomalies in system performance, preventing resin fouling or premature degradation.

- Deep learning models expedite the discovery and testing of new radiation-resistant polymer structures and functional groups for advanced resin development.

- Adoption of digital twins powered by AI simulates resin behavior under various operational stresses, validating product performance before deployment.

DRO & Impact Forces Of Nuclear Grade Resins Market

The Nuclear Grade Resins Market dynamics are shaped by a unique combination of high regulatory barriers, essential safety requirements, and long-term investment cycles inherent to the nuclear energy sector. Drivers primarily include the global commitment to carbon reduction targets necessitating nuclear energy expansion, the mandatory nature of water chemistry control for reactor integrity, and life extension projects requiring continuous replacement and refurbishment of resin beds. Restraints involve the extremely high initial capital cost associated with nuclear power plant construction, which dictates the rate of new demand, the complex and prolonged regulatory approval processes for new resin technologies, and the public perception challenges surrounding radioactive waste management, which indirectly influences resin uptake in waste processing applications.

Opportunities in this market are significant, particularly centered around the development and commercialization of specialized resins for Small Modular Reactors (SMRs) and Generation IV reactors, which often operate under different temperature and pressure regimes and require customized purification solutions. Furthermore, increasing global focus on the decommissioning of older plants creates a persistent, specialized demand for resins tailored to handling complex, highly concentrated radioactive waste streams generated during final cleanup phases. Innovation in highly selective ion exchange materials that target specific radionuclides (e.g., Cobalt-60 or Cesium-137) offers manufacturers a premium market niche.

The impact forces within the Nuclear Grade Resins Market are heavily weighted toward operational safety and environmental protection. Regulatory stringency acts as a primary force, compelling adoption of the highest quality resins irrespective of cost considerations to ensure primary circuit integrity and minimize occupational exposure. The scarcity of specialized manufacturing capacity constitutes a moderate impact force, creating potential supply bottlenecks and favoring established, accredited suppliers. Lastly, the macroeconomic force of global energy policy, particularly the shift toward decarbonization, is exerting a strong positive influence, institutionalizing the demand for nuclear infrastructure and consequently, for the reliable supply of nuclear grade resins essential for its functioning.

Segmentation Analysis

The Nuclear Grade Resins market is meticulously segmented based on the type of resin material, their functional application within the nuclear facility, and the specific technology of the nuclear reactor they serve. This granularity allows manufacturers to tailor products precisely to the exacting specifications required for purity, capacity, and radiation stability. The differentiation between strong acid and weak acid resins, or strong base and weak base resins, is critical, as their chemical properties dictate their suitability for environments ranging from highly acidic condensate streams to moderately alkaline effluent treatment systems. Understanding these segmentation nuances is key for strategic market penetration, focusing on high-growth segments such as specialty macroporous resins or customized isotopic selective media.

Key segmentation analysis reveals that the Type segment, dominated by ion exchange resins, is further categorized by their functional group, size, and matrix material, which dictates their performance in critical applications like primary coolant purification. The Application segment highlights the dominance of high-volume uses such as condensate polishing and primary loop cleanup, which require large initial fills and scheduled replacements. Meanwhile, the Reactor Type segmentation reflects the operational differences between PWRs, which typically use lithium hydroxide control, and BWRs, which often require deep bed demineralizers for feed water treatment, influencing the type and blend of resins procured by operators globally.

The consistent growth of the market is expected to be led by the increasing demand for specialized media utilized in radwaste volume reduction. Nuclear facilities are increasingly under pressure to minimize the long-term burden and cost associated with waste disposal. Consequently, highly regenerable or volume-optimized resin systems that can concentrate contaminants into a smaller, more manageable solid form are gaining significant traction, particularly in mature markets focused on asset integrity and environmental stewardship. This trend reinforces the shift toward value-added specialty products over commodity resin types.

- By Type

- Cation Exchange Resins (Strong Acid, Weak Acid)

- Anion Exchange Resins (Strong Base, Weak Base)

- Mixed Bed Resins

- Specialty/Selective Resins (Chelating Resins, Macroporous Resins)

- By Application

- Primary Coolant Purification

- Condensate Polishing (Feedwater Treatment)

- Radioactive Waste Treatment (Radwaste)

- Spent Fuel Pool Cleanup

- Auxiliary Water Treatment Systems

- By Reactor Type

- Pressurized Water Reactors (PWR)

- Boiling Water Reactors (BWR)

- Heavy Water Reactors (HWR/CANDU)

- Advanced Reactors (SMRs, Generation IV)

Value Chain Analysis For Nuclear Grade Resins Market

The value chain for Nuclear Grade Resins begins with the highly specialized upstream segment involving the production of key monomers, notably styrene and divinylbenzene (DVB), and the subsequent polymerization and functionalization processes. Due to the extreme purity and traceability requirements of the nuclear sector, only a select number of chemical manufacturers are authorized to supply these base polymer beads. Strict quality control and certification are essential at this stage to prevent chemical leaching or degradation under high radiation, establishing significant barriers to entry for new suppliers. Manufacturers must maintain rigorous batch consistency and provide exhaustive documentation regarding raw material provenance and processing parameters.

The midstream process involves the precise manufacturing and blending of the final nuclear grade resins, including processes like bead size uniformity control, isotopic cleanup (washing to remove non-essential ions), and specialized packaging under strict cleanliness standards. Distribution channels in this market are typically direct or rely on a very limited network of specialized, accredited distributors. Direct sales dominate, especially for large, recurring supply contracts, as plant operators prefer direct engagement with manufacturers to ensure technical support, quality assurance, and traceability protocols. Indirect channels are sometimes used for smaller volume maintenance purchases or spare parts supply in regions where the manufacturer lacks a local presence, but oversight remains intensely controlled by the resin producer.

Downstream analysis focuses on the end-users: nuclear power plant operators, decommissioning contractors, and specialized radwaste management companies. The selection and procurement process is highly technical, involving extensive technical qualification tests, long-term supply agreements, and adherence to specific plant operating procedures. The final step in the value chain involves managing the spent resin, which, upon exhaustion, becomes a form of radioactive waste. This necessitates specialized services for dewatering, encapsulation, and disposal, often handled by third-party waste management firms, highlighting the integral role of post-use handling within the total cost of ownership for nuclear grade resins.

Nuclear Grade Resins Market Potential Customers

The primary customers for Nuclear Grade Resins are the operators and utilities responsible for the physical running and maintenance of nuclear power generating stations globally. These entities, such as government-owned utilities, independent power producers (IPPs), and state-sponsored nuclear energy corporations, are mandated to maintain optimal water chemistry within their reactor systems to prevent corrosion, scale formation, and the mobilization of radioactive species. Their purchasing decisions are dictated not by price elasticity but by performance reliability, longevity, and adherence to stringent safety documentation and quality assurance protocols required by national regulatory bodies.

A secondary, yet rapidly expanding customer base includes firms specializing in nuclear decommissioning and remediation services. As older reactors reach the end of their operational lives, these contractors require significant volumes of specialized resins to process the large amounts of liquid waste generated during the cleanup and dismantling phases. This demand is often project-based but highly intensive, focusing on resins optimized for bulk decontamination and highly selective removal of specific, long-lived radionuclides. Furthermore, research reactors and government facilities involved in nuclear material processing also represent niche, high-value customers requiring specialized, traceable resin supplies for their specific purification needs.

Finally, Engineering, Procurement, and Construction (EPC) companies involved in the construction of new nuclear power plants, particularly next-generation SMRs, act as influential indirect customers. They specify and procure the initial large-volume resin loadings required before the plant begins operation. Therefore, manufacturers must strategically target EPC firms during the design and build phase of new projects. These customers prioritize resins with documented operational history and guaranteed supply security for projects spanning multiple years.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 665 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lanxess AG, The Dow Chemical Company, Purolite Corporation (now part of Ecolab), Mitsubishi Chemical Corporation, Thermax Limited, Samyang Corporation, Ion Exchange (India) Ltd., Resintech Inc., Novasep, Finex Oy, Kurita Water Industries Ltd., Kinetico Incorporated, SUEZ Water Technologies & Solutions, BASF SE, Calgon Carbon Corporation, Sybron Ion Exchange, Eichrom Technologies LLC, Graver Technologies, Beijing Huirongyuan Environmental Protection Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nuclear Grade Resins Market Key Technology Landscape

The technology landscape of the Nuclear Grade Resins Market is highly focused on optimizing the polymer matrix and functional group chemistry to enhance radiation resistance and selectivity. Current state-of-the-art involves highly cross-linked polystyrene-divinylbenzene (DVB) matrices, engineered to minimize chemical breakdown (radiolysis) when exposed to intense neutron and gamma radiation fields within the reactor core environment. A critical technological evolution is the development of monodisperse resins, characterized by uniform bead size, which significantly improves hydraulic performance, reduces pressure drop across the resin bed, and enhances kinetic efficiency by ensuring uniform flow distribution and utilization of all exchange sites. This precision manufacturing is paramount for applications like condensate polishing where flow rates are extremely high.

Another major technological advancement involves the creation of specialized selective ion exchange materials, often referred to as "scavengers" or chelating resins. These technologies move beyond traditional bulk ion exchange by incorporating functional groups (e.g., specific organic ligands or inorganic active sites) that target specific radionuclides like Cs-137, Sr-90, or Co-60 with extreme efficiency, even in the presence of high concentrations of background, non-radioactive ions. This selectivity is essential for effectively processing low-volume, high-activity waste streams or complex decommissioning effluents, leading to significant volume reduction and reduced disposal costs. Research in this area also includes hybrid organic-inorganic media that combine the stability of inorganic materials with the functionality of polymers.

Furthermore, the industry is witnessing increasing integration of advanced characterization techniques. Technologies such as high-resolution microscopy, spectroscopic analysis (FTIR, Raman), and post-irradiation testing are routinely used to rigorously qualify resins before deployment. Manufacturers are also focusing on developing robust, pre-mixed formulations (mixed beds) that offer optimized ratios of cation and anion exchange capacity, requiring less on-site handling and reducing the risk of contamination during installation. Future technological trajectory points towards developing resins suitable for higher temperatures and pressures associated with Small Modular Reactor (SMR) designs and molten salt reactors, requiring breakthrough materials resistant to exceptionally harsh chemical environments.

Regional Highlights

Regional dynamics in the Nuclear Grade Resins Market are heavily skewed toward Asia Pacific (APAC), driven by aggressive nuclear infrastructure development plans. China, in particular, leads the global nuclear buildout, with numerous reactors under construction and planned, generating massive initial demand for resin inventories and continuous operational demand. India and South Korea also contribute significantly to regional growth through new project commissions and the rigorous maintenance of their existing fleets. This region benefits from governmental support for nuclear power as a long-term strategy for energy security and decarbonization, ensuring sustained high demand for critical components like nuclear grade resins. Manufacturers are strategically establishing production and distribution hubs within APAC to capitalize on this robust growth trajectory.

North America and Europe represent mature, steady markets characterized primarily by replacement demand, life extension programs, and intensive decommissioning activities. In the United States and Canada, the focus is on maintaining the operational integrity of existing reactors, necessitating consistent procurement of high-quality resins for condensate polishing and primary water makeup. European demand is driven by countries like France and the UK, which have significant existing nuclear fleets, alongside a growing market segment focused on complex waste processing associated with reactor retirements. While new builds are less frequent than in APAC, the high standards and stringent regulatory environment in these regions guarantee a premium market for certified, high-performance resin products.

The Middle East and Africa (MEA) and Latin America currently constitute smaller, emerging markets, although they possess high long-term potential. The UAE has established a significant nuclear presence with the Barakah Nuclear Energy Plant, creating a focused, high-standard demand center in the MEA region. Similarly, countries like Argentina and Brazil in Latin America, maintaining existing reactor infrastructure, provide a stable, albeit modest, market. Future growth in these regions is contingent upon the execution of announced nuclear projects and the establishment of stable, long-term regulatory frameworks that support sustained nuclear operations and predictable procurement cycles for essential materials.

- Asia Pacific (APAC): Dominant market share fueled by large-scale new reactor construction projects in China and India; high growth projected due to continuous capacity expansion and energy security mandates.

- North America: Stable market driven by maintenance, refueling cycles, and extensive reactor life extension investments; strong demand for high-end replacement resins and waste treatment solutions.

- Europe: Mature market sustained by the large French fleet, decommissioning projects in Germany and the UK, and high demand for compliance-driven, quality-assured specialty resins.

- Middle East and Africa (MEA): Emerging market concentrated around operational plants like Barakah (UAE); future growth tied to proposed nuclear programs in nations like Saudi Arabia and Egypt.

- Latin America: Steady niche market centered on maintenance and operational upgrades of existing reactors in Brazil and Argentina.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nuclear Grade Resins Market.- Lanxess AG

- The Dow Chemical Company

- Purolite Corporation (now Ecolab)

- Mitsubishi Chemical Corporation

- Thermax Limited

- Samyang Corporation

- Ion Exchange (India) Ltd.

- Resintech Inc.

- Novasep

- Finex Oy

- Kurita Water Industries Ltd.

- Kinetico Incorporated

- SUEZ Water Technologies & Solutions

- BASF SE

- Calgon Carbon Corporation

- Sybron Ion Exchange

- Eichrom Technologies LLC

- Graver Technologies

- Beijing Huirongyuan Environmental Protection Technology Co., Ltd.

- Rohm and Haas (historical influence now part of Dow)

Frequently Asked Questions

Analyze common user questions about the Nuclear Grade Resins market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of nuclear grade resins in a power plant?

The primary function of nuclear grade resins is maintaining ultra-high purity water chemistry in critical circuits, such as the primary coolant loop and condensate stream. They remove dissolved ionic impurities, corrosive agents, and both soluble and colloidal radioactive contaminants (radionuclides) to minimize corrosion, prevent scaling, and reduce radiation levels, ensuring safe reactor operation and regulatory compliance.

How do nuclear grade resins differ from standard industrial ion exchange resins?

Nuclear grade resins are fundamentally different due to stringent requirements regarding chemical purity, thermal stability, and, critically, resistance to radiolysis (chemical degradation under intense radiation). They must be highly cross-linked and manufactured to extreme cleanliness specifications (trace metal content < 1 ppm) and often feature monodisperse bead sizes for superior hydraulic performance, unlike less stringent industrial resins.

Which geographical region leads the demand for new nuclear grade resin installations?

The Asia Pacific (APAC) region currently leads the demand for new nuclear grade resin installations. This is driven by massive investment in new nuclear power capacity, particularly in China and India, which requires substantial initial inventory fills for reactors under construction, alongside persistent operational replacement demand.

What are the key drivers impacting the long-term growth of the Nuclear Grade Resins Market?

Key long-term drivers include the global trend toward decarbonization favoring nuclear energy expansion, mandatory regulatory demands for operational safety and water purity, and the sustained requirement for refurbishment and life extension projects in aging reactor fleets across North America and Europe. Emerging Small Modular Reactor (SMR) technology also provides a specialized growth avenue.

What role do Mixed Bed Resins play, and why are they considered a high-growth segment?

Mixed Bed Resins contain a blend of both cationic and anionic exchange beads, enabling the simultaneous removal of both positive and negative ions. They are crucial for producing ultra-pure water required in high-purity applications like final condensate polishing. They are a high-growth segment because modern nuclear facilities increasingly demand the highest achievable water quality to minimize corrosion and extend the life of critical reactor components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager